How Banks can Prepare for a President Trump

In the wake of Donald Trump's election, what can the banking industry expect in what is likely to be a dramatically different regulatory regime?

As a businessman and candidate, Trump is not a supporter of the current regulatory environment. In campaign speeches and on his website, he has stated that he will reduce the regulatory burden on business, give a shot in the arm to the economy, and create a more level playing field for all participants.

As he transitions into the presidency, the appointment of Paul Atkins and Dan Gallagher to the transition team is a strong indicator for more deregulation. Both are ex-SEC commissioners who have been publicly critical of over-regulation.

What else can the financial services industry expect from a President Trump? We’ve looked at the implications of where the president-elect could take us once his administration is fully established in January:

The Dodd-Frank Act will be dismantled and replaced with the CHOICE Act (Strong Likelihood)

Trump has publicly supported this route. What we can expect here: the jettisoning of Volcker Rule that prevents banks from having proprietary trading activities. There is a strong possibility that the Consumer Financial Protection Bureau (CFPB) will be restructured, reducing the power of its directors and replacing them with a committee. The Financial Stability Oversight Council would be dismantled. Some SIFI (Systemically Important Financial Institutions) designations for banks will be removed. Accountability will also be introduced for regulators by bringing them under congressional purview.

Restructuring regulatory bodies such as the Fed, SEC and CFTC (Strong Likelihood)

Mary Jo White has already announced that she will step down in January 2017 as Chairman of the SEC, and the new administration will need to appoint three commissioners. Janet Yellen may be replaced in Feb 2018. Trump is likely to replace the 7-member Fed committee with Republican nominees.

A moratorium on most new financial services regulations (Moderate likelihood)

This is based on what has been implied in Trump’s stated policy. What this would mean: there will be no new rules for financial services firms to comply with in the immediate future. Deregulation will require amendments to existing rules.

The DOL fiduciary rule could be jettisoned (Weak likelihood)

What this would mean: a slowdown of the move from commission-based advice to fee-based advice. Brokers would remain protected against providing conflicting advice to retirement savers.

Increase in regulatory oversight on KYC / AML and Terrorist financing (Weak likelihood)

What this would mean: There would be increased screening and data requirements for correspondent banking services, and increased enforcement for violations.

Bringing back a version of the Glass-Steagall Act that limits bank participation in equity markets (Weak likelihood)

What this would mean: a separation of banks for different activities to avoid conflicts of interest, and protection of the retail assets.

Despite the strongly-worded comments during the campaign and the many rumors after the election, the full scope of deregulation remains to be seen, yet to be decided by the incoming administration.

For guidance on the scope of the incoming administration’s planned changes, we can draw analogies to the incoming president’s comments on the Affordable Care Act (ObamaCare). While candidate Trump was vehement on the campaign trail that he would repeal ObamaCare in its entirety, president-elect Trump now says that certain popular provisions will remain intact.

It’s reasonable to infer that popular financial regulations—such as consumer protections—may survive unscathed. On the campaign trail, candidate Trump spoke of a full-scale repeal of Dodd-Frank. President-elect Trump now speaks of dismantling aspects of the law as discussed above, but possibly retaining others, such as the SEC whistleblower protections.

Changes are unlikely to be immediate. Some of the changes will require Congressional action. While the Republican party will have control of both the White House and and the Congress, their margin of leadership in the Senate is thin. Other changes will require regulators to adhere to the sluggish Administrative Procedures Act, even when “undoing” regulation.

That said, given the strong wind of a new deregulatory environment blowing through Washington, some regulators may begin to “back off” current enforcement actions or cease initiating new ones.

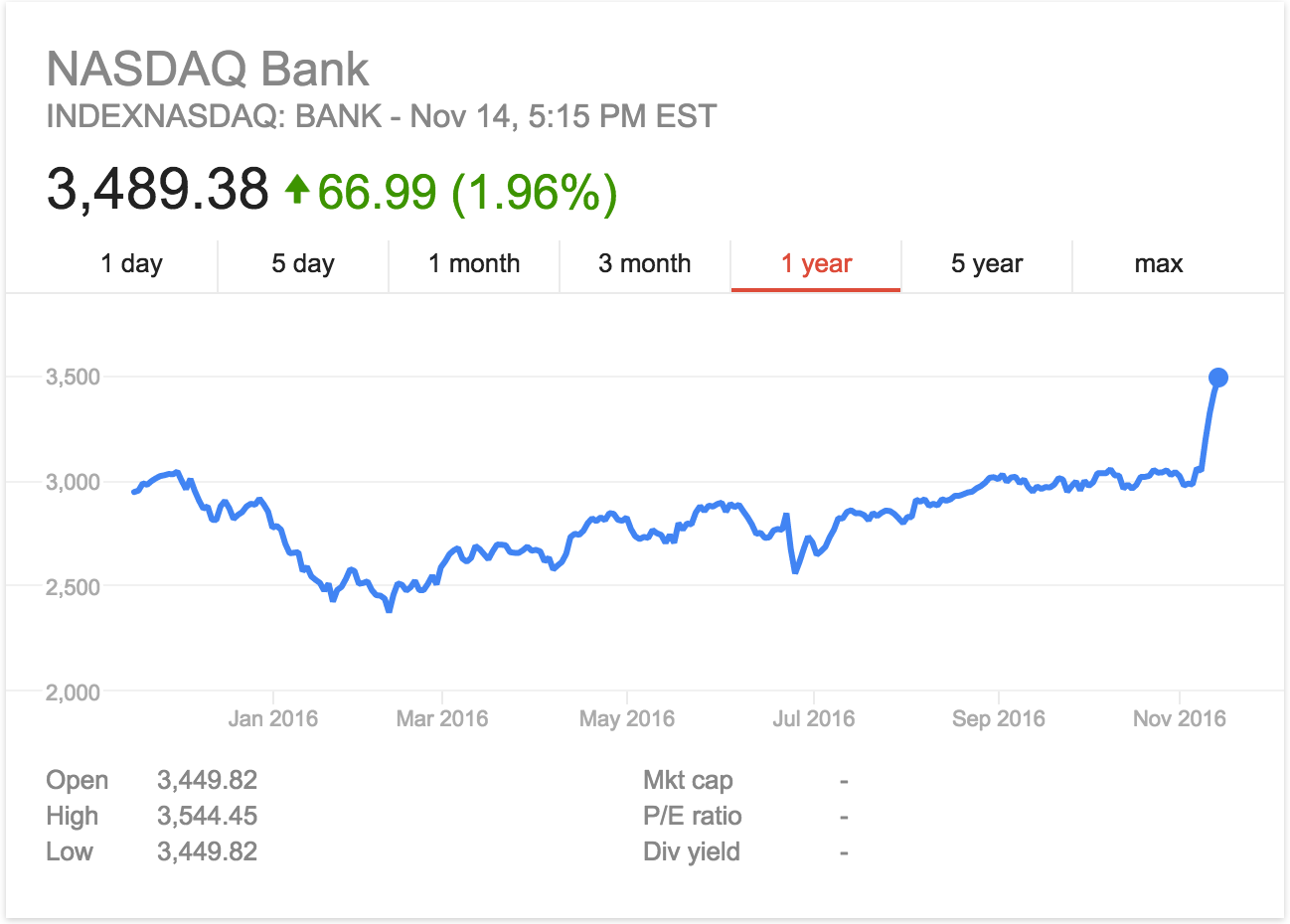

While the scope and timelines for deregulation remain murky, banking investors wasted no time rejoicing. The industry has experienced poor profitability over the last 5 years, and they see the incoming administration as helping them reduce bureaucratic pressures and opening up more profitable opportunities.

The Nasdaq bank index has risen sharply since the election

Should the incoming President act, the new regulatory landscape could be reminiscent of the heyday of the pre-2008 crisis. However, banks need to be careful not to de-prioritize their current compliance and risk programs. A light regulatory regime comes at the price of reduced government underwriting for banking failures. Focus needs to shift from bureaucratic obligations to becoming more risk aware and opportunistic.

How should banks respond?

Reduced regulatory burden is an opportunity for banks to move away from reactive pressure and develop a comprehensive strategy for the future. Compliance teams would have more time to focus on long term projects that can build adaptiveness for the industry changes. Here’s what banks should focus on:

- Agile: Banks have to continuously adapt to new sets of rules and opportunities presented by the changing regulatory landscape. An agile mindset coupled with the ability to deliver new products/services quickly can be a huge competitive advantage.

- Data-driven: Banks can take advantage of the changed regulations if they understand the risk-reward tradeoff better. By becoming a data-driven organization,a bank would be able to fine tune its growth strategies and develop nuanced insights.

- Technology-enabled: Banks can use their compliance spend to shore up their investment in technology assets that provide long term benefits and reduced operational expenditure. For example, banks can reduce manual processes through automation, scale fraud investigation capabilities through machine learning and improve supervisory controls through proactive monitoring.

- Multi-purpose Capabilities: Banks can invest in capabilities that extend beyond the compliance and risk functions. Capabilities that improve decision making, better forecasting abilities, increase customer engagement and closer collaboration with 3rd parties can serve defensive functions as well as for growth pursuits.

We can directionally predict where the new administration would take us, but the actual changes would be slow and the specifics unclear. In the meantime, banks should use the time and resources to prepare for an uncertain future.

Read how banks can prepare for a President Trump.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.