Central Bank Digital Currencies (CBDCs) are set to be an integral part of the future of finance. Here’s how they’re going to impact stakeholders across the monetary system.

Yuel Noah Harari describes money as a ‘collective fiction’. As an accepted standard, money takes the form of the unit which is used to price things, which today means that 90% of all money is nothing more than entries in a server.

Ongoing digitalization of the economy is changing the way people pay. The use of cash is currently the only form of central bank money available to the public and is falling in many jurisdictions. It’s a trend that was well underway before 2020, but since the beginning of the pandemic, it’s accelerated significantly.

Taking cash’s place is private digital money and alternative payment methods. More than cash usage and digital payments, it's the rise of Bitcoin and other cryptocurrencies that is providing a threat to the state control over the monetary system.

With more than 6,000 cryptocurrencies now in use across the globe, and one in ten people invested in them, demand for digital currencies has become impossible for central banks to ignore. Faced with a parallel monetary system that’s completely out of their control, central banks around the world are stepping up to create their own digital currency options.

These Central Bank Digital Currencies have far more in common with cash than most major cryptocurrencies, and represent a natural digital evolution of traditional monetary systems. They’re typically backed in similar ways to cash; whether that’s by gold, or by federal reserves. They’re created and offered directly by central banks, rather than generated through hash solving or mining. And they’re far less anonymous than most decentralized cryptocurrencies, increasing their viability at the cost of user privacy.

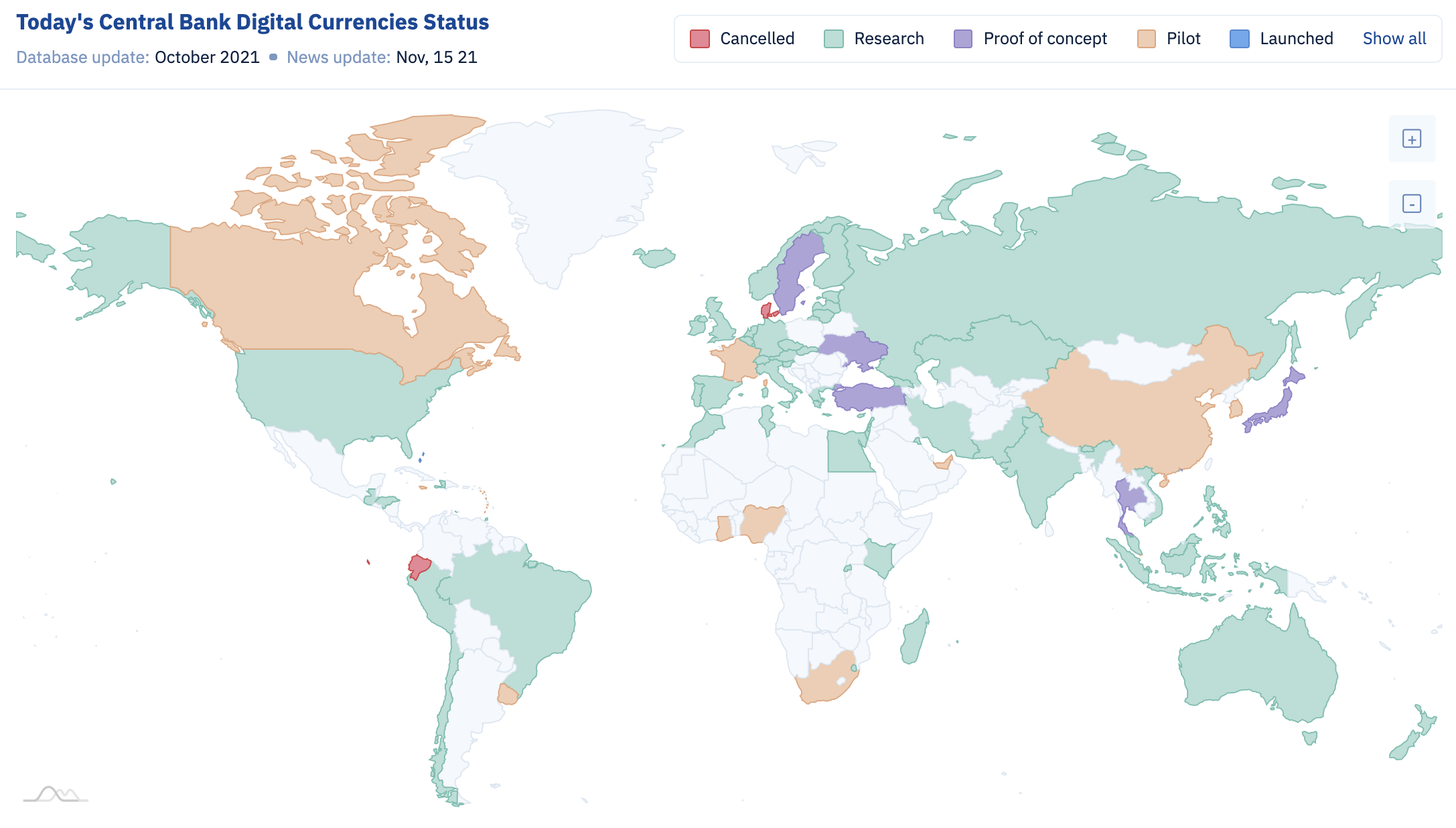

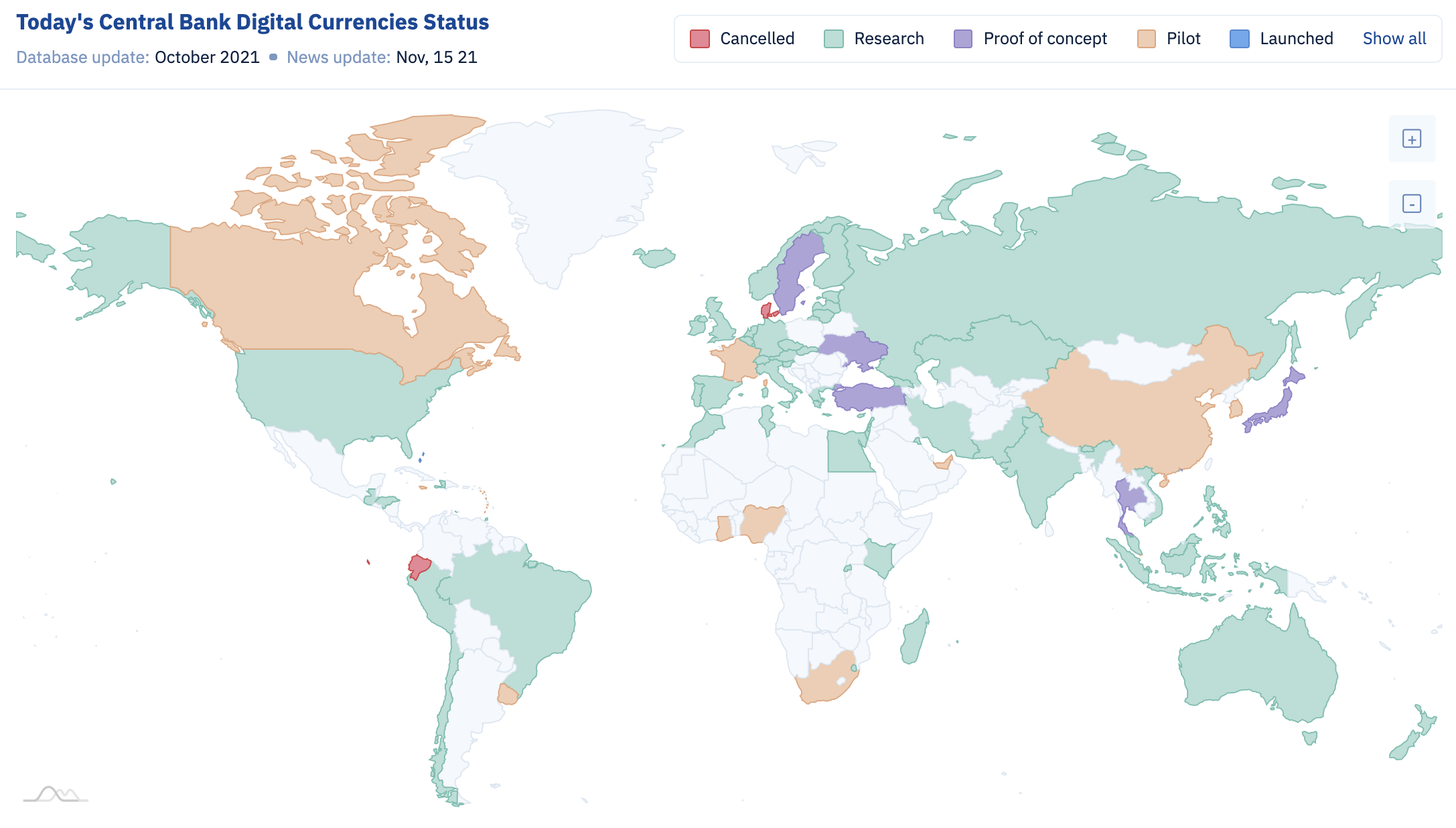

These currencies aren’t a speculative future trend. Central banks everywhere are exploring or actively working on them right now. As the map below shows, there appears to be a global rush to gain first-mover advantage, a shift likely accelerated by a rising global trend away from using the US dollar as the world’s primary reserve currency.

Source: cbdctracker.org

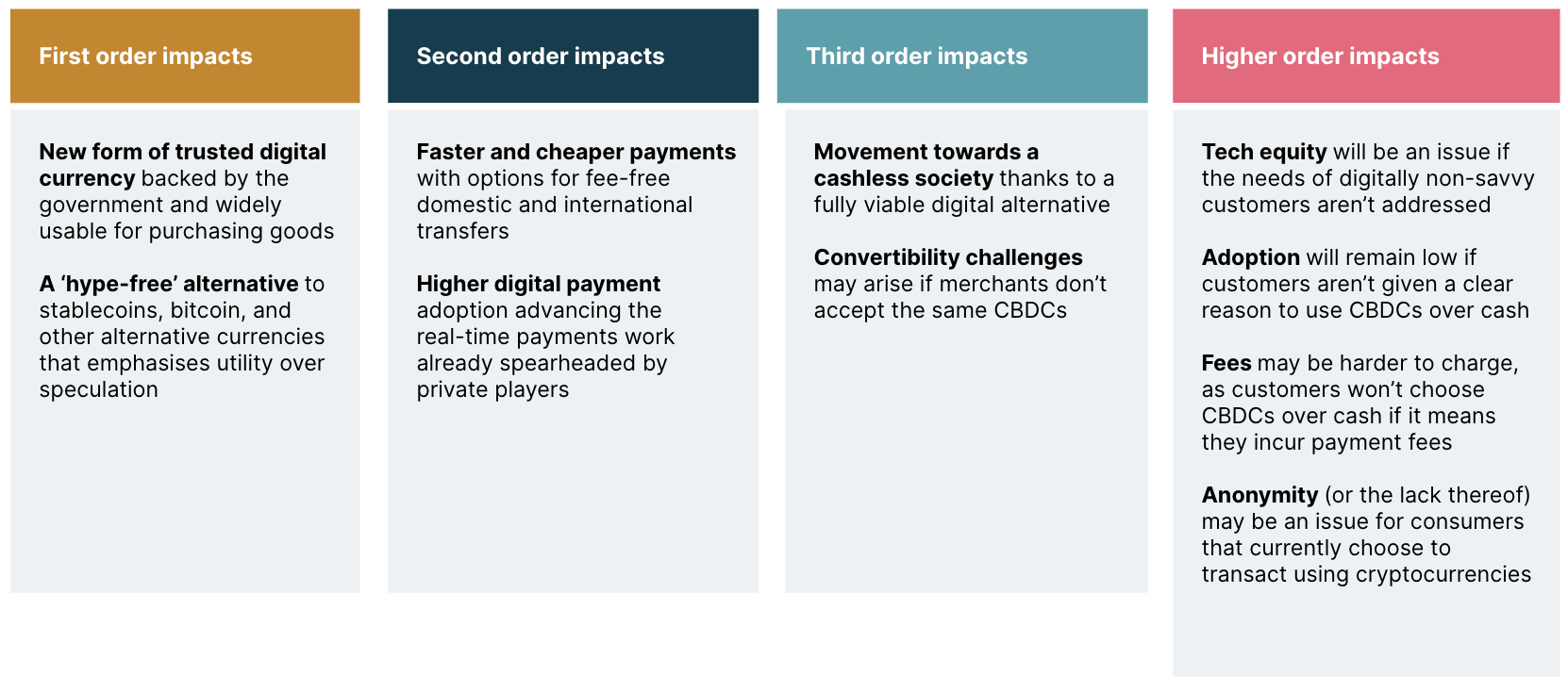

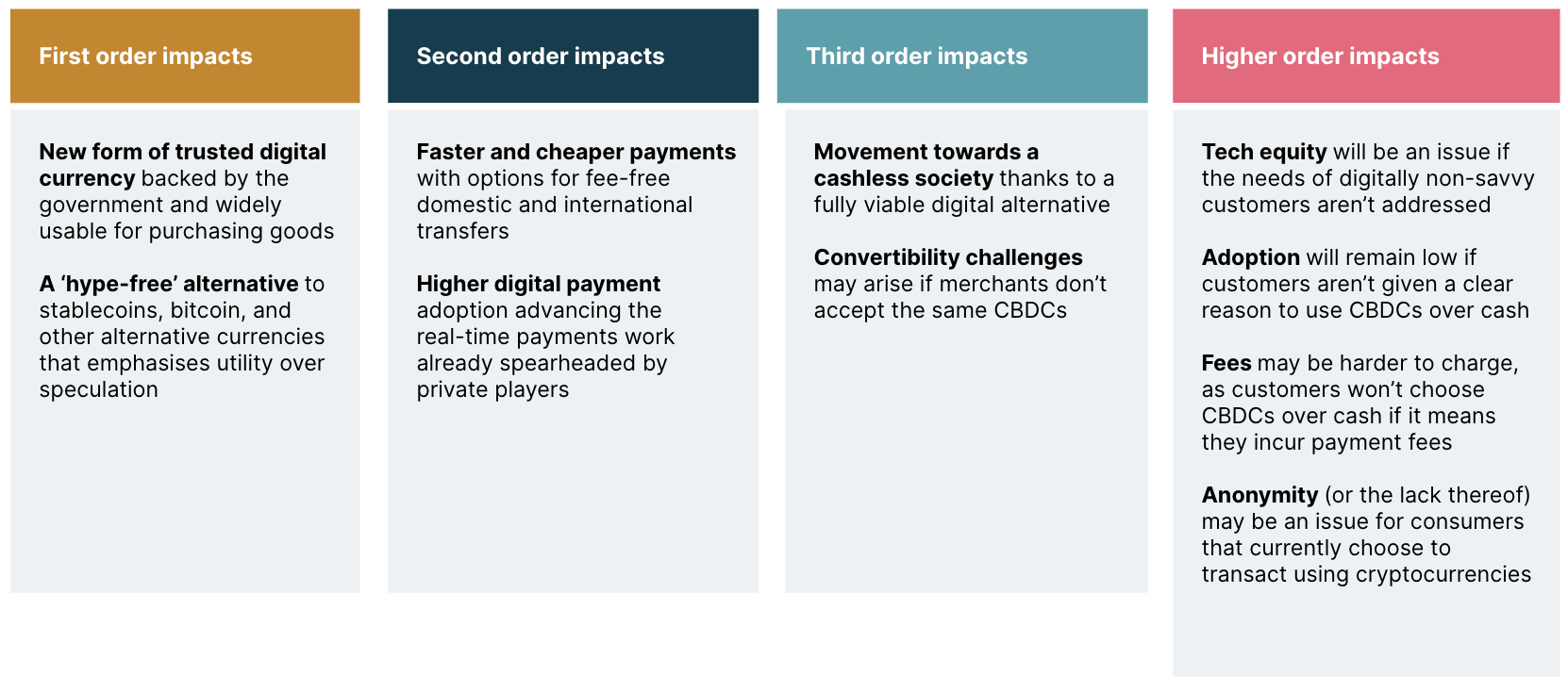

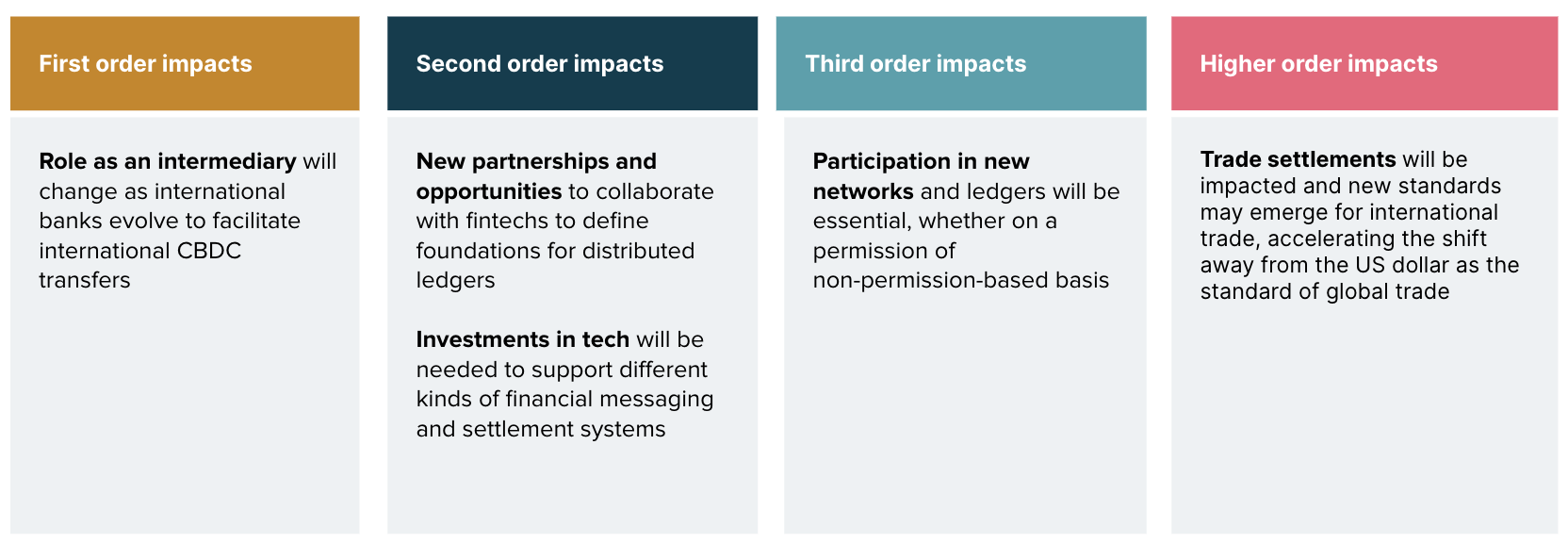

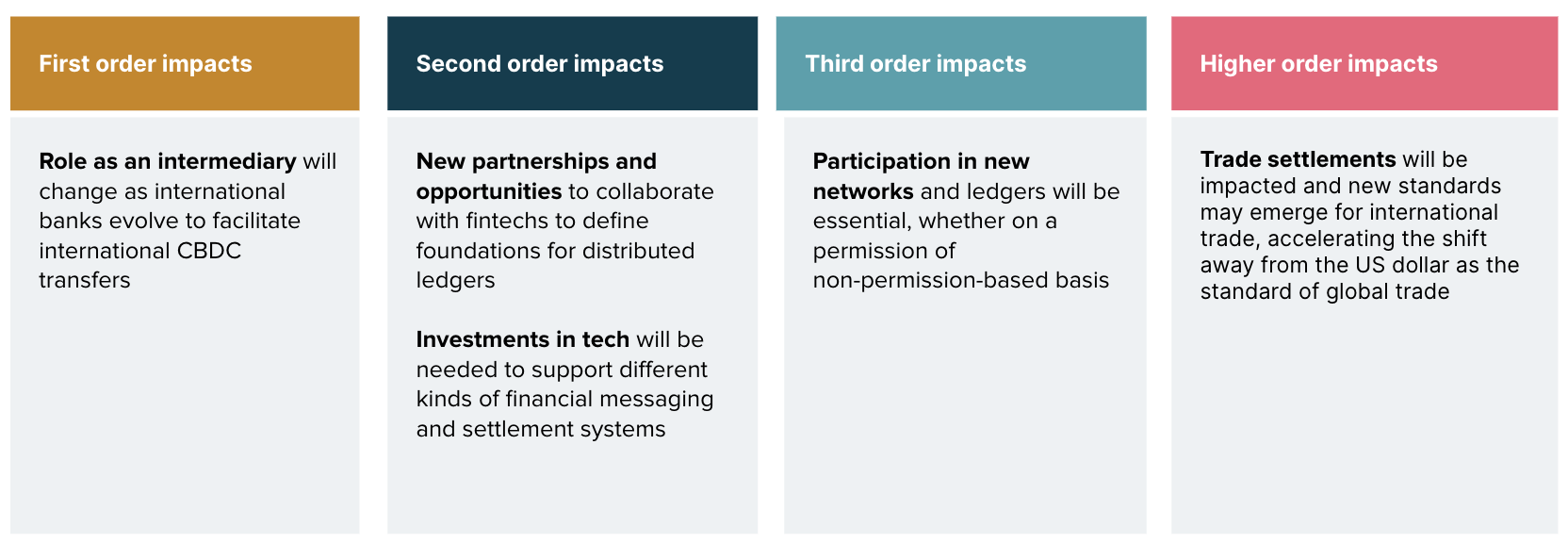

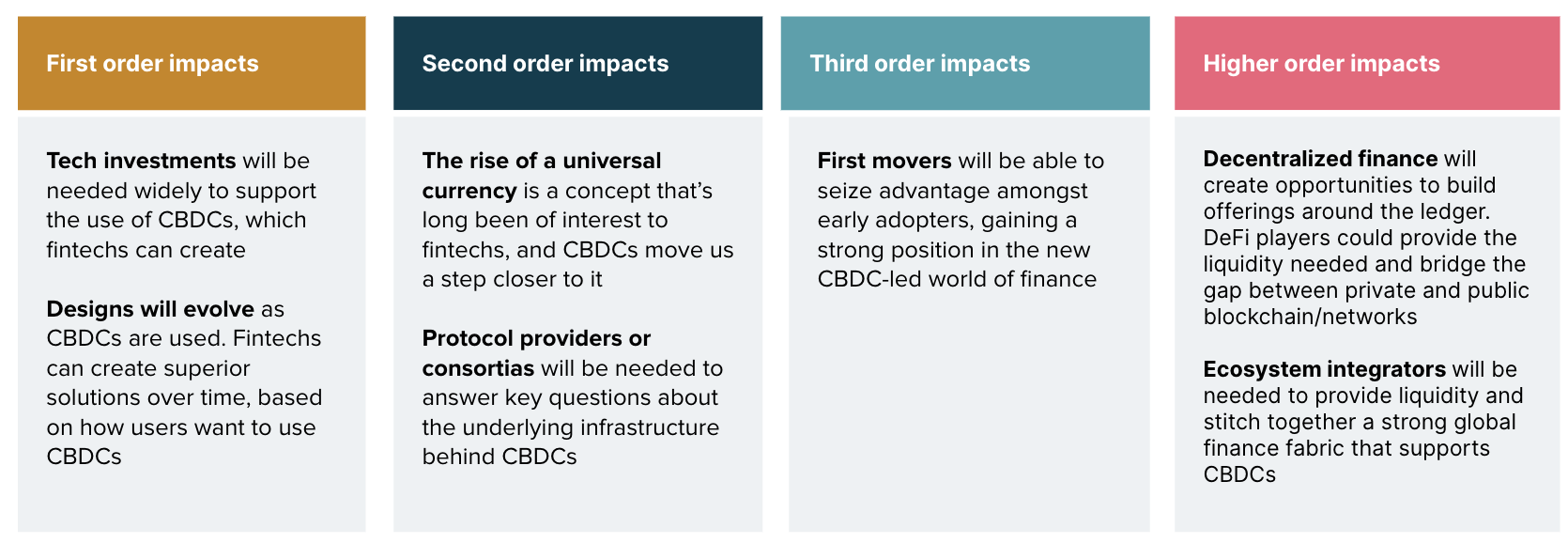

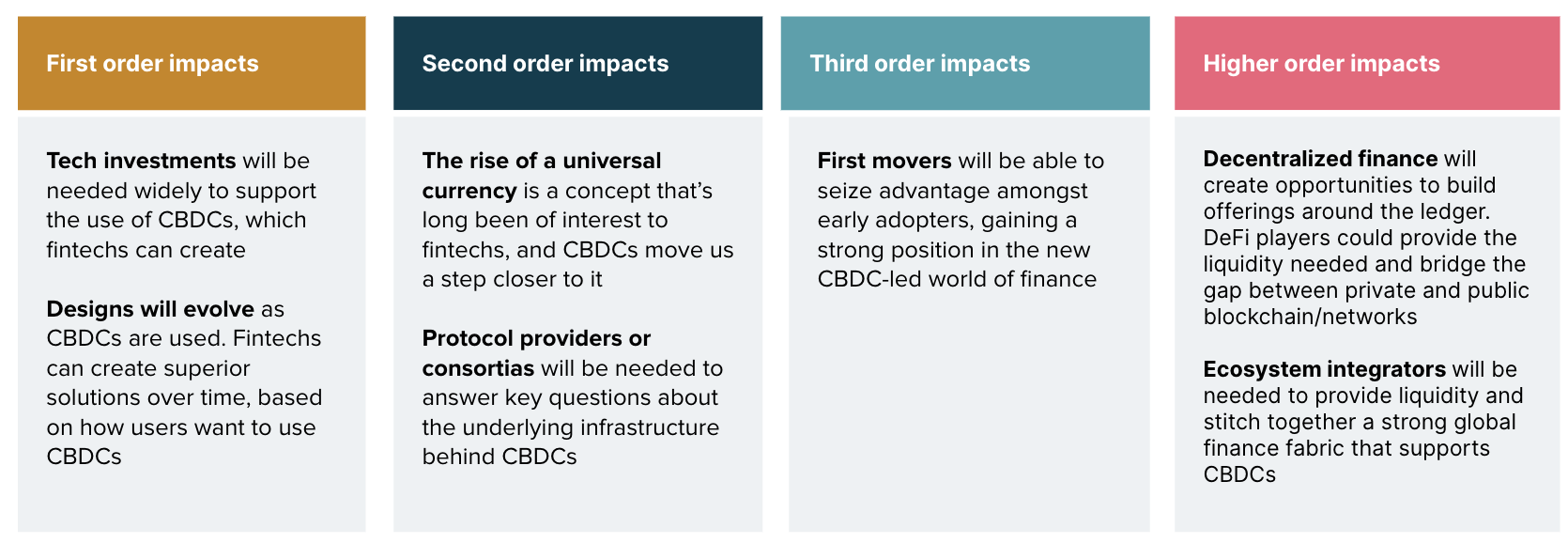

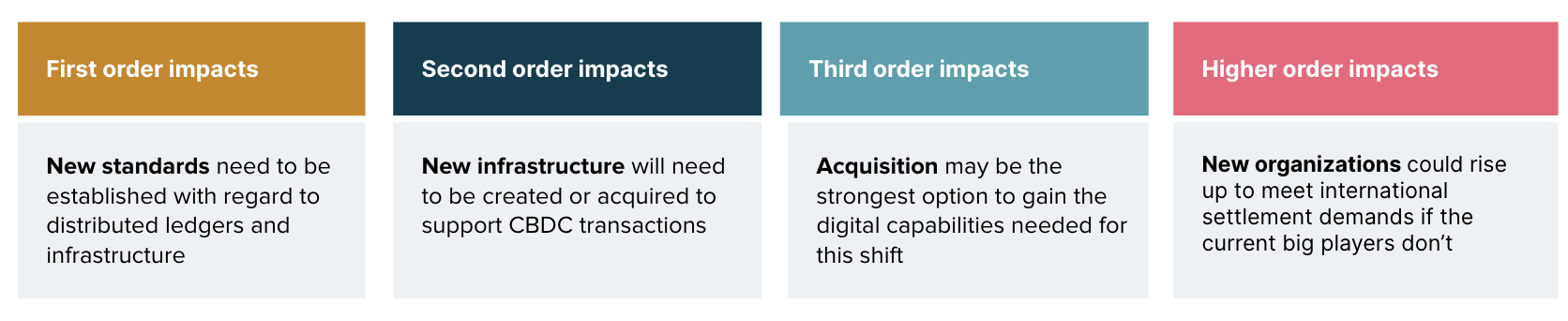

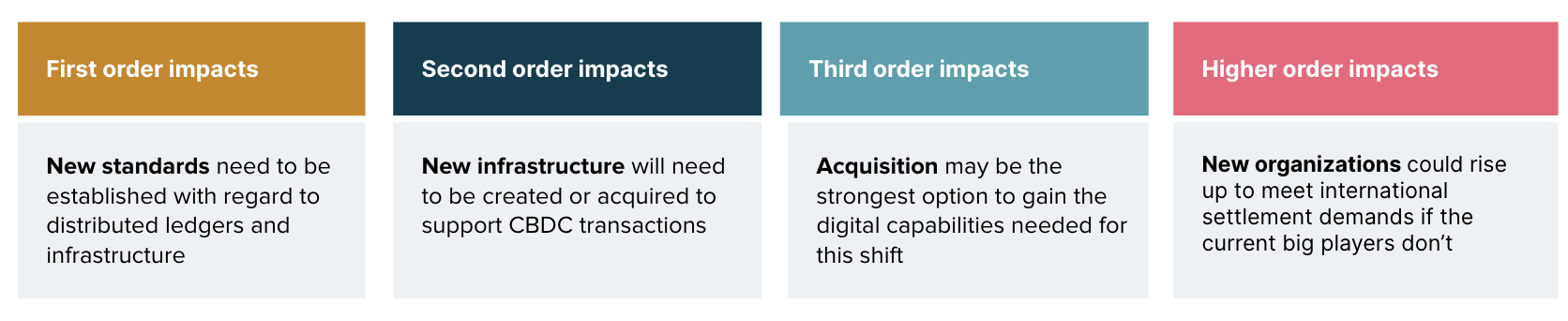

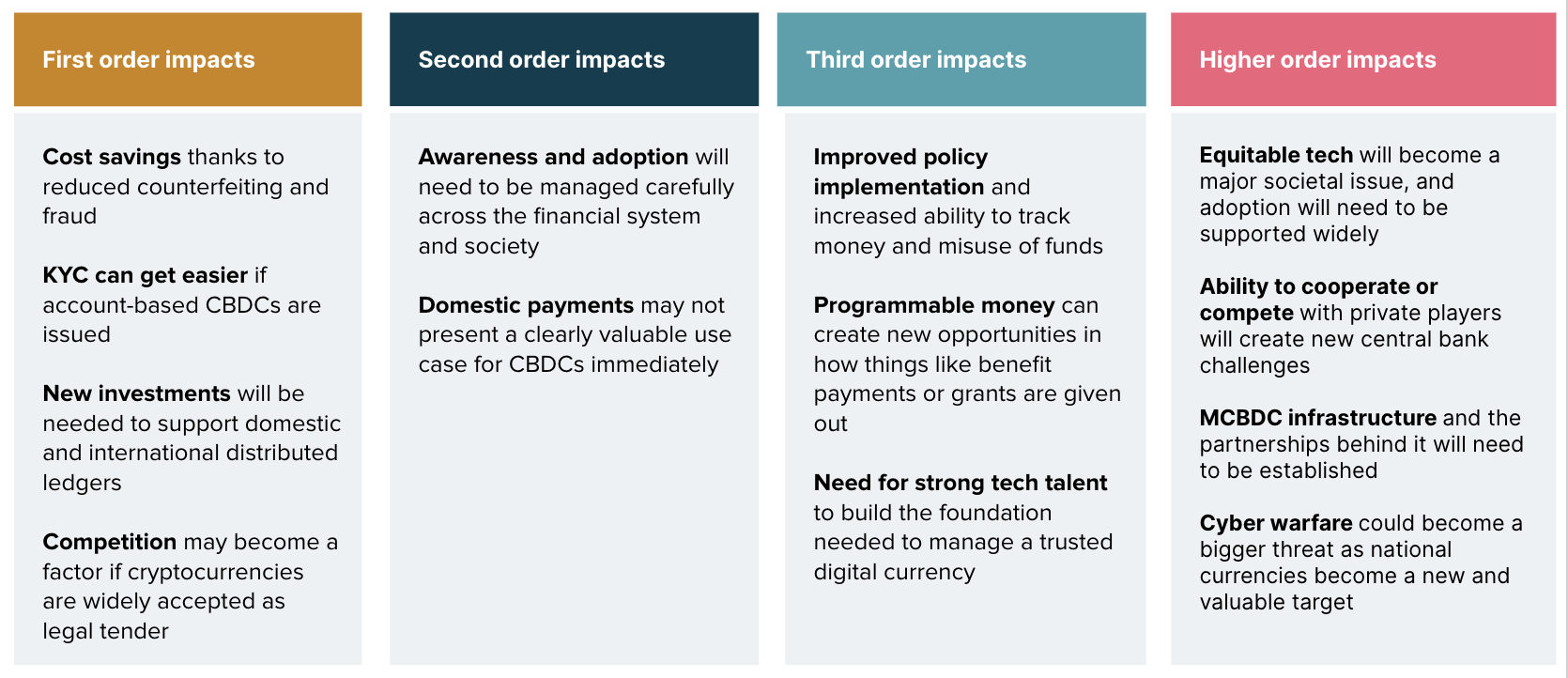

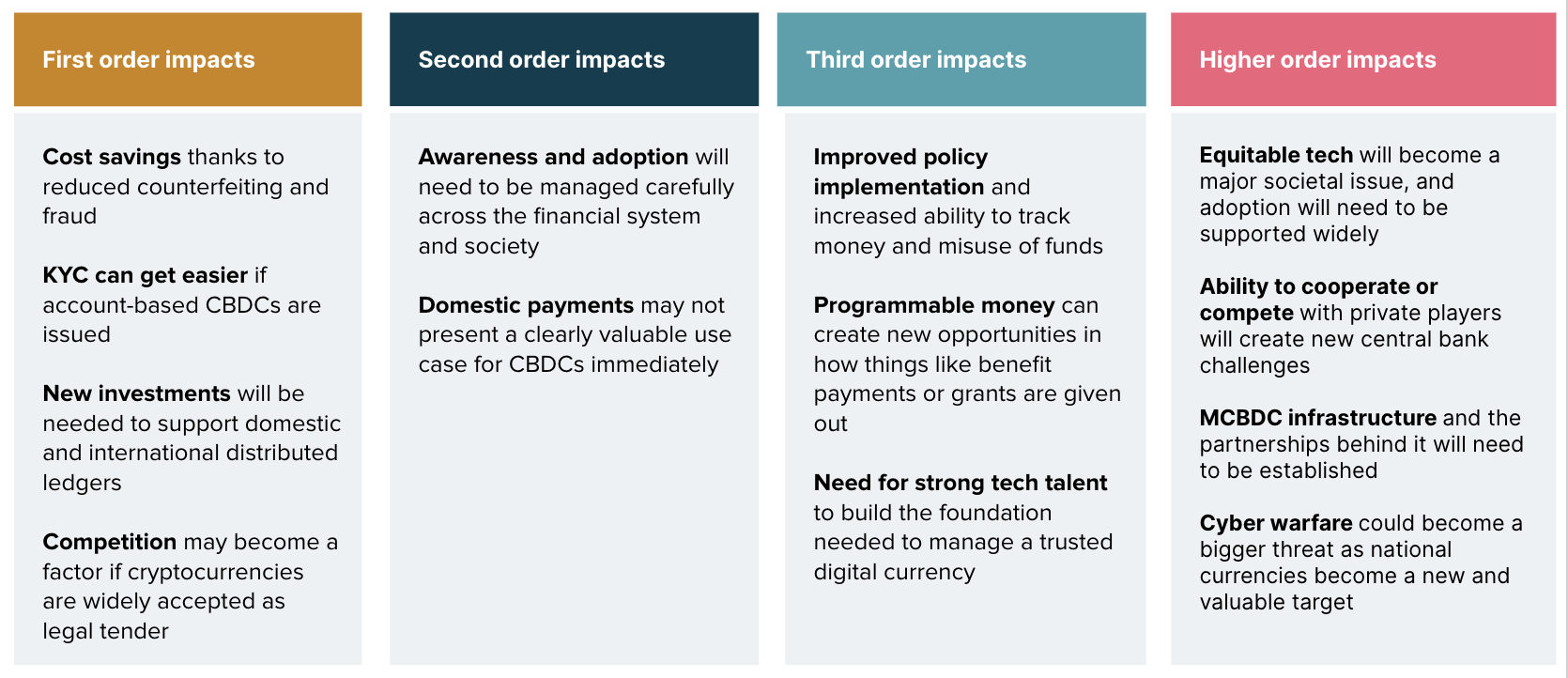

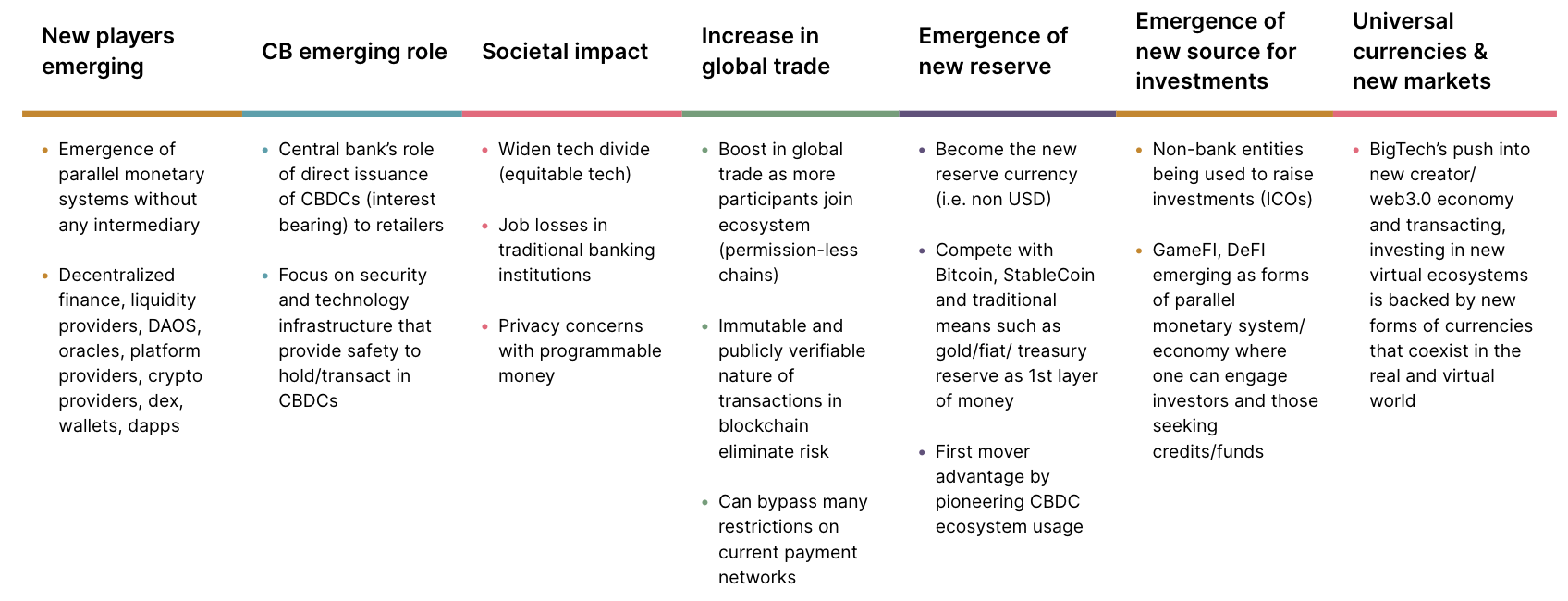

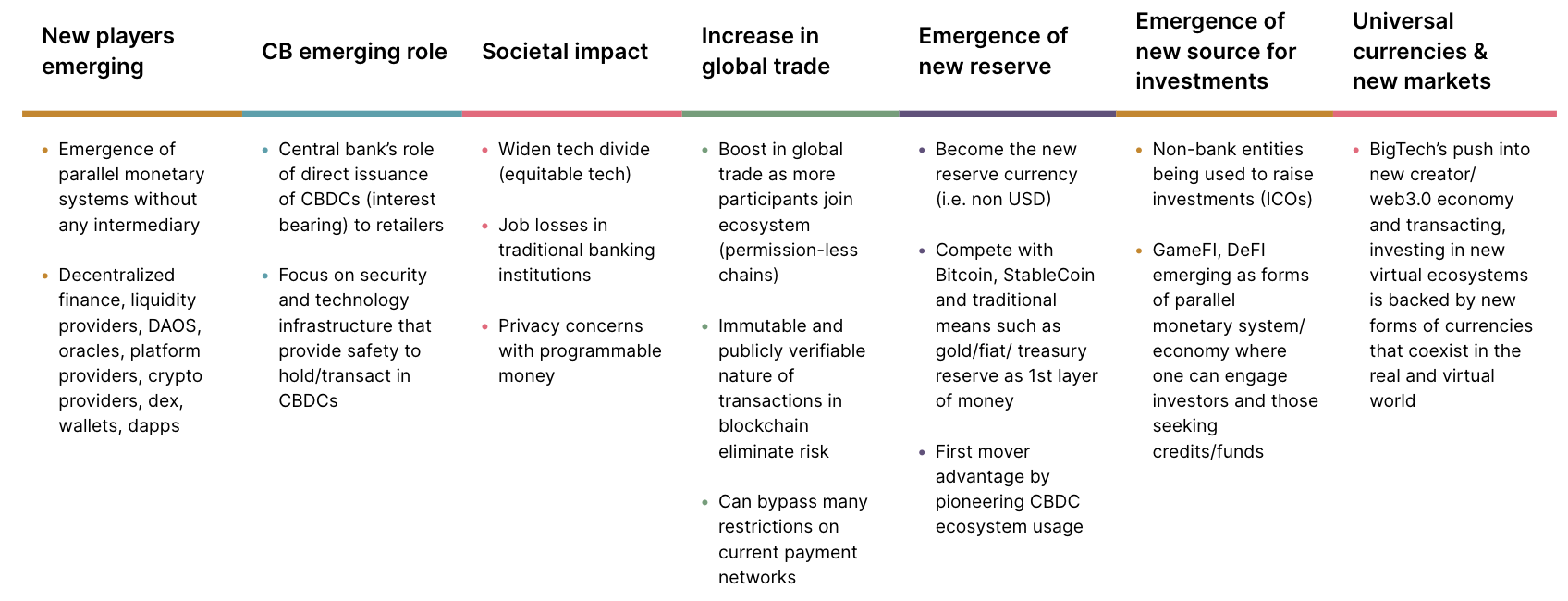

It’s no longer a question of if CBDCs will impact national and international monetary systems, but how it will impact them. To help us understand that, we conducted a Future Wheel exercise to explore how the growth of CBDCs is likely to affect all major stakeholder groups. The diagram shows different levels of impacts (i.e. please refer to the legend in the diagram ) that one needs to consider before embarking on strategic initiatives such as introducing CBDC in a country. Here’s a high-level overview of what we learned.

Future Wheel view to assess the impact of introducing CBDC as a strategic initiative by the central Banks.

Stakeholder group #1: Retail customers

CBDCs provide consumers with convenient digital payment options without exposing them to the volatility of decentralized cryptocurrencies like Bitcoin.

They have the potential to make payments faster and cheaper through immediate domestic and international transfer, as well as enabling fee-free transfers for millions of consumers.

However, retail customers remain one of the hardest groups to convince of the value of adopting CBDCs. If CBDCs carry any restrictions or limitations; if they aren’t accepted by every retailer, for example, then consumers will simply reject them. The needs of non-tech-savvy consumers need to be considered particularly carefully, as adoption may provide particularly challenging for them, and lead to greater tech inequality across society.

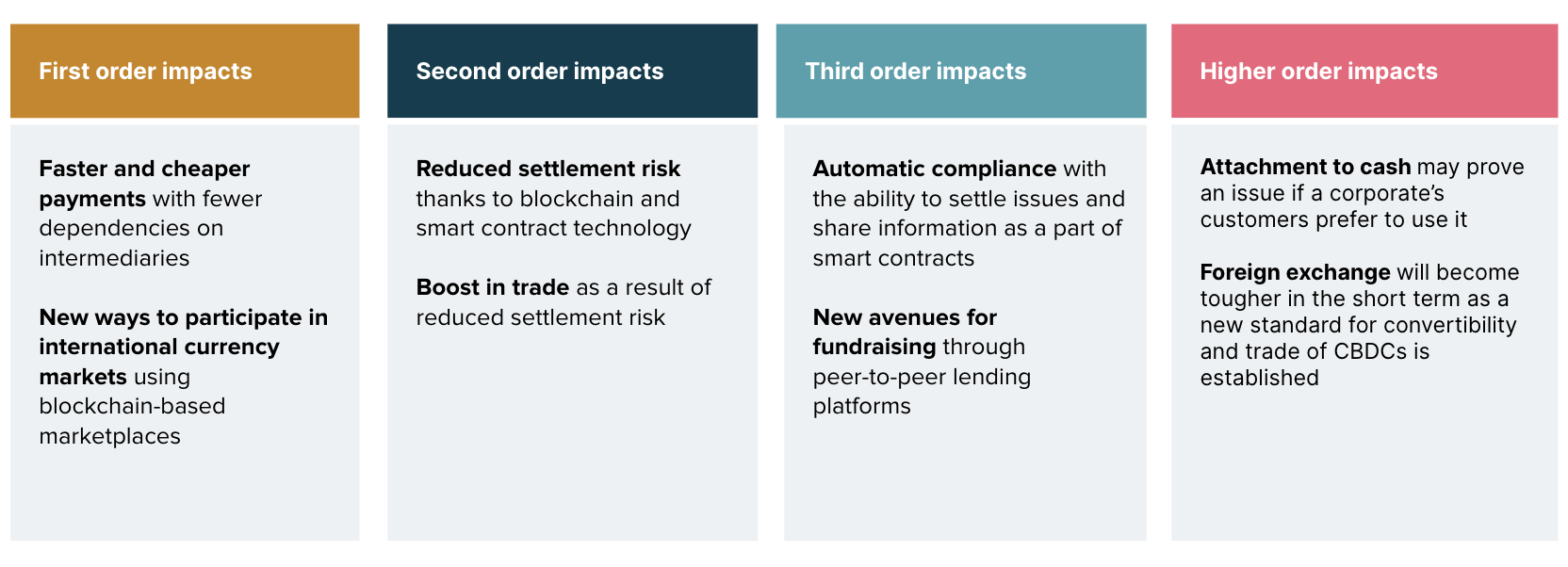

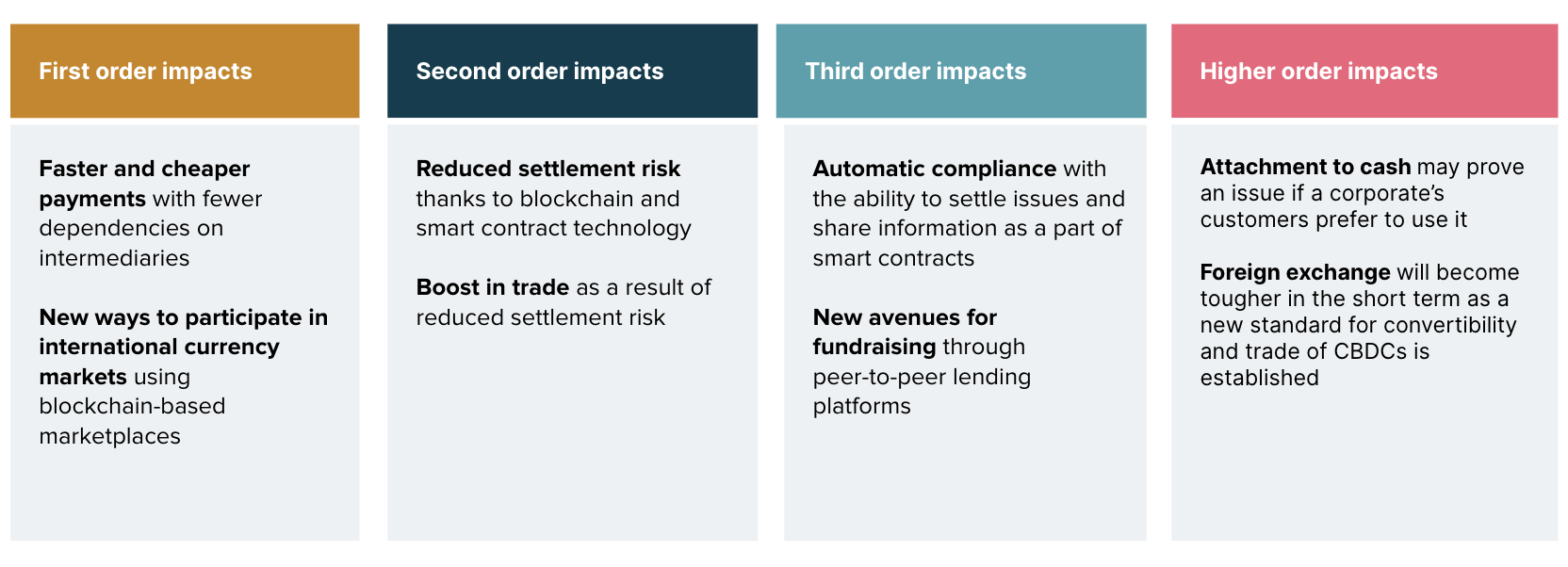

Stakeholder group #2: Corporate Customers

Corporate customers are largely already aware of the value and potential of digital currencies. They understand the advantages, and are excited about the potential of CBDCs to reduce international transfer costs and times without any of the uncertainty and settlement risk of transacting with cryptocurrency. In fact it has been projected that disintermediated cross border payments would bring in savings of about $100 Billion.

Corporate customers perhaps stand to gain more than any other stakeholder group from the widespread adoption of CBDCs. By enabling the use of smart contracts, CBDCs could be used to automatically pay taxes or make other payments to the government as a part of routine transactions. Plus, digital audit trails can simplify and streamline financial compliance.

However, the shift will cause far-reaching changes in how businesses operate and transact with one another. It’s important to note that in order to gain the benefits, corporate customers will have to navigate a period of transition, evolution, and confusion at some levels of the business as they adapt to transacting with CBDCs.

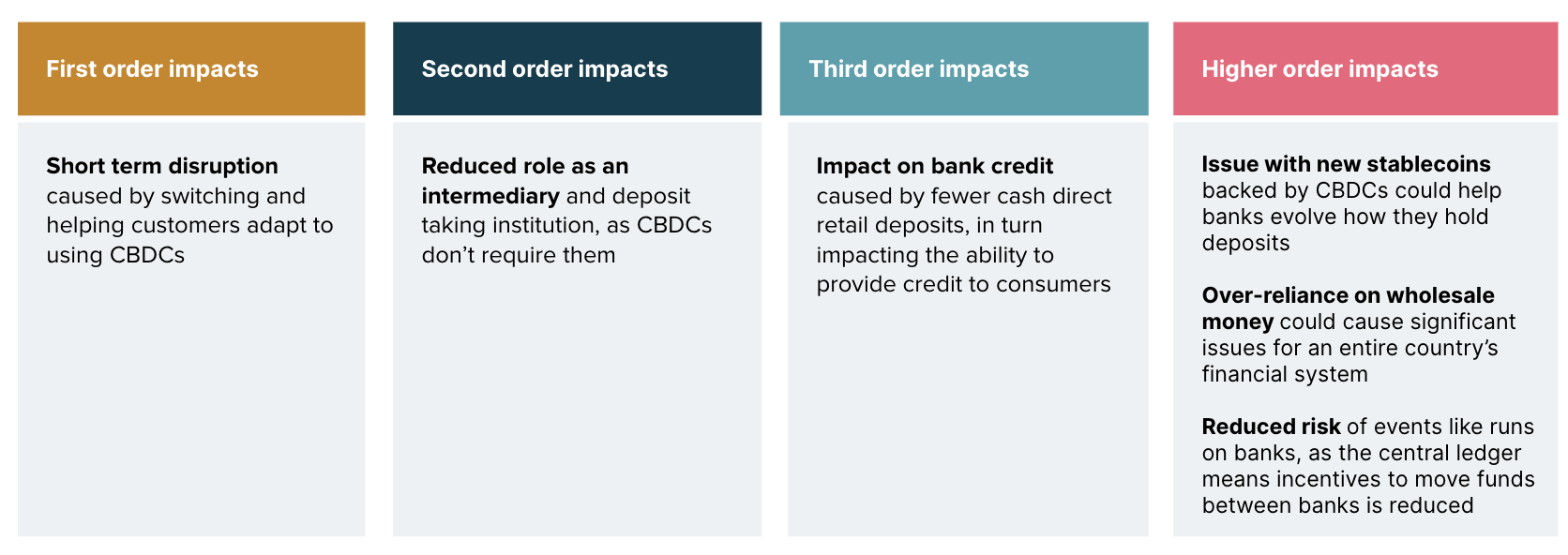

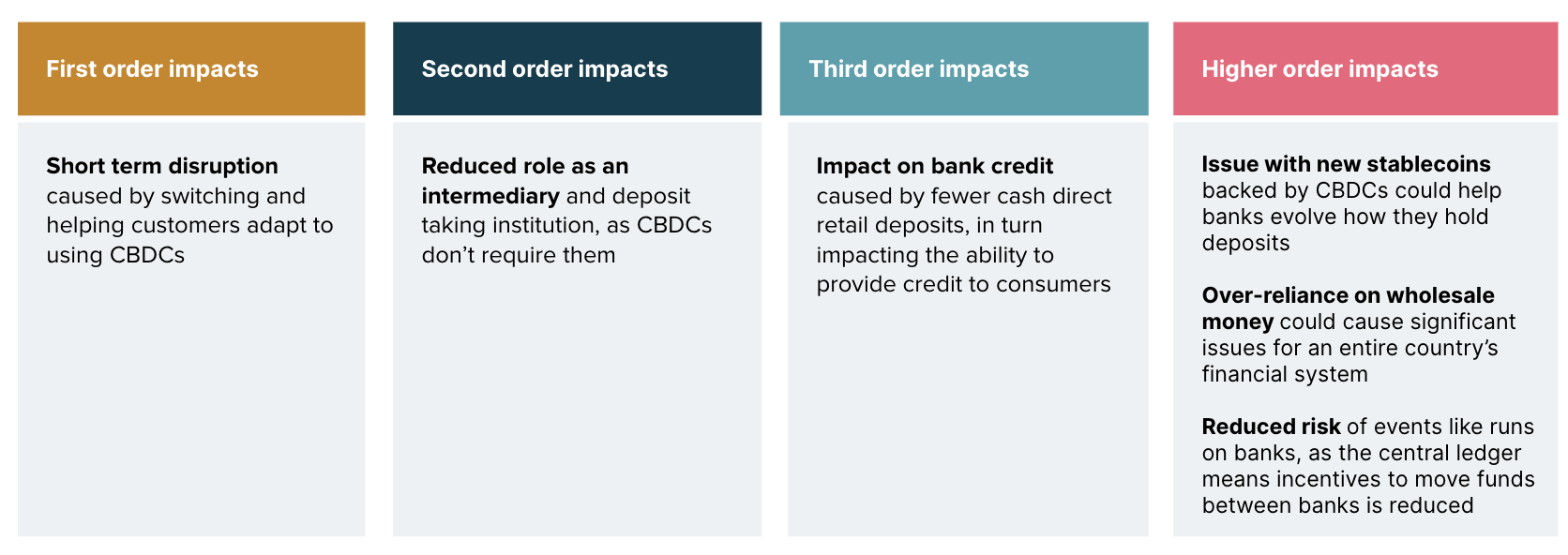

Stakeholder group #3: Domestic banks

For domestic banks, views of CBDCs aren’t quite as positive. When central banks issue a digital currency directly, and provide interest on it, domestic banks’ roles as a deposit-taker and essential intermediary are undermined.

Less deposit-taking means fewer resources to work with, which in turn limits a domestic banks’ ability to provide credit to customers. In that sense, the growth of CBDCs represents a real threat to current domestic banking operating models, which is a big reason why many banks like JP Morgan have taken major steps towards offering their own stablecoins that they can control.

Credit unions and co-operative banks in particular will likely struggle with this shift, as their customer base is very cash-oriented, and will take a long time to warm up to using CBDCs as their primary currency.

Stakeholder group #4: International banks

CBDCs have the potential to completely transform the role of international banks. One of the biggest barriers to widespread CBDC adoption is the enablement of international and cross-currency trade. If international banks can step up as intermediaries to facilitate those transfers, they stand to be successful in the global CBDC-driven economy.

It’s a shift that will require those banks to participate in new networks, work with new digital ledger types, and collaborate with fintechs. Creating the infrastructure needed to support international CBDC transfers at scale carries a significant resource and innovation burden in the short term. But it’s an essential step for those that want to take their place at the core of this new monetary era.

Stakeholder group #5: Fintechs

For fintechs, CBDCs are creating new opportunities to innovate at all levels. From building user-friendly transaction services for consumers, to helping create a stable and scalable foundation for cross-currency transactions, the shift toward cashless digital finance represents the largest opportunity fintechs have seen to date.

Stakeholder group #6: Financial network players

Domestic and international CBDC transactions demand new standards that have yet to be set. Banks will likely want to work alongside established blockchain innovators to determine the best standards for their currencies and establish a robust distributed ledger infrastructure.

If they want to remain key players in the CBDC-driven global economy, today’s major financial network organizations, like Swift, Visa and Mastercard, will need to consider their position in this emerging space and ensure they have the skills, capabilities, and technologies to provide that foundation.

Stakeholder group #7: Central banks

For central banks themselves, CBDCs represent a huge shift in operations. They can significantly reduce the costs of printing, transporting, and managing cash, freeing up resources to meet the new challenges of CBDC management. And they can fight fraud automatically, thanks to policies embedded within currency and transaction code.

But with the arrival and growth of those currencies will come significant shifts in global geopolitics. Desire to move quickly and seize first-mover advantage, the creation of a new global reserve currency, and increased threat of disruption by decentralized finance players could all fundamentally transform the global financial and political landscape.

CBDCs have implications for every data-driven element of finance. From managing Know Your Customer data to tracking illegal activity across billions of transactions, the detailed audit trail that comes with a digital currency can help tackle some of central banks’ biggest challenges.

However, those benefits demand a steep upfront cost. Securing buy-in from all stakeholders won’t be easy — especially at the consumer level. Retraining and re-education will be necessary, new infrastructure will need to be established, and central banks will have to define and master a new era of digital finance.

It’s a big journey, but it starts with the right preparation and partnerships

There’s no doubt that the move to CBDCs is a daunting undertaking for central banks. But, just like the move to cash, it’s a necessary step to support the evolution of our society and monetary system. Using strong simulation models can help central banks answer important questions like whether they should focus on retail or wholesale money first, and whether cash and CBDC should co-exist or not. Those tools might not provide exact definitive answers, but they’ve given central banks strong indications that make the shift far less of a leap into the unknown.

Above are some of the areas of impact that CBDC strategists need to be aware of and adopt a multi-disciplinary approach to address.

Now, as central banks look to the future and imagine what their own CBDCs and the systems surrounding them might look like, they must consider two things: the skills and capabilities they’ll need to get there and how they’ll test their hypothesized currency implementations.

Thoughtworks has been supporting financial institutions with complex implementations and technical decision-making for decades. Today, we help banks perform complex research simulations to model proposed technical changes, using tools such as agent-based modelling which has been very effective in assessing the impact of such strategic initiatives on the overall system. And we provide them with expert knowledge of foundation technologies, including blockchain, distributed ledgers, and smart contracts, to bring the right versions of their ideas to life.

To find out more about how we can help you make the right CBDC decisions, navigate this highly technical evolution, and deliver the right results for every stakeholder across the monetary system, talk to us today.