AI agents are autonomous systems that perceive, reason and act semi-independently to accomplish complex workflows. In banking, they improve efficiency, provide analytics and personalize customer experiences. For payments, they gather customer insights from various channels to make messages more tailored and impactful.

Artificial intelligence is looking less and less like a shift than a complete redesign of how banking works. That’s due in no small part to the dawn of AI agents, which are fundamentally redefining the customer experience. Agents go beyond simple chatbots to enable personalized assistants, providing services that reach unprecedented levels of customization and that anticipate rather than respond to customer needs. Potential use cases span everything from routine transactions, to proactive alerts and fraud detection and the full-scale management of investment portfolios.

Beyond the AI agents deployed by banks, customers will increasingly use their own. This might sound like science fiction, but CXOs discount agents at their peril. Agentic solutions are already in play and quickly becoming mainstream. Analysts project that 33% of e-commerce enterprises will adopt agentic AI by 2028. Payment players like Stripe are already developing toolkits to support this new paradigm.

For financial services leaders, this requires rethinking how they build core systems, design customer interactions and deliver personalized services. The goal is to evolve from a strictly user-centric approach, to one that's augmented and centered around leveraging AI agents to create a seamless and tailored experience for every customer — even a customer using AI agents from their side.

This shift calls for a closer look at the frameworks that can guide financial services in leveraging agentic AI to its fullest potential, starting with the Theory of Mind.

Frameworks for agentic AI in banking

Theory of mind

As in any industry providing services to the end-consumer, deeply understanding the customer’s mind has long been a pivotal goal for financial services firms. In this sense, the concept of a Theory of Mind could be seen as the sector’s Holy Grail. This refers to the ability to model a consumer's beliefs, desires and intentions based on observing their actions and then to use that model to successfully predict how they will feel and act next.

In this process, business intelligence units could be seen as detectives, constantly gathering clues from a customer’s behavior, speech and context to build a picture of their mental activity, with the goal of directing products or services to match. Agentic AI will bring new sophistication and precision, as well as new complexities, to the prediction and modelling of customer behavior.

The multiplicity of identity: Beyond the 720-degree view

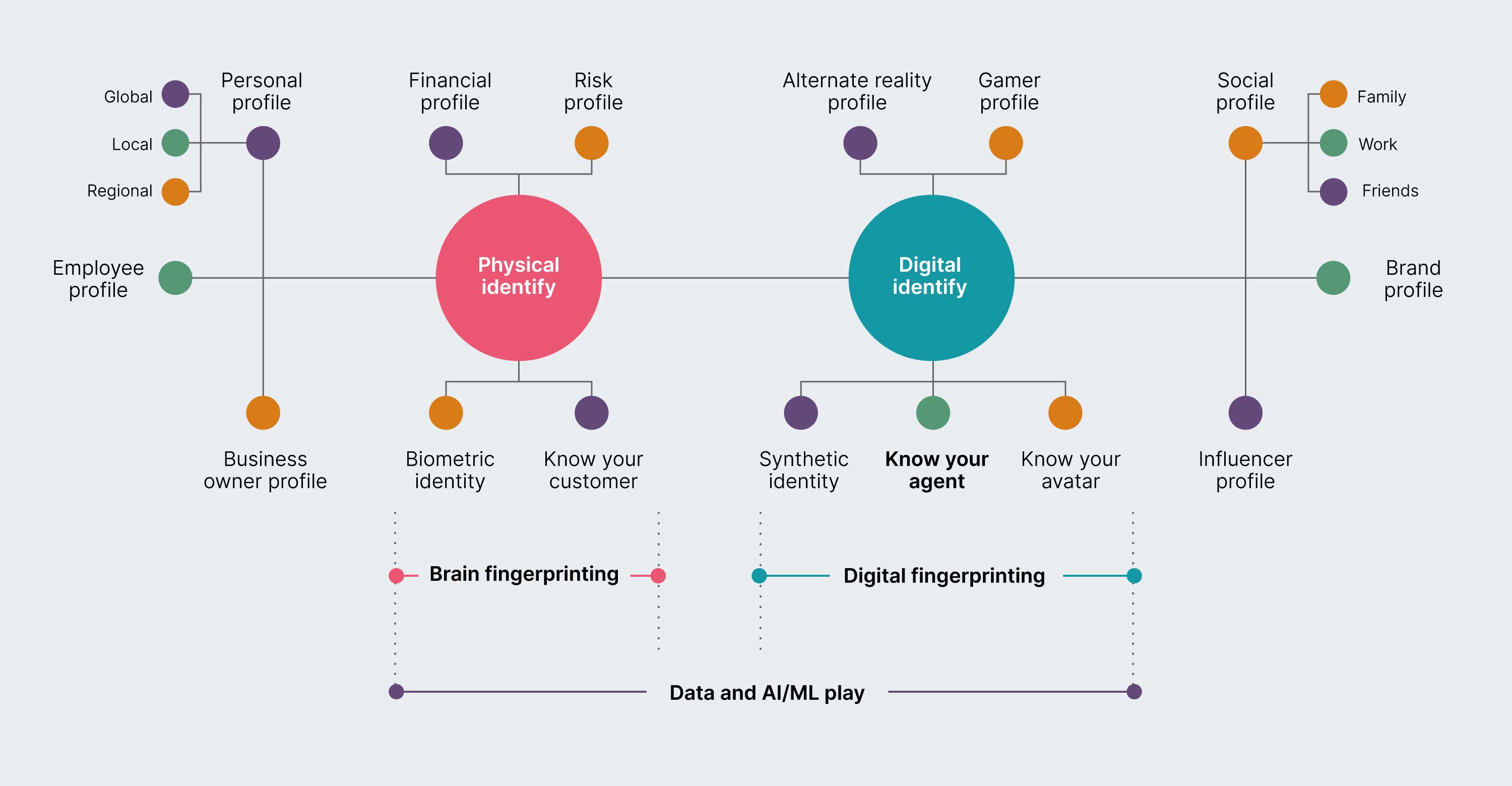

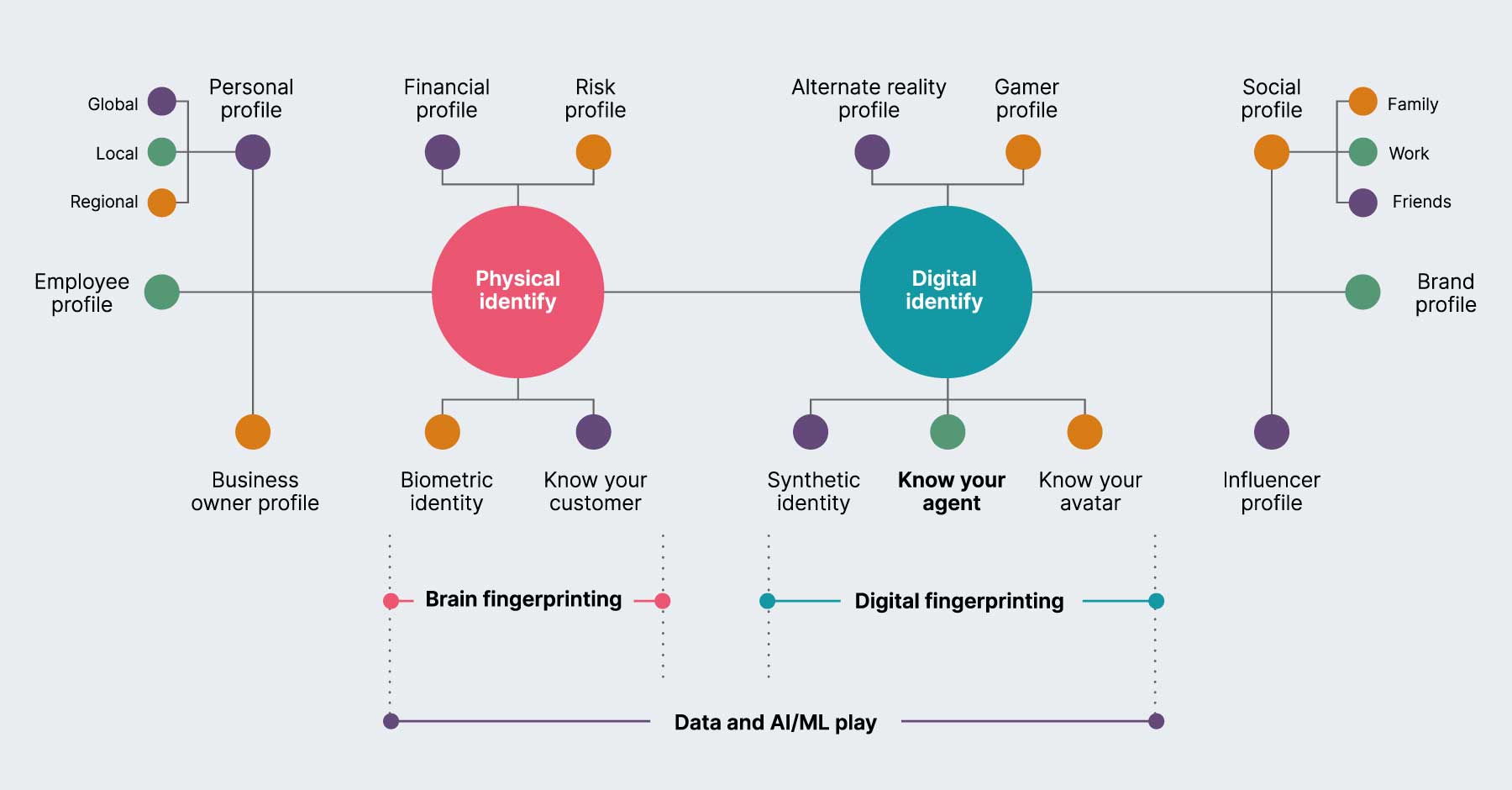

In the digital era, the concept of a single customer profile has become obsolete. A modern customer wears many hats: a parent managing a family budget, an entrepreneur seeking business loans, a gamer engaged in a digital economy and/or a global citizen making cross-border payments. The proliferation of these "personas" creates a complex web of identities, each with its own unique financial needs and expectations.

The advent of agentic AI solutions adds yet another dimension. Agents, acting on behalf of customers or systems, possess their own personas and require a new form of identity management. This must account for:

- Ephemeral lifespans: AI agents often have short, purpose-bound existences, requiring dynamic provisioning and revocation of identities.

- Delegated authority: Agents frequently act on behalf of human users or other systems, necessitating robust delegation chains and clear traceability for every action taken.

- Runtime identity: Banks and systems must dynamically provision and govern agent identities at runtime instead of pre-configuring them at the administrative level.

- Fine-grained, contextual access: Access permissions must move beyond static roles or keys to adapt in real-time, based on the specific task, role and associated risks.

- Cross-domain execution: AI agents operate across diverse software, APIs and platforms, demanding interoperable identities that can function seamlessly across different systems.

- Auditability and observability gaps: Without proper identity management, the actions of autonomous agents can become unauditable, lacking clear attribution or visibility.

Managing this intricate web of digital and agent profiles requires robust data management, privacy and security frameworks. This includes new consent models for ongoing AI data usage, ensuring algorithmic fairness, implementing privacy-enhancing computation (PEC) technologies, which Gartner predicts a majority of large organizations will adopt in their analytics, business intelligence or cloud computing operations and robust agent identity management.

New interaction models: Human-centric, not human mimicry

The goal of AI agents in banking is not to perfectly replicate human interactions, but to solve problems with speed, accuracy and consistency. Customers want a "human-like" experience, defined by natural phrasing, fluid conversation and a touch of empathy but their ultimate priority is effective resolution.

As banks move to meet these demands there is significant danger of falling victim to agent washing, the practice of marketing simple, scripted chatbots as sophisticated AI agents. To be a genuinely autonomous and reliable, GenAI agents in an enterprise context must be designed with six core capabilities:

Understanding Accurately detecting user intent and context from the initial interaction. |

Reasoning Maintaining logical consistency across multi-turn interactions and knowing when to ask for clarification. |

Quality of experience Providing quick, direct and efficient answers without redundancy or latency. |

Transparency and learning Continuously improving based on real interactions and providing rationale for decisions that impact a customer's personal data or finances. |

Operational readiness Integrating seamlessly into existing workflows with robust monitoring, logging and version control. |

Safety and control Operating within defined guardrails, addressing failure modes like lack of transparency and unpredictability and escalating to a human when necessary. |

AI agents can be tailored to embody a company's specific identity, policies, processes and knowledge, ensuring they accurately represent the brand in every interaction. This involves emulating human traits across the cognitive, emotional and kinesthetic dimensions:

Cognitive AI

These systems mirror human reasoning capabilities, leading to faster and more knowledgeable outcomes. Applications include parsing large volumes of data in real-time to track and prevent fraudulent activities, automating routine operations like processing customer queries and optimizing workflows to reduce costs.

Research indicates that LLMs can mimic diverse human reasoning behaviors, including both the fast, intuitive System 1 processes and slow, deliberate System 2 processes popularized by Daniel Kahneman. While the latest AI models achieve high accuracy rates, sometimes of up to 80%, they can still struggle with complex financial queries, highlighting the need for continued development.

Emotional AI (Affective computing)

This encompasses AI systems and sentiment analysis tools capable of recognizing, interpreting and responding to human emotions by leveraging various cues. This technology is increasingly seen as a necessary step for banks to become "AI-first" institutions.

Key use cases include:

- Identifying customers exhibiting signs of financial stress (e.g. frequently logging into online banking and spending considerable time reviewing account balances) and discreetly suggesting budgeting tools or connecting them with a financial advisor.

- Assisting in identifying potential fraudulent activity, for example, by recognizing unusual calmness or a robotic tone of voice when a customer reports a lost credit card, or proactively providing personalized customer support by recognizing signs of frustration.

Case studies demonstrate emotional AI can drive notable improvements, including an up to 18% increase in revenue and a 10% increase in customer satisfaction.

Kinesthetic processing in AI

In financial services, this translates into AI's capacity for fluid digital navigation, adapting to subtle user input patterns and executing multi-step digital workflows. It includes adaptive workflow execution, where AI systems continuously learn from digital transactions and optimize their internal workflows based on real-time feedback.

Intuitive user experience, where AI agents anticipate user needs by interpreting digital "body language" (e.g. browse patterns, hesitation) to offer proactive assistance or recommendations, is another example.

The nuanced understanding of "human-like" in AI underscores the importance of intent over mere imitation. The focus should be on building AI with robust reasoning, strong safety guardrails and continuous learning capabilities, while leveraging emotional AI for proactive, context-aware support. The overarching goal is to cultivate trust through reliable, personalized outcomes, rather than through superficial mimicry of human traits.

While the above examples refer to financial services organizations building their own agents, we're moving into a world where customers will have their own agents delegated with the authority to carry out tasks for them.

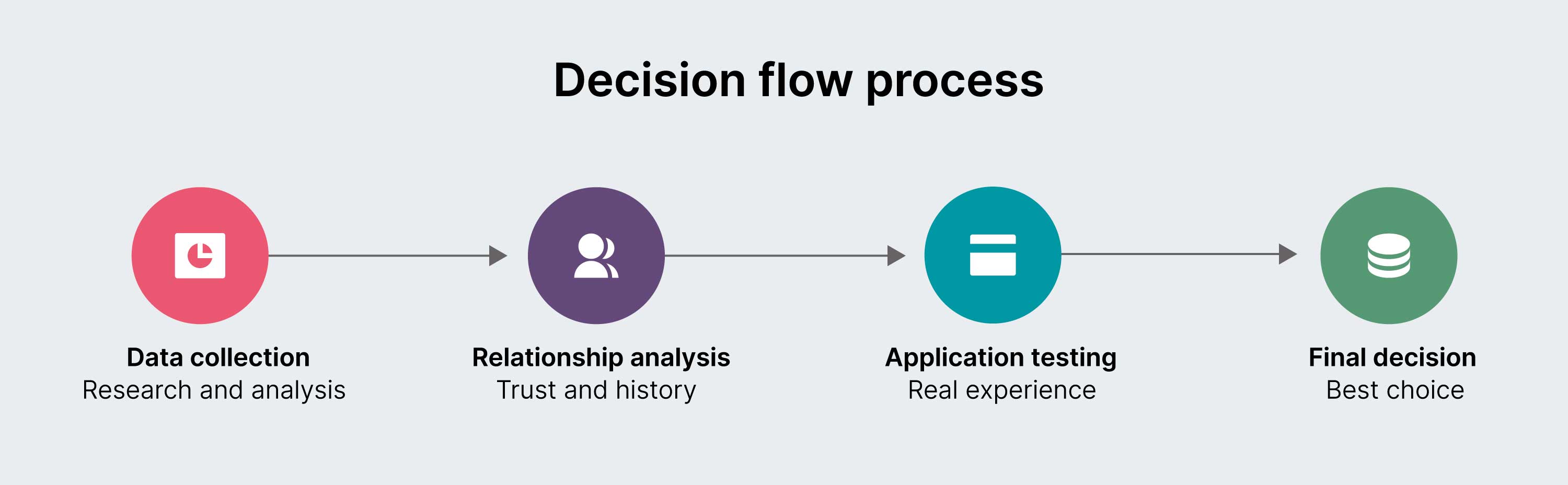

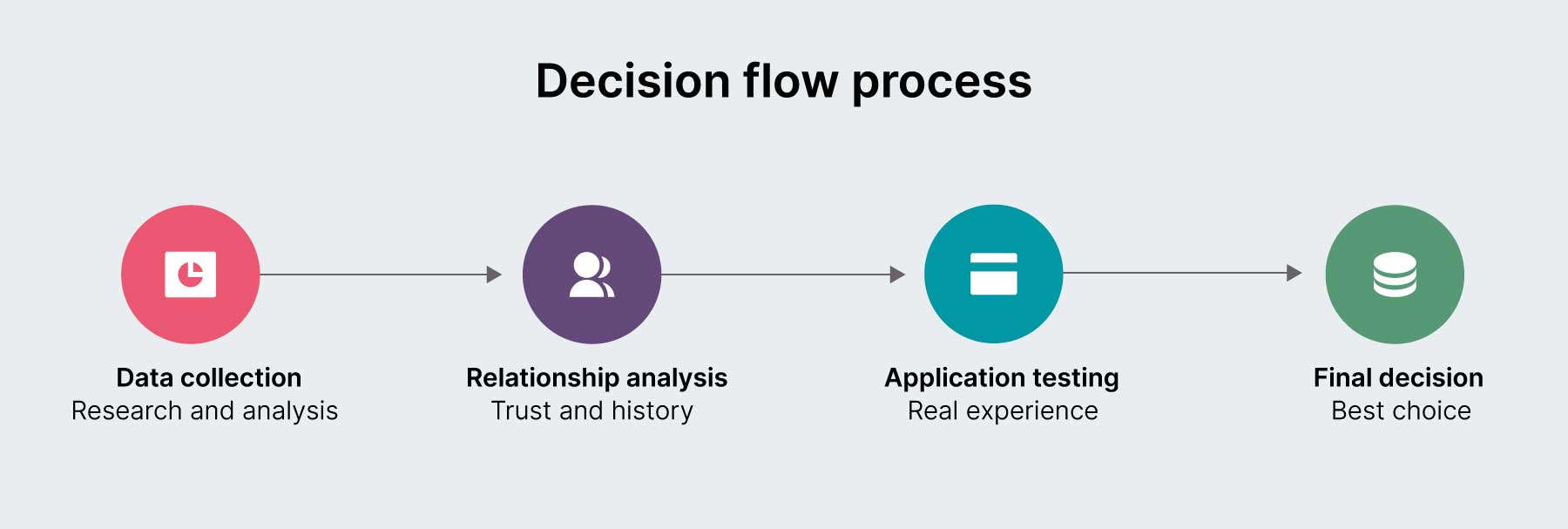

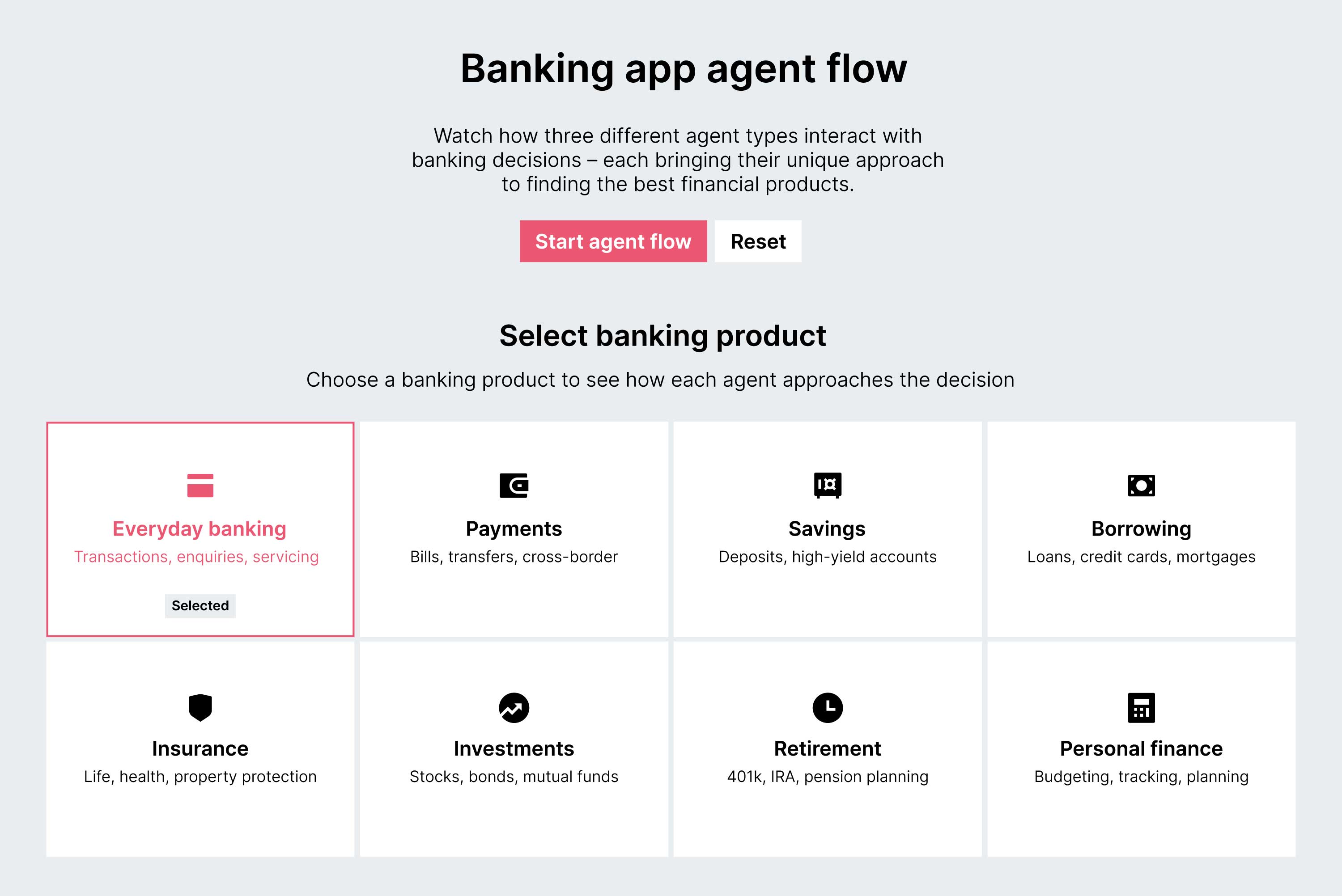

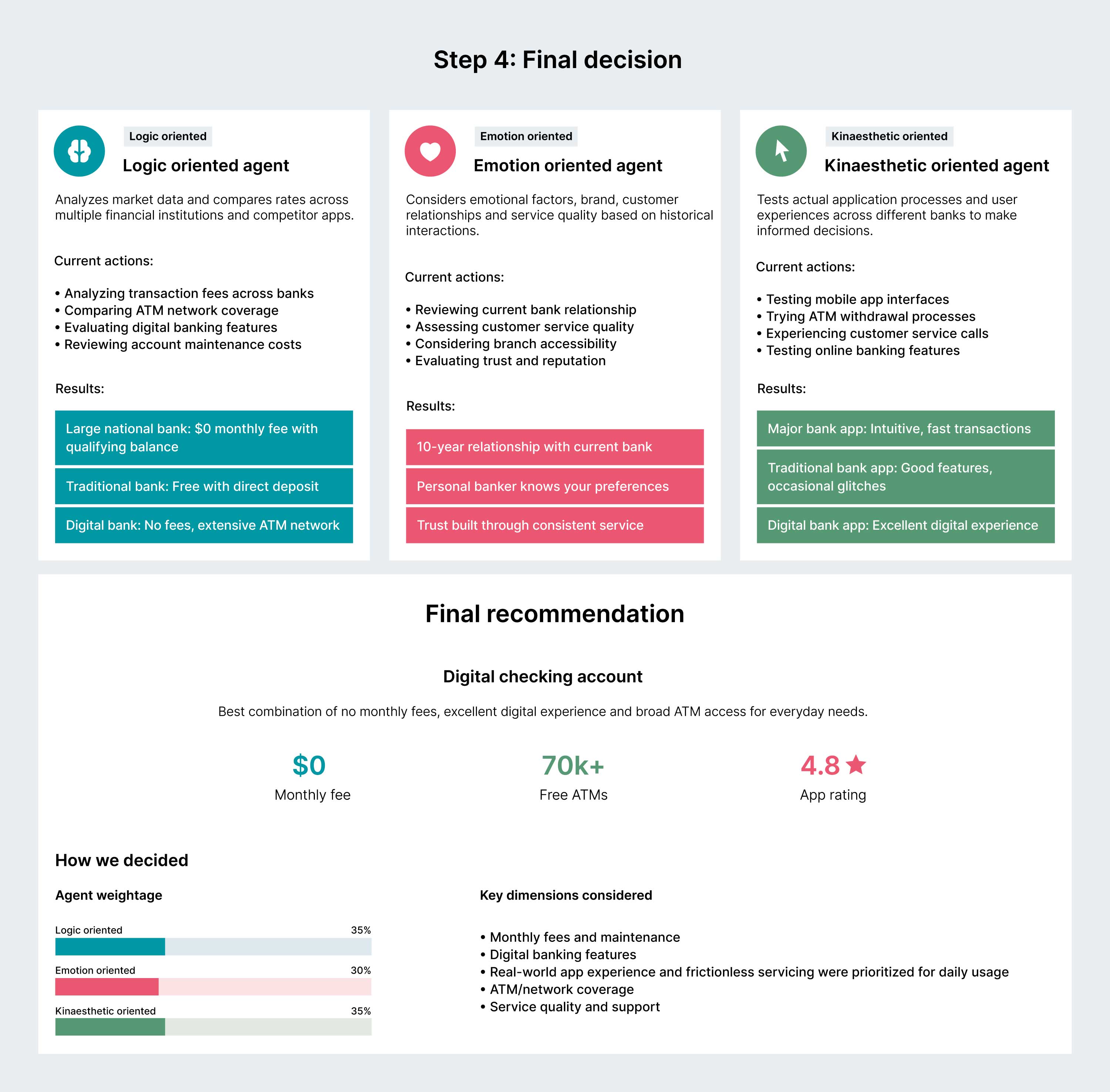

Take the simple example below of choosing the right option for the customer depending upon the type of banking product that is selected. Based on the need perceived through a customer action, the respective logic-oriented agent, emotion-oriented agent and kinesthetic-oriented agent are invoked. Each evaluates products through its respective lens and comes up with a recommendation. Another orchestrating agent combines these recommendations and evaluates what works in the best interest of the customer, finally presenting an option with the rationale of why it’s been chosen. These customer agents could reside in a digital wallet within the smartphone, where the customers preferences, tokenised assets, consents and more, could be stored.

It’s easy to see how this could lead to a complete paradigm shift in the way banks design, optimize and market products, by proactively addressing usability risk and Value risk — two of the four major product risks.

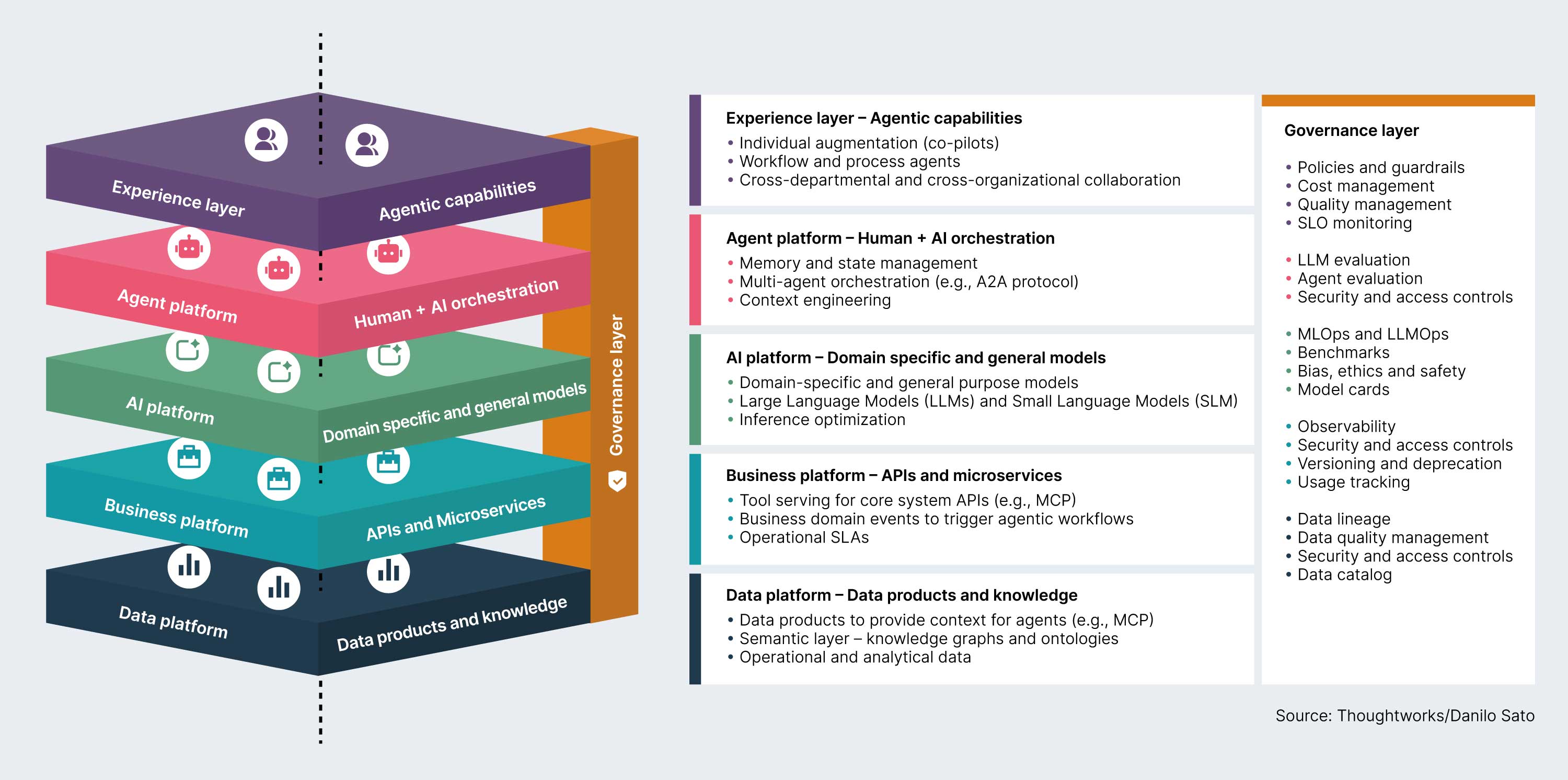

Agentic architecture: A foundation for the future

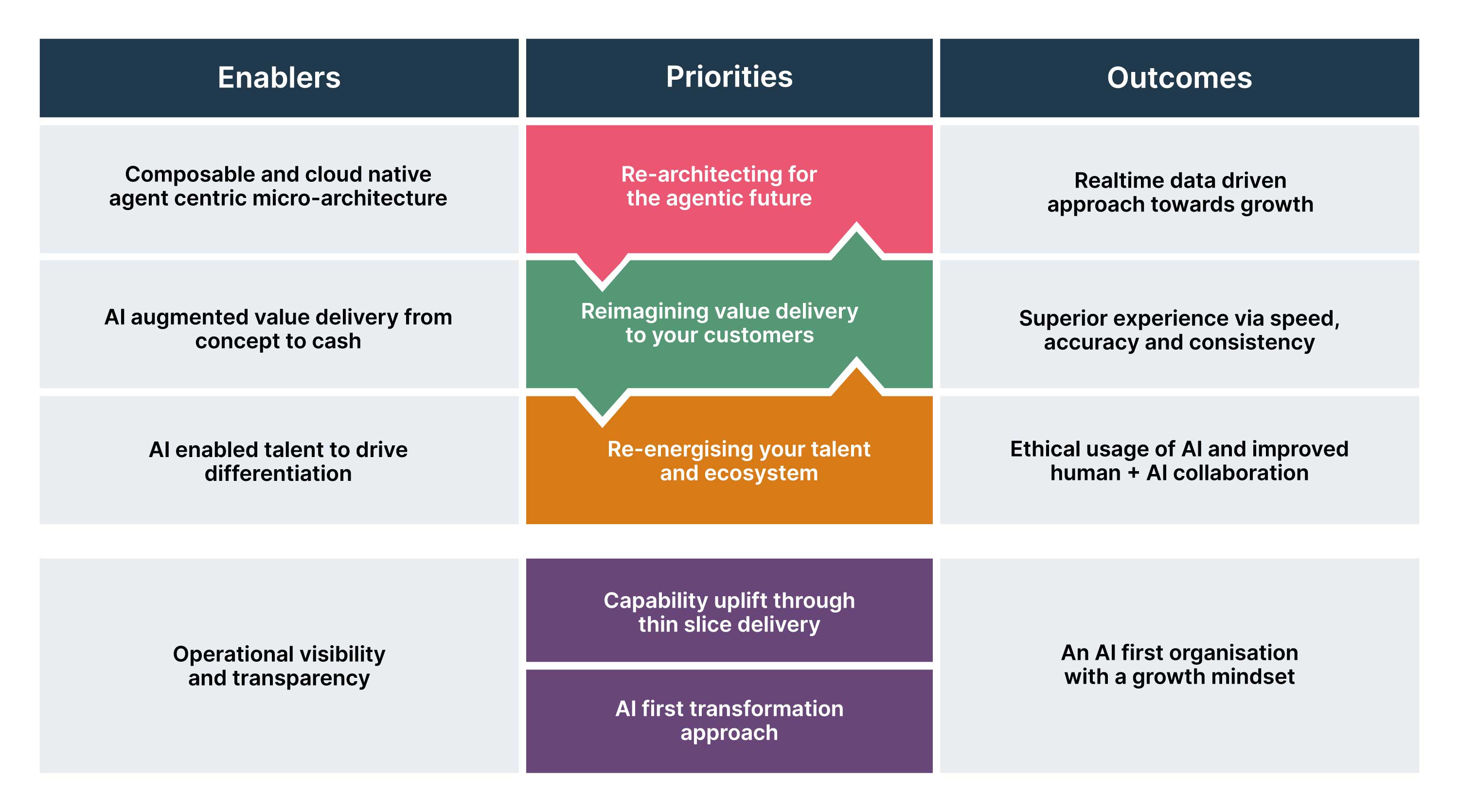

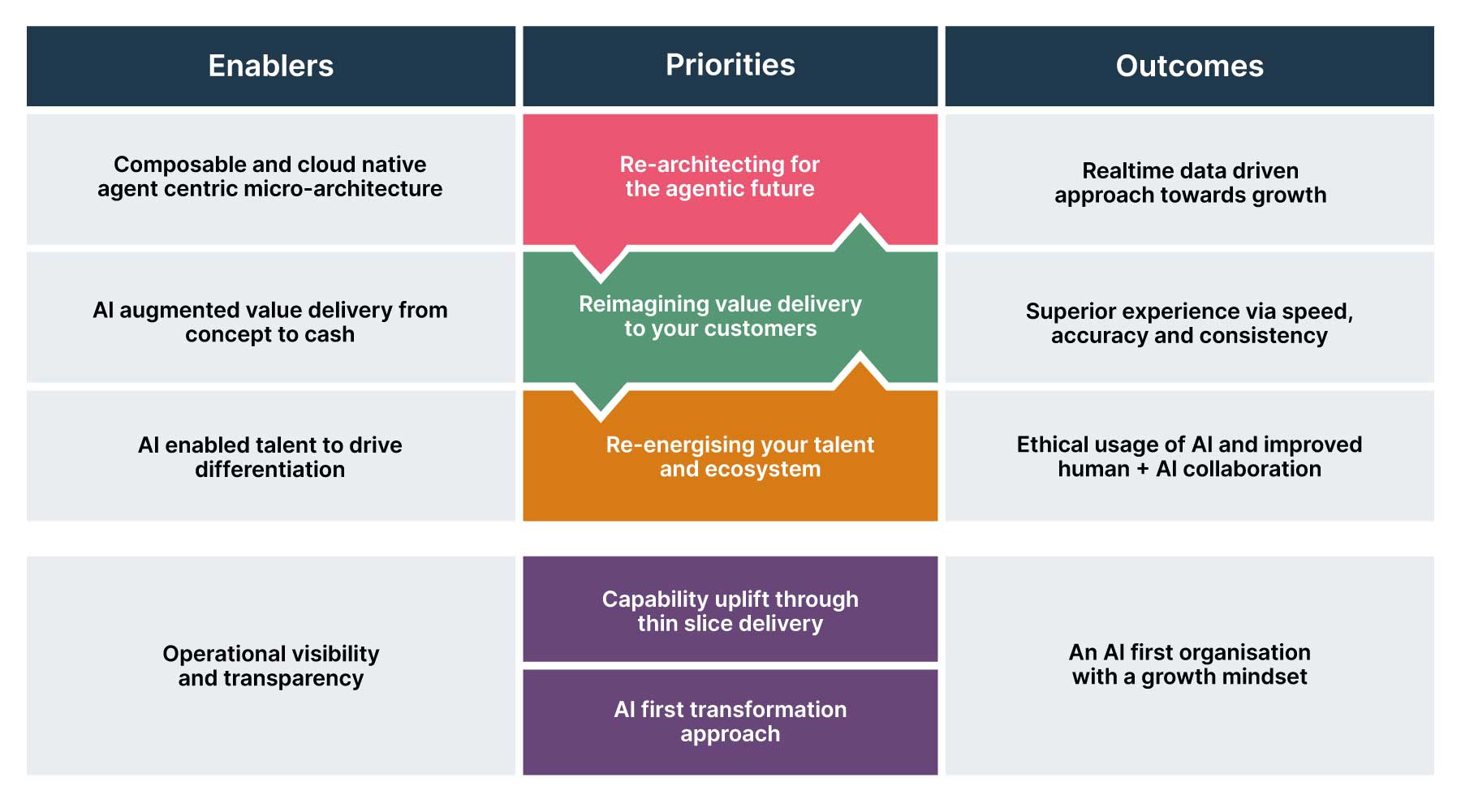

The shift to an AI-first banking paradigm requires a fundamental re-architecture of existing platforms. This means moving from monolithic systems to a composable, agentic micro-architecture built on cloud-native principles.

This new architecture must be designed with an "agent-centric" mindset, where systems are built to enable seamless interaction between agents and their environment. The core design principles for these new workflows are centered on the Three E's:

- Evolution: Agents must be able to continuously learn and adapt their behavior based on new data and environmental changes. This goes beyond simple retraining and requires a system for continuous refinement.

- Emergence: Complex behaviors should arise from the interaction of simpler agents and rules. This allows for flexible and scalable systems that can handle unforeseen challenges.

- Ecosystem: The ability for agents to interact effectively with each other and human users through standardized communication protocols is critical. This social ability is what makes a multi-agent system truly powerful.

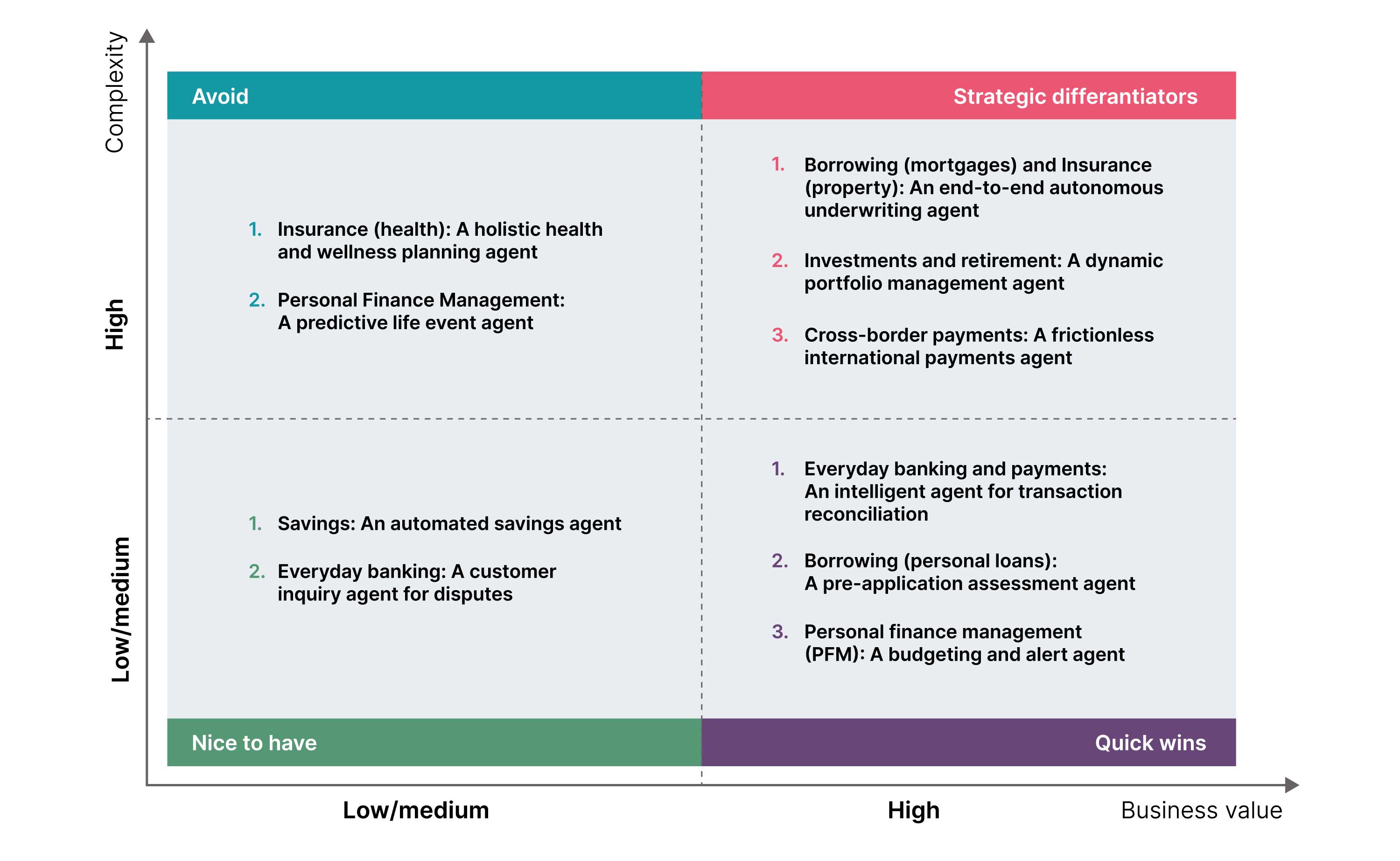

An action plan for CXOs

The transition to an intelligent financial ecosystem is a strategic imperative, but doesn't necessarily require a complete, high-risk overhaul of existing infrastructure. For CXOs, the key is to champion a pragmatic, phased approach that minimizes risk and complexity and focuses on high-value initiatives first. These can be mapped on a complexity versus value matrix much like the following:

A controlled, programmatic rollout allows for the demonstration of tangible value and a clear return on investment early on. It's not about gutting the past — it's about building a smarter, more agile future, through a "thin slice" approach that embeds value and takes the organization towards an AI-first future, one strategic step at a time.

By acting now a bank can secure a competitive advantage. And that action starts with a smart, phased plan:

1.) Adopt an AI-first mindset and position the bank as a customer-obsessed organization leveraging agentic approaches to deliver the best possible customer experience and outcomes.

2.) Re-examine transformation through an agentic AI lens and leverage the potential of AI to simplify and accelerate the modernization of the legacy tech estate. Transition to evolving architectures that reduce operational costs and enhance the technology function.

3.) Embrace new ways of working and thinking by embedding agile concepts and a culture of improvement in all areas of the business.

4.) Improve the time to market of products, capabilities and features, by applying agentic AI to model interactions and identify product opportunities and risks.

5.) Focus on attracting and retaining talent, by continuously building capabilities, encouraging AI experimentation and highlighting the organization’s readiness to embrace new trends and technologies.

For more on how your organization can manage and capture momentum from the shift to agentic banking, feel free to contact us today.