Additional contributions from Joe Delaney

Will the last one out please turn off the gas turbine?

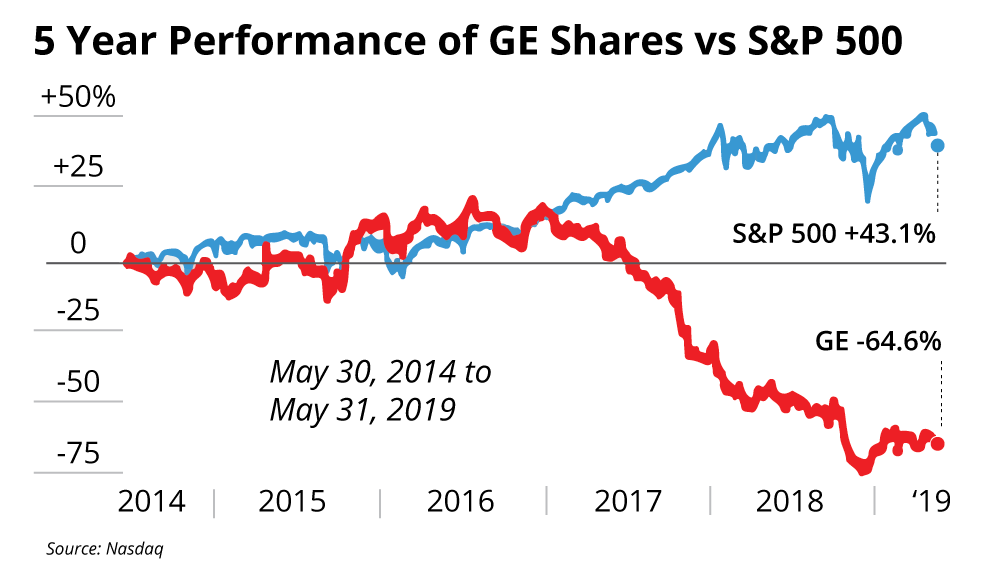

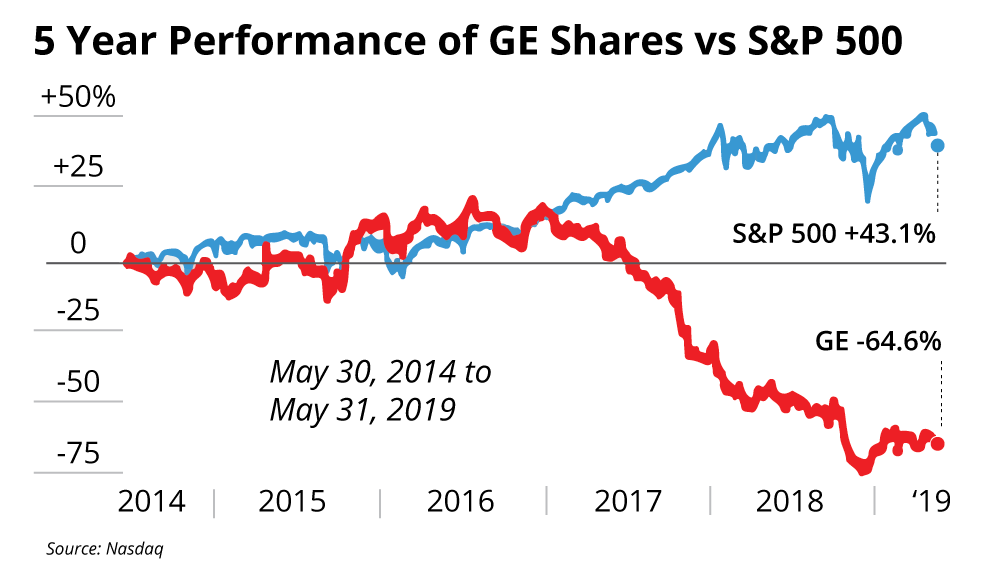

Like a canary in the coal mine, General Electric was caught unawares. GE was purring along just fine in 2016. GE Power had just purchased French industrial giant Alstom SA’s power and grid businesses. GE brought in $4 billion in profits in 2016, and it expected this deal to add $1.7 billion of earnings per share by 2018.

Then, solar panels ‘suddenly’ went utility scale. Suddenly? It really wasn’t sudden, the power industry just wasn’t paying attention.

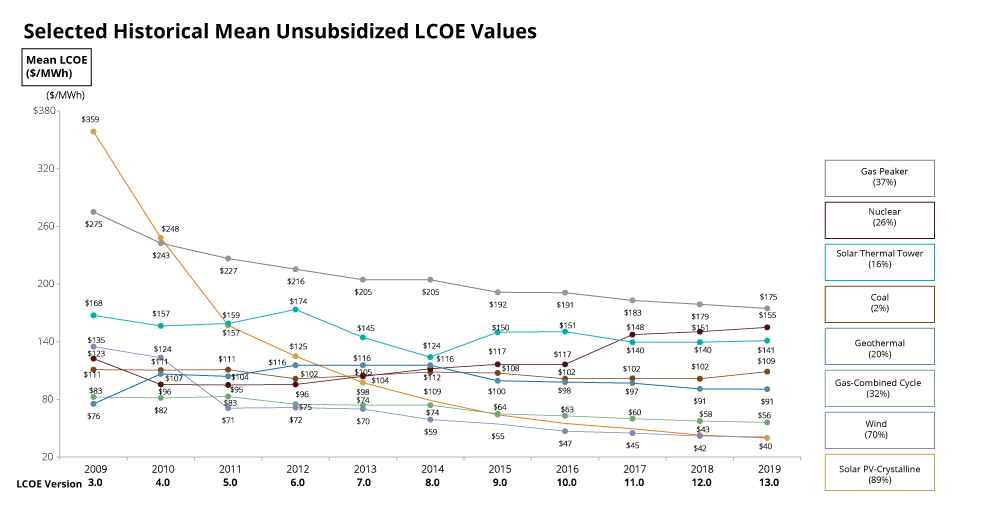

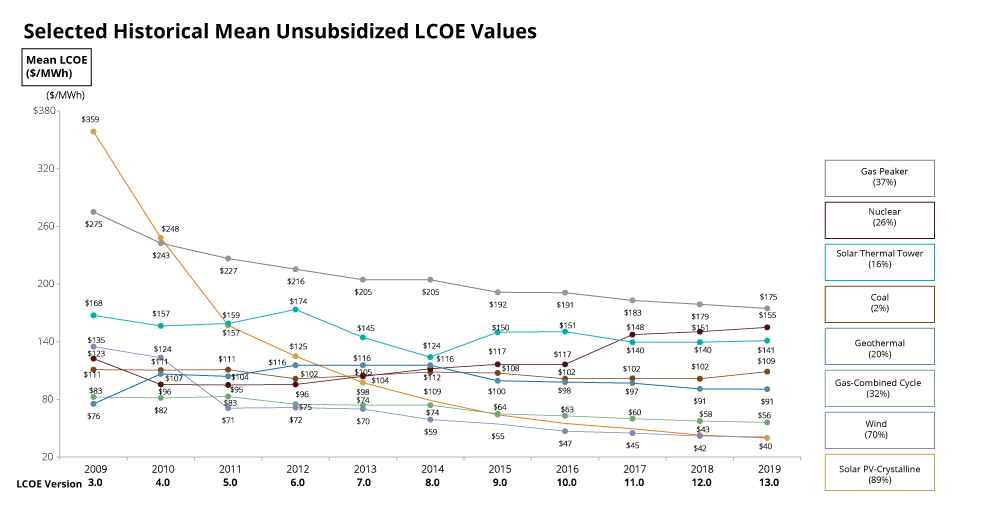

Meanwhile, between 2010 and 2016, the cost of solar dropped a staggering 69% — putting it “well into the cost range of fossil fuels.” GE then lost investors a staggering $193 billion — 74% of its market capitalization in the years between 2016 and 2018. GE Power was a huge driver of this loss as it began to bleed money, going from bringing in $4 billion in profits in 2016, to losing more than $800 million.

What happened? Business Model Innovation happened. Is happening. The Lazard Asset management company reported that building and operating new renewable energy systems had become, in some cases, cheaper than operating older conventional plants. This is just the beginning.

What is Business Model Innovation?

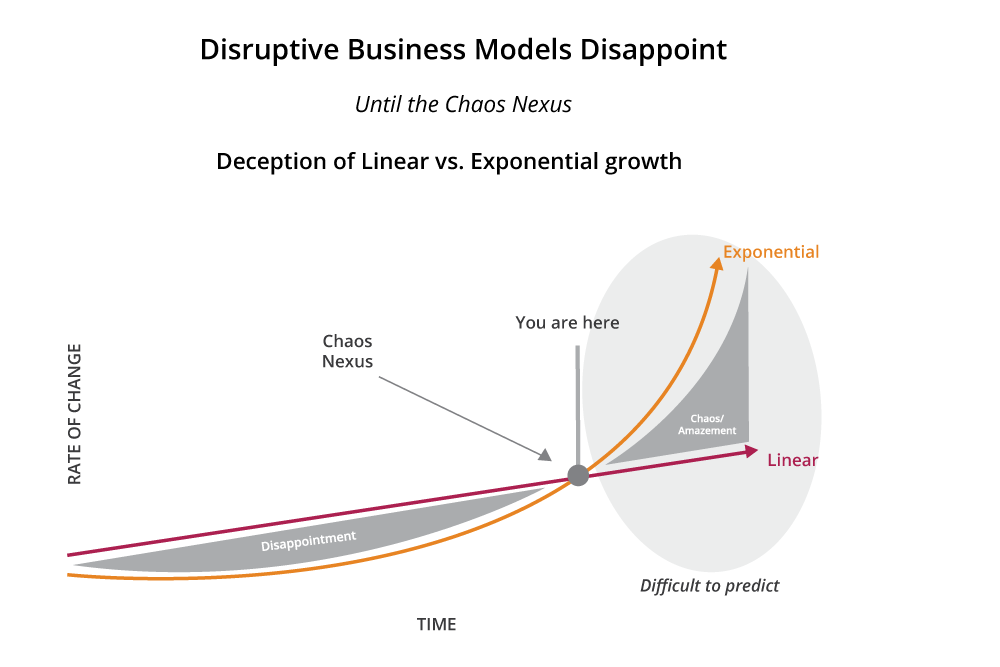

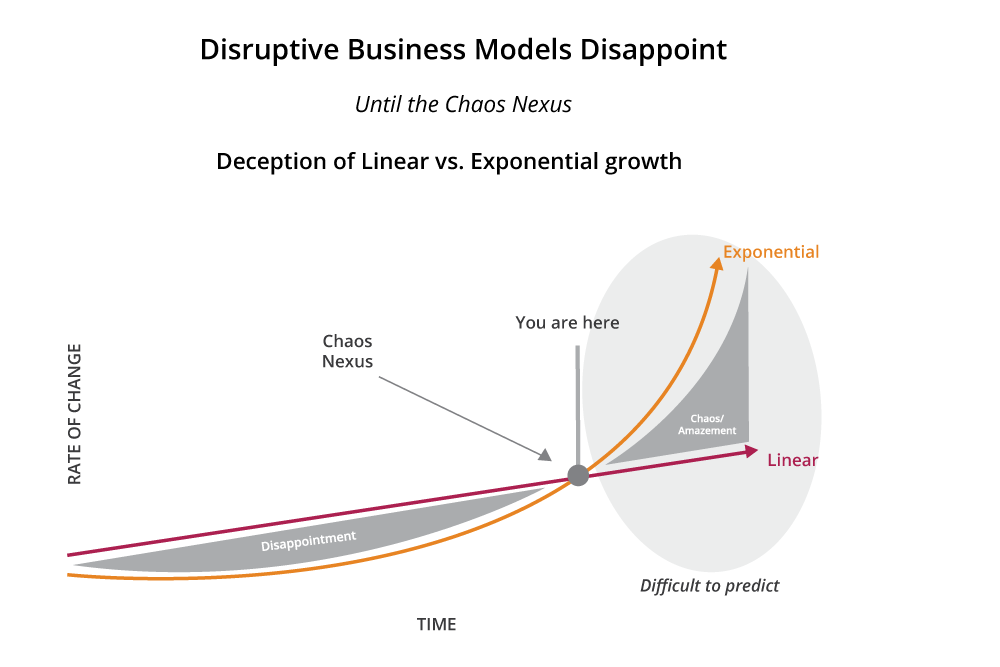

Business Model Innovation occurs when the convergence of multiple technologies enables new or drastically upended business models to emerge. It means new entrants are able to disrupt long-established sectors, with incumbents often left floundering. The changes happen ‘suddenly’ — at the so-called Chaos Nexus — so the disrupted don’t spot the changes until it’s too late.

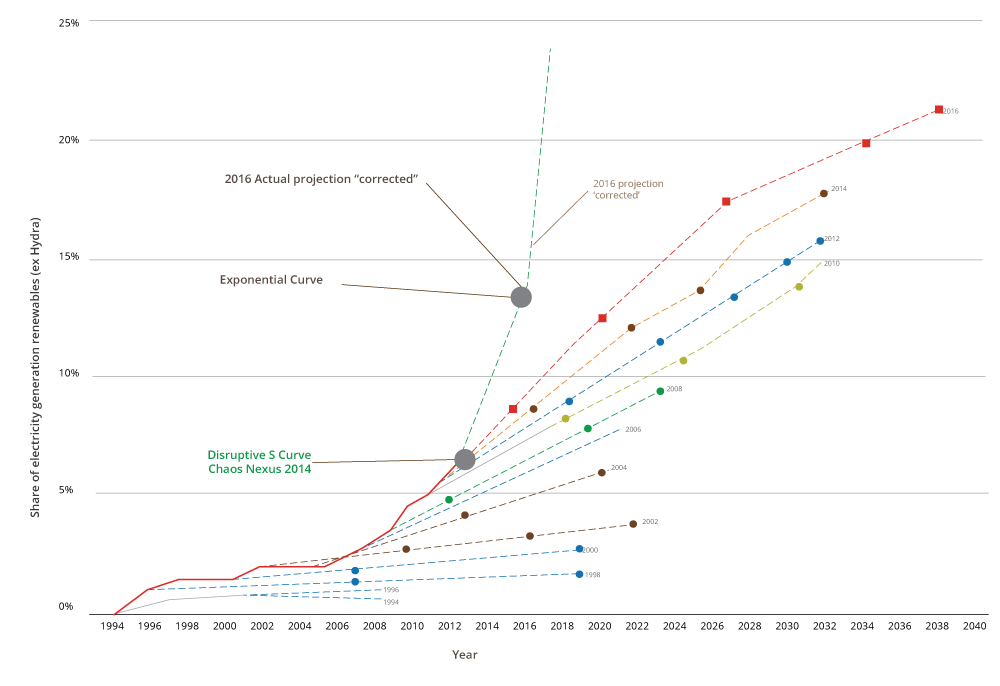

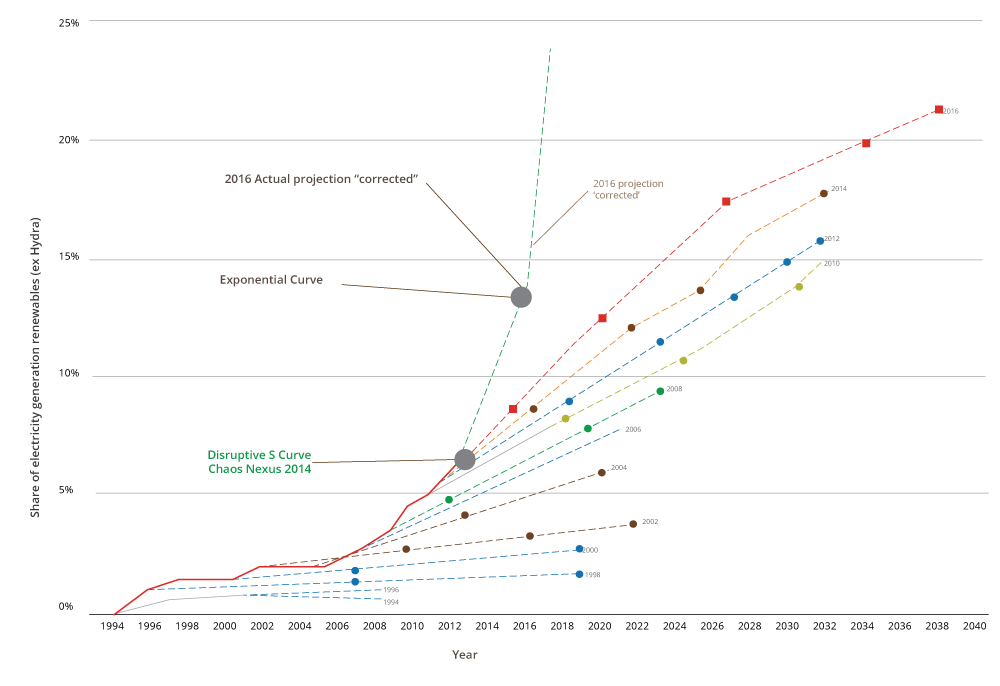

People instinctively expect change to be linear; disruptive change though is exponential, shown here as the orange disruption curve. Disruption disappoints at first, then explodes in growth, creating chaos and surprise.

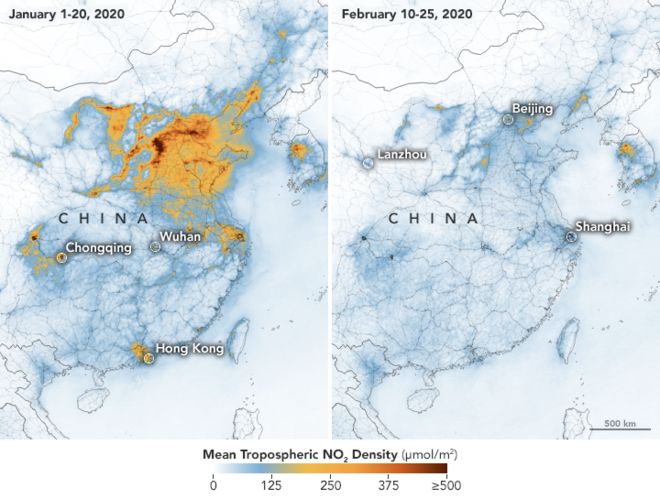

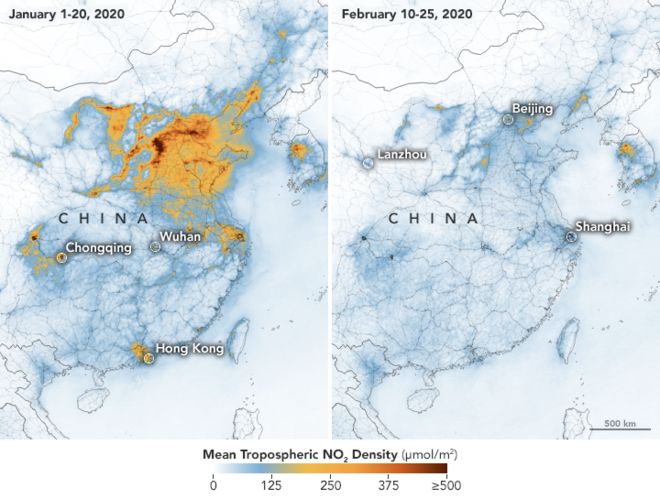

COVID-19 is exposing what an electrified, clean tech energy world could look like. The demand destruction caused by social distancing and shelter in place bodes ominously for oil. The demand shock of not driving fossil fuel transport could mimic the same demand loss after transportation electrification. A barrel of oil sits around $20, nothing near $200 of a few short years ago.

Another recent example was the Business Model Innovation that occurred in 2007, when the iPhone was introduced. In the summer of 2007, Nokia was on top. The company had a market valuation of around $120 billion, $10 billion more than Apple. Nokia's share of the global smartphone market was an astounding 48%. Then, only six years later by 2013, Nokia’s market capitalization had declined by 90%. Now Apple is worth 10x what Nokia was worth at its peak.

So one technological advancement is not enough. Multiple technologies must converge simultaneously to enable new products to be created and new business models to be possible. In the cell phone industry case, convergence consisted of lithium ion battery chemistry that increased power to handle powerful chips, capacitive touch screens to allow a full screen environment with no keys, and the burgeoning high-speed cell data network to allow for the App Store.

What are the technologies converging to causing electrification to surprise us?

The electrification market rout is underway

Decarbonization, decentralization and digitalization

“The Luddites continue to run the old “baseload power” argument, drawing their comfort from the line that the sun doesn’t always shine and the wind doesn’t always blow, while conveniently ignoring the fact that coal fired generators don’t always burn. What is needed most is not inflexible baseload, but rather dispatchable renewable energy, storage, and enhanced transmission.”

COVID-19 has provided a global moment of clarity rarely experienced in many people’s lifetimes — and maybe never experienced, if you’re young enough: that the dramatic reduction in travel — and therefore use of fossil fuels — has left our air cleaner.

If global economies are to meet the Paris Climate Agreement goals, we’ll have to see wide scale decarbonization across all sectors of the global economy. That’s a huge challenge, but it is possible — thanks to technological convergence.

One way this is happening is the energy from centralized (e.g. coal) power plants is being replaced by new, renewable energy sources. For instance, having solar panels on your roof eliminates many costs and grid losses. These distributed, renewable sources are decentralized at the grid edge: closer to communities, consumers and businesses. And the move is gathering pace: in the US, electricity generation from renewables is finally set to surpass that of coal.

Software can use these distributed sources as components of a digitalized ‘smart grid’. Digitalization can allow us to dynamically adjust energy sources and consumption in response to market supply, demand, price signals and incentives. Digitalization requires new software applications, common integration standards and beneficial automation. This applies to both the operation of those networks and their ability to engage with the “prosumers” at the grid’s edge.

The electrification business model is only made possible by the convergence of these three new technologies:

- Energy generation. Increased solar and wind generation will be driven by compelling economics and technical advances

- Energy management. Smart energy IoT management systems and cloud technology will increasingly integrate distributed energy resources (DER) and harness energy efficiency to the benefit of the overall system

- Energy storage. Lithium ion battery advance are accelerating both battery life and energy density, applicable at grid scale and for DER such as electric vehicles and home battery systems

If any of those things are missing, you keep the carbon-intensive energy ecosystem in play: without renewables, you’re reliant on fossil fuels to create energy; without battery technology you have fuel / petroleum as a primary store of energy; and without smart energy software, you have no distributed energy resource sensing, control, billing, pricing, nor analytics.

But there have been significant advances in all three elements, not least of which occurred in 2014 through 2015. This was when utility scale solar became as inexpensive as the least expensive fossil fuel source — natural gas. It was the last leg in this convergence.

This Business Model Innovation’s impact on the electricity market, specifically the ‘electrical supply peaker market’, can be seen in what’s happening in the Australian electricity market. In 2017, Tesla promised to build the world's biggest utility scale lithium-ion battery in South Australia, within 100 days, to support stability services for renewable energy. It would also provide emergency backup power and Frequency Control Ancillary Services (FCAS); FCAS manages the balance between generation and demand. Subsequently the battery’s owner, Neoen Australia, had financial returns in Q4 2019 from FCAS skyrocket — to the highest revenue quarter on record, and that quarter was 70% higher than any previous record.

But few expected building this utility scale battery could happen, at least anytime soon. Why? Again, due to viewing battery technology change in a linear manner. Similarly in the 1980s, AT&T asked McKinsey to estimate how many cellular phones would be in use by 2000. The consultancy delineated all the problems with the new devices and concluded that the total market would be about 900,000. It turned out to be 109 million. McKinsey were only off by 12,100%. Linear projections do not account for tech convergence and miss breakouts.

Below is a graph of the International Energy Agency’s wind and solar forecast since 1994. They also continuously projected linear curves right up to 2015, when solar eclipsed natural gas. But a corrected projection based on actual data — fits an exponential.

Back to our battery in South Australia. By 2018, this single, utility scale battery, 2% of the country’s capacity, was taking 55% market share in emergency power, reducing prices in real time by 90%. One project. “The gas peaker business is pretty close to ending, and lithium-ion is a great replacement,” said Marco Ferrara, a cofounder of Form Energy, an MIT spinout.

The gas peaker business isn’t ending because of natural gas pricing. Pandemic concerns and the 2020 Saudi-Russian petroleum pricing wars are causing massive uncertainty in oil markets. But these factors alone don’t explain this Business Model Innovation. The causes are more fundamental than any short-term price fluctuation.

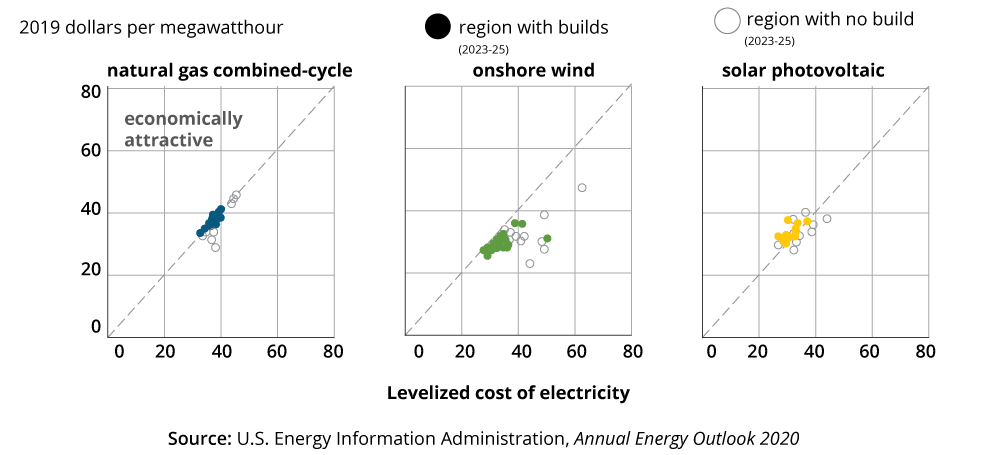

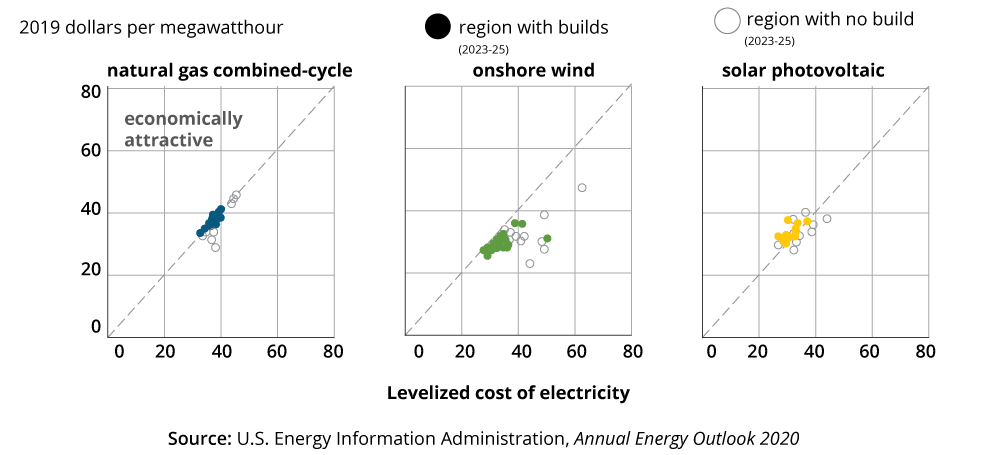

The above chart’s Y-axis of the Levelized Cost Of Electricity represent new plants over a 30-year lifetime. Short-term pricing fluctuations of the fuel component are not a factor in the levelized 30 year cost of renewable plants, meaning their marginal costs are effectively zero. The cost of new wind and solar plants is more economically attractive versus natural gas. They don’t have the complex mechanical, chemical, and electrical systems of fossil fuel plants. Renewables are typically solid state (photovoltaic or PV) or simple mechanical (wind). They are more efficient and cheaper due to technological convergence.

Utility batteries will take market share because:

- Ramp up time. Lithium ion battery-based power has near instantaneous startup time. A fossil fuel plant cannot start in milliseconds

- Minimal management overheads. The utility level battery can be completely automated through software, there are no hydraulic pressure safety protocols to watch. No over-pressure shutdowns to manage. No explosive gas fumes to detect

- Efficiency. Solar panels drive power into battery storage with little energy loss. No pipelines, no mechanical gear loss, no heat exchange loss, and so on

Software-Driven, Zero Carbon Economy

The rapid influx of intermittent wind and solar generation, utility-scale batteries and “behind-the-meter” distributed energy resources (DER), has disrupted the old certainties. That means those well-established and secure operational technology (OT) systems — such as SCADA — that are used to manage the traditional electric grid are becoming outdated.

Unlike OT systems, the software enabling this two-way, decentralized energy market is based on cloud technology, written in common languages, with open APIs. This transformation will open up the traditionally closed energy ecosystem and lower barriers to entry for a new generation of energy-tech disruptors.

For example, “solar plus” is a value-add to solar panel customers, by combining PV with controllable water heaters, air-conditioning, batteries and electric vehicles. This capability uses software to maximize the use of PV electricity rather than grid electricity, mitigate grid-level issues associated with large-scale PV deployment, and can schedule peak period loads to earlier in the day, smoothing energy demand throughout the day.

Whether it’s the Tesla “Big Battery” in South Australia, the aggregation of DERs, or autonomous consumer-facing energy services, software is the critical factor behind the brave new world of decentralized energy.

Software, Solar and the Energy Cloud

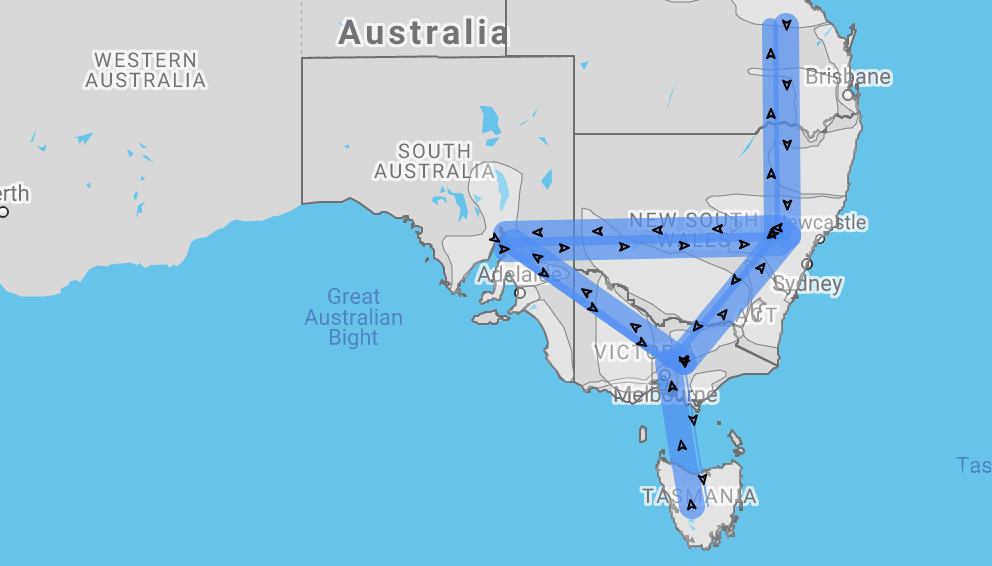

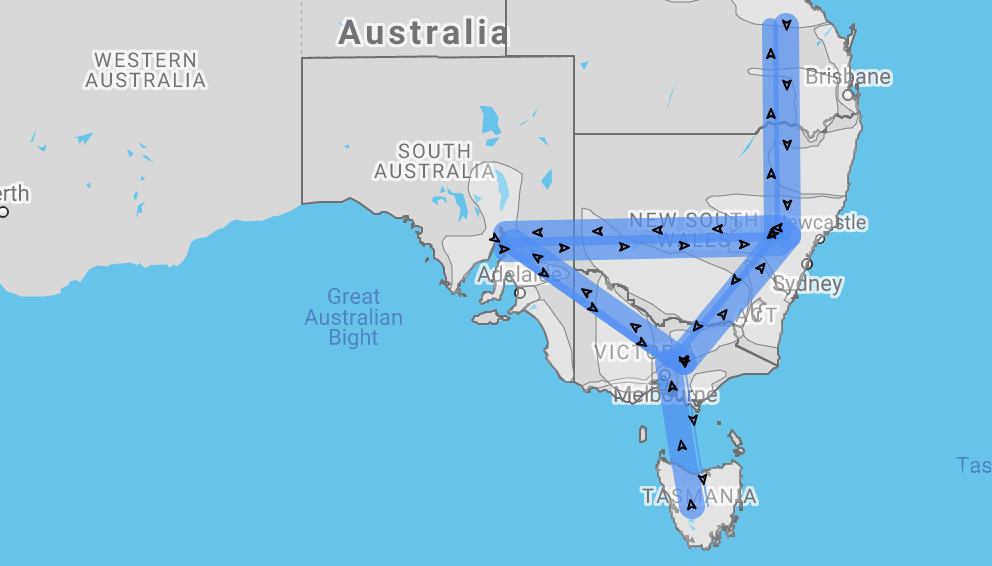

Electricity regulators and operators everywhere are now scrambling to redesign grids and market rules using new modeling software. We recently built the below renewable energy planning and analysis software solution for regulators. In the future, this solution can be used for DERs.

DERs generate power for the utility scale grid and require credits for that generation. Who generates the credits? The macro electrical grid owner uses a digital net meter on the local premises to both sense the generated electricity and credit the account for it.

The aggregation of DERs into virtual power plants (VPPs) also require an automated contracting layer to credit the prosumer and incentivise them to share generation and engage in demand response. An example of this can be seen with the Simply Energy VPPx in South Australia.

DERs feed into the total load (implying a reduction of load) required of the macro grid. In concert, this reduces the needs of the power plants. As above, using longer term analytics and simulations, changing energy use influences power plant building.

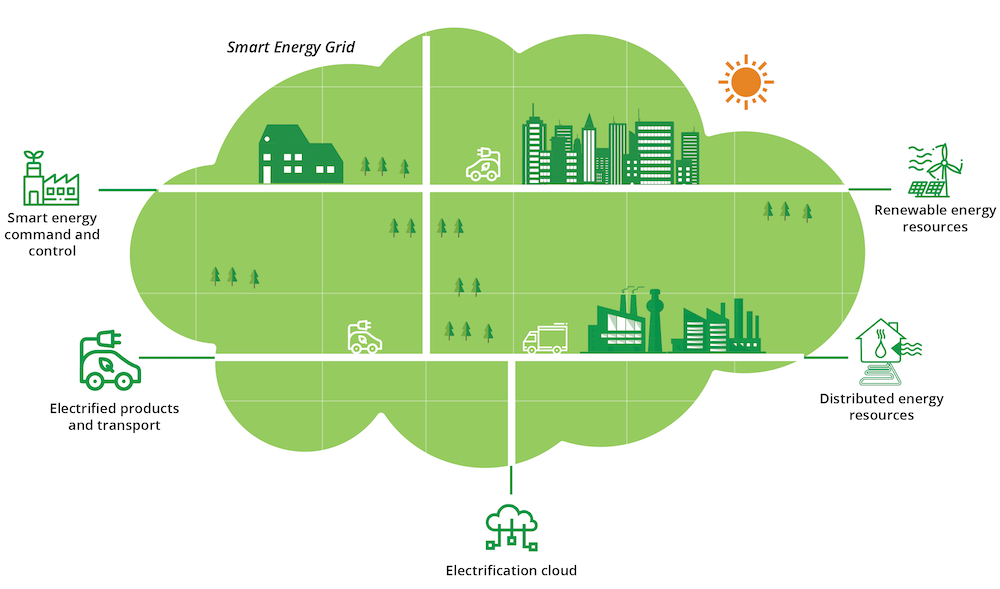

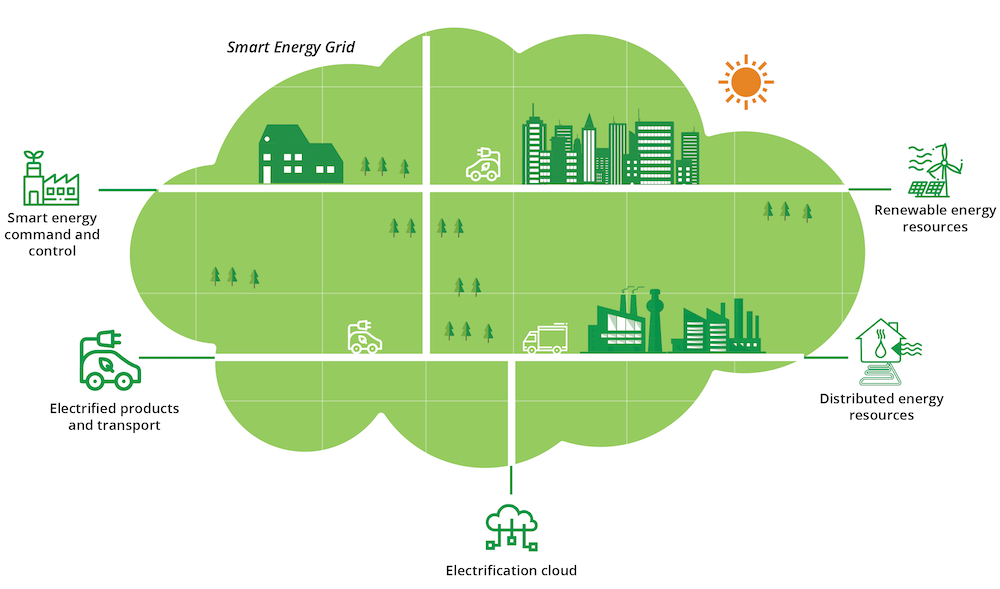

Let’s discuss how the ecosystem components fit together.

The electrification ecosystem

Smart energy command and control

Smart energy enterprise software gives the customer control and visibility of their energy use by displaying generated energy versus grid delivered energy. Typically, this data is produced by another on-premise electricity management device such as an AC/DC inverter that communicates with the electrification cloud. One example of an intelligent and scalable ecosystem is the one Thoughtworks developed with Fresh Energy. Customers use it to manage their local use of electricity: turning energy consumers off, or using them at a certain time of day, or measuring the efficiency of their energy consuming devices. These on-premise devices also control whether to store excess electricity in on-premise energy / battery storage or to sell it to the grid. The decision to store or send power to the macro grid is covered below.

Renewable energy resources

Whether you're an installer, maintainer or warranty owner, when it comes to renewable energy resources, you’ll need enterprise software to monitor your installations and distributed energy generation equipment. Solar panels can have microinverter devices on each panel, generating operational telemetry / IoT sensing data. This information can be used by the warranty owner to measure and analyze, in real time, the operational status of each customer and each panel at a customer site. We built a solution for an energy demand response provider who works with commercial building owners to reduce energy use and cost during utility demand surges. It analyzes IoT sensor data from customer HVAC systems to determine the root cause of any performance issues.

Smart energy grid

For smart electricity grid owners or suppliers, Internet of Things (IoT) sensor data from the on-premise electrical net meters will be vital to tracking what’s happening in real time — and again, some form of software is needed to manage this. We worked with a customer that wanted to provide greater transparency within the electricity marketplace. They saw an opportunity to provide up-to-date information on energy production and consumption. Customer account management is needed to allocate generated electricity credits, lowering a customer’s bills. Aggregate electricity demand and generation measurements feed the grid’s management in the cloud. The measurement data is then in turn used by smart transmission to opportunistically generate and distribute electricity and the growth inherent in new electricity consumers coming online.

Electrified products and transport

Electrified products such as electrified transport are completely different from non-electrified alternatives, for example, petrol-powered vehicles. “Up to 70 control units operating with software from 200 different suppliers must be networked in [VW] vehicles” - VW Board Member Christian Senger. The software architecture of new and advanced electric vehicles surpasses petrol vehicles due to opportunities found when the whole vehicle is electric; the vehicle can be connected to the cloud in real time, receive updates over the air, provide and be provided traffic information to local vehicles. This software opportunity can be a challenge for companies for whom software is not a prime competence where chemical, petroleum and mechanical engineering prowess is preeminent.

The battery management system is a critical component for all ‘electrified’ consumers. We built a battery management system for an electric industrial vehicle manufacturer previously using only spreadsheets to measure their battery capacity availability. We designed the IoT hardware and the operational telemetry subsystem that lead to drastically increased battery life. Some vehicle manufacturers have 33% higher driving range versus other manufacturers with the same electric storage capacity. Software excellence improves on a continuous basis longevity, reliability, and safety. A traditional static, hardware built architecture couldn’t change once a vehicle left the factory. Electric vehicle manufacturers can use IoT technology to deliver over-the-air updates to continuously improve their fleet.

Electrification cloud

This smart ecosystem platform we have built is typical of one on the electrification cloud, connecting all the electrified elements. One key feature of the electrification cloud is that it will allow these loosely coupled cloud users to interact with each other. For instance, when the demand is great — say in summer time, when air-conditioning is needed for cooling — the grid could set their solar panel credits to a higher price to encourage more power to be sent to the macro grid instead of the on-premise storage. That should alleviate the need for the macro grid to startup a coal power plant.

The electrification cloud will obviously run in a datacenter — ideally a green one. A green cloud datacenter approach focuses on aligning three characteristics: its energy source, its energy efficiency and the number of servers in use. Energy savings estimates range from 10–20%, or the equivalent of adding 10–20% more workload. These savings are achieved by using renewable energy, smart cloud infrastructure management optimizing temperature and cooling, and measuring then optimizing compute usage. Once again, it’s the quality of the underpinning software that will determine the effectiveness of each approach.

Software is the key

So how important a role will software play in the Electrification Business Model Innovation? We’d argue: very. You need a platform to bring together the various electrification elements and create customer-enticing services. You could consider doing this at the hardware level, but purpose built hardware has a large achilles heel: it’s not readily adaptable, improvement only comes with buying new hardware, and optimization happens just once in a lifetime.

Another challenge could be that electrification itself will not happen or will not scale. How likely is this to be? Well electrification has been happening since Edison and Nikoli Tesla helped engineer it into existence. Solar energy has snuck up on the fossil fuel industry circa 2015. Scaling has happened. Swanson's law, named after Richard Swanson, says that the cost of the photovoltaic cells needed to generate solar power falls by 20% with each doubling of global manufacturing capacity.

Is Electrification another polluter of a different kind? Green energy generation thrives as a ‘non polluter’ — solar panels acquire energy from the sun, store it in a battery, fill the electrical grid and transportation with this stored electrical energy, with nary a fossil fuel plant in the chain. Recycling is possible with clean tech — for example batteries — what happens when they reach their end of life? Battery materials remain in a cell and can be recycled to recover its valuable materials for reuse.

There are some that argue electric cars are not greener. They secretly or not so secretly assume electricity must come from coal fired or gas powerplants. But research and policy will trump these beliefs:

- A recent study by Florian Knobloch at Radboud University in the Netherlands and his colleagues again found that electric vehicles already have lower net carbon emissions in a number of regions.

- New laws are also forcing the issue, as in New York City Council’s Local Law 97, one of 10 bills in the sweeping Climate Mobilization Act, requires New York City’s 50,000 largest buildings to reduce their carbon emissions by 40% by 2030 and by 80% by 2050. Owners of noncompliant buildings face the prospect of multimillion-dollar annual fines beginning in 2024.

Will the first one in, please hit start

Electrification is here... It can be harnessed by every motive component in our economy. It is controlled, enabled and made available through software.

Electrification’s components are no longer supplied by large monolithic engineering companies connected together through a high voltage transmission line. It is supplied by small, medium and large companies in a cooperative and competitive environment, continuously improving across a growing set of global standards of connectivity. As noted elsewhere, 5G telecommunications technologies, the Internet, Internet of Things, lithium ion chemistry and lastly enterprise and embedded software will bring us not only a carbon free ecosystem, but a constantly improving and healthier one.

This article was published on June 25, 2020