Is Regulatory Tech Really on the Rise?

Compliance and operational risk are top-of-mind concerns for executives in financial services. The changing regulatory environment is forcing firms to rethink how they approach their obligations. Technology is an inevitability as firms look to scale their compliance efforts. Technology has to meet today’s regulatory requirements and evolve with future changes.

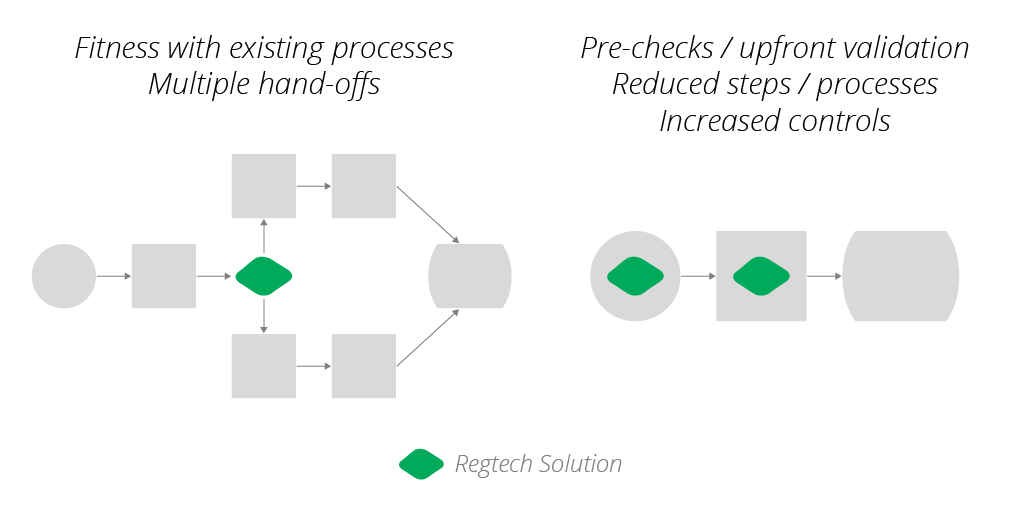

Exciting new companies are emerging with creative solutions to solve compliance problems. Yet they are not attacking the root problem: they are trying to fit in rather than transforming the existing ways of working.

One example of the disconnect is the general ledger which pre-exists regulatory obligations. It is necessary to reconcile the general ledger with the source systems to fulfill regulatory obligations. Efficient reconciliation reduces the manual burden, but it does not change the source of the problem.

Compliance needs to become part of the strategic direction for transactions and tracking. Producing regulatory reports then becomes a feature of the ledger.

With this in mind, how can these start-ups transform the industry? Here are a few of our insights and solutions:

Regtech doesn’t change the game

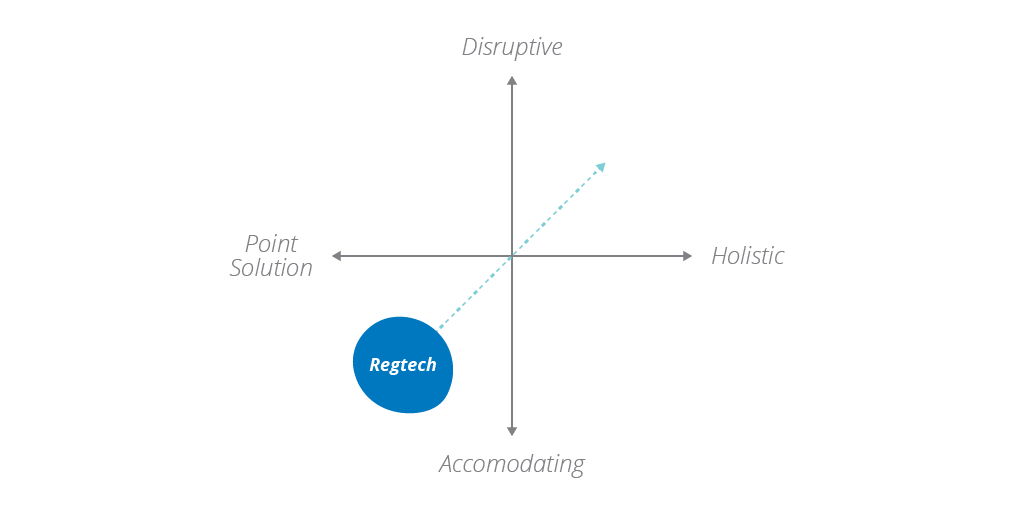

Fintech firms disrupt the revenue models of financial services firms and provide an impetus for change. The regtech firms are not disrupting anyone.

The regtech products offered are a flavor of enterprise software, cloud-hosted and built on a better technology stack. These products are often modeled on current processes within financial services firms. They can slot into an existing process, but do not solve the core problem in a new way.

Regtech is facing significant adoption challenges

Regtech firms have to go through a procurement cycle at the different institutions.

Trialling software is a significant investment of time and effort. Institutions are unwilling to make an investment unless they see a massive upside with the solution. Cloud adoption fears and information security concerns are also proving to be major hurdles.

Regtech needs to pay close attention to where the banks are heading

Financial services firms recognize that regulatory compliance requires a holistic, transformative approach in people, process and technology.

Point solutions to meet specific fiduciary obligations are insufficient for real-time demands that business face. Incremental investments in acquiring point solutions lead to a fragmented IT landscape and a huge workforce. They also do not deliver the scale required to address the growing complexity.

To achieve compliance at scale, firms recognize that they need to have

- Lean processes

- Re-engineered legacy assets

- Reduced friction points for customers

- Strategic technical capabilities

- A data-driven business

The Future of Regtech

What do these issues mean for regtech and the financial services firms? Here are three trends that we believe will shape the industry going forward:

Standardization and industry utilities

Regulators recognize the increasing role of technology to combat the complexity burden. The game-changing evolution could be a regulatory seal of approval for different products. This can lead to standardization and scale that eases the burden for both banks as well as regulators.

The solutions in this space would most likely evolve as industry utilities. Examples of such utilities include; a common reporting framework, trade lifecycle monitoring, suspicious activity detection and fraud databases.

Solving for customer needs, not sophistication

The regtech adoption challenge lies in understanding the specific context for applying solutions. This requires understanding the customer journey as well as integrating with existing systems. A transformative approach would result in fewer process steps and less friction for customers.

Modular, loosely-coupled architecture

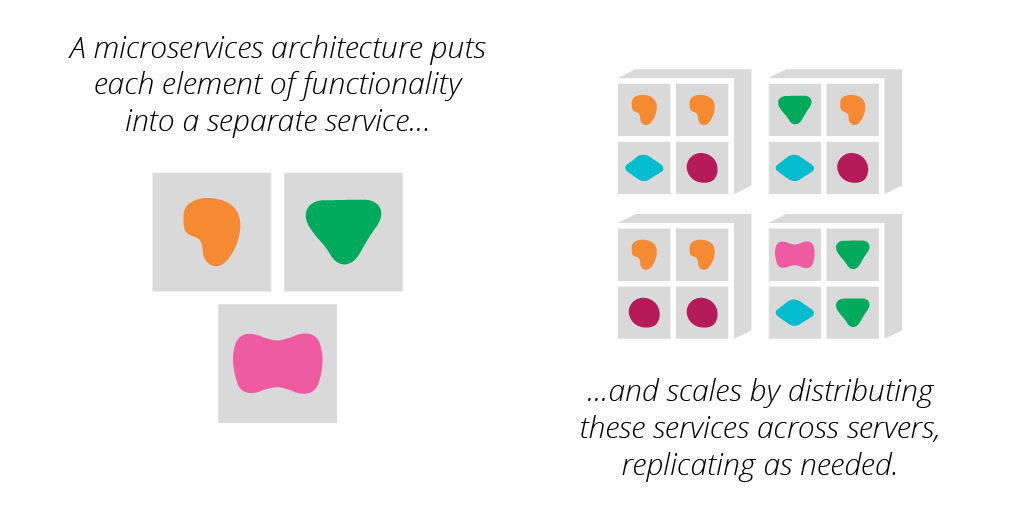

Financial services firms want a loosely-coupled architecture where you can plug and play different services. By configuring the services, one can craft a desired customer journey.

Regtech solutions can fit in this evolving ecosystem by offering stable and secure services. These services are delivered via well-defined APIs, embeddable or white-labeled screens, zero data lock-in and monitoring capabilities.

What Next For Regtech?

Regtech firms need a tighter contextual focus to understand their place in the ecosystem. Despite high executive attention, the level of regtech adoption remains low.

Banks need strategic delivery partners who can deliver transformative holistic solutions. Done right, compliance can transform technology, people, and processes. Strategic compliance can create higher degrees of trust and deliver customer-focused products. It can lead to higher risk awareness and drive better decision making.

In our next article, we’ll dive deeper into how to achieve strategic compliance for a financial services firm.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.