Is Technology the Answer to Reducing Financial Exclusion?

Together, these firms account for more than $500 billion in credit card outstanding balances. They offer sophisticated products for payment, savings and loans for different financial needs.

In stark contrast, at a nearby Shoprite store, patrons are paying for their groceries with age-old means like checks and cash. The shop also houses a Western Union agency which offers services like global remittances, money transfers and bill payments. A plethora of payday lending, pawn brokerage, and cash checking services in the neighborhood cater to those desperately in need of a short-term loan. For some of the local population, the services from the aforementioned banks remain inaccessible.

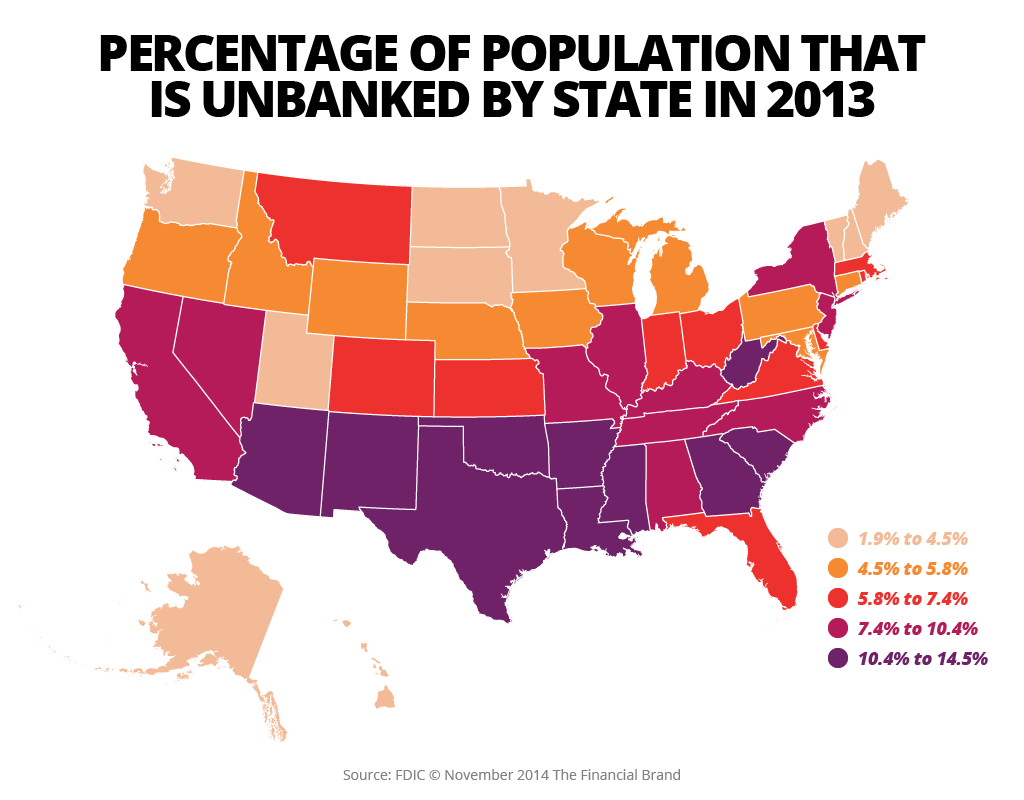

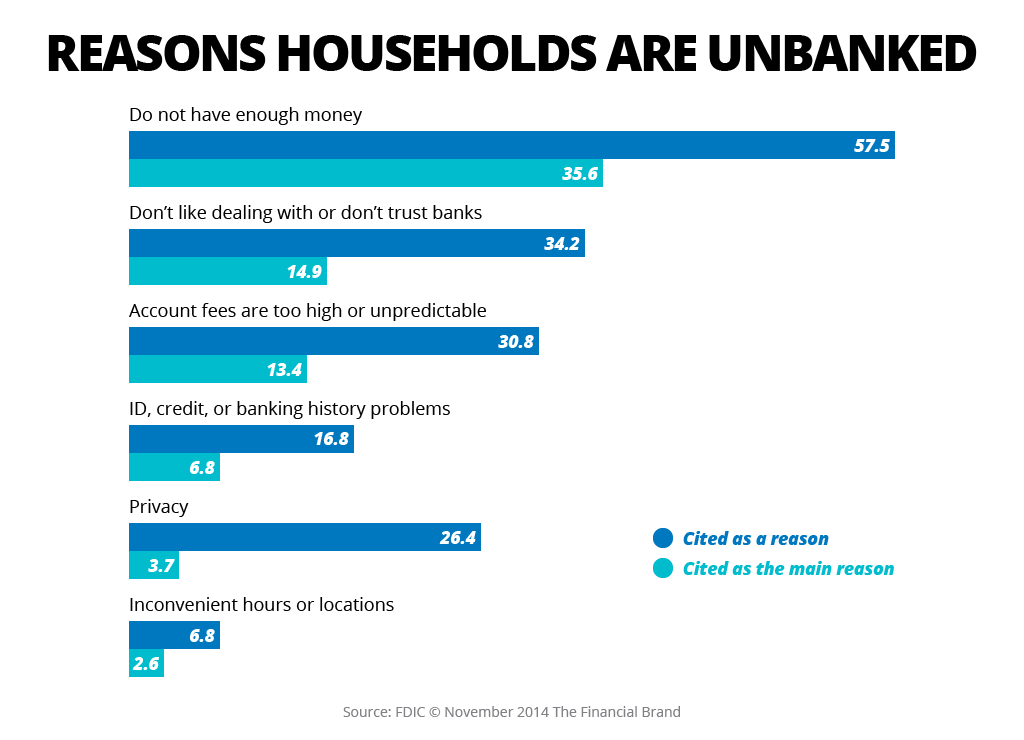

This shouldn’t be a surprise to anyone. According to a 2013 survey, nearly 34.4 million households in the United States are either unbanked or underbanked. In the worst case scenario, some do not have any credit history, rendering them invisible in the financial system. These customers are forced to seek alternative financial services outside of the banking system for their needs, which is invariably more expensive and often, exploitative.

Financial exclusion is a harsh reality not just in underdeveloped nations, but in developed countries as well. There are many factors for financial exclusion including access, financial literacy, pricing and even self-exclusion based on negative experiences with the sector. Shocking as it is, the financially excluded represent only 8% of the population in US . This compares favorably to some nations in sub-Saharan Africa, where more than 80% of the population remain financially excluded.

Governments and regulators across the world are trying hard to address financial exclusion through strong legislation, improving access, and addressing financial literacy. Here’s a look at some examples of the efforts in the US and the UK:

| Initiative | Impact | Examples of US efforts | Examples from the UK |

| Tighter regulation | Regulation can drive greater transparency, regulate pricing, and promote simplification of products in the market. |

The CARD Act in the US has removed unfair fees upwards of $16 billion. |

The Financial Conduct Authority (FCA) in the UK were able to cap the prices on payday loans to 0.8% per day. |

| Improve Financial Literacy | Better understanding of products / financial management tools | The US treasury department is also making efforts to improve the financial literacy amongst the youth through their educational site mymoney.gov. | Money Advice Service, a quasi-government agency, provides impartial advice on money matters to UK citizens pertaining to all the life situations. |

| Increased access to credit | Expanding access to finance has a positive impact on economic activity and poverty alleviation | The Community Development Financial Institutions (CDFI) Fund, part of the US Department of the Treasury, has built a network of CDFIs across the nation to provide credit and capital in underserved areas. | Credit unions in Wales provide simple financial products like savings, loans and pre-paid debit cards. |

Government and regulatory initiatives are necessary, but not sufficient to address the wide-ranging problem. An FDIC report estimates that the overall underbanked and unbanked population has remained largely the same between 2009 and 2013.

The big hope is that technological innovations powered by increased access to internet, big data and mobile can dramatically impact these statistics.

“Unprecedented technological capabilities combined with unlimited human creativity have given us tremendous power to take on intractable problems like poverty, unemployment, disease, and environmental degradation,” observed Muhammad Yunus, Founder, Grameen Bank & Nobel Laureate. “Our challenge is to translate this extraordinary potential into meaningful change.”

How technology can change the game

For someone with a thin or no credit history, it is difficult to access the more sophisticated end of the products offered by bank. Technology enables a path to getting recognized in the system, accessing simpler products and behavioral interventions to enable savings and asset building.1. Building Credit History

Marketplaces for social lending

Social lending is a prevalent practice in underserved populations, where resources are pooled together by a collective to make loans to those in need. Marketplaces like Lending Circles take this practice a step further: not only do they allow borrowers to take loans at a 0% interest rate, they also help build an individual’s credit history by reporting payments to credit agencies and supporting savings plans.

Going beyond the credit score: 90% of lenders use traditional models like FICO (Fair Issac Corporation) to determine the credit worthiness of individuals and make their lending decisions. Traditional models rely on base credit data like existing loans, payment-related public data like bankruptcies, histories of defaults / collection activities, credit inquiries and any late payment history from additional sources, which is then converted into a three-digit score.

For those with low scores or no scores, it is inordinately hard to get access to any traditional banking products.

Companies like ZestFinance are changing the game with the use of big data and machine learning where they incorporate thousands of variables like technology usage, social graph, and behavioral analytics to help drive credit decisions. Earnest, which helps student debt consolidation, pays more attention to the financial discipline of the borrower such as repayment history and leverage than their credit score when deciding on loans.

2. Improving Access

Mobile banking platforms

As smartphones become increasingly cheaper (under $100), digital banking can become the norm for those who are currently underserved. Simple and Moven offer a smartphone based app linked to your no-fee digital banking account and a debit card for transactions. Capital One 360 and Telenor offer a paper-free account where customers can conduct all their transactions, including bill payments, online or via the app.

Peer-to-peer platforms

Crowdfunding platforms have created a win-win situation for both the borrowers as well as investors / campaigners. Kiva has successfully enabled worthy causes to be funded through micro-loans as low as $25. Peer-to-peer lending platforms like Prosper and Avant bring lenders and borrowers together for personal and business loans at a significantly cheaper rate than payday lenders and no hidden fees. Investors get a different asset class within their portfolio that generates better returns than savings accounts.

3. Building Assets

Increase the savings rate

According to a recent Pew research report, Americans are vulnerable to destabilizing shocks, such as income loss or unexpected bills, across all income levels. A policy recommendation in the same report concluded that households benefit from automated mechanisms to generate savings.

Embedding behavioral principles to improve the savings rate of individuals can go a long way towards building that balance. With a Simple bank account, an algorithm calculates what is safe to spend based on a monthly budget and savings goals. Having regular interventions and reminders encourages individuals to save their month end balance towards their goals. Acorns is another application providing an interesting intervention integrated into the customer lifestyle—it rounds up the amounts from daily purchases and puts them away towards an investment portfolio.

The Changing Nature of Work

The authors of “The Portfolios of the Poor” point out that the challenge for low-income people is not only total income, but also the variability of cash flows. Having access to additional means of earning reduces the income volatility experienced by vulnerable people.The sharing economy is changing the nature of work, with individuals able to offer their spare time to offer rides (Uber), or shopping services (Instacart) or running an errand (TaskRabbit). Not all changes are positive as the traditional protection mechanism disappears, but the flexibility it offers can make it a viable additional job.

Technology-enabled services provide a platform for time and labor-saving opportunities for the consumer and an additional means of income for service providers. Seamless transaction of payments and invoicing for both consumers and service providers have radically changed the nature of work and broken down barriers to earning additional income.

Conclusion

As mobile and Internet become more accessible and affordable, more solutions will emerge to increase connectedness amongst people. Novel opportunities could be presented by the sharing economy to reduce income uncertainty. Big data and analytics would enable better assessment and tracking of credit. Behavioral interventions will become further codified and integrated within individual lifestyles.Combined with regulatory efforts to improve access and simplify banking, technological innovations can deliver far-reaching, impactful change to underserved populations.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.