B-Social was founded in the UK in late 2016, with the mission of building a digital bank from scratch. At the core of their strategy was to stop money from becoming an issue between friends and family by combining an expense sharing mobile application with a debit card.

As a startup company taking its first steps into the UK open banking arena, it needed a technology partner to not only develop its app but also set up all of the internal processes and tools it needed in order to meet the strict compliance requirements.

The Business

The founders had a vision and needed support in making that a reality – not just on a technological front but on a business development front too. The Thoughtworks team helped them to develop a product strategy by conducting user research and discovery sessions. Together, they created customer acquisition strategies and supplier management processes.

Internally, Thoughtworks helped to shape the organizational structure; recruiting and building lean teams for B-Social’s business, with an agile product development culture at the core. Together they established internal ways of working, ensuring that the focus was always on the customer experience.

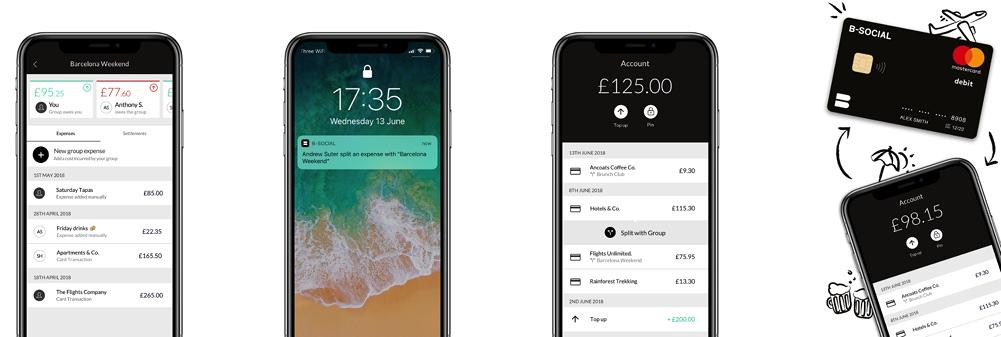

The App

B-Social’s concept was an industry-first, so there was a need to validate the idea. The team, therefore, took an MVP (minimum viable product) approach to develop an app for iOS, then for Android. The first release aimed to prove that the integrations to other banks worked, bearing in mind that they were integrations to legacy providers.

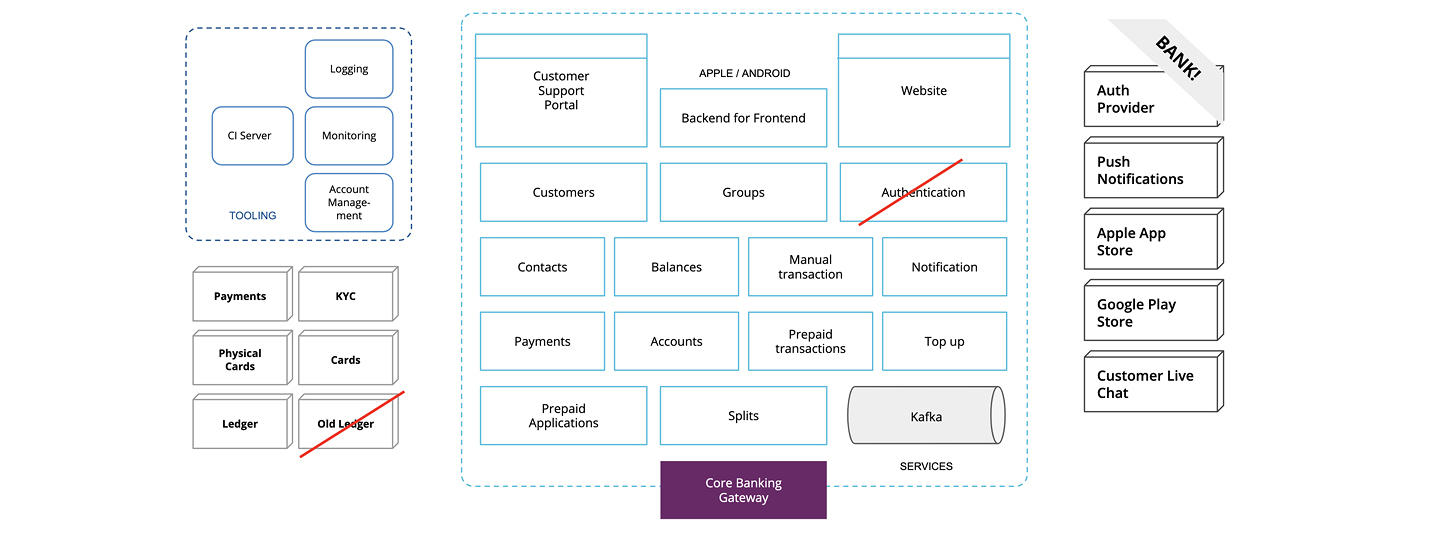

The Thoughtworks team was not just developing a mobile app, but building an entire banking technology platform from scratch. To enable rapid development and testing, the team took a microservices approach, with each domain having its own database. In this way, the team could develop the app as far as possible, without having to wait for a related domain, such as the website. Everything was built on an evolutionary architecture to allow the digital business to grow and scale rapidly. The team was agile in every sense of the word, carrying out continuous deployments – at times every night of the week.

The Bank

While the app was in development, another part of the Thoughtworks team focused on preparing B-Social’s application for a banking license. For the application to even be accepted for consideration by the financial services regulator, a full business plan and compliance programme had to be presented. To meet these requirements, the team set up over 70 business processes. As well as an array of customer-facing processes, the startup organization also needed to develop an internal infrastructure, including tools for financial crime monitoring and reporting.

The Outcome

B-Social’s app is live and available to UK residents. Customers can set up groups to track expenditure with friends and family, split costs, and get paid back.

B-Social has commenced its process to apply for the UK banking license. Its business plan has been successfully submitted to the UK financial services regulator and is undergoing review. If and when the banking application is approved, B-Social will have a license to become a fully operational bank.

Thoughtworks has helped us to build an app that intuitively connects your personal finances with your social world, making it easy for people to buy, track and share the experiences that bring them closer.

Note: B-Social is not a bank yet, but are applying to the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) to become one.

The B-Social card is a Beta debit Mastercard® and can be used wherever Mastercard® is accepted. The card is issued by Wirecard Card Solutions Ltd (“WDCS”) pursuant to a licence by Mastercard International Inc. WDCS is authorised by the Financial Conduct Authority to conduct electronic money service activities under the Electronic Money Regulations 2011 (Ref: 900051). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

This is an e-money product and not covered by FSCS deposit protection.

Read more about B-Social in TechCrunch.