Innovation is Eating Consumer Finance

This is the first article in a four part series, where the authors share their experiences and insights on ushering technology fueled innovation in incumbent financial services organizations. Here are the second, third and fourth articles in this series.

Consumers want everything digital, now. Their financial lives are no different: they expect their online loan applications processed immediately, investment strategies curated and automated, and totally automated and integrated services that pre-populate existing information when accessing a new service.

And they want it all on mobile.

This is the new normal. Technology is now the primary channel of engagement. Mobile phones and cheap computing power are amplifying this digital disruption.

The New Financial Services Economy

Meet Evelyn Rodriguez, 24, a Brooklyn-based college millennial. She is also a much sought-after videographer and photographer in her friend circles. She uses the Venmo iPhone app to receive payments from her Facebook connections, free of any charges.

Venmo allows Evelyn and others like her to receive and send money instantly—for free—with their debit cards.

Companies like Venmo aren’t just flash-in-the-pan technology upstarts. Google recently added banking to Gmail, making financial transactions as easy as sending a picture over email. Digital money managers such as Mint offer budgeting and cash management tools to time-constrained customers.

Consumers are also being wooed by investment startups like Baton and WealthFront, focused on helping investors finance their dreams by offering simple, smart, and transparent investment options.

The technology-fueled economy has left many incumbent organizations—including traditional banks, wealth management organizations and other large financial businesses—gasping for breath. Digital upstarts have the potential to disrupt traditional business models and offer more intuitive, approachable customer experiences for free or almost negligible fees.

There are unique opportunities in this technology-fueled financial services economy. Following the financial crisis of 2007-08, consumers like Evelyn are suspicious of existing financial services companies and offerings. Digital innovators have swept in to build products and brands that create new financial ecosystems focused on simplicity, transparency, and engagement.

Strategic IT versus Utility IT

What do the winners in this new financial services economy have in common?

These new entrants are focused on creating value-added offerings within a matter of few days to weeks, leaving big financial firms surprised—and stumbling to catch up.

In the face of this rapid, accelerating disruptive innovation and changes in the marketplace, expectations for internal IT have dramatically changed.

Traditionally, IT functions as a cost center concentrating on fostering cost savings (efficiency), rather than spearheading initiatives that drive top-line revenue growth (effectiveness). Technology now needs to drive strategic growth, instead of just concentrating on business as usual.

To compete on this new innovation battleground, large financial organizations must stop treating its technology team as a cost center, solely measured by cost optimization and scaling efficiencies. Instead, technology must also be measured by its effectiveness in creating strategic value, driving revenue, and delighting customers through digital channels.

Utility IT can continue to be measured and delivered with an eye on cost containment. Treating Strategic IT the same way will result in lost opportunities, poor customer experiences, and a reputation for being slow to market—a sure way to lose the next generation of both customers and employees.

How Your Organization Can Thrive

Large financial companies that thrive in the turbulent new economy are ones where technologists understand the needs of their customers. They focus on customer acquisition and retention, launching new products that create strategic business advantages and opportunities. They are measured on their ability to deliver customer value.

Creating a culture for innovation is key. Business leaders expect IT to move as a lean, mean speedboat, but for most organizations, IT is still behaving like an oil tanker slowly navigating deep waters. The client-facing front offices and enterprise technologists at large banking and financial firms are still not speaking a common language. They lack an understanding on what success looks like and how to manage IT investments in this new world.

Here’s how you can help turn your technologists into growth engines of the future:

- Build products/platforms for customers, not projects

- Distinguish between strategic IT and utility IT

- Improve processes to instill serial innovation

These three principles will move traditional IT divisions from being predictable and efficient to experimentation-driven and innovation-friendly.

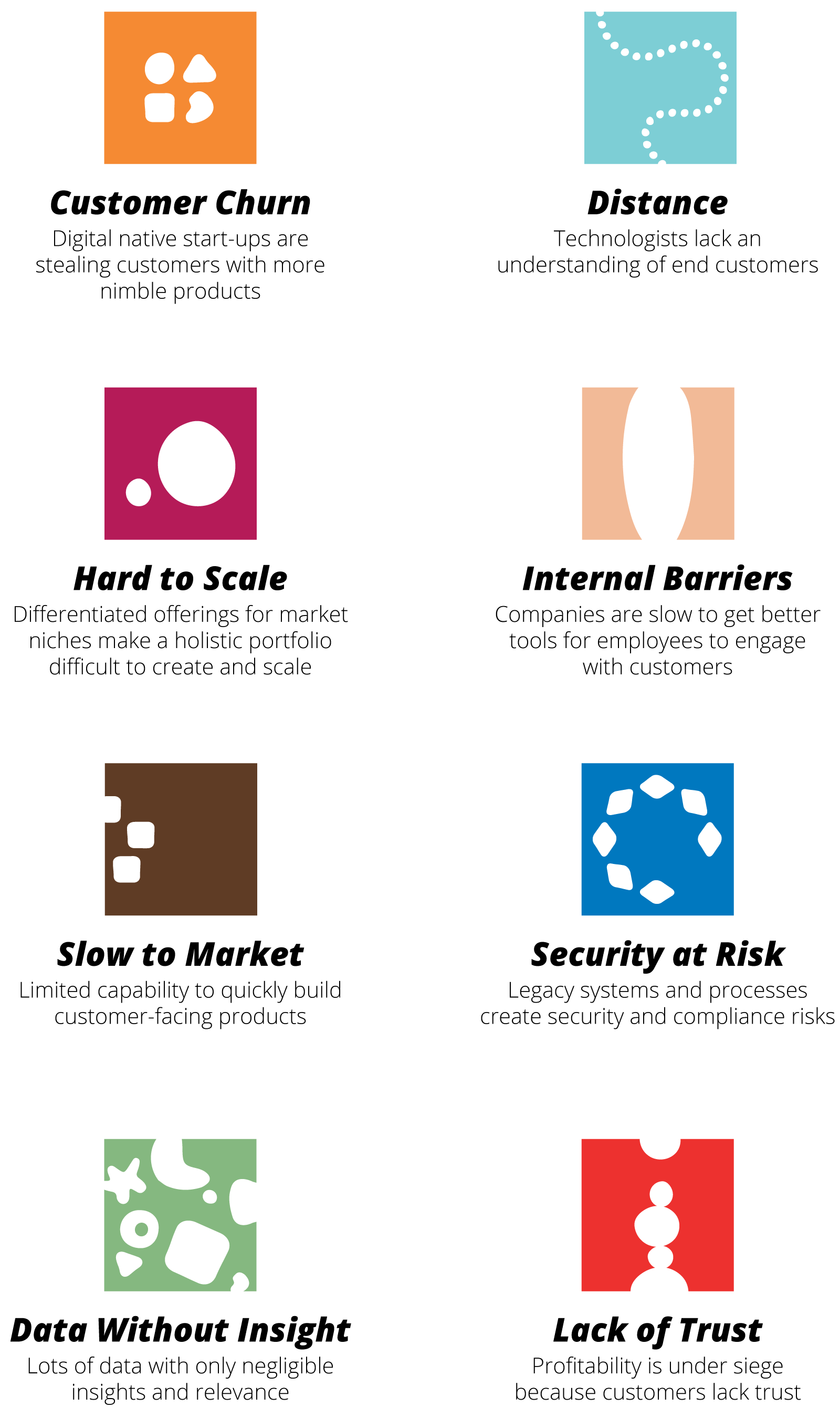

Challenges Facing Large Financial Organizations

Over the next two weeks, we’ll be publishing deep dives into each principle, with examples and case studies. Stay tuned.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.