Partners with Amazon Web Services, Adatree, Mambu and Zepto

to deliver Product in record time

Thoughtworks (NASDAQ: TWKS), a global technology consultancy that integrates strategy, design and engineering to drive digital innovation, has built a new personal loan product for banks and other lending institutions in just eight weeks.

Thanks to the growth of the Fintech ecosystem, businesses can now leverage cloud-based capabilities to rapidly create innovative products. Thoughtworks took advantage of these capabilities to manage, define and deliver this solution along with partners, Amazon Web Services, Mambu, Zepto and Adatree.

This modern approach to rapid delivery can put an end to multi-year big budget efforts to launch a new product, and sets the scene for rapid product innovation and faster time to value.

More than a proof of concept (POC) this is a market ready solution that an organization with an Australian Credit Licence (ACL) could use to provide personal loans from day one. The solution is currently available for Australian financial institutions but there is a potential to scale it to other regions in the future.

The initial scope delivered included:

Money available immediately (disbursed to a nominated account)

Responsive web-based user interface requiring minimal data entry

Minimal credit decisioning for rapid turnaround

Loans for fixed amount ($1,000) and fixed term (12 months)

Restricted customer segment (over 18 years old, Australian bank account holder)

The scope was intentionally constrained, but with the use of modern software engineering practices additional features can be added in rapid iterations based on customer feedback and business priority.

“We are honored that we get to work alongside these inspiring brands to demonstrate the power of using the fintech ecosystem to bring innovative solutions to market in record time,” said Manu Iyer, Director, BFSI & Fintech at Thoughtworks Australia and New Zealand.

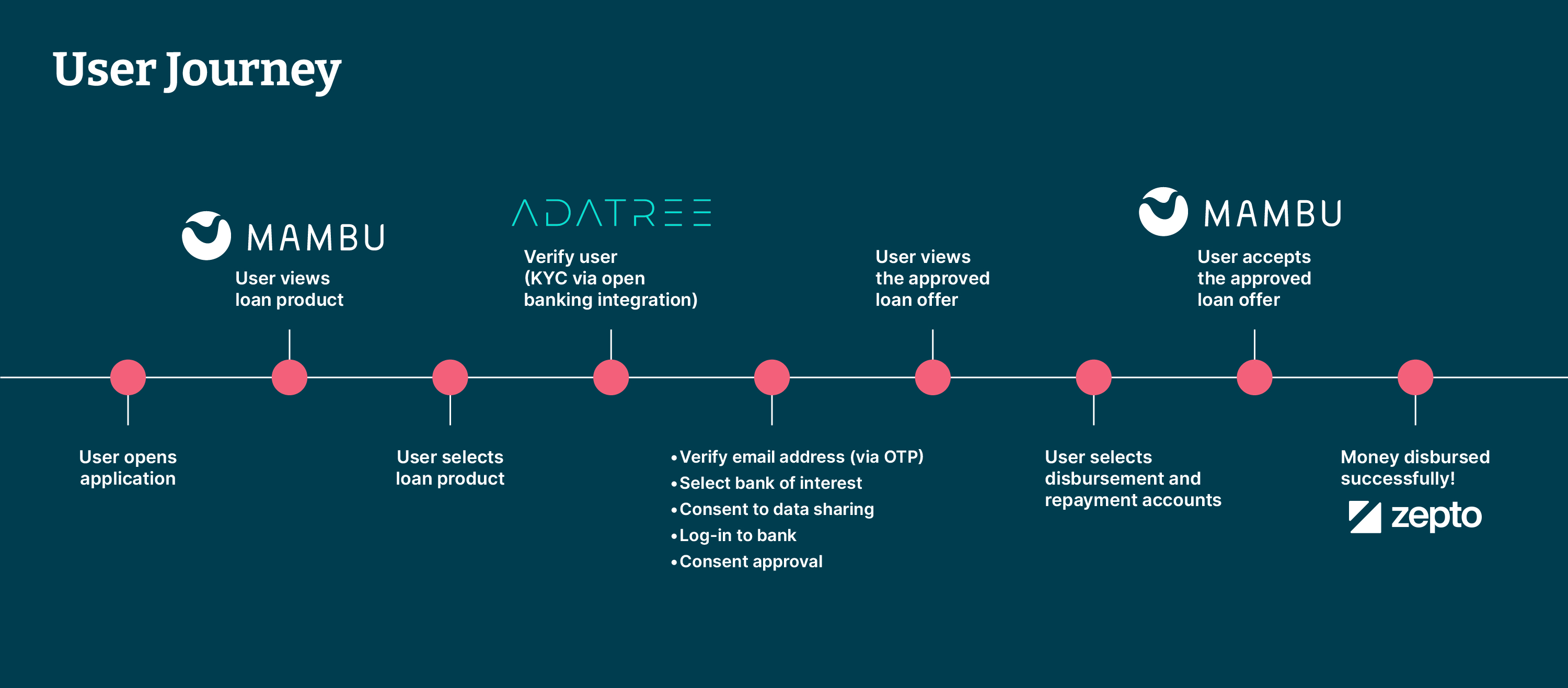

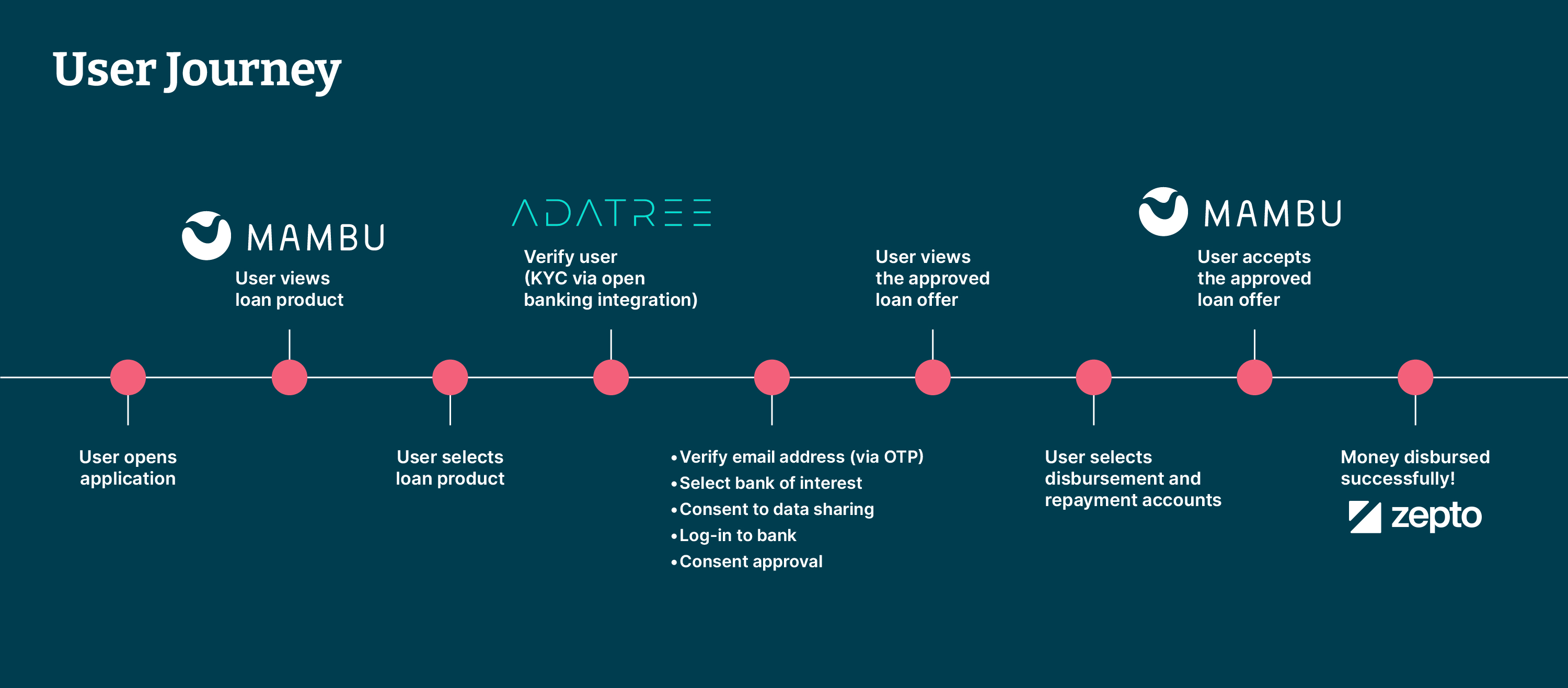

The supported user journey of the first release runs from applying for a loan to successful disbursement as illustrated below:

By leaning heavily on cloud-native service providers of Fintech solutions, Thoughtworks was able to get to a market-ready solution in such a short period of time:

Adatree verifies user suitability for a loan in real-time via their open-banking integration. Timeframes were accelerated by leveraging on the packaged Consumer Data Right (CDR) experience that Adatree offers.

Amazon Web Services enables the product to deploy quickly on a secure, resilient and observable platform, it also simplified the deployment of a set of distributed components.

Mambu delivers out of the box product definition and loan servicing and management capability.

Zepto delivers real-time disbursement capabilities with minimal development required. It allowed utilization of the new payments platform through some simple and lightweight API invocations.

- ### -

Thoughtworks is a global technology consultancy that integrates strategy, design and engineering to drive digital innovation. We are over 11,500 Thoughtworkers strong across 51 offices in 18 countries. For 30 years, we’ve delivered extraordinary impact together with our clients by helping them solve complex business problems with technology as the differentiator.