Across industries, but particularly in Banking, Financial Services and Insurance Services (BFSI), organizations are experiencing a seismic shift as digital transformation becomes less buzzword and more boardroom priority. Technology has evolved - from a tool for achieving a specific result to a critical driver of innovation and growth in its own right, all at an accelerated rate that defies Moore's law. And in the banking world, there are further changes afoot.

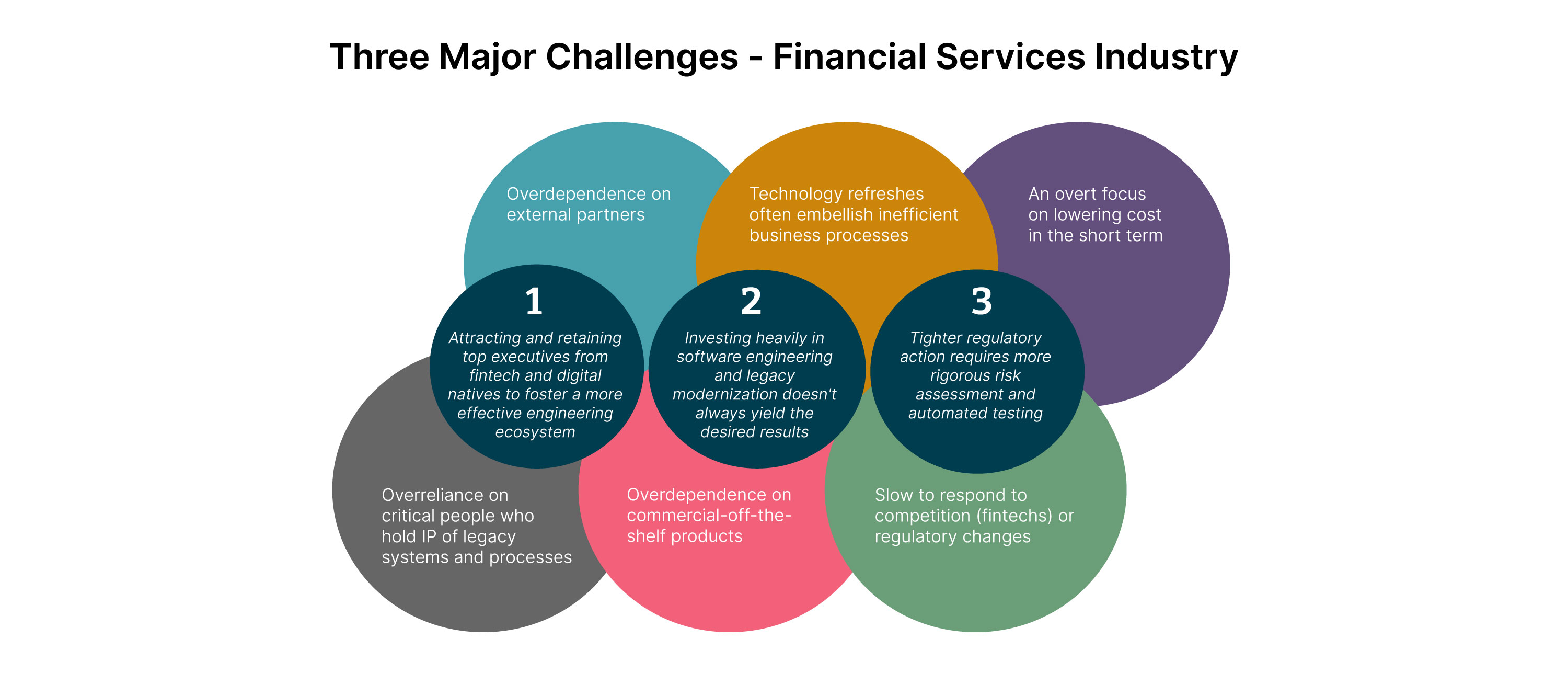

Based on our recent observations of the BFSI industry, we have identified six factors that are negatively impacting the major transformational initiatives its members are taking:

Overdependence on external partners that do not promote internal capability-building

An overt focus on lowering cost in the short term

Technology refreshes often embellish inefficient business processes

Knowledge management challenges: overreliance on critical people who hold IP of legacy systems and processes, and low re-use of knowledge across the organization

Overdependence on commercial-off-the-shelf (COTS) products

Slow to respond to competition (fintechs) or regulatory changes

Forces of change

More than ever before, large BFSI institutions are required to navigate a complex and rapidly changing regulatory landscape, with many subjected to crippling regulatory audits and penalties due to system failures. As a result, they are taking active measures to reduce the concentration risk of partners, and external solutions, including a move towards building in-house capabilities and owning their own tech assets.

But to scale for the future, there must be a balance. Along with investing in these reusable capabilities internally, BFSI organizations must also decide where to leverage trusted technologies and partnerships from the external world to make them available to their customers. Many are investing in early-stage companies with the hope of owning their tech assets and actively experimenting with the latest technologies.

Furthermore, BFSI companies are now hiring tech talent from fintech and other startups, and the war for skilled engineers is fierce. They must make their workplace attractive to potential hires in a highly competitive market and need a strategy to retain and use them effectively.

The industry has been greatly affected by these market and technology forces, resulting in three major challenges that BFSI institutions need to overcome but fail to. In this article, we’ll explore these challenges and our recommendations for addressing them.

Three major challenges of the BFSI industry

Challenge 1: Leadership & Talent — Attracting and retaining top executives from fintech and digital native companies is not enough to foster a more effective engineering ecosystem

Financial institutions must prioritize hiring executives from fintech and digital natives to enhance their software engineering capabilities and foster an innovative ecosystem. Goldman Sachs, for example, actively hired Marco Argenti, a former executive at Amazon Web Services, to lead its technology division and drive transformation with remarkable results.

By bringing in individuals with experience at the forefront of technology development, BFSI companies can stay ahead of the curve and continue to deliver cutting-edge solutions to their clients. However, it is important to note that this strategy alone is not a silver bullet for widespread organizational change.

To succeed, they must establish the necessary organizational structures, processes, and culture supporting software engineering excellence. They should invest in technology infrastructure and resources and provide their software engineers ongoing training and development opportunities. Furthermore, BFSI organizations must focus on building strong teams rather than relying solely on individual talent and shift from a project-based approach to a product-based approach to enable their leaders to adopt, adapt, and replicate successful approaches that have worked in their earlier organizations. Failure to prioritize these efforts will result in being left behind by competitors and missing opportunities for growth and innovation.

Challenge 2: Legacy Modernization — Investing heavily in software engineering and tech modernization isn’t yielding the desired results due to blockers from complex interlinkages with legacy models.

In recent years, BFSI companies have made significant investments in technology and software engineering as part of their growth strategies. But despite this heavy investment, we continue to witness an alarming number of employee lay-offs across the industry, indicating an inability to achieve their desired outcomes and transformation objectives.

Well-known examples include Deutsche Bank, which laid off 18,000 employees in 2019, despite major investment in technology to improve efficiency and reduce costs, and HSBC, which announced a restructuring plan in early 2021, impacting 35,000 employees. Similarly, Goldman Sachs made cuts to 10% of its global workforce in 2019, and a further 3,200 this year, including technology-related roles.

Our view is that while software engineering is a significant investment in banking and insurance institutions, there is still a lack of understanding of how to integrate the practice into organizations effectively. This lack of integration results in a waste of technology talent and resources on activities not directly related to producing value for the customer or the organization. These activities include prolonged wait times for approvals, challenges in information discovery, understanding the organizational ecosystem and identifying existing capabilities.

Additionally, organizational silos in large organizations often result in repeat efforts across functions and departments, leading to further waste. It is unsurprising that these investments do not yield desired results, causing disappointment, financial loss, and the need for strategy re-evaluation.

To effectively transform legacy systems, organizations must take a proactive approach. They need to identify emerging system complexities early and have the appropriate interventions and framework in place, including anti-corruption layers, to support system changes. Don’t let inertia and fear of large-scale failure hold you back. Instead, invest in new technologies and design approaches like distributed systems, microservices-based architecture, domain-driven designs, cloud computing, artificial intelligence, and blockchain that align with your organization’s business goals. Doing so can improve operational efficiency, reduce costs, and enhance the customer experience.

Challenge 3: Modern Testing Strategies — Tighter regulatory action requires more rigorous risk assessment and automated testing

The complexity of the financial system has significantly increased, with many financial institutions engaging in multiple lines of business and complex financial transactions. This reality poses a significant challenge to accurately modeling the impact of stress scenarios. It makes it difficult to design stress tests that capture all potential risks, including cascading failures in the financial sector due to systemic risks.

With this added risk, many financial organizations have found themselves at the mercy of systemic failures that have resulted in tighter regulatory action. The 2008 financial crisis, the Libor scandal, and the Wells Fargo fake accounts scandal are just a few examples of incidents that have led to increased government regulations and scrutiny in the financial sector.

To mitigate these risks, organizations must be viewed as complex adaptive systems that require sophisticated modeling. It is critical to invest in technology to connect the various parts of organizations to assess any impact of initiatives on the overall system. Rather than focusing on isolated outcomes that can be manually controlled and thus are prone to errors, organizations should prioritize understanding the interconnectedness of their operations to identify potential risks and implement appropriate safeguards.

Looking to the future.

BFSI institutions must embrace a holistic approach that successfully combines internal capabilities with external partnerships and technologies to navigate these challenges successfully. Investing in robust risk assessment and automated testing processes, aligning software engineering efforts with business goals, and attracting top tech talent to foster an innovative ecosystem will be critical. Additionally, they should prioritize building strong teams and adopting a product-based approach to drive sustainable change.

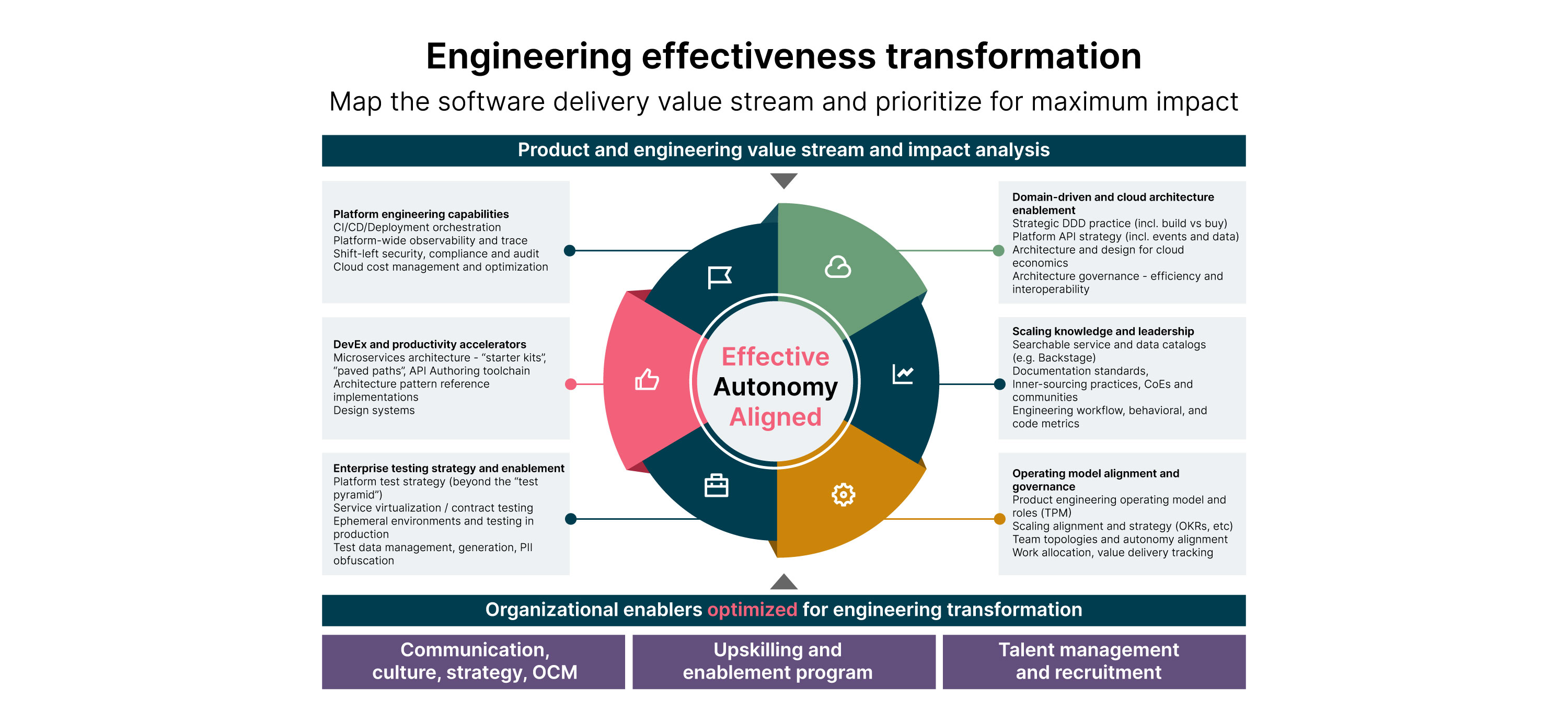

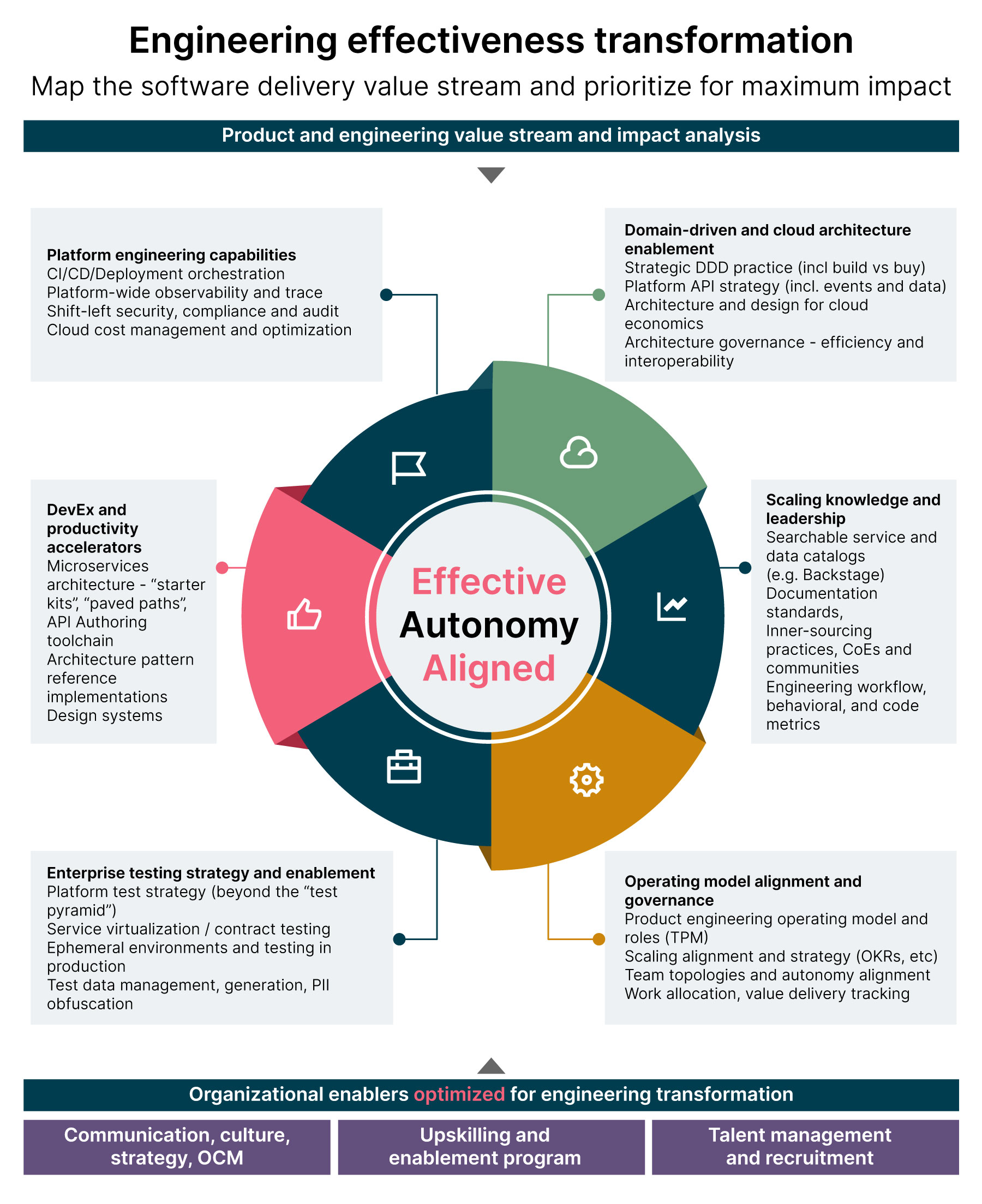

Our solution, Engineering Effectiveness, has been created in partnership with leading global BFSI providers to address these challenges, transforming their engineering capabilities and enabling their leaders to focus on priority efforts. The framework breaks down into six focus areas that help identify waste and friction and provide impactful interventions and investments to drive the meaningful, lasting, and systemic change needed to overcome the challenges of the industry.

A framework for Engineering Effectiveness

By prioritizing which of these six elements to tackle first, BFSI institutions can successfully address the outlined challenges to achieve the following outcomes:

Reduced time to market for new digital products,

Improved productivity of engineering organizations

Improved predictability of outcomes, and

Reduced regrettable attrition

To illustrate this strategy in action, here are some of our top recommended approaches:

Recruiting and retaining top talent: Design and develop a strategy to engage your engineering workforce in high productivity via a platform, ecosystem and process view, with a clear line of sight to business outcomes.

Keeping pace with technology: Invest in continuous learning and development to stay up-to-date with the rapidly changing technology landscape. This requires ongoing investments in training and development and a culture that values experimentation and innovation.

Balancing innovation and risk management: Balance the need and benefit of innovation with the imperative to manage the risks introduced by new technologies and approaches. This requires a culture that values risk management and a robust governance framework to ensure that new technologies are implemented safely and effectively.

Integrating new and legacy systems: Carefully plan and execute seamless integration of new and existing systems by improving your capabilities in managing technical debt, modernizing legacy systems and retiring old systems safely and quickly.

By embracing these actionable strategies, BFSI enterprises can position themselves as leaders in the digital era, delivering enhanced customer experiences, operational efficiency, and long-term growth. The time for action is now, and the BFSI industry must seize the opportunities presented by digital transformation to secure its future in an ever-evolving landscape.