Digital banking is now for everyone, how will you choose to compete?

However not all banks have kept pace with the increasing move to digital over the last thirty years. Some digitised without becoming digital, while others spent millions on apps that failed to engage their customers with distinction, settling for unsustainable offers. Delivering differentiated, digitally enabled service experiences is the key, wherever customers want to do their banking.

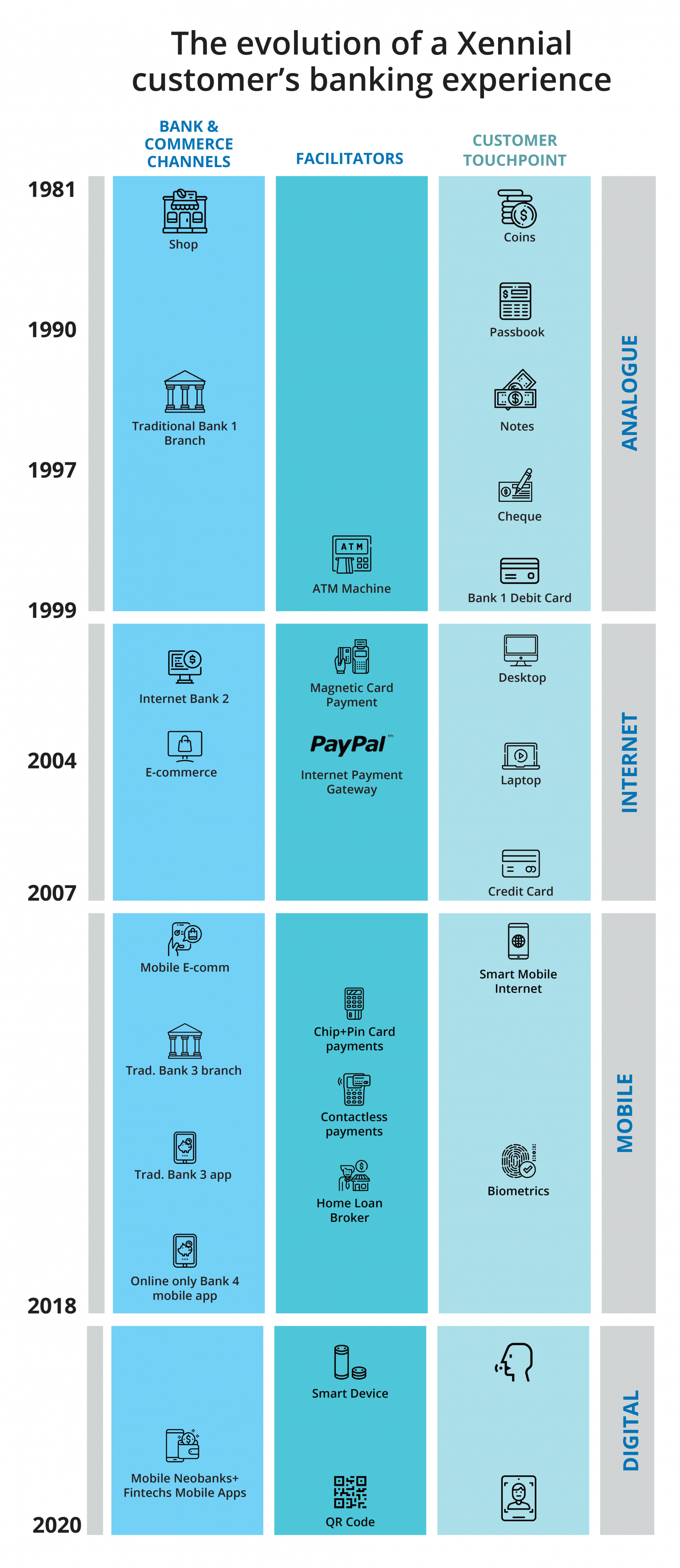

One generation’s evolution from analogue to digital banking

Before diving into digital banking, I think it’s worth taking a quick tour of my Xennial banking life as the transition from analogue to digital happened.

In 1990, at age 9, I opened my first savings account at the local village branch. Every week I would pay in half my pocket money, and with some early gamification, receive a satisfying stamp from a teller in my passbook. Three years later, with my first cheque book, I took great delight in laboriously writing out amounts like “twenty-eight pounds and fifty-five pence” and signed to pay for the occasional school trip.

Towards the end of the nineties, with the advent of the internet, the gradual shift towards digital meant I had fewer reasons to visit a physical branch. By then, I was receiving direct payment into my account from my weekend job, and using my debit card to withdraw money from the ATM. I even managed my university student loan on a desktop computer with a new online bank that had no branches. By 2006, at age 25, I decided to quit my job in London and travel the world for a year. With internet banking, a backup credit card and PayPal, I took care of nearly all of my finances online.

In 2007, the promise of mobile internet became a reality with my first iPhone. When I moved to Australia with my wife in 2012, I had not stepped in a bank for 14 years. The Australian bank we opened an account with offered a mobile app (ahead of its time compared to most UK banks), and soon I no longer needed the laptop either to do my banking.

By 2016, age 35 at another lifestage, we switched to an online only bank to get a home loan, negotiated by a broker. The print your own pdf paperwork and identity verification at the post office was a bit inconvenient, but the intuitively designed mobile app was much faster.

Which finally brings me to the digital era of 2020, age 39 where I now have 18 banks and fintechs on my mobile I can sign up with in under 5 minutes and immediately assess their capabilities. Although an extreme case, given my career, the gradual stepping stones from analogue, internet, mobile to digital banking I experienced, although still available, are now irrelevant to subsequent generations.

Digital’s global tipping point

Looking to the future, by the time my first child is age 9 in 2030 they will almost certainly not bank in the way I do now. Their experience will be digital-first, demanding even faster, more intuitive, convenient, personalised, transparent and almost invisible financial services. They will have no tolerance for generic comparison rates, incomprehensible legalese, system downtime, awkward third party handoffs or sudden unknown changes to their credit access. If they do, they will switch instantly, or their personal A.I. assistant will have done it before they even notice.

This digital-first future could have perhaps been delayed a little longer, but then the COVID-19 crisis has accelerated and amplified trends that were perhaps previously less important to older generations.1 In 2020, traditional banks who rely on their heritage, branch footprint and customer inertia for ongoing engagement will be left reeling from a world where everyone is looking to get their banking done efficiently from the safety of their home.

Of course many banks have long invested in “going digital”, introducing websites and mobile apps, but these are often facades. Wallpaper over the cracks of disjointed processes and paper forms, aided by the manual putty of call centre and branch staff who battle with legacy backend systems. Anyone who has ever had to deal with a traditional bank’s bureaucracy after a family death suddenly becomes very aware of the cracks, as I did after my stepfather died. I supported my mother through the branch visits, delays and forms in triplicate to close his account and migrate funds.

The rise of the neobanks

In the last 2 years we’ve seen the emergence of neobanks that take full advantage of digital capabilities. Harnessing mobile-first channels and API-enabled platform services to generate social engagement, rapidly onboard with eKYC (electronic Know Your Customer), instantly provision digital cards and deliver automated insight and support to their customers. Although the neos targeted digitally native millennial and Gen-Z segments, their low cost of service has allowed them to compete on interest rates, attracting older early adopters looking for a place to grow their retirement savings.

Although the COVID-19 crisis has created a more difficult environment for neos,2 with venture capitalists wanting to see returns sooner on their investments, the momentum it has created for engaging with digital services will expand the market for digital banking. Traditional banks who don’t accelerate becoming a modern digital business will see the increasing erosion of their market share. First gradually, with high value, low risk customers cherry-picked by neos and fintechs, then suddenly, with whole segments who migrate once confidence is established and the digital players expand their propositions to mass markets.

Differentiation is the key to survival

There have been attempts for traditional banks to break free from their analogue worlds and colonise new digital planets. In 2019, the USA JPMorgan Chase’s neobank Finn, and in 2020, the UK Royal Bank of Scotland’s neobank Bó both failed to establish themselves, despite massive investment.3 Internal politics and competing technical platforms have been cited as potential root causes but these challenges are insignificant compared to the lack of any desirable, differentiated value proposition for customers. Without one, existing customers of the parent bank had no reason to try them, and were most likely internally discouraged to avoid cannibalisation. Potential new customers in underserved segments had no reason to select them. On the other hand, the established neos had unique propositions developed in collaboration with their customers, building trust and engagement, and scaling growth organically.

Without a deliberate strategy around differentiation, it is not only traditional banks who will continue to fail at digital, but so will the explosion of independent neos and fintechs. When unattainable feature parity with competitors drives product roadmaps and turns product teams into ‘feature factories’, customers fail to see any 10X factor needed to tip them into using something new. Even the successful European neobank N26 struggled without differentiation amongst Monzo, Revolut and Starling in the UK, pulling out to instead focus on the USA.4

The era of introductory offers is over, bring on service experience

If digital banks choose to rely on cost and rate leadership with unsustainable offers, it will inevitably lead to customer backlash and brand damage. There needs to be more than the best rate, lowest fees, incentive payments or even free. They won't stop customers from switching to the next best offer, and even faster with the advent of open banking. Customer loyalty cannot be bought, it needs to be earned, and differentiating on price is a race to the bottom. It is easier to lead with price to make a splash, but the waves rapidly dissipate as we have seen with Australia’s neobanks’ high savings rates.5 Any difference soon becomes the default across the board only to recede, leaving account usage concessions that sacrifice ongoing engagement.

Delivering great service experience is where all banks need to play. For many years it is what the financial services sector has forgotten. Financial “products” meant the service experience ended with the sale of a loan, or the signup for a credit card. The ongoing customer use and support of the product was a cost centre to outsource and minimise. It’s in the service experience where the most successful digital banks will create brand loyalty and customer stickiness, deepening their relationship with every interaction and able to scale that engagement. They will reimagine the end-to-end service, from fun and informative product information, to personalised products and pricing.

Underpinning this, the employee digital experience is key, providing colleagues the opportunity to do more meaningful work to proactively engage, serve and support customers, with the right data and interaction channel at the right time. Pensionbee, the UK pension fintech, exemplifies great service experience. Its digital web and app channels streamline the usually painful process to consolidate pensions, supported by their dedicated “beekeepers”, who provide intelligent chat support to address any concerns.

Responding to the next challenge

The ability for a digital bank to continue to evolve and adapt to changing customer needs, and business and technology opportunities is imperative to face the next challenge after COVID-19. In the following articles we’ll explore how digital fluency and evolutionary architecture can enable banks to best set themselves up to respond.

1. See e.g., https://www.nielsen.com/eu/en/insights/article/2020/covid-19-the-unexpected-catalyst-for-tech-adoption/

2. See e.g., https://www.linkedin.com/pulse/neobanks-cant-fight-covid-19-flight-quality-richard-turrin/

3. See e.g., https://www.forbes.com/sites/ronshevlin/2019/06/06/why-did-chase-shut-down-finn/#5c4116d702b4 ; https://sifted.eu/articles/rbs-bo-close-decline/

4. See e.g., https://sifted.eu/articles/n26-brexit-uk/

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.