The scale of opportunity: Insurance penetration gap in focus

The global insurance industry stands at an inflection point. While global premiums reached approximately €7.0 trillion in 2024, insurance penetration ( measured as total premiums relative to GDP ) reveals a striking disparity that represents the sector's greatest untapped opportunity. Global penetration averaged 7.4% in 2024, but this headline figure masks profound regional variations that define the industry's growth challenge.

In mature markets, penetration rates typically range from 7-12% of GDP, with countries like the United States (11.2%), United Kingdom (11.8%), and France (over 10.8%) leading globally. However, emerging markets tell a different story, averaging just 3.14% of GDP overall, and removing two outliers - Taiwan and South Africa, it will come down to 2.10%. The gap is particularly pronounced in Central and Eastern Europe, where countries like Poland hover around 2.24% penetration - less than one-fifth of mature market levels.

For European and UK insurers, this isn't a distant market opportunity; it's an immediate strategic imperative. Even within mature markets, structural gaps persist: 67% of UK adults remain critically underinsured for life insurance.

A new generation of digitally-native customers increasingly rejects traditional insurance models, citing overwhelming complexity and inadequate personalization. Past investments in digitization have delivered incremental efficiency but failed to close the penetration gap. Now, with Big Tech and agile insurtech poised to capture the customer relationship, insurers risk being relegated to commoditized balance-sheet carriers.

This article outlines how agentic AI — autonomous digital agents capable of completing complex tasks — can break through these barriers. By enabling personalized, affordable and scalable protection, agentic AI offers insurers a path to democratize coverage, expand reach, and capture a multi-trillion-dollar growth opportunity.

Underlying challenges: The systemic barriers to insurance access

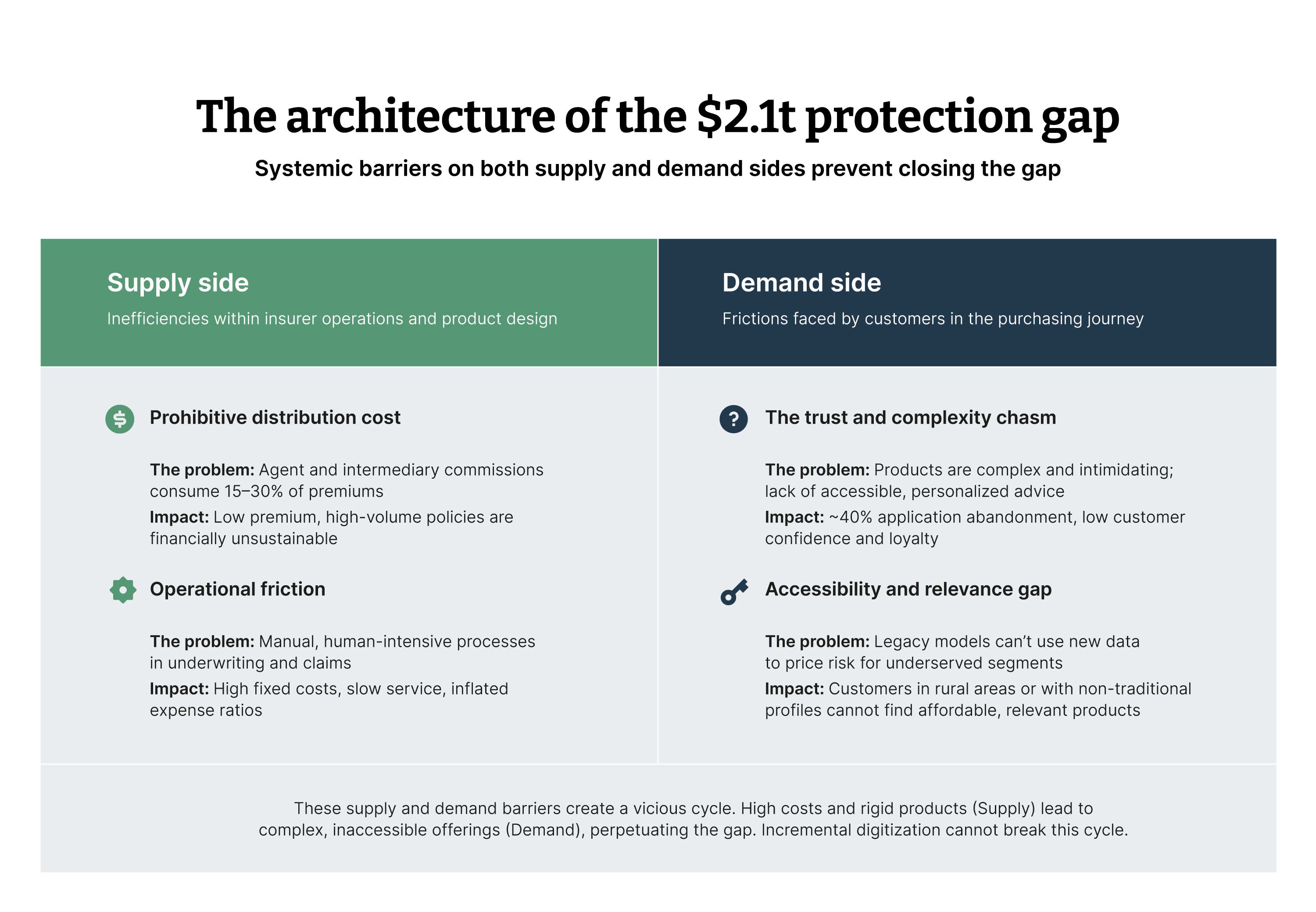

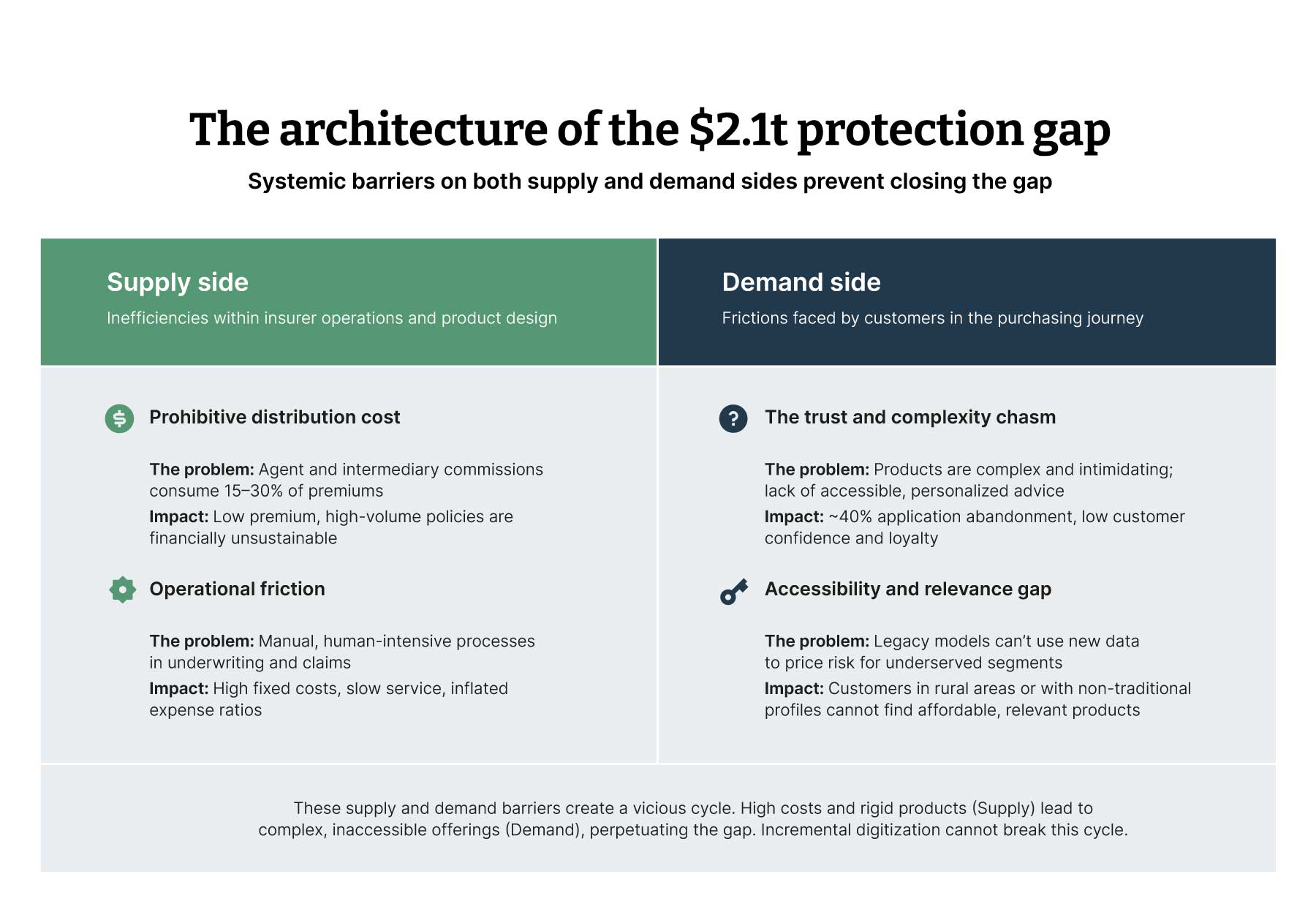

The insurance penetration gap is not a failure of demand — it is a failure of supply too. Legacy models, built for a different era, create structural inefficiencies that make serving emerging and underserved markets uneconomical. These barriers explain why digitization has delivered efficiency gains but not real market expansion.

These supply and demand barriers create a vicious cycle. High costs and rigid products (supply) lead to complex, inaccessible offerings (demand), perpetuating the gap.

These systemic barriers cannot be solved by incremental digitization. They demand a step change in how insurers design, distribute, and deliver protection — precisely the role Agentic AI is built to play.

Agentic AI: The great equalizer

Defining Agentic AI: Beyond generative capabilities

The systemic barriers visualized above form a vicious cycle. Inefficiencies on the supply side; prohibitive costs and operational friction - directly create the problems of trust and accessibility on the demand side. Incremental solutions have failed because they optimized within siloes; they could not break this cycle.

Agentic AI has the potential to rewrite this equation. It represents the critical evolution from assistive intelligence, which answers questions (e.g., an app explaining short-term accident cover), to operational intelligence, which orchestrates outcomes (e.g., automatically activating protection when a courier or ride-hailing driver starts a shift, monitoring for incidents, and if an accident occurs - then initiating medical support, settling the claim, and ensuring income continuity). This shift from task automation to outcome ownership is what allows agentic AI to address penetration gaps in fast-growing but underserved segments like the gig economy.

Think of it not as a tool, but as a digital business unit - one that can be tasked with profitably serving an entire underserved segment, autonomously executing the strategy from product design to claims payment.

This shift from task automation to outcome ownership is what allows agentic AI to dismantle the interconnected supply-demand barriers simultaneously, creating a new, virtuous cycle of growth.

Bridging the divide: How Agentic AI neutralizes systemic barriers

Supplier side problems |

|

Prohibitive distribution cost Commissions destroy mass-market economics.

|

Zero-marginal-cost distribution:

Intelligent agent network engages millions of customers at once via digital channels, replacing high-commission models and making low-premium policies viable.

|

Operational friction Manual processes cause high costs and slow service.

|

End-to-end autonomous processing:

AI agents own entire workflows (e.g., claims, underwriting), reducing process time from days to minutes and drastically cutting operational overhead. Through autonomous processing, insurers can drastically reduce administrative costs, enabling them to offer more affordable policies and respond to market changes with unprecedented speed.

|

Demand side problems |

|

Trust and complexity chasm

Insurance is often seen as complex, opaque and doubtful that claims will be honored.

|

Seamless and transparent claims experience

An autonomous claims facilitator guides customers seamlessly through the claims journey — through step-by-step visibility, plain-language explanations and evidence-based assessments. By making claims fast, fair, and transparent, it builds confidence and removes the friction that discourages people from seeking protection.

|

Accessibility and relevance gap Insurance often fails to reach people because products aren’t accessible or relevant to their real-life needs. |

Context-aware product agents

Context-aware product agents use real-life signals — like income, health, occupation or local conditions — to create affordable, adaptive insurance. They also reach non-customers through embedded discovery, micro-moment activation and trust via local context

|

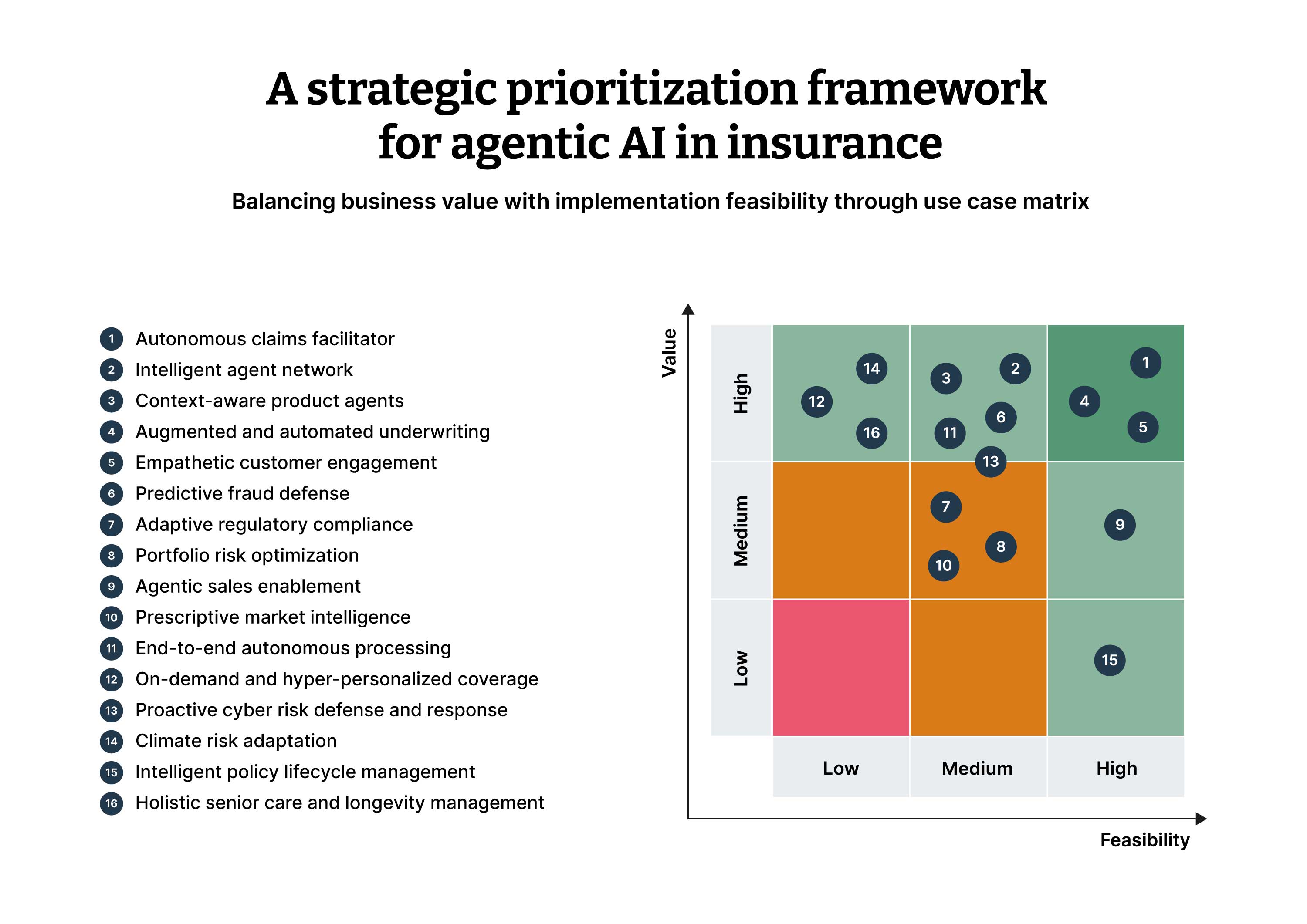

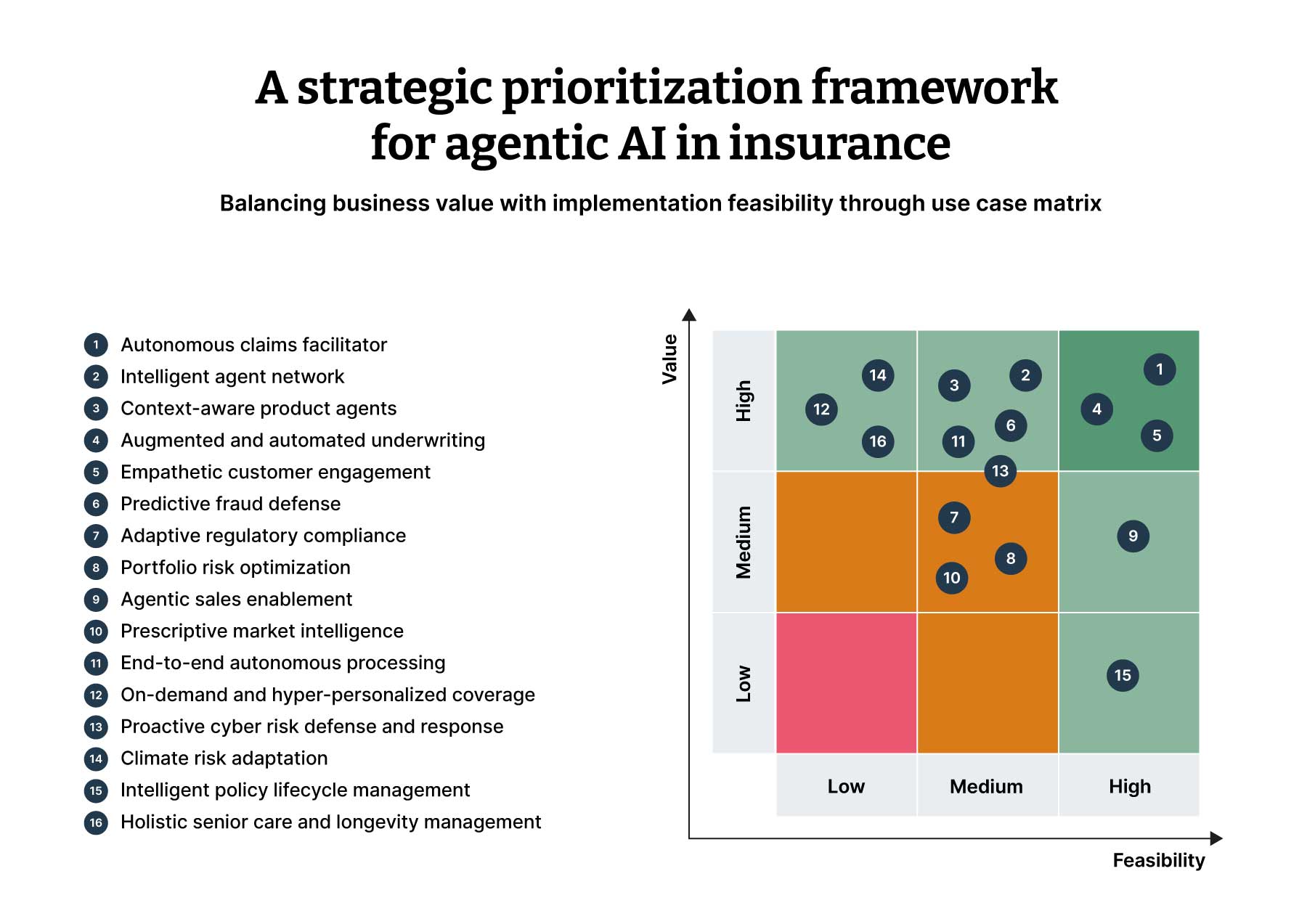

In addition, a broader range of high-impact, agentic AI use cases is emerging — many of which have the potential to fundamentally reshape insurance operations and customer engagement.

To provide a more strategic view, the following map outlines additional use cases, each evaluated on business value and implementation feasibility. This visual helps insurers prioritize initiatives that align with both short-term impact and long-term transformation goals

The organizations that deploy this capability will not just improve margins; they will architect entirely new markets, unlocking the multi-trillion-dollar opportunity that has been hiding in plain sight. The following section provides a strategic framework for building this capability.

Agentic AI isn’t an overkill / Why insurers need agentic AI now

Agentic AI isn’t hype — it’s survival. Traditional tools like portals, automation and chatbots have delivered most of the easy wins but failed to move the needle on customer engagement or market penetration. What insurers need now isn’t more incrementalism, but a step-change: digital agents that don’t just process tasks, but proactively guide customers, simplify choices, personalize advice, and act autonomously to close the trust and access gap.

The competition is no longer just other insurers — it will be with tech giants with superior data, AI muscle and more importantly capital backing. Agentic AI is how insurers unlock growth in stagnant markets, build adaptive products, and create resilient risk pools for an AI-first economy. The first movers will carve out a moat — deeper customer relationships, lower costs and a position as lifelong financial protectors. Those who hesitate risk being reduced to commodity providers in a disrupted industry.

Building Agentic AI: Strategic implementation framework

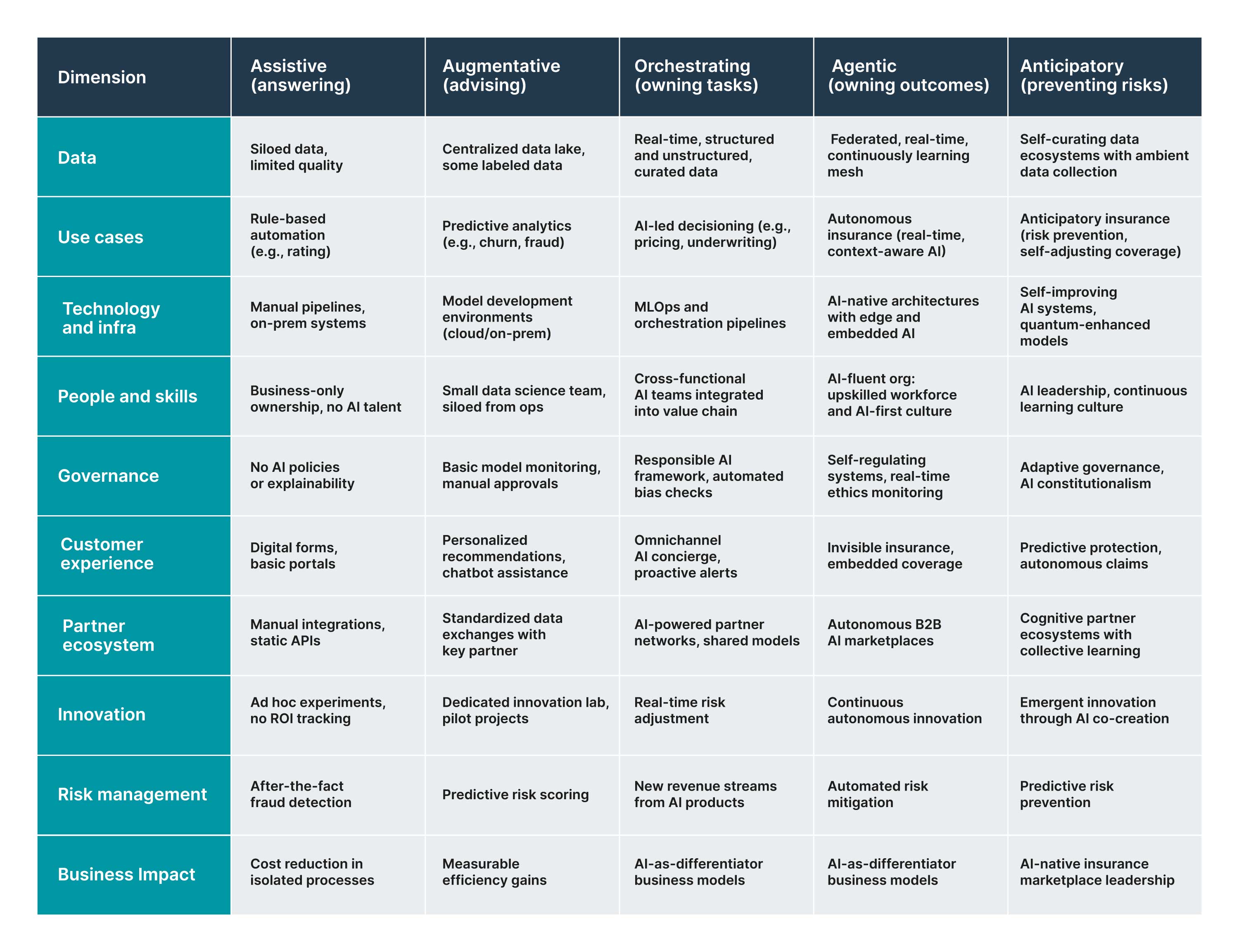

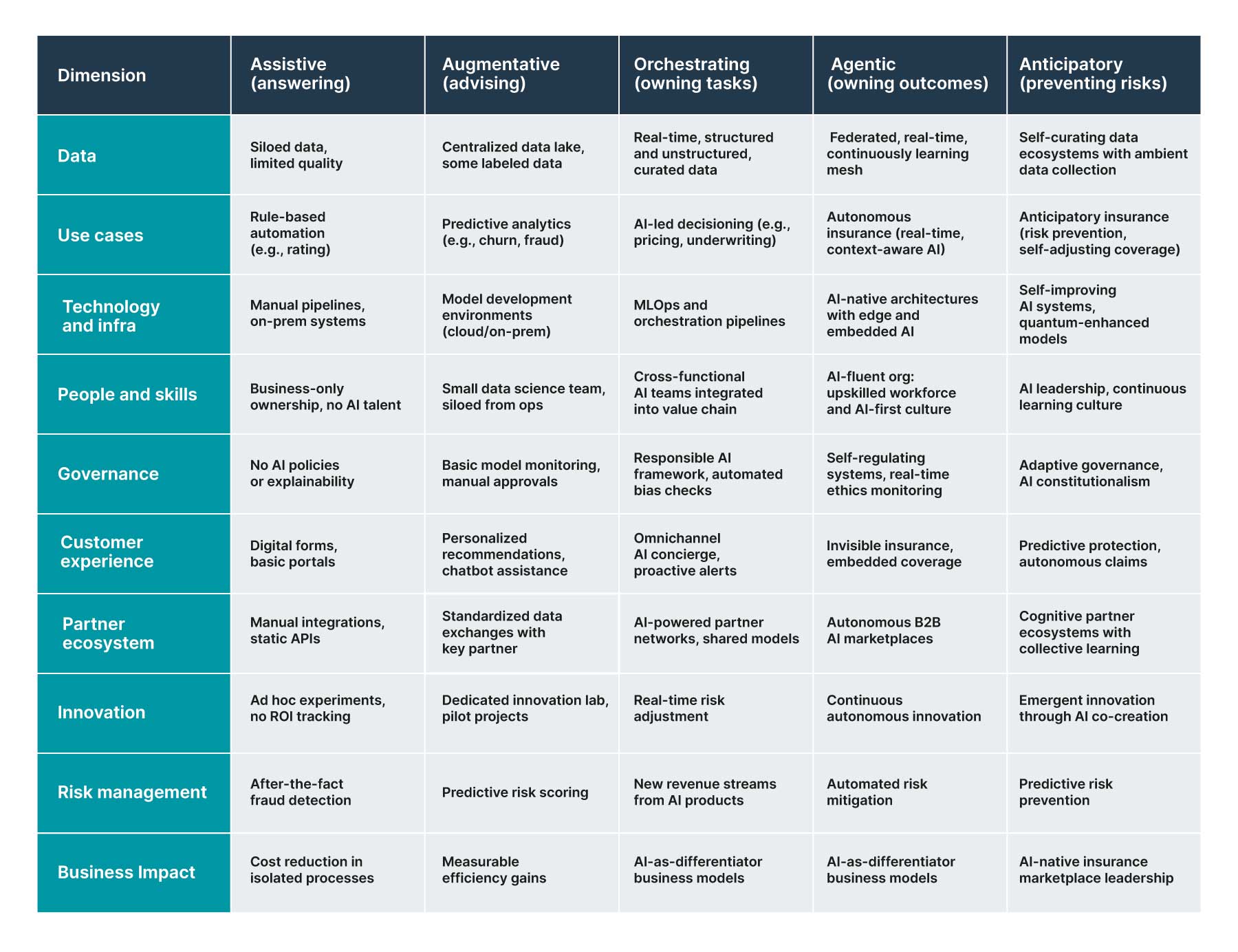

As insurers begin to explore the transformative potential of Agentic AI, it becomes clear that successful adoption cannot rely on isolated pilots or one-off tech integrations. Instead, it demands a strategic, enterprise-wide approach — one that aligns business goals, operational readiness, and technology evolution.

A strategic implementation framework can serve as a practical guide for this journey. It allows insurers to evaluate their current maturity across key capability areas and identify the specific steps required to move forward. By aligning investment with long-term business goals, this approach ensures that each phase of development builds toward a scalable, agent-driven operating model.

The following model outlines this progression in a structured, maturity-based format — enabling leadership teams to assess readiness, prioritize initiatives, and plan for sustainable adoption of Agentic AI.

The path forward: From disruption to transformation

The insurance penetration gap represents more than a market opportunity — it's a societal challenge that agentic AI is uniquely positioned to address. Organizations that begin their agentic AI journey today will shape the future of financial protection globally.

Success requires more than technology adoption; it demands organizational transformation, regulatory navigation, and customer-centric design thinking. The convergence of AI capabilities, regulatory frameworks, and market demand creates a narrow window for competitive advantage.

The question isn't whether agentic AI will transform insurance — it's whether your organization will lead or follow this transformation.