Digital innovation

The future of food: the stomach wars are on

Over 60 retail technology executives attended the Thoughtworks Retail Roadshow in Melbourne, Brisbane and Sydney on the topic ‘Platforms for Growth’.

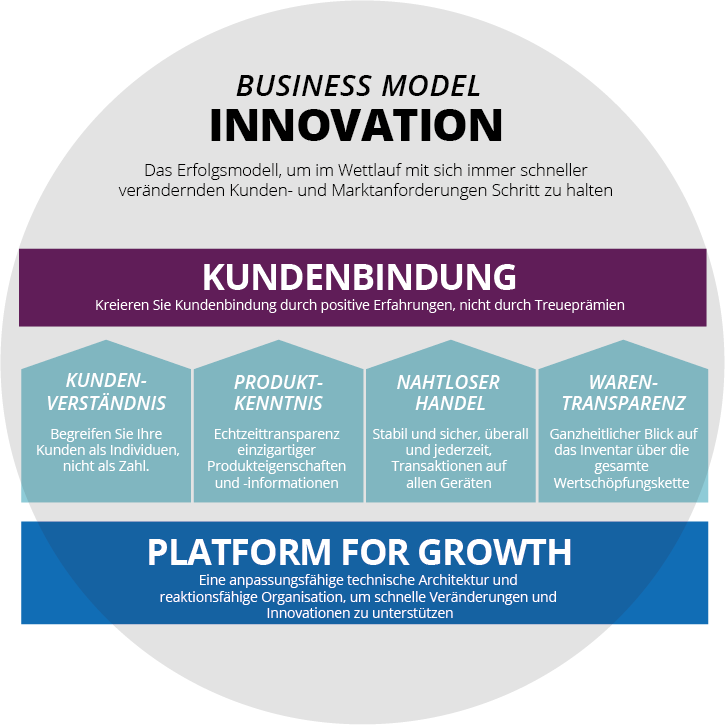

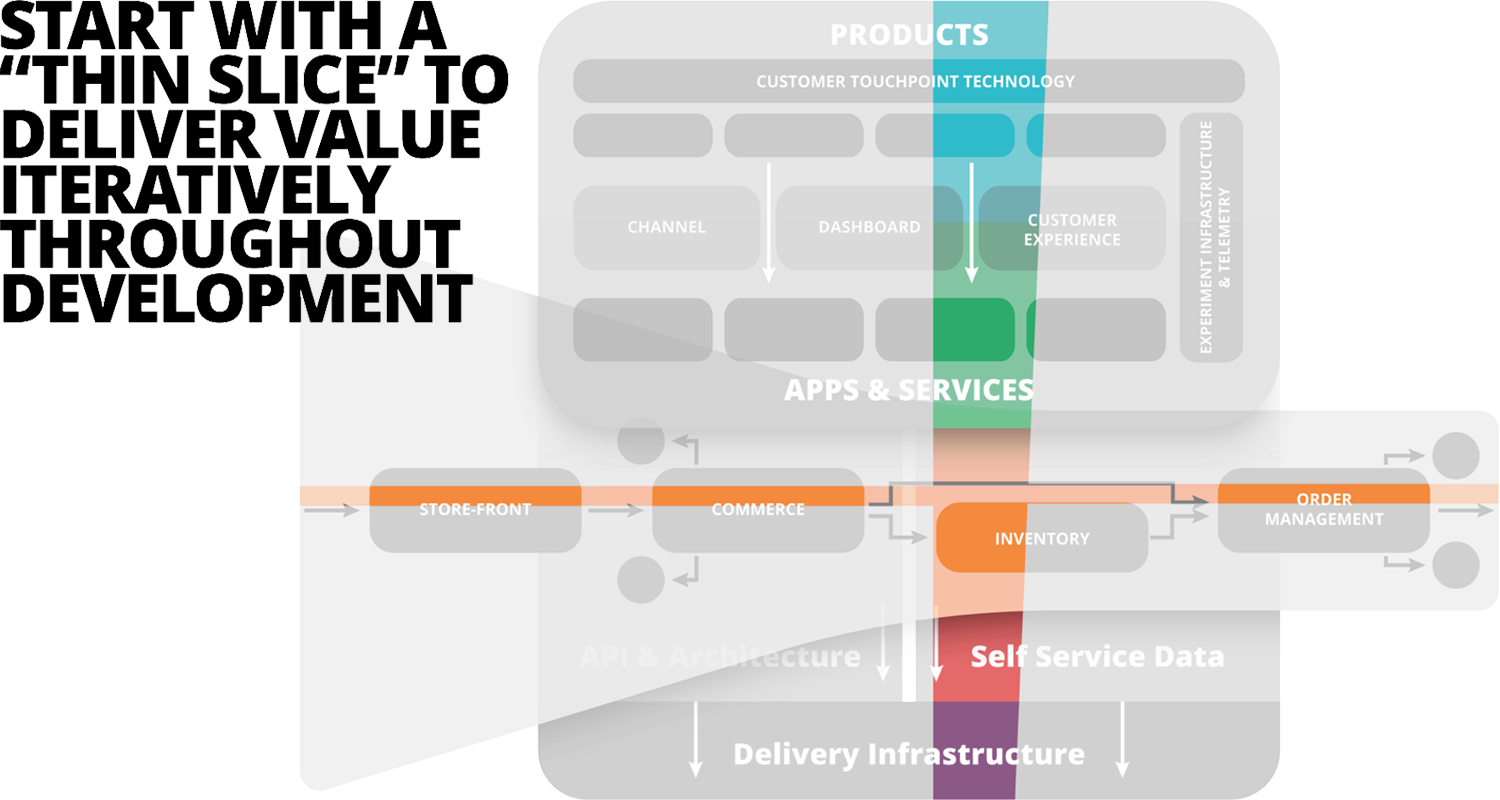

We've been looking at where retail and retail technology is going, and what a modern retailer will look like. We identified four key pillars that are challenging at the moment and many retailers concentrate on.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.