The best is yet to come: How will you shape the future of Australia's payments landscape?

Rewards schemes have become the biggest group to utilize the Consumer Data Right (CDR) specifications allowing a rich marketplace of traded data and data usage consent. It’s difficult to now remember a time without fast settlement, and the removal of merchant fees for NPP routed payments has made that the dominant payment pathway for all domestic payments. The tipping point of 50% of small and medium businesses going cashless was reached last year, and the reserve bank has reduced the mint capacity down to 10% of what it was at ten years ago.

A decade might be plenty of time but will seem like just a blink of an eye when looking back. Let's explore what might make this utopian picture a reality.

The way we pay is changing

Payments have evolved from something we would be quite explicit and focused on to something that is now almost incidental that we are barely conscious of the individual transactions. The conscious actions of ensuring you have enough cash in your pocket or even writing a cheque and subsequently balancing your cheque book have now all but disappeared. Today, contactless payments using chipped cards, smartphones or connected watches are not just a possibility but they’ve become the default payment methods for a majority of Australian consumers.Initially accelerated by online purchases and its obvious inability to facilitate a physical exchange of funds, the in-store mechanisms have also kept pace by giving speedy abilities to electronically complete transactions. It seems that this was steadily being driven by customers acceptance but also increasingly by their desire for this form of digitally transacting. Then we had the coronavirus outbreak, which forced many people to shelter in place and highlighted any physical contact in everyday life. Contactless payments have now become a selling point and something that if not mandated is at least what customers expect.

Each piece of the payment flow has seen innovation and technology changes to continually evolve the entire experience. The big tech companies have sought to ensure that their devices are invaluable to that experience and have dragged the large financial institutions along whether they were willing or not. This has been seen by the seemingly reluctant acceptance by the banks of Apple and Google pay. The fintechs are constantly searching for disruption as well, with the most success possibly coming from a new line of credit product commonly referred to as ‘buy now pay later’.

Death of Cash?

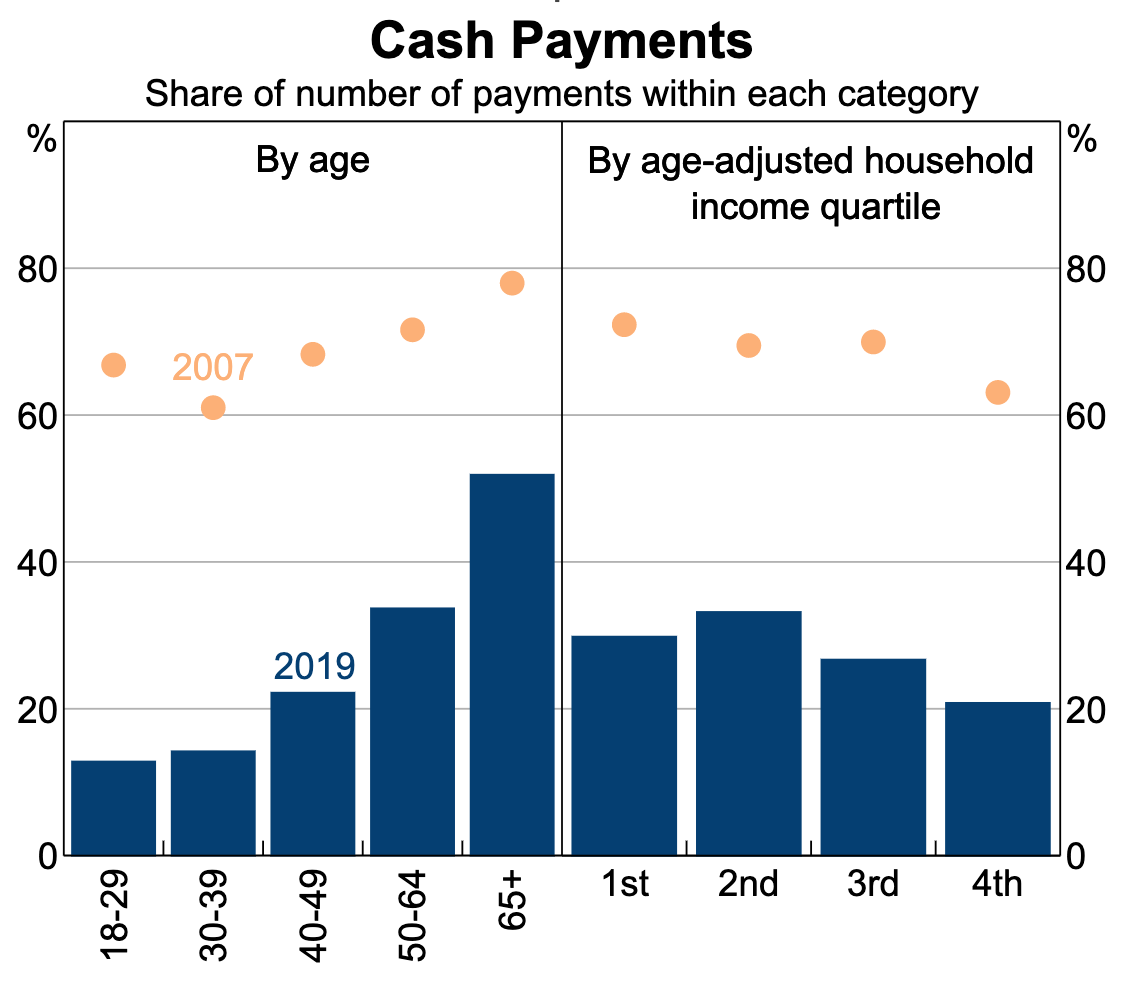

It is difficult to imagine that only a little more than a decade ago in 2007, 70% of all in-person payments were made by cash (Fig. 1). Today, cash payments have fallen dramatically to 27% according to a study by the Reserve Bank of Australia (Fig. 1). However, this study was done a few months prior to the COVID-19 outbreak, meaning this number is likely to have dropped even further. Today, in person cash payments have largely been replaced by digital payments. Similar to a smartphone, which has completely changed our lives forever, it is now difficult to imagine a life without digital payments.

Figure 1. Cash payments: How cash usage has decreased as a percentage from 2007 to 2019 (RBA)

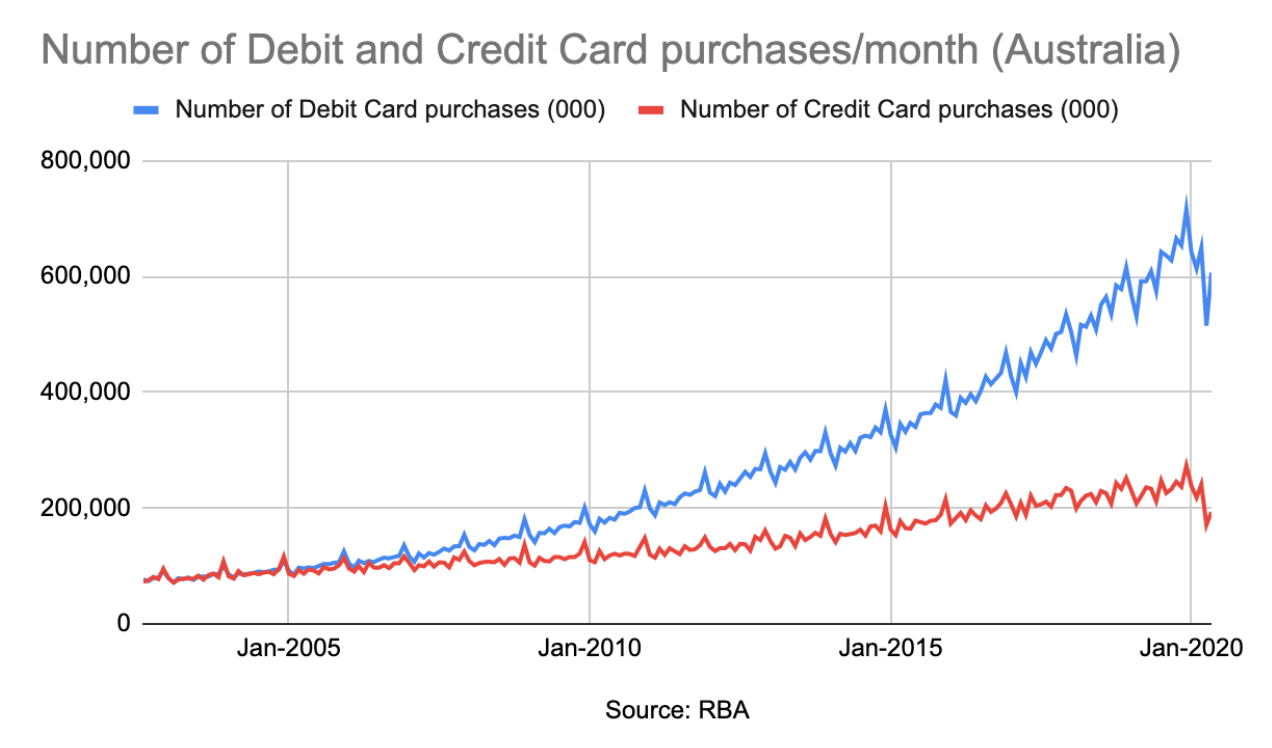

With more online and physical stores wanting an alternative to cash, digital payments are becoming popular. Merchants favour digital transactions over cash because of cost, fraud and security concerns while consumers favour paying by digital means because of convenience and ease. In addition, consumers are moving away from cash because of the attractive incentives and rewards offered by major credit card companies (VISA, Mastercard, American Express) together with the banks, while also providing consumers with access to a line of credit. In Australia, the number of credit and debit card purchases have increased year-on-year over the last decade (Fig. 2).

Figure 2. Number of debit and credit cards purchases per month in Australia (RBA)

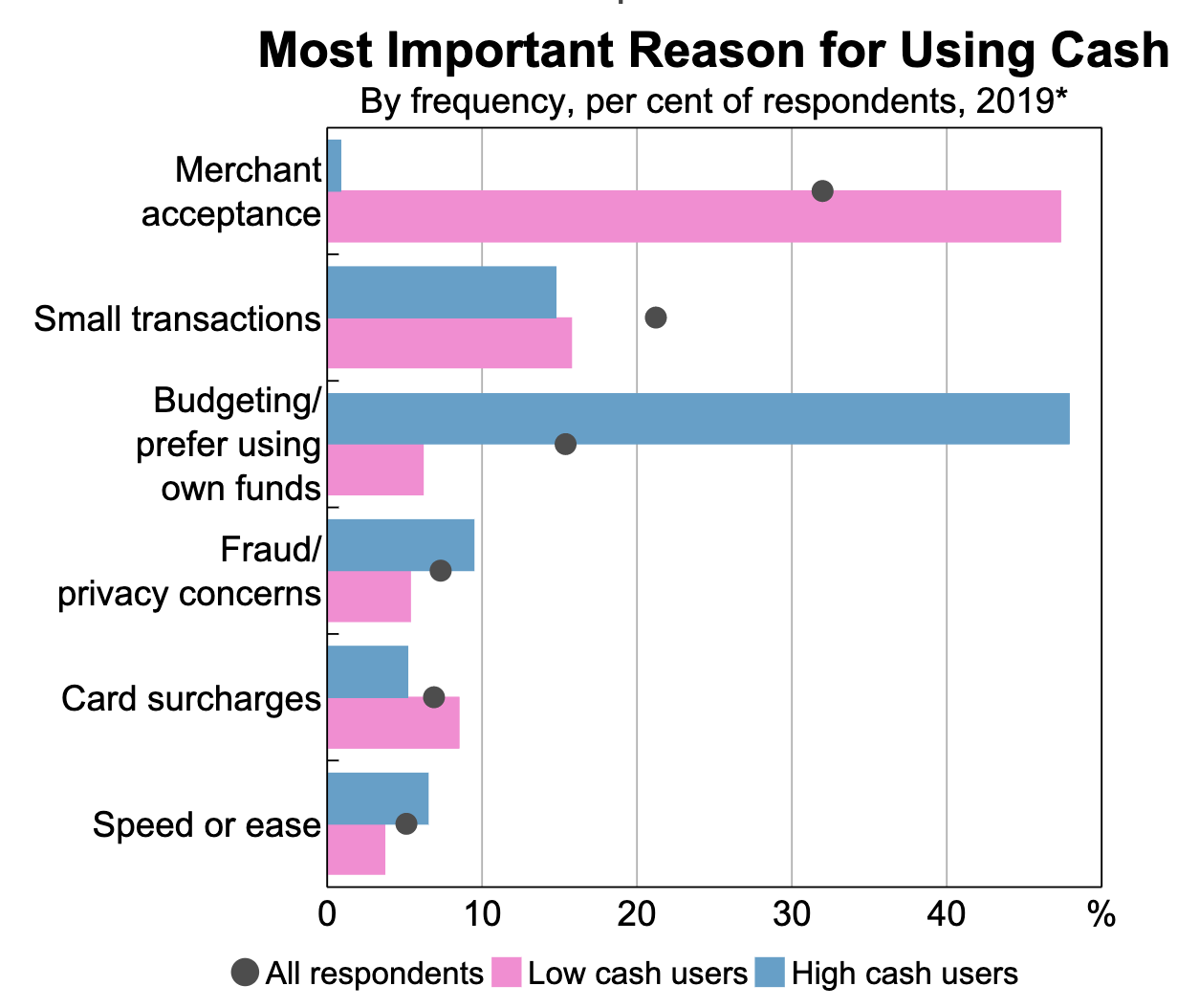

However, cash is not dead (just yet). First of all, socio-demographic factors seem to be a strong indicator of cash usage. People in older age brackets (50 to 65+ years old) continue to use cash, which is likely due to ingrained old habits and difficulty adopting new technologies (Fig. 1). Also, lower income quartiles (1st and 2nd) use cash more than higher income quartiles (3rd and 4th), but even those in the lower income quartiles dropped cash usage from well over 70% in 2007 to 35% today (Fig. 1). Another reason why cash is still in use is because of merchants who do not offer a card payment option (e.g. cash only businesses). Almost 50% of low cash users cite this as the reason they still use cash (Fig. 3). Another reason why cash is still in use is the cost of using credit cards. Credit card surcharge fees are common and the fees can range from 1% all the way up to 3%.

Figure 3. Most important reasons for using cash (RBA)

Despite these reasons, there is a significant downward pressure on cash usage which is likely to continue. The current health crisis has stimulated older age groups to adopt digital payments and more merchants and trades people are accepting electronic payments.

What drives the cost of payments?

The marginal cost to process a digital payment is trending towards a dollar figure that is very low. When compared to processing cash and cheques (e.g. handling, transporting, data-entry, OCR and bouncing cheques), digital payments are a much cheaper alternative. At the same time, however, there are factors that drive up the cost of digital payments.

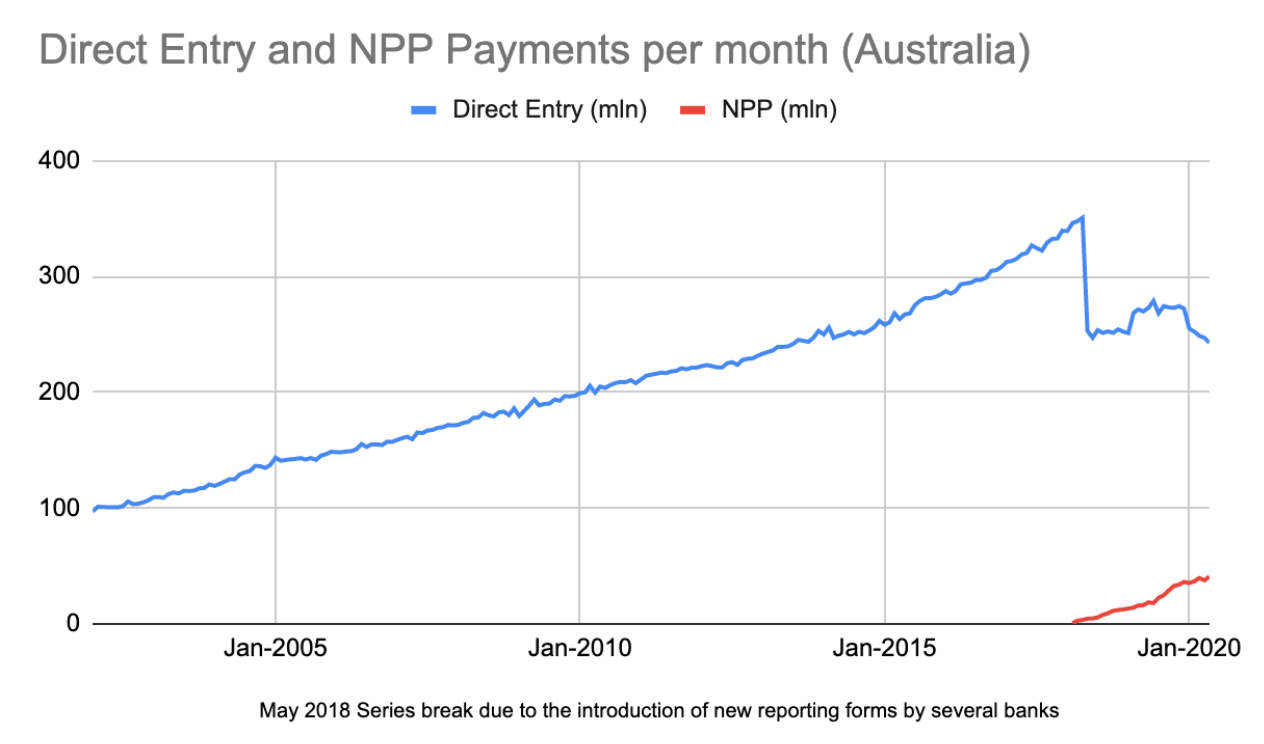

First is the compliance-related costs in the payments value chain. Transaction monitoring systems to prevent and deter financial crime (e.g. money laundering, terrorist financing and tax evasion) is costly, for the banks in particular. Also, developing and implementing a new payment system like the New Payments Platform (NPP) requires a significant initial investment. In Australia, the NPP was introduced less than 2 years ago and is making inroads. NPP transaction volumes are increasing quickly (Fig. 4) and Pay-ID (an overlay service) already has more than 5 million users. In the past, Australia has been an early adopter of new payment methods, especially contactless payments which were adopted more quickly than many other developed countries. This shows that as long as there is real customer value in terms of speed, security or convenience, we can expect high penetration and acceptance of the services offered in Australia.

Figure 4. Direct entry and NPP payments per month in Australia (RBA)

Revenue from payment processing is under pressure because of regulatory intervention by the RBA in the form of mandating lowering interchange fees and pushing for least-cost routing options for merchants. Despite this, new entrants in the payments arena have found ways to generate additional income from payments, which as a consequence have driven up merchant costs. Buy Now Pay Later (BNPL) companies are charging merchants a lot more for accepting a BNPL payment than a debit or credit card payment. Similar to BNPL, PayPal also charges hefty fees to online merchants for accepting their payment method.

On the one hand, we have a push for more cost-effective payments, but on the other hand, we see increased pricing for payments. The reason why the latter is happening is also related to consumer’s demand for convenience and security. Fintechs have responded to these needs while the banks might have been asleep behind the wheel. Newcomers in the market have provided added value by making purchase easier, increasing security and/or smoothening the payments of the purchase.

For example, PayPal understood 20 years ago that in an online environment, shoppers were not always comfortable to leave their credit card details behind with the online merchants (in fear of fraud and identity theft) or reveal banking account details for in person payments. Also having to repeatedly type in card credentials and shipping information wasn’t everybody’s favorite thing to do either. Merchant acceptance of PayPal payments comes at a cost for the merchant since PayPal fees are higher than payments made directly via a card, but not having PayPal’s convenient check-out process also deters customers from the merchant in the first place. Similarly, digital wallets, like Apple Pay and Google Pay, have leveraged this removal of payment friction by having simple, easily accessible mechanisms for card payments.

The Buy Now Pay Later products are also relatively expensive for merchants, but there are other compelling reasons forcing the merchant to accept the higher cost. BNPL companies have centred a line of credit around the customer and the purchase. They have also removed some of the tainted credit card jargon that has lost favour. They no longer talk about a ‘credit product’ as that has developed a stigma. Buy Now Pay Later is much more a description of the purchasing experience and carries with it a notion of empowering the customer rather than indebting them. For those reasons, many customers favour the BNPL product. So again, by not offering a BNPL check-out option, merchants might miss an opportunity to sell.

Future Consolidation

The number of players in the payments value chain has increased and is looking to further grow in the future. These new players have filled the voids the incumbents left open, redesigning processes that have the customer in mind (convenience, speed and security), basically taking away friction.

There are still opportunities to improve the customer experience further. For instance, the way we pay bills or initiate a payment when you are at the receiving end of the transaction. Think of Uber where after initial set-up, payments are happening in the background every time the service is used. Uber connects the trip data gathered via their app and initiates the payments automatically immediately when the customer leaves the car. This incidental payment will become more prevalent as interfaces to the payments companies are exposed. Removing the friction of having to explicitly perform a payment will become a crucial value add for the overall transaction experience.

We expect some of the payment methods will disappear altogether. Cheque usage is already at very low levels and could potentially, similar to other OECD countries, be decommissioned altogether. Longer term, NPP potentially could replace Direct Entry. There are also talks of BPAY, NPP and eftpos merging at some stage, combining an Australian payment entity that brings together strength, capability and investment might make sense to counter big tech and international schemes. It would make sense to investigate and strengthen the environment, simplify, eliminate cost and legacy, making sure that we are fit for purpose for the needs of consumers and businesses well into the future.

The different forms of unsecured credit will amalgamate, meaning features that are today quite dissimilar between credit cards and BNPL, for instance, will be moving towards each other. Some of Australia’s major banks (CBA and NAB) have responded already to BNPL products by introducing a crossover between something that looks like a credit card with BNPL features (no interest, pay back over time). In turn, BNPL will adopt further to an ‘open loop’ strategy where merchant contracts are not in place and the BNPL payment can be widely used. We have also seen ‘Frequent Flyers Rewards’ (and other loyalty programmes) that were traditionally tied to credit cards are now included in some of the Buy Now Pay later offers. New regulatory measures will also potentially bring certain features of credit cards and BNPL payment closer together. The RBA is reviewing, due next year, the payments regulation which investigates, for instance, if BNPL should still be able to prevent merchants from passing on the cost of their service.

Whatever the outcome is, the winners will have the customer in mind when designing the next product or new feature. True customer centricity (ease, speed, security) and providing better customer outcomes (less effort cost, not necessarily cheaper) are key. The days customers do not have any choice are over.

Conclusion

The disruption and further streamlining of the payments industry is still in its early stages. We have already seen great innovations by non-traditional payment players over the last decade, which have made payments easier, more secure and provided faster (real time) settlement. They have undeniably added value to the end-consumer and merchants. But there is still work to be done.

Organizations like Paypal, BNPL players, Apple and many more that ‘infiltrated’ the payments value chain have also proven that merchants and consumers are willing to pay a premium price. While bringing the cost down is on everyone’s agenda, creating added value and better customer experience becomes the focus over cost efficiency.

Australia’s payments ecosystem has gone through a significant transformation in recent years and is an ever-changing landscape. For whatever the future holds, one thing is certain: Australia’s payments landscape in the future will be vastly different from what it is today. The question is, how quickly will we get there and who will benefit from the innovations the most. Everyone is a participant in the payments landscape, and whether they like it or not, organizations will need to decide how active they want to be in shaping that landscape; know what part of the future vision they want to fulfil or whether to stand by and risk being left behind.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.

Related Blogs

-

Digital innovationWill credit cards become a thing of the past?Learn more

Digital innovationWill credit cards become a thing of the past?Learn more -

Digital innovationCollaborating for success: An effective approach for fintechs to partner with large institutionsLearn more

Digital innovationCollaborating for success: An effective approach for fintechs to partner with large institutionsLearn more -

Digital innovationDigital banking is now for everyone, how will you choose to compete?Learn more

Digital innovationDigital banking is now for everyone, how will you choose to compete?Learn more