Feeding the future: How the food industry is changing

Amazon’s acquisition of Whole Foods has been one of many shock waves to the food industry over the past year, with many retailers considering specifically “What should my Amazon response be?”. While it’s an important question, this shouldn’t be the primary concern. Businesses need to look outside the competitive set to understand the structural shifts impacting retail.

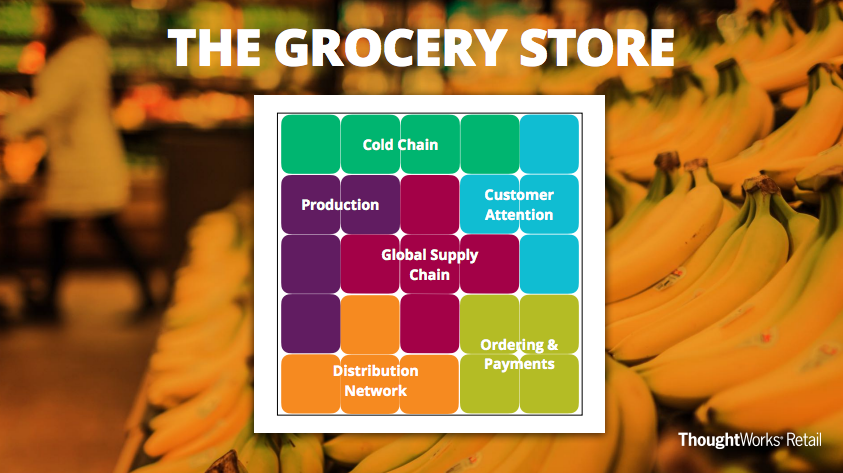

The grocery store

The key capabilities of food retailing can be broken down into six components, shown in the graphic below:

The war for customer attention

Social platforms and messaging apps have captured a large amount of our daily attention. Customers no longer wait until they are walking through the store to understand what is new or interesting - discovery now happens on Instagram, Facebook, or your group chat.

We believe the disintermediation of department stores, and the media industry, are a sign of what’s to come in grocery. Let’s take a look.

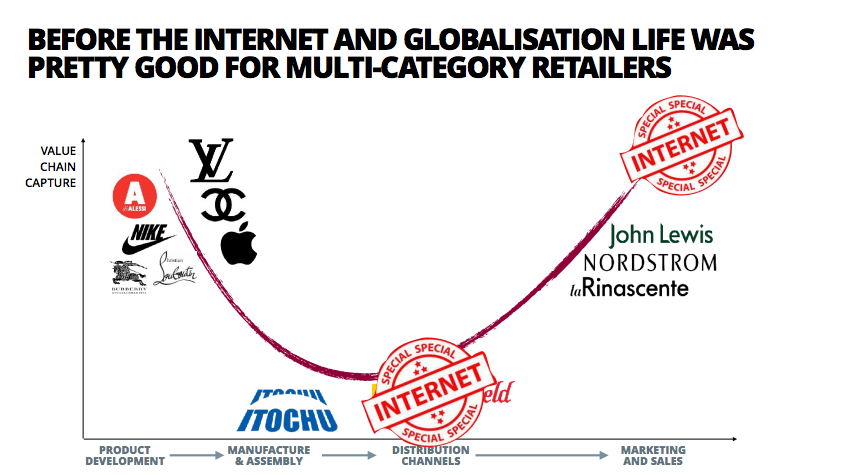

Before the Internet, life was pretty good for multi-category department stores. Product brands strived to develop unique and differentiated goods and there was low value to be captured in manufacturing and assembly, as well as distribution. These were capital intensive businesses that required scale efficiencies, or geographic monopolies to create a meaningful profit. Those able to capture customers through marketing and sales, often as well as distribution, generated tidy profits. Most department stores had control of a large piece of real estate within a geography, and so if you were a brand - particularly a new brand, you wanted to have your product available in store as it was a great way to access consumers.

After the Internet, aggregating all retailers online provided an alternative to the physical store as a means to capture customer attention. Today, there is almost an infinite selection of product, and content at the click of a button. This created a new problem for brands; discovery. As more content fights for our attention, product discovery has become an increasingly valuable business. Enter the technology giants. All of a sudden, retail outlets start to slip down the value curve to become distribution points, creating downward pressure on margins. Department stores are now fighting for attention. There is a challenging relationship between brands and retailers when it comes to managing product profitability and advertising investment.

Digital becomes physical

Ordering and payments

The disappearing middle-aisle

Disintermediation of brands

It’s not just about Amazon. Let’s begin with a piece of smart home technology, a smart fridge. Let’s say the fridge could use its connectivity to talk to your phone and let you know that you need eggs, creating an ecosystem. By extending our ecosystem we can have the fridge actually order the eggs from the grocery store. So what happens when your customer becomes a fridge? You’re now one step removed from the individual - your consumer. Of course we don’t have to stop there. This is about personal nutrition. We could have the fridge access all sorts of other information as it shops for you. What’s your wearable technology saying about your health? What’s the budget look like this week? What’s the latest published information about diet and health? Now we have created a digital partner - one that creates the life you want - not just a simple labour-saving device.

This is happening today

Platforms for experimentation

The supply chain: scaling complexity

When it comes to managing and scaling distribution, the name of the game is productivity. The next wave is integrating more deeply with your partners to collapse the supply chain.

The future of distribution networks

For the first time in history, Americans spend more on eating out than on groceries

Food aggregation

Digital platforms

What to do?

Regardless of your business, what should you do, and where is there value to be had?

Within your leadership team, spend enough time together thinking through the possibilities so that you are able to build your own view of the future. The best views of the future - are directionally right, and not specifically wrong. It helps you to remain open to new possibilities while moving forward, rather than becoming dogmatic - or worse, dogmatic and wrong.

We see five main structural trends starting to transform food over the longer term:

1. Vertical agriculture

Today we are beginning to see signs of viability from indoor agriculture, and through the course of the coming 10 years we see a position where sensors, algorithms, data fusion, machine perception, and robotics come together to remove many of the labour and yield constraints of existing outdoor farming methods.

2. Intelligent food grids

Smaller, automated warehouses, operating closer to city centers, with goods fulfilled through small autonomous electric vehicles able to deliver fresh food to smaller merchants or become stores themselves.

3. Advanced food manufacturing

Have you tried the Impossible Burger? It’s a David Chang (of Momofuku) backed, plant-based burger alternative that tastes identical to real meat. Eating an Impossible Burger over a regular burger saves the same amount of water as a time minute shower. Advances in bioscience and material science couples with changes in customer preferences will impact how and where our food is produced.

4. Borderless retailing

The name ‘store’ came to represent a place where goods were stored for the community. This meaning seems less relevant today - the retail store is going borderless, it will appear in many forms, satisfying a diverse set of needs. Backed by a globally efficient supply chain and predictive inventory management.

5. Augmented humanity

To operate at scale many of these things will be capital-intensive solutions. The biggest differentiators moving forward will involve making strategic bets with capital - either human capital in developing your technology capability, or financial capital in bringing an efficient food experience to each of the communities you serve.

What to focus on now

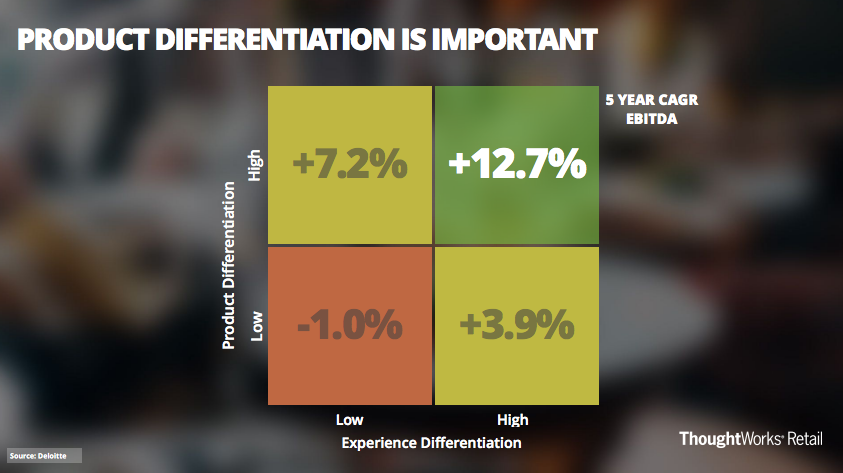

The importance of product differentiation

A recent retail industry study from Deloitte found that those with low product and experience differentiation had shrinking profit of 1% a year over the past 5 years. Those who differentiated solely through experience, saw 3.9% growth in EBITDA, while those who differentiated through their product, saw 7.2% growth. Those who did both grew 12.7%. If you have to make tough choices around where to invest your capital and management efforts then take a hard look at how differentiated your product offer is in the eyes of your target shoppers.

Transformative technology

Understand the role of technology in building your modern food platform. If technology isn’t enabling a core transformation in the way you operate as a retailer, from building empowering partnerships with your suppliers, to enabling you to scale the work of your best category managers, inventory and pricing analysts, then as you are pushed down the value curve, your EBITDA will continue to shrink faster than revenue falls. In understanding what to do next, building and training digital talent across all parts of your organisation is mission critical.

Focus on strategic opportunities

Ensure virtual vertical integration, become algorithm-driven retailers, capture moments and predict delight If you can only choose one. Ensure you are the most efficient way for customers to access food - in terms of their time, and your cost structure.

The food and grocery industry is evolving at such a rapid rate, and retailers, distributors, and producers need to rethink their business models and focus on innovation to succeed in this evolving market. We are passionate about partnering with ambitious leaders who are up for the challenge. Is that you? We'd love to hear from you.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.