When Apple announced the launch of “Apple Pay Later” in March, it put the BNPL (Buy Now Pay Later) business model back into the limelight.

So what is BNPL?

Simply put, BNPL means receiving goods before paying. It’s similar to a virtual credit card. When shopping, choose a credit card (virtual or otherwise) to pay. Repay before the payment date or use an interest-free payment plan after receiving the product.

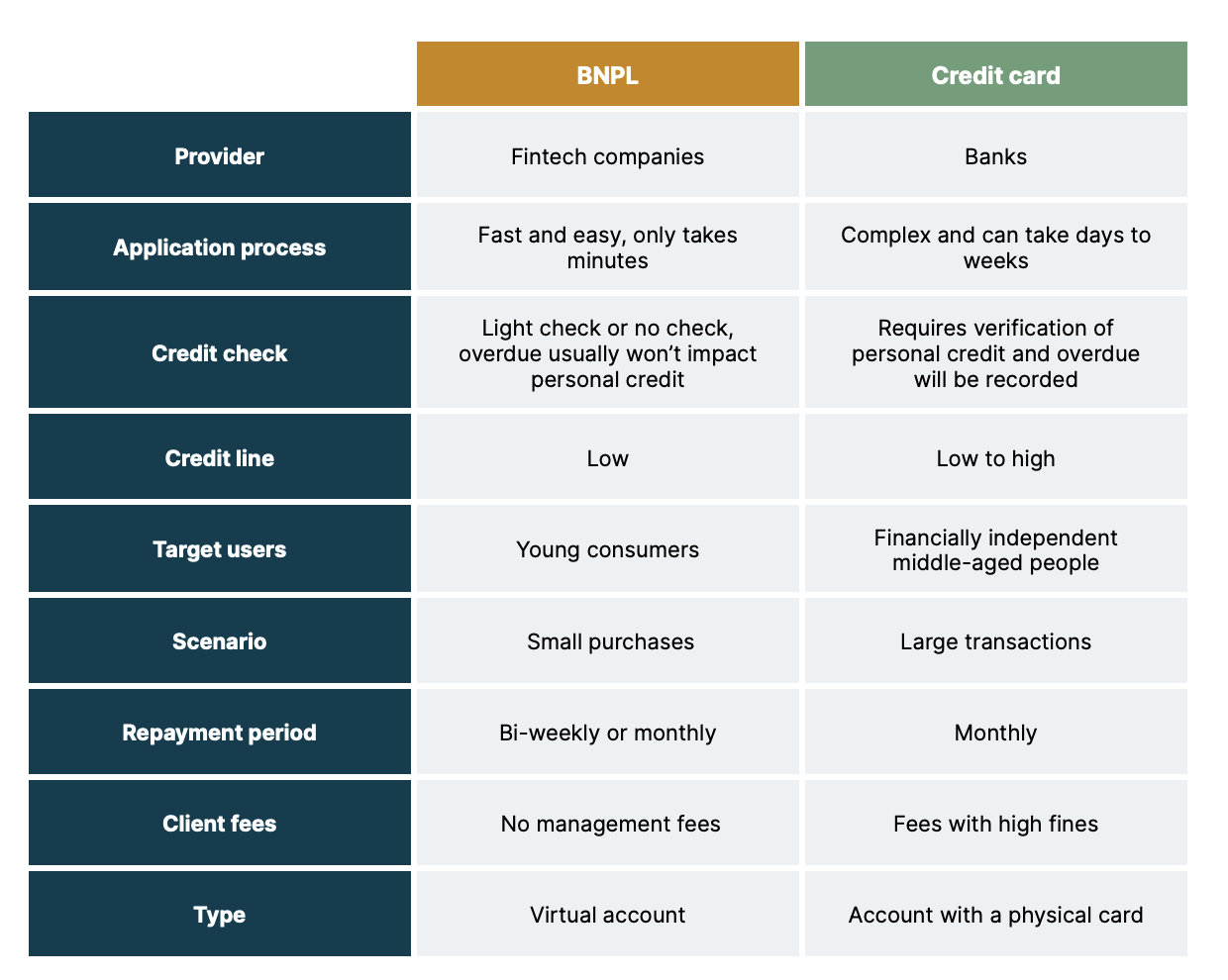

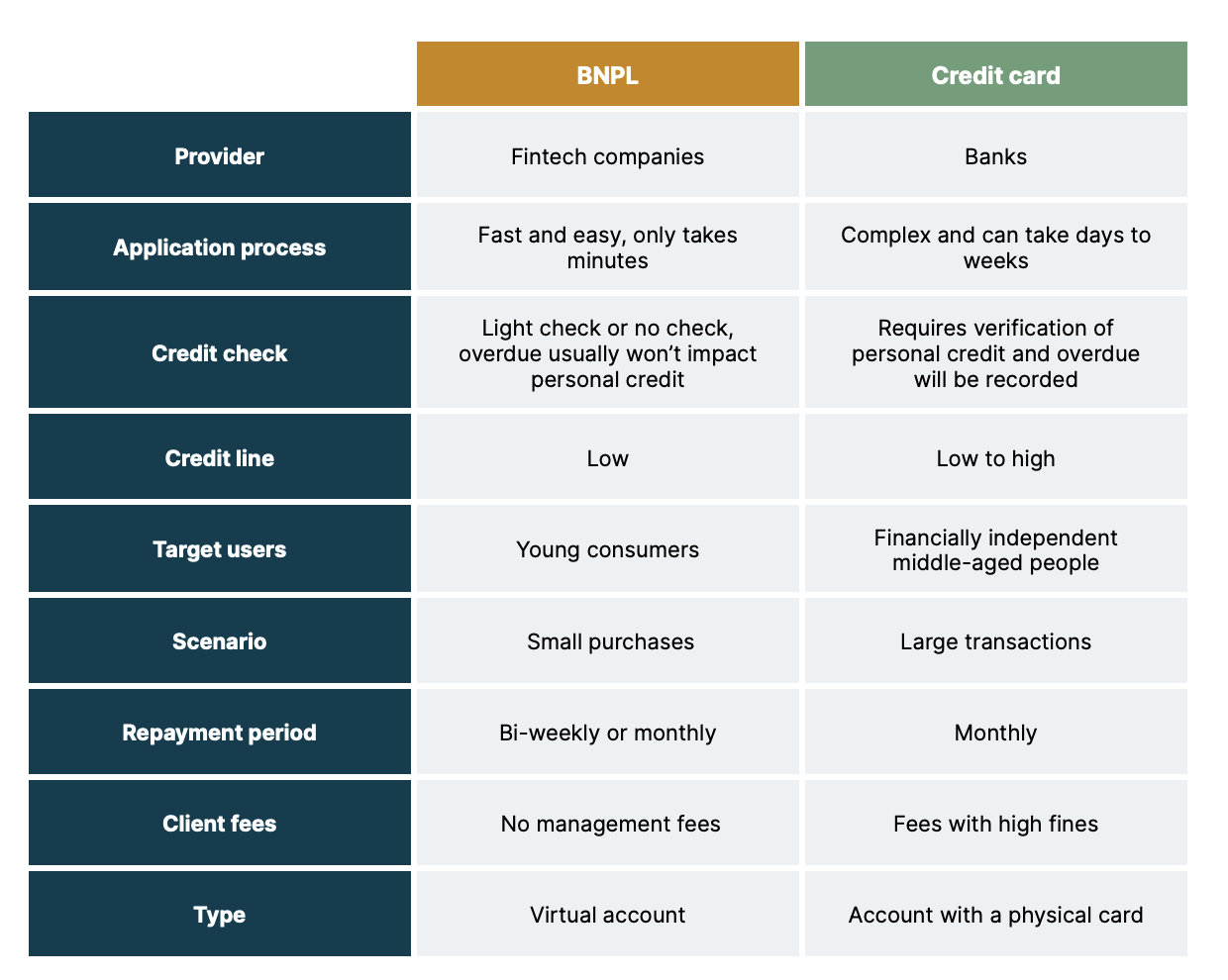

However, there are still differences between BNPL and credit cards.

Compared with credit cards, BNPL can be considered a lightweight microfinance product that is simple to start and doesn’t put too much debt pressure on its users. It meets the needs of both young users and merchants. However, with the development of BNPL and credit finance, there’s an increasing overlap between BNPL and credit cards. For example, BNPL company Affirm increased its purchase limit to $17,500 while Klarna doesn’t have a predefined credit limit.

What are the advantages of Buy Now Pay Later?

The customer perspective

Millennials and Gen Z are BNPL’s main customer groups. The adoption rates among Gen Z are expected to increase from 36.8% in 2021 to 47.4% in 2025. They are more sensitive to the lengthy application process of credit cards, but enthusiastic about new technology products. Generally, there are no handling fees, including installment and management fees; some BNPL institutions don’t have any fines. BNPL also allows users to shop on credit with partial immediate payment or even without immediate payment, which is an obvious benefit in the short term as it provides more options regarding their financial plans.

The merchant perspective

BNPL institutions aim to provide merchants with one-stop services, including payment, new traffic, financial operations and data analysis services. Even though merchants have a set-up cost, BNPL can expand traffic channels for merchants, and increase the exposure of products and brands while reducing the pressure on cash flow. With more BNPL products available, certain add-on features like data analysis and promotions also make this payment option more competitive.

BNPL can bring a 20% - 30% transaction conversion rate for merchants and a 30-50% increase in average sales, according to the data provided by Global Payments’ 2022 Commerce and Payment Trends Report’.

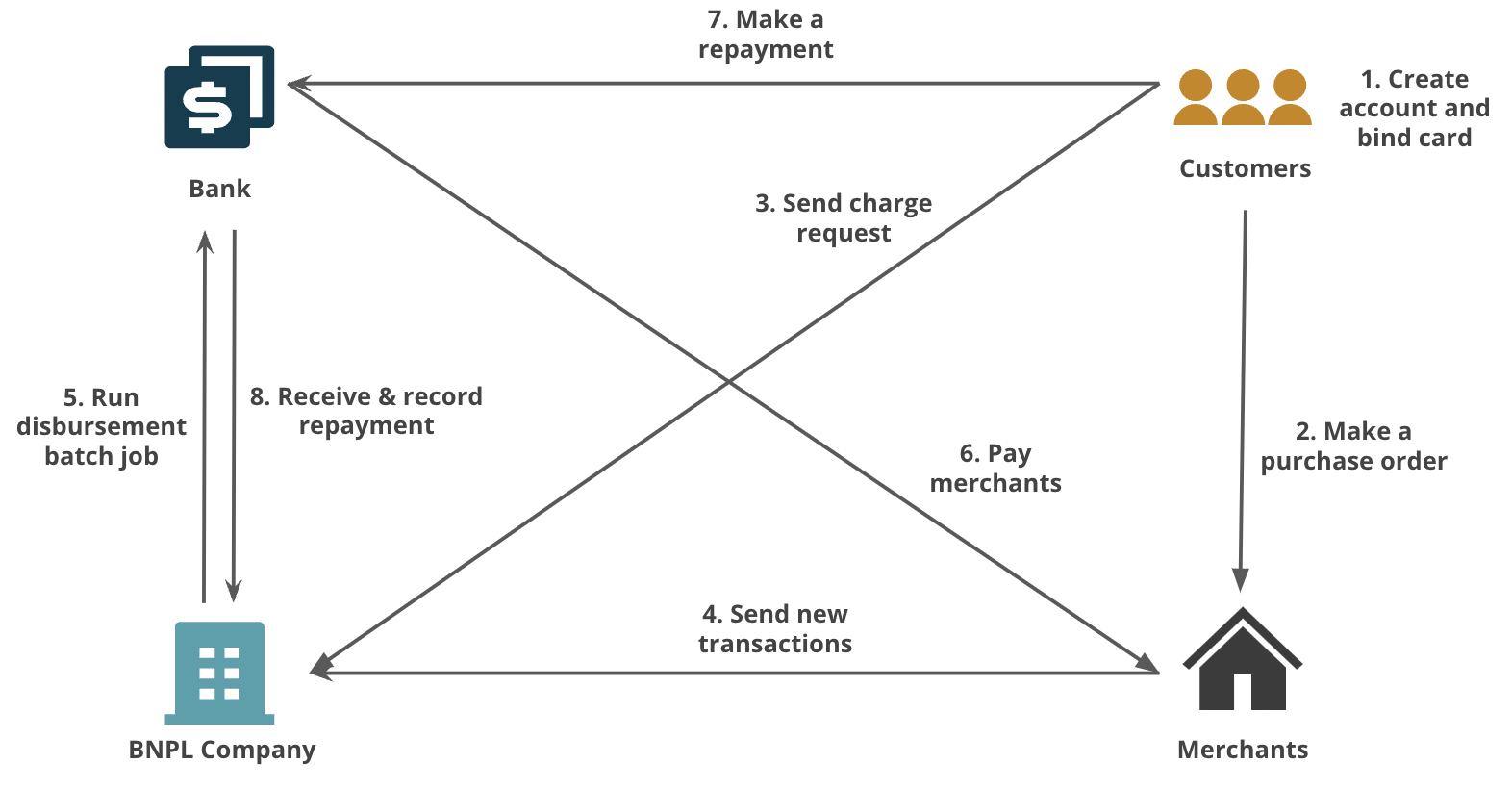

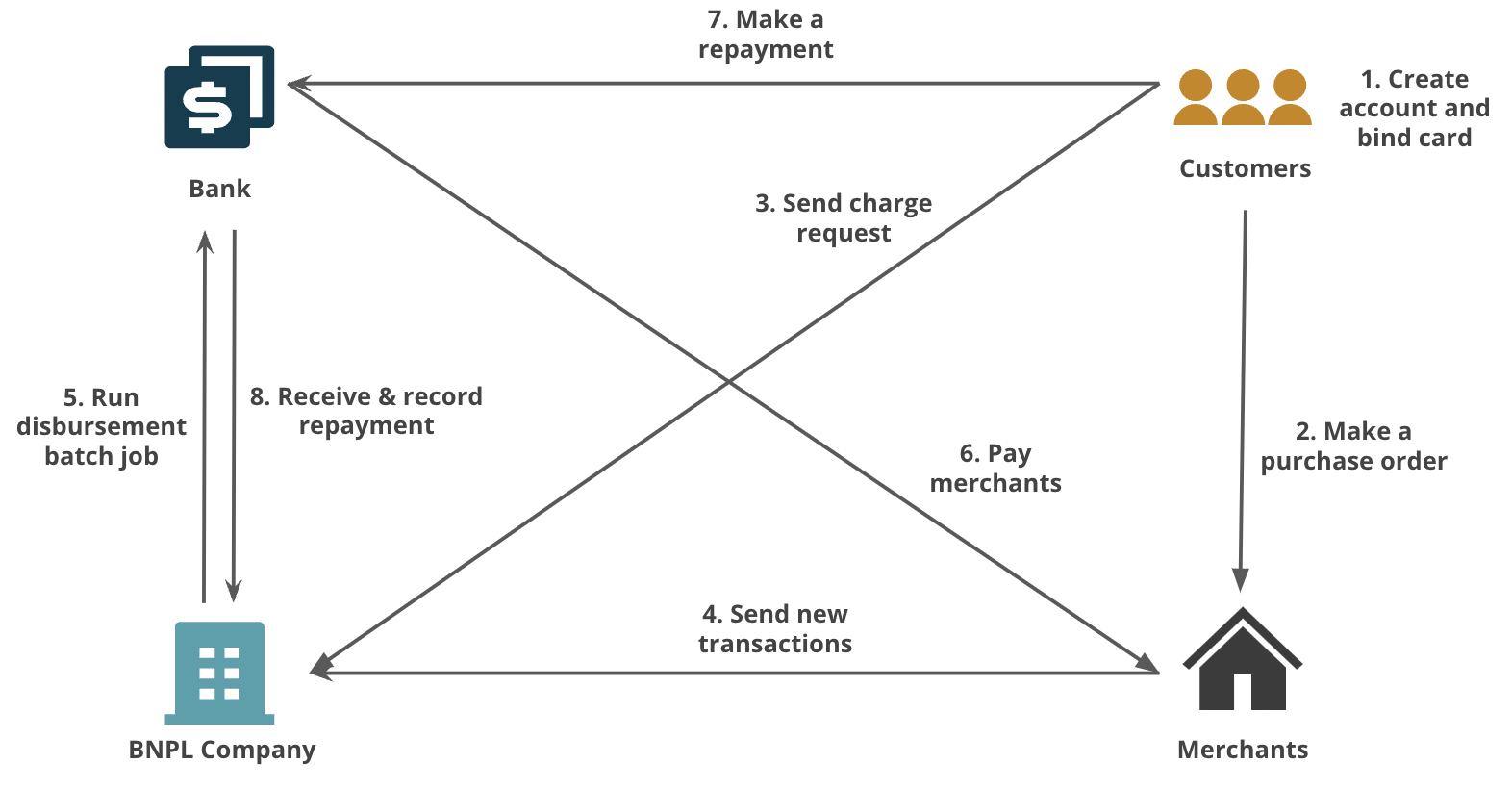

The Buy Now Pay Later business process flow

The business flow of BNPL includes card binding, order payment, disbursement, and repayment.

The transaction flow generally takes eight steps.

Customer creates an account and binds their card to it

Customer makes a purchase order to merchants

Customer sends a charge request to the BNPL company

Merchant sends the new transaction to the BNPL company

The BNPL company runs a disbursement batch job to the bank

The bank pays the merchants

The customer makes a repayment to the bank

The bank receives and records the repayment to the BNPL company

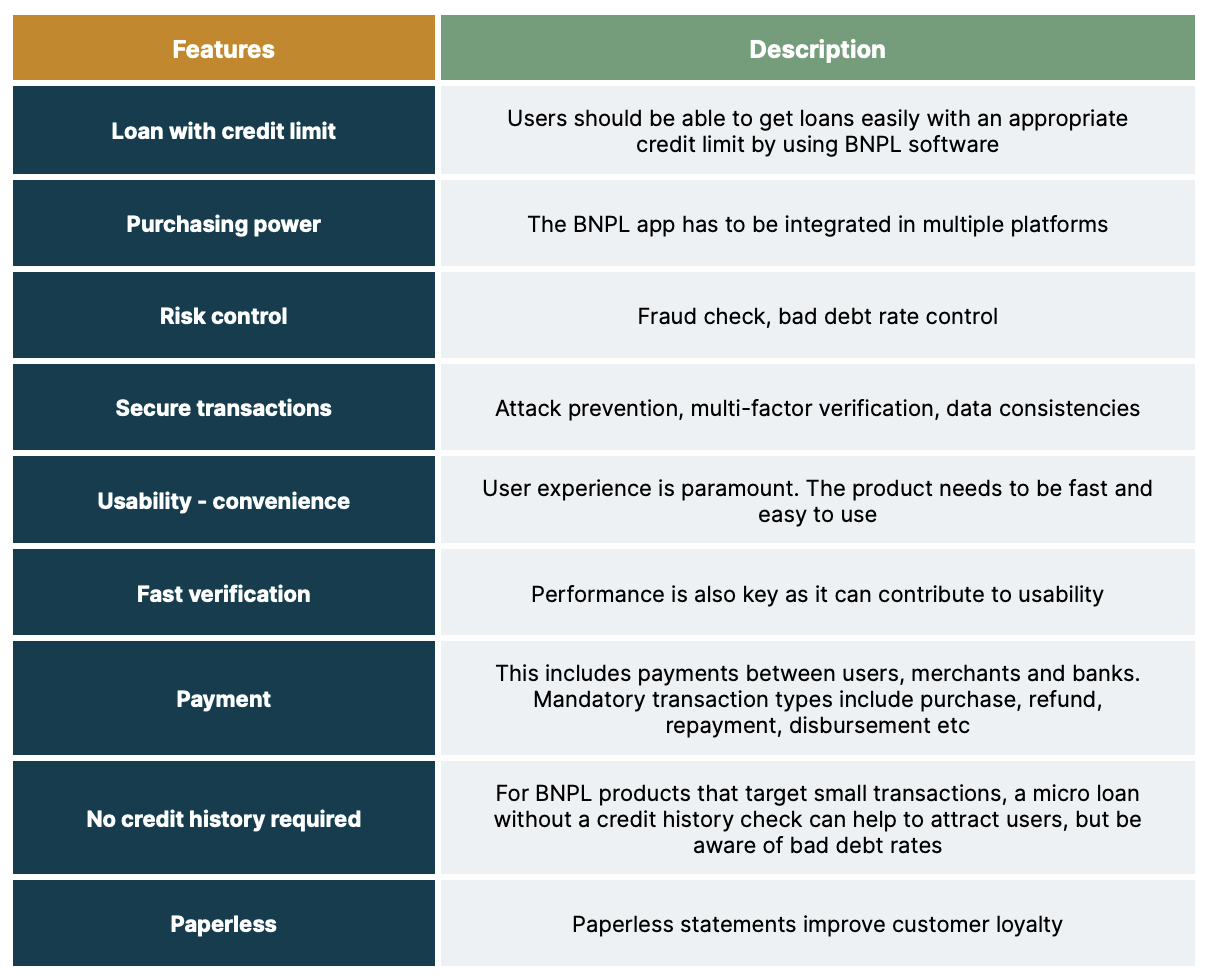

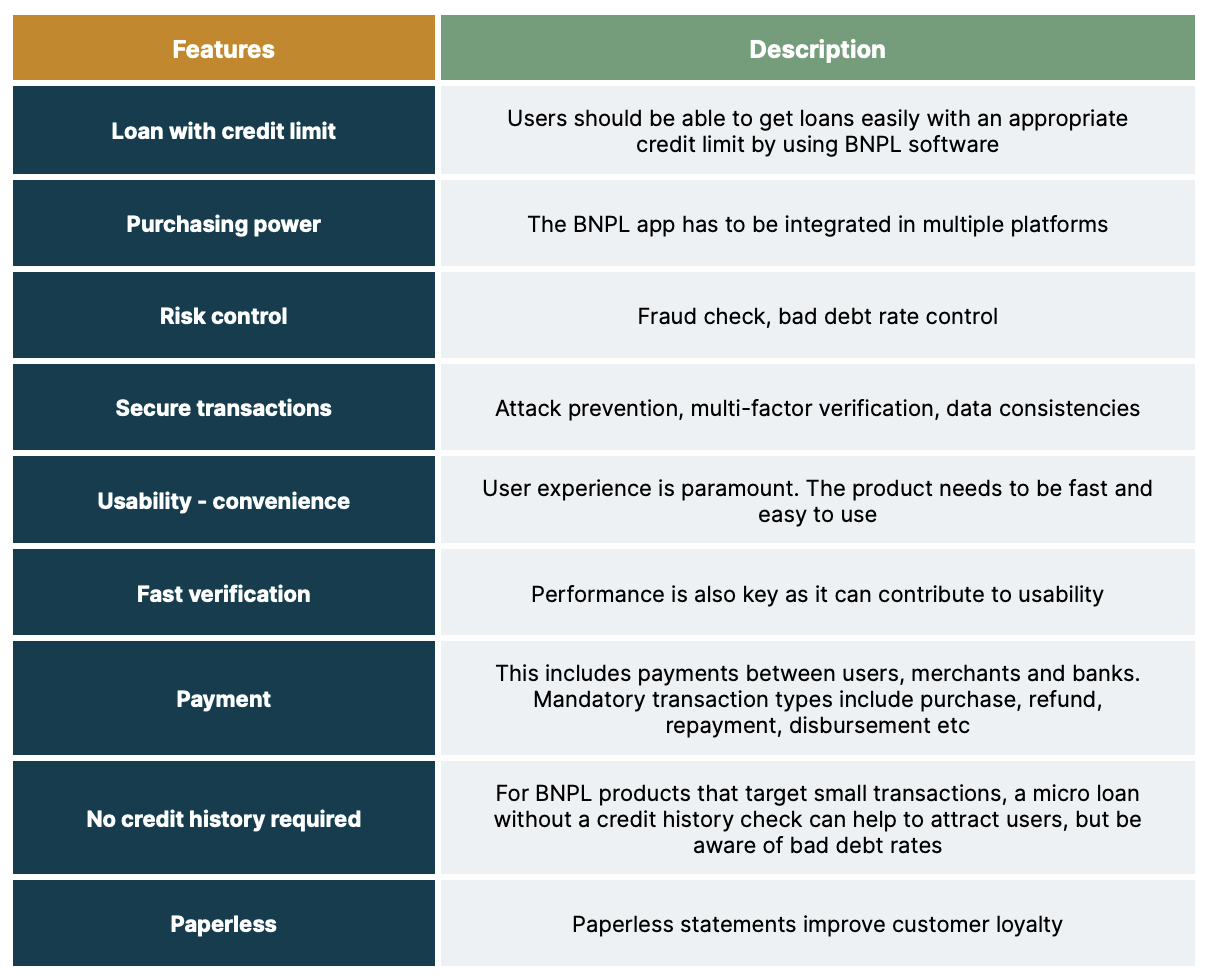

To achieve this business flow, a BNPL product needs the following features:

The profit model

There are three main sources of income for BNPL: transaction fees from merchants, late payment fees from users and account management fees from users. Transaction fee from merchants is the primary source of income and can account for over 70% of a BNPL company’s total income.

BNPL costs include financing costs, bad debt costs, and developing and operating costs.

Financing costs: the interest from advance funds given by banks or other funders.

Bad debt cost: funds that cannot be recovered on schedule due to overdue repayments from users. The bad debt cost is a cost that cannot be neglected; the business owner should constantly monitor the bad debt rate.

Developing and operating costs: this includes the marketing and promotion costs for its products, development cost, property rent, personnel costs and daily operating costs etc.

This gives us the following profit equation:

BNPL's profit = (transaction fee + late payment fee + account management fee) - (financing costs + operating costs + bad debt costs)

The increase in the number of BNPL users and its continuous expansion can reduce financing costs, increase transaction fees for merchants and improve its ecology by continuously supplementing value-added services, such as adding advertising spaces in its app to obtain new sources of income.

Conclusion

BNPL has become increasingly popular, especially among younger consumers who prefer alternative payment options to traditional credit cards. As long as risk is managed, this payment model can benefit both customers and merchants. In the next blog post, we’ll share some tips on what to do before starting a BNPL project.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.