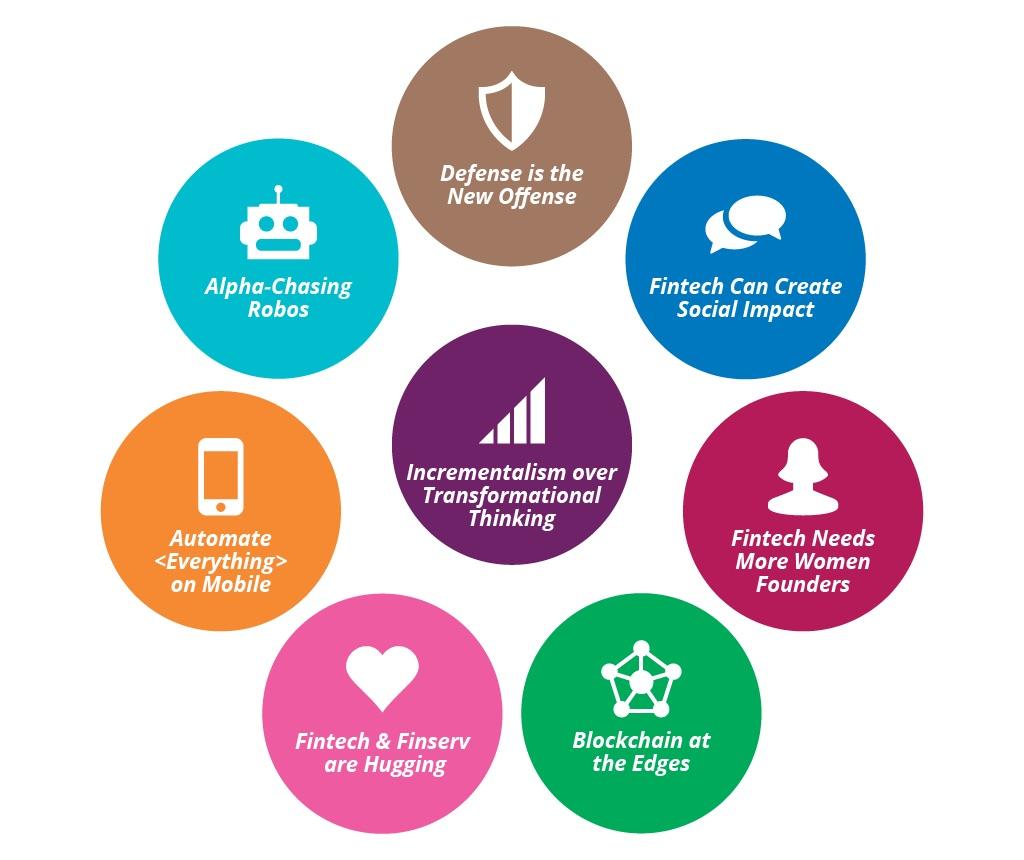

8 Fintech Trends to Watch

Last week, over 72 companies demonstrated their approaches at Finovate Spring 2016. As VC funding slows down, entrepreneurs and intrapreneurs are now focused on incremental improvements instead of transformational game-changers.

What's next for fintech?

Here are the eight major themes, trends, and implications that you should know.

Incrementalism over Transformational Thinking

The overarching theme emerging from the upstart companies was “we’re your allies, not your threat.” There were no new business models being explored, no reconceptions of value creation. Offerings were focused on incrementally improving workflows and extending the reach of existing products to new customers.

As a simple metaphor, we saw no leaps from Blackberry to iPhone, we saw iOS 7 to iOS 8 on display. Given funding challenges, and an industry where scale beats service design, that may make sense in the short term.

Alpha-Chasing Robos

While well-known consumer-focused robo-advisors have primarily focused on offering simple, passive investment automation solutions, new Financial Advisor (“FA”)-focused robos are now enabling greater levels of granularity.

These robos enable FAs to directly integrate their wirehouse investment committees, enabling automated execution of their proprietary investment theses. This can bring a three-week process of bringing organization insight into clients’ portfolios down to less than three minutes. These white-label robos also enable clients to feed their own ideas into the investment process, creating a new kind of partnership between FAs and their clients—sometimes in real time.

Companies to watch: Polly Portfolio, Worth.fm, Forward Lane

Defense is the New Offense

With the rapid change in regulatory regimes across the world, regulatory tech is a billion dollar industry that is attracting the attention of regulators, financial institutions and investors alike. These RegTech companies provide tools and services that automate compliance tasks, improve identity management and authentication, and reduce fraud risks.

Though this market is still too young to measure the impact of RegTech on the bottom-line, multiple companies are now touting the benefits of their products to improve the defensive posture, increasing the ability to move faster on offense.

Company to Watch: QumRam is a Switzerland-based company that records every interaction between advisors and their clients, making recordings auditable without manual intervention. UBS is one of their pioneer clients.

Automate <Everything> on Mobile

Portfolio allocation, risk management, customer care, marketing communication, offers and promotions, mortgage origination, bill payments, student loans management—name any friction-filled financial services process, and there’s an app automating the experience. Entrepreneurs are automating complex, underlying experiences—and making it a delightful experience customers can tap into on their smartphones.

Company to Watch: Blend Labs is bringing a Rocket Mortgage capability to all banks, delightfully automating the entire mortgage lending experience and making it available on smartphones.

Fintech and Finserv Are Hugging

Fintech ventures have loads of great ideas, but lack the scale necessary to grow into profitable and sustainable companies. Almost all of the 72 demonstrating companies spoke about their eagerness to get into commercial partnerships and agreements with incumbent financial services firms to gain traction. Tools and services were designed to be white-labeled, or offered through open APIs to integrate into the complex technology eco-system of existing large financial institutions.

That supply was met by great demand: the show was well-attended by senior executives from large banks, smaller credit unions and incumbent financial institutions from across the globe, all of whom were scanning for the next innovative tools and services that could accelerate their own innovation efforts.

Fintech Can Create Real Social Impact

Financial institutions clearly have a major perception gap among the general public. However, industry insiders are moved when fintech firms focus on solving vexing global social and economic challenges. The Finovate audience selected two firms focused their businesses on directly meeting the needs of the under (un)-banked in the US, and the completely dispossessed globally. We are certain that financial institutions that do well by doing good will win at the expense of the many firms that profit by simply extracting value out of their customers, and out of society.

Companies to Watch: Best of Show winners BanQuApp and PayActiv focus on creating social impact with financial service technology. While BanQuApp uses blockchains to create individual economic identity in less privileged societies across the globe, Payactiv is focused on encouraging better ways to foster savings, thereby improving the financial wellness of all of our neighbors.

Blockchain Still at the Edges, Not the Core

Blockchain hype has definitely slowed down. We heard only two real blockchain products among 72 demos during the two days of the conference. This corroborates with our point of view that blockchain is not as hot as its hype cycle implies. This will ultimately be a positive development, as start-ups and and incumbents will focus on direct usefulness instead of making non-fundable bets on long term, game changing impacts. It will grow into a game-changer as it becomes a preferred automation and transparency tool across more use cases.

Companies to Watch: Digibyte is a Hong Kong-based technology firm using blockchains to provide and secure and confidential document signing service. BanQuApp uses blockchains to create individual economic identity in less privileged societies across the globe in partnerships with global aid agencies and large foundations.

Fintech Needs More Female Founders

While there were many women presenters at the conference, there were not many women founders. Worth.fm and Meetinvest were probably the only two women-led start-ups that made compelling pitches at Finovate Spring. As women become the majority of investors and household CFOs, their concerns and needs will become the mainstream method of delivering banking and investing services. Only those companies that can build trust and confidence with this emerging investor audience will survive this transition.

Companies to Watch: WorthFM is the brainchild of Amanda Steinberg and Michelle Smith, two entrepreneurs deeply dedicated to women and their money. Meetinvest is a Switzerland-based robo advisor founded by the husband-wife duo of Michel and Maria Jacquemai. It provides sophisticated and scalable digital B2B2C investment solutions for the global financial industry.

These patterns unite a disparate group of companies. While we are excited to see major improvements in customer experience, lending facilitation and greater empowerment of people through technology, we are also excited to find the next transformative leap that will create true transparency and alignment between customers and financial institutions.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.