Are traditional banks losing the digital game to newcomers? Revolut, a fast-growing European neobank, has surpassed traditional banks with over 26 million app downloads since its 2015 launch. Neobanks and fintechs provide superior customer experiences, with seamless customer journeys and sleek digital products. Traditional banks would benefit from adopting operating models and approaches that make newcomers so successful in developing innovative products and reaching customers faster.

Siloed functional organizations that prioritize efficiencies above all are no longer suitable for the digital age. This is where agile digital-first organizations come into play. This new breed of organization champions a culture of experimentation, brings cross-functional teams together and reacts rapidly to changing customer expectations to bring innovative products to market. Developing these capabilities offers numerous benefits for banks, including improved customer experience and loyalty, which translate into increased market share and revenues and; critically, the ability to rapidly pivot strategies.

The adoption of modern digital practices in banking isn't living up to its promise

In our work with clients, we observe a common anti-pattern in banks that attempt to organize for the digital age. They adopt agile practices in name but continue to operate in their old ways. Setting up tribes and squads is a good start, but it's not enough if teams can't work autonomously. Constraints will remain due to customer-facing functions and tech teams sitting in different parts of the organization, separated by reporting lines, functional set-up and outdated prioritization methods. Simply adopting modern labels isn’t enough — true change in the way of operating is needed.

Organize around value instead of functions

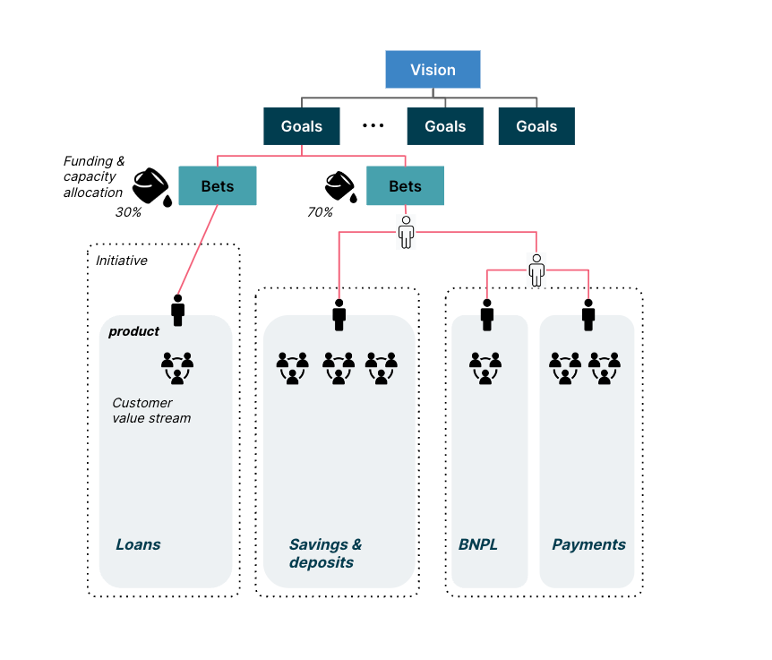

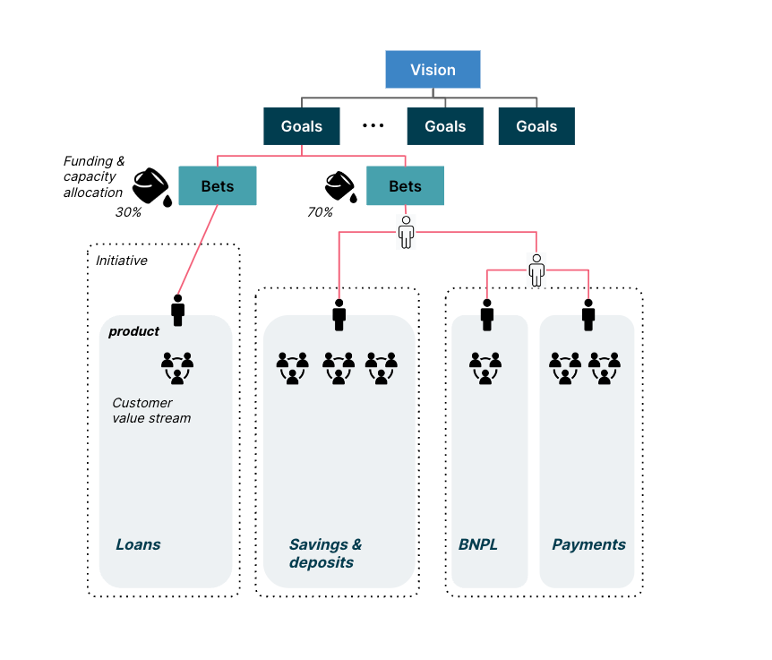

Banks should assess what value they bring to their customers and organize accordingly. It may mean organizing around customer value streams or products (per figure below) with dedicated product owners that are responsible for them — including commercial performance and product evolution — along the product roadmap. Long-lived cross-functional teams that are dedicated to the products they are responsible for should be the cornerstone of the modern agile organization.

Fund value streams, not projects

Organizing around value clusters aligns both funding and your priorities with the overall strategy. Thoughtworks uses a portfolio management approach that we call the Lean Value Tree to help facilitate this. A bank’s strategic vision should be translated into clear goals that become bets the bank is willing to take in a given period. Funding and capacity then should be allocated according to the value each bet represents (see the figure above). For example, in a given period the bank may decide to allocate funding to the lucrative young consumer segment and develop BNPL (buy now pay later) products. If all allocated funding is not spent, or the market signals are inconclusive, this approach allows the bank to quickly pivot to another value cluster while still realizing value from the area where investment was directed initially. This is strikingly different from project-based funds allocation.

Speed to market should come before chasing efficiencies

Banks tend to organize for efficiency, aiming to reduce duplication and centralize capabilities. While the speed of execution was previously a less significant factor, a single-minded focus on efficiency might have worked; with focused, nimble neobank competitors in the game, it doesn’t. To compete effectively, banks should identify the strategically important products that require ongoing innovation and organize those products for speed to market.

Organizing for speed to market is bound to lead to a duplication of capabilities and greater inefficiency because teams need to be as autonomous as possible, with minimal dependencies. Digital natives understand that this compromise on efficiency is acceptable until the product is stable and has captured market share. Banks should prioritize speed to market before shifting in emphasis towards creating efficiencies through self-service and shared platforms.

'Big Bang' transformation is best confined to the past

The principles of agile should apply to organizational transformation. Banks should move away from the 'Big Bang' approach of changing everything at once and instead opt for small, incremental changes (akin to sprints in agile methodology). This allows for risk mitigation, learning, and course adjustments as needed. Scaling the transformation to the rest of the bank should only happen after successful implementation in smaller areas. This approach is especially beneficial for transformations involving significant human and organizational change, as momentum needs to be built behind the change.

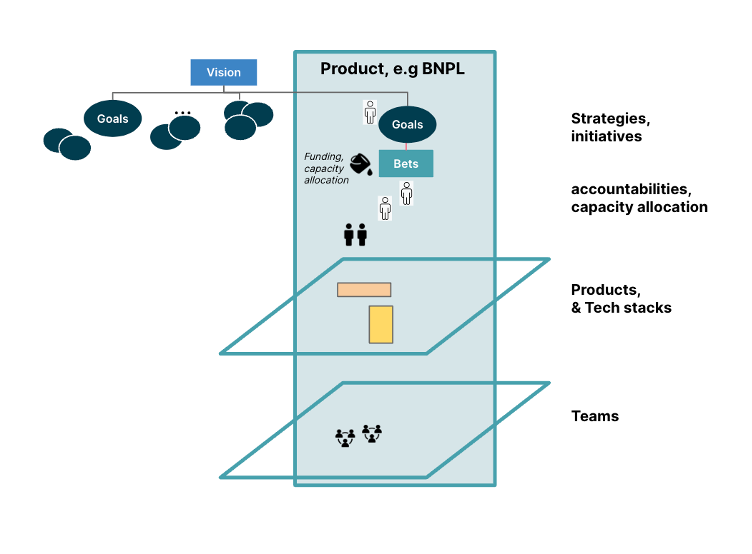

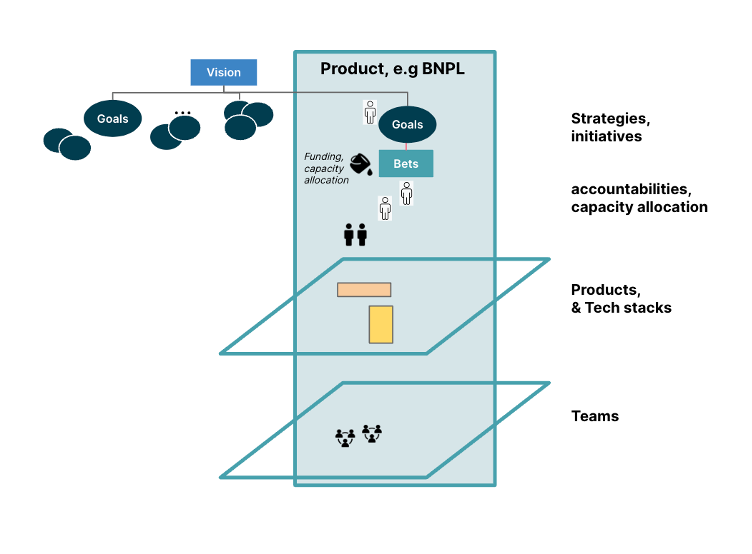

We recommend using the ‘thin-slice’ approach to digital transformation (per Figure below), where change focuses on one value increment (i.e. product), and slices vertically through the whole organization – from the way strategies are set and cascaded into initiatives, to how products are organized around value through decoupled tech stacks and autonomous teams.

Decoupled tech stacks can enable faster time to market

To achieve a faster time to market, it's essential teams operate autonomously in product delivery. However, this is challenging in the context of tightly coupled monolithic tech stacks that are still common in many banks. This is why the "north star" for banks should be decoupled systems that allow teams to develop their products independently. This is especially urgent for legacy applications that are hard to maintain and lack staff with the necessary skills to work on them. We recommend you follow best practice when attempting to tackle complex legacy modernization projects.

Take the prioritization burden from your teams with value outcomes rankings

Banks should always aim to modernize their architecture into a loosely coupled system stack. In reality, however, this can be a costly and lengthy process. Nevertheless, product teams that aren't able to deliver products and features independently should aim to coordinate their backlogs based on organizational value outcomes. Leadership should rank value outcomes based on strategic priorities, making it easier for teams to prioritize at the backlog level.

Adopting agile practices will benefit most areas of the bank

Naturally, there are areas in the bank where going all-in on modern agile ways of working may not be appropriate. For instance, regulatory initiatives constitute a large bulk of the development backlogs in a typical bank and require a different approach that emphasizes compliance and adherence to guidelines, with fixed timelines and scope — and limited bandwidth for experimentation. However, cross-functional teams can iteratively deliver solutions using short sprints, tech spikes, and retros to minimize delivery risks and meet regulators' expectations.

In private and corporate banking, personal contact with clients is essential for deepening relationships. However, client-facing bankers should allocate time to convey client needs to the digital teams working on innovative solutions. Similarly, enabling functions like risk, compliance, and finance could adopt product thinking and agile iterative practices to develop the best solutions for their internal customers. By considering the unique needs of each area, banks can determine which elements of modern ways of operating are appropriate.

A better way to drive transformation

To remain competitive, digital transformation in banking is a must. That entails redesigning operating models for speed to market, with digital-first processes and journeys for customers and employees. Transformation of such scale will have a higher chance of success if approached incrementally by employing modern agile ways of working and approaches pioneered by digital natives.

Thoughtworks has been at the forefront of the agile movement for more than 20 years and works with banks and fintechs of all sizes to help them thrive as modern digital businesses.