Contextual banking implies understanding the variety of relationships, purposes and contexts that underpin transactions. It is what happens when a bank starts listening to its customer and pays attention to the details of their journey. In short, it explores the context of a transaction and factors this into its services and counsel. With contextual banking, a bank’s digital offering anticipates what the user is trying to achieve and directly upsells and cross-sells to them (thus, positively impacting the bank’s sales revenue).

In this sense, it has a data-driven vision, like in the case of Apple's virtual assistant Siri which uses historical transaction data and data analytics tools (read, AI and ML) to recommend customer specific solutions and advice. Also, contextual banking uses client data to refine how transaction banking services are provided. This could include anything from identifying account deficits and suggesting how to remedy them, to using artificial intelligence and data analytics to determine an optimal payment method, balancing speed, convenience, cost and risk.

Customer interaction

Information is valuable but cannot be used alone to make a decision without some kind of...

Analysis that represents the information in context and highlights where and what action is needed. This drives a...

Decision that is the 'right' one given the context. This can result in a...

Transaction at the click of a button producing the optimal result for the specific situation.

With Contextual banking, make smarter transactions and stay business aware.

The example below maps how contextual banking impacts customer experience:

Chris Fletcher | Male | 45 yrs

- native of London but lives in Melbourne

- corporate treasurer with a leading Australian Telecom firm

- job includes dealing with currency risk, creating critical hedging strategy, managing a global complex payroll and most importantly managing liquidity efficiently

Current context:

- high flier, loves his Apple iPad and Watch, sports fan, rises with the sun, knows the market like the back of his hand and has no time for fuss

- likes his coffee black with a side of The Financial Times

- likes the Nike adage; "just do it"

1

Chris connects to bank through corporate banking web channel. He checks existing cash position to quickly assess upcoming payments scenarios

Clicks cash flow forecasting tab to assess upcoming payments

In session hyper personalized homepage and listing page | contextual & engaging content

2

Chris discovers a critical invoice coming up for payment in the next two days

Accurate forecasting of future scenarios

3

The bank proactively determines (based on cash flow projections) that Chris won't have sufficient money to make the payment in two days

Proactive analysis of financial position

4

The app shows Chris a notification about the shortage of funds and provides him with two alternatives as the ‘Next Best Action’ - transfer available money to a different account or remind him to ask the bank to fund the account in the interim

Personalized messages with customized offer | cross selling products based on transactional behaviour | best offer on possible scenarios at the time of need

5

The bank alternatively offers Chris a ‘Next Best Offer’ – a temporary credit facility through short term supply chain financing options

Providing convenience to customers and increasing customer engagement

6

Chris discovers he is short on funds for his other accounts too and accepts the 'Next Best Offer' to avoid defaulting on his upcoming payment. Chris is extremely happy with his bank as it understands his needs

Customer satisfaction with contextualized product offerings

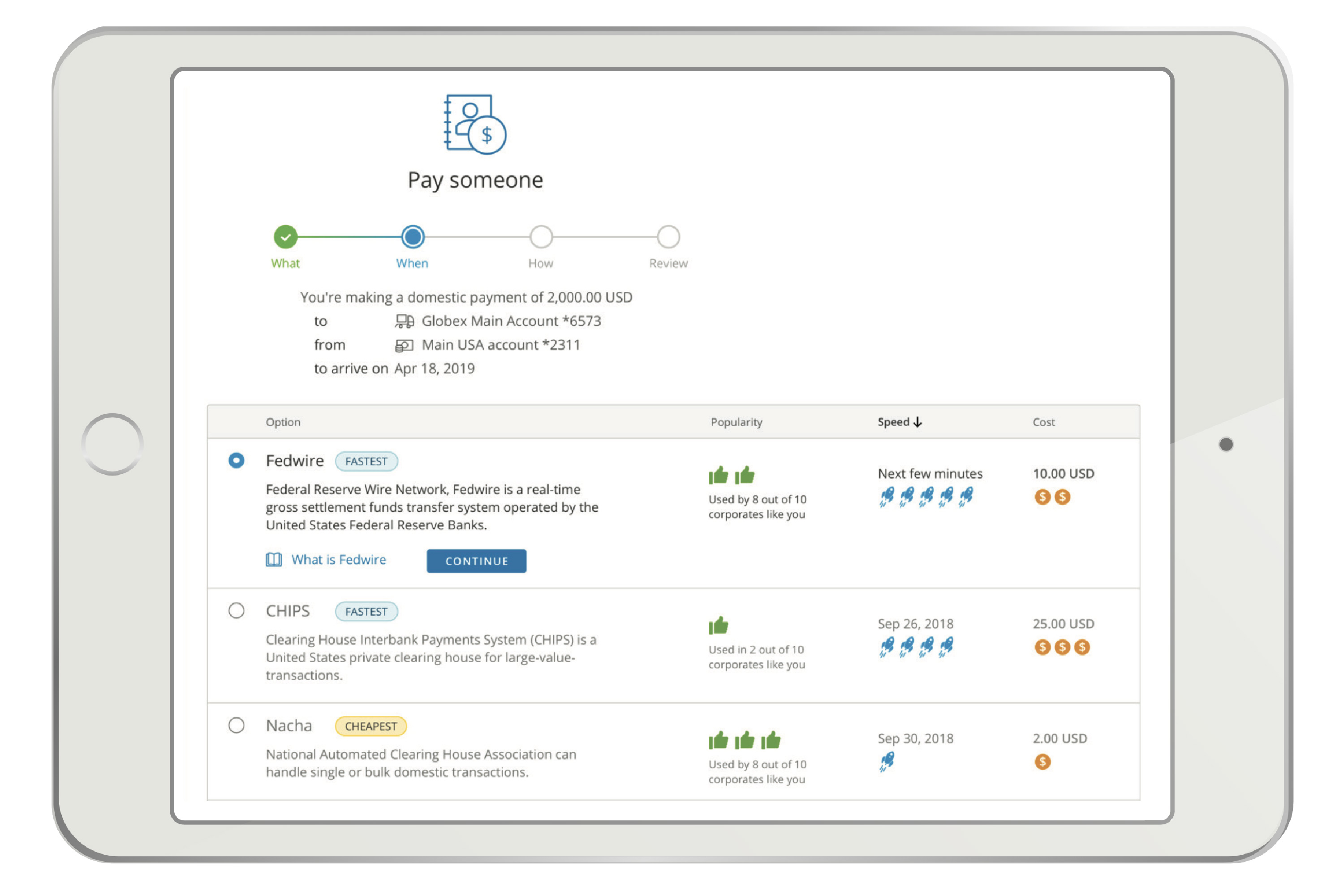

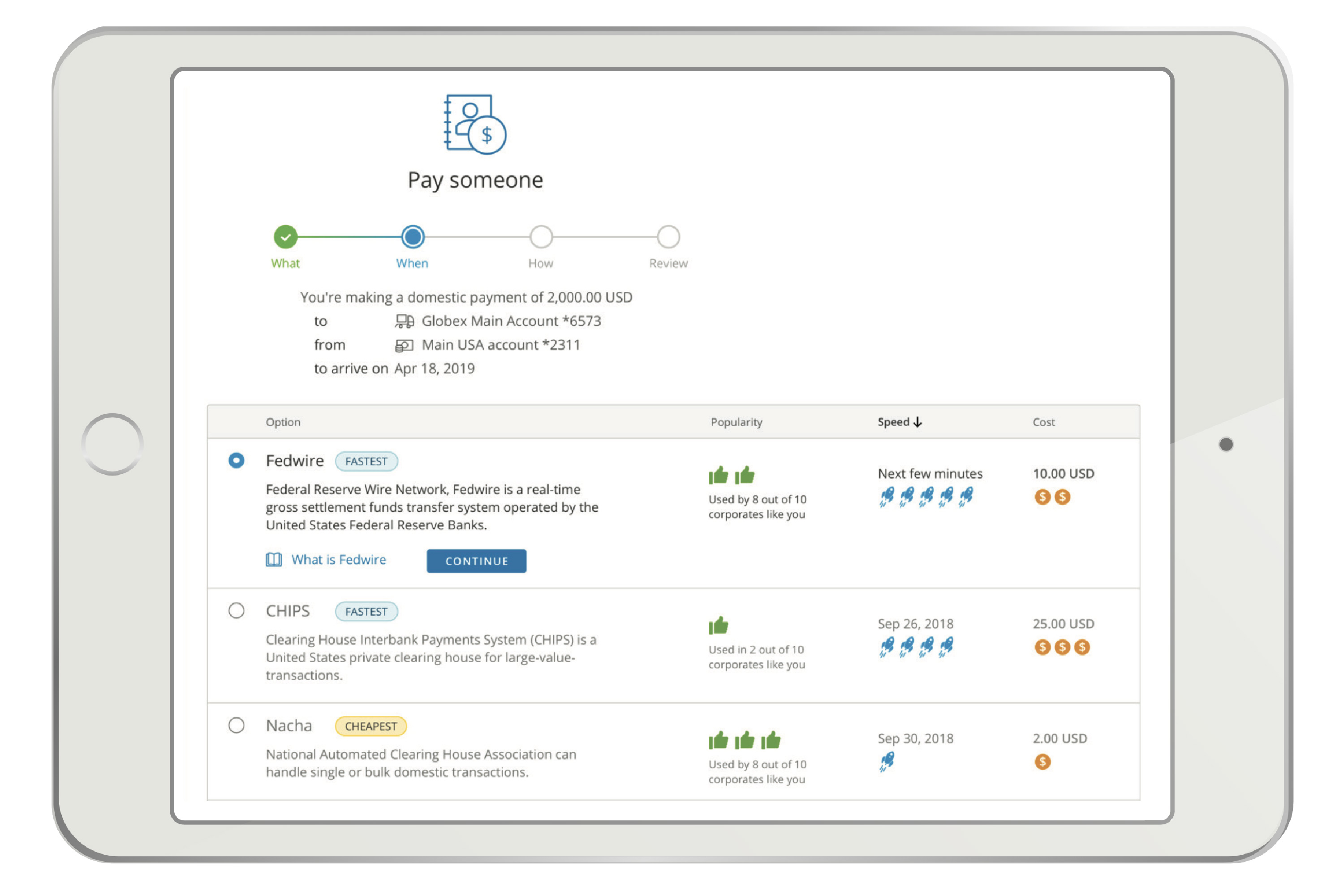

The following illustration shares how contextual banking solutions offered by banks improve corporate customers’ payments experience:

Simplified and intelligent contextual payments

Background: the customer is trying to send money to someone to pay an invoice.

Context: the customer provides basic information, which includes the account from which the payment is to be made from, the account to which the payment is to be made to, the date on which they need the amount to reach the seller and the purpose for which the payment is being made.

Best next action: The customer is provided with a clear list of options, indicating the fastest, cheapest and most popular option to make the payment.

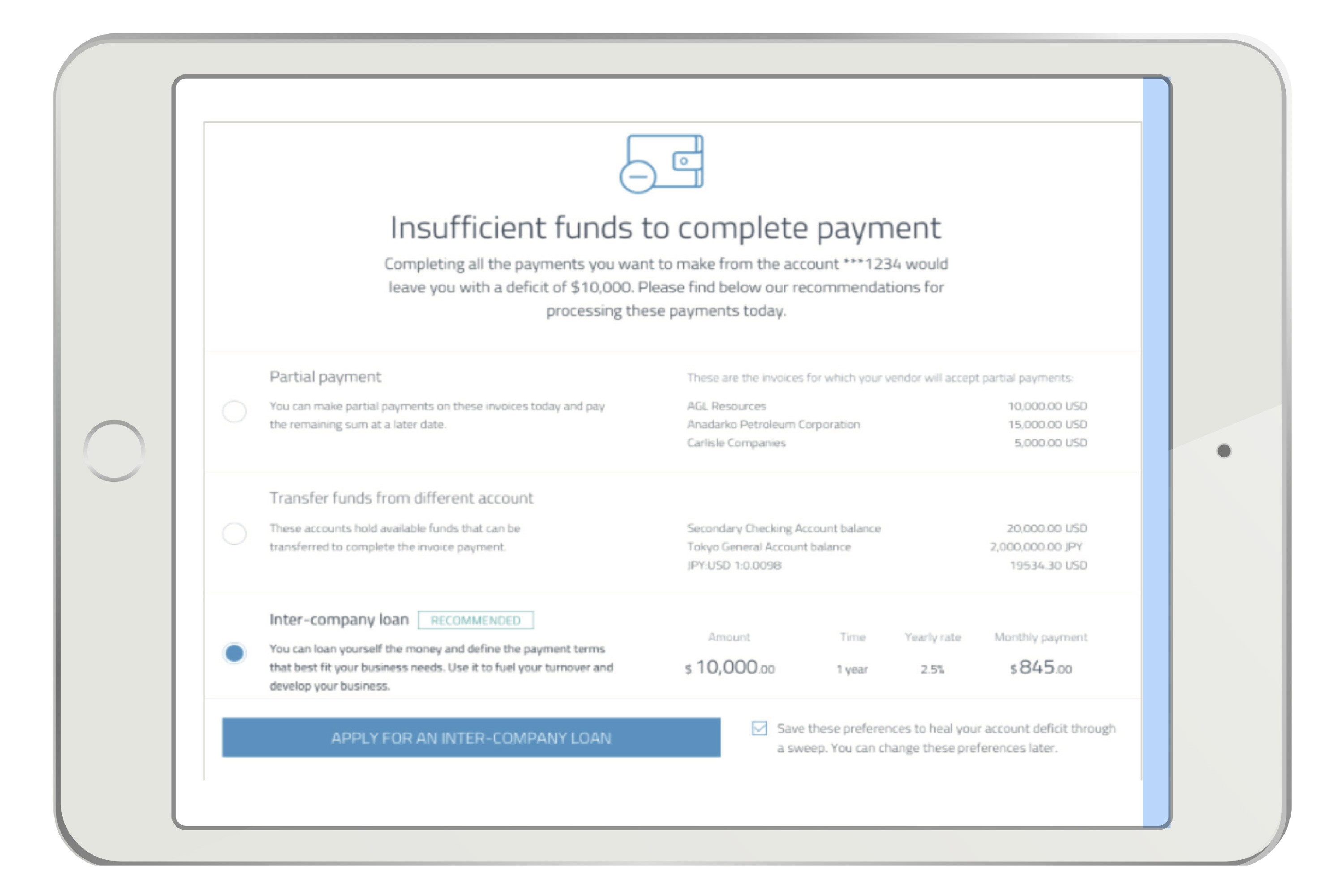

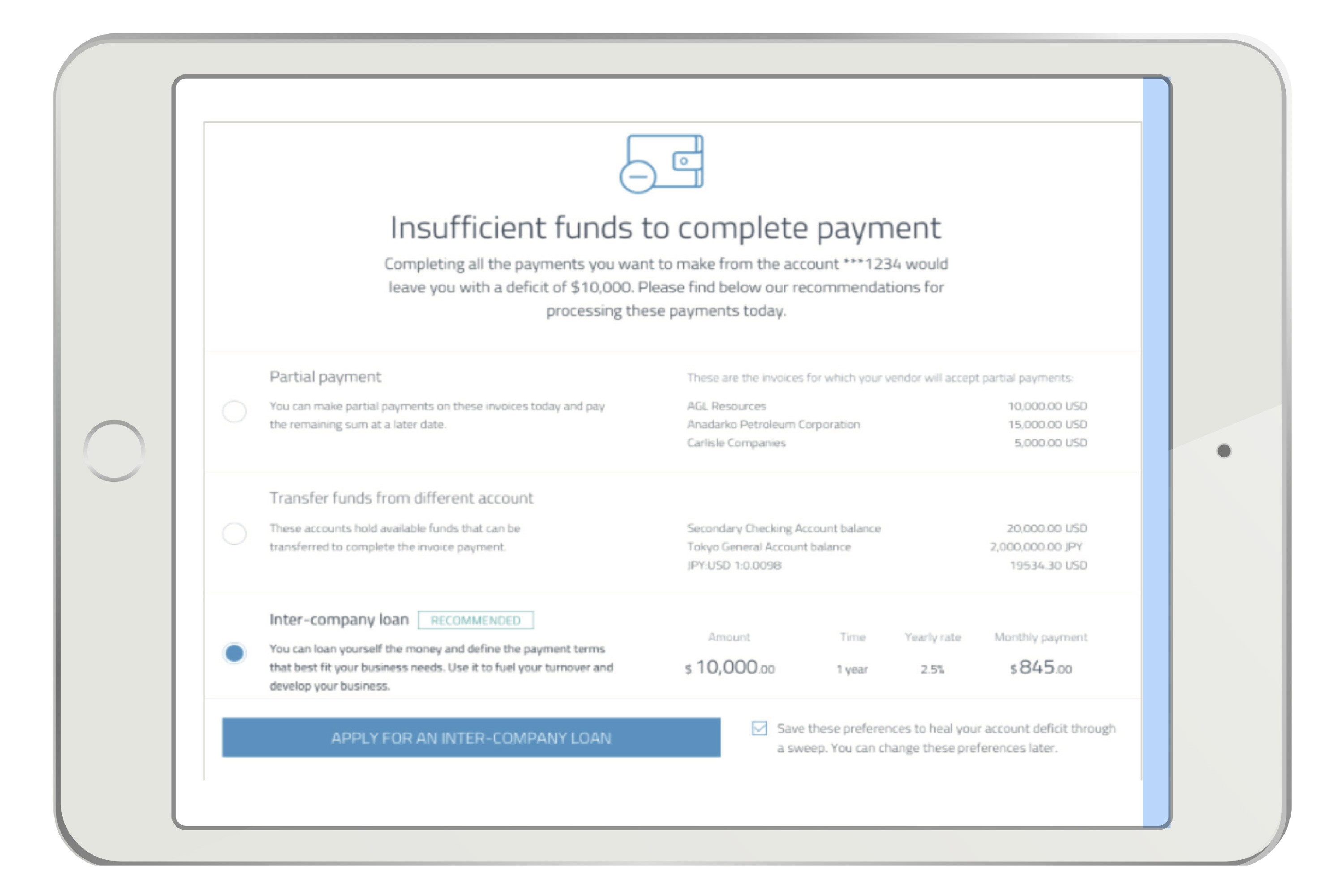

Addressing a payment shortfall Ccntextually

Background: the customer is trying to send money to someone to pay an invoice.

Context: the customer does not have sufficient funds to make the payment.

Best next action: the customer can make a partial payment of the invoice to the extent of funds available or use money available in a different account to make the payment.

Or best next offer: the customer can make an inter-company loan from another account with a different related business entity and repay that over time based on terms agreed between the two entities.

A roadmap to realizing the potential of contextual banking

Banks looking to reap the complete potential of contextual banking may want to adopt the following recommendations:

Move from a product-centric approach to a customer-centric approach: aim to create a single view of the customer, using the vast volumes of data generated at internal and external touch points. Derive insights from the volumes of existing data to understand and predict customer behavior, enabling contextual recommendation to transform and tailor products and services. Ethnographic research further crystallizes customer insights.

Design product and experiences to meet customers’ needs: shift focus from selling products to addressing customers’ needs. Innovate to adapt existing products and services to simplify, personalize and expand the customer base. Focus on creating social and emotional value for existing customers, which in turn increases customers’ trust and willingness to recommend the brand, ensuring stickiness.

Personalizing product features, pricing and channels of access based on the customer's income, behavior and attitude: is required to build an emotional connection and attract customers. Strike a balance between a bank’s need for customers’ data and customers’ desire for privacy and control. Educating customers on who is asking for their data, why they are asking for it, what kind of data is being asked for and how that data will be used alongside giving them the option to disallow any usage not mandated by regulations, helps provide control and creates trust.

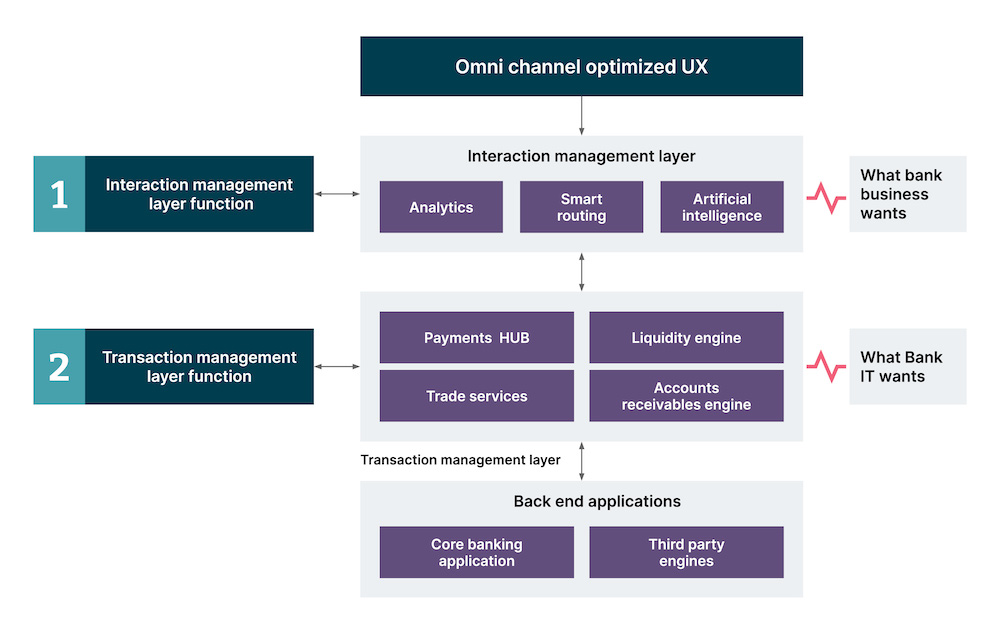

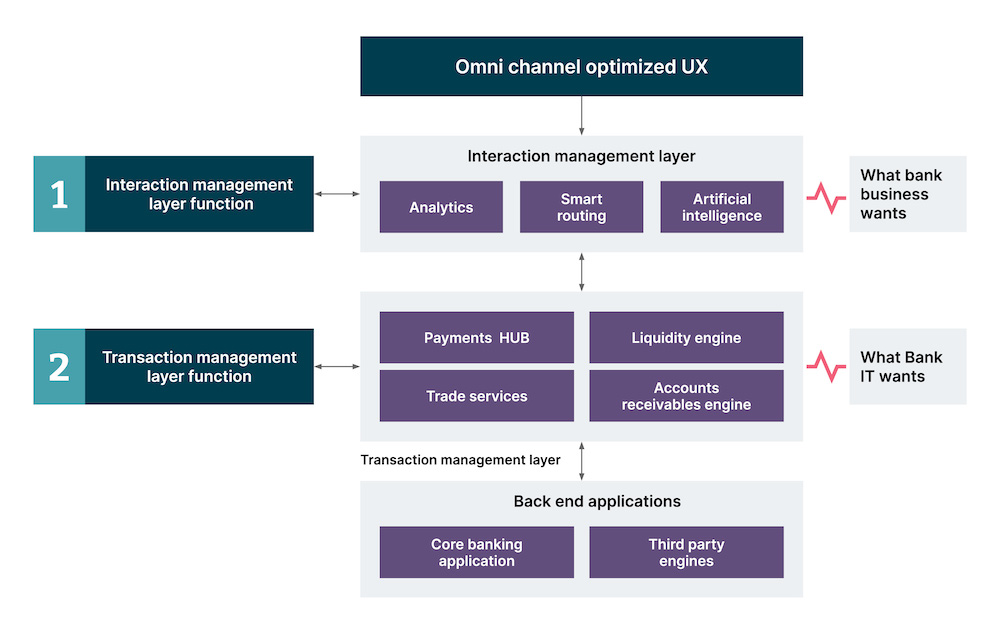

Use technology as a lever to build a contextual experience

The building block for getting a better understanding of customers is to upgrade the business’ data analytics capability to ensure data is captured and new data is frequently generated. Integrating and using structured and unstructured real-time data from internal and external sources is the key.

While legacy technology makes innovation difficult, contextual banking is not that hard to implement. Below is an illustration of how contextual banking solutions can be implemented alongside its key architectural elements.

Why invest in contextual banking?

It allows winning more wallet share through happy customers:

optimized customer experiences including savings on transaction fees and upsell optimal products to become the principal bank for the corporate customers

minimal data entry with an intuitive optimized omni channel experience

effortless tracking of transactions with dashboards

It saves customer and transaction erosion:

contextual digital banking solution helps banks fend off stiff competition from not just other banks but increasing number of fintechs

a ‘do nothing’ approach adopted by banks has led to a customer/transaction erosion of 15-20% in 3 years

It enables greater efficiency:

the all-digital solution, contextual banking, is an excellent means of driving up operations efficiency – drastically improving Straight Through Processing (STP) rate (by 99% plus) by eliminating manual tasks and reducing cost by 25% in the first year alone

Financials

Net present value

Internal rate of return

Profitability index

Payback

Discounted payback

In summary, contextual banking is a strategic imperative for banks. Financial institutions that seize the challenge rapidly and deliver end-to-end hyper-personalized products and services will create a significant advantage over competitors by differentiating their brands and multiplying revenues.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.