A Banking Revolution or a Revolutionary Bank?

Published: April 03, 2019

In my previous post, I looked at why a ‘trust mantra” is not enough to stop customers from leaving if they feel their trust has been abused. To succeed, integrity needs to be an intrinsic part of your business; this means laying the foundations, serving customers the way they want, building confidence through useful services, and being proactive on their behalf.

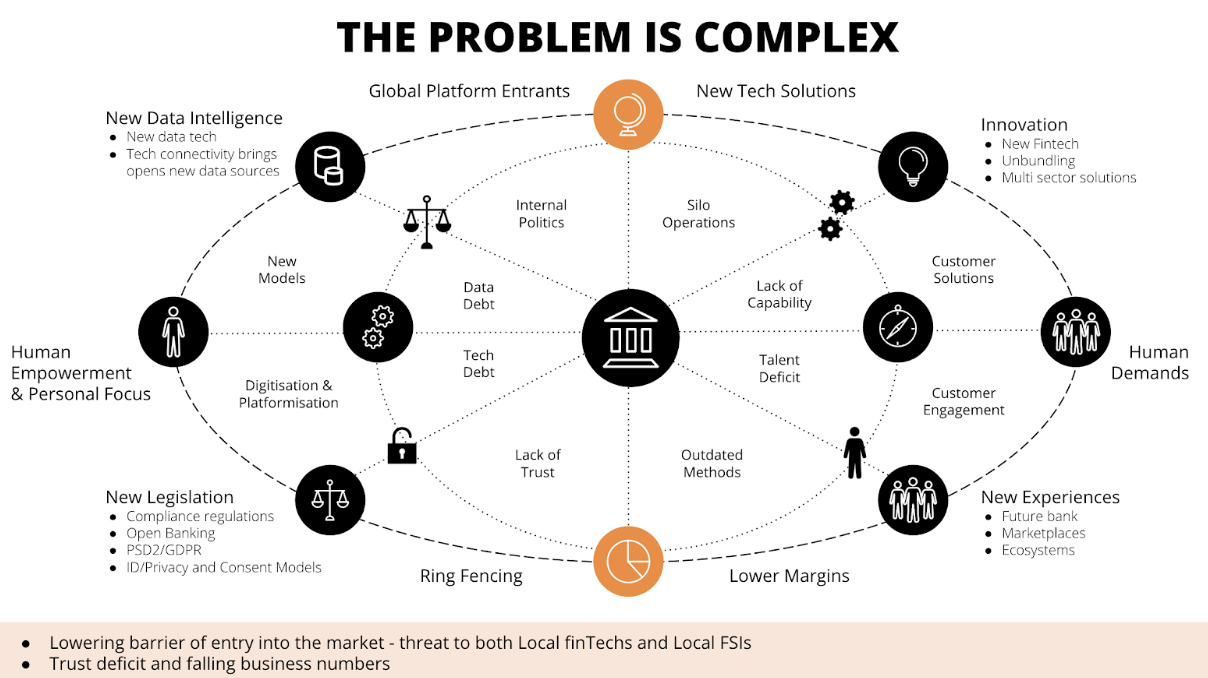

There is a burning bridge for many of the banks, as the open banking revolution is underway. It is difficult to think of an industry so under pressure from all angles (fig 1.). The new market is compounded by challenger entrants (and huge ecosystem players), with new enabling technology, empowered people, new models acting on behalf of the customer, and promises of better outcomes.

A business-agile mindset enables leaders to set a clear direction, and it is important to create value that is aligned to customers. Designing, building, and delivering tech solutions beyond legacy probably comes down to a choice of platform or “bank as a service” strategies. This is an important distinguishing choice, as the decision will determine where the bank operates In the future marketplace and ecosystem.

Knowing how - and having the capability - to harness Open (Life) Banking as the catalyst for change along with other qualities will lead banks towards a“life service partner model.” This is a new category where banks support their customers’ changing needs throughout their life. Orchestrating this is not for the faint-hearted, as this is a culture and strategy of collaborating that is very different from the legacy past.

However, banks don’t have the luxury of time if they want to respond to the revolution they find themselves in - without losing a significant number of customers in the face of mega-platform companies - not forgetting the BaaS entrants.

So revolutionising your organisation to achieve the above will mean looking at everything from your business mission and strategy all the way down to your internal processes and systems.

The winners will be those who truly take advantage of this opportunity to spin the banking revolution on its head in order to win back their customers’ trust and become lifelong partners. It looks like a dual strategy: digitise the existing and revolutionise for the new. That is why it is a people issue in the first phase: it is tough to balance and keep morale high across the bank. However, there are responsible organisations tackling this head-on, launching new and servicing existing customers better.

Who knows where this will end up; all that is certain is that platforms, BaaS, partnerships, and collaboration will be key.

There is a burning bridge for many of the banks, as the open banking revolution is underway. It is difficult to think of an industry so under pressure from all angles (fig 1.). The new market is compounded by challenger entrants (and huge ecosystem players), with new enabling technology, empowered people, new models acting on behalf of the customer, and promises of better outcomes.

Fig. 1 The Shifts, Forces and Pressures facing Banks Today

Becoming proactive instead of reactive

Incumbent banks recognise why they need to embrace the revolution. The visionaries are already taking the first steps towards revolutionising their organisations, rather than allowing the revolution to happen to them. Banks need to create new business models and focus beyond financial transactions towards services within marketplaces. This will also mean better use of tech to remove legacy, create data capabilities and more effective ways of working.A business-agile mindset enables leaders to set a clear direction, and it is important to create value that is aligned to customers. Designing, building, and delivering tech solutions beyond legacy probably comes down to a choice of platform or “bank as a service” strategies. This is an important distinguishing choice, as the decision will determine where the bank operates In the future marketplace and ecosystem.

Knowing how - and having the capability - to harness Open (Life) Banking as the catalyst for change along with other qualities will lead banks towards a“life service partner model.” This is a new category where banks support their customers’ changing needs throughout their life. Orchestrating this is not for the faint-hearted, as this is a culture and strategy of collaborating that is very different from the legacy past.

Revolutionising your business takes time, but we don’t have long

While revolutions tend to be fundamental and sudden, shaping and being active in revolutionising is different. It involves far-reaching changes beyond digital transformation, which can take a long time.However, banks don’t have the luxury of time if they want to respond to the revolution they find themselves in - without losing a significant number of customers in the face of mega-platform companies - not forgetting the BaaS entrants.

So revolutionising your organisation to achieve the above will mean looking at everything from your business mission and strategy all the way down to your internal processes and systems.

The winners will be those who truly take advantage of this opportunity to spin the banking revolution on its head in order to win back their customers’ trust and become lifelong partners. It looks like a dual strategy: digitise the existing and revolutionise for the new. That is why it is a people issue in the first phase: it is tough to balance and keep morale high across the bank. However, there are responsible organisations tackling this head-on, launching new and servicing existing customers better.

Who knows where this will end up; all that is certain is that platforms, BaaS, partnerships, and collaboration will be key.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.