Data in Financial Services

The financial services landscape has changed significantly in recent years, creating a level playing field for new fintechs and superapps who are changing the game, alongside large enterprise banks.

The need to harness data, drive business growth and strategy through data intelligence has fast become an area of focus and investment, spurred by three main drivers:

- Customer hyper personalization : customers expect experiences which are tuned to the individual and can be looked at as a segment of one

- Speed of new product creation : the rise of fintechs and challenger banks are changing the service landscape with speed and diversity of product creation

- Ecosystem collaboration : Ecosystems are becoming center stage with marketplaces, banking/insurance as a service, partnerships needing to share customer information, with consent.

These factors are driving decisions on how investments are being prioritized and how organizations are building their data roadmaps. Alongside, however, large organizations are also struggling with the need to modernize their data estate and continue to meet enterprise reporting and compliance requirements.

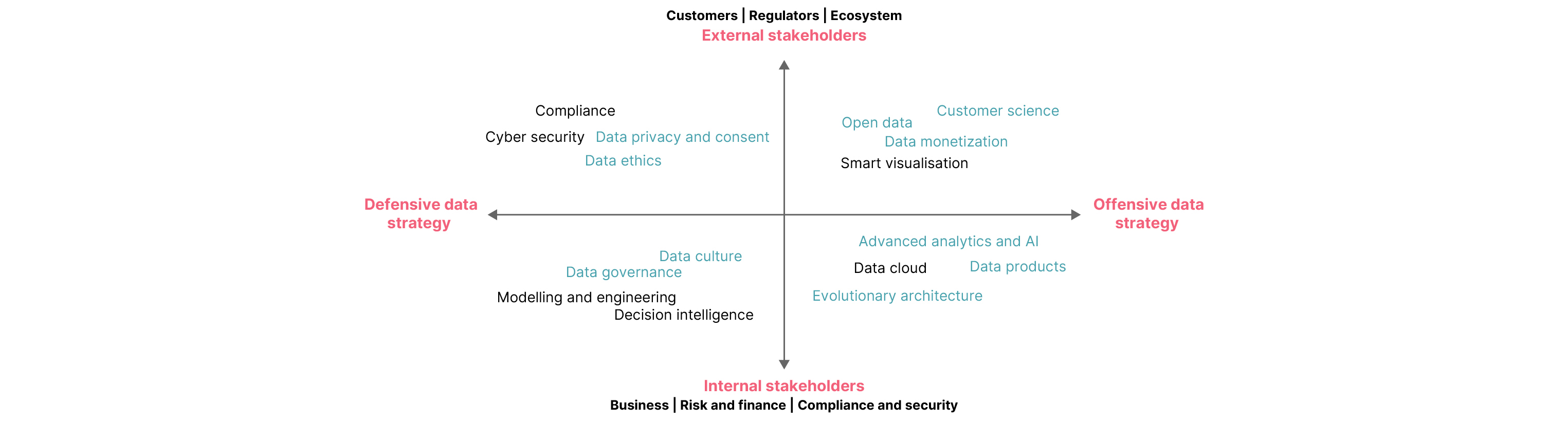

The reality of having to meet the data needs of diverse stakeholders such as digital business heads, ecosystem collaborators, finance and compliance teams, operations and governance teams requires a balancing act of investing in a roadmap which meets a combination of offensive and defensive data strategies. We have identified a set of ‘data narratives’ and their relevance to data strategy and to stakeholders, as showcased in Figure 1. A ‘data narrative’ as defined by Thoughtworks are the specific areas within data that an organization has identified as the area(s) of investment. In Southeast Asia, organizations in the FSI sector are primarily focused on eight data narratives as they strive to extract the maximum value from their data and alongside continue to modernize their data estate.

Data narratives for a data driven financial enterprise

Fig. 1 Highlighted data narratives seen in focus in financial services in Southeast Asia

Organizational choices on balancing offensive and defensive data strategies and correspondingly the data narratives they will invest in, is also impacted by the history of the institution and the environment they operate in. Some of the key factors which has influenced organisational background of financial institutions in Southeast Asia are:

- Different levels of economic maturity : a market like Singapore is highly banked and home to digitally-enabled customers. Banking activity data is therefore abundant to deliver enhanced financial products and solutions and highly personalised experiences. A market like Indonesia on the other hand, though home to more than 1600 institutions, is a mix of banked and low-banked populations and does not produce similar data for every customer.

- Data-native or not : a wide mix of domestic institutions, foreign banks, digital challengers and fintech companies result in differences in approaching data across modernizing legacy data assets urgently to data-native innovation.

- Regulatory thrust : regulators in the region have recognized the importance of data and its sharing and have allowed for open APIs in most markets without mandating open banking regulations.

To cater to the many layers of complexity in becoming a data-driven financial institution - balancing a data strategy to meet stakeholder needs, recognizing specific organizational challenges and changes needed and applying data platform technology successfully, there is a need to have a blueprint that helps define this path. A blueprint for data-driven enterprises should help organizations take a structured approach driven by agile thinking and value-driven use cases and delivered by modern data engineering.

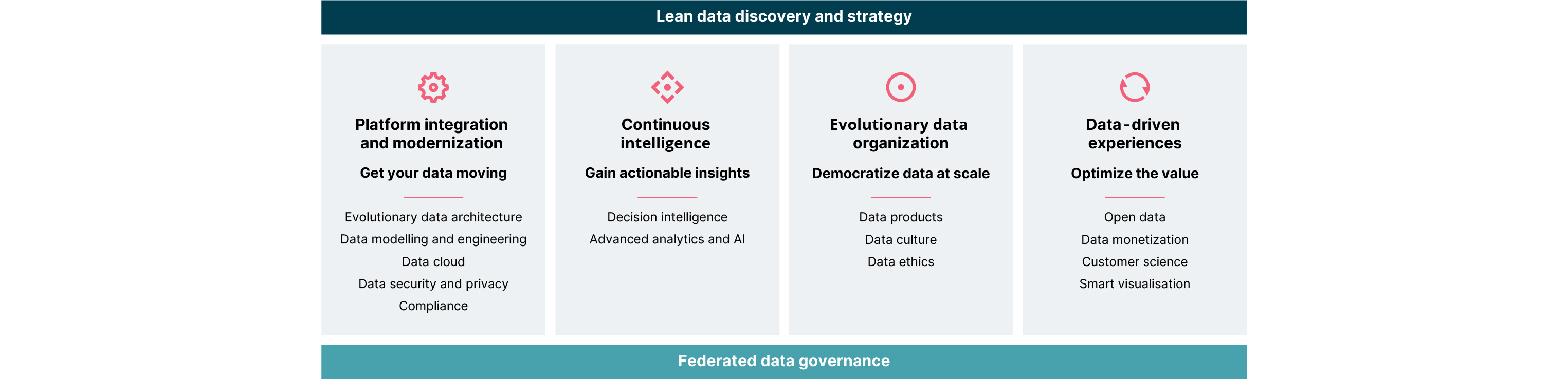

Our blueprint for data- driven enterprise

Our blueprint for data driven financial enterprises comprises of the above six aspects of data management and data value realisation -

- Lean Data Discovery and Strategy : lean principles applied to data landscape discovery and strategy roadmaps

- Platform Integration and Modernization : agile data engineering and build-in security for data assets with modern tooling

- Continuous intelligence : build-in CD4ML for analytics workbenches to self-serve descriptive, predictive and prescriptive intelligence

- Evolutionary data organization - domain-driven design and product thinking applied with the Data Mesh approach for data democratization

- Data-driven experiences : open data APIs implemented to engage in innovative business models.

- Federated data governance : decentralized implementation of data catalogs, quality, access control and more with centralized policy and tooling support

The phased or accelerated adoption of this blueprint will guide the speed of data-driven transformation. We are seeing data and digital initiatives as the two cornerstones of financial services transformation and a data-driven financial enterprise will not only drive business growth but also prepare organizations to be adaptive to changing business needs.

Industry Panel Discussion

Navigating your data swamp: Journey and approaches to unlock business value and drive innovation with data

Data Mesh, Monetization, Innovation, Open Banking - the data landscape has gotten murky with many leaders focusing on defining the best data strategy and approach for their business. Watch this recorded webinar to learn more about the approaches, challenges, use cases, considerations that can help businesses maximize the value of their data.

More content delivered to your inbox

Stay up-to-date with our latest business and industry insights.