In the past few years, the global payments market has changed beyond all recognition. Amid this accelerating cyclone of change, it can be hard to identify which trends really matter most to you and how you can best respond. Here, we breakdown the megatrends that are upending the payments market and provide a model that enables you to finetune your response strategy.

The key drivers of change in payments result from factors such as the emergence of new digital entrants, pandemic-induced shifts in customer behavior and expectations, and a growing realization that payment capabilities aren’t just a basic cost of doing business — they can transform experiences and deliver true competitive differentiation.

To grasp the scale of the change it helps to consider these changes in three broad megatrends: payments digitization, payments modernization and rapid evolution in the fraud, risk and compliance decisioning landscape. Those three areas account for nearly two-thirds of global spending in the payments market today. For each of those areas, we’ll draw out the top three areas of focus for payments providers, and then demonstrate how you can prioritize your response.

Payments digitization

From enhancing customer experiences to reducing costs and accelerating transaction speeds, there’s no shortage of promised benefits you can get from digitizing payments.

Key payment digitization trends

Instant payments

The value of global instant transactions is forecasted to grow to $428 billion by 2026 — that represent around a quarter of all transactions in most major economies.

Driven by migration to fast and flexible cloud infrastructure, instant transfer options are no longer a “nice to have”. They’re rapidly becoming a core customer expectation.

Cross-border payments

The cross-border payments landscape has been fundamentally reshaped by the rapid growth of open banking standards and the adoption of enabling technologies like APIs.

To facilitate international remittance, mobile money operators have begun partnering with money transfer operators — combining their capabilities to make cross-border payments a core part of their services.

B2B payments expansion

According to Digital Commerce 360, B2B ecommerce will exceed $2 trillion in 2024. Digital channels have rapidly become the standard for B2B purchases, and institutions are evolving their services to support digital B2B payments at scale.

Today’s B2B buyers want the same freedom and convenience as their B2C counterparts. They need to be able to transact seamlessly whether they’re buying through web or mobile channels, with total confidence in the speed and security of their payments service.

Payments modernization

Most modernization efforts center on the consolidation, streamlining and standardization of payments processes.

This push towards greater standardization across the payments space is good news for everybody. It accelerates routine processes, makes B2B payments easier to manage at scale, and creates new opportunities for collaboration and partnership between institutions.

Key payments modernization trends

Payment hubs

Internally, many organizations are opting to build and/or transform existing payment hubs, where payments data is collated and processed in a standardized way, and centrally converted into the right formats to support connectivity with global banks.

These hubs improve the efficiency of payments and financial workflows, while helping ensure that everyone complies with company policies and ISO 20022 regulations.

ISO 20022

By 2025 ISO 20022 will be the universal standard for all high- or large-value payments systems. It’s expected to support 80% of transaction volumes and 90% of transaction value globally.

Understandably, institutions are taking large steps to adapt their technology and processes to ensure compliance with this new standard. Additionally, they are looking for ways to monetize in new ways the incremental data that will be one of the outcomes of the migration of ISO 20022.

Cloud migration

Cloud migration is helping organizations gain the flexibility and new capabilities they need to adapt to emerging standards and build highly interoperable payments foundations.

Cloud also supports the delivery of highly personalized customer experiences and makes it simple for organizations to collaborate with one another — pushing it to the top of many institutions’ innovation agendas. Organizations finding a way to build creative and innovative business cases to justify and accelerate the speed with which they migrate legacy platforms to the cloud will find themselves with a competitive advantage over those that do not.

Fraud, risk and decisioning

Minimizing fraud and maintaining compliance with regulations is a constant challenge for businesses and financial institutions of all sizes. For the first time, emerging technologies like AI are now helping institutions solve those challenges at scale.

Key fraud, risk, and decisioning trends

Instant payment decisioning

Instant payment decisioning can help businesses reduce their costs by eliminating the need to manually review and approve payments. Suspicious transactions are instantly flagged, helping teams cut costs while detecting fraud and other serious financial crimes at the earliest opportunity.

Cross-border decisioning

Cross-border payments tend to be slow, expensive, and considerably less transparent than domestic payments. But emerging regulations are laying the groundwork for their modernization.

Leading innovators are creating powerful ways to accelerate cross-border decisioning, so that processes are as seamless as domestic ones — yielding better experiences for customers, and greater efficiency for businesses.

Sanction screening

With new sanctions and regulations constantly emerging, many sanction screening systems struggle to keep up. Most generate a huge volume of alerts, of which around 95% are false positives.

Now, technologies like AI are helping teams transform their approach to sanction screening. These capabilities help sort false positives from real ones, so that teams can focus their attention where it’s really needed, and continuously adapt to the shifting sanctions landscape.

With so much change happening, where should you focus?

Financial institutions are used to making careful, considered decisions about their future. Typically, they change once the risk of standing still outweighs the risk of driving change. When it comes to payments transformation, that time is now.

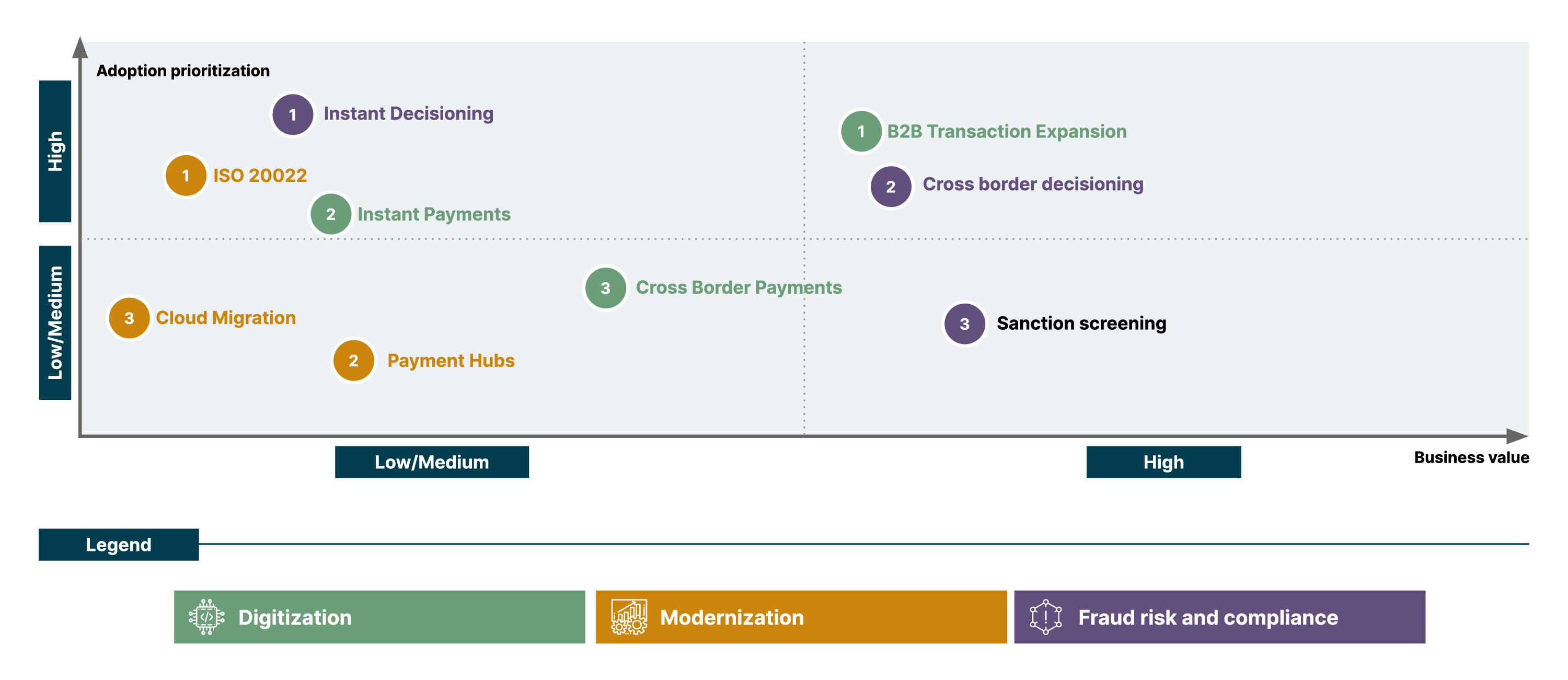

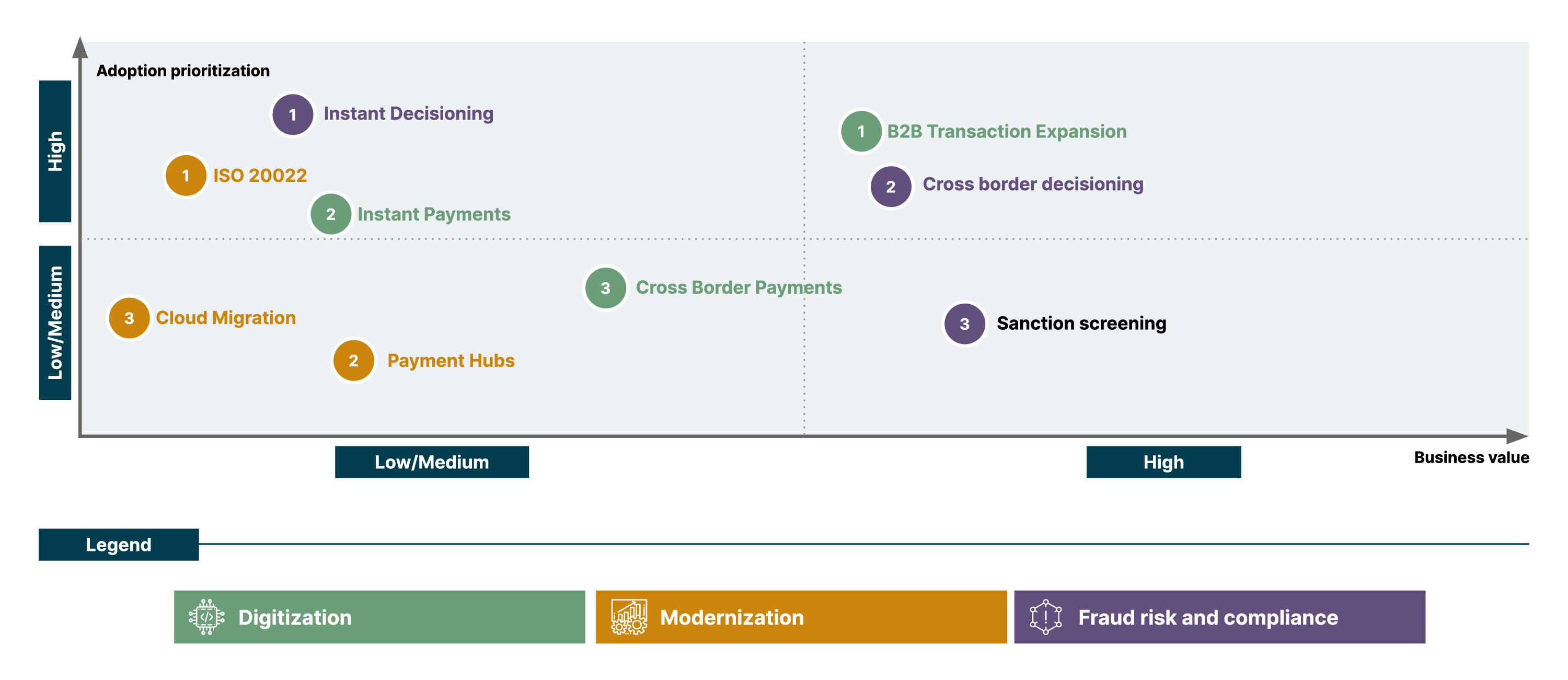

With so much change happening across the payments space, where should you start? At Thoughtworks, we developed the below matrix to reflect where the current trends reside based on current industry organizational strategic plans. By observing the industries plans you can determine where you can how to respond to these shifts, and help you visualize what each of them could help you achieve from a strategic competitive advantage perspective:

Where would you place your payments strategic imperatives on this matrix? Shifts with high adoption prioritization are ones that organizations need to start working towards right now. They’re driven by external factors like new regulations, market demands, and the actions of competitors.

Shifts with high business value have the greatest potential to deliver major business benefits such as:

Delivering incremental revenue and profit

Improving customer retention

Increasing average transaction values and checkout associated revenue

Reducing fraud losses

Improving customer approval rates

Don’t wait for change to happen. Drive it.

Payments services and capabilities now sit among the top competitive differentiators for financial services providers and their customers. To keep your place in your market, it isn’t enough to simply keep up with the pace of change — you need to get ahead of the curve. Our payments priorities matrix helps you establish how technology can help you solve your biggest challenges.