In this article, Thoughtworks colleagues explore approaches to driving innovation and greenfield efforts in established financial services firms.

Across the industry, there is a growing divide between financial services firms that are thriving and those that are struggling. Successful financial services (FS) firms are able to adapt and innovate in line with changing customer expectations. The firms that are unable to adapt are destined for stagnation or decline (some 50% of the banks globally are already value destroyers, while another 35% will not be able to continuously create value, McKinsey, 2022).

Despite the economic headwinds and major structural changes affecting the sector, successful FS firms continuously bring innovative new products and reinvent business lines. For example; Goldman Sachs launched Marcus, an online platform offering personal loans and savings accounts to retail clients. JP Morgan launched its digital bank in 2021 in the UK under the Chase brand. Santander developed its platform PagoNxt, a one-stop shop for innovative payments and integrated solutions. Barclays Bank teamed up with Amazon to enter the lucrative 'buy now, pay later’ (BNPL) market.

In contrast to the outperformers, there are many financial services firms that struggle to innovate. Reasons range from missing strategic drivers for innovating, budgets absorbed by the ‘run the bank’ priorities to aversion to risk-taking and other factors. These constraints are further compounded by the difficulty in attracting top tech and product talent who prefer cutting-edge innovative firms.

In our experience, the strong antidotes for constraints to innovation in financial services firms involve the following:

1. Define the innovation agenda and the path to its execution

Attempts at innovation in the form of Innovation Labs, Digital Accelerators, and similar initiatives sprang up often in the FS firms, usually to explore new cutting-edge technology. Often, these initiatives fizzle out as they aren’t aligned with the business drivers. Outperformers ensure that the innovation strategy is defined in direct response to the business imperatives, this includes identifying key drivers (a combination of customer needs and market dynamics) and defining values and measures to guide the progress.

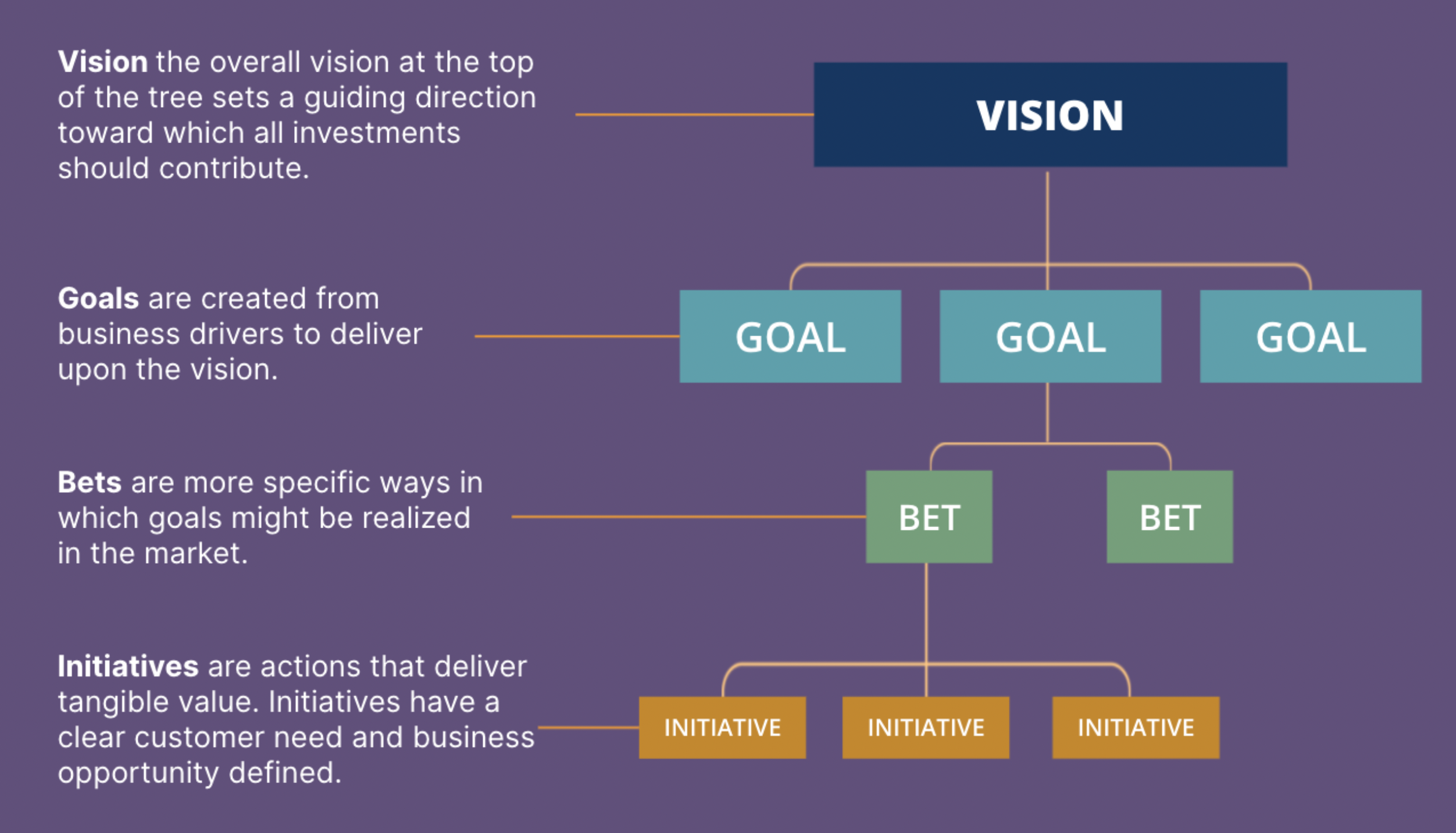

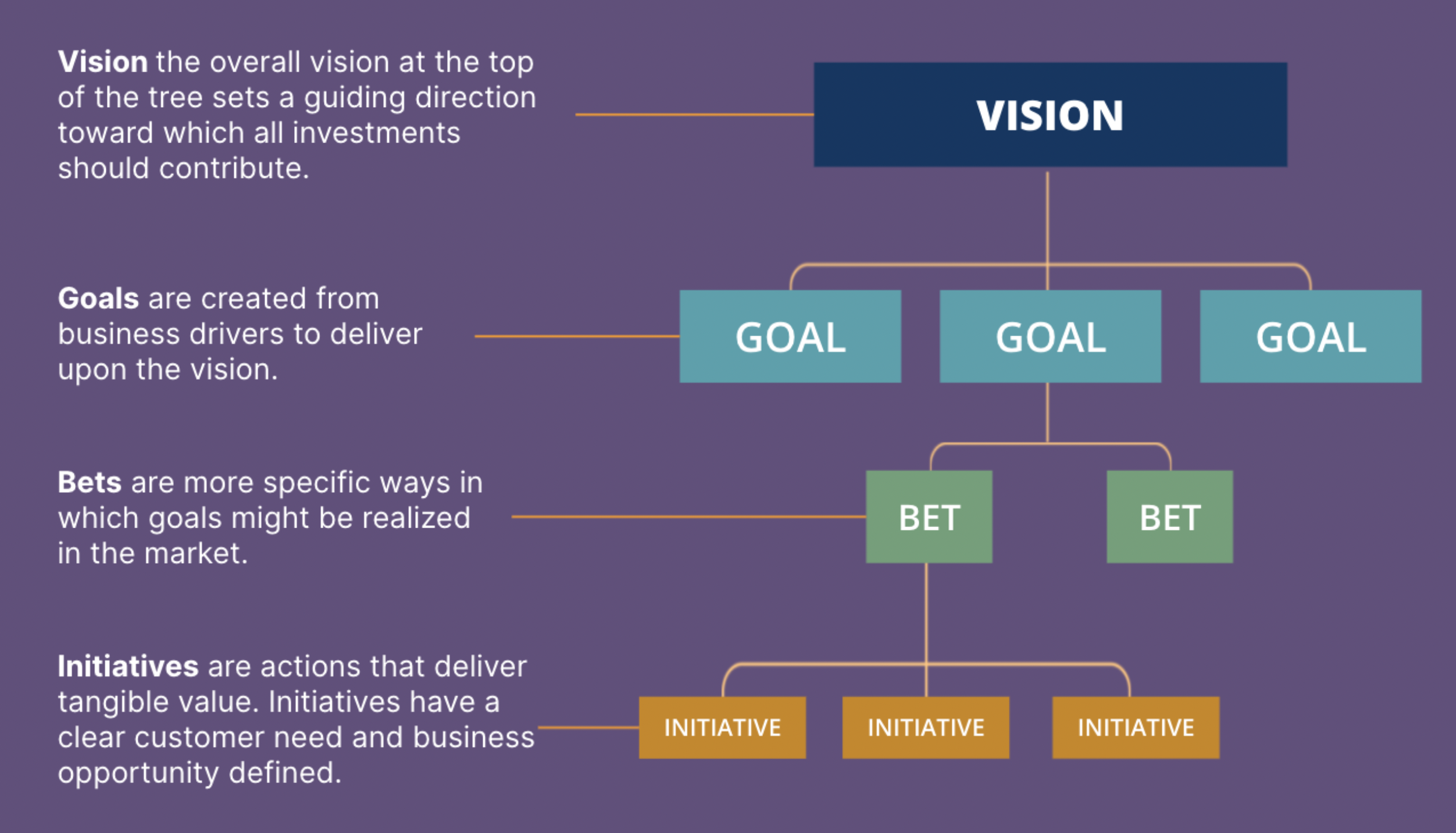

We recommend Lean Value Tree (LVT) to define the path to the innovation strategy execution. The figure below illustrates how LVT works - the strategic vision cascades into a number of bets firms should be willing to take, and the vision is realized through concrete initiatives for prioritization and funding. LVT is an essential element of EDGE, an operating model for the digital age.

2. Prioritize investment across short and long-term horizons

Large financial services firms dedicate an overwhelming proportion of their IT budgets to the ‘run the bank’ activities, over 80% by some estimates (Itopia, 2019). The focus on short-term priorities in financial services is further evident in the expectations of quick commercial pay-offs, closely aligned with annual bonuses.

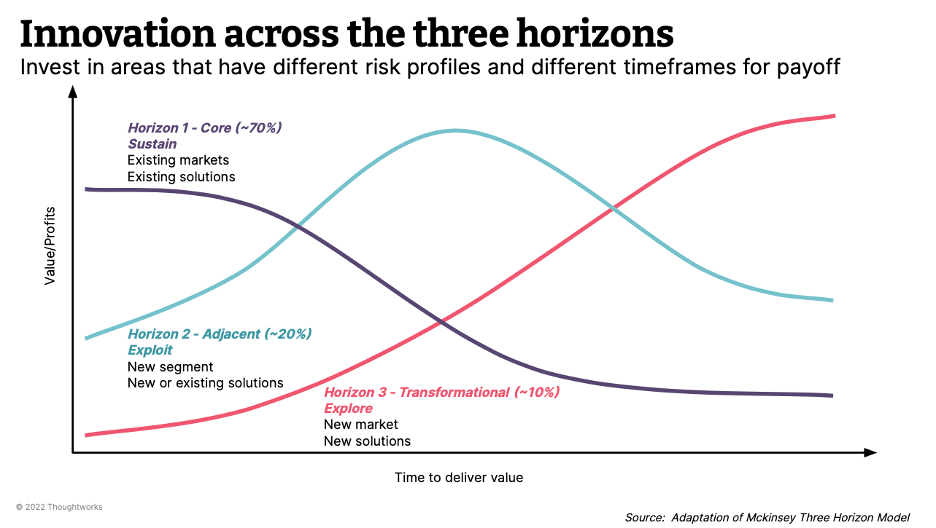

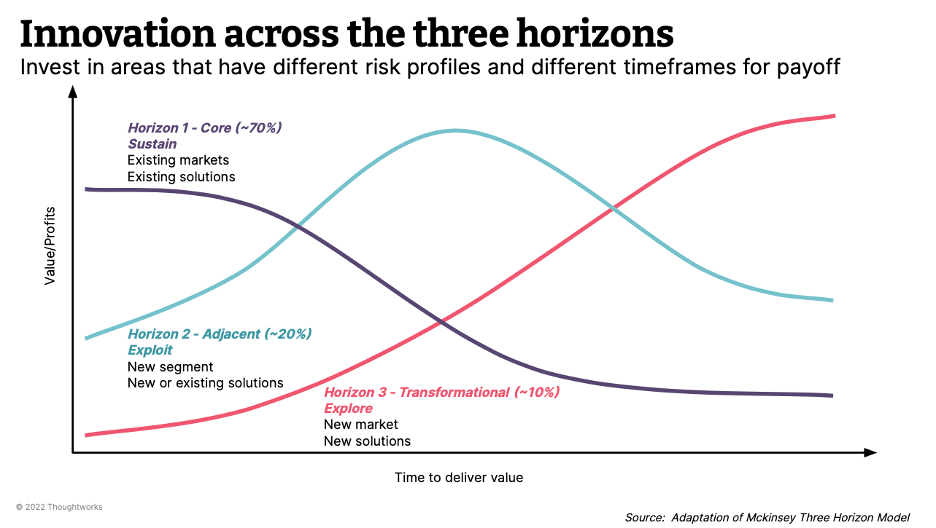

For an enterprise to succeed in the long term, it is important to think beyond short-term priorities and invest in the future drivers of growth. A helpful way to think about it is to visualize enterprise innovation priorities across three horizons with 70:20:10 investment allocation (figure below):

Horizon 1 focuses on the core that represents sustaining existing business and immediate priorities.

Horizons 2 consists of ideas and initiatives aimed to extend the current business model and capabilities.

Horizon 3 focuses on transformative opportunities and developing new capabilities to counter emerging disruptive forces. This segment is critical for long-term success.

The bulk of innovation budgets should concentrate on Horizon 1 initiatives, while funds are still allocated appropriately to Horizons 2 and 3.

3. Define an innovation framework to funnel ideas

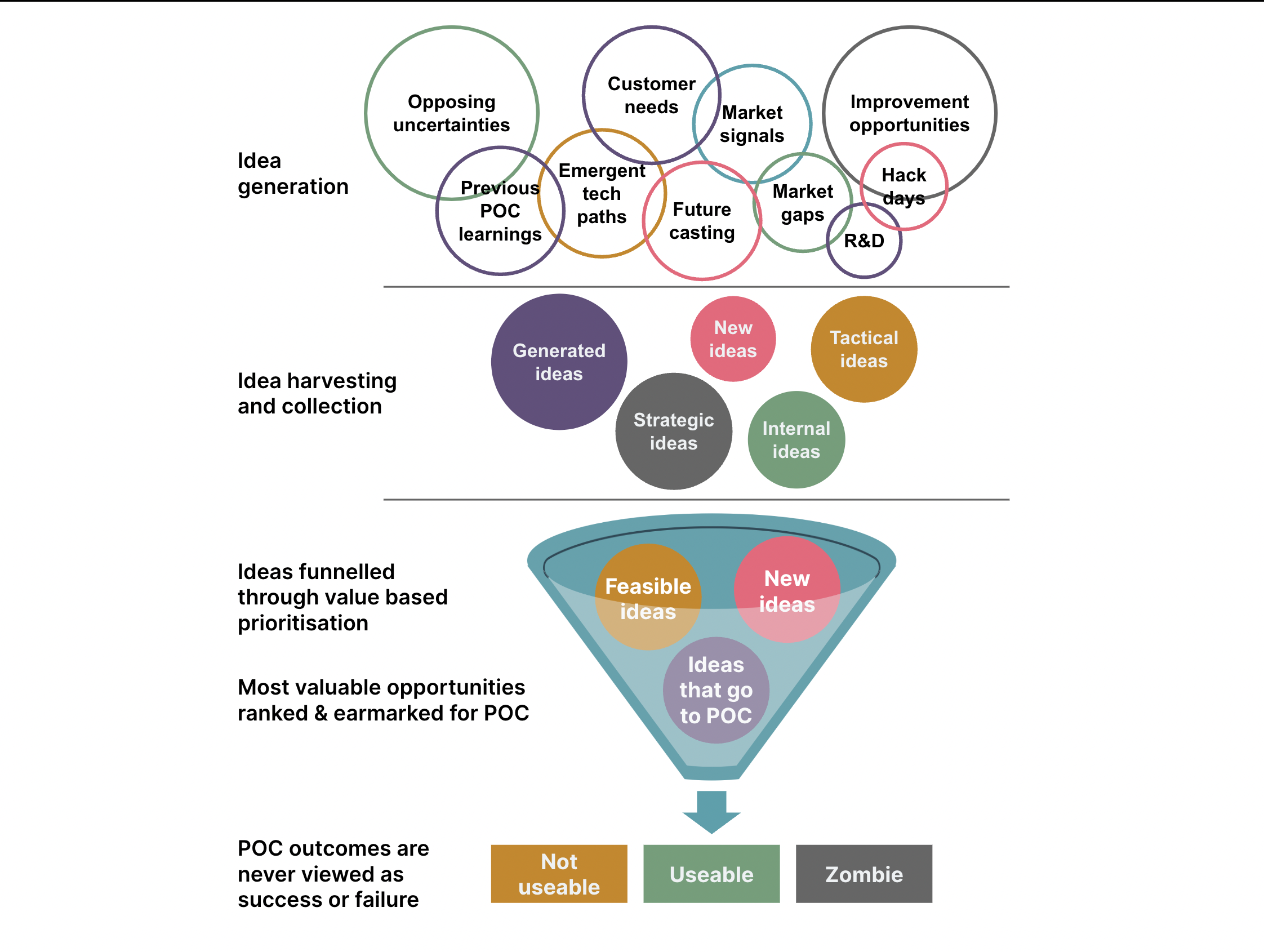

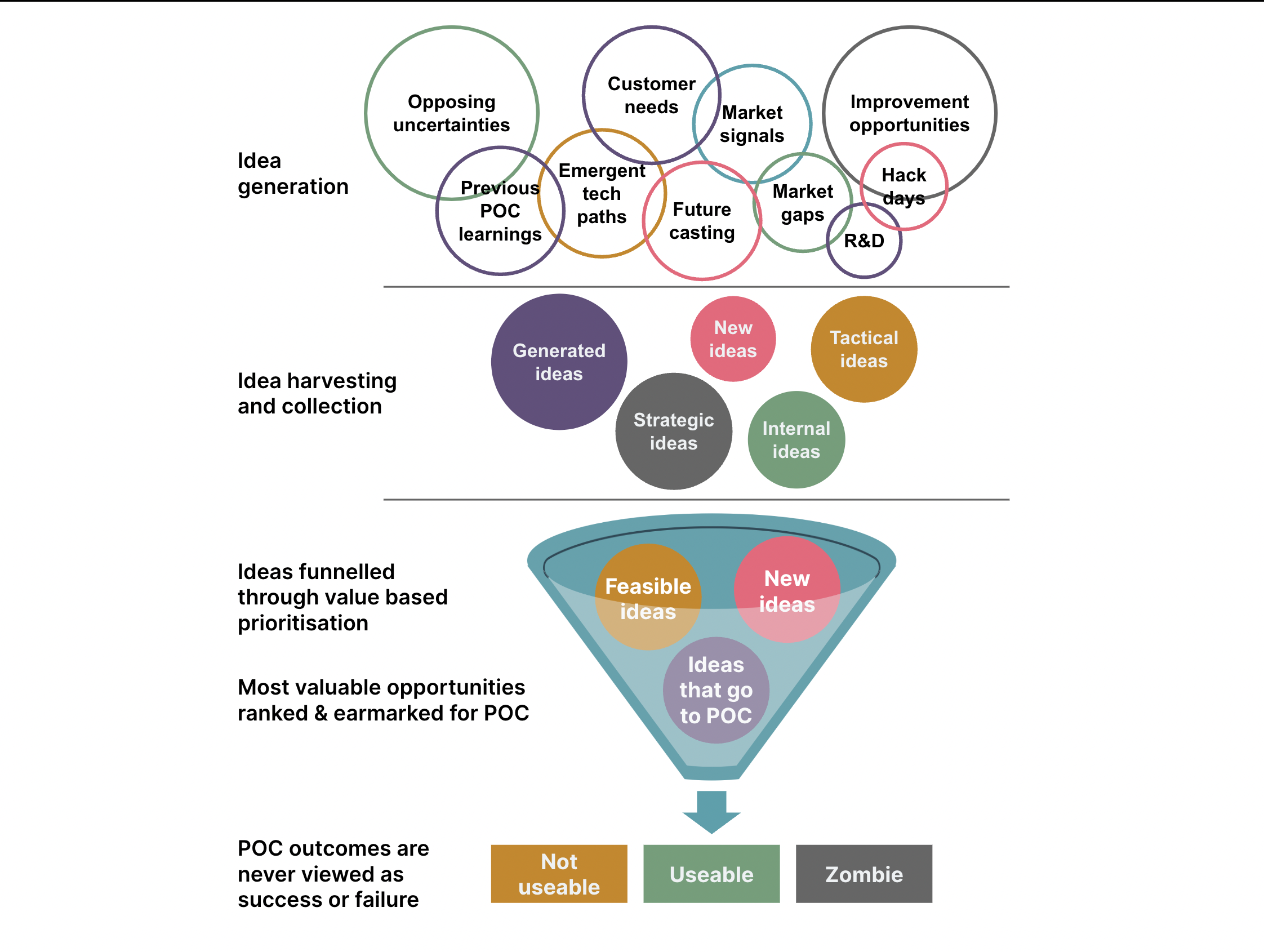

A well-defined process can pave the way from idea generation to execution. This organizational process should be an enabler in exploring and validating innovative emergent technologies, and business models that generate new revenue streams, brand equity, and disruptive competitive advantage.

The initial stages of the process should allow for divergent thinking, picking up signals from the market and customers to develop a wide range of ideas. Subsequent steps funnel the candidate ideas for testing in the market as POCs (proof of concept).

Critical to success in driving innovation in traditional FS firms is reframing ‘failure’ as a learning opportunity, as inevitably not all POCs will succeed whereas outcomes could serve as valuable indicators of where to pivot and what other opportunities to explore. The figure below demonstrates what the innovation process could look like:

4. Minimize the risk with experimentation and validation of ideas

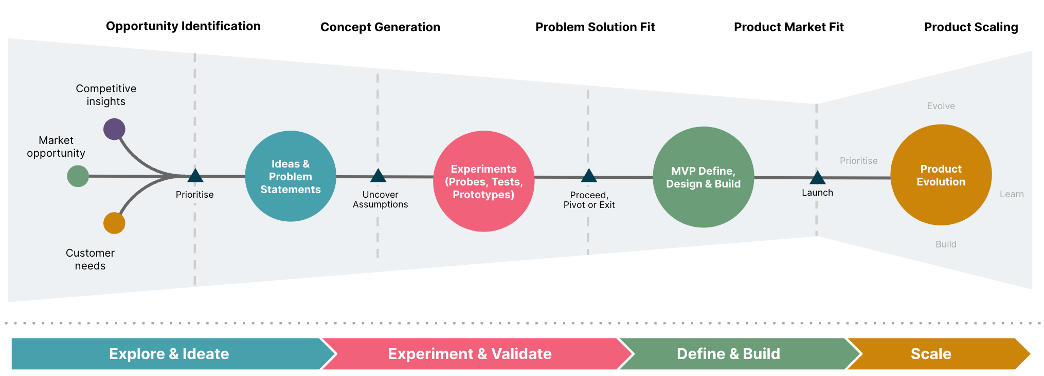

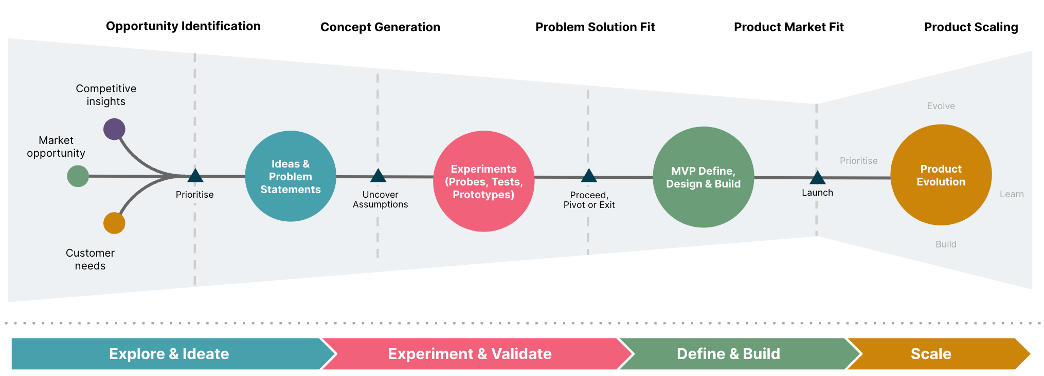

In the aftermath of the global financial crisis, FS firms went from being only too willing to take risks to become highly risk-avoidant. Taking ‘bets’ or calculated risks is an essential element of innovation, as not all initiatives are destined to succeed. Risk elements however can be minimized if innovation is framed in terms of experiments and validation of new ideas before committing to them fully.

At Thoughtworks we place experimentation and validation at the heart of the new products development process (figure below). This involves defining the hypotheses for the potential idea, prioritized based on customer and market insights, and running experiments to validate this idea. Results from experiments will inform whether the idea is worth the time and investment into MVP (minimum viable product) to validate its commercial potential.

To further alleviate risks inherent in untested ideas, we advocate Lean Experimentation - time-boxed, low-investment experiments led by a small, cross-disciplinary team to rapidly explore emerging tech prototypes to validate an idea or solve a problem statement.

We apply our field-tested frameworks, with a heavy emphasis on experimentation, to ensure the success of innovative initiatives for our clients:

Thoughtworks worked with the syndicate VAKT, to develop the blockchain energy trading platform; it attracted two-thirds of the deals in North Sea crude oil trading.

Standard Chartered’s innovation lab engaged Thoughtworks to explore how the future of banking could look with immersive technologies.

Thoughtworks supported the fintech B-Social to bring the idea of 'social banking' to the market. The effort was driven by a lot of lean experimentation to find the product market fit.

5. Nurture innovation capabilities

Finally, successful innovation needs the right capabilities and mindset in the organization. In our experience, the hallmarks of innovation maturity for FS firms include:

- Outcome-based investment: funds gradually released to the initiatives with concrete business outcomes (e.g. increase in MAU (monthly active users), AUM increase, improved retention rate). This is opposite to traditional output-based thinking, where spent on projects allocated at the start of the year regardless of outcomes.

- Evidence-based decision making: decisions about the future of the product or service are made based on solid data rather than ‘executives' intuition’. Preference is for data on leading indicators early in the product life cycle (e.g. customer interest in a new product), vs lagging indicators (e.g. profitability metrics).

- Value-driven ways of working: work is prioritized based on the value for the customers and the business. Agile cross-functional teams are best placed for value-driven ways of working.

- Technology at the core: modern engineering practices (e.g. platform thinking, DevOps, microservices architecture) to deliver products and services optimized for performance, scaling and incremental innovation.

- Customer experience orientation: customers and their needs are at the center of product decisions and evolution.

FS firms that are able to thrive despite their significant constraints demonstrate that it is possible to create ripe conditions for innovation in the enterprise. With the pace of change continuing to accelerate, financial services firms need to start building their innovation agendas in order not to be left behind.