Ecosystem for financial services in SEA

The platforms created by businesses are increasingly only a starting point. Meeting rising customer expectations often requires joining up with or being open to other participants, turning platforms into ecosystems of related products and services that evolve dynamically as constituents cooperate and compete.

Scanning the signals

Ecosystems are the reality of the market today — whether organizations want them or not. Organizations set out to build platforms that they control and expand, but the messy reality of modern interconnected businesses is that often an ecosystem of diverse participants will emerge, and an organization will be forced to participate or lose its place in the market. The better you acknowledge that reality, the better placed you are to compete.

The key difference between a platform and an ecosystem is control. An organization can create and run a platform, which gives them control over who can participate. But a company can only loosely set standards for an ecosystem, and participants may emerge spontaneously. Like a biological ecosystem, a technology ecosystem involves competition and ‘survival of the fittest.’ This means symbiotic, parasitic and predatory behavior, as well as a continuing need to adapt or perish. There are limited resources — often economic, but sometimes something such as “consumer attention” — and the struggle for these fuels interaction, innovation and evolution.

Signals here include:

- Organizations with more than one ‘platform,’ and cooperation across and between those platforms.

- Dynamic introduction and removal of participants within an ecosystem

- More “peer” relationships between components as opposed to relationships between “platforms” and “consumers” — this implies no central ownership of information, such as user accounts.

Drivers for ecosystem models

- Change in Customer expectations resulting in concepts like Embedded Finance and super-apps, which solves customer problems with collaboration across various industries.

- It's imperative for customers to find transparency while exploring the right offers of different financial institutions across marketplaces, comparison websites, where demand and supply is matched.

- Increase in cost of acquisition of Customers due to high competition in market and with traditional models adopted across finance industry

- Technology Innovative Solutions like Cloud APIs enable the Finance Industry to easily integrate with other industry partners or fintechs.

The opportunity

Consumers make purchasing decisions based on how your product fits in their ecosystem. Misunderstanding your position in the ecosystem can lead to poor business outcomes, while knowing when to share or ‘let go’ can create a source of competitive advantage.

For example, Singapore’s OCBC provides a marketplace for parents that serves as a one-stop portal offering everyday essentials, nursing and feeding products, medical services and, of course, the ability to open a bank account for the child. Moreover, OCBC operates a digital home buying platform whereby customers, for example, can search for properties and get valuations, insurance and house renovation design ideas.

The lesson here is that enterprises that play to their core strengths, and make sure their offerings are built to interact with surrounding ecosystems that are evolving holistically, will be best placed to win over customers and succeed in the emerging business environment.

What we’ve seen

In Singapore, DBS offers a one-stop online market for customers looking to purchase or sell cars through its Car Marketplace.Through the marketplace, users have access to a budget calculator to estimate the loan amount, they can search for cars based on their budget, and they can arrange a test drive online. Once the car is purchased, customers can benefit from additional services like savings on petrol and insurance. But DBS’s ecosystem efforts are not limited to the mobility space —they are also targeting other life moments through marketplaces in the utilities, housing and travel spaces.

For example, small and medium sized enterprises (SMEs) spend a significant proportion of their time on non-business activities, such as banking, tax, bookkeeping and payroll management. More importantly, many may be facing challenges about accessing basic banking services due to the difficulty of assessing their businesses’ profitability and accurately quantifying their risk exposure. By creating an ecosystem that goes beyond servicing the core financial needs of SMEs to integrate their broader needs as well, banks can establish themselves as a vital component of the SME lifecycle.

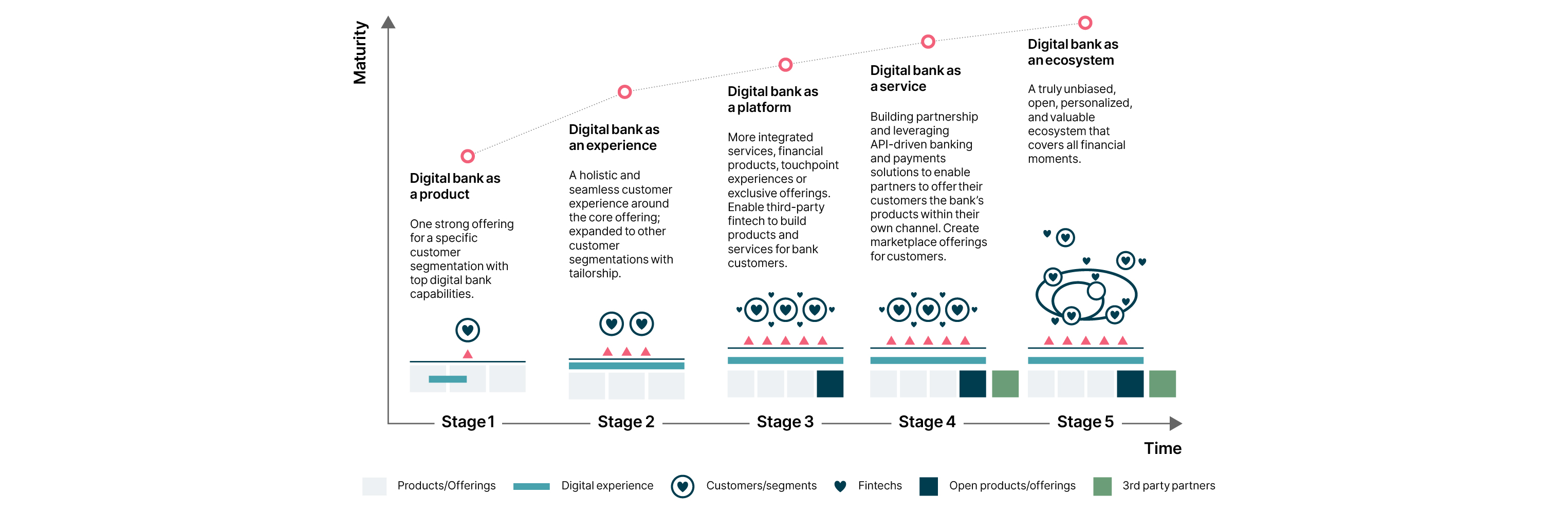

Ecosystem roadmap for financial service enterprises

For financial institutions (FIs), participating in these ecosystems is no longer an option but a competitive imperative.These ecosystems, enabled by digital platforms, bring different parties across industries together to seamlessly collaborate and create new value-added products and services.

Digital platform enables publishing and utilising services from the entire network of partners and customers.Collect & correlate “digital exhaust” across channels and partners; Insights as a Service to allow partners to create customised offerings;

Ecosystems have the potential to create dynamic financial marketplaces that are disaggregated, yet connected through a broader ecosystem of networks, data and information.

Financial Services need to focus on a strategic digital journey

Roadmap - Advice for adopters

Think beyond platforms

In most organizations today ‘platforms’ have momentum, mind share and often significant investment. But it’s important while creating and building on platforms to also think about the ecosystems that are taking shape in your space, and to ensure the platforms and products that you build can be peers in something larger.

Act fast, and be flexible.

As with a biological ecosystem, the worst thing for participants in a technology ecosystem to do is stand still — they must continually compete and evolve. It’s important to be somewhat opportunistic with your participation in ecosystems, and recognize other participants are likely doing the same. Participants may cooperate when it is clearly beneficial to them, but only until one party feels they can out-compete a rival or choose a better partner.

Consider the ecosystems of your customers

Beyond technology, consider ecosystems from a go-to-market perspective. Ask yourself: are there opportunities to integrate better with your customers’ ecosystems? Should you partner with other companies in order to create or extend an ecosystem of complementary products?

Look for new connections.

Challenge your existing notions of how your products interact with the outside world, as well as the scope of those interactions. Look for opportunities in those interactions to deliver more value to your customers, and to make your products and services more valuable by nature of them being part of an ecosystem.

Industry panel discussion

How is coopetition driving financial institutions to embrace ecosystem play?

Ecosystems are the reality of the market today — whether organizations want them or not. Organizations set out to build platforms that they control and expand, but the messy reality of modern interconnected businesses is that often an ecosystem of diverse participants will emerge, and an organization will be forced to participate or lose its place in the market. The better you acknowledge that reality, the better placed you are to compete.

More content delivered to your inbox

Stay up-to-date with our latest business and industry insights.