Elevating the wealth management experience

Rising global affluence presents a huge opportunity for wealth management firms. But how can wealth managers keep up with investors' growing demands for automation and efficiency? In this edition of Perspectives, our experts discuss why increasing global wealth makes it a pivotal time for wealth management firms to transform the customer and advisor experience, and how they can achieve it.

Our wealth management expertise

Seamless customer engagement

Your customers now expect a frictionless experience, driven by technological advancements, changing demographics and a growing awareness of what’s possible in wealth management.

Our experts will help you to offer great customer experiences by modernizing your existing, monolithic customer-facing applications into a fast and flexible digital platform that supports everything from customer onboarding and risk profile assessment to the ability to transact across multiple asset classes and eventually customer servicing. Our experience in building such platforms lets you stay nimble, empowering you to add features quickly, launch new products and bring in partners and ecosystem players.

Typical wealth management platform capabilities

Client acquisition and onboarding

Risk profile assessment

360 degree view of portfolio

Transaction capability across asset classes

Goals based investing

Integrations with ecosystem players

Personalized investment recommendations

Seamless launch of new products and features

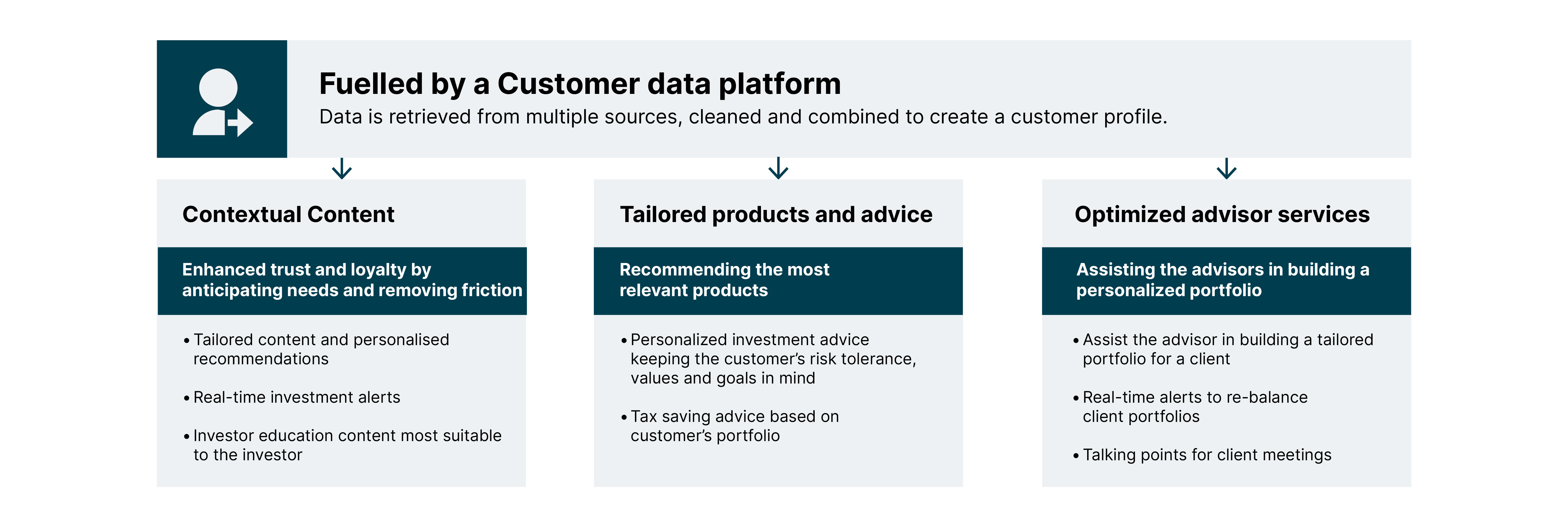

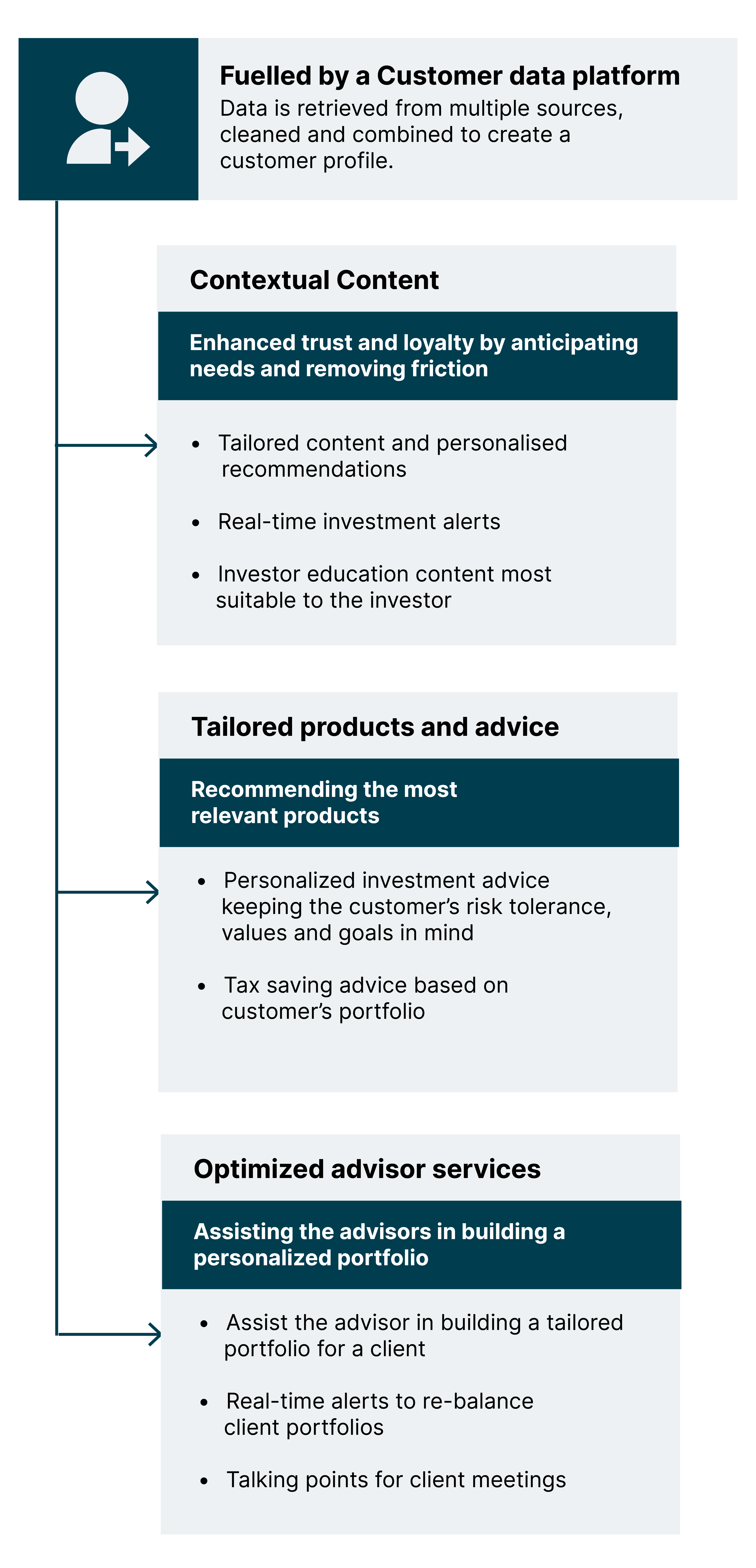

Personalized customer experiences

You know your customers’ incomes, risk tolerance levels and investment goals are all unique. Whether they’re using an app or speaking to an advisor, they expect an experience as unique as their individual needs.

We can show you how to harness the power of customer data to build personalization into every step of your customer journey, including contextual customer education, investment recommendations and alerts about potential tax saving options. Plus, your advisors can access a wealth of data to support prospecting and lead generation.

Advisor and portfolio transformation

Old, legacy applications slow your advisors down, which has a knock-on effect on your customer acquisition and a customers’ experience with the firm.

We help our customers build an end-to-end advisor platform with modern data and AI-driven applications that empower your advisors to build strong customer relationships through enhanced prospecting and personalized advice across the entire customer journey. These applications are modular and reusable across your contact center, branch and advisor.

Our capabilities include:

Enabling better prospecting, lead generation and sales conversations

Seamless client onboarding

Advisor dashboard

Financial planning and portfolio construction and management

Assisting advisors in investor meetings

Integration with COTS trading systems

A product marketplace with ability to trade across asset classes

Client servicing

Recommended insights

-

ArticleBuilding intelligent wealth management systemsRead this article

ArticleBuilding intelligent wealth management systemsRead this article -

Client storySee how we helped a top 10 wealth management firm to streamline efficiency with a new data platformRead this client story

Client storySee how we helped a top 10 wealth management firm to streamline efficiency with a new data platformRead this client story -

ArticleGenAI and predictive AI: How wealth management firms can adopt a two-pronged AI strategyRead this article

ArticleGenAI and predictive AI: How wealth management firms can adopt a two-pronged AI strategyRead this article