Risk-based pricing: Strategies for a new reality in banking

As it stands, the barrage of questions, calculations and credit checks that precede lending decisions has minimal impact on the prices of retail lending products (i.e., interest rates) charged to the consumer, which almost always track closely to the nearly identical rates advertised by the big four lenders. That means there’s little connection between what the borrower pays on a mortgage or credit card, for example, and his or her personal risk profile.

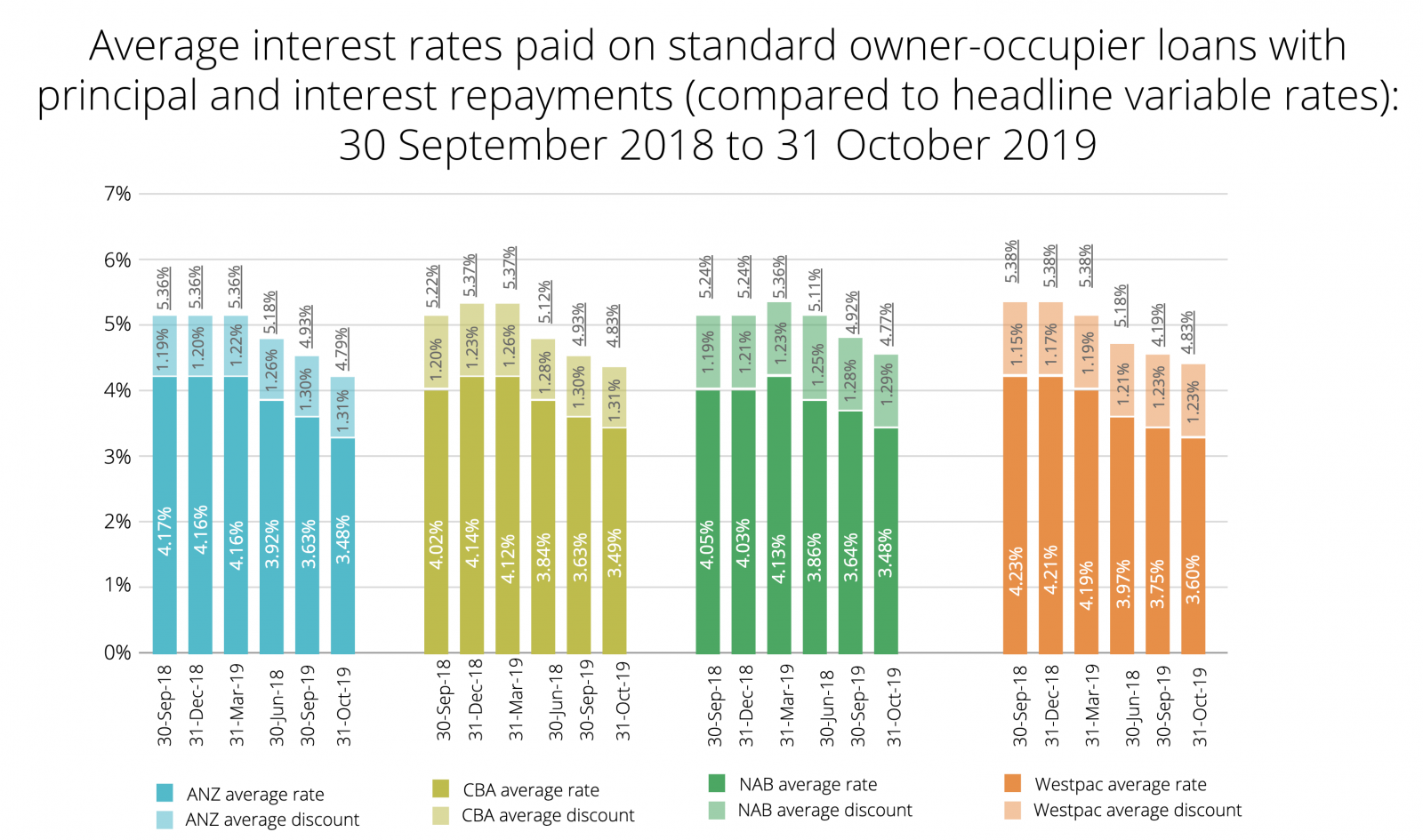

ACCC analysis of home loan data supplied by the big four banks. (Source: ACCC)

ACCC analysis of home loan data supplied by the big four banks. (Source: ACCC)

Looking at home loans, where pricing varies it’s often due to determined bargaining on the part of the borrower - or for the wrong reasons, like the ‘loyalty tax’ currently in the sights of the Australia Competition and Consumer Commission (ACCC), which refers to the practice of banks luring new customers with offers of discounted loans, while long-term clients are stuck paying higher rates.

Making risk count

Risk-based pricing is already the norm in the insurance industry and would seem to be a win-win alternative. Linking loan prices directly to the borrower’s risk profile and past credit behaviour would allow banks to optimise revenues from lending, and reward deserving, financially disciplined customers. Yet despite the clear advantages this approach has so far failed to gain traction for a number of reasons, including technology limitations, concerns about the broader impacts and simple inertia.

That’s unlikely to be the case for much longer. The ground is shifting, and banks will essentially be forced into action. Standard practices are facing increased scrutiny by regulators like the ACCC, and emerging standards such as Basel IV demand more precise measurement of and accounting for lending risks.

Pressure will also come from consumers, who are increasingly sensitive to distortions like the loyalty tax and, thanks to the rise of neobanks and fintechs, have more alternatives to choose from than ever. The advent of open banking, as well as advances in artificial intelligence and machine learning, have brought the data and automation tools needed to support effective risk-based pricing on a mass scale within closer reach.

Open banking simplifies the calculation of financial positions, and minimises errors from intentional or unintentional omissions. The low cost of on-demand cloud computing power means machine learning can process more data, and refine the patterns and categorisations that may signal defaults.

Weighing the impacts

Concerns about the negative effects of risk-based pricing are understandable, and deserve more exploration. As industry leaders like ANZ CEO Shayne Elliott have noted, the worry is that basing lending rates on risk profiles will result in relatively wealthy, stable customers getting showered with offers of low-cost loans, while less well-off borrowers with spottier track records will no longer be able to bear the costs of funding. That could effectively choke the supply of credit to entire segments of the community.

There’s no denying risk-based pricing has the potential to make loans more expensive for certain customers. But this possibility has to be considered in context, along with the advantages. The experience of markets like the United States indicates greater availability and use of data in lending decisions boosts transparency and competition, pushing prices down overall as a result.1

The potential to draw on more data sources (such as rents and utility bills) will also encourage lenders to extend credit to new customers for whom information was previously insufficient. Historical trends have shown a correlation between the use of credit data and greater credit availability, particularly for lower-income earners.2

We shouldn’t forget that the government and regulators can and should continue to play a role in ensuring the flow of lending to various customer groups, via targeted programs or legislation like the US Equal Credit Opportunity Act, which was introduced to prevent creditors from discriminating against certain customer profiles.

Prepare for transformation

There is also an argument that under Australia’s current ‘one size fits all’ approach more credit-worthy customers effectively pay a premium to subsidise riskier ones - hardly a fair or desirable approach for the long term. By forcing borrowers to confront their financial habits more directly and making the consequences of those habits more immediately apparent, risk-based pricing could encourage more responsible borrowing and lending overall, leading to a more sustainable form of economic growth than the credit-fueled booms of years past, and positive social outcomes.

Taken a step further, risk-based pricing could evolve into goal-based pricing. While today loan prices are typically locked in at origination, over time customer circumstances and the balance of risk inevitably changes. The value of the underlying security (e.g. a house) may increase; debts diminish as they are repaid; customer income and credit scores often rise. All this reduces risk exposure for the lender, creating room to reward the customer with more favourable pricing as certain conditions are met. This could enable a virtuous circle in which customers see positive financial behaviour recognised and become even more committed to that behaviour - and the lender.

Like any new model, risk-based pricing will come with challenges. But the ‘push’ factors and positive implications for both banks and borrowers are simply too powerful to ignore. The institutions who prepare for the shift now by building their data capabilities and pulling together systems to build a more holistic view of customers will be positioned to capitalise on the opportunities - while others are likely to see clients gravitate towards challengers with more dynamic pricing models. In our next article, we’ll look at how banks can build readiness for the ‘new pricing normal’ from the ground up.

1 See e.g. https://www.centerforcapitalmarkets.com/wp-content/uploads/2013/08/CCMC_RiskBasedPricing_FINAL_to_post_10_24_2014.pdf

2 See e.g. https://www.centerforcapitalmarkets.com/wp-content/uploads/2013/08/CCMC_RiskBasedPricing_FINAL_to_post_10_24_2014.pdf

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.

ACCC analysis of home loan data supplied by the big four banks. (Source: ACCC)

ACCC analysis of home loan data supplied by the big four banks. (Source: ACCC)