Financial services newsletter

By Prashant Gandhi, Director, Financial Services and Luke Vinogradov, Digital Transformation Partner

Every business fears the Kodak moment. The moment at which your business loses all relevance. Kodak failed to capitalize on their digital photography innovation because they had a virtual monopoly in the print market – from cameras to film to processing. Kodak executives failed to recognize the computing revolution that would make digital photography mainstream. They tried multiple ways to fit digital photography into their print and film value chain and paid for it by losing more than 97% of their market capitalization over the years.

The annals of corporate history are filled with such missed opportunities and usually with fatal results. The challenge for most firms has never been the lack of early-stage innovation or technology adoption. Businesses failed to take advantage of the technological opportunity because they failed to understand the accompanying architecture innovation.

Systems of knowledge

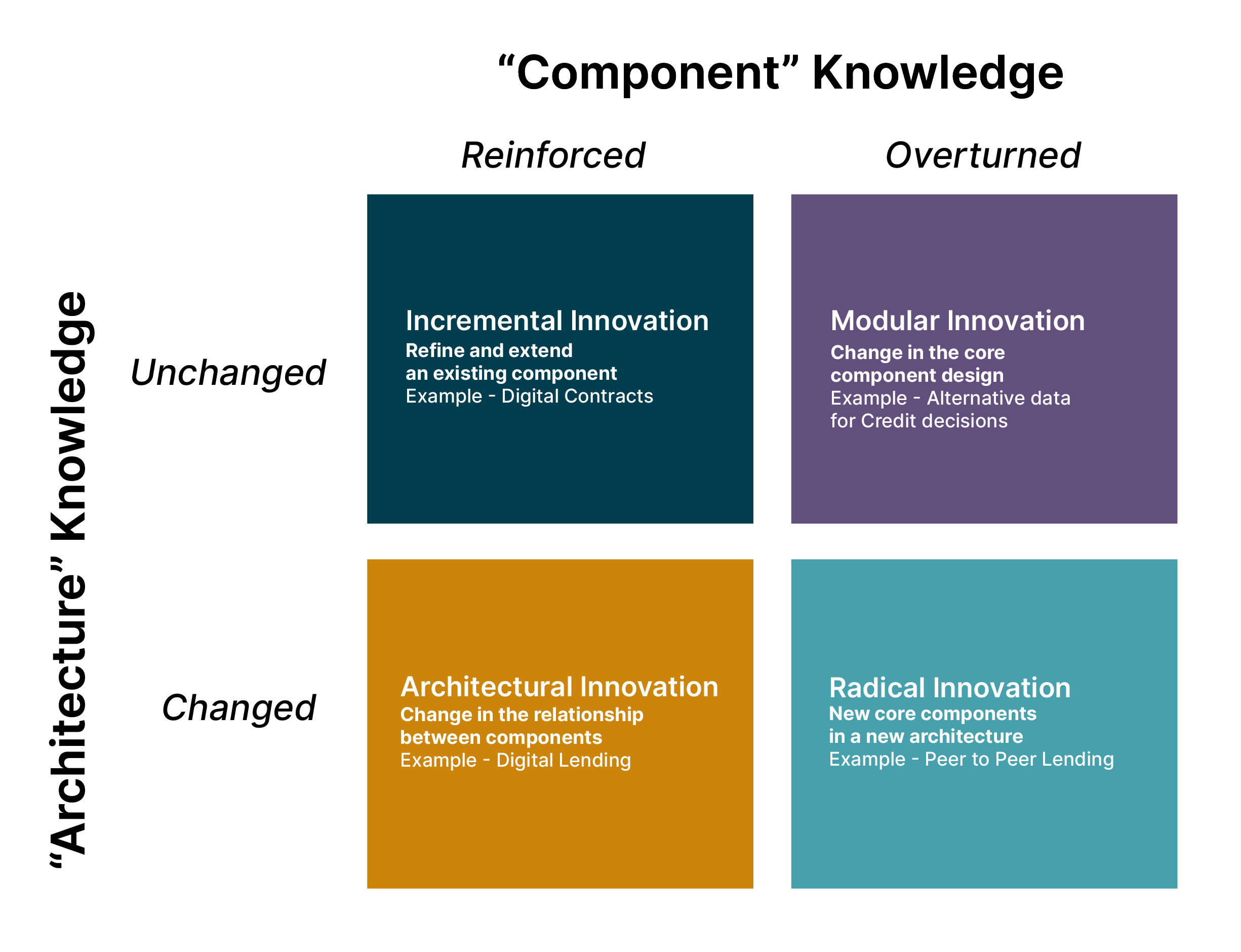

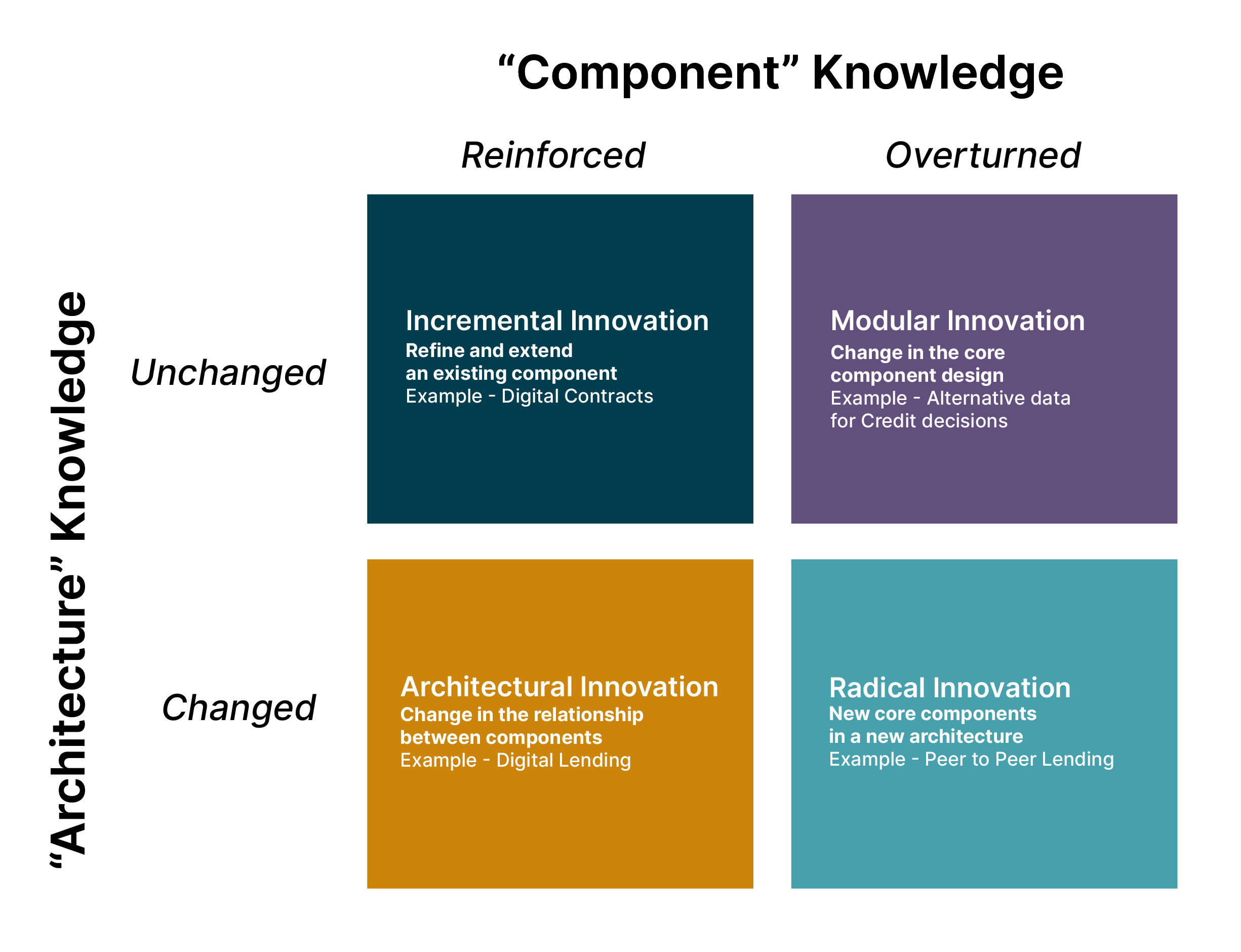

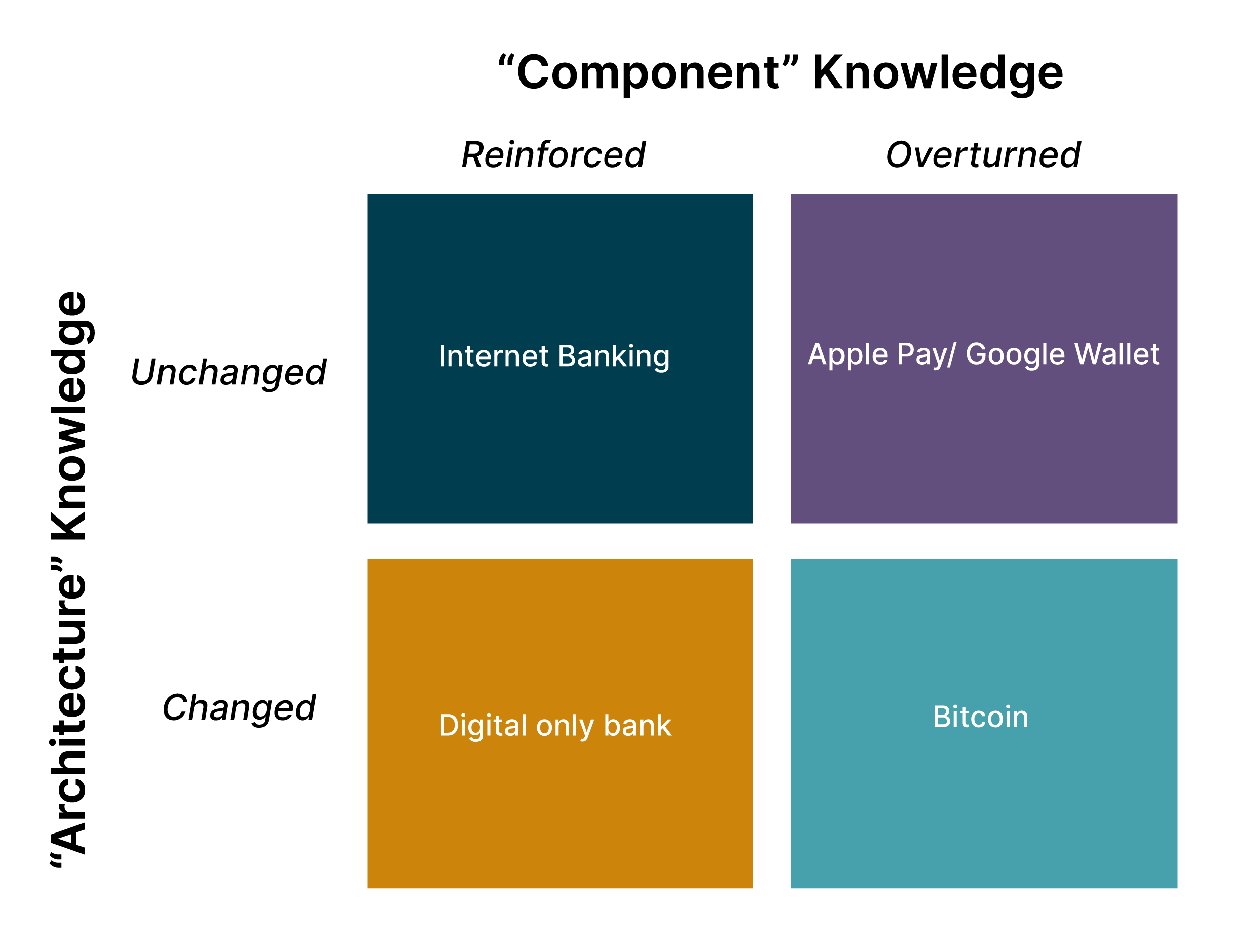

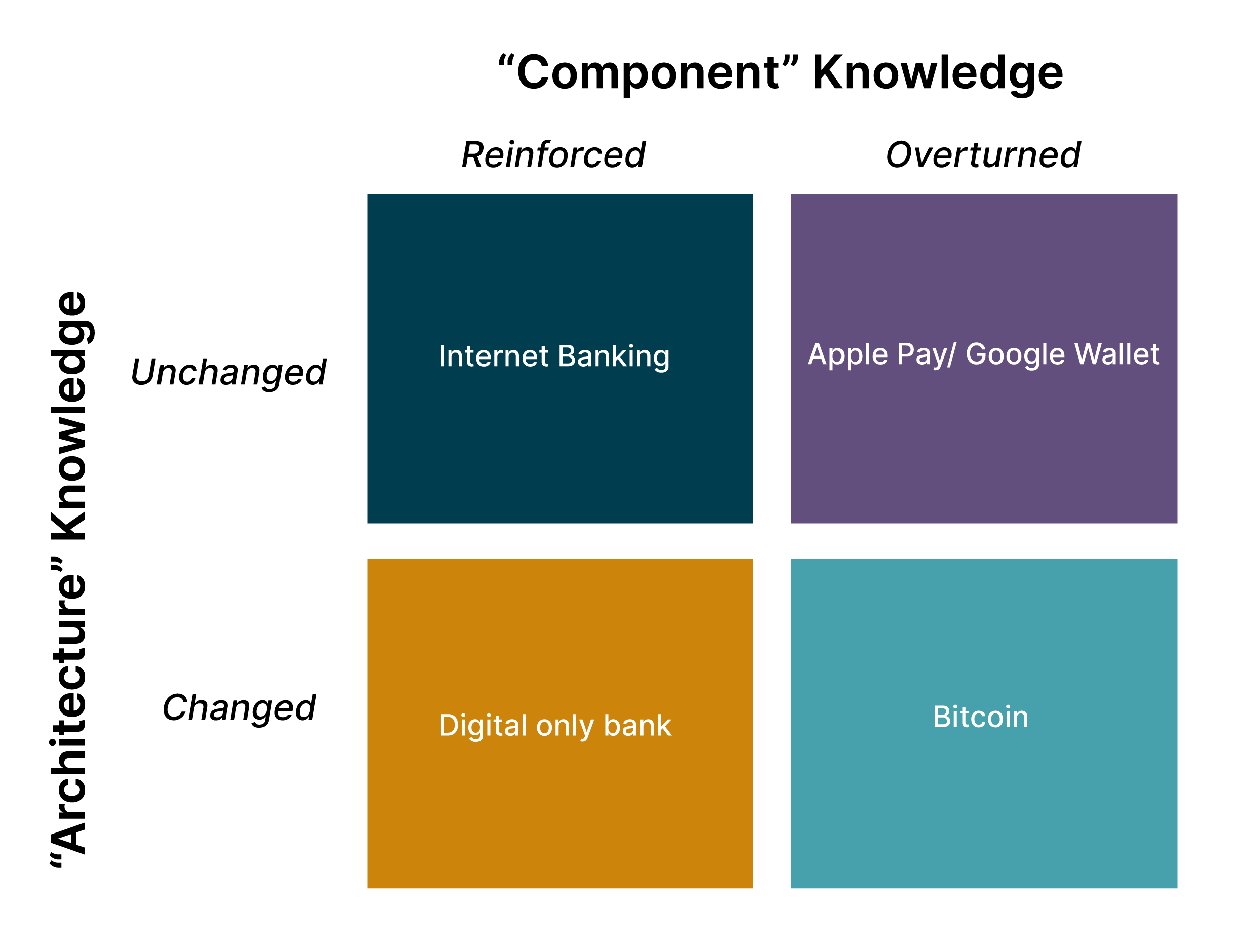

Within every organization, there are two systems of knowledge at work – one is the knowledge of the ‘components’ and the other is the knowledge of its ‘architecture, (Henderson-Clark, 1990). Component knowledge refers to a focused body of knowledge that can be mastered by individuals or a tight-knit team. For example a credit analysis team has the component knowledge for developing models for credit decisioning. Architecture knowledge refers to the knowledge about how these components interact with each other and the impact of the component design decisions on the whole product. For example, integrating and linking components such as credit decisioning, payments, client onboarding and compliance together as a coherent lending business is architecture knowledge.

Architecture innovation happens when the system is reconfigured to link together components in a new way. The framework below explains the impact of any innovation on the existing architectural and component knowledge of the firm.

Architecture innovation destroys the usefulness of current architectural knowledge leading to disruption. Established firms miss reacting to disruption signals because they see these innovations through the lens of their current architectural knowledge. The innovation is often ignored because the organizational knowledge is deeply embedded in its organizational structure, communication channels, information filters and problem-solving strategies. For example, digital lending is not just a digital layer on top of an existing lending business. Digitally native lending firms establish a data-driven relationship between customer data, underwriting, collections and business risk appetite to dynamically price and monitor loans. They have unique funding models and customer acquisition strategies. This is an architectural innovation that is often missed or misunderstood by established banks and lending firms.

Dominant design pervades the thinking within financial services firms

Many industries later criticized for failure to adapt have rich histories of innovation. Financial services firms were the first to adopt technology for record-keeping. They were also some of the early adopters of newer technologies to provide customer self-service models and reduce their operating costs. Bank of Scotland had an online banking service as early as 1983 via TV to check account balance and pay bills. Midland Bank formed the branchless direct bank First Direct in 1989. Deutsche Bank launched its internet banking in LATAM in 1996.

In these cases, the successful model to achieve this digitalization became a ‘dominant design’ for the firm’s IT organization and how it grows its technical capabilities. Most firms have instituted a project-based approach (“change the bank”) for developing initial ideas, design and delivery of technology assets. The long-term evolution of these assets is then handed over to a separate part of the organization (‘run the bank’), to keep the lights on and fix incidents. The incentives for both these organizations are at odds with each other and often drive the wrong behavior. This design has also dictated organizational models for resourcing, governance, funding, vendor selection and shape of delivery teams. This organizational design and ways of working is now a deeply embedded architectural knowledge with the incumbents, knowledge which is hard to break away from when the system fundamentally changes.

Imperative for change

The disruption potential of converging technology evolutions like the internet, mobile and cloud computing is significant. A new class of competitors is building on these technology evolutions to deliver novel business models addressing newer markets and capturing customer segments. These competitors are benefiting from the rise in angel investing and venture capital funding, lower regulatory barriers and by being attuned to the changing customer expectations. This marks a significant horizon shift.

Financial services firms are already seeing the attack on their core business model. The threats of disintermediation and commoditization are real. Retail banks fear that open banking will consign them to a utility. Institutional brokerage services are being disintermediated by electronic platforms. Advisors are feeling the existential threat from robo-advisors. In parallel, fees and commission revenues are being driven down towards zero. Financial services incumbents need to address these disruptive threats by reinventing themselves as modern digital businesses.

The execution playbook is outdated

To combat the disruptive threat, financial services firms are acquiring capabilities in various digital technologies through organic investments as well as acquisitions. Executives are expecting to use these technologies and practices to help them deliver better customer service, cut costs and grow revenue.

Incumbents have not always been able to manifest these capabilities into real businesses and products. For every successful Marcus, there are many examples of failed endeavors because the existing players fundamentally misunderstood ‘digital’ as another channel investment and as an execution problem. Incumbents often make a category mistake by treating digital as an incremental innovation whereas fundamentally it is an architectural innovation.

Goldman Sachs attributes its success in consumer banking to their renewed tech strategy and execution playbook. For example, before they ventured into consumer banking, they conducted more than 10,000 interviews across the country to understand the financial needs of their customers. They launched Marcus online savings account with an attractive rate, no fees and no minimum deposit as a direct response to what they learnt from their customers. Over the 5 years, it has grown more than $60 billion in deposits and $7 billion in loans across the US and UK. They are also adopting that playbook into their existing business operations.

At the same time, JP Morgan failed to excite the market with their digital bank Finn because it did not offer any differentiated features to their customers compared to their Chase online banking app. Finn also had no compelling market feature to attract new customers compared to other challenger banks. Ultimately, they were unable to succeed because they did not have the focus or the processes to truly understand the needs of their potential customers. They failed to understand that digital-only challenger banks represent an architectural innovation.

A similar narrative played out with Investec’s “Click and Invest” robo-advisor and RBS's digital bank Bo, consuming millions of dollars of investment without achieving traction in the market.

Digital business is an architectural innovation

With a stream of new market entrants betting on reinvention rather than recharging, pressure on Financial Service firms is increasing, bringing the realization that it isn’t enough to simply buy new components and drop them into an existing model. This brings architectural knowledge to the fore, requiring reimagination of existing business and operating models.

Executives need to recognize that it is no longer sufficient to build only technology capabilities (often focused at the component level) to fully realize the opportunities available to them. By focusing on the components themselves as the endpoint, executives risk undervaluing the knowledge required to successfully develop and integrate these new elements. For example, having a sophisticated AI based credit decision engine is limited value if your current application process captures only standardized data. Firms are forced into a constant flow of change to cater to internal and external consumers, who now expect continuously improving products and services with reduced cycle times. In this situation, the capabilities associated with creating need to be reweighted relative to the traditional focus of operating.

Modern digital businesses – those organizations whose disruptive influence is being felt in Financial Services and well beyond – recognize that a broader set of capabilities contribute to digital success.

Read more in part two of our Transforming Financial Services into Modern Digital Business.

Want to receive our latest banking and finance insights ?

Sign up for the financial services series by our industry experts. Delivering a fresh take on digital transformation, emerging technology and innovative industry trends for financial services leaders.