The clock is ticking for Europe’s financial institutions to implement profound changes to the securities settlement timeline — from T+2 to T+1. If that sounds like a simple change, the reality is anything but. Here we walk you through the risks and challenges, some recommendations to mitigate these risks and, finally, some of the key technical considerations that will enable you to manage the change effectively.

The European Securities and Markets Authority (ESMA) has set an October 11, 2027 deadline for Europe’s financial services markets to move to T+1 settlement. The UK and Switzerland have similar deadlines.

The intention of this proposed regulation is to:

reduce settlement and counterparty risk — with close to €50 billion of daily trades across the European region, the unsettled trades at the end of each day are a major source of risk.

make markets more efficient.

improve liquidity.

align with other regions of the world (the US recently moved to T+1; China, India and many other countries are already on T+1 settlement timeline).

But this is not going to be easy. Europe’s complexities with multiple countries, currencies and custodians make the whole exercise complex. The European region has 41 exchanges, 18 central counterparties (CCPs), 31 central securities depositories (CSDs) and 3 time zones. This would require comprehensive planning with multiple stakeholders across many countries, extensive technology upgrades, improvements to operational processes and significant adjustments to how things are currently done.

Some key challenges that make a move to T+1 for Europe so much more difficult include:

Market infrastructure silos. Euronext cites 18 different CSD relationships across Europe. Currently, the settlement of equity trades in Europe is fragmented across more than 30 different CSDs.

Currency barriers. Non-Euro settlements require additional liquidity management and ensuring that FX is available in time for the shortened settlement cycle.

Fails management. While there has been a decline in settlement failures across the EU, the CSDR penalty regime still sees millions of Euros in daily fines. This indicates continuing challenges in the settlement process.

Legacy systems and inconsistent automation in trade processing in both in-house technology and B2B confirmations and settlement services. Trade matching is a crucial area if T+1 is to succeed and its automation needs to be complete, efficient and robust.

Data standardization. Lack of unified standing settlement instructions(SSI) formats. SSIs, which relate to information that remains the same from one transaction to another, are another critical component of the post-trade lifecycle that requires further standardization and automation to avoid trade fails and facilitate accelerated settlement. Manual SSIs and the current absence of storing, and sharing of SSI data in a standard and automated fashion across the industry lead to inconsistencies, inaccuracies and incompleteness. This introduces risks and inefficiencies in the post-trade process and is often the primary reason for trade failures.

Lessons from US’s move to T+1

Europe can learn from the US - there are innumerable lessons from the US’s move to T+1 for Europe to see - impeccable planning, a strong focus on automation and technological upgrades, effective communication and client education, and the need to streamline upstream processes in the trade lifecycle. Not everything will apply to Europe but this gives great directions on how this significant change can be tackled to ensure a smooth transition.

Some key lessons from US’s move to T+1 in 2024

Early and comprehensive planning: Along with all key participants in the market is absolutely essential for success. US’s transition was strongly supported by the DTCC demonstrating the importance of working closely with the CSDs.

FX execution challenges: Aligning FX within the compressed timeframe is critical to avoid settlement failures; pre-funding or earlier execution may be required for cross-border transactions.

Standing settlement instructions (SSIs): Sending SSIs on T0 is crucial, a significant challenge with Europe's 31 CSDs.

Trade allocation and confirmation: Must occur on T0. The US showed that T0 allocation is possible. Automating these post-trade processes is vital to overcome the operational pressure experienced by firms relying on manual workflows in the US. Resolving clearing breaks by T+0 is paramount.

Technology upgrades: Many firms needed to upgrade legacy systems for faster processing and increased automation. Robust, integrated platforms, effective data management, and real-time information access are crucial.

Cross-border hurdles: Time zone differences, especially for Asia-Pacific firms, amplified FX complexities and potential funding costs. Alignment with T+2 markets caused mismatches. ADRs and dual-listed securities also presented unique challenges. International coordination and FX management strategies are vital for T+1 adoption.

Securities lending impact: T+1 compressed recall times for on-loan securities, increasing settlement failure risk. Adjusting operational practices, ensuring prompt collateral receipt, and enhancing communication are key for lenders and borrowers.

ETF processing: Potential disruption due to underlying securities settling on different cycles (T+1 and T+2).

Operations: the operational headcount at firms increased during the transition period with focus being on assisting trade processing and settlement - something Europe will have to prepare for.

Technical considerations for faster settlements

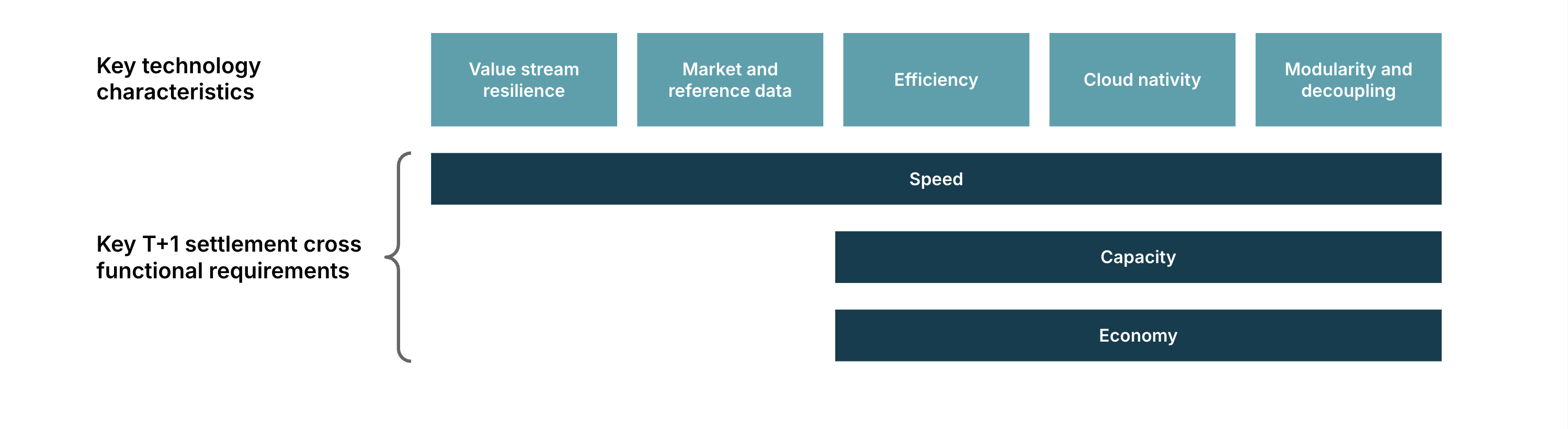

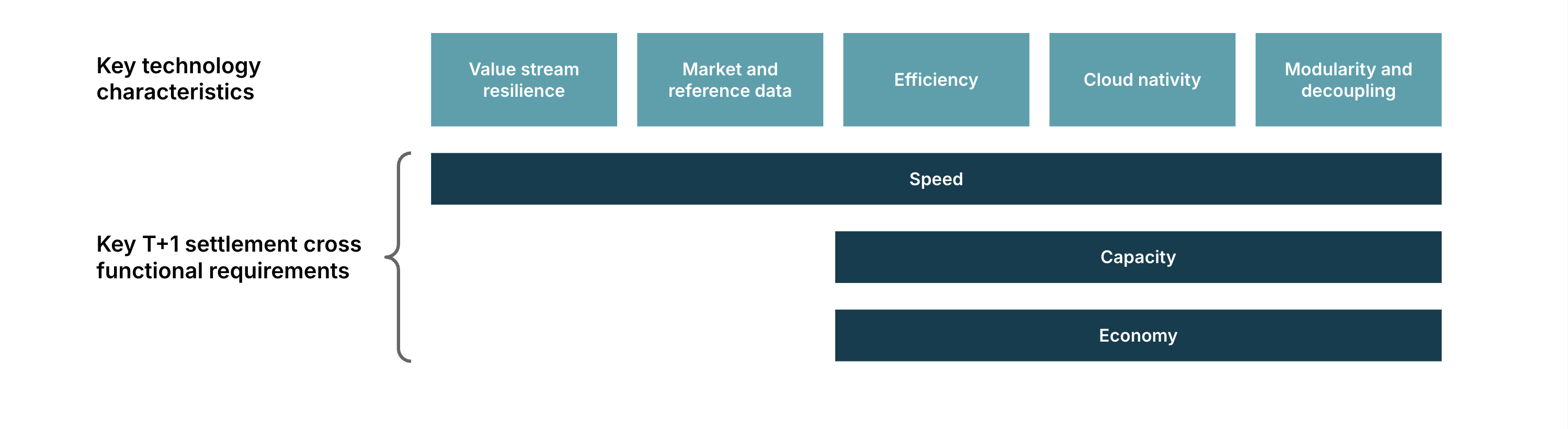

The key cross-functional considerations for faster settlements are speed of processing and scalable processing capacity. Both together lower response times while the latter helps scale the capacity economically as the transaction volumes vary during a working day.

This presents a key challenge for any party that still uses monolithic or tightly coupled systems on-premise in their data centers. Horizontal scaling on demand is both limited and costly, mainly because tightly coupled systems lead to high overprovisioning and expensive scale-out operations.

This means the following for the middle and back office technology:

Decouple systems and services so they may granularly scale horizontally with the varying transaction volumes.

Optimise for compute, storage and communication to achieve the speed of processing with efficiency.

Consider hosting on public cloud for on-demand capacity and storage to avoid costs associated with idle infrastructure.

Ensure the resilience of the processing value stream to minimise data and processing errors.

Ensure the timely availability of correct and complete market and reference data for necessary enrichments, including efficient and effective ways to normalise and validate different SSI formats.

Modularising and decoupling systems

Horizontally scaling monolithic or coarse grained services is expensive. Their scale out costs are higher because of the significant resource requirements for every instance. The entire monolith needs scaling out even if the bottleneck is because of the load on one specific capability.

Modularising a monolithic service into granular, domain aligned and decoupled services can significantly reduce the scale out costs. Here, only the services that experience a processing bottleneck need scaling, providing both capacity and performance. Because each of the modular services consume a fraction of resources the corresponding monolith would, scale out costs can be significantly lower.

Achieving performance through efficiency

Optimising computation, storage and communication helps achieve higher performance at reduced costs. This requires regularly profiling services to identify and remediate processing hotspots. Using data structures and messaging formats that optimise storage, retrieval and communication contribute to reducing latency and eliminate the need for expensive caches keeping the overall architecture simple. Optimised services have a reduced computational footprint which also reduces the scale out costs.

Public cloud hosting

The key benefit public cloud offers to T+1 processing is on-demand elastic capacity. On-premises infrastructure has physical limitations with firms having to over provision to meet the stringent requirements of T+1 processing. Also, the idle capacity during off-peak hours leads to wasted investment with additional overheads of maintenance and administration, especially to ensure ongoing compliance.

Hosting on a public cloud offers substantial benefits like substantial reduction in maintenance and administration overheads. With elastic scalability and consumption based charging, firms have a significant opportunity to reduce costs through optimised, modular and decoupled services that scale granularly.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.