Financial services newsletter

By Isa Goksu, director of technology, financial services, UK

Across the Financial Services industry, organisations are making substantial investments in predictive analytics to make smarter portfolio decisions, improve fraud detection, and streamline the customer experience. Deutsche Bank’s Autobahn 2.0 and JP Morgan’s DeepX are examples of such AI-enabled equity trading platforms that modify trading strategy in real-time by sensing market momentum.

Capital market players are increasingly feeling the acute need to use data-driven insights to respond to market volatility. They have embraced digitisation and cloud-migration in full force, which generates huge swathes of operational data that’s hiding in plain sight. Many of these disparate data sets get locked up in layers of communications and digital interactions, making it hard to convert them into actionable insights. So, how can they unlock real-time insights from such structured and unstructured data, and integrate it into their decision-making process and create value? In this article, we explore how capital market firms can become data-driven businesses by adopting it as an organisation-wide discipline.

One reason why organisations fail to make better use of data is rooted in their rigid culture. Financial services firms are primed to prioritise personal compliance and organisational stability over collaboration and creativity.

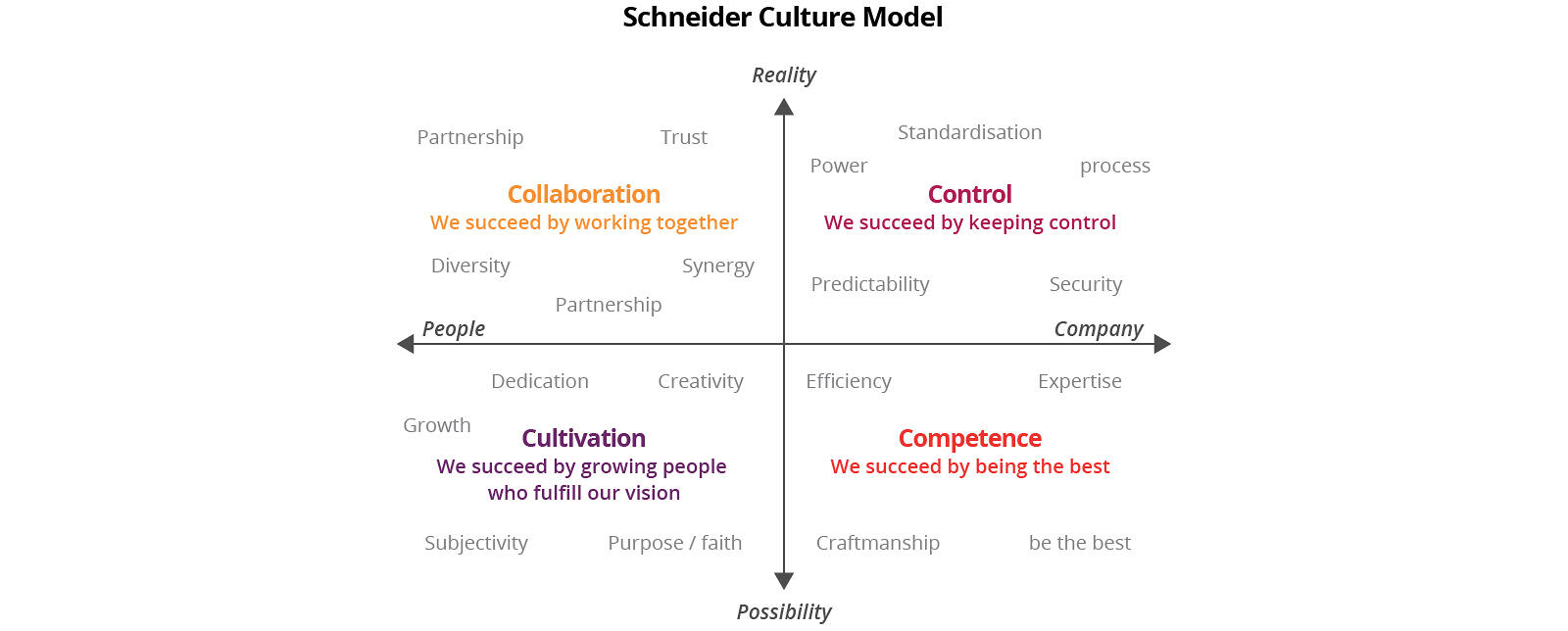

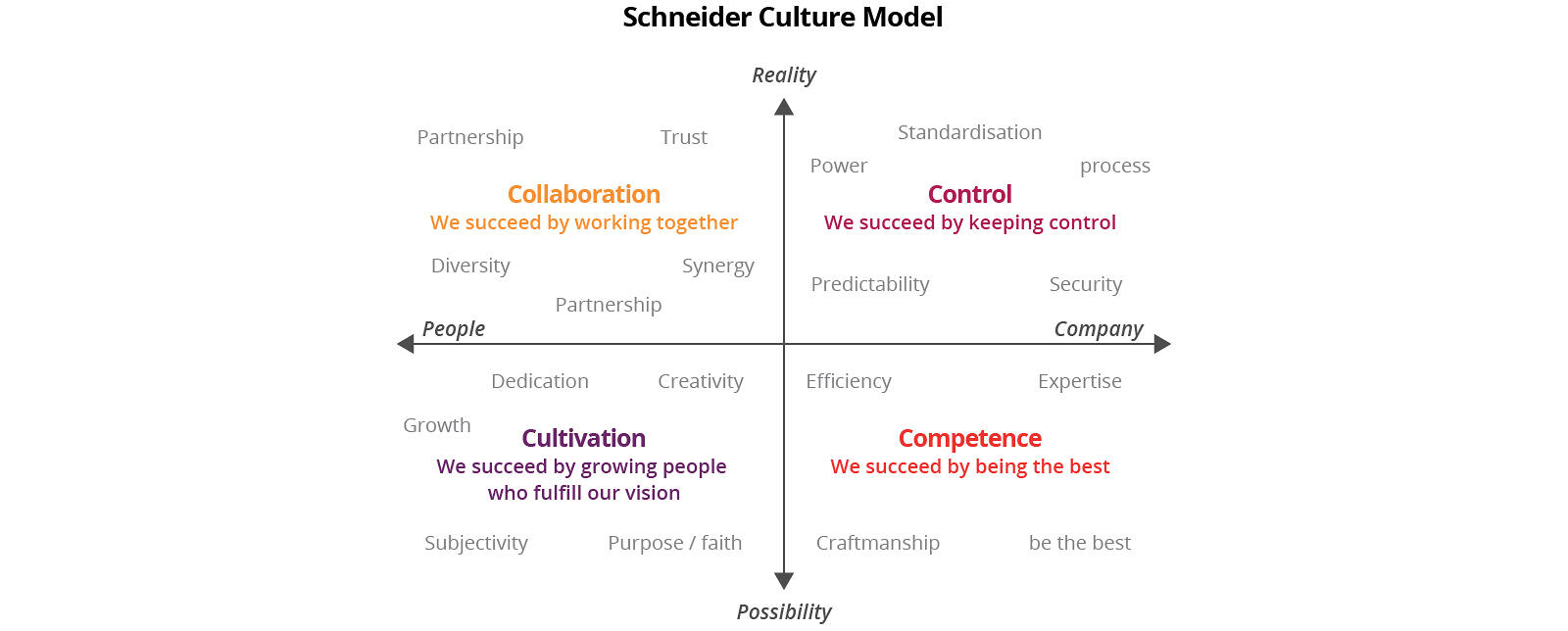

The Schneider Culture Model (see below) shows us that organisations which focus on compliance and stability create a culture of control. These organisations incorporate rigid structures, constraining potential change. They find it hard to look forward, and difficult to innovate. Their use of data tends to focus on supporting day-to-day business as usual operations, rather than innovation.

All large organisations exhibit multiple cultures, but the dominant culture at investment banks favours controls, in the most part due to strict regulatory requirements. This restricts their potential to unlock business value from insights. In this culture of control, innovation does not progress beyond the pilot phase, and speed to market is constrained by legacy IT infrastructure, limiting their ability to respond to change.

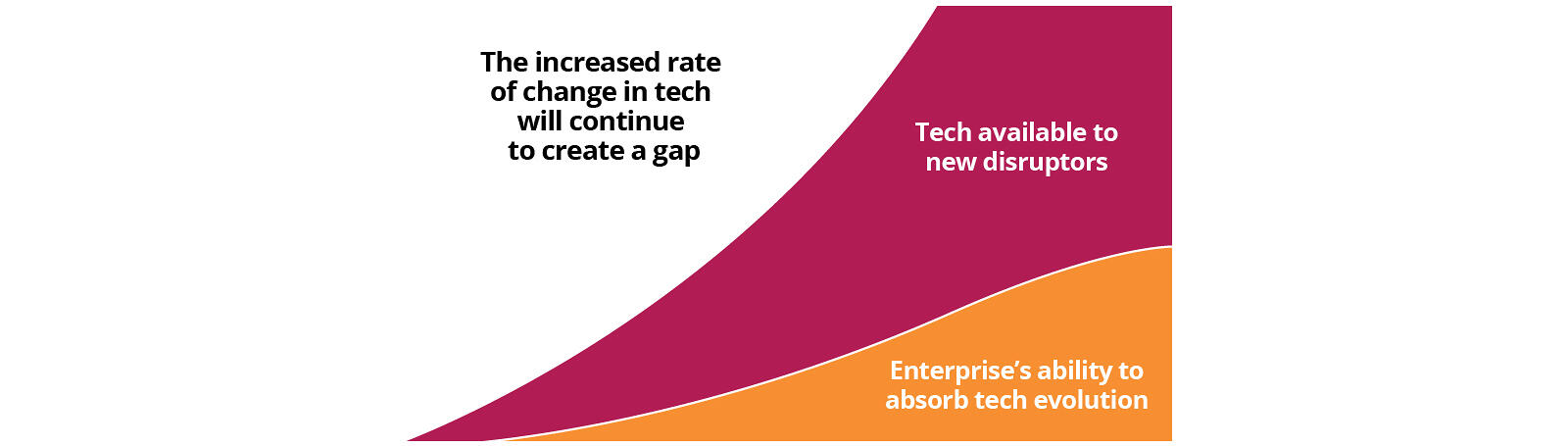

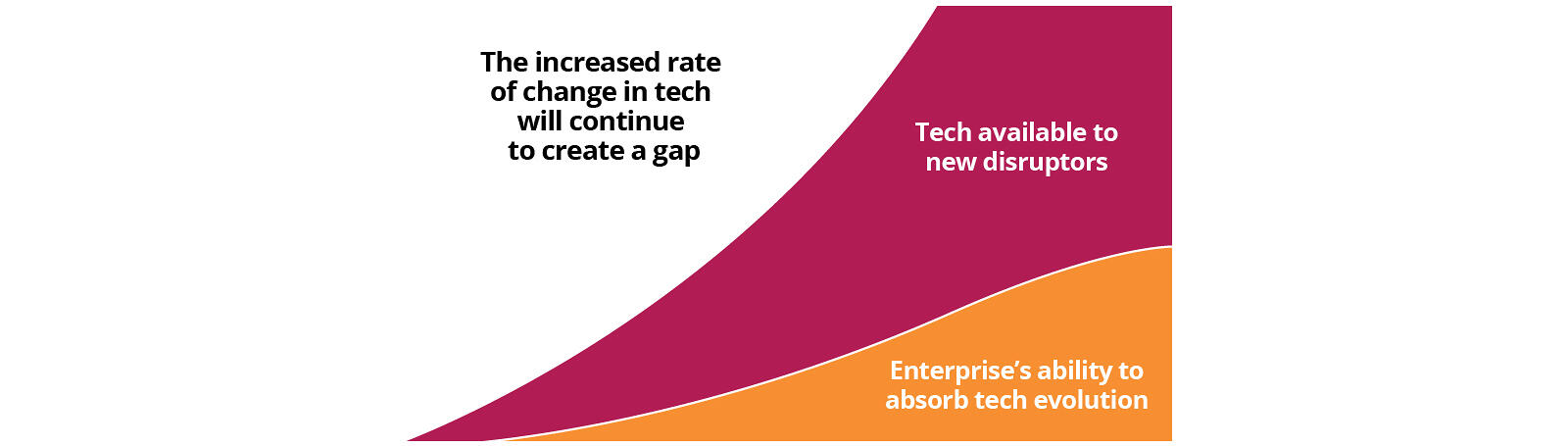

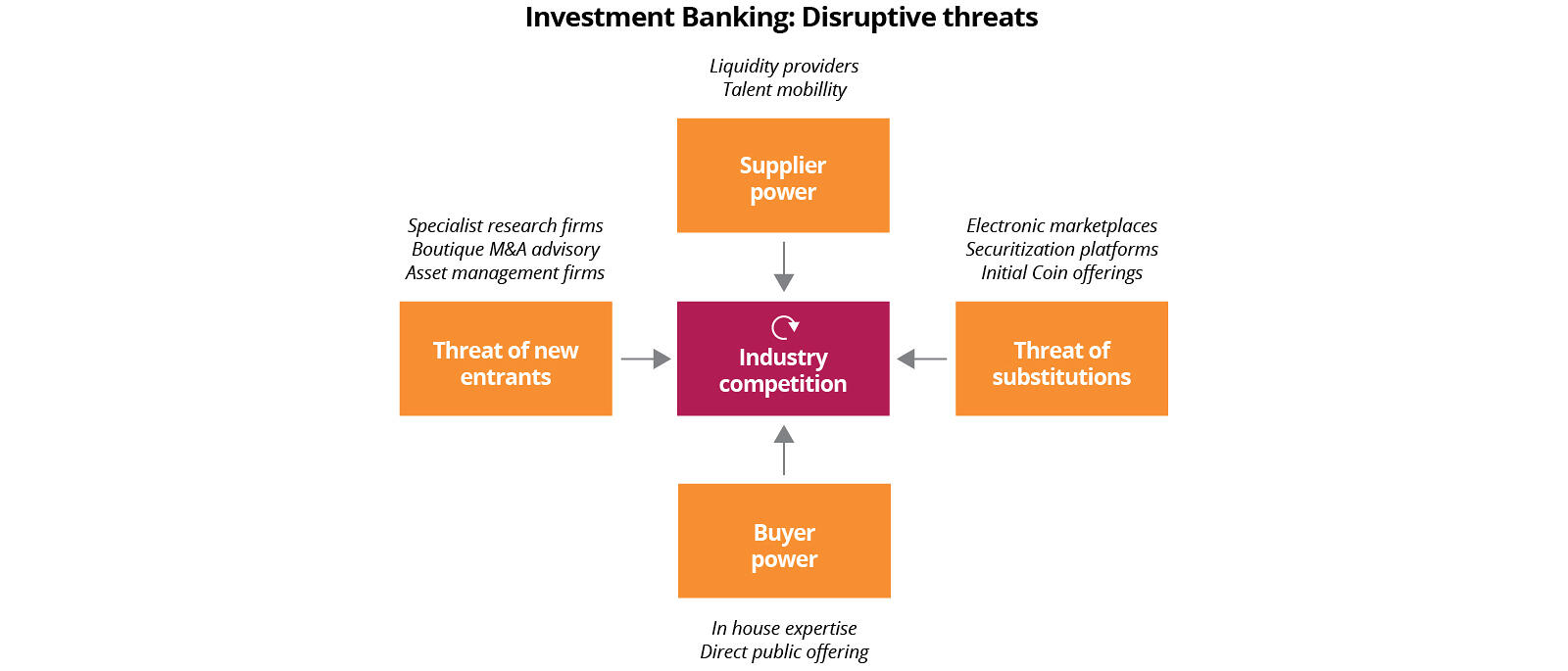

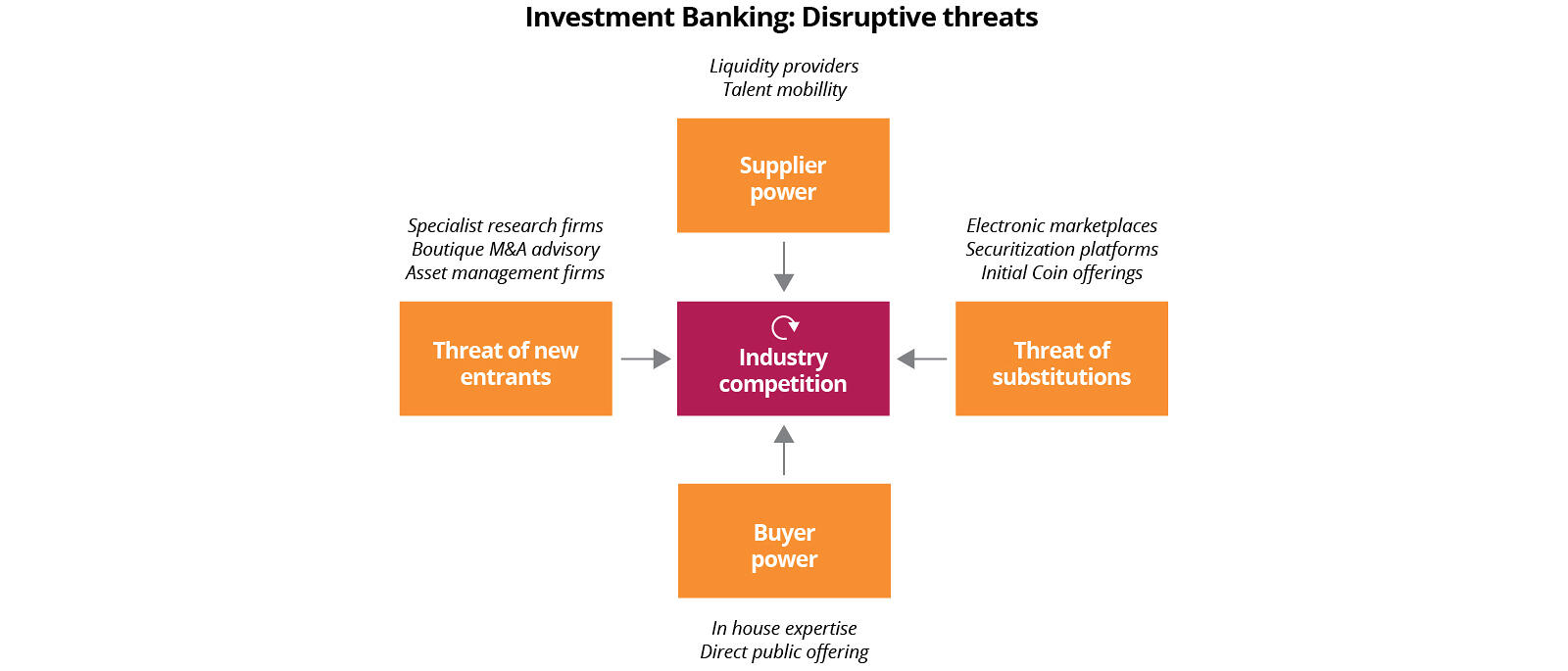

A forward-looking approach is increasingly essential to overcome this. Incumbents in the capital markets are becoming victims of Martec’s Law, which states that, while technology changes at an exponential rate, organisations change at a slower, logarithmic rate. Over time, the gap between the two grows, leaving a large window of opportunity for new entrants.

In other industries, the forces behind Martec’s Law have led to the demise of all kinds of household names. And while today’s fintechs may not currently threaten the dominance of the big investment banks and exchanges, as they mature, their technological superiority (and the business agility and innovation it enables) will gradually shift the balance of power.

It’s a stark choice for incumbent players: shift away from a culture of control and close the widening technological gap, or risk becoming irrelevant.

Data: the ace up the sleeve?

Large capital market organisations, who can close Martec’s gap, have a wealth of data assets they can leverage to gain an advantage. But few organisations are getting much business value from these assets. We even see exchanges – where data has always been an important part of the offering – paying third parties to buy back their own data.

Organisations have a massive opportunity to increase operational efficiency and reduce costs, just by making their data visible to the people who need it. For some, this realisation has led them to create vast data lakes (at vast expense), but as research by Forrester shows, on average, between 60% to 73% of all data within an enterprise goes unused for analytics. That means the majority of organisations are paying millions of dollars for little or no return.

There are many reasons data lakes fail to deliver value, but typically it’s a combination of factors, including:

- Not changing data ingress and egress processes across enterprise systems, making real-time insight all but impossible

- Centralising all data in a single place without considering the varying needs and taxonomies of different parts of the organisation

- Failing to train employees on how to use complex data lake dashboards – or failing to replace the knowledge when employees leave the organisation

- Poor data quality and a lack of data stewardship

Building a strong data strategy: five practical recommendations

So, how can CIOs and CDOs create a stronger data strategy – one that helps them build an intelligent enterprise that’s ready to thrive in the data-driven future? Here are five practical steps technology leaders can take to prepare their organisation for success.

1. Implement effective data stewardship

To maximise value from data, capital market organisations must treat it as a product. Data needs a dedicated team to look after it with overall responsibility for data quality and governance.

In large enterprises, if there’s no data stewardship, opportunities for efficiency gains and cost savings get missed as different departments work on data projects in silos. Complex data flows become even more complex as a patchwork of topologies emerges over time. And enterprise knowhow gets lost as the people who can parse information coming from legacy systems leave the business.

2. Consider domain-driven design and event streaming

As we saw earlier, enterprises have invested heavily in data lakes that are more about buzzwords than business value. Access to a single centralised data repository can indeed bring benefits, but often a more effective approach is to build multiple data marts that centralise data in ways that are relevant to different business domains. Prioritising domain-driven design preserves the taxonomies and business logic of different departments while making data more accessible.

To enable the rapid, data-driven decision-making capital markets organisations need to consider event streaming. Modern stream processing systems give users access to real-time insights based on the constant flow of market and business events. By building event-driven architectures using microservices to plug streaming capabilities into applications, organisations can respond much faster to market changes and shifting business demands. It’s important to note that the streaming data we’re referring to is the business or domain events data, and not systems event data.

3. Introduce Work in Progress limits

In most technology functions, there’s a lot of partially completed work; projects start but never finish. That’s why it’s vital to set work-in-progress limits, confining resources, budget, and effort to projects that align with the enterprise strategy and will help meet defined business goals.

For example, in one financial services company we worked with, only 12 of its 120 in-flight projects had good strategic and business goal alignment. By shutting down the 108 zombie projects, the company repurposed £2.9 million in the first week alone. After a year, it had gained £12 million of budget saving that would have been spent on unnecessary projects.

4. Avoid overproduction

We’ve all seen data projects that have fallen victim to “feature creep”, where bloated reporting or insight requirements with unrealistic timelines knock the entire project off course. It’s important to have an agile mindset, where ideas are tested and validated without massive investments. Making small bets and failing early can save organisations many millions of dollars and accelerate time to market by killing unnecessary features before they weigh projects down.

5. Minimise delays

Another useful strategy for maximising the value of data-driven initiatives is to borrow an idea from lean manufacturing, where sites are brought together to remove the logistical effort of transporting raw materials to production lines. As with everything lean, it’s all about increasing organisational efficiency and reducing waste.

Similarly, by bringing related data work together, organisations can identify and remove the dependencies that slow projects down, build more efficient architectures and network topologies, and create better quality applications.

Assess your data strategy

Discover how you can leverage your existing data assets to unlock intelligence and enable data-driven decision-making to create more business value. If you’d like to get an expert assessment of your current data infrastructure and strategy, please get in touch with us at contact-uk@thoughtworks.com.

This article was published on July 31, 2020

Want to receive our latest banking and finance insights ?

Sign up for the financial services series now. Delivering a fresh take on digital transformation, emerging technology and innovative industry trends for financial services leaders.