Financial services newsletter

By Prashant Gandhi, Director, Financial Services and Luke Vinogradov, Digital Transformation Partner

Following on from part one of our Transforming Financial Services into Modern Digital Businesses.

Transforming as a Modern Digital Business

Embracing the reality of constant change, modern digital businesses have shaped themselves around their customers as the anchor point, and are relentlessly focused on understanding and meeting their needs. Adopting processes suited to the creation of compelling digital propositions, they have a strong learning orientation built on integrated feedback loops and strategic use of data. They use a value-driven approach to prioritize their investments, managing their activities with the expectation of change. A focus on manageable workloads and speed of decision-making gives them the ability to rapidly change direction.

This digital mindset can be seen not only in their processes but in their structures, governance approaches and leadership styles. Applied right across their business activities – rather than narrowly within the digital domain – this mindset drives the development of capabilities which allow them to innovate at every level. The relative success of firms like Goldman Sachs and DBS Bank is the result of their reinventing themselves ground-up.

Developing the digital mindset

Whether digital natives or organizations who have successfully transformed, those businesses who are competing successfully in an era of significant digital change share a number of characteristics.

Organizations wishing to accelerate their transformation should question themselves on the existence of these characteristics within their own businesses.

1. Customer value focus

Is customer value truly driving all our operations, or is it simply a by-product of our activities?

Lemonade is focused on customer satisfaction by having quick turnaround on claims. To be able to make these decisions, it sells insurance through chatbots, rather than online forms, allowing it to collect 100x more data.

2. Outcome aligned organization

Do our structures, measures and funding processes reflect this customer focus?

Banks allocate capital to acquire other banks at prices lower than the book value (‘badwill’) to boost the bank’s capital ratios . This is an accounting maneuver and not about achieving any customer outcomes.

3. Responsive to Market Shifts

Do we manage our workload on feedback and flexibility? How rapidly can we change direction?

ING’s adoption of agile ways of working allows their squads and product teams to review progress every two weeks giving them more dynamic control of the direction of the work based on the outcomes it generates. A quarterly business review also allows management teams to provide feedback and holistic prioritization.

4. Test and Learn Culture

Do we use experimentation to learn and reduce uncertainty, or assume we know everything now?

UBS assumed that a mass affluent audience for its robo advisor SmartWealth would be willing to shell out expensive fund fees and a minimum investment level of £15000. Predictably, there was very low takeup and they stopped accepting new customers 18 months post launch. Could the learning have been achieved faster / at lower cost?

5. Strategic use of information assets

Is the organizational decision making objective and data-driven?

The ill-fated acquisition of ABN AMRO by RBS for £49B was carried out on the basis of two lever arch files and a CD. This inadequate due diligence prompted an FSA investigation and extensive report into the failure.

6. Structures and Governance

Does the way we are organized result in speed or friction? Where are decisions made?

Among the many reasons for their failure, TSB relied on an overburdened three lines of defense to manage risks for a highly complex programme of work to migrate to a new platform. The resulting IT meltdown cost them upwards of £330 million in penalties.

7. Technology is at the core

Is technology a part of our business strategy, or a separate, even second class, concern?

Goldman Sachs is prioritizing the experience of developers inside and outside the firm. They have embarked on a platform approach with externalized APIs that can be integrated within the client workflow and systems for a seamless user experience.

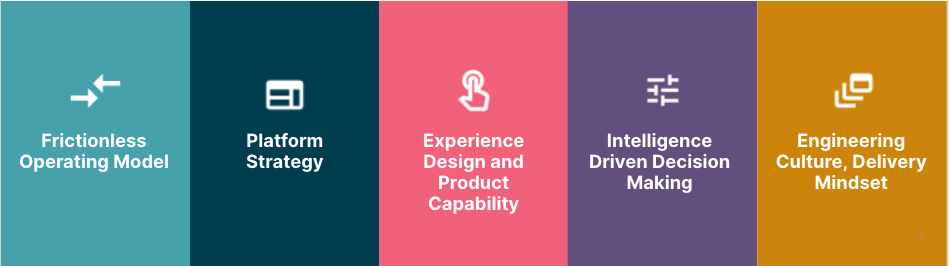

Building digital capability

While a digital mindset is the starting point for successful reinvention, ultimately this change is delivered through capability. We have identified five areas of capability which are critical to digital evolution – investment in these areas will have the greatest impact on creating sustainable change within the organization.

As the building blocks of a modern digital business, these foundational capabilities run across the organization, impacting the core operations as well as innovation, and addressing every layer of the organization from senior executives down to developers.

Building blocks of a Modern Digital Business

Within each building block, there are many investments in capability that an organization could make, and it’s neither possible nor sensible for every organization to pursue them all. Instead, decisions about the direction, sequence and pace of change efforts must be specific to an individual organization. Failure to recognize this may result in generic transformation plans which are hard to start, difficult to sustain and are unlikely to be successful.

At Thoughtworks, we use the idea of Digital Fluency to identify and prioritize those capabilities necessary for an organization to achieve its ambitions. Rather than a rigid, normative approach setting seemingly impossible goals, fluency instead emphasizes those capabilities which will have the greatest impact on an organization's digital success, relative to its broader ambitions. For example, Goldman Sachs’ platform strategy enables it to gain scale advantages and rapidly integrate new products. Stripe’s product capability allows them to offer enhanced innovations to its customers with new products such as Stripe Atlas and Stripe Connect. Striving for class leadership in an area where customers (or the strategy of the business) don’t require or expect this may distract from more significant opportunities elsewhere.

The approach to managing transformational change is also key; our experience is that executing change in the context of ‘thin slices’ which rapidly deliver real-world value for customers is markedly more successful than overweight, complex programmes which focus more on describing than doing. This also removes the tension between changing practices and ‘building things’; the organization can develop and refine its new practices in the context of creating new value for customers. Change brought about in this way is more likely to ‘stick’.

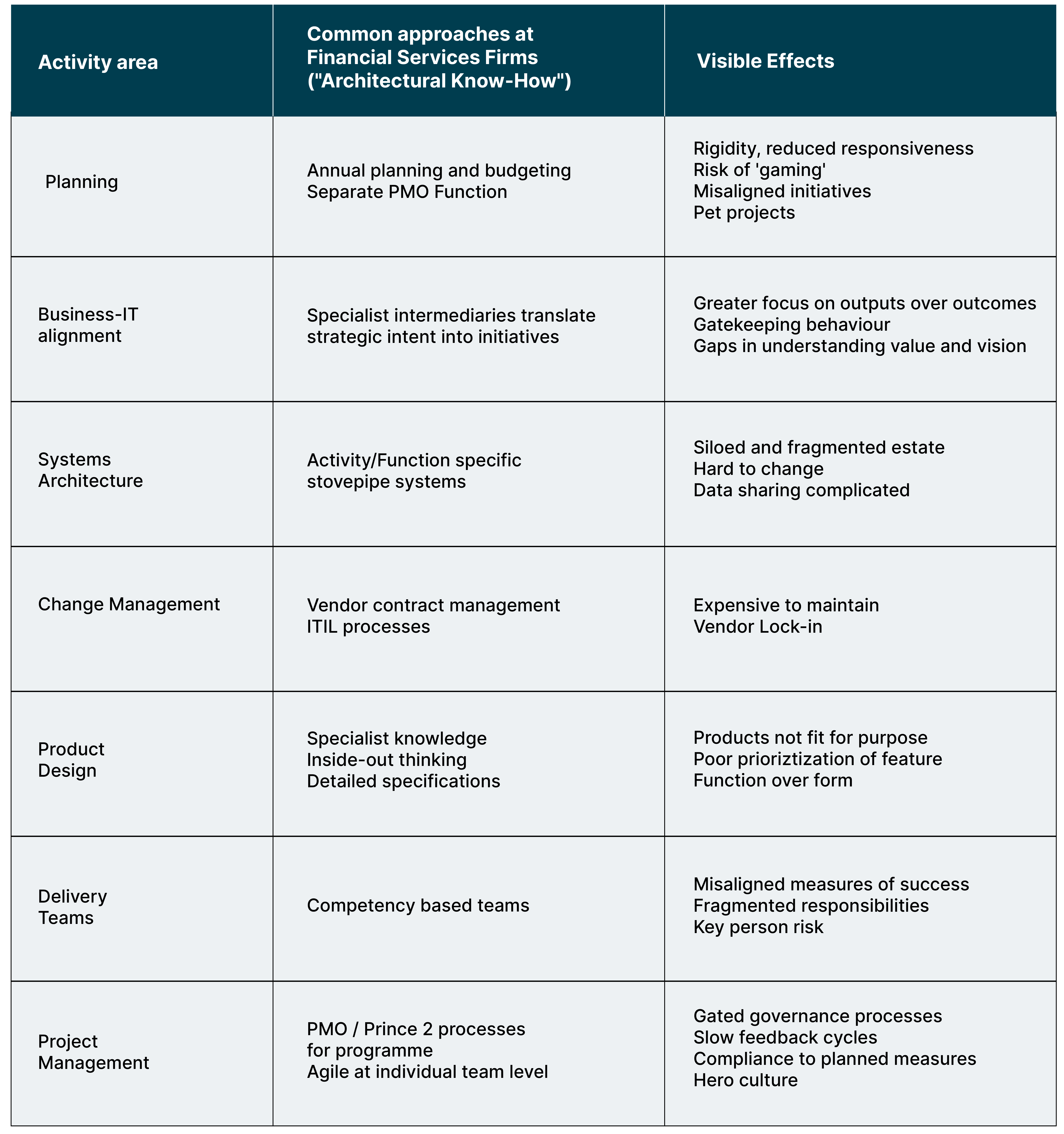

Understanding the impact of our current knowledge

The ambitions and genuine needs of an organization should drive its digital change efforts, but these programs take place against a backdrop of today’s reality. Current architectural knowledge – seen in the mental models, org structures and processes commonly found in organizations – is often a major constraint to effective change; those very approaches which helped an organization be successful in the past are often the main obstacle to its success today.

Executives need to make an honest assessment of current capabilities and approaches. Driving iterative systemic change that traverses every layer of the organization requires an understanding of how in many areas, dominant practices may produce negative effects.

However familiar (or indeed, comfortable) some of these established approaches might be, the contrast between these practices and the desired outcomes for the organization may be stark. The cumulative result of these negative effects goes beyond tolerable inefficiency or lack of pace, or poor outcomes at a project or team level. It can drive a systemic lack of competitiveness for an organization which can mean an existential threat.

Taking action

Digital disruption in financial services firms is driven primarily by architectural innovation, devaluing the firm’s existing architecture knowledge. The once valuable know-how is now a constraint for progress. Organizations need to transform by developing and strengthening the capabilities required to cope with digital change.

Thoughtworks’ Digital Fluency Model helps leaders to understand, explore and prioritize those capabilities for their organizations. Investment in these building blocks is an investment in future competitiveness. As modern digital businesses, these firms will be in a leading position whatever the next innovation brings, with the capability to survive and thrive.

If you'd like to discuss the current state of digital fluency in your organization, please reach out to us at

contact-uk@thoughtworks.com — we'd love to hear from you.

Want to receive our latest banking and finance insights ?

Sign up for the financial services series by our industry experts. Delivering a fresh take on digital transformation, emerging technology and innovative industry trends for financial services leaders.