The changing wealth management landscape

The wealth management and investment landscape has transformed significantly over the last decade. Fast-growing WealthTech platforms from pioneers such as Wealthfront, Stash, and Betterment have taken what was once a niche offering for ultra-high net worth individuals and democratized it for the mass affluent, bringing millions of new customers into the market.

Modern WealthTech platforms and digital services enable anyone to start investing from the comfort of their home using just a mobile phone. This is especially true for mass affluent millennials who are now empowered to invest and manage their own wealth anywhere, anytime. Moreover, the proliferation of new asset classes, including cryptocurrencies and NFTs has ushered in a new era of diversification and choice in wealth management, bringing new investment opportunities that meet growing demand for choice and diversification across personal asset portfolios. As a result, investors now have more choice across the risk spectrum, enabling them to invest in ways that are aligned with their risk appetite.

With the increasing number of investors comes a greater range of needs, psychologies, risk tolerance levels and preferences to accommodate. Everyone has unique financial goals they want to achieve, different personal values that influence their investment decisions (like investing in firms that build sustainable products), and different levels of appetite for risk.

Traditionally, wealth management firms have focused on the HNI (High net worth individuals) and UHNI (Ultra high net worth individuals) segment, largely ignoring the mass affluent segment. Mass affluent customers typically manage their wealth themselves, don’t pay for advice, and frequently make investment decisions based on the advice of friends and family.

But as the number of mass affluent investors grows, there is an opportunity here that is hard to ignore. By embracing hyper-personalization, wealth management firms can elevate their capabilities, increase their customer base, provide contextual advice and craft tailored portfolios that differentiate their services, attract more customers, and drive growth. The value proposition for the mass affluent segment of customers can be elevated several times.

On the other end of the spectrum are advisors whose technology systems have not changed in many years. They are often bogged down by outdated systems, which hinder their ability to address client needs swiftly. Consequently, their attention is diverted from their primary capability: dispensing expert advice and nurturing client relationships. We believe that while the legacy systems undergo modernisation, a hyper-personalization solution for advisors can be used to empower them to have meaningful, contextual conversations with their customers and build better portfolios for their clients - improving customer outcomes and driving loyalty.

The need for personalization

Wealth management services have traditionally been highly personalized, with advisors tailoring their advice and portfolios to the unique needs and preferences of individuals, particularly HNIs and UHNIs.

But today, the challenge lies in delivering the same personalized, bespoke customer services at scale to the mass affluent segment.

Based on research by Citigroup, 71 percent of wealth managers say that client experiences are one of their top priorities. But if organizations want to deliver contextualized, personalized experiences to a far larger customer base, they’ll need to evolve how they operate and engage with their customers.

With the advent of new technologies like AI, and the rising availability of data, it’s now possible for firms to enable personalization at scale and deliver hyper-personalization in wealth management.

It is also true is that technology will not replace human expertise completely. Instead, it will most likely be applied in ways that augment it.

As per the Morgan Stanley Wealth management pulse survey - 8 out of 10 wealth managers believe that AI will complement the way the human- led advisory works and that a hybrid advisory model is what will ultimately work for them.

Today, wealth management firms face a critical challenge: striking the perfect balance between harnessing cutting-edge technology and preserving the invaluable expertise of human-led advisors — the cornerstone of their longstanding success. This can be achieved by applying data and predictive AI in two key ways:

Empowering customers to drive their own wealth management journeys.

Improving advisor productivity.

We believe that customers at the outset of their investment journey are best served by automated personalized services. With their primary objective being to initiate their wealth accumulation journey through savings investment, automated solutions can offer simplicity and alignment with their goals.

As their financial situation becomes more complex (a bigger family, broader financial objectives, larger income etc), a skilled advisor steps in and draws upon their experience in managing the financial complexities facing the client.

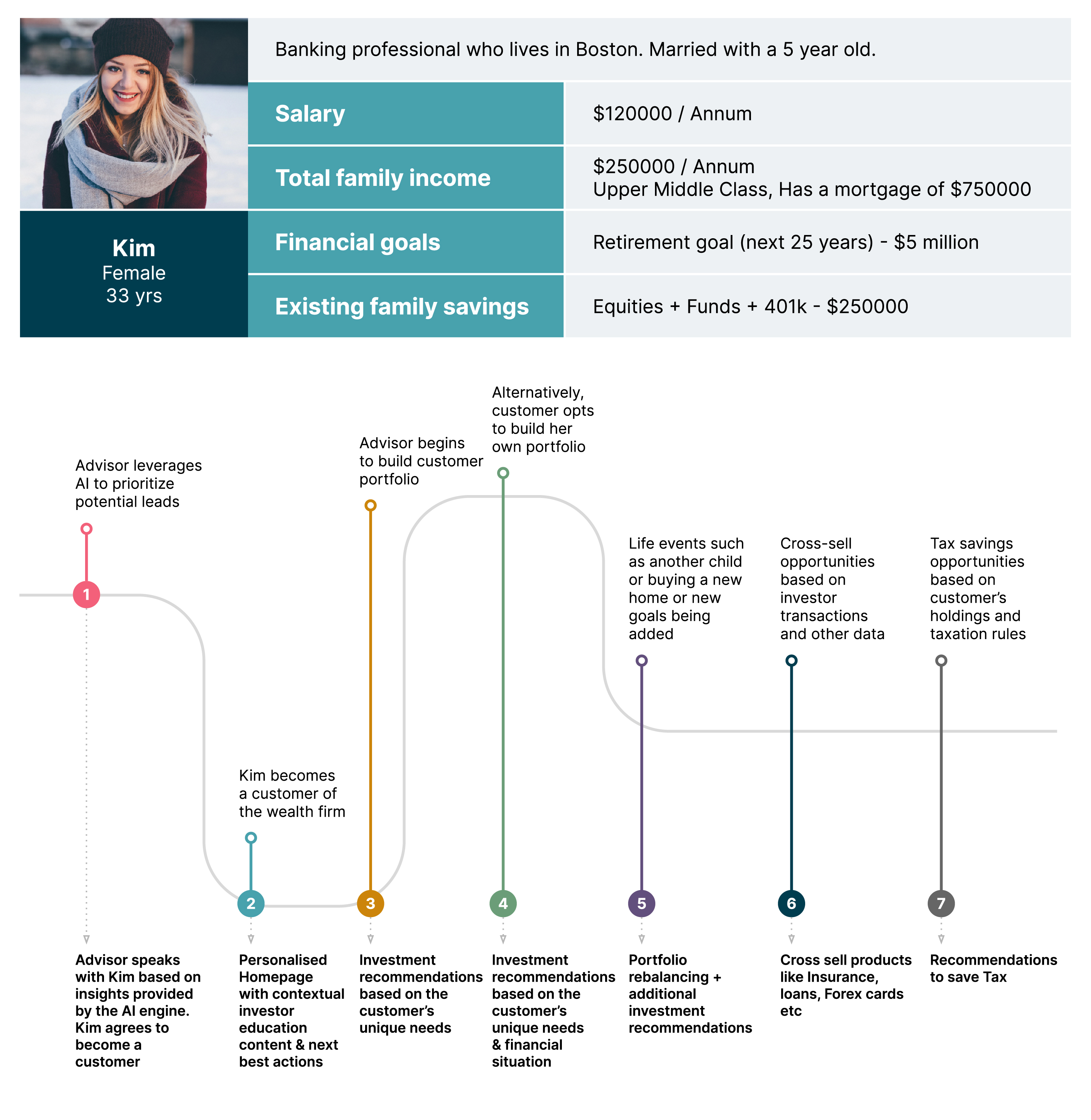

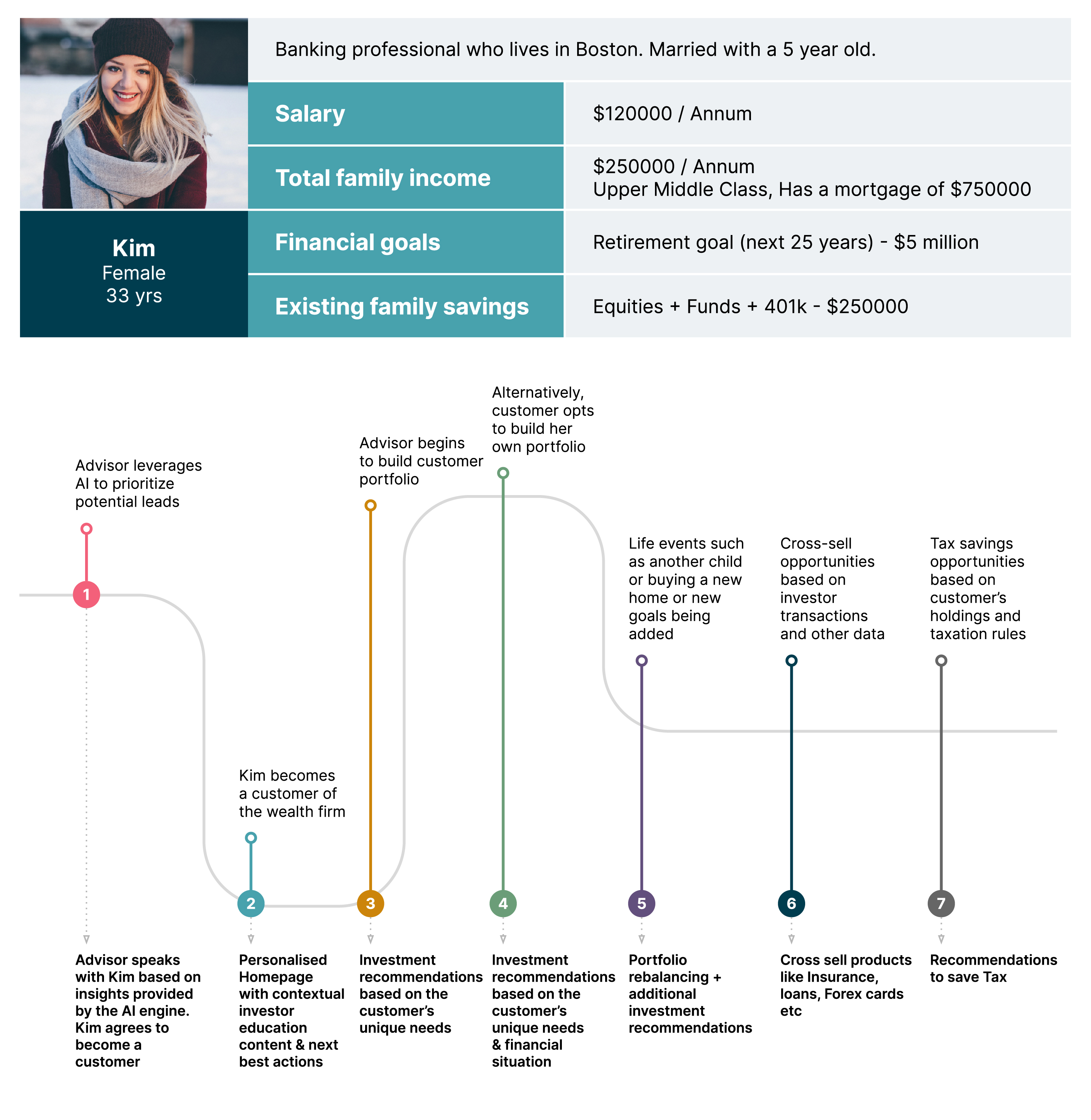

What a personalized journey looks like for customers and advisors

To fully understand the impact hyper-personalization can have on customers and advisors, we have illustrated a typical journey that wealth management customers go through and the difference personalization can make in that journey.

Hyper-personalization for wealth management customers

Post-onboarding – After a customer has been onboarded, their risk profile and financial goals information are available. This data can then be used to provide:

Relevant investment education content (contextual enhancement can be made through generative AI)

Next best actions for a customer’s unique situation

Suggestions on starting their investing journey through a personalized and contextually relevant homepage

Investment recommendations – Investment recommendations for a customer to build a portfolio are based on the customer’s risk profile, existing savings, time horizon, and financial goals. An AI-based engine can consider all these factors and more (like customer personalized data) and suggest the most suitable investment products for the customer’s unique situation. The intelligence from the firm’s research desk can be baked into the product recommendations. (regulation permitting)

Investment alerts - Alerts for investment opportunities are triggered when new bond issues or fund offerings align with the customer's risk profile and goals.

Key life events - When a customer goes through a major life event such as marriage, a new home, or the birth of a child, they’re automatically served portfolio rebalancing suggestions and additional investment recommendations aligned with their shifting financial goals and means.

Tax recommendations - With data on a customer’s holdings and local taxation rules, AI can automatically provide personalized tax recommendations to help the customer get the best returns from their investments or even leverage some of the tax loss harvesting rules.

How hyper-personalization empowers advisors

Prospect prioritization and engagement - AI provides the advisor with a complete view of their prospects’ digital DNA, based on:

- Demographic data

- Region etc

This view empowers advisors to identify prospects with the highest potential and have contextual conversations with them, increasing the chances of conversion.

Building portfolios - With a complete view of customers’ risk tolerance levels, investment time horizon, financial goals and investment preferences (like those driven by environmental concerns), advisors can build bespoke portfolios and provide customers with personalized investment recommendations. An AI engine automatically generates investment recommendations that are then verified by the advisor before being taken to the customer.

Cross-selling opportunities - As customers make progress on their investment journey, the firm — and by extension, its advisors — get to understand them better. This enables the recommendation of other relevant products and services (like insurance, loans, or Forex cards), creating new upselling and cross-selling opportunities.

Empathetic customer conversations - Advisors are able to have far more empathetic conversations with their customers with access to personalized data and talking points.

While hyper-personalization holds the potential to revolutionize experiences and interactions for both customers and advisors, its application can vary depending on the firm's focus. For those catering to HNWIs or UHNWIs, empowering advisors is poised to yield greater value. Conversely, firms serving the burgeoning mass affluent market may find greater relevance in empowering customers directly.

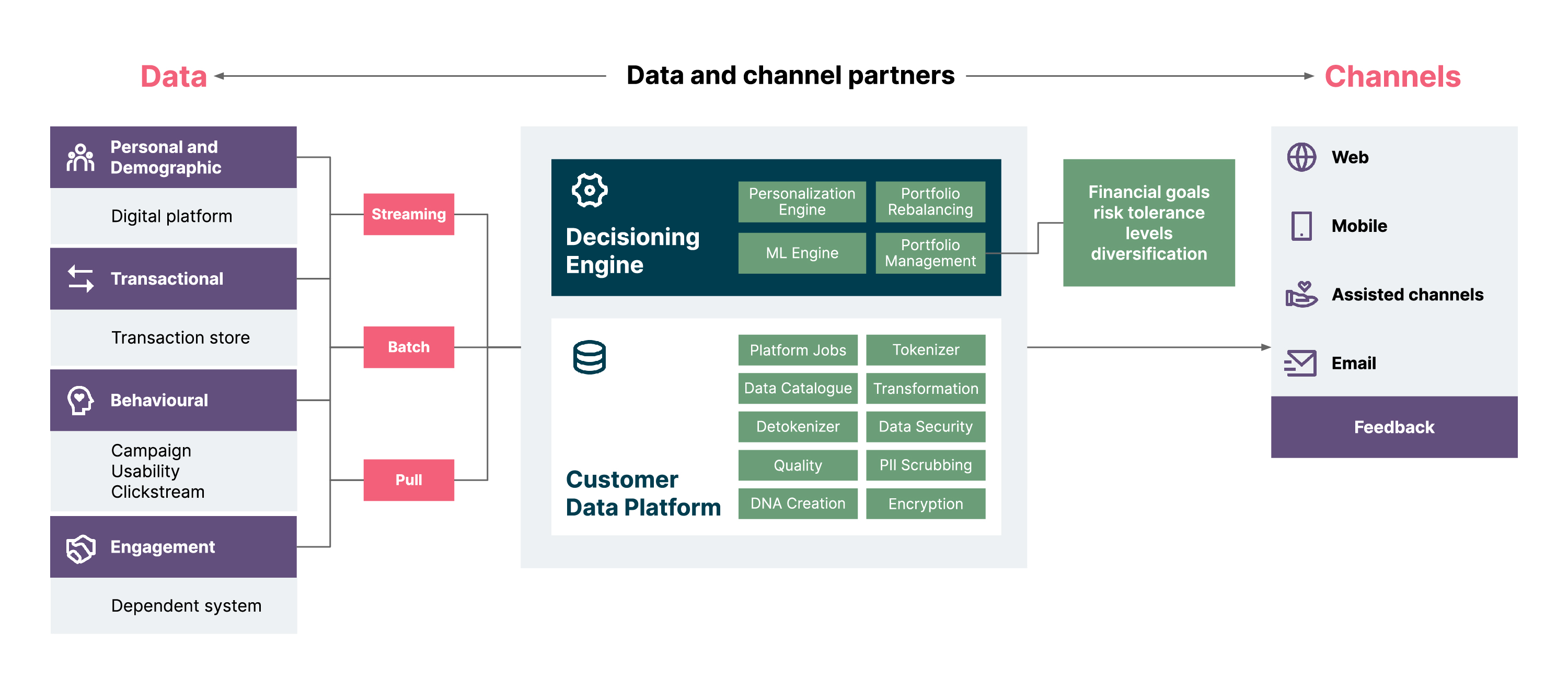

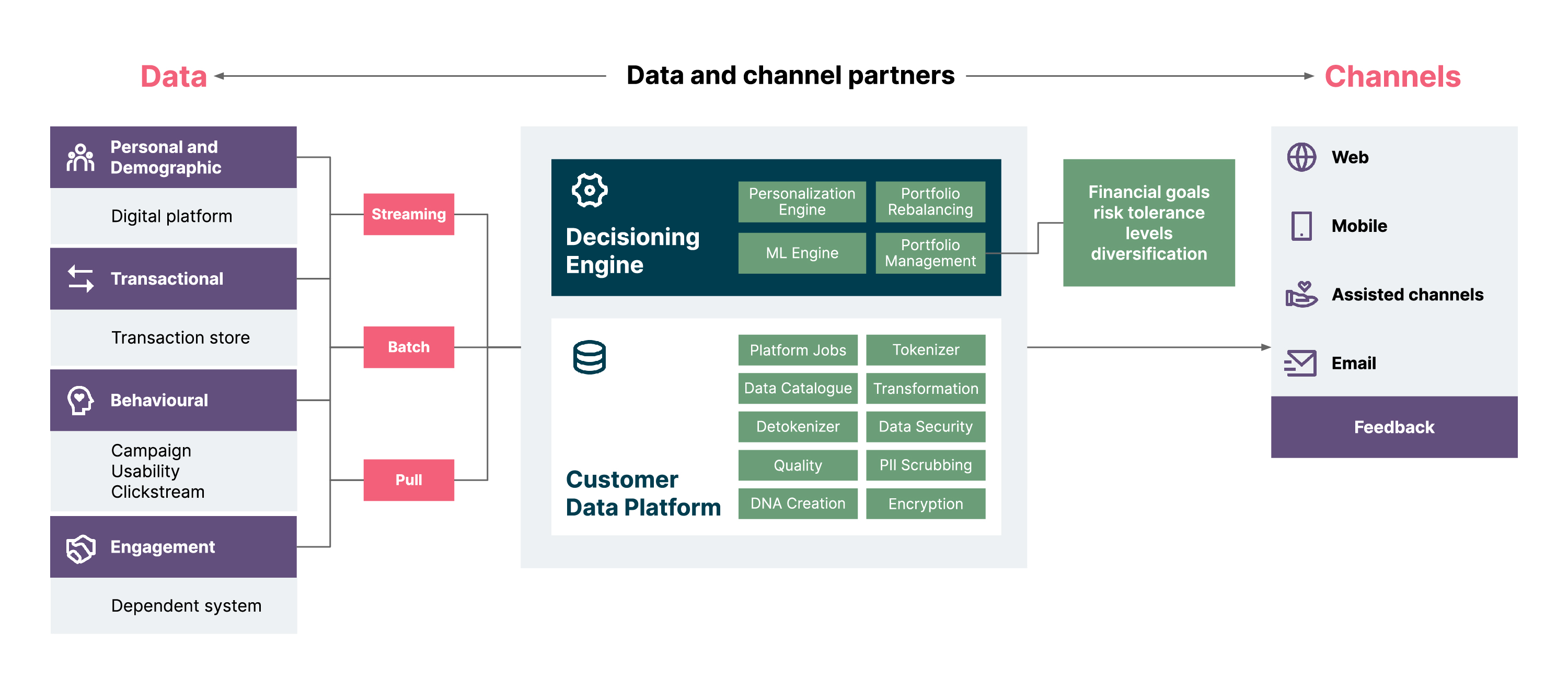

Our approach to building a personalization platform

So, the big question is, what does it take to build a hyper-personalization solution in wealth management?

Thoughtworks takes a platform-based approach to enabling hyper-personalization at scale. We enable firms to adopt diverse personalization use cases and apply personalization in ways that drive growth, advisor productivity, and outstanding customer outcomes.

Each personalization platform is built on a robust data foundation. Valuable data sets and streams are standardized and brought together so the platform can process them and turn data into actionable insights. This typically includes personal and demographic data, transactional data, behavioral insights, risk appetite, financial goals, previous engagement data, and more.

That data is then streamed and pulled into a customer data platform. The customer data platform acts as a single source of truth and insight into customers, holding all relevant information about them in a secure and accessible manner.

Within a customer data platform, encryption, regulatory checks, and other guardrails are embedded to keep data highly secure and consumed responsibly in compliance with all relevant regulations and the organization’s data standards. The data is aggregated, transformed, and prepared to ensure it’s relevant, usable, and of a high enough quality to support hyper-personalized decisioning.

With that robust data foundation in place, we can build an AI decision engine, which is where we start to unlock unique value for wealth management firms. Within the decision engine, AI algorithms are applied to enable the firm’s desired hyper-personalization use cases.

Use cases and algorithms can be tailored to a firm’s unique needs and goals. However, we typically start by enabling three key AI use cases that we know can deliver differentiated value for wealth management firms:

Portfolio recommendations: Using an LLM to process a customer’s complete digital DNA, this model provides recommendations on which funds and products an individual should invest in. The outputs of this model can either be provided to advisors, so they can deliver tailored advice to customers, or directly to customers to help them guide their own DIY investment journeys.

Portfolio rebalancing: This capability provides automatic portfolio rebalancing suggestions based on a customer’s psychological approach to investment and financial goals, and changes in the market. This is achieved through AI/ML which is implemented based on customer data and market patterns. The outputs from that logic are then pushed into relevant channels, depending on how the firm delivers its services and wishes to provide rebalancing suggestions to its customers.

Advisory support: An advisor leverages the output generated by AI, which helps them to advise customers in more unique and metric--oriented ways.

The end result is an ecosystem that continuously turns client insights into proactive recommendations. When an individual changes their behaviour, shows a shift in preferences, or approaches a key life event, your decision engine can adapt and immediately recommend how advice, product recommendations, and investment content should evolve to better support them.

Build a foundation for hyper-personalized wealth management and seize the biggest growth opportunity your industry has ever seen.

According to a study by Forbes and Temenos, 82 percent of professionals believe wealth managers who adopt hyper-personalization are more likely to succeed than those who don’t. And when you look at the benefits it can deliver, it’s clear to see why.

Wealth management firms face unprecedented opportunities to engage a huge influx of new customers, and empower advisors to deliver better investment outcomes — and no firm can afford to miss them.

Thoughtworks has decades of experience helping organizations like yours turn their data into actionable insights and enable deeply personalized experiences and journeys.