Read the full report

This chapter investigates how businesses are using technology today, and how this impacts future growth prospects, sector competitiveness and business confidence. The research looks at how companies around the world are using technology to compete across a number of key business areas and how frequently C-suite decision-makers discuss technology in management meetings.

1. Businesses switching on to technology possibilities

In an increasingly digital world, technology proficiency matters. Companies need more than awareness of the latest innovations; companies must understand how technological innovations can be applied across all areas of the business — utilizing data and analytics, improving customer experience, product innovation, effective use of cloud technology, or investing in digital transformation programs.

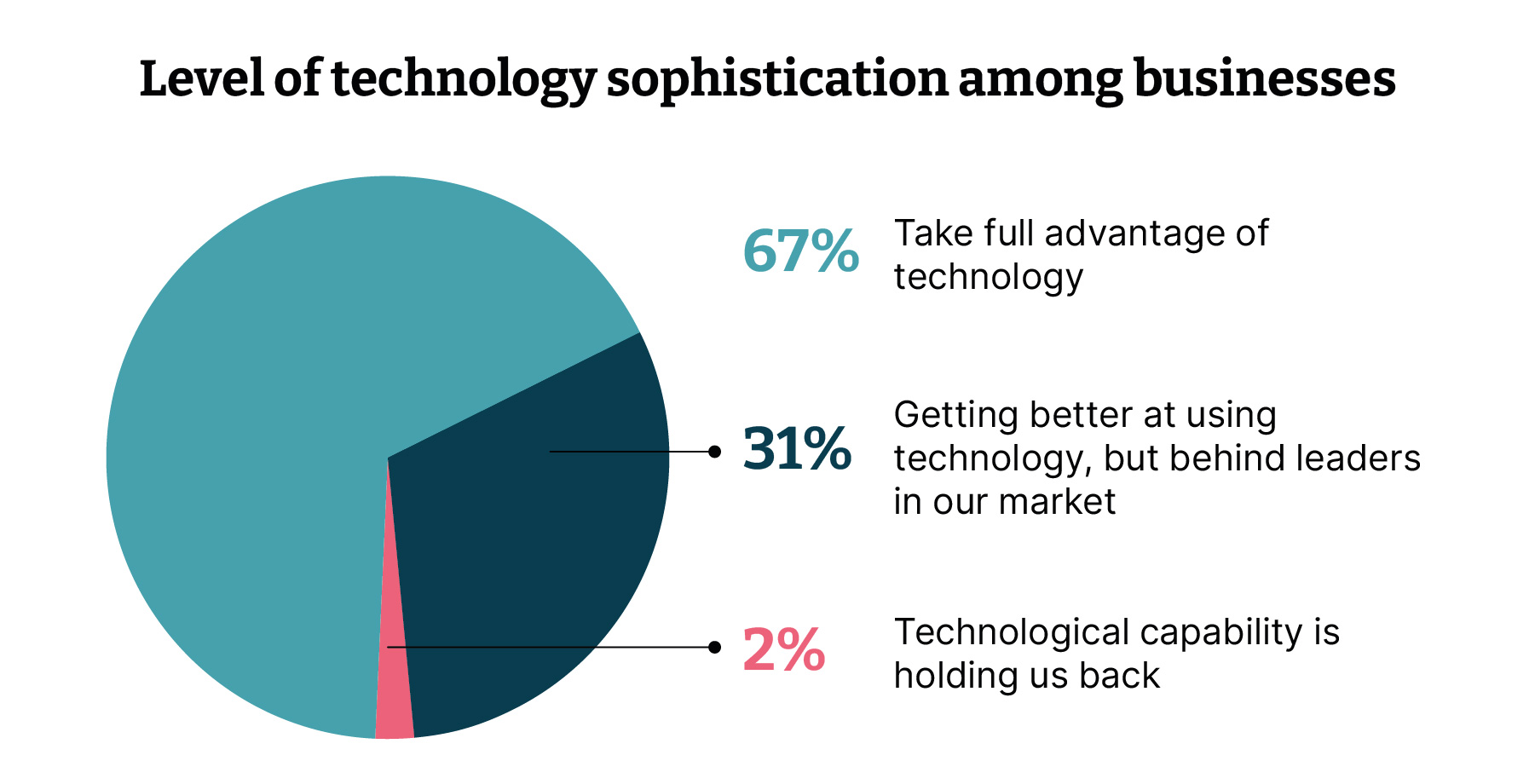

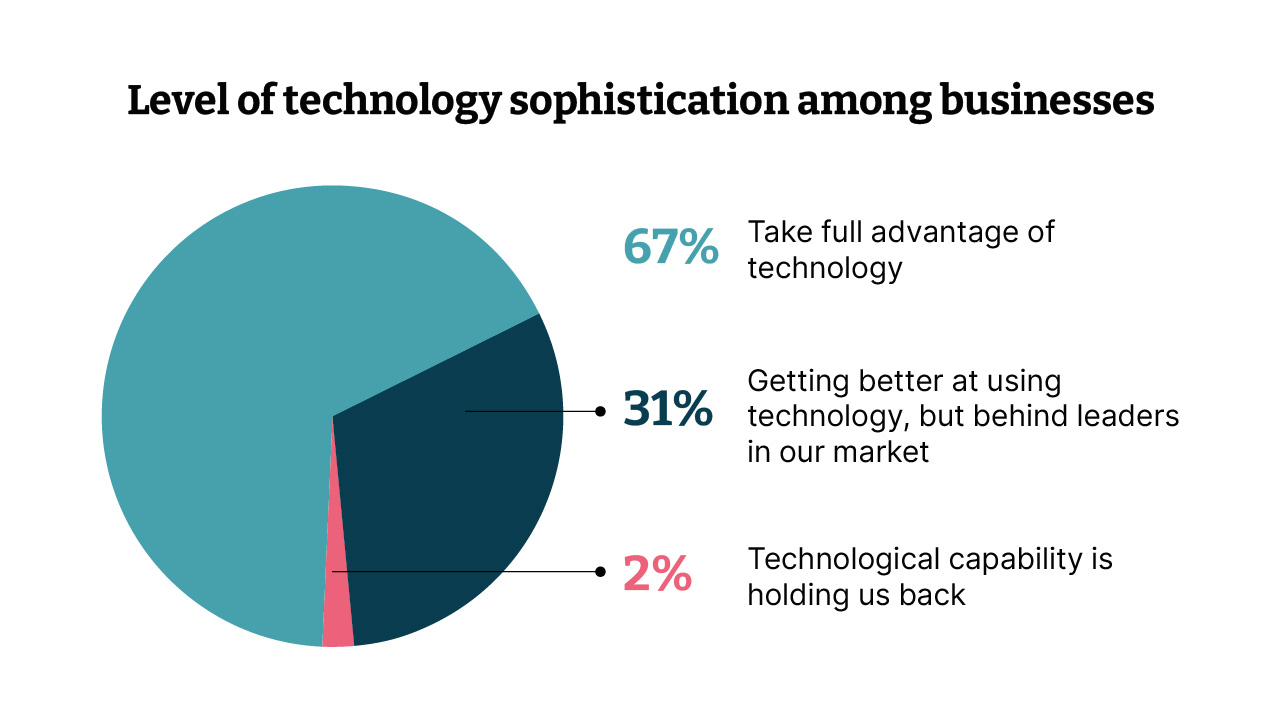

One of the positive findings from this study is that most enterprises now describe themselves as ‘technologically advanced’ — in other words, they are making full use of new technology across operational, customer-facing and internal parts of their business, to win new opportunities, boost profitability, run efficient systems and attract the best talent.

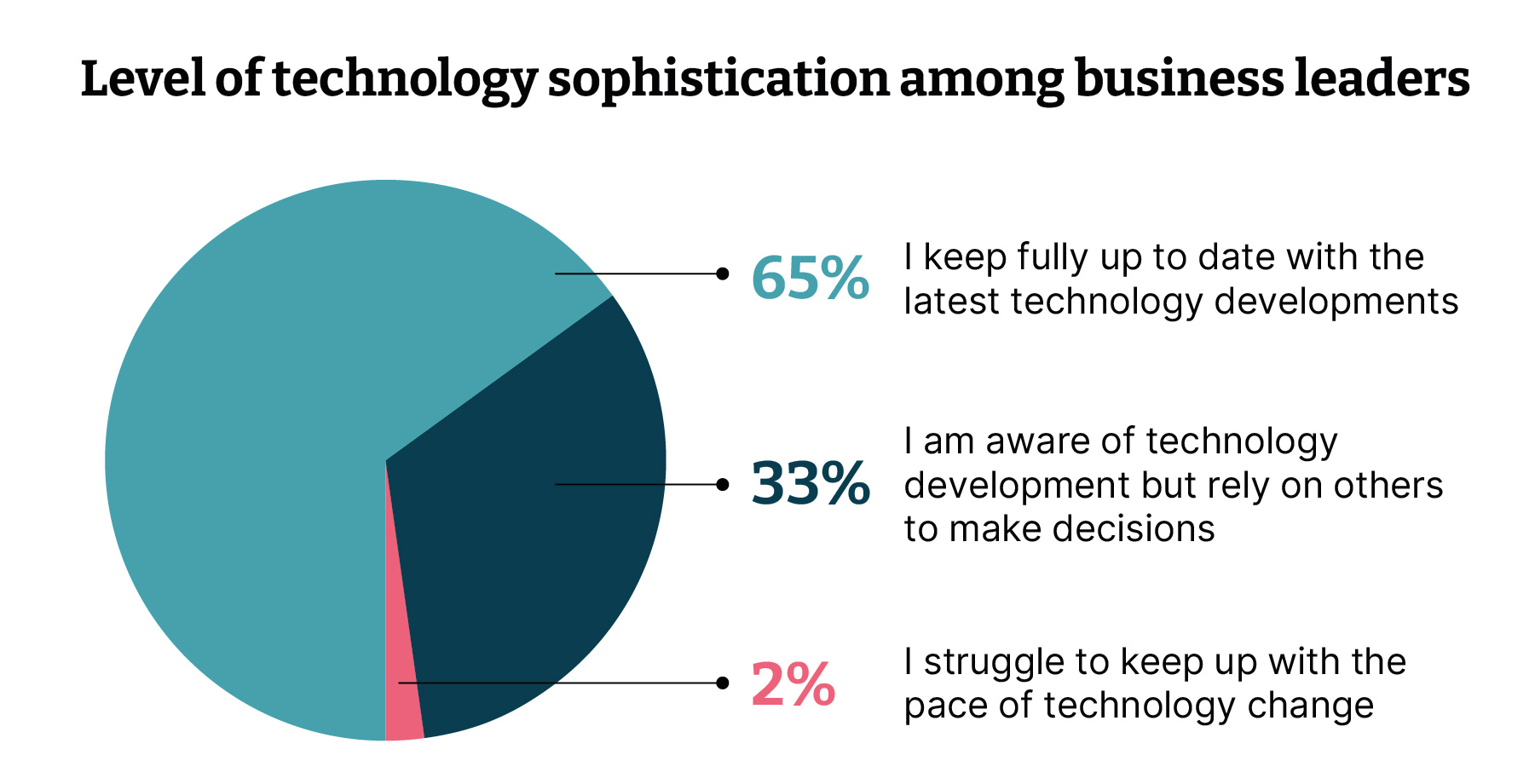

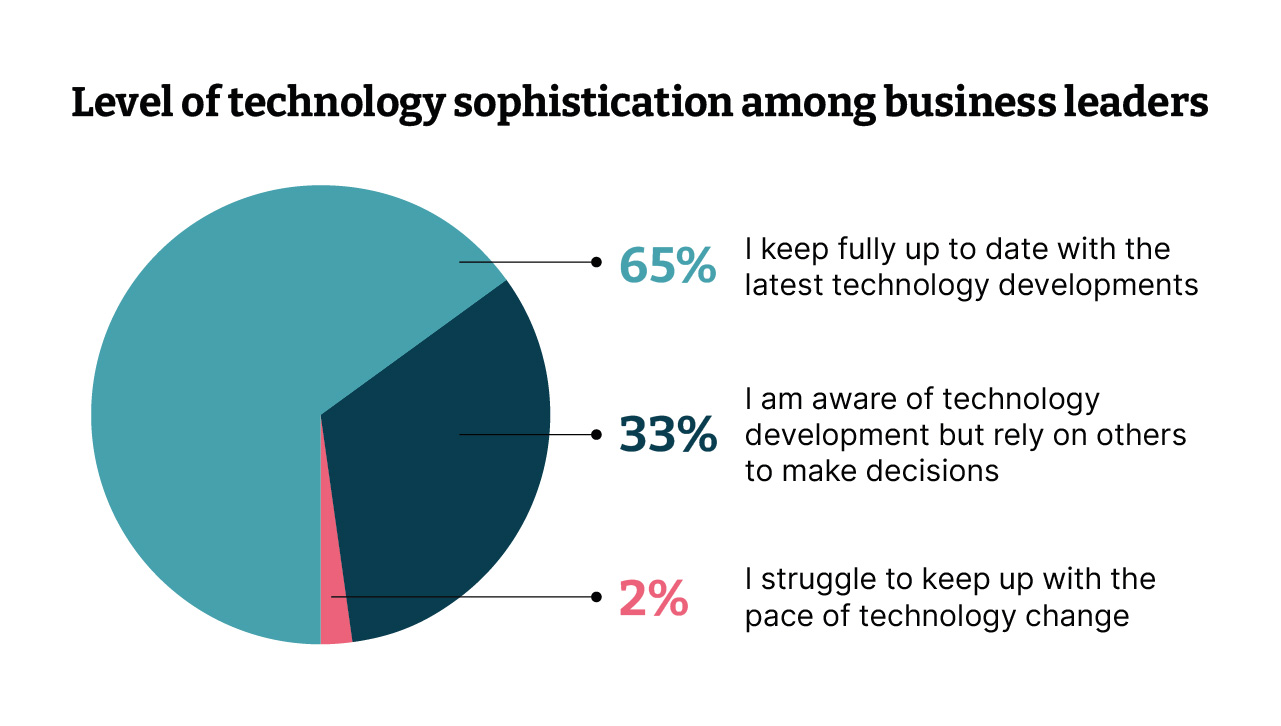

On further examination, the research identified a clear link between a company’s technological sophistication and the technological skills and knowledge of its leadership team. Business leaders were asked to rate their own knowledge and skills in this area — with a remarkably similar spread of results.

One of the most important findings in this research is the strong correlation between technology proficiency and business growth. Of those businesses that described themselves as technologically advanced, 82% anticipated their business would grow in the next six months. In contrast, among businesses that admitted being held back by their use of technology, just 39% were anticipating growth soon.

This trend is also evident in the knowledge and skills of senior executives and business leaders. If a company’s senior team has proficient technology skills, they are more likely to have a buoyant growth forecast. In contrast, those who lack the skills to make decisions on technology for the business are twice as likely to report negative growth than those who are fully up to date and see this as a strategic business issue.

2. Where are the most technology-proficient companies?

The research findings suggest that companies worldwide are now prioritizing technology, although there are regional variations — with a far greater concentration of technology-proficient companies in the emerging economies of Asia, and in North and South America.

Companies in fast-growing economies such as China, India and Brazil — as well as the technology-focused U.S. — were more likely to see technology giving them a competitive edge over rivals in these various areas than were European companies.

In China, more than eight out of 10 companies described themselves as ‘technology proficient, utilizing these applications across all areas of their business. In contrast, just over half of companies in Singapore claimed the same high level of technological sophistication.

Interestingly, the study also explored the personal technology proficiency of individual directors to see what proportion now considers technology to be a core part of their business outlook and how many keep up to date with the latest innovations in their sector.

By country, there was broad alignment between the personal technology proficiency of directors and the organization’s likelihood to be using their technology advantage to secure new business opportunities, run efficient systems and attract the best people. The consideration here is the importance for management teams to make technology central to their business thinking because this directly impacts the ability of their business to compete and grow.

What are the most technology-proficient companies?

|

Technology proficient companies |

Technology proficient directors |

Australia |

63% |

54% |

Brazil |

78% | 66% |

China |

83% | 70% |

Finland |

62% | 47% |

Germany |

53% | 47% |

India |

70% | 74% |

Italy |

67% | 68% |

Netherlands |

52% | 70% |

Romania |

61% | 62% |

Singapore |

51% | 61% |

UK |

76% | 76% |

USA |

70% | 82% |

3. Using technology to build a competitive advantage

The relativity of technology proficiency is also important. While many firms claimed to be technologically proficient, many were failing to use it to achieve competitive advantage within their own business sector. Across a range of criteria — including creativity and innovation, communication and collaboration, research fluency and problem-solving — less than one in two businesses said their technology proficiency gave them a tangible advantage over the competitors.

These results suggest that technology is helping firms to keep up with the competition, but it is not always being utilized to give them a competitive edge. This may be because firms are adapting to technological changes as they happen, rather than using technology to help unlock the strategic answers on how a business will evolve longer-term and gain market share from its competitors.

How does your orgnization's level of digital proficiency compare to competitor brands in your market?

|

More advanced | On par with competition | Trailing competition |

Creativity and innovation |

49% |

41% | 10% |

Communication and collaboration |

46% | 47% | 7% |

Research and information fluency |

42% | 48% | 10% |

Critical thinking, problem-solving and decision making |

45% | 46% | 9% |

Digital citizenship (the responsible use of technology by companies to engage with wider society) |

37% | 49% | 12% |

Technology operations and concepts |

43% | 48% | 9% |

4 . The big conversation: technology in the boardroom

The research also examined how frequently technology is discussed in the boardroom. The findings suggest there is a clear correlation between how frequently technology issues are discussed at the board level and a company’s growth prospects. Growing businesses were more likely to discuss technology at the board level on a monthly basis than firms with stagnant growth. Further, the proportion of respondents that only discussed technology ‘every few months’ broadly aligned with the percentage of companies that described their technology proficiency as ‘improving but behind the competition.’

The most discussed technology issues were digital transformation — increasing agility, resilience and ability to compete — and driving growth through differentiated, customer-centric, digital experiences. Around one in two business leaders said these issues were discussed at least monthly (49% and 48% respectively). In addition, 46% of respondents talked about Enterprise Modernization each month — transforming their people processes and technology to modernize and create sustained change.

The alignment between how often technology is discussed in management meetings with growth prospects for the business underlines the need for enterprises to ‘normalize’ these conversations, and make sure all senior directors are conversant with and knowledgeable about technology developments in their areas, so technology moves beyond a stand-alone agenda item and is something that washes through the entire boardroom conversation.

This primary research also shows that companies struggling with technology are less likely to have board-level discussions around all these issues than proficient ones.

63% of technology-proficient companies said they discussed technology issues relating to customer experience, product and design at least once a month.

Just 22% of companies, who are struggling with technology, discussed this issue monthly.

A similar split applies when it comes to discussions on enterprise modernization, digital transformation, operations and data strategy, engineering and analytics.

These are not just circular arguments where businesses that describe themselves as ‘technology proficient’ are more likely to discuss these issues at regular board meetings. The evidence from this report suggests that these board-level discussions have real-world consequences, in terms of business growth and development.

Conclusion

This research shows a clear and compelling correlation between the technological proficiency of a business and its growth prospects.

However, it is noteworthy that many of the enterprises that rate themselves as technology proficient fail to exploit it for meaningful competitive advantage — and here may lay the difference between businesses that act tactically, reacting to change and those that embed technology at the heart of their business planning in how they harness technology to inform their critical thinking, problem-solving and decision-making.

This is a significant issue: the earlier that technology features in the business planning and problem-solving, the greater will be the value of its application and the tangible impact on staff, customers and suppliers.

This research highlights the importance of tailor-made solutions for businesses. A generalized knowledge about technology and digital solutions may be insufficient to help a business thrive in a competitive market.

The findings also make clear that talking about technology matters. Boards that regularly discuss how technology can help improve all aspects of their business are better placed to make decisions that will improve competitiveness and help their agility at a time of unpredictable and changing economic conditions.

Technology is not just about hardware or software products that can be plugged in to solve a problem. It is about the culture of an organization — and that culture starts at the top. Today’s C-suite decision-makers need to be as well versed in data strategy, platform capability and engineering excellence, as they are in sales, marketing, and accounts. These will all have an influence on future business performance.

So, the technology solution is not just to update cloud capability for example. It is about looking in a more thoughtful way at the architecture of such services and how they can benefit the business.

Read the report