Over the past few years, financial service institutions have been aggressively adopting digital technologies to maximize reach and reduce cost of operations. While changes to customer touchpoints are relatively easier to execute, most transformation of back office operations is deemed risky and requires interventions on both the process and technology fronts.

Which is why, barring a few leaders and digital natives, lending institutions are yet to tap into the opportunities afforded by going digital-first. This is especially true of the collections arm in lending organizations – the function primarily responsible for pursuing payment of debts owed by its customers.

As part of a huge digital transformation program for a large financial services company, Thoughtworks recommended a transformational strategy for loan collections and introduced the right technology interventions for operational efficiency gains and better end-to-end customer experience.

The business challenge

Our client, in Thailand, was facing extensive operational pressure when it came to their collection teams – nearly 35% of their workforce made up the collection arm.

An increase in the client’s customer base was linearly proportional to the growth in their collections workforce. Not to mention, a majority of this workforce spent vast amounts of time calling defaulting customers to secure promises of payment.

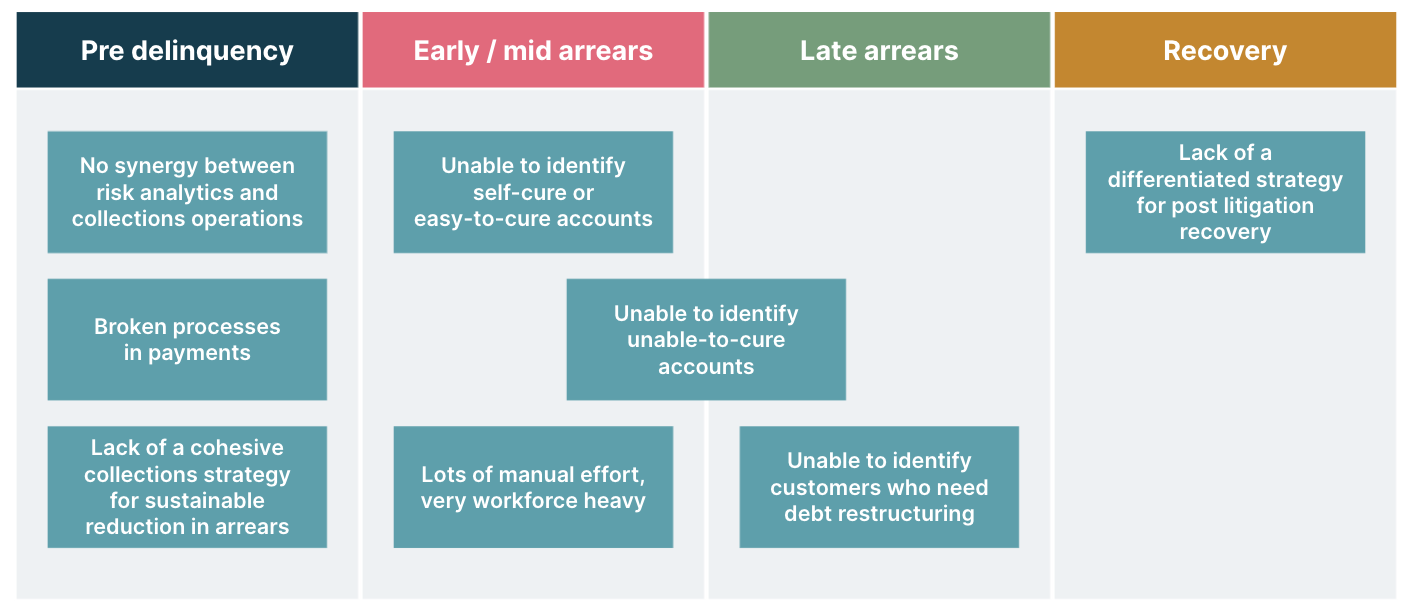

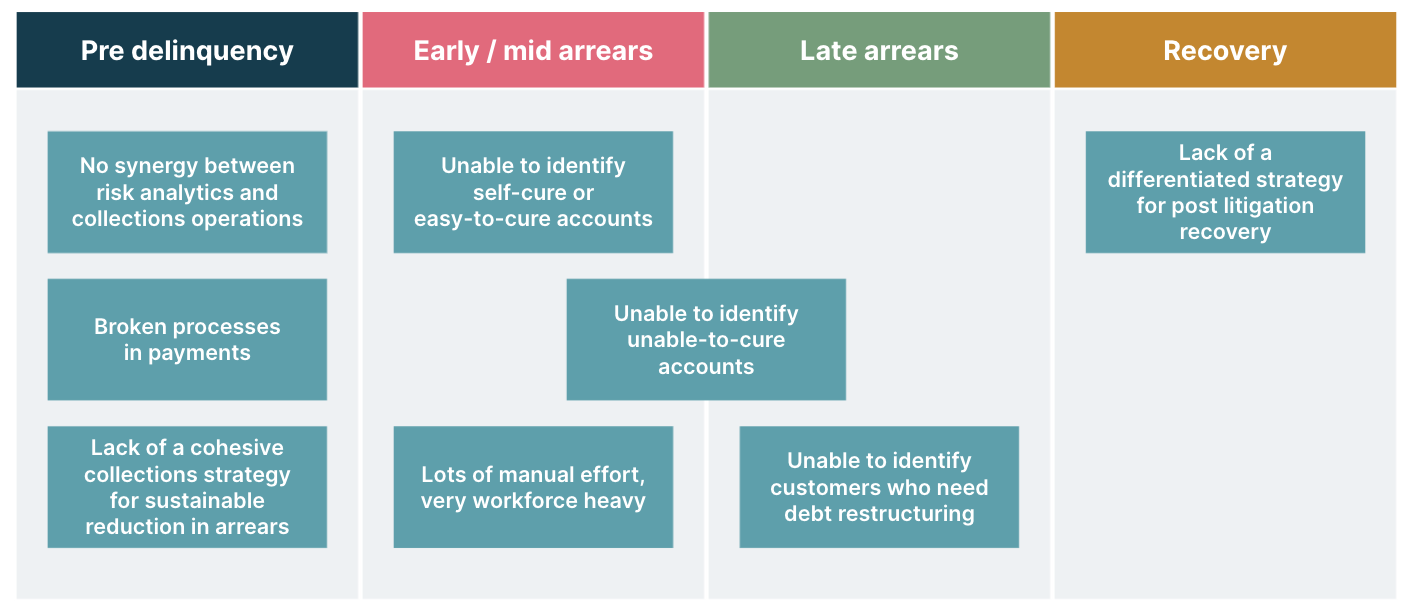

During our discovery, we identified the two key factors driving this trend:

Collection strategies were traditional in their approach; relying on calls to secure a promise of payment

Customers were landing in the ‘collections funnel’ because of process inefficiencies that weren’t addressed upstream

Problems seen in loan collections

Our approach

To address these two problem areas, we recommended two distinct technology interventions:

Transition from the company’s traditional collections to an analytics-based customer segmentation treatment, driven by appropriate technology interventions

Fix gaps in the payments and account management journey to minimize the number of customers who land in delinquency buckets

1. Analytics-based customer segmentation and treatment

Call prudently. Don’t call everyone.

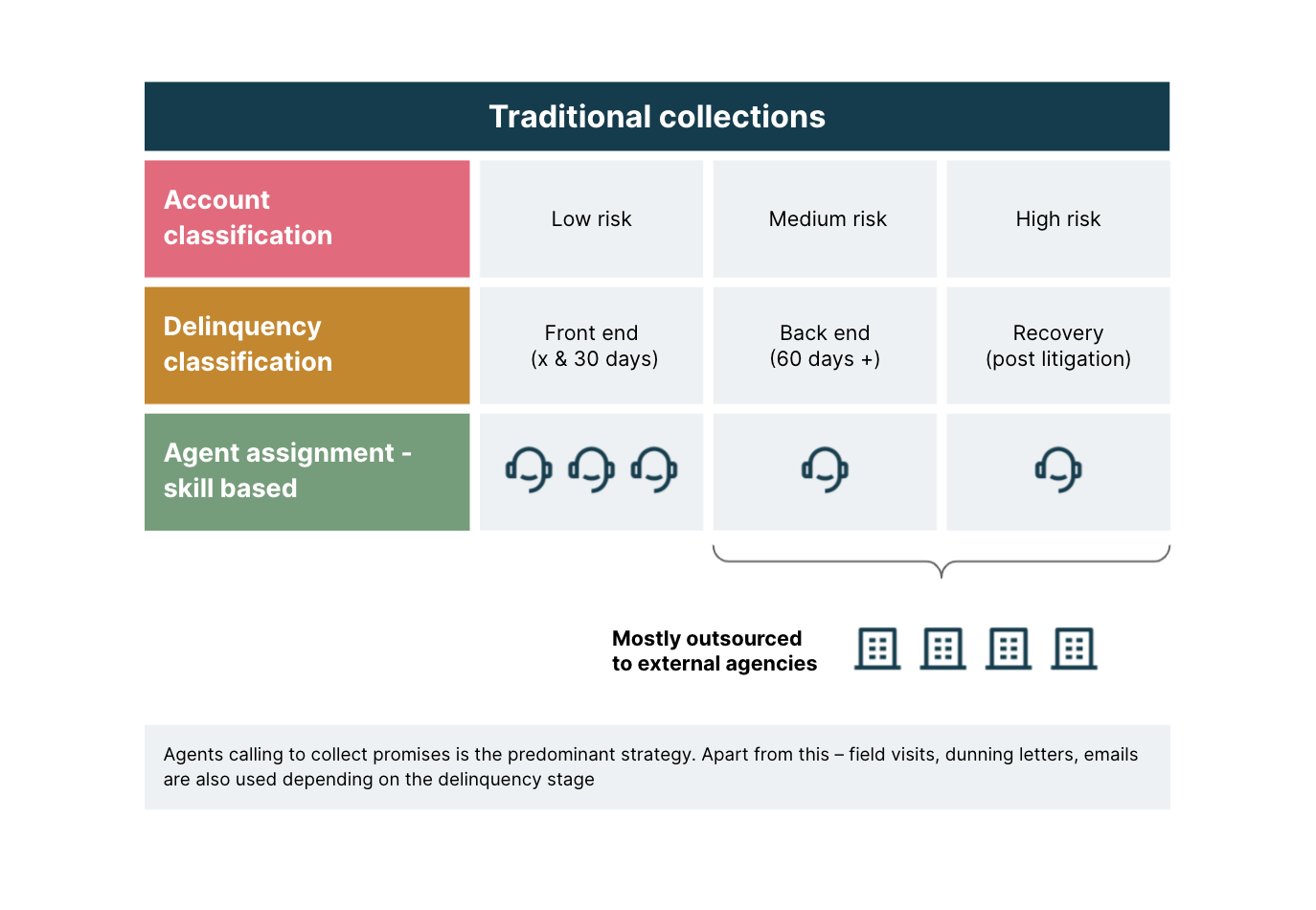

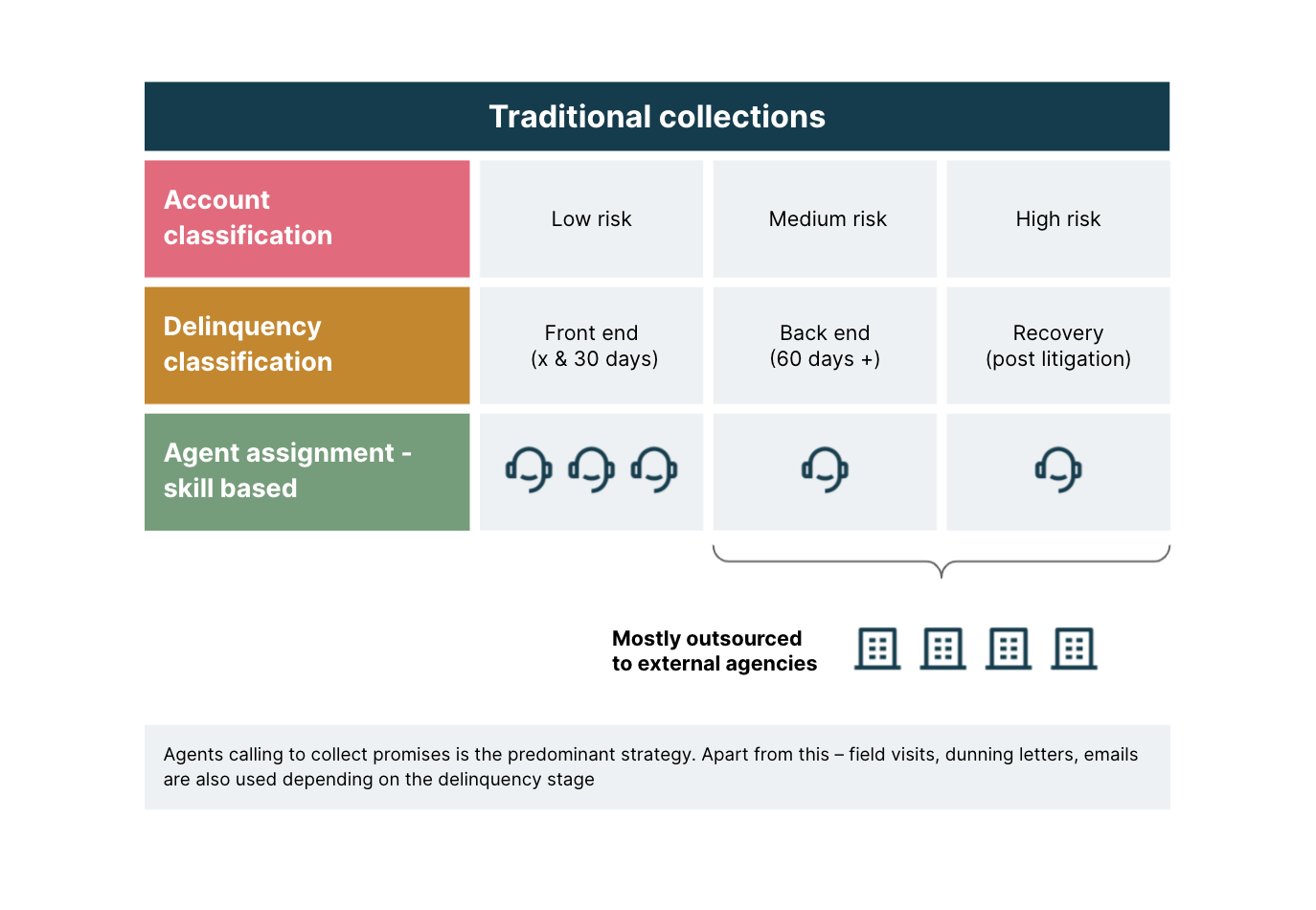

The client’s traditional collection strategy relied heavily on employees (or outsourced agencies) to call customers who, irrespective of their risk level, had fallen into front end, back end or recovery stages of collection.

The likelihood of securing a promise (to pay) increases with more calls, making the respective department focus their energies on calling customers early in the delinquency cycle. The assumption here is; the longer an account stays in delinquency the lessesr the chances to cure it.

This approach needed a change. Customer accounts in the high and medium risk category required intensive human contact to gauge if they either needed proactive debt restructuring (towards cure) or needed to be assigned for an exit.

More often than not, customers in early delinquency and pre-arrears stages such as self-curers, otherwise called forgetful customers could be persuaded with digital interventions. Based on this understanding, we developed technological interventions on two counts.

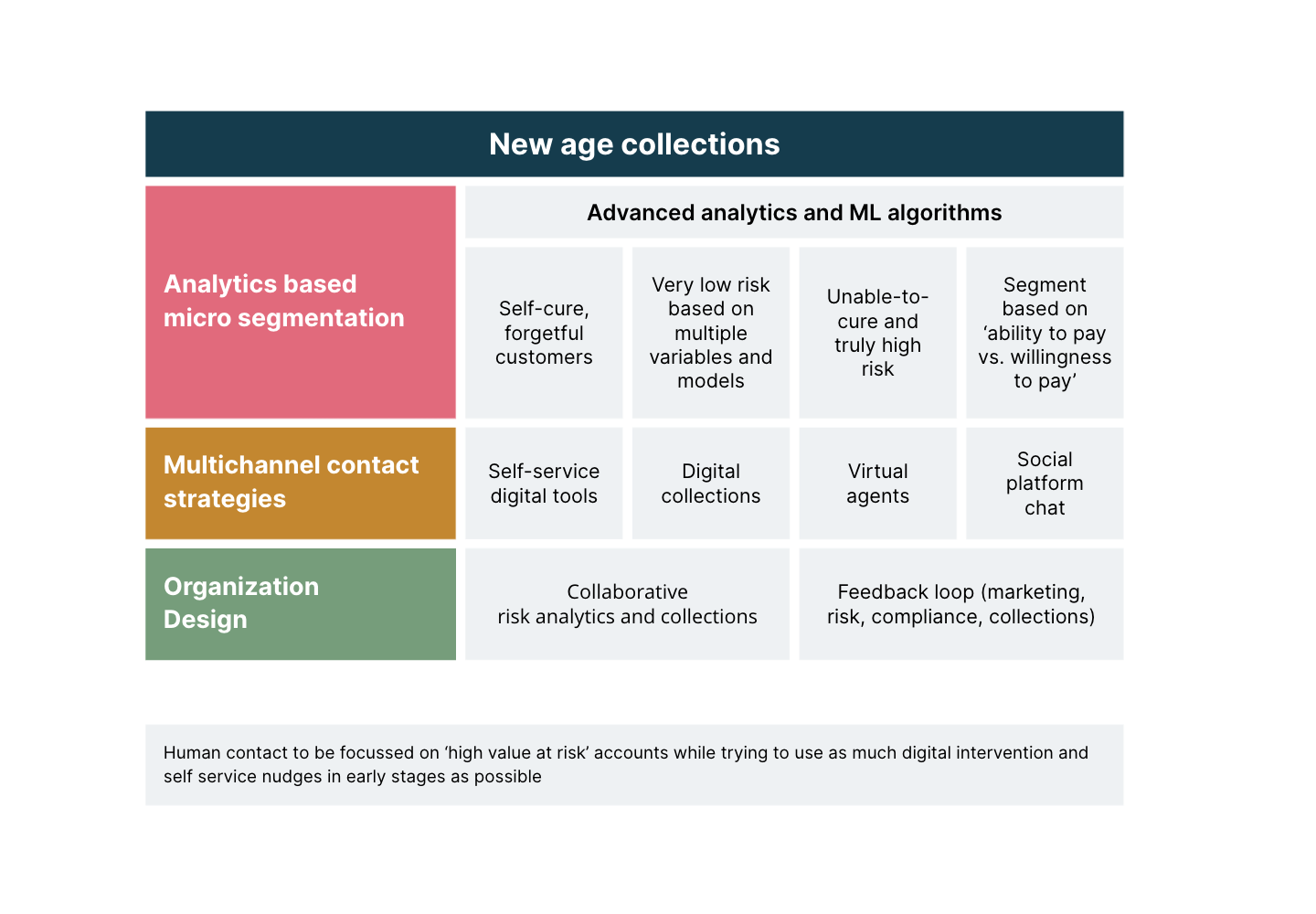

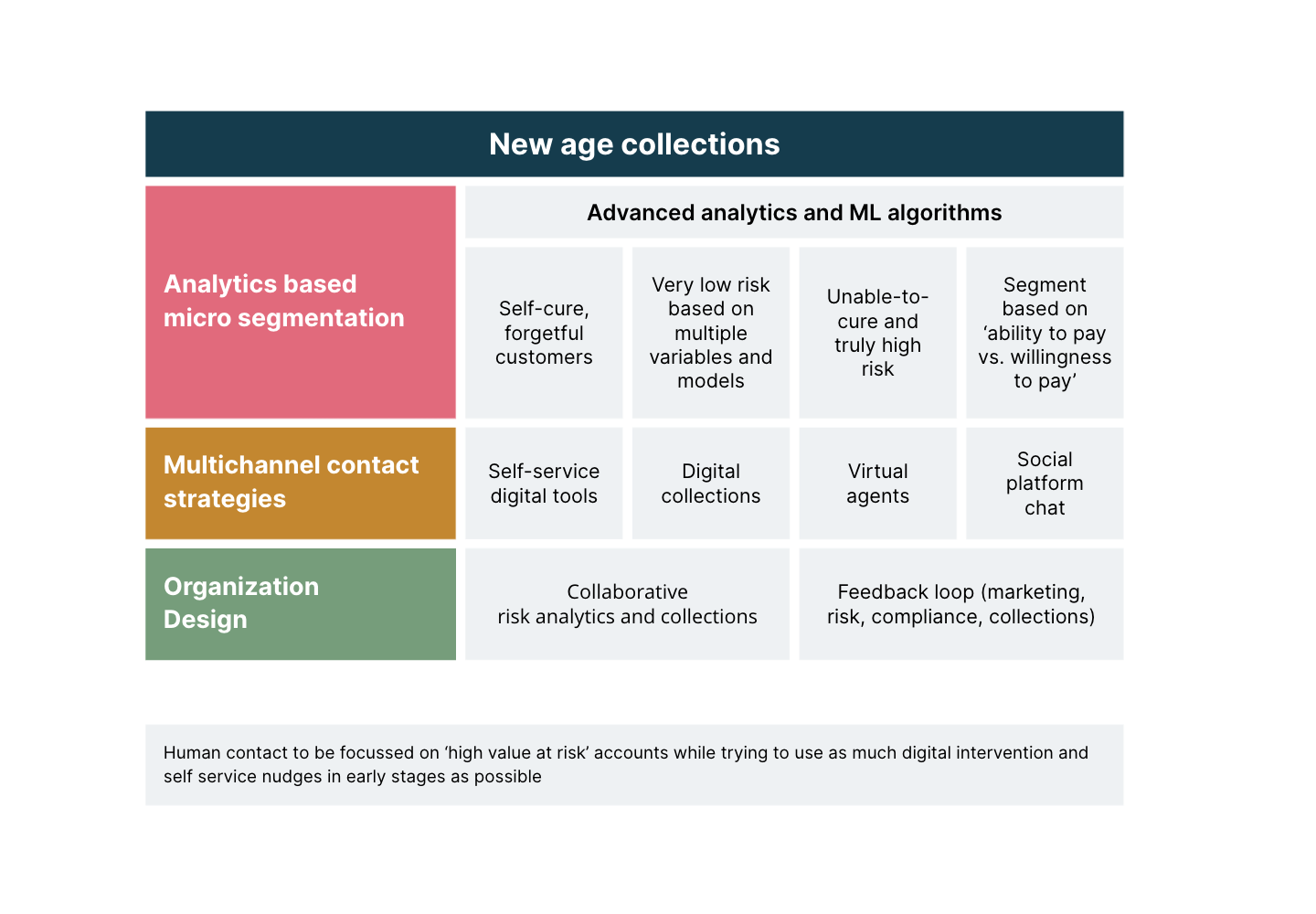

Analytics-driven micro segmentation customer strategies

Based on customers’ demographics, risk profile, payment behavior and other supplementary data, we were able to ensure:

Early identification of self-cure and forgetful customers

Segmentation of customers based on their ability and willingness to pay

A path ahead that diversified into either a path-to-cure or a path-to-exit

Customized restructuring offers; a win-win for both parties

Multi-channel contact strategies

This analytics based segmentation approach helped direct the human effort into non-self-cure accounts while leveraging digital automated nudges or tools for self-cure and offers. This would also reduce the client’s reliance on external agencies, who could otherwise be involved more strategically in non-cure accounts.

Together, both the described strategies would ensure customers do not linger in the backend buckets,which would further reduce the reserve provisioning with the central bank and improve the client’s overall operating margins.

2. Fixing the payments journey to limit customers landing in delinquency

Online, wallets, kiosks, social payments - give them more!

On analyzing the customer data in early delinquency, we learned many customers were landing in the collections funnel because of process inefficiencies. Such issues were not effectively addressed upstream, in the payments function. Add to this, varying repayment behavior alongside unavailable or fragmented digital self-service functions.

Our recommendations included:

A mobile/web app that ensured real-time visibility of outstanding bills or online bills

Multiple payment options like Line Pay, WhatsApp Pay, and other local wallets

Integration with external payment platforms that could support offline payments for customers in remote locations

Incentivising customers to sign auto-debit instructions

Real-time receipts and notifications

Payment reminders, promise-to-pay reminders

App-based provisions to provide detailed information like upcoming promise-to-pay dates along with the amount to be paid on that date

Notifications for broken payments with penalties (when applicable)

Ability to raise debt relief request/proactive debt restructuring offers (based on qualification criteria)

Digital interventions such as these, would require the client to double down on its platform capabilities, directly influencing its digital strategy and ecosystem play.

The pandemic increasing the need for remote loan servicing

Since the pandemic, lending institutions are proactively seeking fully remote end-to-end loan servicing capabilities. Our client was no different.

The ‘new normal’ has presented a significant opportunity for retail financial services players across Southeast Asia and other markets to reexamine their loan servicing journeys and drive transformational changes in the space. We believe fully remote digital loan servicing may in fact, become a norm.

However, transformation to a completely remote and end-to-end loan servicing model requires thin-slices of change that spans the organization’s people, processes and technologies in use. And, lending organizations must be prepared to look beyond software products and approach this journey as the business transformation it is – powered by digital technologies.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.