Resilience is the ability to adapt, recover and thrive amid disruptions. To thrive, financial enterprises must forge a dynamic equilibrium, reflecting the human body's resilience. The human body offers a natural blueprint for resilience, using interconnected systems to regulate and respond to changes. Similarly, financial enterprises can build resilience by ensuring alignment between their control mechanisms, key operational parameters and response strategies.

This article uses the human body as a model for financial enterprise resilience, offering actionable steps to build adaptability through technology and operating model strategy.

Financial enterprises: A parallel model for resilience

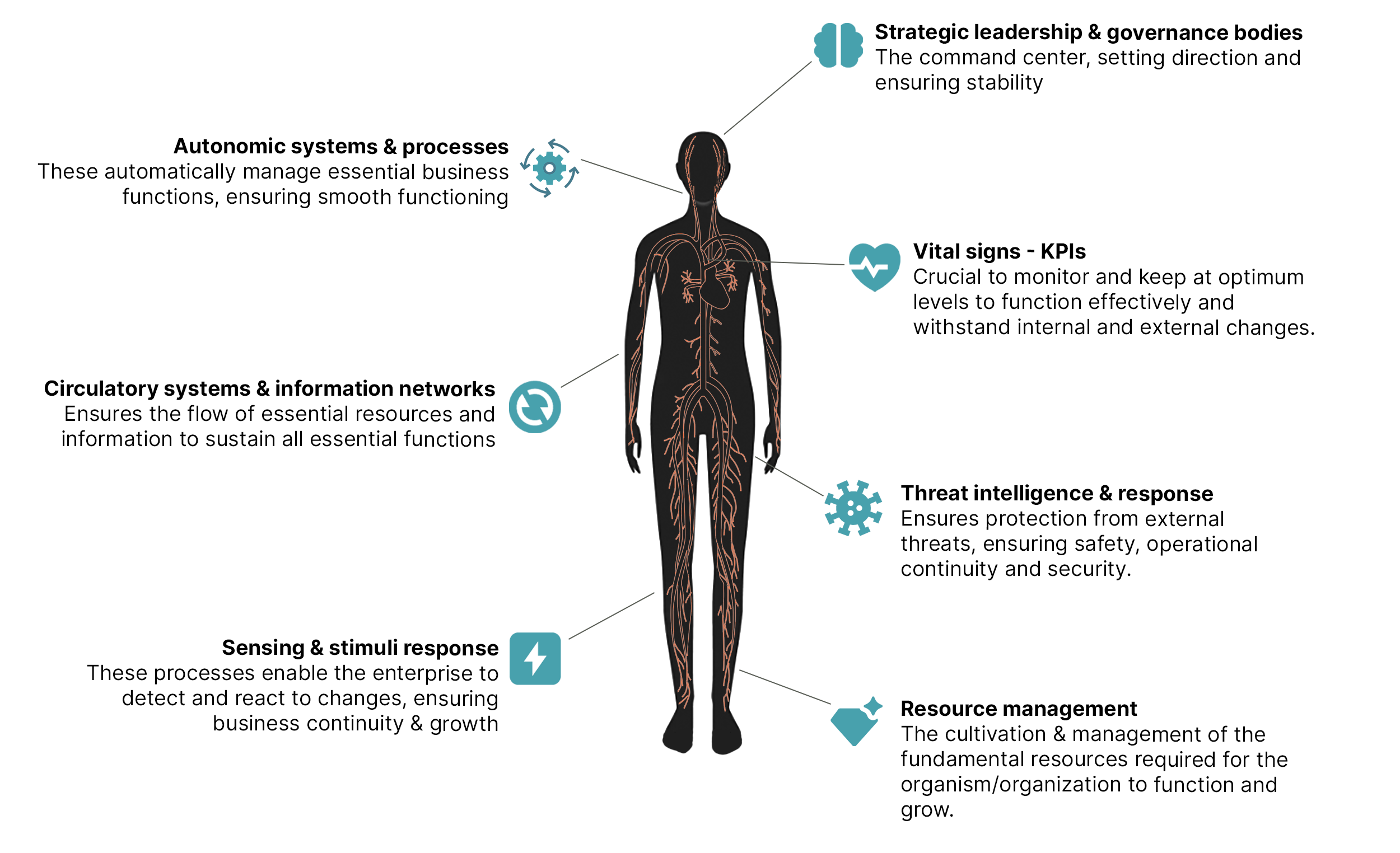

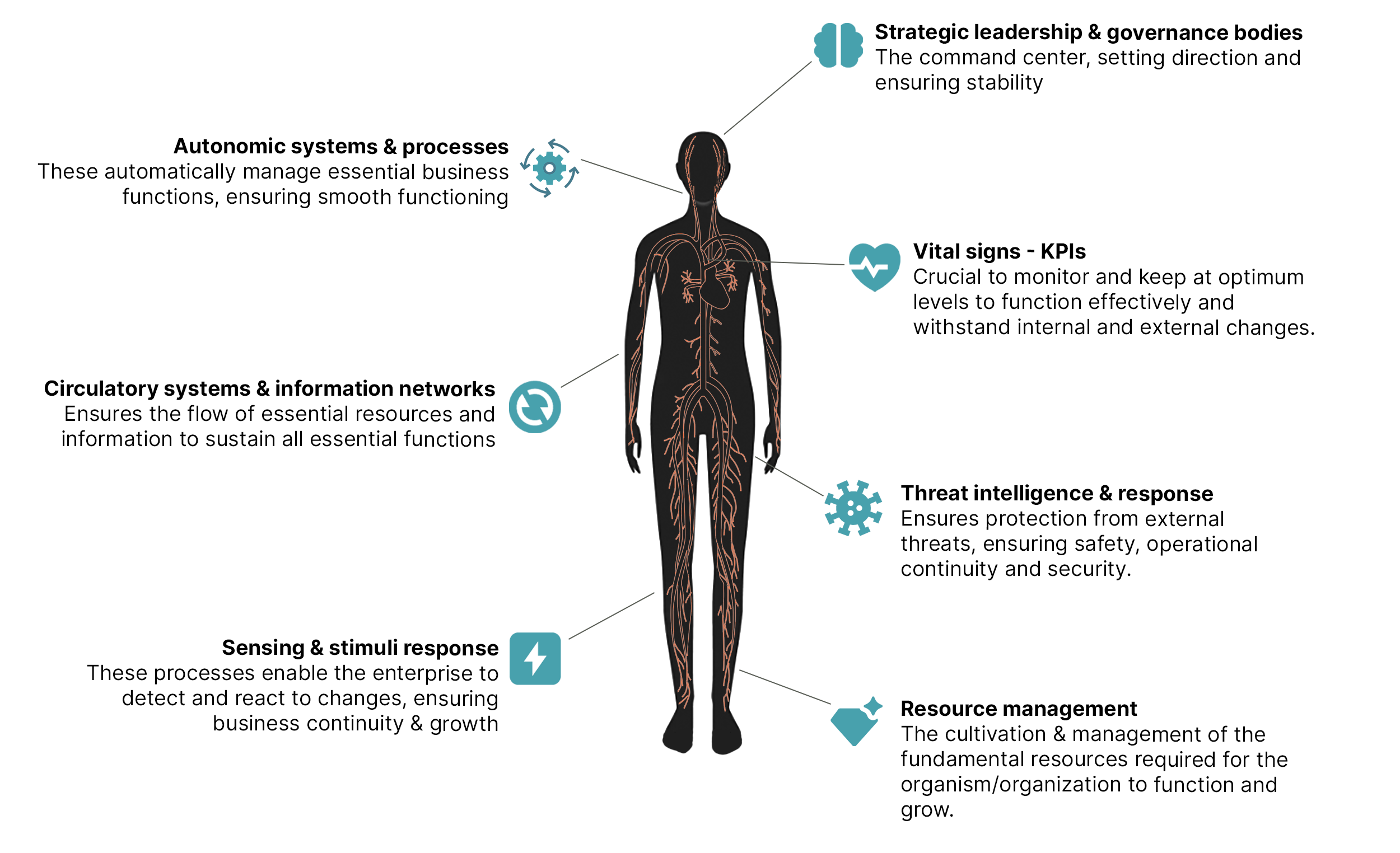

The human body and financial enterprises share a strikingly similar approach to maintaining stability and adapting to external and internal disruptions. In human systems we call this homeostasis, and in enterprise systems we use terms such as adaptability and agility to describe similar concepts organizationally. Both rely on structured control systems, key regulatory parameters, and dynamic response mechanisms to ensure long-term survival and efficiency. These have their independence but are aligned with the overall functioning of the larger organism/organization. Different organizational units in an enterprise system need to co-ordinate to respond to change - for example, a new compliance regulation, or a new competitor entering the market.

We can draw more parallels between Financial Enterprises and the Human Body than we might imagine at first glance.

Just as the body relies on air, nutrition and water to survive, financial enterprises depend on information, funding and decision-making to thrive. Like the body’s response to stimuli, organizations must adapt to external and internal changes to maintain resilience. And just as the CNS ensures the body responds to threats, the CEO and Board must guide the organization through market shifts, regulatory changes, and internal challenges.

A resilience framework for leaders

The human body is a marvel of adaptability, capable of operating in a variety of modes depending on numerous factors. From the moment of conception through to old age, it constantly adjusts its functioning based on its stage of development, the availability of resources like food, and external stimuli such as threats or environmental changes. This remarkable ability to reconfigure and respond offers valuable lessons for organizations striving to build resilience.

Any enterprise operating in the current world is subject to a similar reality — constantly changing internal and external environments.

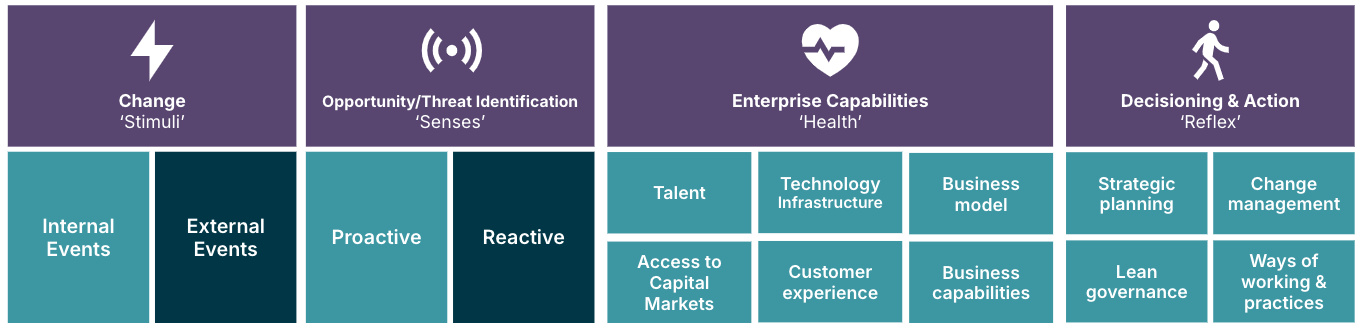

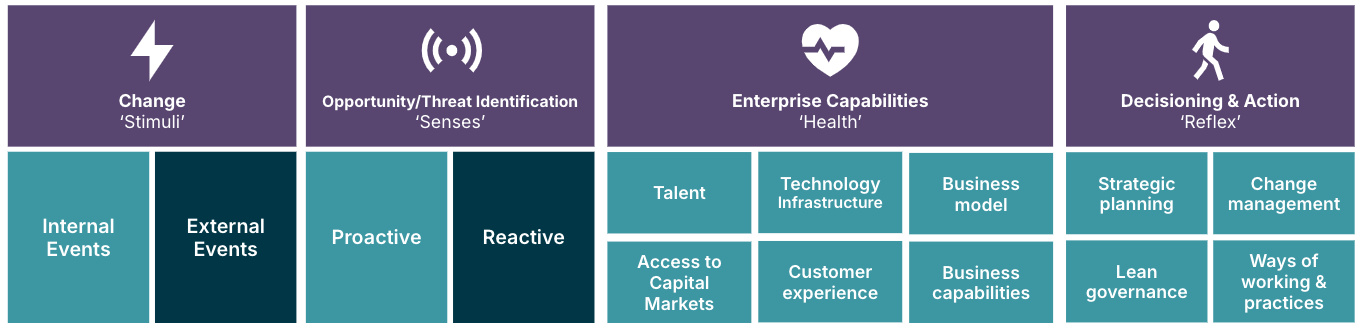

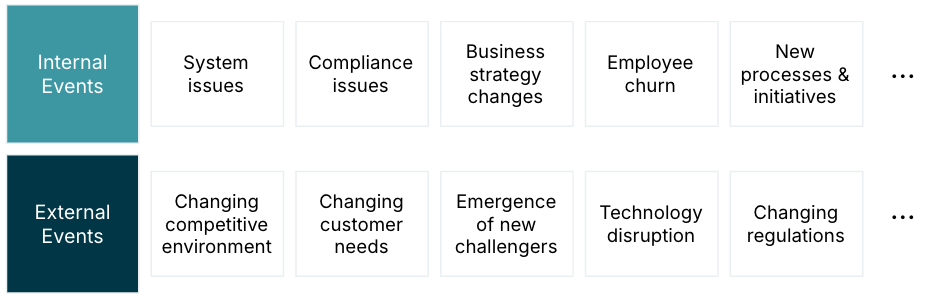

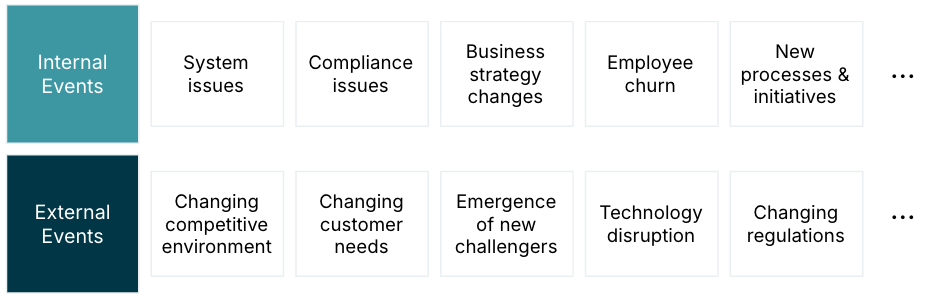

Change - ‘stimuli’: This is the set of all business context changes — triggers that must set off an adaptive reaction from the company. These can be internal to the company, or from external factors such as the market or local regulations.

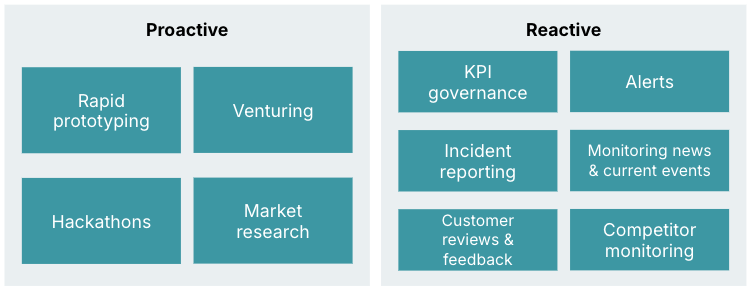

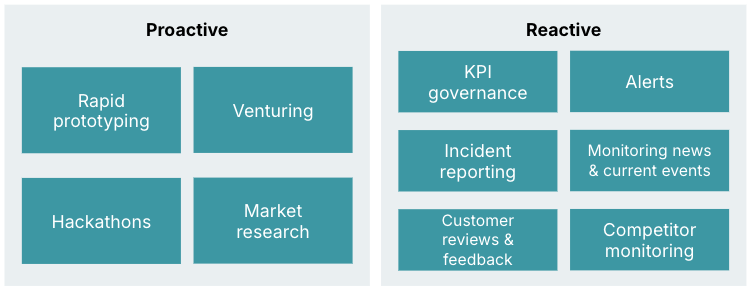

2. Opportunity/threat identification - ‘senses’: Enterprises must be able to detect these changes in business context as early as possible so that they can react before competition does, and while keeping costs low. Other than identifying changes in lagging metrics, it is the prerogative of the CEO and CSO as well as the CTO for the technology lens, with their forward-looking teams to predict disruptions before the fact, using proactive sensing mechanisms.

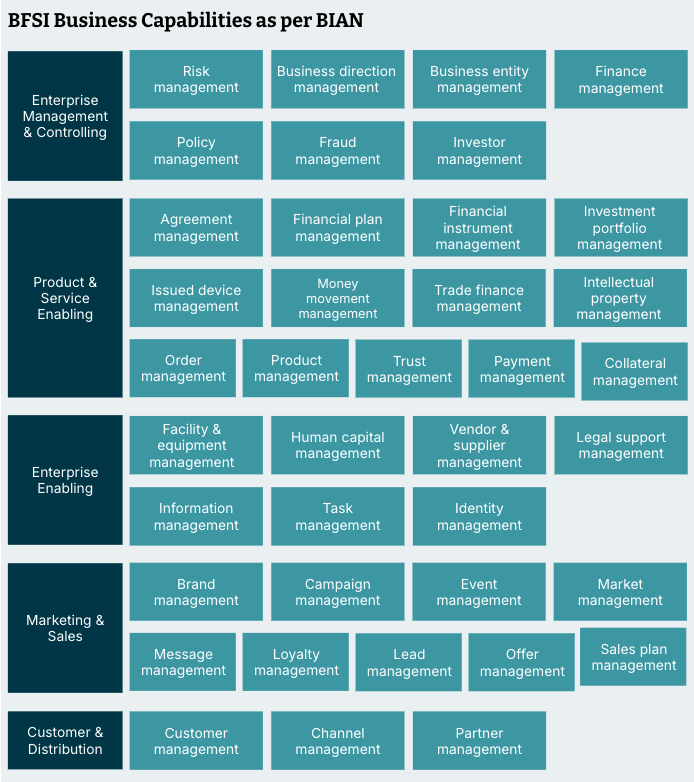

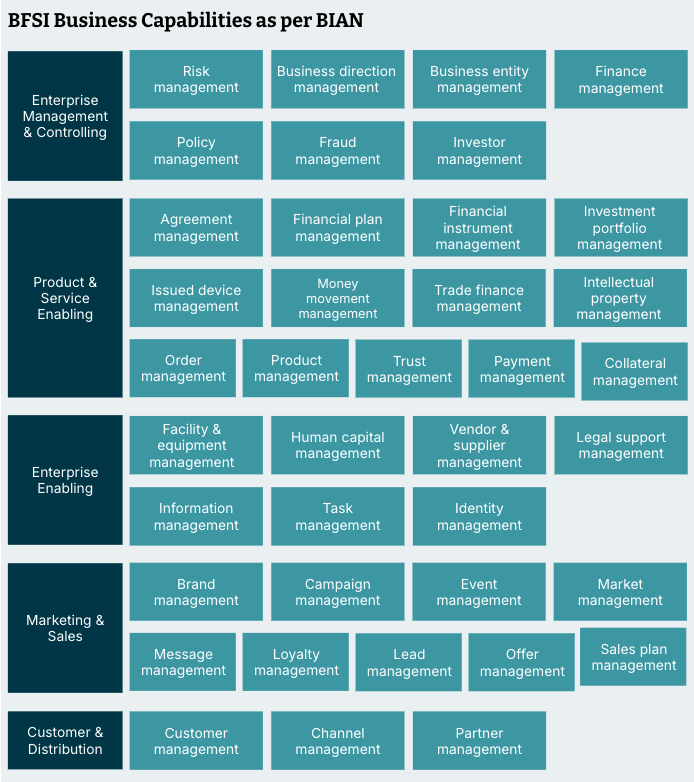

3. Enterprises capabilities health’ - To be able to react, enterprises must be in good ‘health’. This includes banking, financial services and insurance (BFSI) business capabilities that are conveniently standardized and defined in frameworks such as BIAN (business leaders and the Chief Product Officer must ensure these are running at their peak performance) as well as strong supporting functions such as talent, technology (which is the CIO’s charter), strategy, customer experience management and more depending on the enterprise.

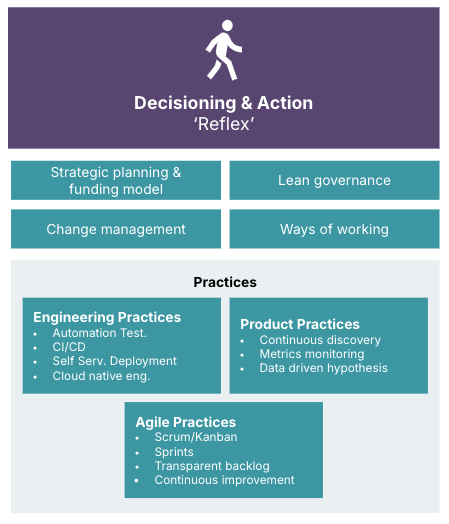

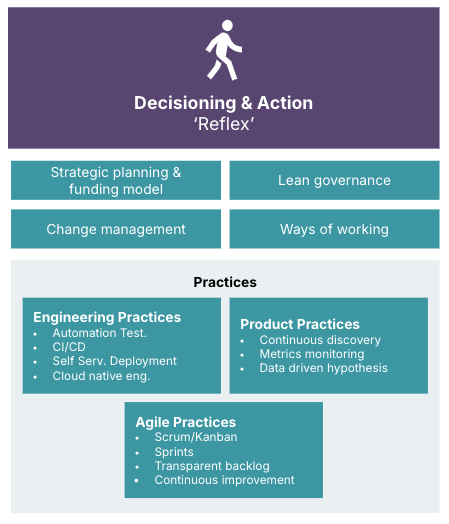

4. Decisioning and action - ‘reflex’ - This is the mechanism that the enterprise must have in place to process the changes it senses, and make the best decision on what actions must be taken to adapt effectively.

To truly be resilient, focusing solely on one aspect of the model may not yield the desired impact for an agile and adaptable organization. It is essential to evaluate existing capabilities and prioritize those that require enhancement.

We propose a simple approach to embark on this journey toward resilience:

A mechanism for resilience for today’ financial enterprises

From more than 30 years of working with enterprises around the world, we believe this journey can be designed as follows:

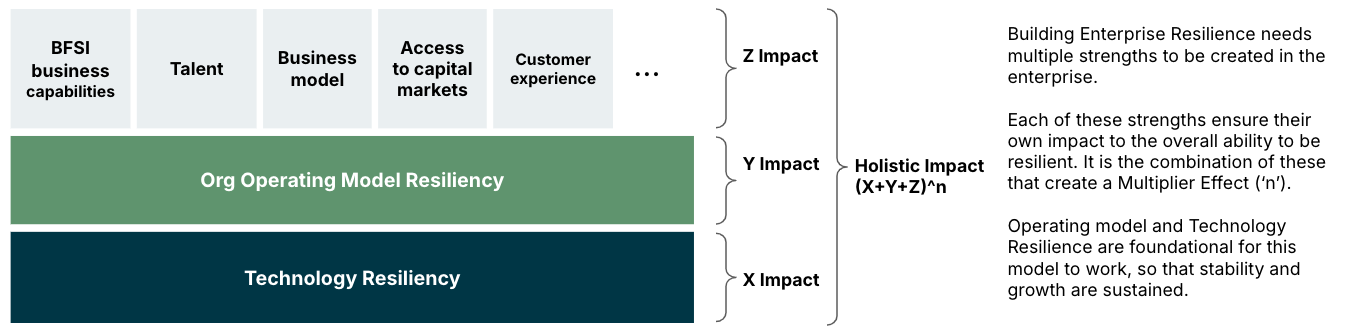

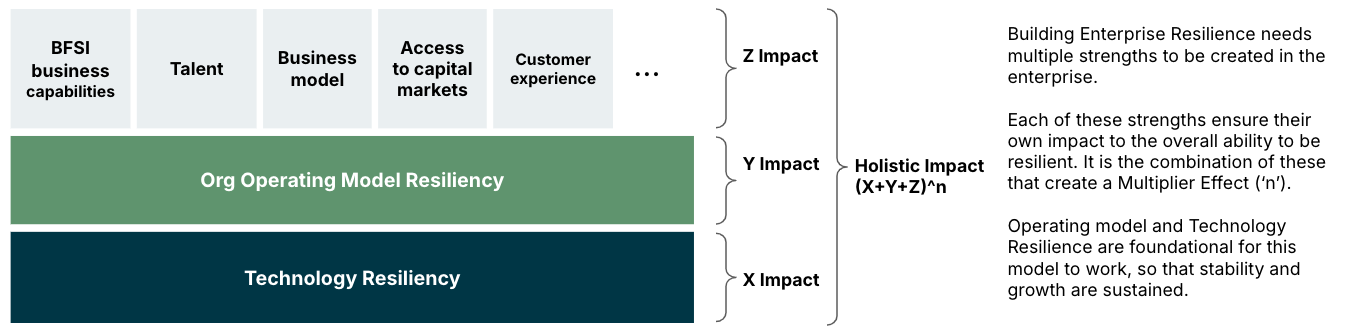

Here we will outline an approach to drive the technology resilience and operating model resilience aspects. The elements from the ‘Z impact’ on the diagram above will differ for each enterprise.

We must follow a deliberate process to benchmark our current state, identify a set of realistic yet ambitious goals, and then enable our teams with the clarity they need to execute.

We must follow this flow for both, technology resilience as well as operating model resilience. Each track will have its own objectives and methods - however, we’ve seen that they will feed into each other as progress is made.

1. Technology resilience track

The tech track focuses on modernizing systems, improving monitoring, and ensuring robust testing and recovery mechanisms. This strengthens the organization’s ability to respond effectively to stimuli, similar to how the human body uses its nervous system, senses, and reflexes to react to its environment.

Key focus areas:

Modernizing legacy systems: Transitioning to cloud-native architectures for scalability and reliability.

Resilience metrics: Establishing KPIs like mean time to recover (MTTR), recovery time objective (RTO) and recovery point objective (RPO).

Domain-level decoupling: Ensuring partial system availability during failures to prevent complete breakdowns.

Chaos testing and resilience engineering: Simulating failures to build robustness.

Advanced monitoring & AI-driven observability: Enabling proactive detection and response to disruptions.

Security and performance testing: Embedding resilience into software development.

Federated data governance: Implementing decentralized, domain-driven data ownership for better control.

2. Operating model resilience track

The operating model track focuses on fostering collaboration, smooth ways of working and keeping the organization focussed on the customer, and consequently, revenue. This is akin to optimizing the body’s processes — metabolism, digestive and sleep cycles, etc. for sustained energy and performance.

Key focus areas:

Strategic planning and funding model: Ensuring clarity on vision, goals, and outcome measures across the enterprise.

Cross-functional collaboration: Breaking silos to enhance agility and coordination.

Embedded compliance and regulatory champions: Proactively addressing evolving legal frameworks.

Incremental and experimental product development: Minimizing risk through an iterative, test-and-learn approach.

Talent enablement and workforce resilience: Upskilling employees to adapt to emerging technologies and roles.

Risk management and governance: Embedding resilience in decision-making and operations.

Lean operating model: Identifying inefficiencies and optimizing processes for long-term sustainability.

Organizational design: Ensuring teams are organized and collaborate with each other in the most efficient and effective manner.

For the human body, focussing on just one dimension of resilience will cause harm — for example, just devoting energy towards its nervous, circulatory and other such critical systems while not honing the way it uses these to respond to stimuli will lead to a comatose state. This stands true for enterprises as well - this approach will ensure progress is made holistically on both fronts.

Achieving sustainable resilience

Financial enterprises must proactively balance technology resilience and operating model resilience. Organizations that master this dynamic equilibrium will thrive in an ever-evolving financial landscape, withstand disruptions and emerge stronger in the face of challenges.

Business leaders of financial enterprises must embrace this framework, much like a well-functioning biological system, ensuring their organizations remain agile, competitive, and resilient in a rapidly changing world. By adopting this resilience framework, financial enterprises can enhance adaptability, withstand disruptions, and emerge stronger in an unpredictable market.

For more details on how your organization can embark on this journey, and what the outcomes from this exercise might look like in your specific business context, please reach out to us through this form . We would love to hear from you!

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.