In the fast-changing world of finance, innovation is becoming critical. It sets financial enterprises apart, attracts new customers, and retains existing ones. In the naturally risk-averse finance sector, learning to unlock that innovative spirit requires effort, but here, we’re sharing some ideas to help.

Some financial institutions are reluctant to launch new applications or features until they have been thoroughly tested and vetted. They can be slow to adapt to change, and they may not have the same level of agility as smaller, more nimble fintech companies. And today, that can be an existential risk.

It’s not unlike the situation In the early 2000s when mobile banking was a new concept. Traditional banks were cautious about its adoption due to security concerns. This caution allowed fintech startups to gain a competitive edge. Banks like JPMorgan Chase eventually caught up, but the delay impacted their early market share.

We’ve seen firsthand that JPMorgan Chase is not alone. We’ve seen one bank that wanted to implement a security feature that would enable customers to check if incoming calls were genuinely from the bank. But the layers of complexity, with additional security and compliance requirements, turned a four-month project into one that took longer than a year. And the fallout didn’t just impact customer-facing services: team frustrations at the glacial pace of delivery meant many were exploring career opportunities elsewhere.

We’re seeing those same issues repeated today, as banks struggle to deliver customer-pleasing apps. Just look at the example of one of Australia’s leading banks, which took around six years of effort to come up with a new accounts app, which when launched, lacked basic functionalities like enabling customers to view their account statements.

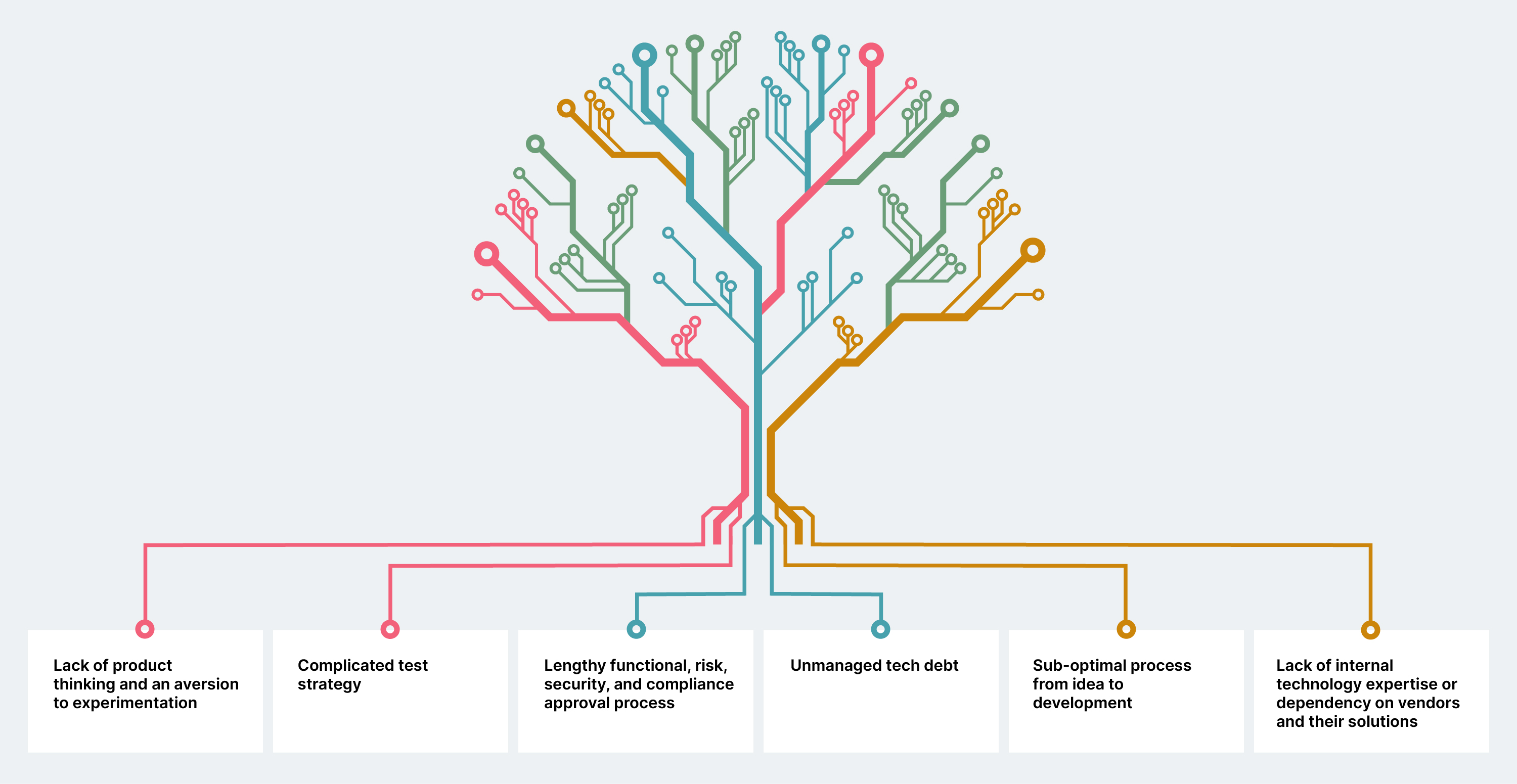

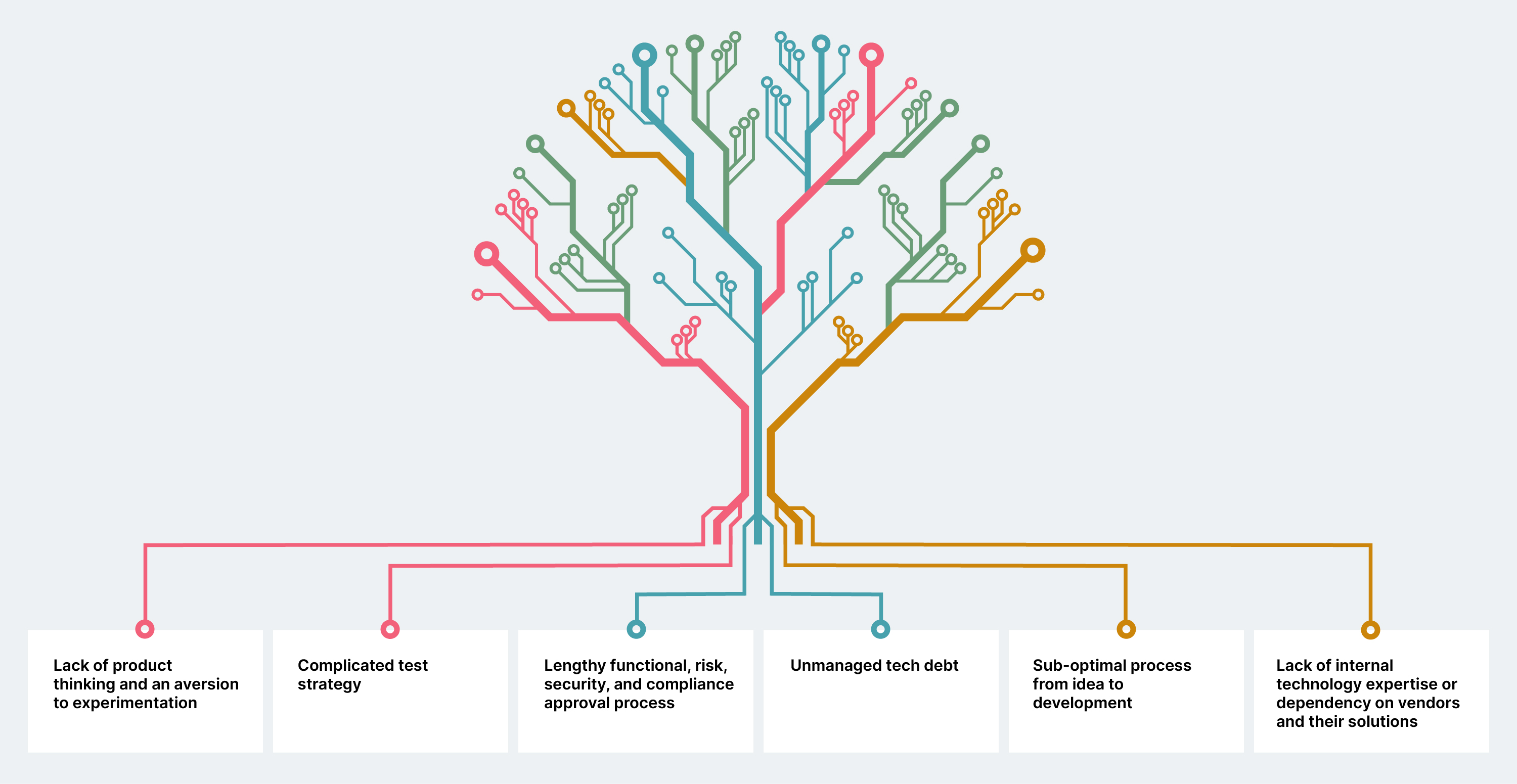

This scenario plays itself out regularly in most financial institutions; some even accept it as the norm. But for those thirsting for change, it helps to understand the underlying reasons for the morass. In our work with banks, we’ve identified six common roadblocks to innovation:

What financial institutions could do

These root causes can be addressed, and here’s how:

Root cause |

Probable solution |

Lack of product thinking and an aversion to experimentation |

Understand how products can be developed using an experimental, test and learn, and incremental approach Bring in the necessary new thinking from outside, via hiring at different levels A technology strategy that facilitates experimentation Bringing in business leadership who understand what makes technology delivery successful |

Complicated test strategy |

Optimal use of production-like environments for testing Make environment and test data provisioning easier, by using cutting edge technologies like AI More stable and reliable end-to-end (e2e) tests Increase e2e testing throughput to reduce the testing time and environment allocation Introduce formal contracts between service and subsystems to enable service and subsystem level testing with confidence |

Lengthy functional, risk, security, and compliance approval process |

Dissecting key principles valued by regulators and internal audits and integrating these checks early in the development process - ensuring a robust and compliant framework Connect subject matter experts from risk, security, and compliance with nominated champions for each of these areas within initiatives and reestablish regular cadence with the SMEs. Plan for early and frequent assessments rather than waiting for the tail end of initiatives. |

Unmanaged tech debt |

Prioritisation. Quantification of the impact of the tech debt to business risk Use of DORA 4 key metrics to measure tech health Testability or granularity of testing |

Sub-optimal process from idea to development |

Optimal operating model. Identify waste and suboptimal processes in the entire delivery value chain and systematically improve it |

Lack of internal technology expertise or dependency on vendors and their solutions |

Governance to ensure that these issues are identified and mitigated A technology strategy that differentiated versus non-differentiated business capabilities and where buy makes sense over build |

Why innovation remains a challenge

Taking a limited approach which overlooks the vital user feedback

Today’s leading financial enterprises are defined by their ability to capture user feedback and deliver changes based on that feedback into production. In a fast-changing market, this capability is an essential part of responding to market dynamics and user demands.

To achieve that, many financial enterprises need to overhaul their development processes and fully embrace continuous deployment, monitoring, and user-driven design.

Early feedback is imperative for trying out new ideas at an early stage. This is where minimum viable products (MVPs) and product thinking come into play.

Automated testing needs to become an integral part of the development process, not an afterthought. It should encompass infrastructure automation, compliance as code, and test-driven development. By weaving automated testing into the development process, financial enterprises can identify and address issues swiftly, leading to quicker and more confident delivery.

Failing to incorporate product thinking (change management)

The failure to transition to an operating model that embraces product thinking and change management practices can be a major hindrance to innovation and rapid feature deployment.

The traditional financial sector's legacy processes often resist change, impeding the shift towards a product-centric mindset, with a focus on user needs and market dynamics. This resistance to change results in

Inefficient workflows. Legacy processes, incompatible with the iterative nature of product development, lead to inefficiencies. This includes excessive red tape and a slower response to changing market demands, thereby prolonging the time it takes to bring new offerings to the market.

Siloed operations. Organizations that struggle with change management often retain departments that work in silos. This impedes the integration of product thinking across teams. This isolation slows down collaboration and hinders the coordinated effort required for quick time-to-market.

Resistance to innovation. The absence of change management promotes resistance to innovative ideas and modern methodologies. This resistance keeps organizations rooted in stagnant practices, delaying the adoption of innovative features and slowing down the release of new products.

Inflexible culture & complacent mindset. An organization's culture that is resistant to change is often ill-suited for adapting to new technologies, tools, and practices essential for quicker development and deployment. This inflexibility can be a significant barrier to achieving swift time-to-market goals. Some financial institutions, particularly the largest ones, may adopt a complacent mindset driven by continuous income growth, leading to a preference for short-term success over contemplating potential long-term consequences.

Organization-wide issues like lack of test environments are parked as being “too big for this initiative to fix”

Test environments are often perceived as too complex to fix. Challenges can include bottlenecks in the testing phase, compromised quality assurance, inefficient resource allocation, a heightened risk of implementation failures, complexities in regulatory compliance, and a competitive disadvantage.

Additionally, inadequate testing can lead to unresolved bugs, post-release updates, and potential customer dissatisfaction. The perception that fixing this issue is too formidable can result in suboptimal resource allocation, perpetuating the problem. As a result, financial enterprises risk implementation failures, regulatory hurdles, and loss of competitiveness in a rapidly changing industry.

Vendor lock-in

Vendor lock-in limits financial enterprises’ ability to adapt to evolving market needs and introduces complexity when trying to integrate third-party tools. Many organizations rely on commercial off-the-shelf (COTS) products to streamline their operations and enhance efficiency. Challenges surface when COTS product evolution doesn't synchronize with the financial enterprise's vision and innovation, hindering flexibility and alignment with long-term strategies. Slow adaptation to emerging tech and market trends can result in vendor dependencies, limiting the enterprise's ability to make strategic innovations beyond the vendor's offering. This misalignment may ultimately lead to a competitive disadvantage in a rapidly evolving financial landscape.

Finding quick wins for innovation

There is a need to bring in the right kind of thinking from both business and technology, to develop products using an experimental and test-and-learn approach, along with the necessary technology strategy that allows experimentation. This may need to come from outside the organization and hiring for key roles may be the first thing to do when looking at starting a new initiative.

With the right leaders in place, next, focus on the root causes of your innovation roadblock. Assess where you stand on each of them and baseline the cycle times at different parts of the value chain. For example, how long does it take for a new feature that enters the product backlog to be prioritized into the product roadmap or how long does it take to get feedback on usage after deploying a new version into production?

Based on the root causes, create an improvement plan, where the overall measure of success will be time to market — but ensure you have more granular measures that target the specific root causes.

Pilot the improvements with the new initiative and measure whether your cycle time has improved. You’ll need to strive for continuous improvement since it is unlikely you can iron out all the issues the first time around.

Innovation can’t wait

The financial sector's hesitancy to embrace uncertainty in strategy often results in delayed innovation and protracted delivery timelines. Root causes such as a lack of product thinking, complicated testing strategies, and a lengthy approval process hinder rapid deployment. To address these challenges, financial institutions must adopt an experimental mindset, streamline testing processes, and engage subject matter experts early in the development cycle. By fostering a culture of adaptability and innovation, financial enterprises can overcome these barriers, ensuring quicker time-to-market and staying competitive in the evolving financial landscape - like the example of Xapo Bank, who made strategic, well-aligned improvements to their architecture, thinking, and workflows, giving impressive results, including 50% time to market improvement for new features!