The rapid adoption of digital payments presents a prime opportunity to enhance efficiency and experience throughout the payments value chain. Two broad waves of change are making this possible: the adoption of standardized messaging formats in the form of ISO20022, and the evolution of AI in the form of GenAI, compound AI, and Agentic AI. In this article, we explore how agentic AI can resolve some of the key challenges to data sharing among participants in a payment ecosystem, and how this will mitigate systemic risks and ultimately benefit the customer.

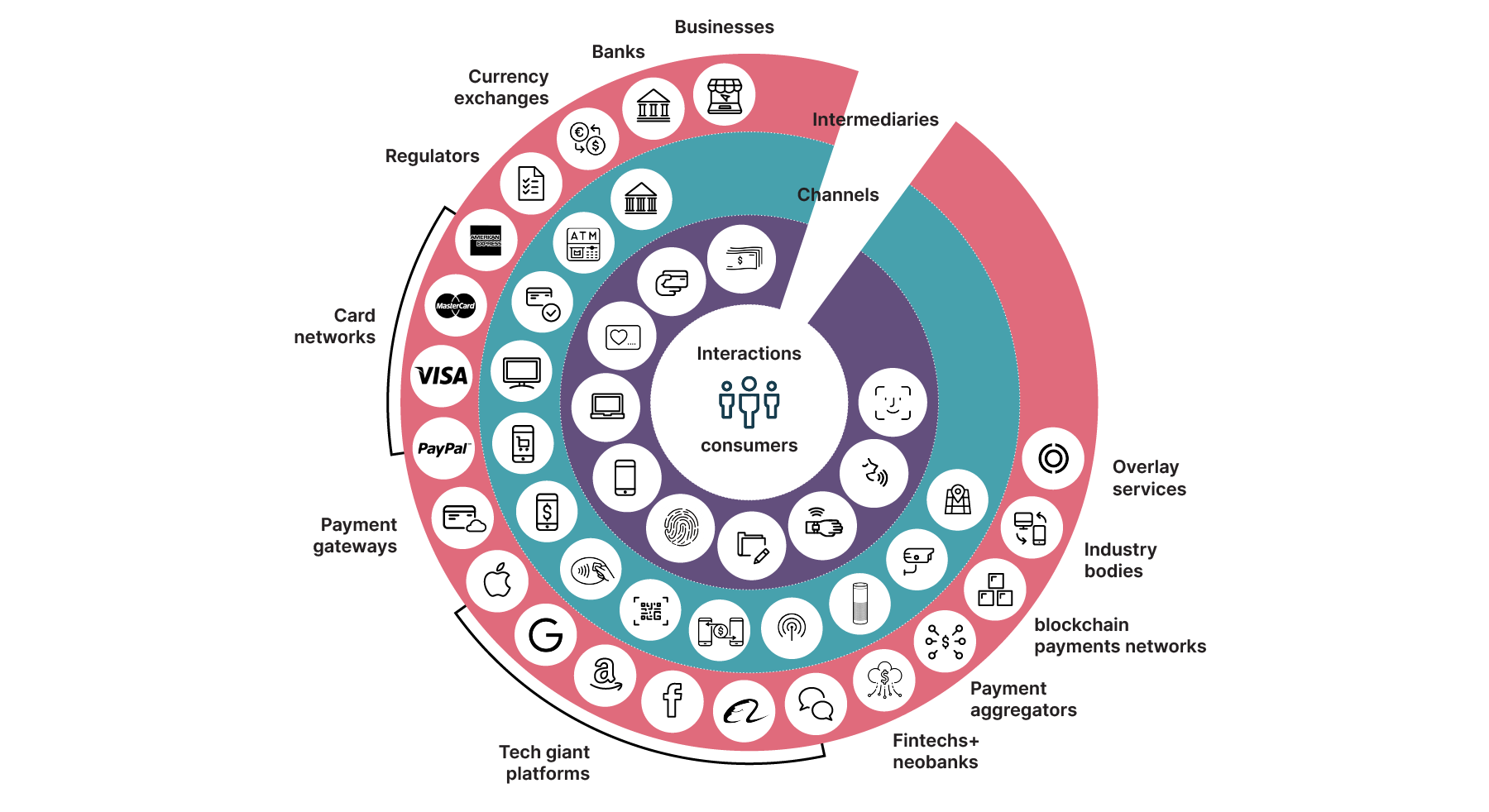

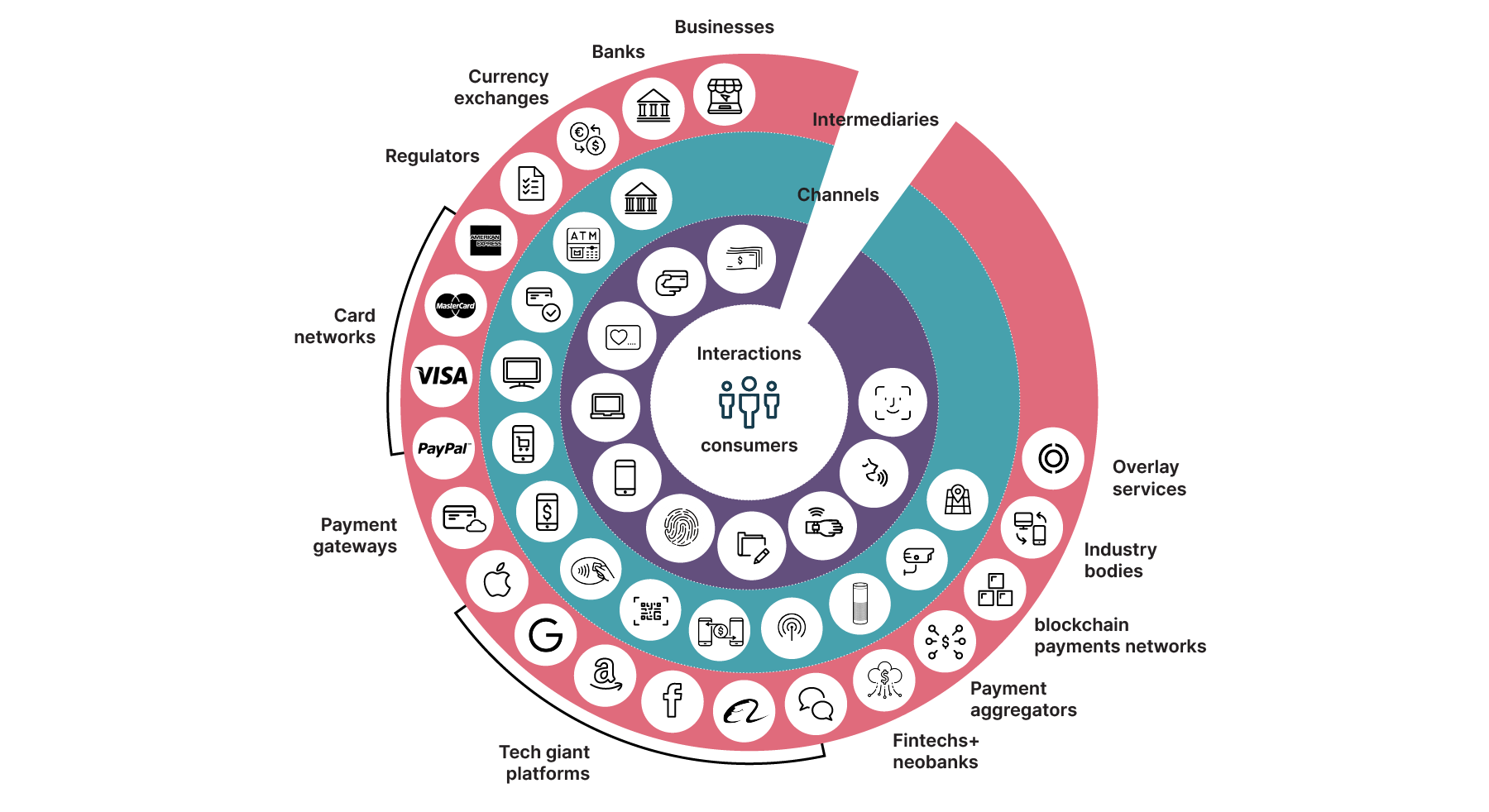

Payments have evolved from a simple process into a vibrant ecosystem with multiple actors. The number of entities, channels and possibilities around the end-customer has expanded in line with the digital economy. The success of a payment is now dependent on the participation of organizations throughout the value chain, and sometimes on factors less related to the direct participation of each player than to the collective value of the network's efforts.

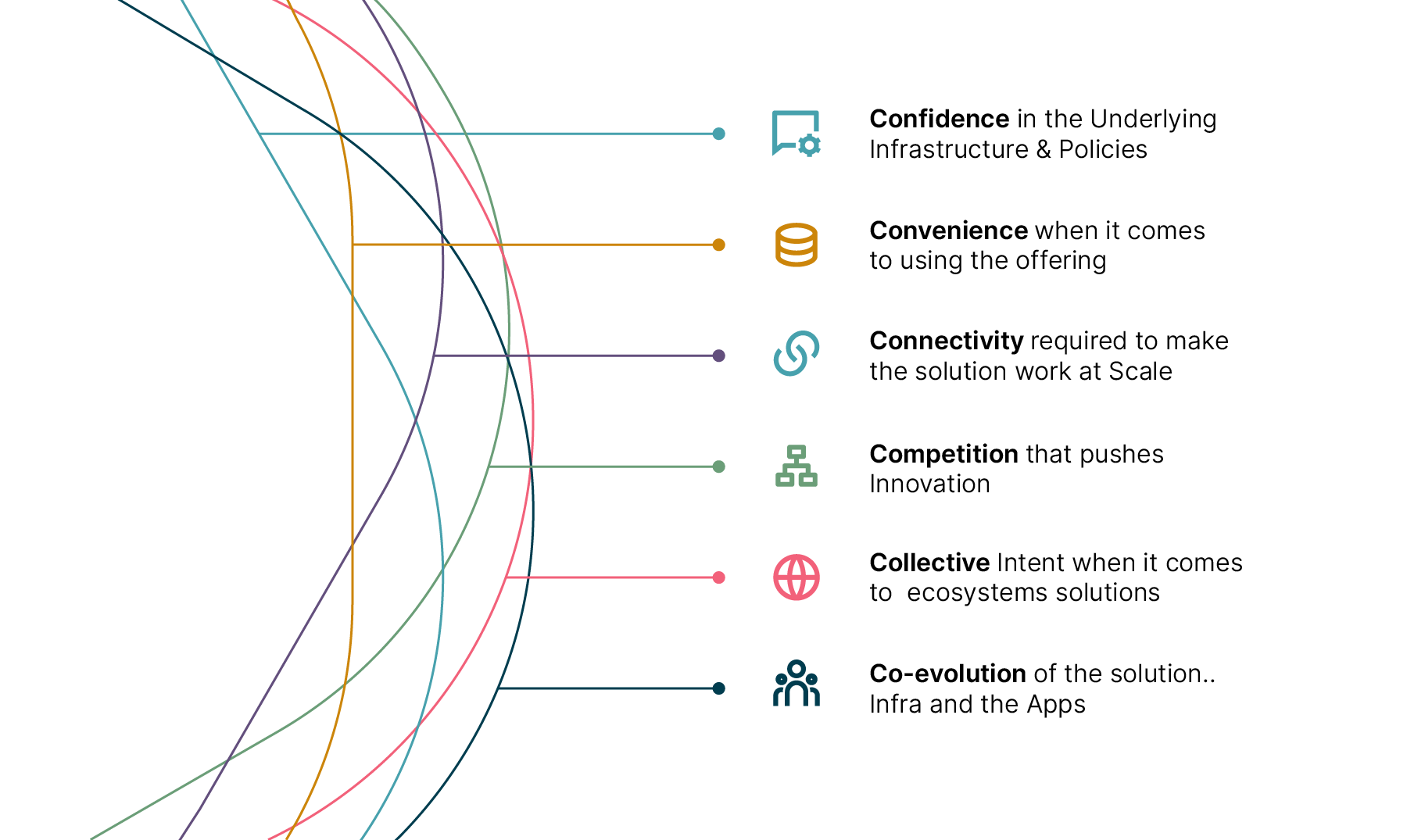

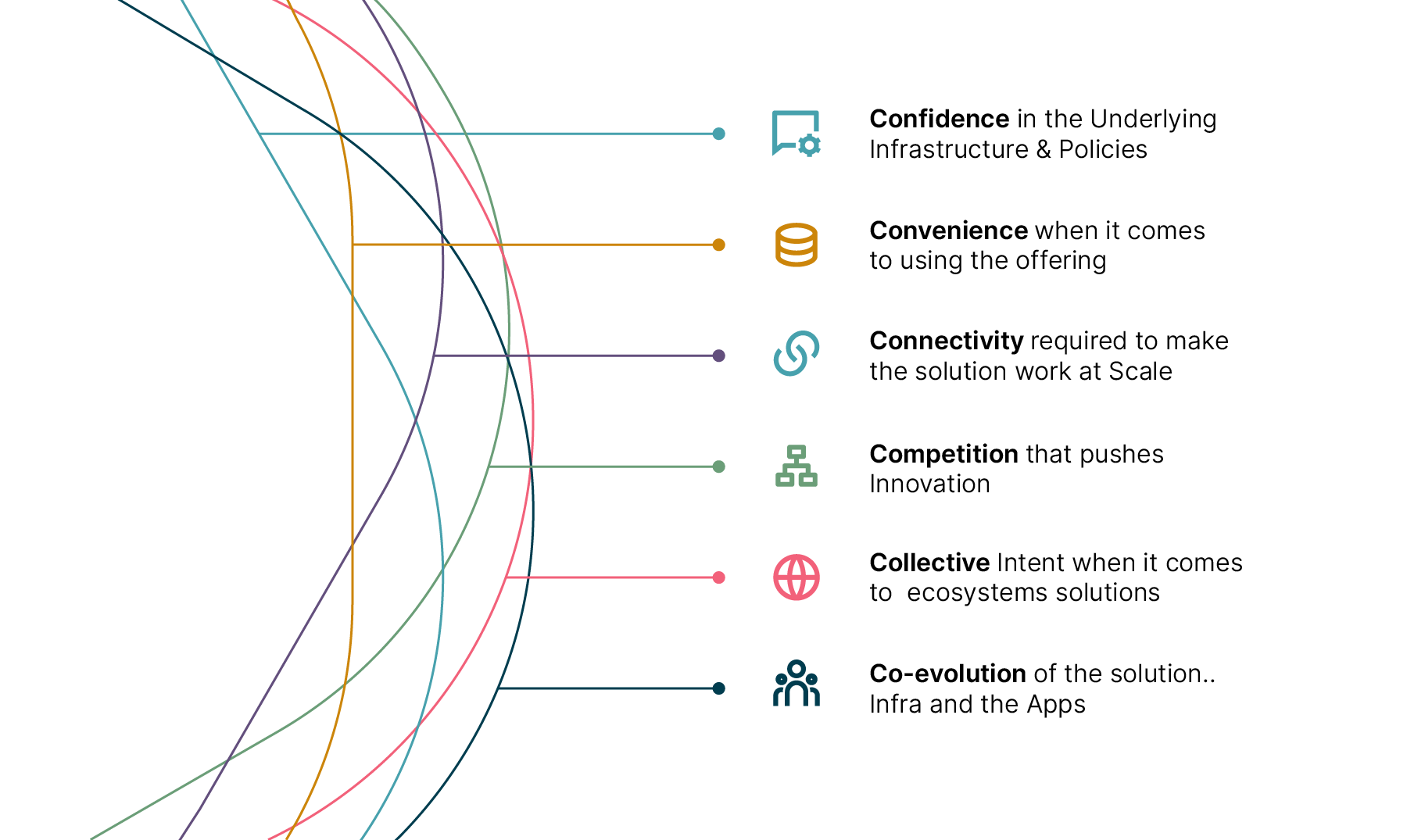

Real-time payments, advanced by regulators and gaining traction globally, are a good example. Adoption of these solutions requires collective intent – that is, network participants need to think holistically about the customer if they want the overall network to be successful. Along with trust, convenience, availability of choice and evolvability to address additional customer needs, maximizing the potential of these networks requires connectivity that is accessible and affordable, as well as incentives for each participant in an ecosystem to contribute towards its success.

The promise and power of network effects are especially evident in two aspects of payments supported by rapid technological advancements: improving customer-centricity and reducing fraud.

Both these goals have become more achievable with the availability of richer current and historical payment information, which is typically spread across different participants in the network. A customer of an e-commerce site will have an issuing bank, whose payments must pass through a merchant processor and their gateway, as well as often the systems of card operators like Visa or American Express, before they are successful. Beyond the direct payment players, the device used for payments and the mobile phone network will also retain customer information. The value of the data spread across these organizations is multiplied when it is collated and assigned to the same person, as only then can it be used to drive ecosystem-level personalization and risk management.

Motivating providers and meeting customer needs

Traditionally, incentives such as lower fees have been dangled before participants in the payment value chain to encourage them to share data. But enterprises are increasingly aware that data is a critical asset that can drive differentiation, especially as new, richer messaging standards take hold. That’s made incentives less enticing – unless they’re in the form of a common challenge, like fraud, that could impact the reputations and revenues of all participants in a payments network.

Rather than trying to combat fraud themselves, organizations generally rely on a central agency to help create a registry that can be referenced to identify suspect transactions. While the adoption of improved messaging standards such as ISO20022 has enhanced transparency, the rise of AI, and particularly agentic AI, models will do even more to drive win-wins for both participants and the collective ecosystem. Agents can enable participants to contribute to fighting fraud, or to leverage data to drive customer insights and differentiation, without necessarily needing to share data to a central repository. This promises to make the entire payment value chain both more efficient and more robust, and to create a better insight-driven experience for the customer.

To illustrate how, let’s focus on tackling fraud. The number of layers or organizations across which customer information is spread can be massive. The unchecked rise in fraudulent transactions shows that unless there is a universal way to link data across the organization and to cross-reference that data while approving a transaction, it’s all but impossible to eliminate fraud. Most fraudsters thrive by leveraging information silos, which can create customer data blind spots.

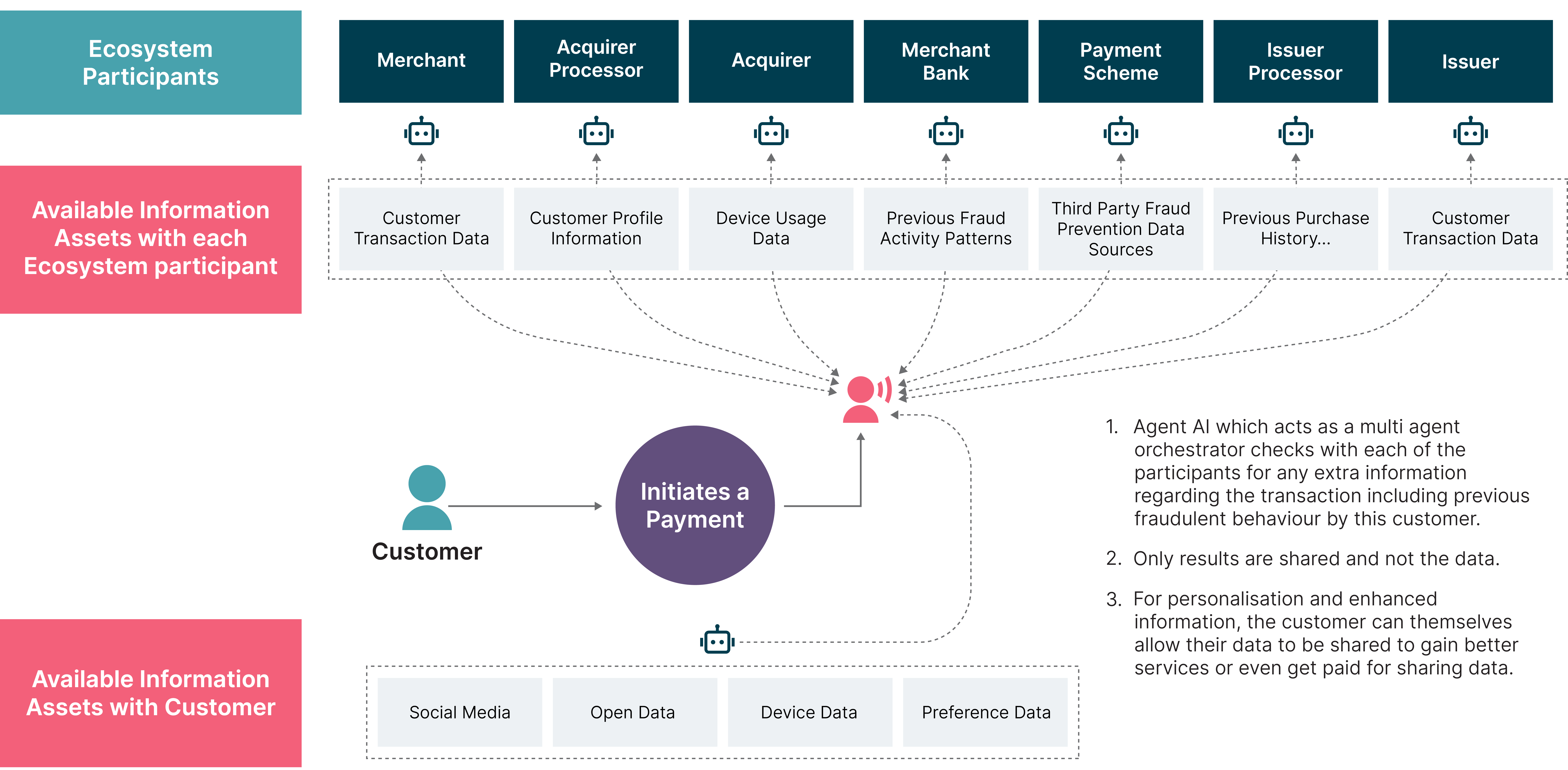

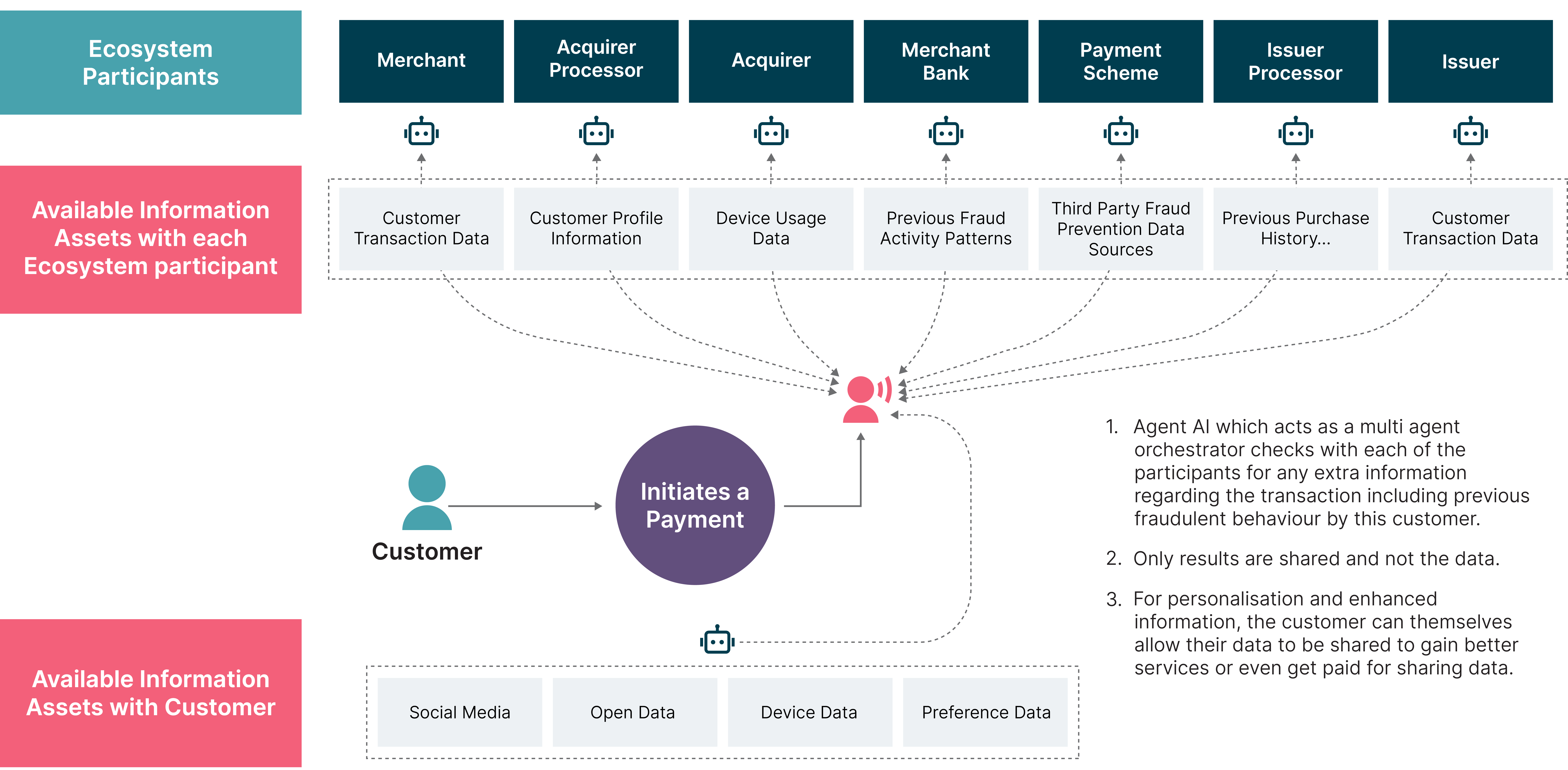

How does an agentic approach address this challenge? With agents, the focus can shift from asking organizations to share their data to asking them to share insights, without the underlying data. When trying to tackle fraud for example, an agent deployed at each of the value chain participants can check their respective organization’s database and confirm whether a customer appears on a blacklist or not, providing the most vital information without all the proprietary data behind it.

The ability to potentially leverage such insights from a broader set of ecosystem players – for example, telecom providers, device manufacturers and digital public infrastructure providers – will make validation processes even more robust.

What’s more, payment fraud detection and resolution are complex, high-stakes processes that demand rapid collaboration between humans, data and systems. As transaction volumes rise and fraud tactics become more sophisticated, traditional methods are straining human analysts, who must juggle cognitive load, operational risks and customer experience considerations.

We have developed a transformative concept for a multi-agent AI system designed to reduce this burden by augmenting human decision-making across the entire fraud management lifecycle, from detection to prevention. This has opened the door to multiple possible use cases:

Use case 1 : Digital Fraud Intelligence Exchange Platform

The diagram below maps out a platform in which, instead of asking each ecosystem player to share data on the customer, only insights are requested. This kind of structure is beneficial when tackling systemic risks such as fraud. While it requires the cooperation and coordination of all ecosystem players, participants are incentivized to share, as any transactions initiated by them will also be safer, which fosters higher overall levels of customer trust.

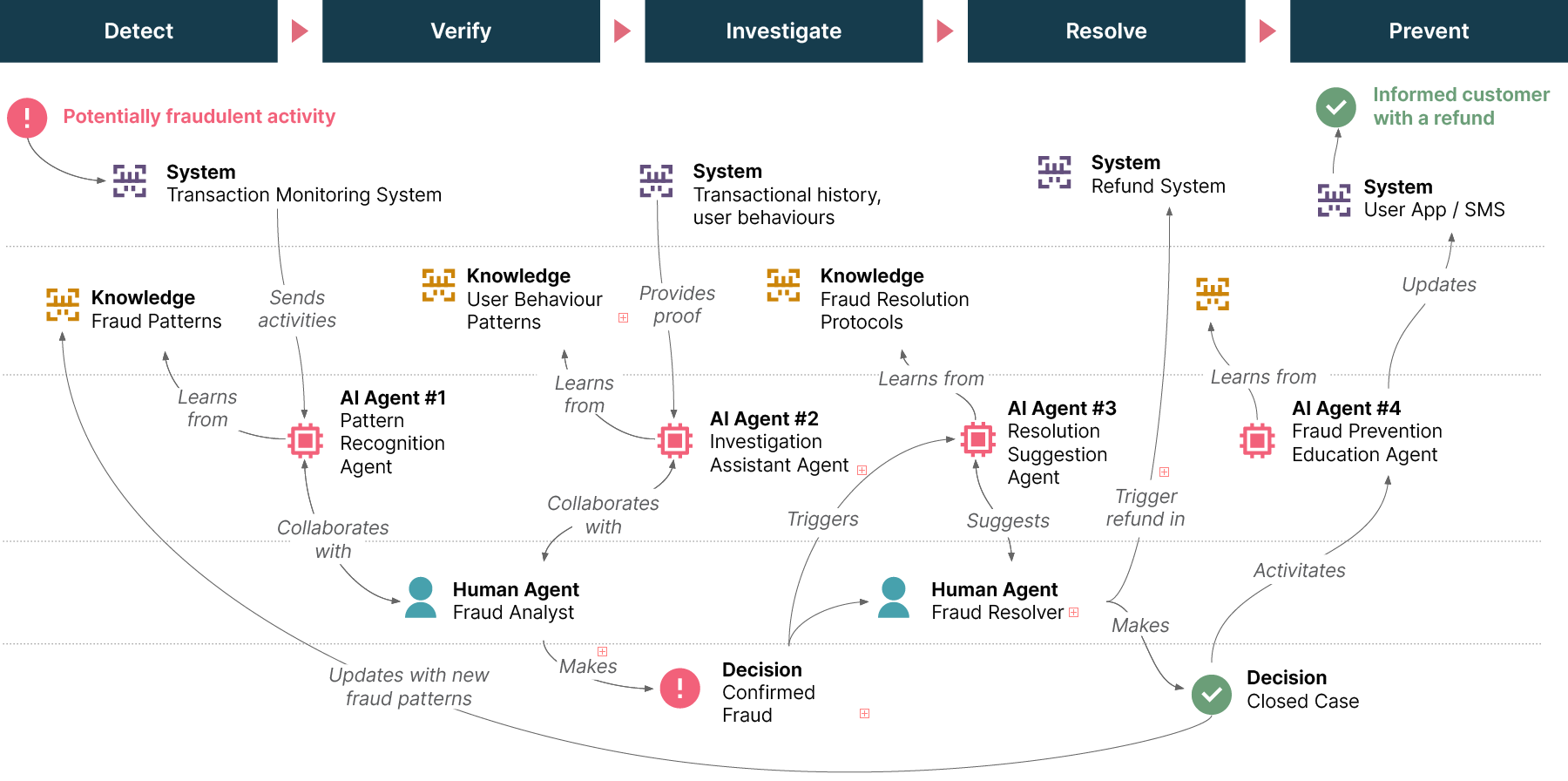

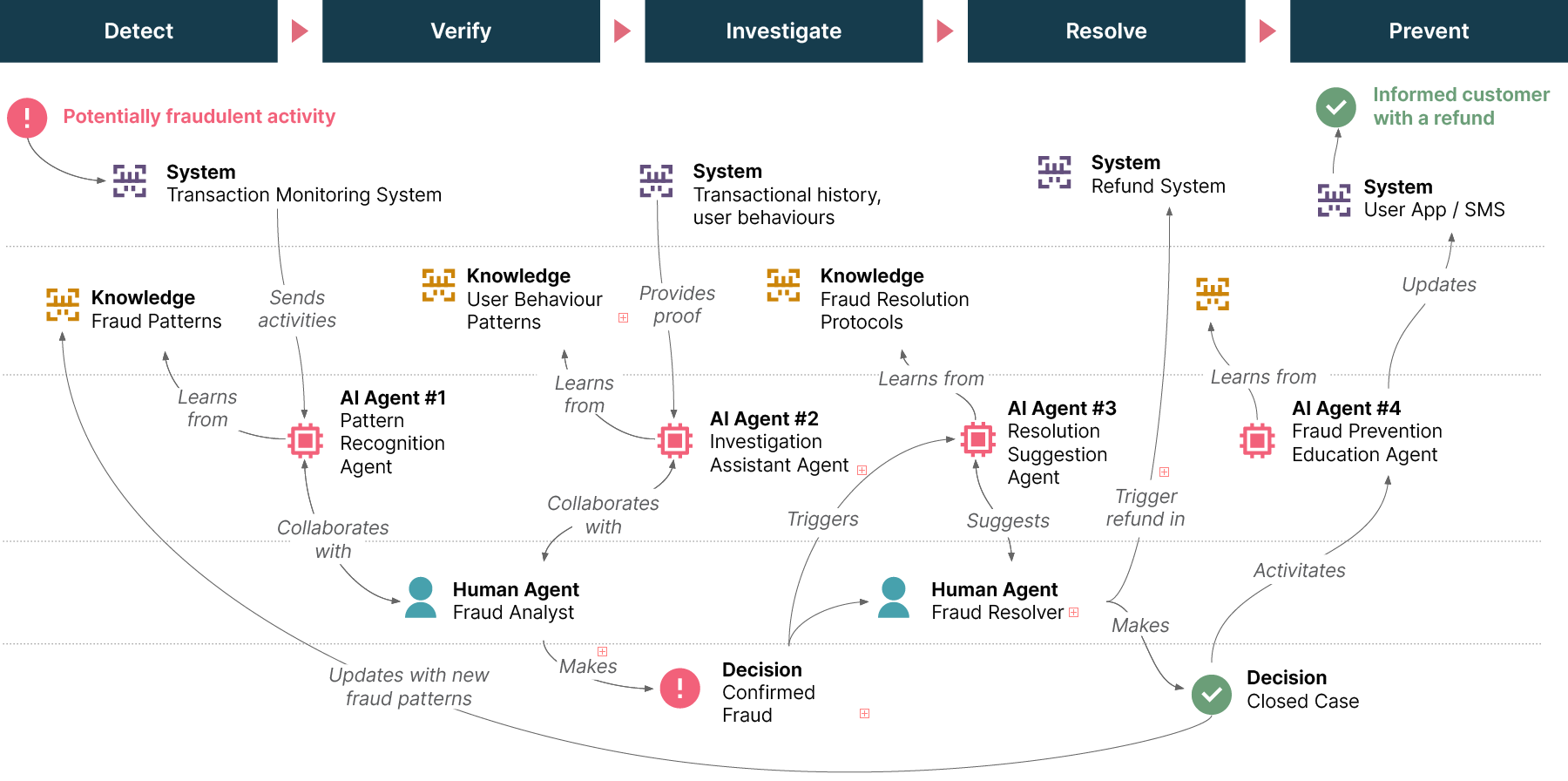

Use case 2 : The multi-agent approach: Bridging gaps in the fraud value chain

This hybrid system integrates semi-autonomous AI agents with human expertise at critical touchpoints, creating a seamless workflow:

- Detect & verify: Collaborative intelligence in action

When a transaction monitoring system flags suspicious activity, AI Agent #1 springs into action. Leveraging historical fraud patterns and client risk profiles, it prioritizes cases and suggests verification steps to a human fraud analyst. Meanwhile, AI Agent #2—armed with deep knowledge of user behavior—cross-references transactional systems to gather contextual proof (e.g., login anomalies, geographic mismatches). Together, these agents provide analysts with a consolidated view, enabling them to make faster, evidence-based decisions.

- Investigate & resolve: Streamlining high-stakes choices

Once fraud is confirmed, AI Agent #3 takes charge. It scans resolution protocols, regulatory guidelines, and past case outcomes to recommend actions, such as refunds or account freezes, to a human resolver. This “co-piloting” model ensures resolvers act swiftly while adhering to compliance standards, balancing operational efficiency with risk mitigation.

- Prevent: Closing the loop with proactive education

Post-resolution, an AI Agent #4 translates case insights into personalized client education. By analyzing the fraud’s root cause, it delivers tailored guidance (e.g., security tips, phishing alerts) via the user’s preferred channels, building trust and reducing future vulnerabilities.

Use case 3: Improving payment personalization via customer agents

To enhance personalization, each agent can provide insights or gather information about the customer from various available channels (e.g., social media, open banking) to make payment messages more personalized. This can be purely customer consent-based data sharing in which the agent can keep track of the data shared and analyze how it can inform better services for the customer, or even additional revenue opportunities. This reduces the need for each player to perform additional work to enhance payment data, which is now automatically enriched based on what each participant chooses to share.

The agent-augmented future

With more payment players enabling their usage, the impact of agents on the payments value chain is only going to increase. Forward-looking institutions like Australia’s Commonwealth Bank are already deploying agents for real-life business use cases such as resolving payment disputes. By embedding AI agents into key decision points, while ensuring that sufficient thresholds and guardrails are in place, organizations unlock scalable and agile tools that can derive more value from the payments ecosystem.

These systems won't replace humans but will instead elevate their capabilities, empowering people to be strategic overseers and rapid responders. Any collaborative frameworks we develop need to be built with sufficient resilience, ensuring that however payments change, the vital role of the human touch and human judgment in delivering customer value and managing risks remains intact.

For more on how Thoughtworks-developed agentic frameworks can enhance security and customer experience throughout digital payment ecosystems, contact us!

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.