The global financial system is on the cusp of a revolution, transitioning from a fragmented, traditional structure to an interconnected, efficient and user-centric ecosystem known as the "Finternet". This paradigm shift, conceptualized by figures like Agustín Carstens of the Bank for International Settlements (BIS) and Nandan Nilekani, aims to dismantle existing barriers in financial services, fostering universal access and participation, much like the internet transformed information exchange.

Finternet: A re-architecture of trust and value

The Finternet is envisioned as a network of interconnected financial ecosystems, placing individuals and businesses at the center of their financial activities. The analogy to the internet is particularly instructive: just as HTTP revolutionized information dissemination, tokenization and Finternet protocols are set to liberate financial value from silos, unleashing unprecedented innovation.

The current financial system, despite digital advancements, largely relies on outdated infrastructure. Cross-border payments remain slow and expensive, and financial complexity adds significant costs. The Finternet addresses these inefficiencies by fundamentally rethinking how financial services are structured and delivered.

Key concepts and guiding principles

The Finternet is not a single product but a fundamental protocol shift. Imagine global trade before shipping containers — fragmented, slow and costly. Tokenization acts as the "shipping container" for finance, standardizing how assets like money, invoices, bonds and even identity are packaged and moved. Unified ledgers serve as the "modern ports" — programmable platforms for storing, tracking and executing on these tokenized assets. Interledger protocols are the "shipping lanes," ensuring seamless movement of assets between different ledgers.

The Finternet operates on three guiding principles:

User-centricity: Shifting power from financial institutions to individuals and businesses, offering enhanced control, transparency and personalized services.

Unified: Creating an integrated digital finance ecosystem through unified ledgers and interledger protocols to overcome fragmentation and silos.

Universal: Fostering universal access and participation, particularly aiming to include unbanked and underbanked populations.

Regulation is embedded within these foundational blocks through:

Smart contracts. Self-executing agreements digitally encoded to automate transactions and workflows, enhancing efficiency and reducing reliance on intermediaries.

Verifiable Credentials (VCs): Secure digital attestations for identity and other proofs, streamlining processes like KYC/AML while enhancing user privacy.

Zero-Knowledge Proofs (ZKPs): Cryptographic methods allowing parties to prove a statement's truth without revealing underlying sensitive information, crucial for privacy-preserving compliance.

Technical architecture

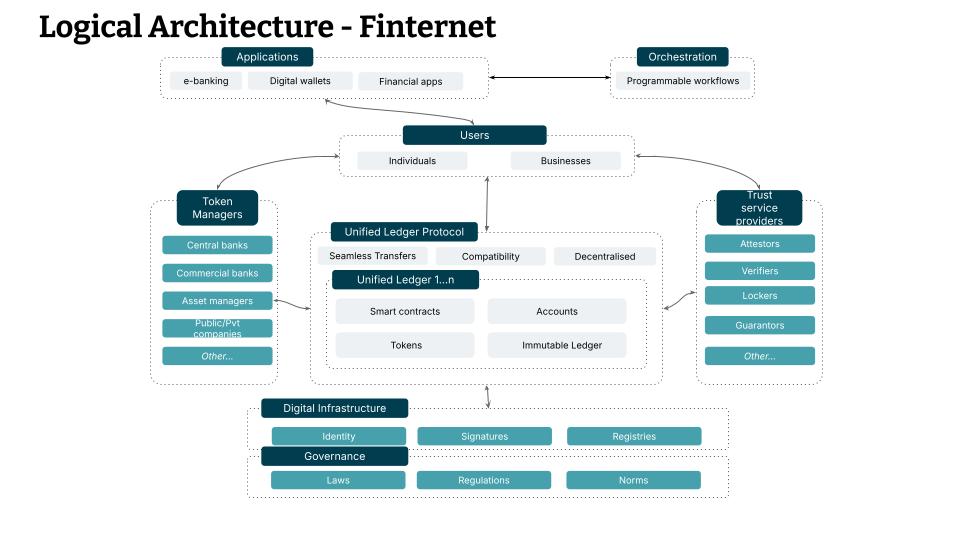

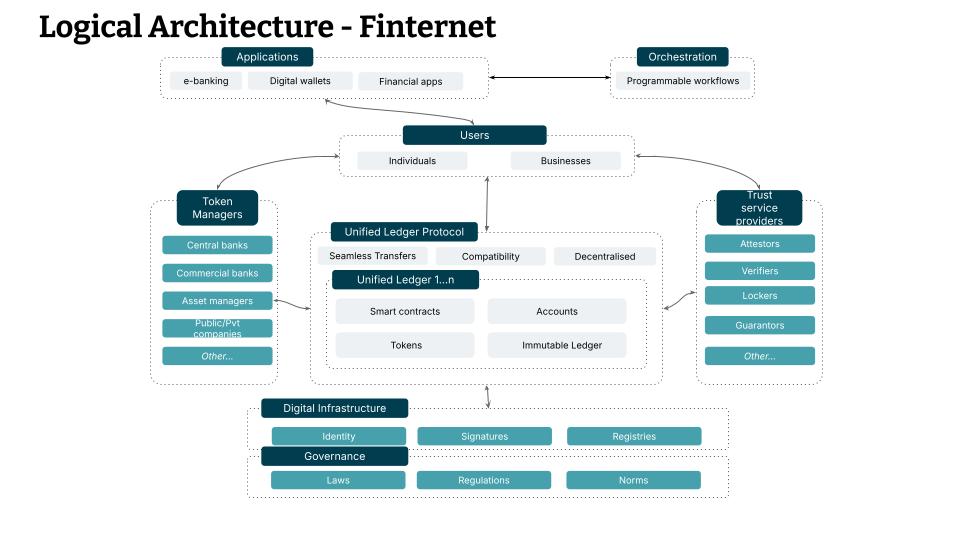

The Finternet is a vision for a future financial ecosystem built on a modular and interoperable architecture that would enable programmable finance across both public and private institutions. At its center is the Unified Ledger Protocol (UILP), a decentralized coordination layer that connects multiple tokenized ledgers, each capable of handling accounts, smart contracts and asset representations. This layer abstracts over underlying infrastructure, enabling value and state transfer between systems.

Surrounding the core ledger protocol are four primary actors:

Token managers (e.g., central/commercial banks, asset managers) that issue and maintain tokenized representations of value.

Trust service providers that enable verifiable credentials, attestations and contextual proofs.

Users (individuals and businesses) interacting with assets and workflows through wallets and apps.

Orchestrators that build programmable workflows across the system using smart contracts and composable logic.

Applications (e-banking, digital wallets, financial tools) operate at the edge of the stack, while governance and digital infrastructure (identity, signatures, registries) anchor the stack with compliance and authentication primitives.

This architecture supports:

Token composability via the descriptor layer.

Cross-ledger operability via UILP (Unified Inter Ledger Protocol)

User-centric auth models including custom chains and revocable credentials.

Trust as a service layer, separating verification logic from transaction execution.

By decoupling trust, control and execution, the Finternet stack is slated to enable scalable, policy-compliant automation across diverse financial environments, without central points of failure or lock-in.

This diagram outlines the core logical components and their interactions:

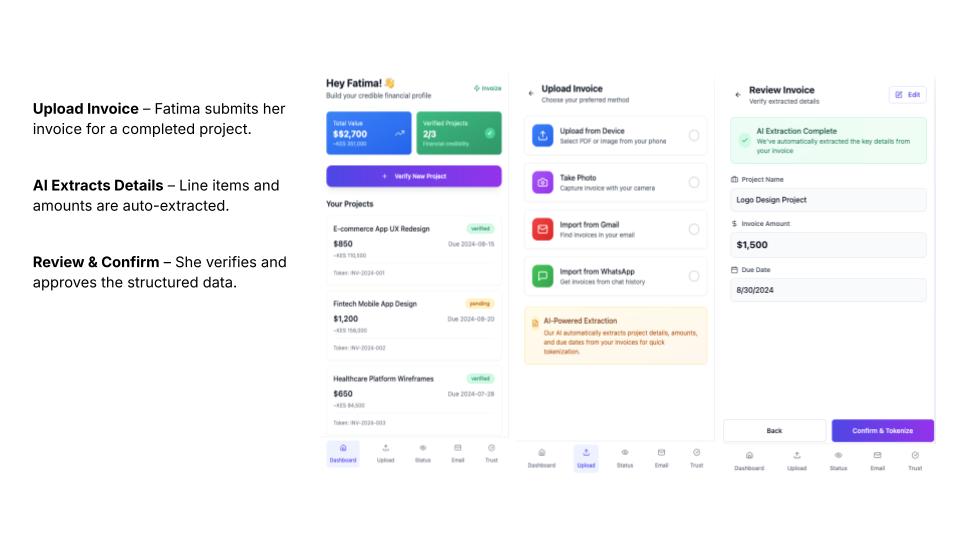

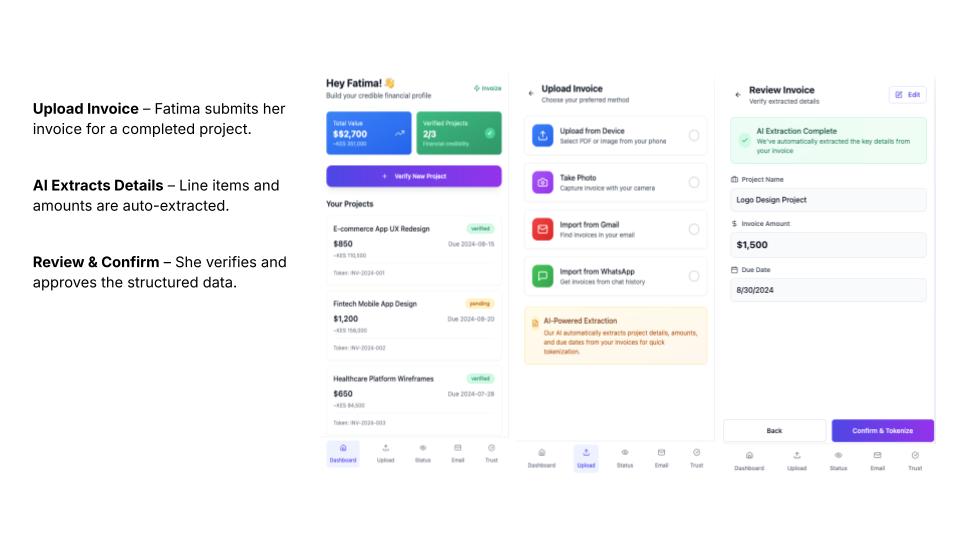

The human impact: A trust network for all

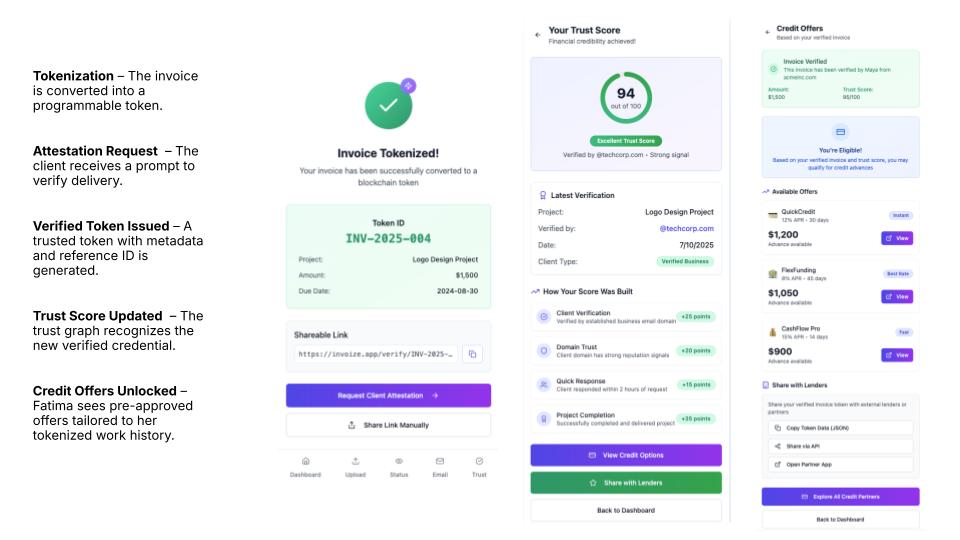

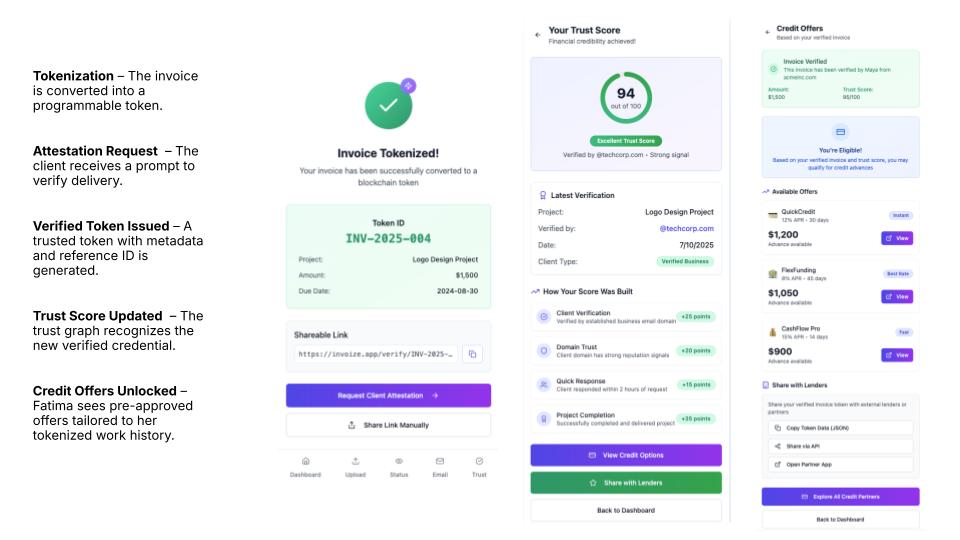

Consider Fatima Njeri, a 28-year-old freelance designer in Nairobi. Despite steady income from global clients, her traditional bank struggles to recognize her financial credibility due to having an unverifiable income. This is a common plight for over 435 million people in the global gig economy who are excluded from essential financial services.

The Finternet changes this. When Fatima finishes a project, her invoice is uploaded and key data is extracted and converted into a tokenized asset. This token includes proof of work and attestation requests. Once verified by her client, this token becomes a building block in her "trust graph", which is a growing, cross-platform profile of her verified work accessible to credit providers. This allows lenders to assess her creditworthiness based on verified tokens rather than traditional, often restrictive, banking criteria. Fatima's story exemplifies how the Finternet can provide dignity, access and economic agency to those currently underserved.

Central Bank digital currencies stablecoins and agentic AI payments

To build a truly programmable financial infrastructure, you need programmable money. That’s exactly what central bank digital currencies (CBDCs), stablecoins and AI‑native payment rails such as Mastercard’s Agent Pay, Visa’s Intelligent Commerce and Coinbase’s x402 hope to deliver.

CBDCs and stablecoins: Dual rails of trust and speed

CBDCs are digital forms of sovereign money issued by central banks. Over 90% of central banks are exploring or piloting them to drive financial inclusion, improve domestic payments and maintain monetary sovereignty.

Stablecoins such as Tether (USDT) and USD Coin (USDC) are privately issued tokens pegged to fiat. With a market cap of over $227 billion and facilitating $27.6 trillion in transfers in 2024 (larger than Visa and Mastercard), they support cross-border payments, remittances, DeFi and business cash management.

CBDCs offer trusted public money while stablecoins deliver market-based liquidity and composability. Both are essential in a programmable future because they form a hybrid rail system.

Agentic payments: Money that thinks

Beyond storing value, programmable money must move autonomously. That’s where agentic payment rails enter:

Mastercard Agent Pay: enables AI agents to make purchases on users’ behalf, through tokenized credentials and pre-authorized spending rules

Visa Intelligent Commerce: Opens Visa’s payment network to AI agents via tokenized AI-ready credentials, filters, fraud controls and user-defined spending limits. This is built with partners like OpenAI, Anthropic and Stripe

Coinbase x402 Protocol: A public HTTP‑based standard that allows apps and AI agents to pay with stablecoins in real time, thus turning API access into direct programmable commerce.

These systems aren’t prototypes sitting in some innovation lab. They’re already live, already moving money. Whether it's an AI agent settling a subscription in the background or a chatbot handling a transaction mid-conversation, we're watching payments become autonomous, context-aware and instant.

And this shift isn't just about launching new tokens or wrapping APIs onto old rails. It's something deeper: the emergence of a true money layer for the internet, where assets are not only digital but intelligent.

CBDCs bring the weight of institutional trust. Stablecoins add fluidity, making value borderless and programmable. And rails like Agent Pay, Intelligent Commerce and x402 turn that digital money into action, connecting people, platforms and machines in ways the old system simply couldn’t.

Strategic shifts and actionable steps for financial leaders

The Finternet has the potential to touch every layer of the financial ecosystem. And, like any deep infrastructure shift, it doesn’t land evenly. The opportunities, challenges and responsibilities look very different depending on where you are placed.

For consumers, it promises more control, lower costs and broader access. However, it may also demand greater digital literacy and trust in new systems. For banks and fintechs, this is an opportunity to reinvent themselves as programmable nodes in a network of value. Governments and regulators must now think not only in terms of oversight, but also infrastructure design and embedding public policy directly into financial protocols.

And at the heart of it all, there’s a new question every stakeholder must ask:

Am I prepared to plug into a network where trust, value and identity are portable, programmable and global?

The table below outlines how Finternet adoption is likely to impact each major stakeholder group and strategic pivots required to move forward.

| Stakeholder | Key benefits | Key challenges | Strategic responses |

| Consumers |

|

|

|

| Businesses (SMEs & Large) |

|

|

|

| Traditional FIs |

|

|

|

| Fintech Companies |

|

|

|

| Central Banks |

|

|

|

| Regulators |

|

|

|

| Governments |

|

|

|

The Finternet marks more than a technological evolution; it’s a foundational shift in how we design, distribute, and trust financial systems. It challenges legacy models and places individuals at the center of value creation. At Thoughtworks, we've seen firsthand how inclusive, programmable infrastructure can reshape societies. The future of finance isn't just interoperable, it's intentional.

The Finternet marks more than a technological evolution; it’s a foundational shift in how we design, distribute, and trust financial systems. It challenges legacy models and places individuals at the center of value creation. At Thoughtworks, we've seen firsthand how inclusive, programmable infrastructure can reshape societies. The future of finance isn't just interoperable, it's intentional.

Are you Finternet ready?

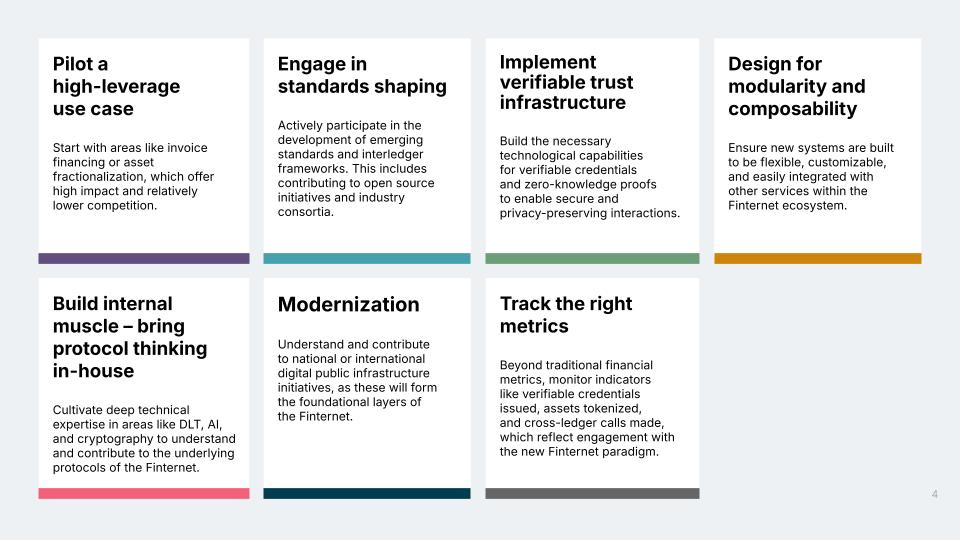

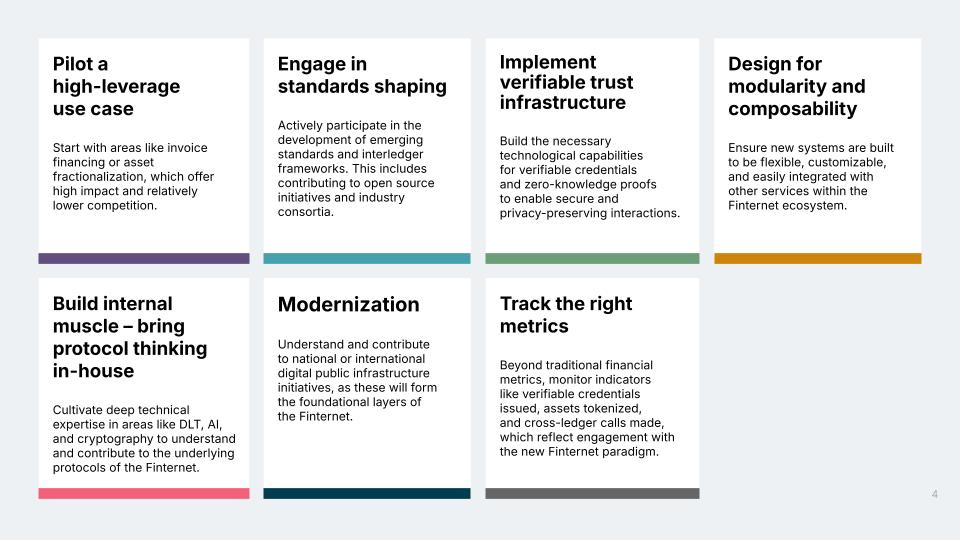

Working with financial leaders navigating this transition, we have realised that this isn’t just a tech roadmap, it’s a mindset shift.

The Finternet challenges long-held assumptions about control, value, and trust. It rewards those who start early, prototype boldly, and lean into interoperability rather than waiting for clarity. This checklist captures the patterns we see among organizations that are truly preparing for what’s next.

Conclusion: This isn't an upgrade. It's a re-architecture.

Every generation rewires something fundamental.

The last one rewired how we communicate. The one before that, how we compute. This one is now rewiring how we trust, transact and build financial relationships from the ground up.

At Thoughtworks, we’ve been at the frontlines of this kind of transformation. From Aadhaar to UPI, from MOSIP and Bahmni, we’ve helped shape systems that serve millions through scale, inclusion and intent. That experience puts us in a unique position to support forward-looking institutions ready to engage with the next great shift in financial infrastructure. If the Finternet is the new ground floor, we’re here to help you build on it.