Direct-to-consumer (D2C) is transformative—just not the way you expect it.

Original equipment manufacturers (OEMs) are expanding and modernizing their consumer-facing capabilities. New revenue sources, including marketplaces and subscriptions, offer revenue growth as well as income and cash flow stability. Payment modernization promises faster settlement with a wide variety of supported tender types.

At first glance, adding revenue and payment mechanisms appears to be little more than integrating additive capabilities via SaaS—a gateway for payment and subscription management—into an established technology estate, channeled through the veneer of a new or revamped eCommerce experience.

In practice, changing how owner/operators buy and service machines, along with their capabilities, is proving to be too much for captive OEM finance to handle. Marketplace facilitation laws complicate the accounting and tax treatment of sales orders. Cancellations and upgrades make revenue recognition of subscription sales a new problem to manage. Routing payments throughout the dealer network makes treasury management more complex. Fraud management and associated provisioning are now the responsibility of the finance function.

Corporate finance functions already struggle to deal with years of accumulated complexity, such as:

Decades of commercial changes that defied automation resulted in layers of extracurricular activity, i.e., administration by spreadsheet, to compensate.

Years of exceptions and edge cases have created knowledge asymmetry, concentrated in the minds of a few accounting specialists nearing retirement.

A finance modernization abandoned midway through a global rollout resulted in a multi-ERP landscape, “temporary” integrations old enough to vote, and reporting infrastructure designed to narrow down—but not rectify—the constant flow of reconciliation errors.

It’s no wonder that adding more systems to integrate, more rules to codify, and more regulations to comply with in pursuit of entirely new commercial lines of business is not met with open arms by finance.

To rise to the challenge, corporate finance functions are using direct-to-consumer initiatives to transform from service providers to corporate platforms. Specifically, corporate finance is using D2C to reduce labor intensity by rationalizing operational complexity, improve its regulatory posture through policy-as-code, reduce employee friction inside and outside of finance through self-service, and accommodate edge cases through configurable orchestrations.

D2C increases finance complexity

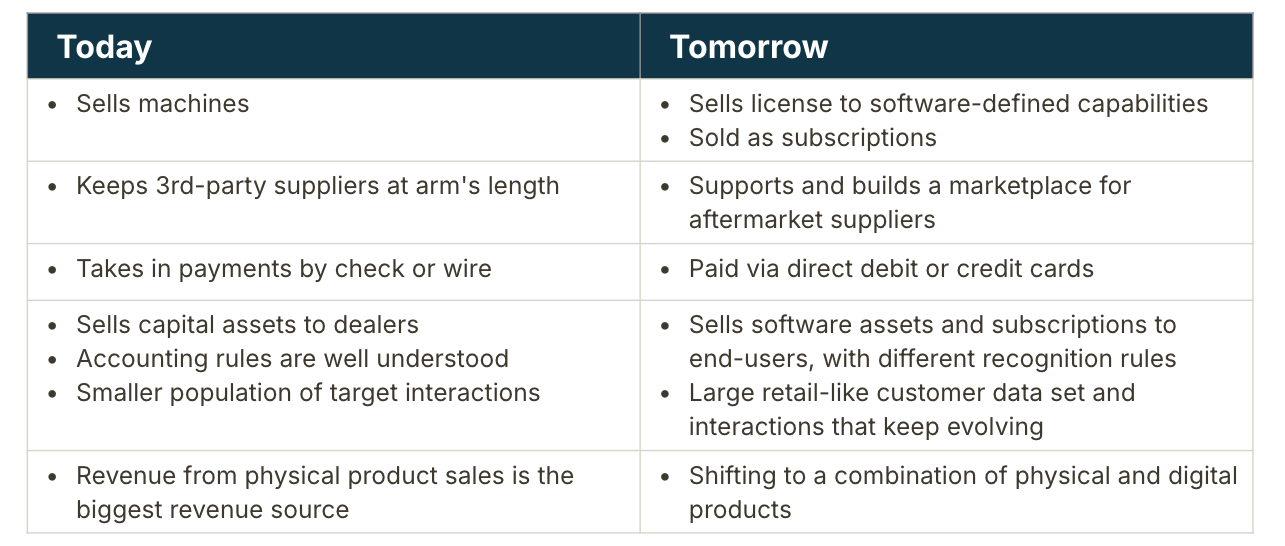

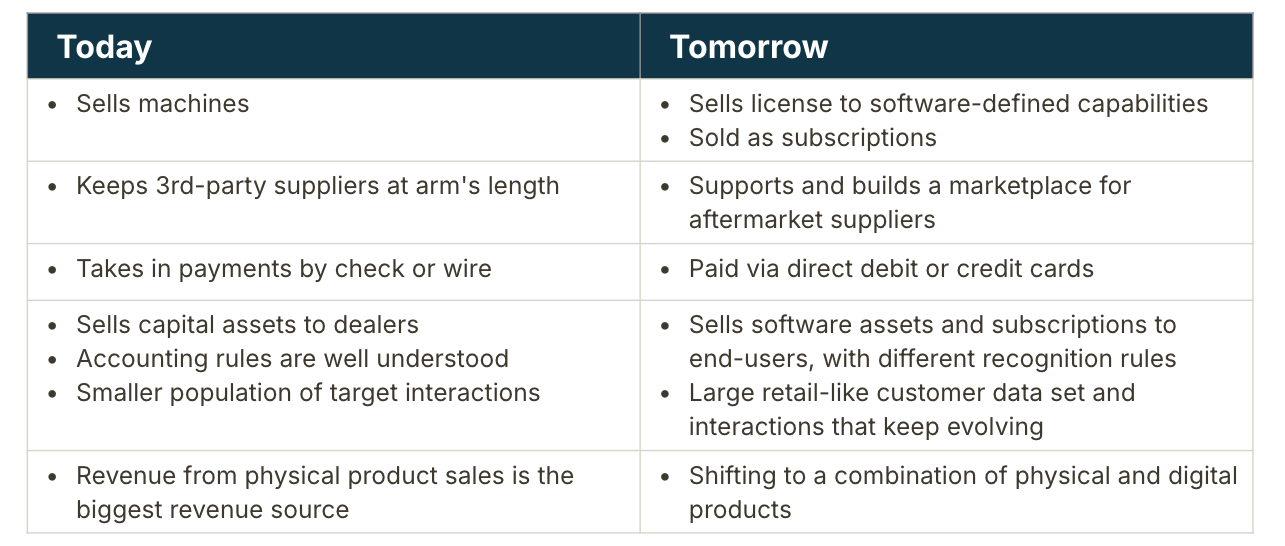

The goals are simple enough, but the evolution in business model and finance complexity is significant enough for OEMs to focus on driving this change.

This D2C transition is sold as “transformative”. It is transformative, but not for the obvious reasons. Yes, D2C will change the income statement with larger gross margins, and yes, OEMs will get a glut of sales and operations data directly from owner/operators. But the biggest transformation opportunity spurred by D2C is in corporate finance.

What appear to be straightforward commercial activities are actually significant problems for the back office. Here are some examples:

The sales tax remittance obligation rests with the company that ingests the transaction, not the company that fulfills it. Both cash receipts and accounting entries for marketplace sales orders must be split among different legal entities.

There are 11,000 sales tax jurisdictions in the United States alone, and both tax and tax exemptions are an intersection of jurisdiction, customer, items purchased, the policies of tax authorities, and ultimately, the intended use by the buyer. OEMs that have only transacted through resellers have a lot of foundational work to make the correct indirect tax calculations, from catalog rationalization to jurisdictional rule definition to ingestion and application of tax-exempt certificates.

Subscription revenue is recognized incrementally over the term of the subscription, not all at once. Not only must finance deal with timed renewals, but also with events that interfere with the subscription, such as unscheduled downtime, cancellation, or refund. This means booking provisions for subscription cancellations and refunds and dealing with edge cases and exceptions reported via customer service that will increase in lockstep with the number of subscriptions sold. It also means devising policies in collaboration with sales to staunch revenue erosion from cancellation (e.g., offering a reduced plan to retain the customer), and working in collaboration with customer service to harmonize operational metrics (e.g., close customer tickets ASAP) and financial metrics (e.g., protect topline revenue). These nudges to retain customers who might churn further increase the complexity of realizing and booking this revenue.

Direct debit transactions have no metadata that associates them with specific customer invoices—although faster than wire and paper check, direct debit offers no intrinsic mechanism that matches payments to invoices.

A company cannot expand what it sells and how it sells unless finance is in a position to scale. Before Finance can scale, it must undergo massive change, which ushers in a new class of problems:

The income statement will look different and investors need to understand why.

Returns and refunds create a hole in the income statement regardless of policy. The company either has to pay for labor to process each one, or the costs to absorb the return—or both.

- The company will have increased exposure to fraud; detection, prevention, and investigation—and above all, incidents—cost money. Solutions to these new problems are not straightforward cost/benefit propositions but balancing acts, e.g., the “optimized cost of fraud prevention” is a balancing act of how much fraud the company is willing to risk against how much business it is willing to risk driving away due to the added friction.

- Industrial firms have long had the luxury of doing business with a high-trust network. The policies that work for transacting in a high-trust environment such as a captive dealer network are inadequate for transacting in a low-trust network such as D2C sales.

The biggest problem of all is staying the course of a D2C strategy.

Direct-to-consumer is a slugfest.

OEMs have no implicit “right to win” the business of machine owner/operators over dealers; OEMs have to win that business with each transaction. A never-ending cycle of promotions and discounts to lure business, twinned with ever-increasing investments in the sales network to mollify dealers, makes both key performance indicators unattractive and sales margins anemic. Finance does not have the luxury of simply reporting the numbers: the criticality of D2C strategy to the board of directors invests the CFO in D2C success. Finance must both quantify performance and frame that performance in terms of sustainability: what can the income statement and balance sheet absorb, and for how long, to bring its D2C strategy to fruition? Finance must also surface the intangible benefits of the strategy, such as the value of market intelligence: transacting directly with owner/operators gives the OEM firsthand data about market needs, the value the OEM can provide owner/operators through new and existing offerings, and what works and does not work in fulfilling those needs.

Is Finance ready to modernize?

D2C looks like an eCommerce problem: add some digital capabilities to the manufactured products, put some digital tools in front of customers, take their orders and payments. In practice, D2C requires a considerable amount of back-office finance rewiring.

Changing the back office requires two things:

- People knowledgeable in the "how", i.e., the nature of the problem (as described aboved), the account rules that capture them, and the processes and systems to implement them. This is where the problems start. Operating companies are staffed with people who know how to do the job in front of them and to deal with exceptions to that job. They are experts at the “what”. D2C introduces entirely different accounting treatments for very different kinds of activities. Architecting D2C finance needs leaders who can escape the imaginative limitations of “this is how we’ve always done things” to design “this is how we will do things tomorrow”.

- Adaptable processes and systems. The aging systems that drive most industrial firms’ finance operations are an impediment. Recklessly customized ERPs, thoughtlessly expanded charts of accounts, and fragile legacy systems increase the labor intensity of the back office and necessitate a web of supporting spreadsheets to compensate for their inflexibility. Operating complexity—whether automated or supplemented with manual exception handling—is an impediment to integrating contemporary financial infrastructure necessary for D2C execution.

And, of course, mapping a new finance landscape depends on finance leaders with the luxury of time to dedicate to the task. Consulting subject matter experts can frame the decisions and recommend solutions, but unless those consultants are contractually obligated to demonstrate success to the standard of “evidence that it does work”, they are likely to deliver to a standard of “no evidence that it will not work”. Finance modernization requires competent and dedicated finance leadership that can separate systemic impediment from FASB guidelines, learned helplessness from misguided policy, vendor smokescreen from transformative change.

Solve for D2C, not for all past sins

The substantial changes required to support D2C transactions will create an overwhelming sense of futility with regard to the status quo: there will be many in an overburdened finance department who will see sweeping systemic change as the only way of comprehensively resolving years of accretion of half measures and incomplete upgrades. D2C need not be a back door for that long overdue ERP upgrade or sales order management system. D2C does not inherently increase finance complexity, in fact, D2C is an opportunity to rationalize it.

To solve for D2C without solving for all of finance, we need to explicitly define processes independently of systems. Process is difficult to separate from systems in finance, as, over time, systems come to dictate process. This consists of two components. One is the logical model that defines what must be true for finance to accommodate D2C transactions. The other is to confirm granular addressability of underlying finance systems. The prior defines the “to-be” state, the latter separates the real from the perceived obstructions that legacy systems create, the combination confirms that D2C solutions need not be tightly coupled to systems.

While the purpose is not to solve for all of finance, the purpose is to comprehensively solve for an impacted problem space. Modernizing payments requires an in-depth look at the ramifications to and deficiencies of the entire order-to-cash cycle. Creating an online marketplace requires a thorough understanding of the flow of sales order, invoice, sales tax, payments and returns data among multiple legal entities and their corresponding journal entries. Even the simplest, most narrow of modernizations will be impaired, if not outright derailed, by unreliable upstream or inadequate downstream processes.

There are four activities in modernizing finance to support D2C: policy definition, domain mapping, point solution definition, and orchestration.

Define the policies

The first problem to solve is policy, across all of the domains for which we have to solve. If we are now taking subscriptions where we have not before, what are the policies for revenue recognition when the sale is booked, when time passes, if the subscription is canceled, and so forth? If we are taking credit card payments where we have not before, what are the policies for fraud prevention that minimize customer friction and violation of sanctioned party transactions? If we are calculating retail sales taxes where we have not before, what are the policies regarding merchandise classification and tax exemption eligibility? Policies create the logical models that provide the “why” answers for what we want to do.

Long before we get into solution, every class of problem we need to solve for in D2C requires the appropriate set of policies. This is not “big up front design”, this is thoughtful consideration. Bypassing the policy questions entirely—that is, leading with a solution with an expectation that policy can be backfilled—distorts both policy and implementation, and quickly runs a D2C strategy aground. At this stage, preliminary policy and a mechanism to clearly communicate it and communicate future changes is enough. Policy definition is an evolutionary process; making it up as you go along is not evolution, it is reaction.

Map the domains

Policy definition exposes the finance domains that need to be defined for D2C. Because D2C domains overlap with the historic B2B domains, having clarity in domain definition both prevents the expansion into D2C from creating domain confusion, and is an opportunity to clarify and improve legacy domains that have been run roughshod over throughout the years. One common anti-pattern in this process is to start with the legacy domains and identify “enhancements” — instead, start with D2C and identify areas of potential reuse.

For example, suppose an OEM is going to start selling its own as well as 3rd party aftermarket items directly to customers as part of a new marketplace. In this case, the A/R Invoice, A/R payments and A/R customer, as well A/P vendor domains, will all need to be expanded. Because the company is new to D2C sales the A/P sales tax domains will need to be created. While this sounds like relatively standard ERP contexts, a company with multiple business lines will not only have underlying products with different characteristics, but will have one customer facing invoice that spans purchases from multiple legal entities posted into different ledgers.

The services that compose each of these domains will interact with multiple underlying systems. Having a clear bounded context for each domain is essential to discreet definition of those services; otherwise, the underlying systems will corrupt services definition and add to, rather than rationalize away, underlying finance complexity.

Define the solutions to the problems that need to be solved for D2C—and only these problems

Policy tells us why we must solve for something, the domains tell us what needs to be solved. The next step is to identify cost-effective and technologically viable solutions to those problems.

Finance modernization exposes a lot of problems—some large, some small—that need a definitive solution. As examples:

- The chart of accounts may be untidy, but we can create an abstraction layer for the as-is account structure for posting purposes that does not tightly couple transaction posting rules to specific general ledger accounts.

- The ERP may never have had the revenue recognition capability activated and, being so long out of date, the ERP vendor is no longer willing to license it; we can use a rules engine for determining accounting treatment of different transactions.

- The sales tax product can house tax exemption documents but not accurately apply those exemptions because the customer’s intended use is too cumbersome to capture; we can create an exception handling process so that customers can work directly with the customer service team to identify which items meet exemption criteria and which ones do not.

- The vendor supplied fraud detection has sanctioned party capability, but our particular industry is scrutinized by Congress, so we will substitute our own sanctioned party screening as part of the payment process.

- Historically, finance staff have manually matched wire payments to invoices; an online bill pay function will allow customers to select the invoices—down to the line items—that a customer wants to pay with a specific digital payment.

As mentioned earlier, there will be a penchant for defining “boil the ocean” solutions to the myriad of long-lived finance problems that inhibit D2C implementation. Defining explicit solutions to the specific challenges presented by D2C obviates the need for sweeping finance reform as a precursor to D2C.

Orchestrate the solutions

Finance modernization is not sum-of-the-parts. A customer submits a sales order for several products of which one is eligible for tax exemption. The customer later amends that sales order with a subscription and submits the order. The order is fulfilled and at that point it is invoiced and a customer makes a payment, perhaps multiple payments using multiple tender types. The day the customer receives the shipment, they discover one of the items they ordered was wrong, and initiate a return. Six months into the annual subscription, they upgrade the subscription. The point solutions that are created to satisfy each event will still yield a labor-intensive back office without contextualized orchestration. Contextualization is important because orchestration must be configurable in response to different conditions that surround every event. The adaptability—and therefore, scalability—of finance is largely down to the extent to which the orchestration of events is defined through configuration rather than code. Software developers define what it is that finance capabilities do; finance defines how those capabilities behave, independently and in concert with one another.

Policy, domain mapping and point solutions enable finance to process D2C transactions; orchestration allows finance to process D2C transactions at scale.

Simplification is the gateway to modernization

Done right, the combination of policy, domain modeling, point solution, and orchestration does not add layer upon layer of complexity to finance, making it more sclerotic; it rationalizes away labor intensity that appear to be solvable only through “lift and shift” exercises while increasing the adaptability of finance to future changes. And, despite what technology vendors tell you, there are no turnkey solutions. As mentioned above, process is not a function of systems. Swapping one system for another, or augmenting existing systems with new ones, will only compound existing process problems. D2C need not be held hostage by legacy system replacements, nor does it have to add to a polluted landscape. Designed thoughtfully, D2C enables effective use of modern financial infrastructure while adding years of service to legacy infrastructure by rationalizing rather than reinventing the underlying finance domain.

Finance is more than a service, it’s a core business platform

Most corporate finance functions as a services provider. Its core mission is the financial reporting of the firm. Key to this is providing confidence in compliance with accounting standards and policies. Finance does this by posting transactions and running reports in core and specialist finance systems, handling exception cases through spreadsheets, consulting on the implementation of peripheral systems that create transactions that find their way into the core, and engaging outsiders to audit practices, policies, and statements. In short, finance is both a service provider to the company itself and a shared service among all departments and functions.

Services scale through people. The greater the demands placed on the service, the more people required to fulfill. In finance, technology has made service professionals more productive, but it has not changed the nature of what finance is—a service performed by humans for humans.

A different way to think about finance is as a business platform. Business platforms scale through consumer self-service: let the consumer interact with technology to solve their problem, rather than having the consumer interact with an expert who uses technology to solve the problem. D2C can be the agent through which corporate finance transitions from being a service to a platform. Specifically:

- Decoupling labor from operational complexity: incremental changes in finance—changes that have accreted over decades—increase labor intensity within narrow areas of specialization, increasing finance bloat. D2C reduces that bloat when rationalizing away complexity is intrinsic to its design and implementation.

- Improved regulatory posture: the critical question in any compliance audit is “why”, as in, “why was this transaction treated in this manner?”. “Why” for everything from sales tax to sanctioned parties to customer collection and vendor payouts is easier to answer when orchestration is specifically traceable to policy.

- Less friction: lengthy period-end close, manual adjustments, additional finance operations reporting and reconciliation-by-spreadsheet are tactical solutions to systemic shortcomings. Solving the specific problems that need to be solved for, and implementing with configurable orchestration, automates finance operations, reducing employee friction.

- Scale down while scaling up: adaptable orchestration allows automation of edge cases. This not only contains bloat, it increases finance capacity for accommodating a wide range of customer and employee journeys.

Platforms, in turn, benefit from product thinking. Among other things, product thinking prioritizes product consumers over systems and transaction flows. D2C solutions are products built on the corporate finance platform. Those products have external (e.g., customers making payments) and internal (e.g., finance staff doing period-end close) customers. Consumer empathy in the development of finance products is essential to D2C being an agent of positive change in corporate finance.

Direct-to-consumer requires finance transformation. When that transformation is accidental, with repeated gap exercises to integrate D2C technologies, it adds to finance cruft. When that transformation is intentional, it is immensely beneficial.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.