Buy Now Pay Later, a point-of-sale (POS) financing product, is growing as the preferred e-commerce payment mode – especially among millennials and Gen Z. This market is expected to grow by 181% and account for 13% of all global e-commerce payments by 2024.

Fintech players are eating into traditional banks’ annual revenue with Buy Now Pay Later (BNPL) products, taking advantage of banks' slow reaction to changes in the POS financing ecosystem.

For traditional lenders and banks, BNPL presents an opportunity for customer acquisition, revenue generation and long-term growth.

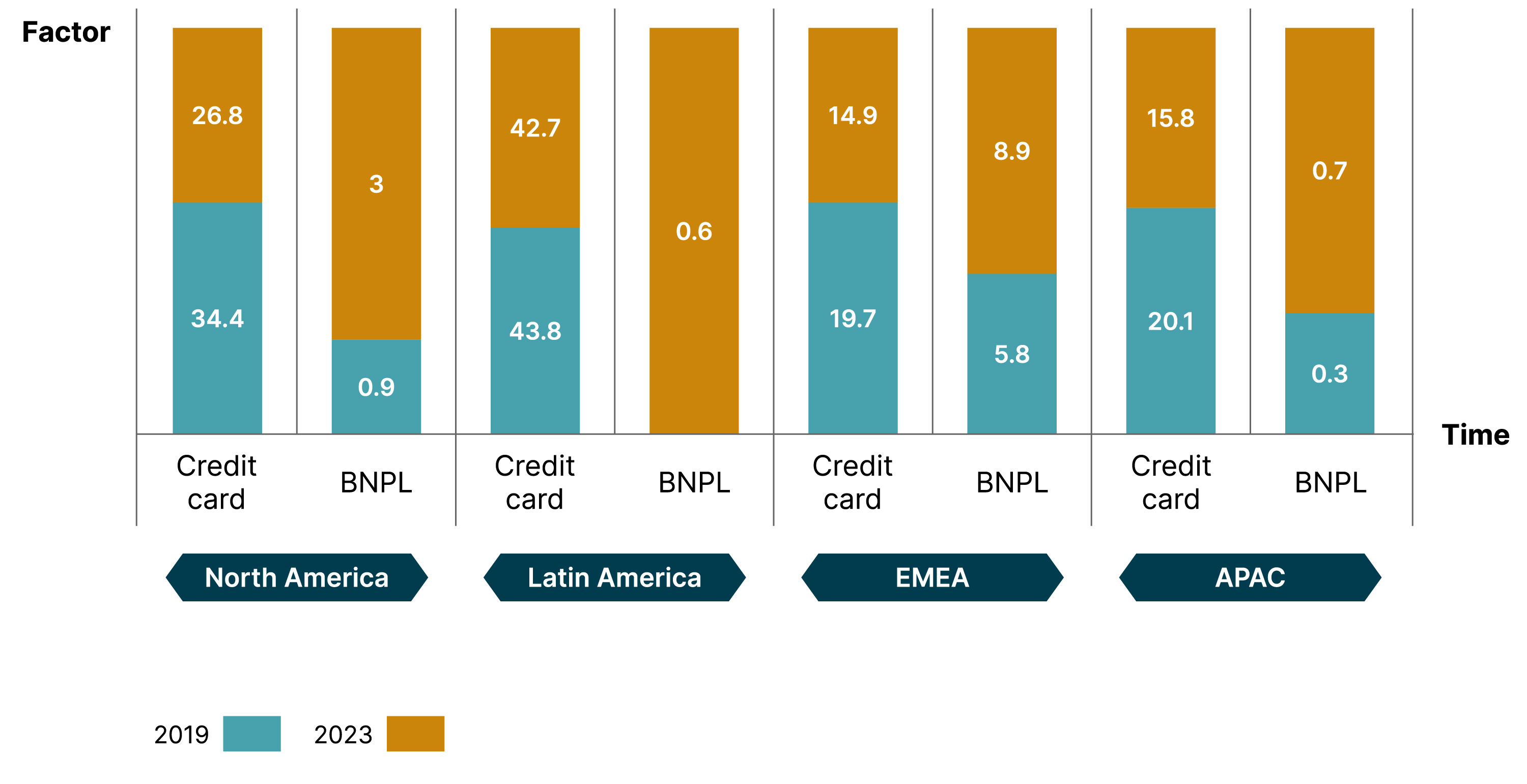

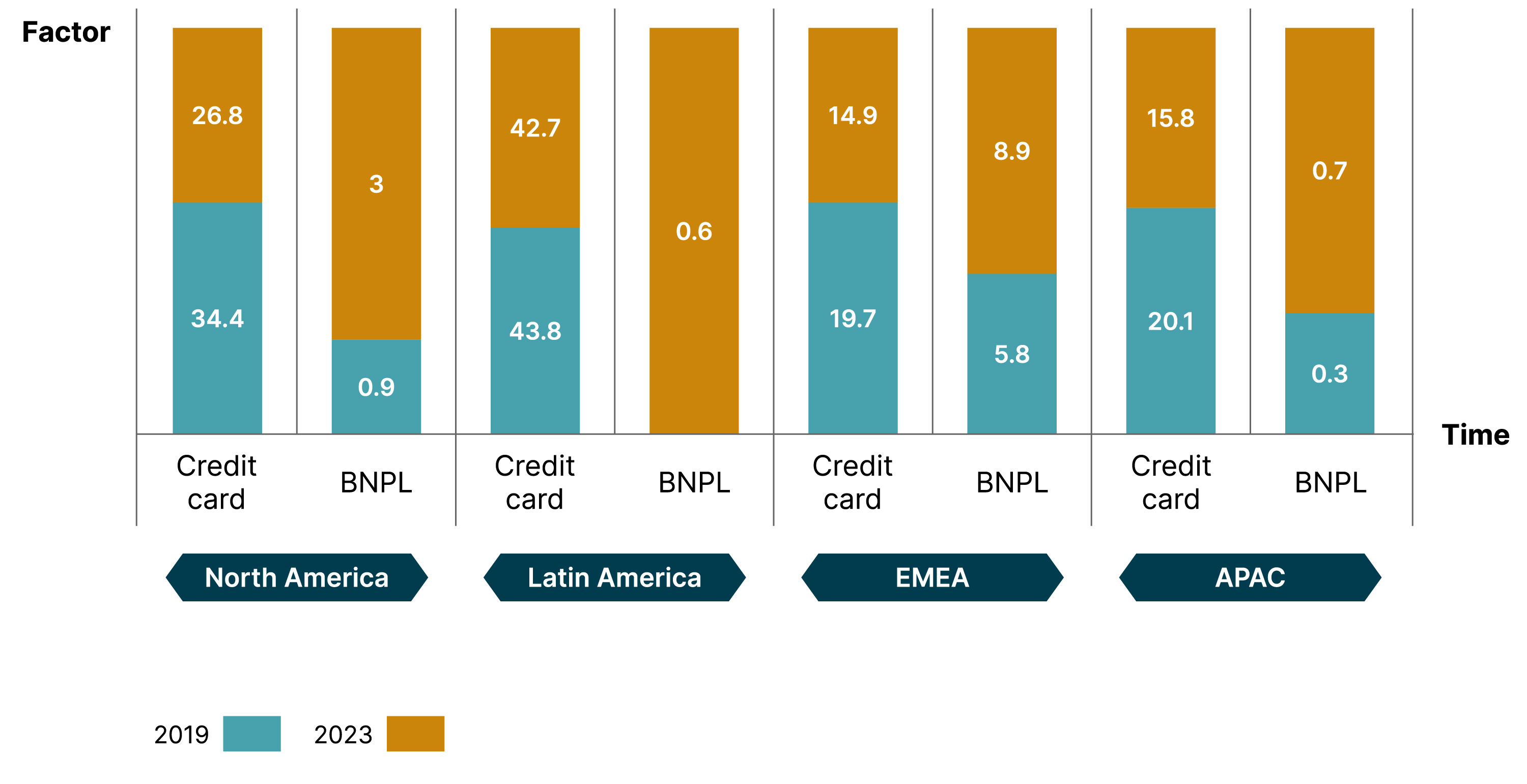

Increase in global popularity of BNPL versus a decrease in preference for credit cards. Source: The Global Payments Report

Choices ahead for new BNPL entrants

Fintechs accelerated customer erosion and revenue for traditional players by capitalizing on customers’ affinity to digital tech and being quicker to market because of no legacy dependencies. We recommend traditional players adapt to the threat by leveraging BNPL as a new source of customer acquisition and revenue generation.

However, BNPL is still unregulated and demands a higher level of digital fluency to ensure desired returns. This article highlights important considerations that aspiring BNPL players should make before entering and winning the market.

Revenue impact: BNPL has eased how consumers can obtain finance - fewer checks, online application processing, etc. BNPL’s increasing acceptance fueled by e-commerce growth is impacting traditional financing companies through customer attrition, loss in consumer credit and loan businesses – because more customers are choosing to pay for products in 30 days or in installments of 0% interest rate.

Question for business leaders – what is the expected impact on the businesses and how do we justify the investment in BNPL offerings?

Growth potential: BNPL enables customer acquisition through an entirely new channel – driving both spend-per-customer and overall digital adoption. It also furthers customer trust and loyalty by actively meeting their needs. BNPL works as an alternative to credit cards, especially in markets with low credit card penetration.

Question for business leaders – does BNPL adoption create long-term value? If yes, how does it align with the organization's vision?

Risk appetite: credit card companies’ repayment structures are built on the belief customers, to avoid a negative credit score, will not default on payments. BNPL does not have this guarantee, exposing companies to a higher risk. Hence if customers are unable to pay their dues, offering them BNPL leads to a higher risk.

Question for business leaders – are businesses ready to accept this risk? If not, are they prepared to invest in building capabilities to minimize this risk? Does it justify the overall business case?

Executing a successful BNPL product

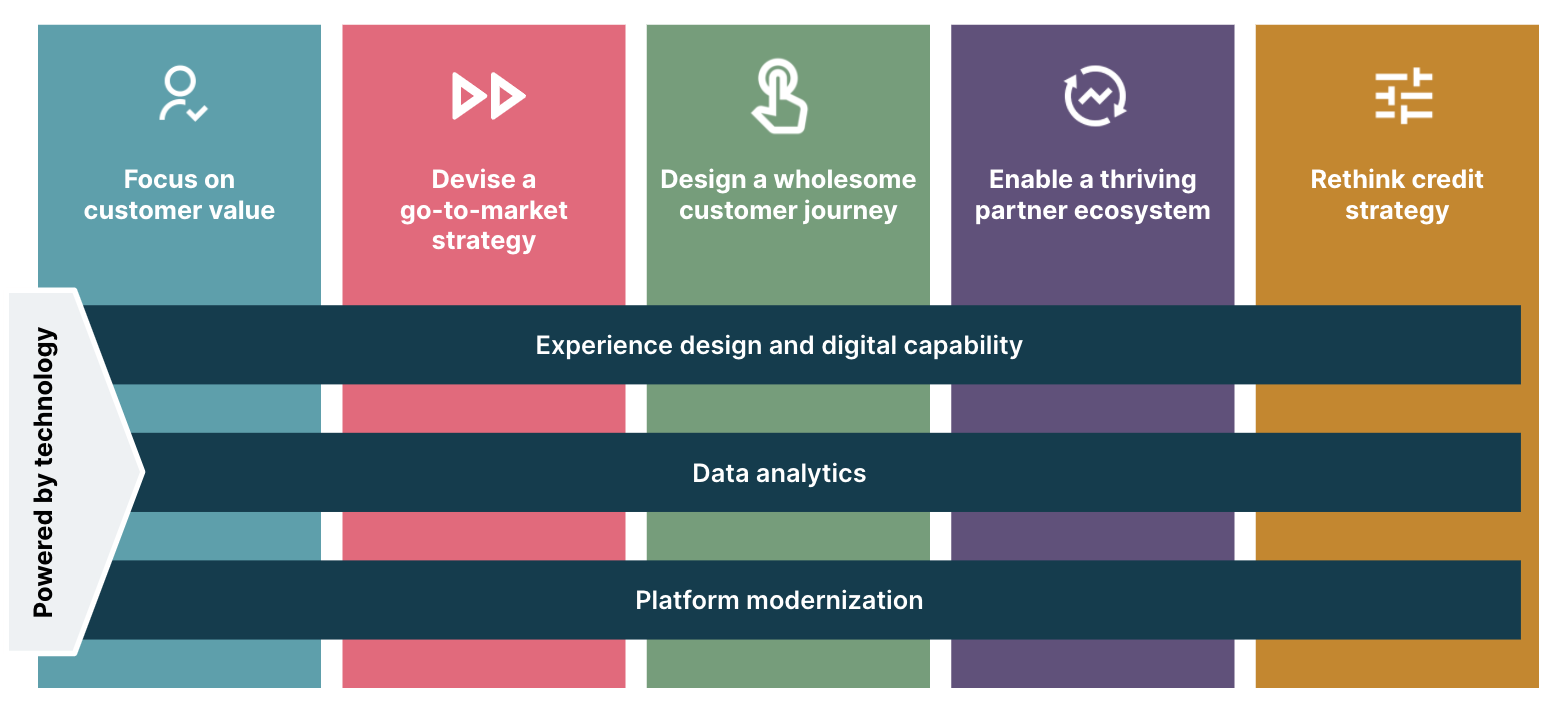

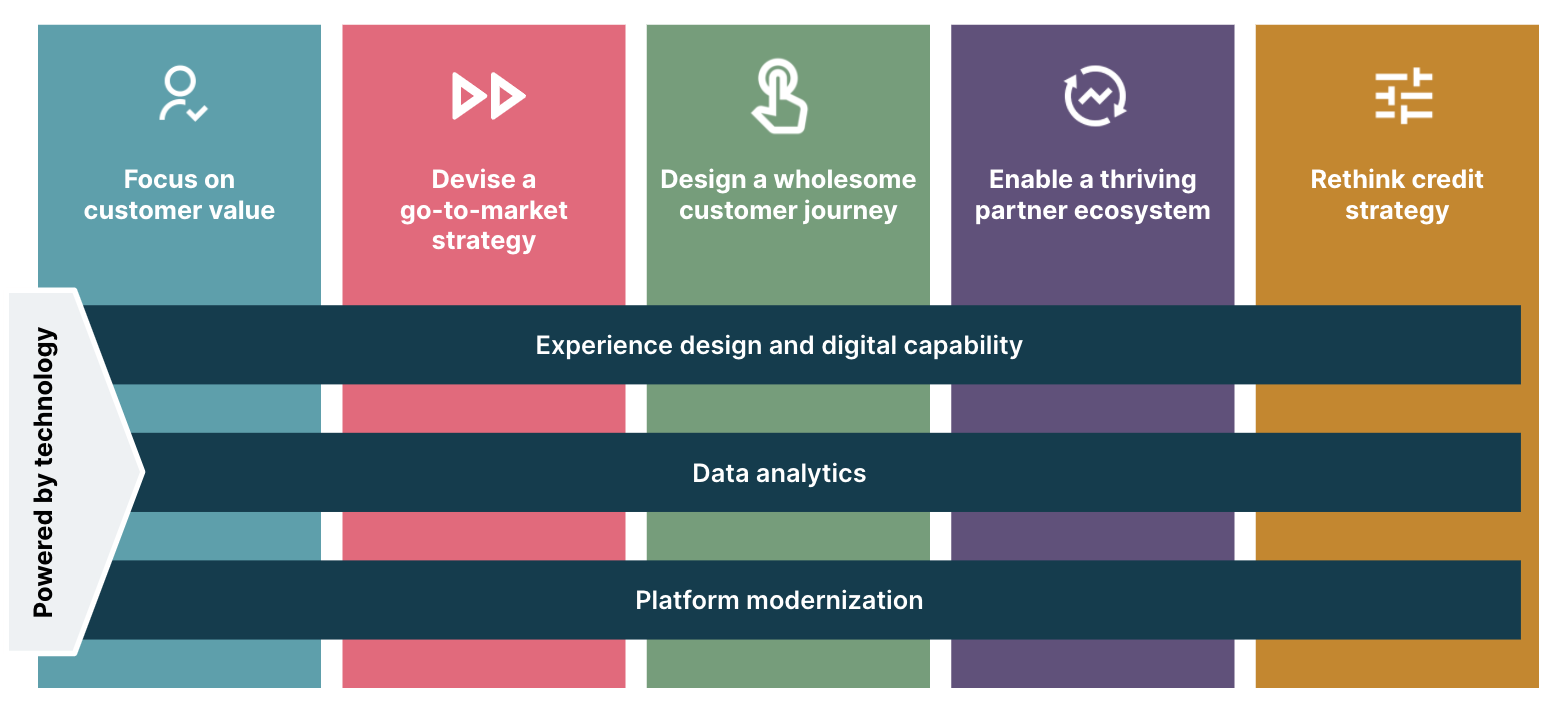

Thoughtworks’ two decades of experience in working with global financial services leaders to build new products has helped us arrive at the five building blocks that are key to the Buy Now Pay Later strategy – empowered by technology.

Focus on customer value

Build the proposition by identifying the target customer segment and select the most suitable spending category, financing offering (card-based/off card) and installment model.

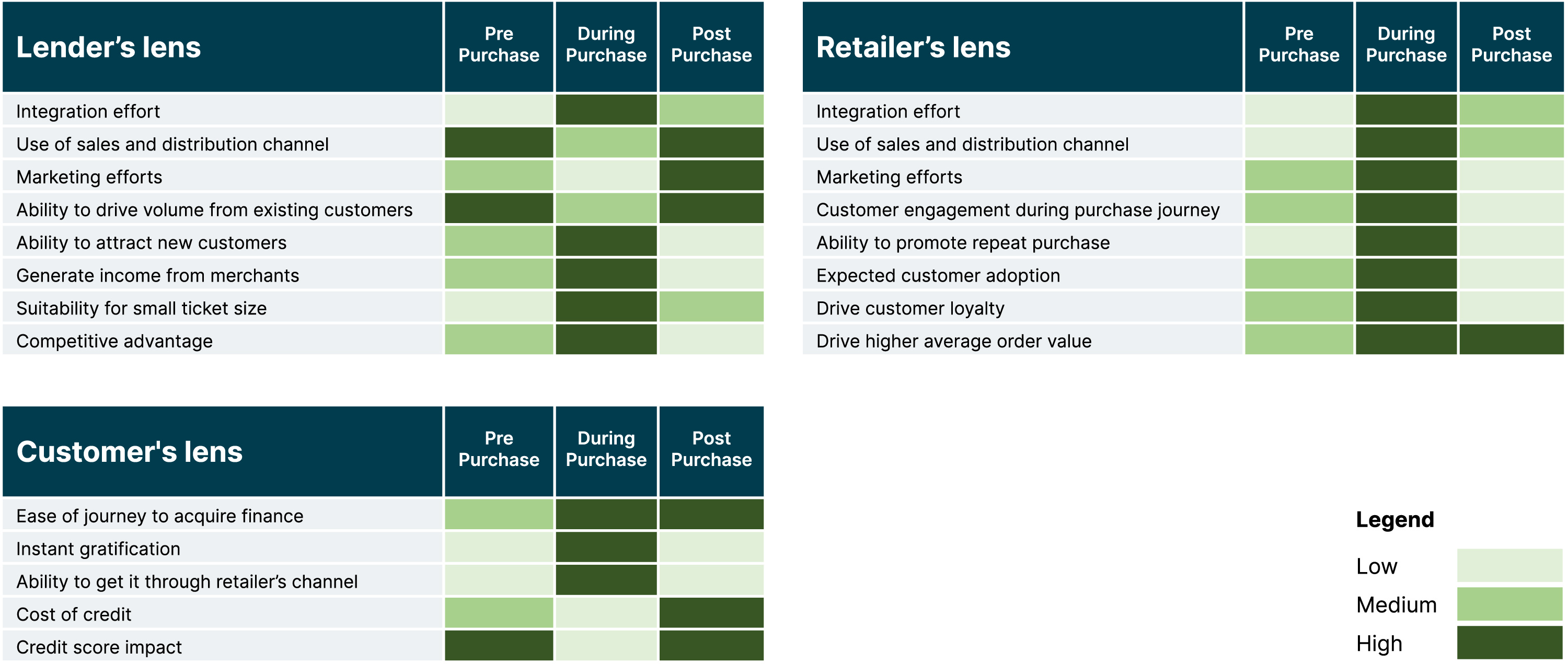

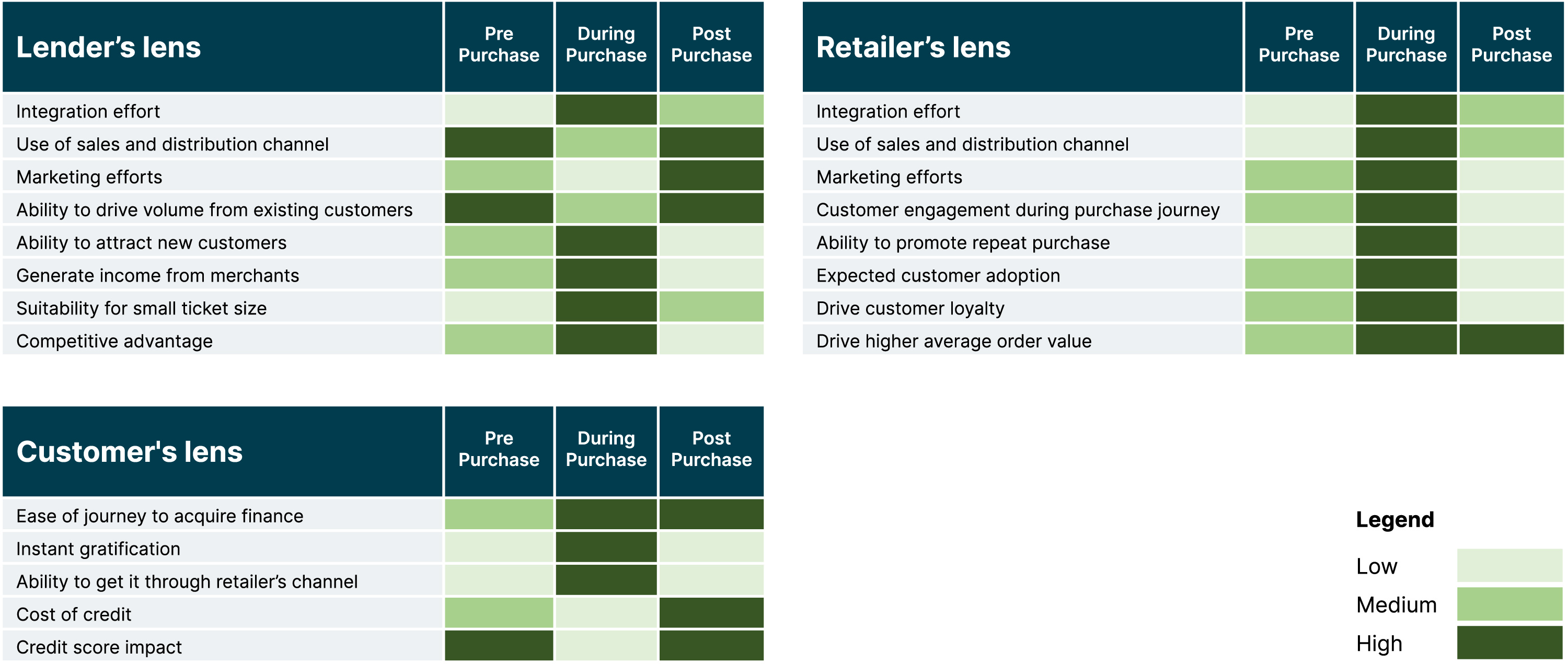

BNPL features three main installment models, broadly grouped when the consumer enrolls — pre-purchase, during purchase and post-purchase. Interest and fees associated with all three are similar i.e. zero or very low-interest rates or fixed fees over a defined period.

However, investment and outcomes may vary depending on lenders and merchants, while customers could also find one better than the other. Here’s a view of those differences:

Our guidance is to outline the business’s primary objectives and their relative priorities, compare the three models on these parameters and then choose the model that fits the requirement.

Devise a go-to-market strategy

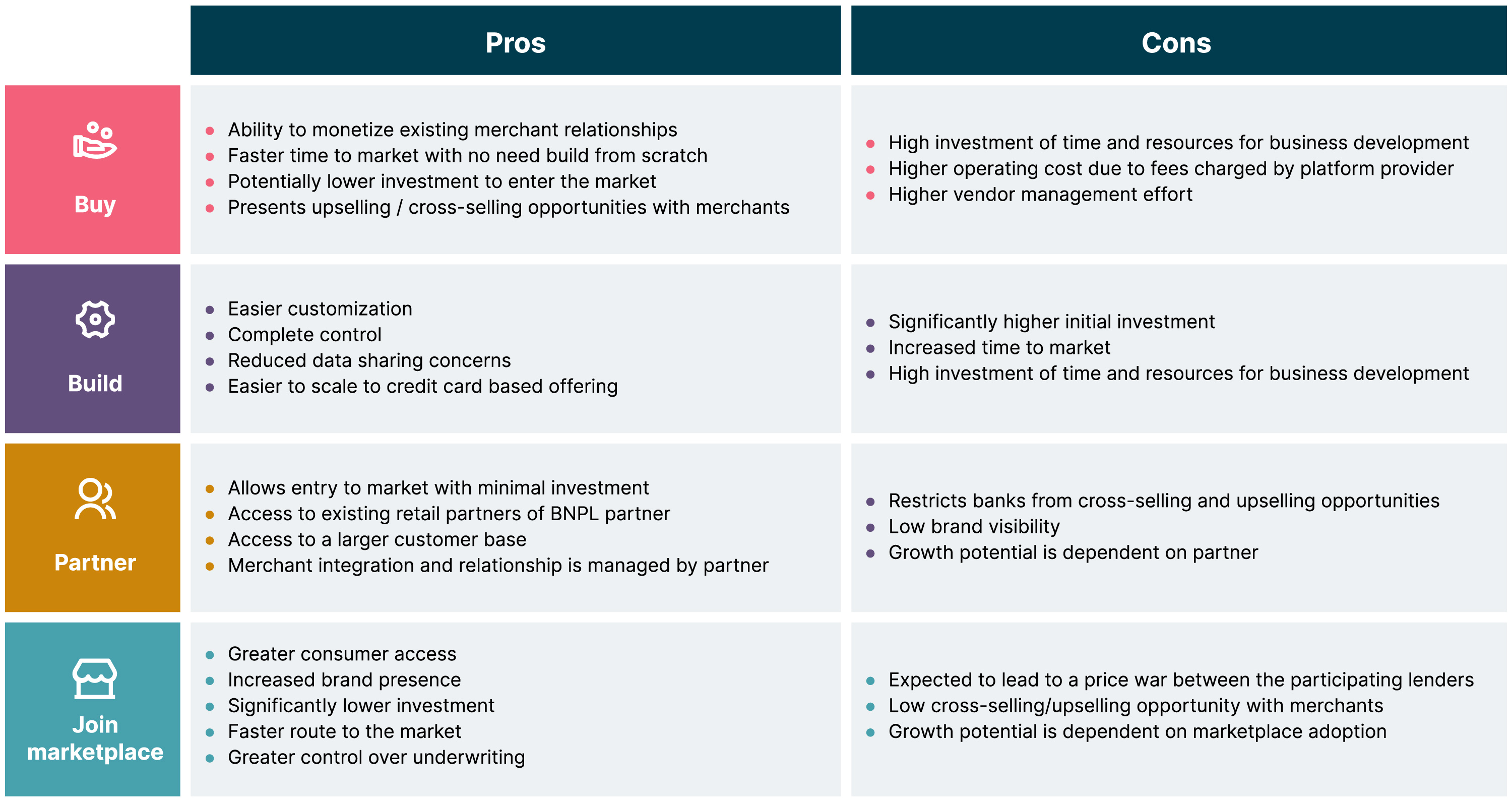

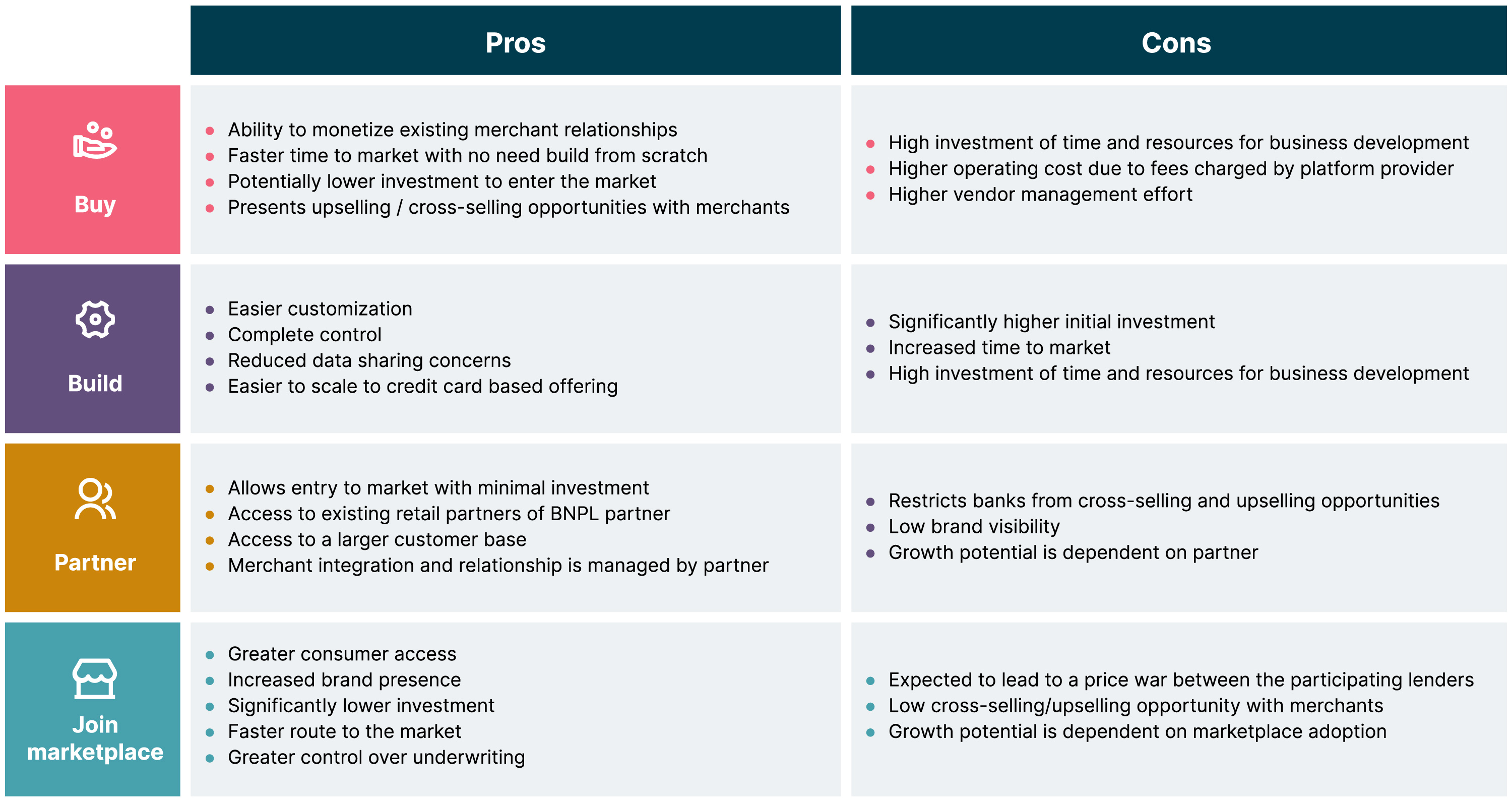

To achieve intended speed-to-market and exemplary customer acceptance, evaluate multiple go-to-market options, based on the organization's strengths and current market positioning. Here is an overview of the available options:

Buy the license of an existing POS platform and create a white label solution – covering origination, decision, underwriting, disbursing of funds or servicing. Businesses can choose to use a full product suite or just a few modules as per the requirement. Either way, the technical heavy lifting will lie with a technology partner. Acquisitions are an option too, for example, Square’s acquisition of Afterpay.

Build an end-to-end POS financing solution that will take the fintechs head-on. Credit card providers can build the offering around their existing platform for faster time-to-market. This approach captures a larger share of ‘borrowing needs’ and monetizes unutilized credit lines. This option works best if the organization’s digital maturity is high.

Partner with an established BNPL player for originations – either finance the entire portfolio or pick up higher ticket loan applications. This taps into the partner’s expertise, digital experience and ability to drive adoption.

Join a marketplace that connects customers with a network of lenders and is funneled through a single checkout experience. Customer data is put through a waterfall of diverse lenders providing the former with various financing options post approval. This model is favored by merchants as it promises a higher approval rate, leading to a higher average order value.

Design a wholesome customer journey

Our guidance is for the end state of the customer experience to go well beyond the first purchase. Think repeat purchases, repayments and loan servicing alongside long-term stickiness. Here are a few ways to achieve this:

Ensure ease of repayment through tools like installment dashboards, statements, payment reminders and integrated repayment journeys. These can be served through customer's preferred channel of usage to help them manage their finances.

Build omnichannel experiences by encouraging customers to choose a financing option in brick and mortar stores and online through a seamless, consistent checkout experience across channels.

Integrate customer support to offer a connected customer experience by plugging in existing digital capabilities (services) to the merchant's ecosystem and also leveraging other support channels for exceptional scenarios.

Nurture wider acceptance through a no-restriction policy to shoppers’ credit facilities and by not binding customers to a particular merchant. Our recommendation is to integrate with leading digital wallets as another way to increase acceptance and reach to small merchants.

Provide enhanced loyalty offerings to compete with traditional credit card offerings, putting the incumbent's strength to use. Push for offerings that reward repeat purchases, on-time payments, exclusive products and discounts.

Enable a thriving partner ecosystem

BNPL products’ success is dependent on ecosystem development. While end-customer choice prevails, merchants’ adoption and promotion of the product is also critical for its success.

Traditional players have an edge – a big ecosystem allows for increased product penetration, geographical expansion and new spend categories. Here are a few ideas to nurture the ecosystem thinking:

Connect with merchant partners to tap into an existing ecosystem of SMEs and corporate customers. Build such strategic partnerships that capitalize on shared marketing and sales opportunities through upselling and cross-selling to achieve economies of scale.

Leverage payment network players with whom incumbents have a longstanding relationship to co-create a BNPL solution. Opt for such symbiotic growth alongside access to the former’s huge network of retail partners. Mastercard and Visa are already making significant investments to broaden their offering in this space.

Choose BNPL solution providers as the partner of choice when it comes to speed-to-market. Partners who enable scalability when it comes to merchant integration and geographical expansion are key to growth.

Rethink credit strategy

Applying the credit strategy designed for credit cards to BNPL will not yield the right results. Here are a few parameters to consider when re-defining credit strategies:

Build product propositions by studying factors like target customer segment, spend category, ticket size, loan tenure and terms of split payment. We recommend re-assessing credit checks and scores to evaluate customers for BNPL products.

Raise application approval rates by reviewing application evaluation criteria. Lower approval rate hampers customer experience leading to cart abandonment – impacting merchants who do not realize the expected benefit.

Customize application processing to have a rational number of application questions for decision making, rather than lifting-and-shifting the credit card journey. Longer processing time to receive funds leads to customers leaving at the application stage, especially in a journey integrated with merchant checkout.

For the currently unregulated BNPL market, technology can extract the maximum benefit from data to devise a prudent credit risk strategy. Our guidance is to use contextual information related to loans that will enable more dynamic risk scoring – which helps determine the likelihood of customers paying back. Hence, improve approval rates, lower default rates and be able to create tailored consumer pricing.

The road ahead for BNPL

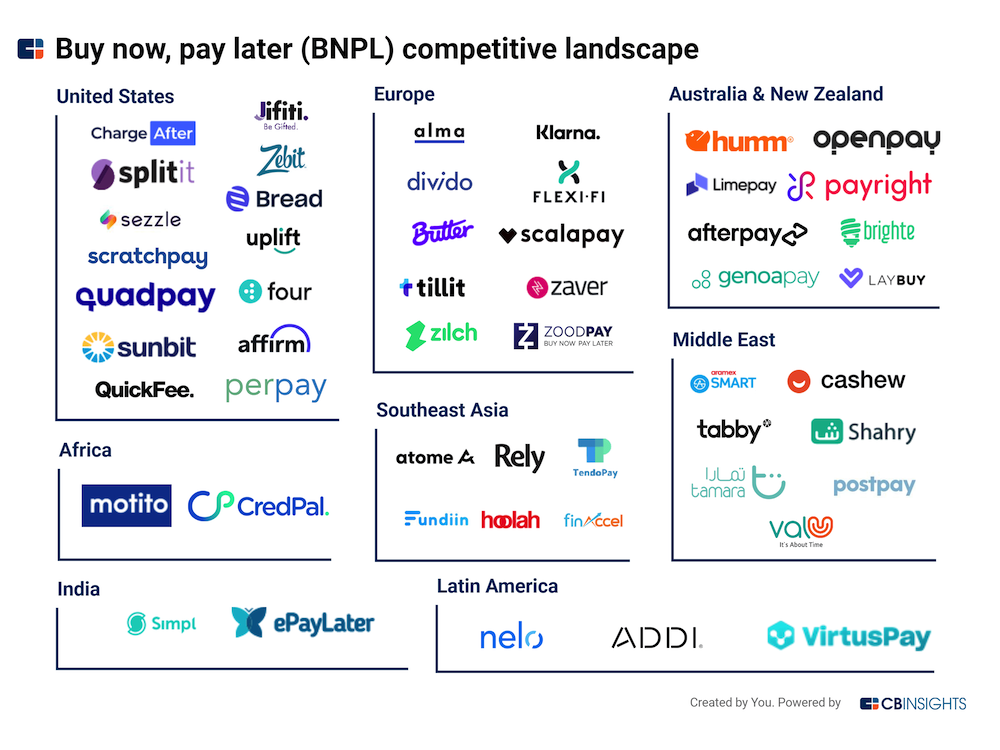

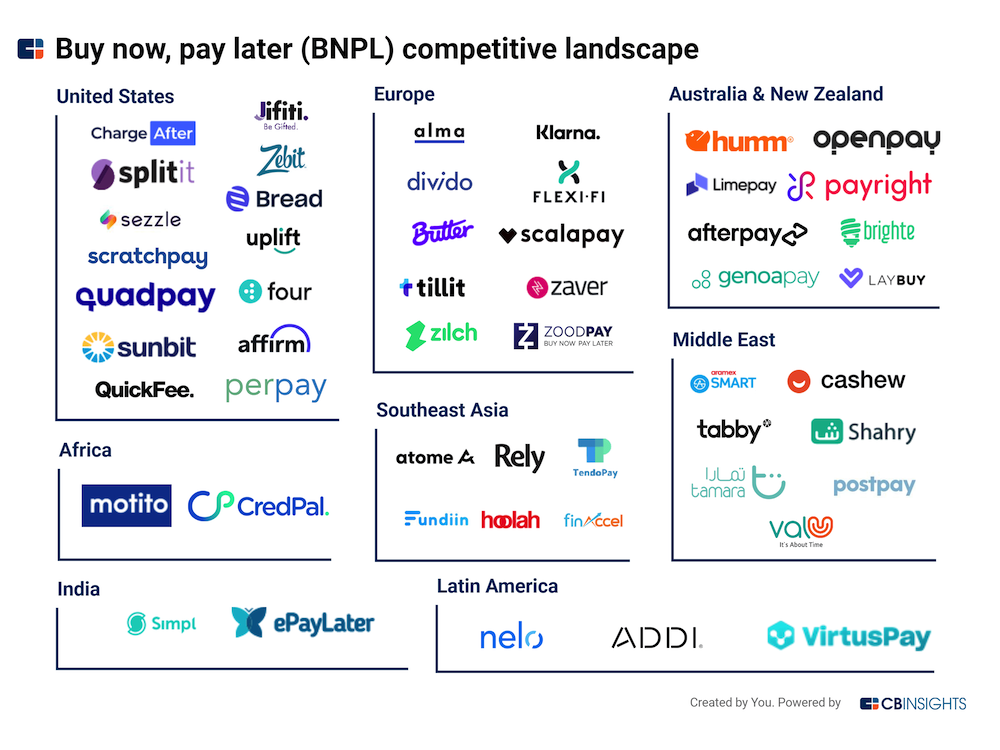

Source: CBInsights

The current BNPL market is dominated by fintechs who are evolving to remain competitive. The key to the BNPL success is speed-to-market and they are already maturing across geographies. In a couple of years, traditional players will either find it difficult to compete because most retailers will already have financing partners or will require heavy investment to enter the market. If you’re a lender, the time to think about Buy Now Pay Later is now.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.