Lost in translation: Why good ideas don't get funded

I recall engaging with a market leading global sports technology company. They were facing immense board pressure for margin improvement amidst stagnant revenues and creeping costs. I was working directly with the CIO and CTO to shift the conversation away from cost optimization towards growth and strategic positioning.

My initial narrative centered on the competitive threat: nimble niche players and new entrants chipping away at their market share. I argued that without proactive transformation they were ceding ground and that their scale advantage had a limited window to be leveraged before it was too late. In response we outlined a transformation program spanning operations, technology and people; representing a much needed leap forward for the company. However, the CEO perceived this large capital investment as overly risky given the prevailing financial pressures and board focus.

Unable to articulate a direct link to profitability and longer term gains, the initial pitch failed not on its merits and inherent value, but because that value was not articulated in the unambiguous language of financial outcomes. This scenario is frustratingly common and underscores a critical disconnect between the people shaping solutions and the people deciding how and where to invest. This article explores how to overcome this disconnect.

The main imperative: Outlining potential as profit

Continuing the example above, the initial rejection by the CEO forced me to shift from a narrative of competitive threat to one that explicitly mapped the proposed operational, technical and people transformation streams to quantifiable business outcomes. We moved to articulating the interconnectedness of these streams and their joint contribution to business metrics such as revenue and cost.

The core argument is simple but profound: For technology and digital product leaders to secure capital investment, influence business strategy and elevate their functions beyond a utility or feature factory, they must master the art of translating technical and product potential into demonstrable business outcomes in financial terms. Sophisticated solutions and engaging digital products are not a convincing argument on their own; their direct contribution to profitability, competitive positioning and enterprise value-add must be articulated in a language the board and C-suite understands.

In the sports technology company example, the turning point came when we shifted from primarily discussing overcoming competitive threats to meticulously detailing the benefits quantified as top and bottom line impact. This focus on tangible financial gains ultimately convinced the CEO. In hindsight, this was a sound investment as the transformation led to significant improvements including addressing a multi-million annualized cost of delay and cutting the existing time to market in half.

Deconstructing business value

Technology initiatives and digital product evolution generate value in multiple ways. Recognizing these distinct contributions is the first step towards effective translation where the second step is then connecting the low-level improvements to high-level financial results:

Operational efficiency and cost optimization: Examples of this type of work are streamlining workflows, automating tasks, reducing errors, optimizing infrastructure or rationalizing your product portfolio. In these cases, the executive message could be focused around freed up capacity and quantifiable savings. Link this to EBITDA improvement (earnings before interest, taxes, depreciation and amortisation), margin enhancement, or reduction in COGS (cost of goods sold) and SG&A expenses (selling, general and administrative).

In the sports technology company example, the operations part of the transformation was aimed at reducing waste on low-value projects and establishing a more efficient funding mechanism. The goal wasn't just better processes but reduced cost of wasteful work and faster feedback on value realisation. We projected how streamlining these workflows would free up capacity, quantifiable in actual savings or redeployable to revenue-generating activities, directly impacting EBITDA.

Enhancing capabilities: This type of work revolves around new systems, tools, data insights or product features that empower employees, enabling new actions, better decisions or novel services.

In the sports technology company transformation program, re-platforming was seen as a main component of the technology improvement, to create a leaner and easier-to-work-with codebase. While the technical benefits were clear (e.g. shorter change lead time and increased deployment frequency with generally less time and effort needed to create new features), our business message focused on how this translated to reduced time to market for new revenue streams and increased engineering capacity that could be directed to innovation. This theme around speed and reducing the cost of delay on a backlog of revenue-generating initiatives enabled predictable delivery at scale and accelerated time to revenue.

Reducing and mitigating risk: Here common benefits are a more robust infrastructure, security, compliance and disaster recovery to protect assets and ensure continuity. A lot of risk mitigation, security and compliance requires decoupling systems. A positive side effect of this — beyond risk, security and compliance — is faster time to market and softening the impact of reduced availability. This, in turn, means accelerated revenue streams and increased revenue protection in case of failures.

While not the primary driver, aspects of the people upskilling stream for our sports technology company such as improved DevOps practices contributed to reduced risk through a reduced change failure rate and increased system availability. What this means in financial terms is the safeguarding of significant downstream revenue.

User/employee experience and product-led growth: Often, work results in improved interfaces or experiences driving customer metrics or enhancing employee engagement. If so, focus the message on market share growth, CLTV (customer lifetime value), CAC (customer acquisition cost) reduction, productivity gains or even reduced attrition costs.

Again, for the sports technology company, the people part of the transformation included improving engineering practices and ways of working. One reason for this was to lower the cost to onboard engineers and reduce the time to value to address the large backlog of revenue generating features and the resulting multi-million cost of delays. Looking specifically at improving voluntary attrition, this not only reduces hiring costs and the bottom line, but contributes to improved productivity over time, also contributing to a healthier top line.

Doubling down on the connection to business outcomes

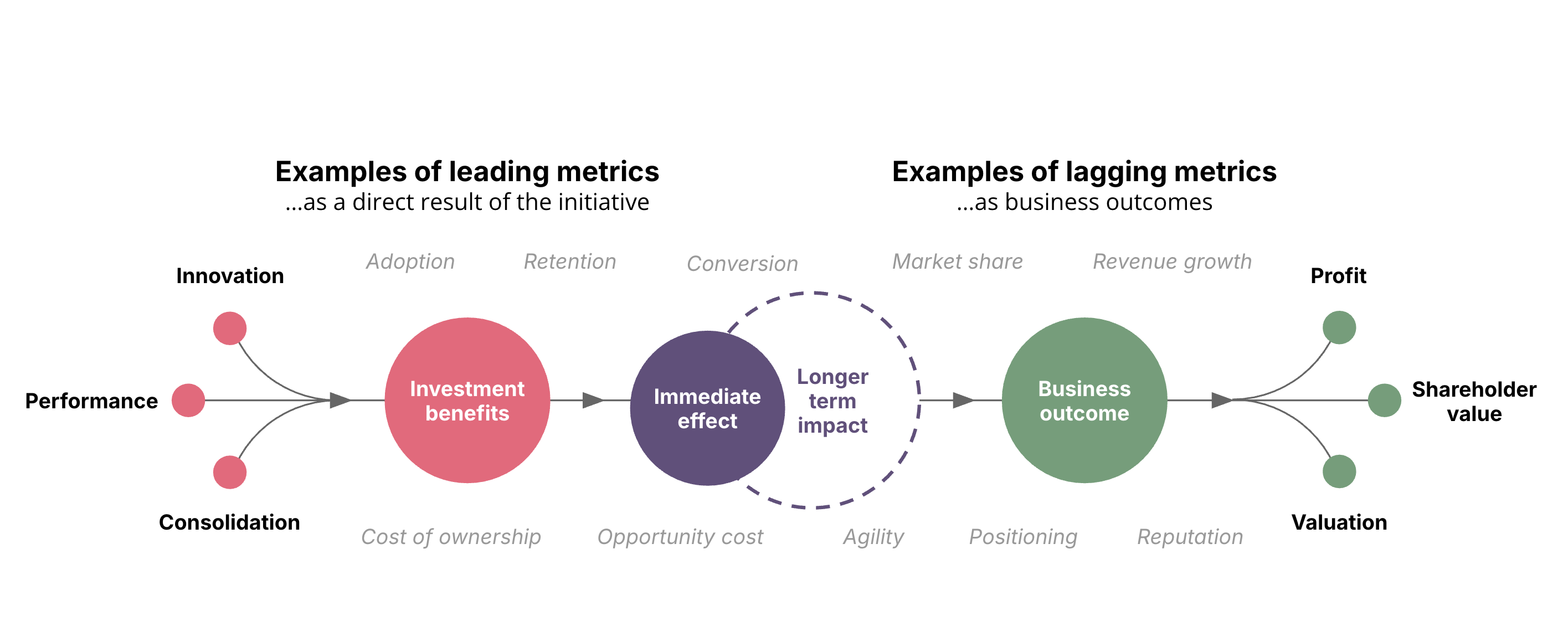

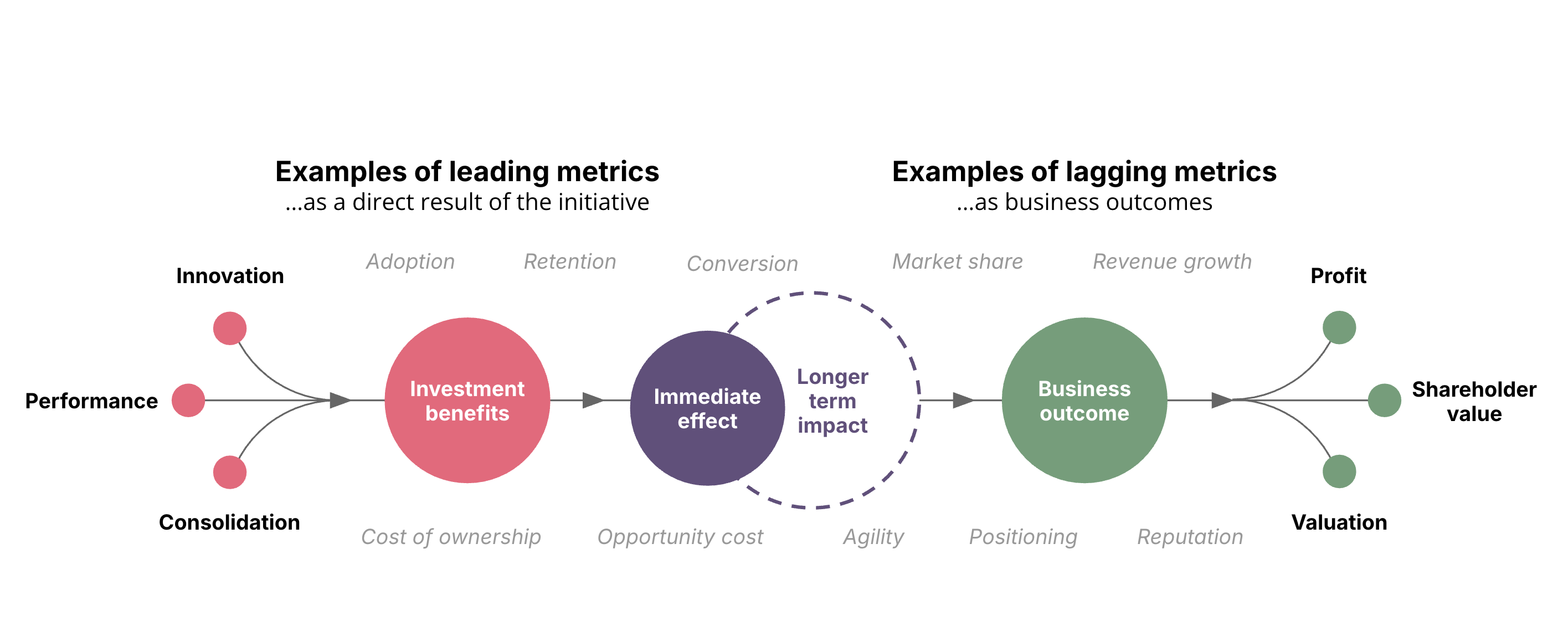

From the C-suite’s perspective, metrics like system uptime, deployment velocity or user adoption are merely leading metrics. Their business relevance is realized only if they’re translated into commercial impact and competitive standing. In addition to leading and lagging metrics, our metrics should also be both outcome-oriented and balancing. Balancing metrics help avoid the unintended consequences of overdriving the outcome metrics. For example, if speed to market is an outcome metric, quality is a balancing metric to ensure that speed does not come at the expense of quality.

In the illustration below you will see that while initiatives might focus on innovation, performance, or consolidation, their value is measured by a chain of effects: immediate benefits of the investment (leading indicators like user adoption or conversion rates) must demonstrably drive intermediate business outcomes (like market share or revenue growth) which ultimately impact lagging financial metrics (like profit, enterprise value, and shareholder return). Different initiatives impact different metrics along this path, but the ultimate executive focus remains on financial results.

In our engagement with the sports technology company, leading metrics for technology improvement like shorter change lead time and increased deployment frequency were explicitly linked to the lagging business outcome of reduced time to market and its impact on increased revenue. This connection was vital to demonstrate how technical improvements would address the multi-million annualized cost of delay. Similarly, improved mean time to restore wasn't just a technical win; it meant greater system availability, protecting revenue.

Shaping the narrative: Telling a compelling story where the case resonates

The bridge from technical metrics to business impact can be reinforced through established frameworks and tailoring the message to an executive audience.

1. Categorize the benefits to make them easier to understand

Here, something like the Gartner Run-Grow-Transform (RGT) model is relevant for both IT and product investments to help frame the purpose, costs and benefits of an initiative as an understandable and compelling narrative.

Run: When maintaining existing systems and product stability, ensuring operational efficiency, focus the executive message around reliability and cost optimization.

Grow: If enhancing existing IT capabilities or evolving existing digital products, focus the executive message around improving existing revenue streams, customer retention or scaling.

Transform: For creating or evolving IT capabilities and/or digital products/business models to enter new markets or drive significant strategic change you could focus the executive message around new revenue streams, competitive advantage and strategic positioning.

The sports technology company transformation was primarily a ‘Grow' and ‘Transform’ initiative to enable faster capture of revenue opportunities and fundamentally shifting capabilities for strategic positioning.

2. Use common language

Another way to ensure that a narrative resonates is by framing it using concepts and structures familiar to executives. Technology Business Management (TBM) is a value-management framework specifically designed to help technology organizations communicate and manage their contributions in business terms:

Transparency and context: Link IT/product spending to specific services and business units to help you move beyond opaque cost summaries to instead frame the discussion around strategic, value-based capital allocation decisions.

Standard taxonomy: By employing a common financial language across IT, finance and business units you can make sure everyone is discussing the same thing in the same way for more productive value conversations.

Linking costs to consumption: Allocating costs based on actual business consumption patterns will help you reveal true cost drivers and service TCO (total cost of ownership) across the enterprise. This will help you demonstrate value-for-money to inform strategic sourcing and demand management.

Value conversations: Provide a factual, financial basis for strategic trade-off discussions (cost vs. performance vs. risk vs. value) to facilitate collaborative and data-driven decisions aligned with enterprise outcomes.

The benefits case we developed for the sports technology company served as a practical application of TBM principles by providing transparency and context, linking the proposed investment to specific business outcomes like increased revenue, improved margin and reduced operational risk.

3. Communicate for impact

Effective communication sounds simple but is proven hard because what matters to you as the communicator might not be exactly the same as what matters to your audience. This is why the focus must always be the common business priorities such as revenue, cost, risk and strategy:

Quantify benefits as top or bottom line improvements: Use financial terms such as ROI (return on investment), NPV (net present value), IRR (internal rate of return), and payback period as common executive metrics. Even risk mitigation can be framed by quantifying the potential cost of not acting.

Speak plainly supported by data: Avoid jargon. Frame technical and product achievements from a financial perspective.

Instead of: "Completed v2 of the mobile app with improved user flow and new personalization engine"

Communicate as: "The new mobile app drove a 15% increase in average order value through personalization and a 5% reduction of cart abandonment through a simpler purchase completion process"

Connect to strategy and business goals: Reiterate focus on the “so what?” for the business strategy and P&L (profit and loss). Show how IT and product initiatives directly support company goals and targeted KPIs (key performance indicators). Make sure there is a link to the company vision and business strategy to connect the value of the work with the business outcomes of the highest importance.

Our initial pitch for the sports technology company focused on competitive threats. The successful benefits case focused on increased revenue, lower cost, improved quality, and reduced risk. The narrative shifted from defense to a proactive plan for financial improvement. Being able to state that the program might cut time to market in half was far more powerful than discussing platform modernization in isolation.

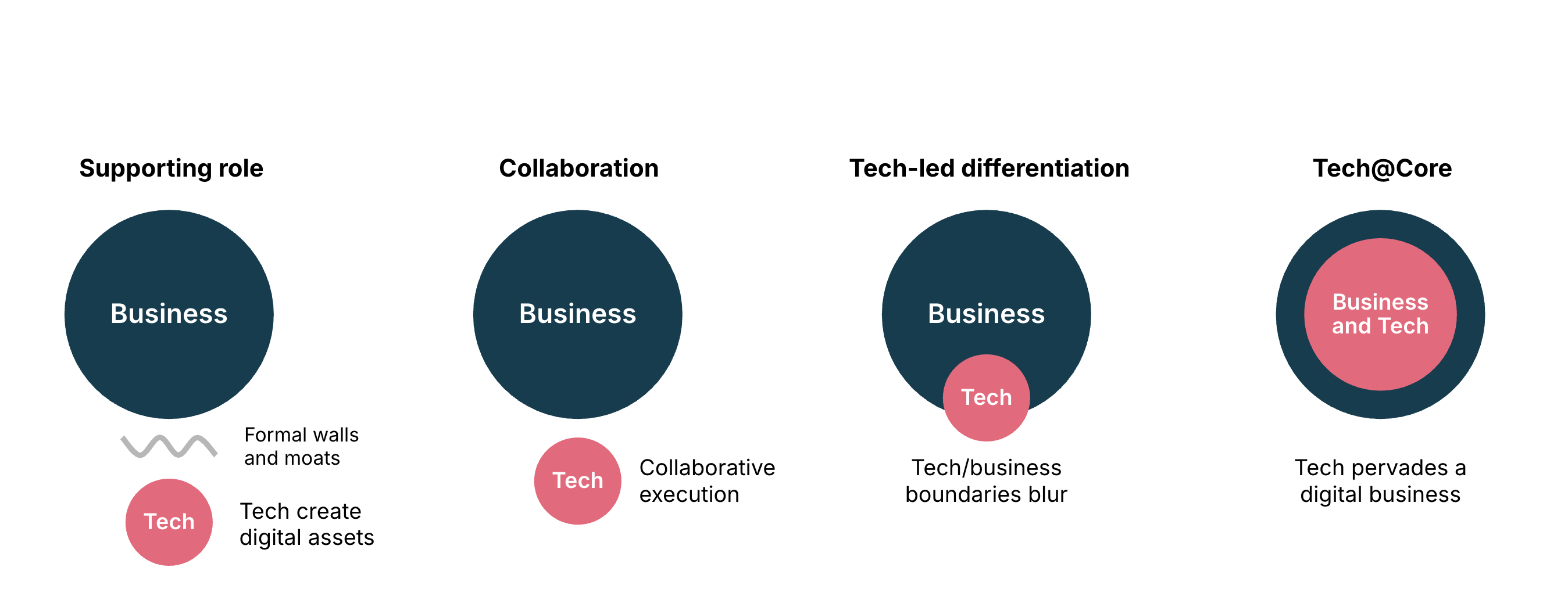

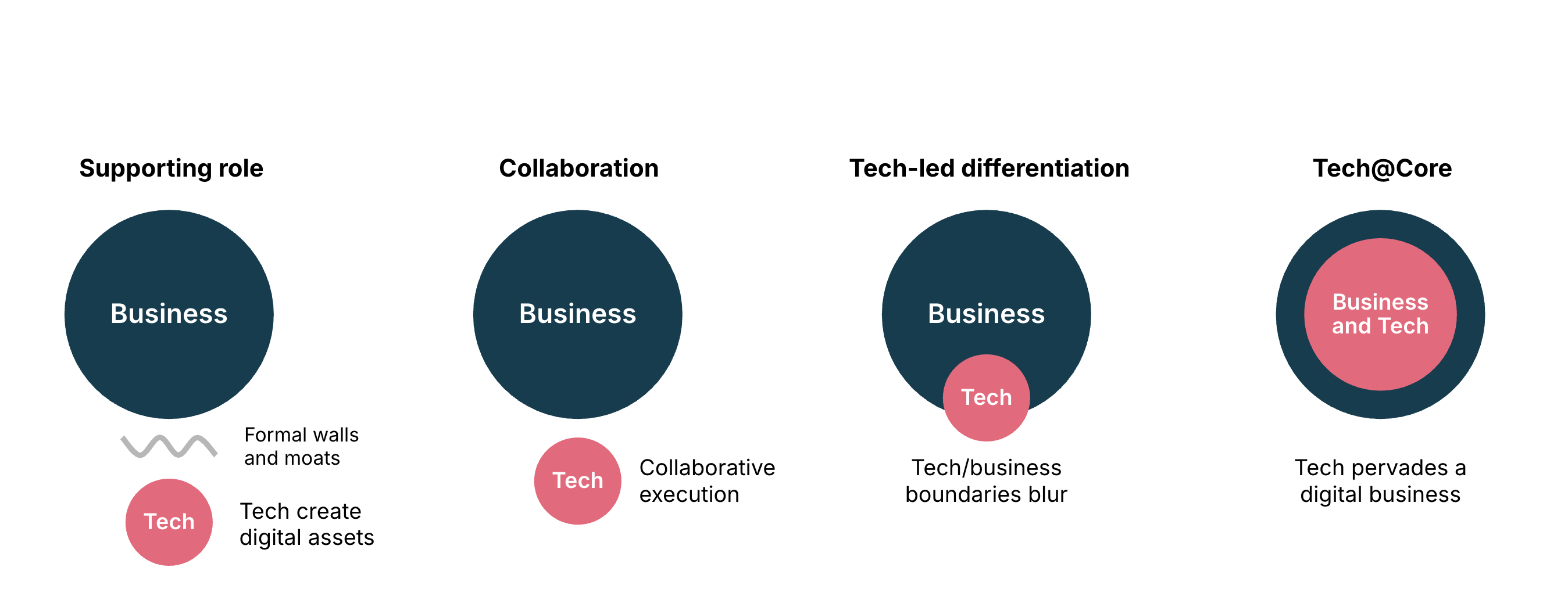

Beyond alignment: Fusing technology and product with strategy

In a modern digital business, technology and digital products are not merely aligned with strategy; they are the strategy. They are fundamental drivers of competitive advantage, market differentiation and enterprise value. Achieving this requires more than collaboration; it demands a deep fusion of technology, product, and business strategy.

The successful funding of the transformation program at the sports technology company wasn't just an IT win; it was a strategic business decision. It was enabled by framing the technology and operational changes in terms of their contribution to core enterprise objectives like margin improvement and competitive agility, ultimately resulting in significant revenue gains while safeguarding downstream business.

Conclusion

Technology and digital product leaders must position themselves as strategic business partners. This requires going beyond direct benefits to articulate the business value of the work, embracing the language of revenue, profit, risk and strategic value.

Done right, as demonstrated in the case of the sports technology company, technology and product functions will find it easier to unlock capital, build deeper trust and fundamentally reposition themselves as core drivers of enterprise success.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.