What is trade finance?

The development of trade, specifically international trade, generates trade finance. The initial business of trade finance was simply to provide remittance and payment for the trade activities of traders in various countries. Later, it gradually expanded to trade-related financing and cash flow management.

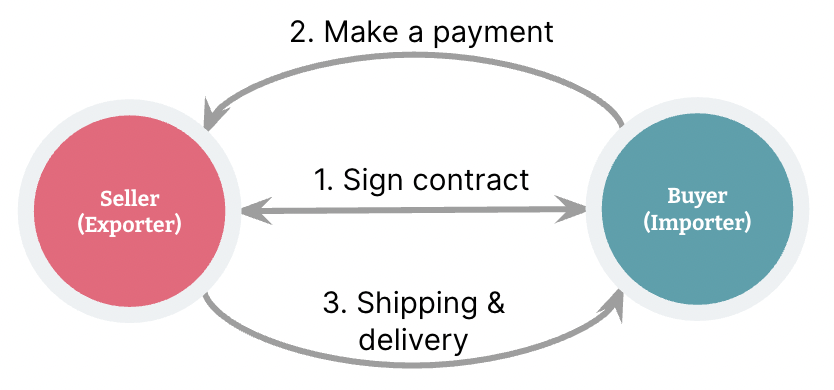

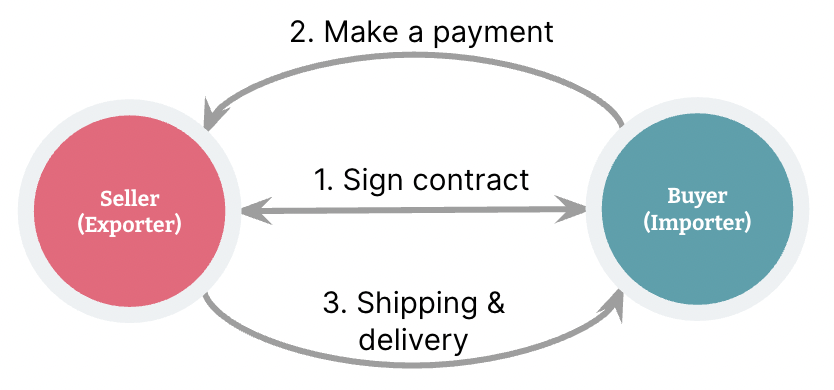

Financing is the essential feature of trade; either the supplier finances the customer, or the customer finances the supplier, depending on the timing of the payment. If we set the delivery time as the node, payment before delivery means financing from the customer to the supplier; otherwise, it means financing from the supplier to the customer. Unless payment and delivery happen at the same time, one party is always financing the other one.

Why are the sellers and buyers willing to pay for trade finance?

It’s not easy to reach an agreement on the key trade terms of who will finance whom due to different cash flow strengths, different negotiating chips and different levels of mutual trust. In international trade activities, it’s hard to build trust between the buyer and the seller. The buyer is worried that the seller won’t deliver the goods as stipulated by the contract after the payment is received. The seller is also concerned that the buyer won’t pay as per the contract after the goods are delivered. Therefore, it’s common to introduce third parties willing to provide financing. Banks are the preferred option to fill that role. Banks are required to act as guarantor for the buyer and seller, to collect the payment and deliver the documents (e.g. bill of lading) on their behalf, respectively. They replace the buyer and the seller’s commercial credit with bank credit.

What are the common methods of trade finance?

There are four main methods of trade finance:

a. Cash in advance

An importer who selects this method of payment usually has great confidence in the exporter. After the contract is signed, it requires the buyer to pay the seller before a shipment is received or even made. Cash in advance is a method that can be applied or requested in any trade transaction which has a delay between the sales agreement and the delivery of goods.

In addition, cash in advance can also be combined with cash on delivery. For example, an importer can make a 70% pre-payment as cash in advance, but make the remaining 30% once the goods are shipped or delivered. In this method, bank credit isn’t used.

b. Letter of credit

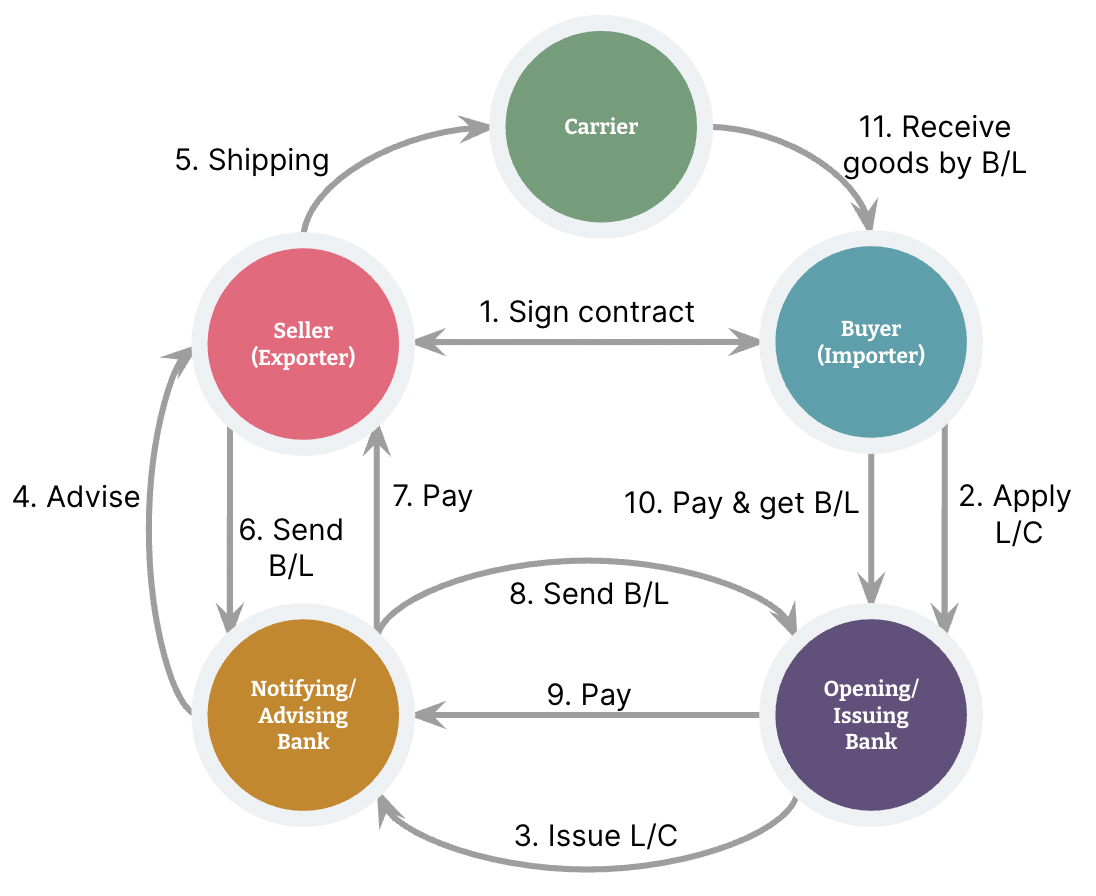

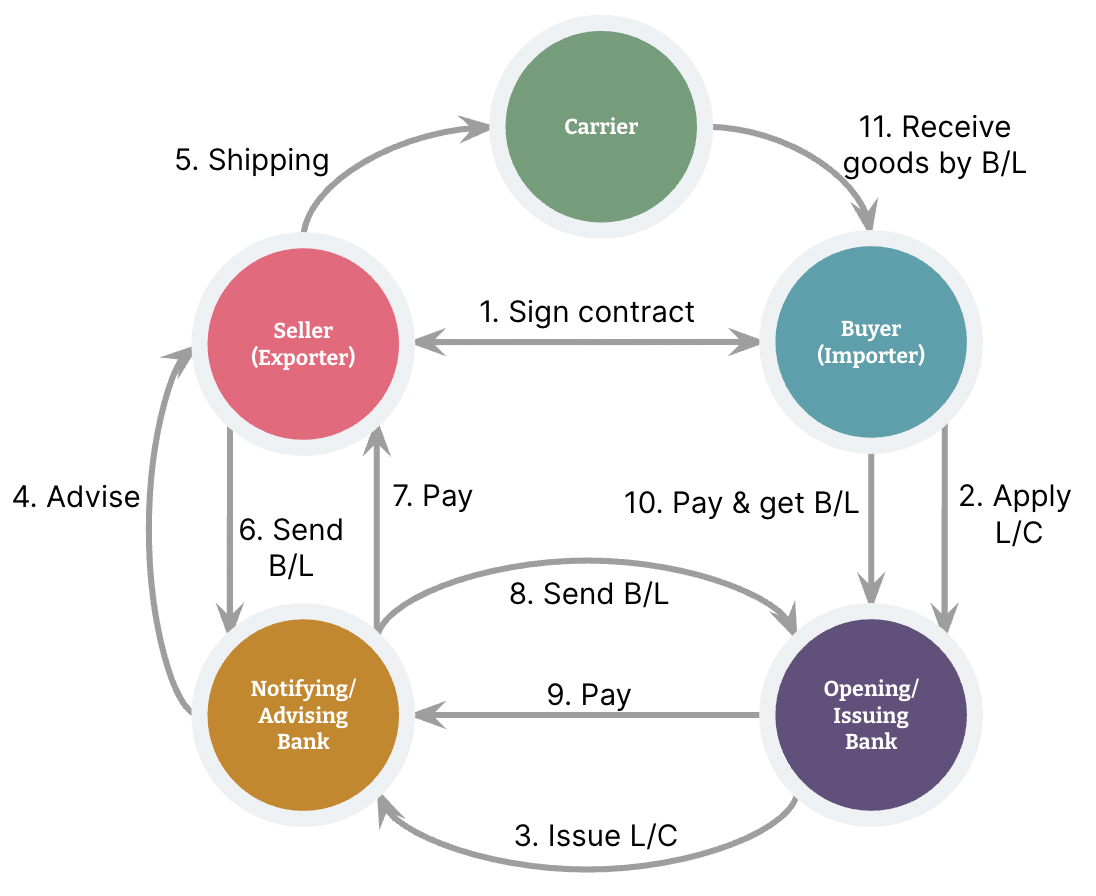

A letter of credit (aka documentary credit) refers to a bill of exchange with shipping documents attached or a letter of credit paid only with shipping documents. This is the most important and commonly used method of payment in international trade settlements.

The bank uses a letter of credit as a guarantee that the buyer and importer can pay or be paid as per the contract. It’s a common method in international trade activities. It goes like this: the buyer first deposits the payment to their bank, which opens an L/C (letter of credit) and notifies the seller's bank to inform the seller that they should deliver the goods as specified in the contract and the L/C. The bank then makes the payment on behalf of the buyer.

* L/C - Letter of credit

* B/L - Bill of lading

Characteristics of letters of credit:

The L/C is not attached to the sales contract, it is separate from the basic trade contract.

The payment of a letter of credit is made against documents, not goods. The issuing bank should pay unconditionally as long as the documents are correct.

A L/C represents bank credit, which is a document of guarantee from the bank.

c. Documentary collection

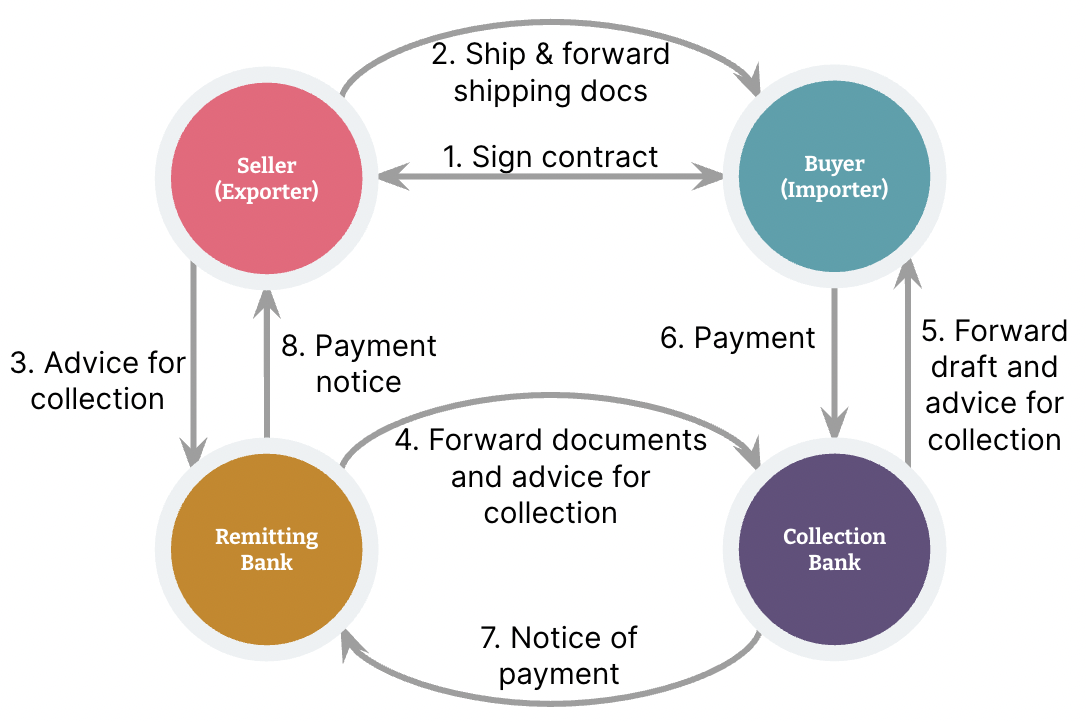

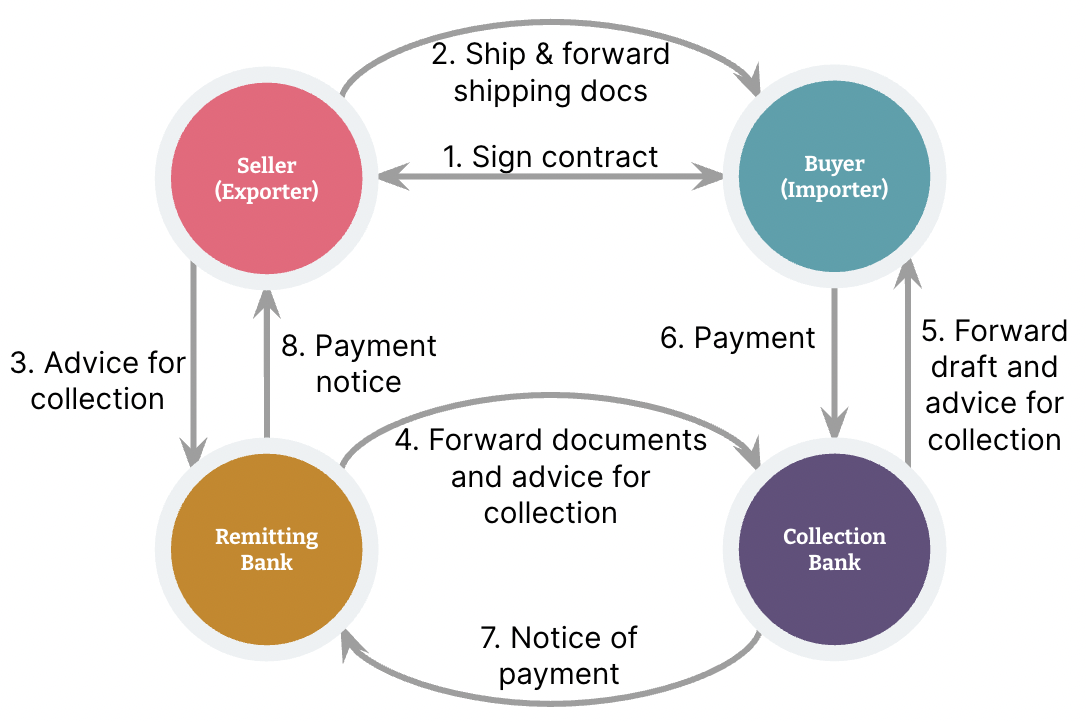

Documentary collection is a settlement method in which the exporter sends the shipping documents to the collecting bank after the goods are prepared for shipment according to the contract. Although documentary collection is based on the sales contract, the collecting bank only collects the payment according to the contents listed in the application submitted by the client, without asking about the contents of the contract and the performance of the contract. According to the documentary payment contract, the importer has the right to inspect the collection documents when they reach the collecting bank, and make the payment.

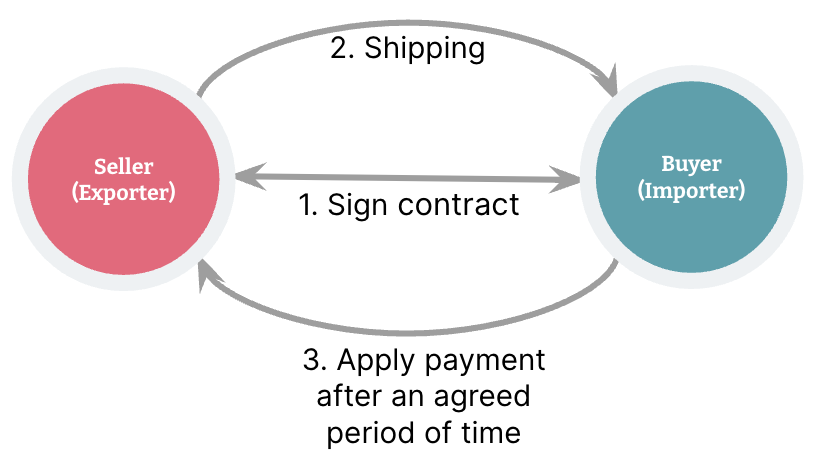

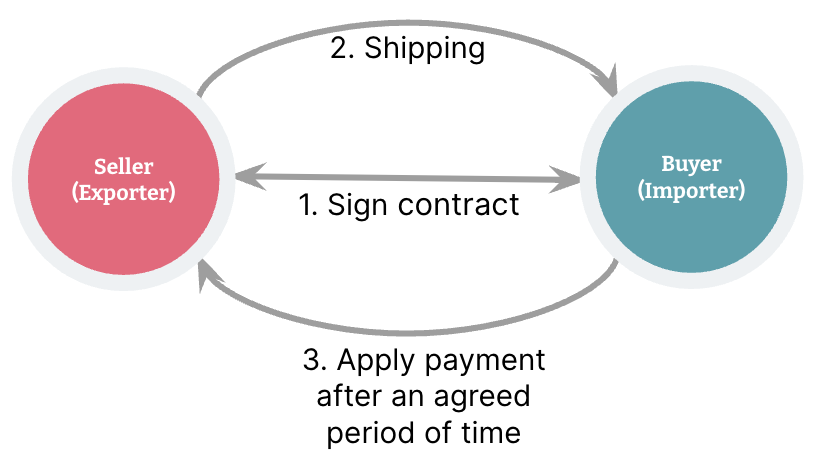

d. Open account

With an O/A (open account), the seller delivers the goods to the Buyer in advance and the payment is settled quarterly, semi-annually or annually. When the payment is settled in this way, the price of goods and the time of payment are fixed. This method of payment belongs to commercial credit instead of bank credit. Whether the exporter can receive the payment as expected depends on the credit of the importer entirely. To be more straightforward, it sells credit, which is to say it releases the account to the supplier and then pays the supplier after receiving the goods over a certain period of time

A large number of the trade between Europe and America is now in non-documentary form, mainly in O/A and DA (Document Against Acceptance), which means the delivery of documents by the exporter is conditional on acceptance by the importer on the bill of exchange form. This avoids a lot of complicated procedures and their fees.

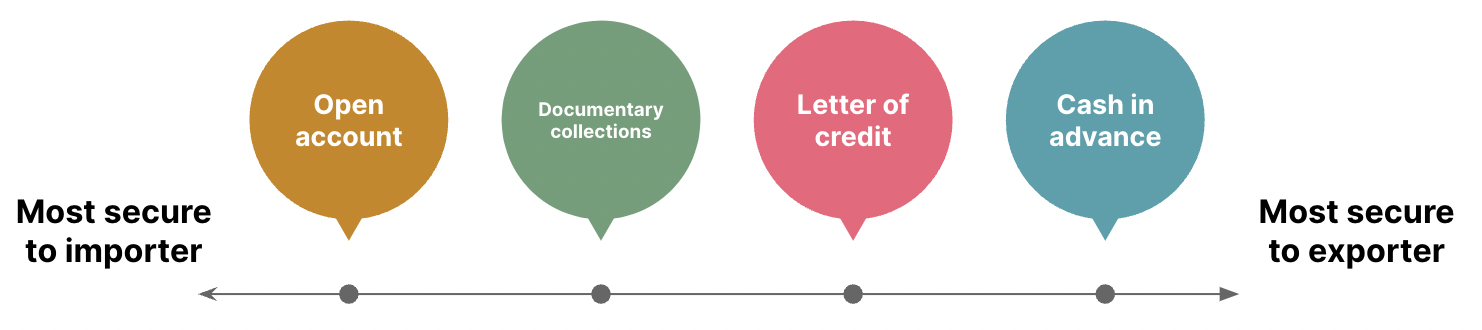

Comparison between the different methods of trade finance

The main difference between these payment methods is the bank charges and the level of risk faced by the importer and exporter:

Method |

Payment |

Risk |

Charge from bank |

Cash in advance |

Before goods are shipped |

Importers may have concerns over the ability and willingness of exporters to deliver. |

Low or none |

Letter of credit |

Guaranteed by a bank, subject to the fulfillment of certain terms and conditions by the importer and exporter |

Receiving goods of poor quality; the issuing bank's bankruptcy; and fluctuating exchange rate. |

High |

Documentary collection |

Processed by banks but just acting as agents for the importer and exporter. |

Payment risk unchanged but mitigated by control over goods. |

Medium |

Open account |

After goods are shipped or received |

Exporters are concerned with the ability of the importers to pay. |

Low |

Trade finance payment risk diagram

Conclusion

The scope of trade finance business is gradually expanding. From traditional international settlement products such as letters of credit, documentary collection and remittance, it is expanding to cover the entire industrial chain of procurement, production and sales.

In the future, with the maturity of big data, Internet of Things, blockchain and other new technologies, fintech will be deeply interwoven with trade finance, and will promote the continuous innovation and application of trade finance.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.