Digi banks are growing in popularity because they are favored by micro and small companies, the underbanked and unbanked customers like freelancers and gig economy employees for certain features including easy opening and operating of accounts, seamless payments, transfer and remittance solutions, and the alternative methods for creditworthiness assessments. The global digital banking market was estimated at $78.02 billion in 2022. It’s expected to reach $359.46 billion in 2026 growing at a 43.52 percent compounded annual growth rate.

Digital banks’ operating models and customer benefits

The two prominent operating models that digi banks adopt:

- Owning a banking license

- Not opting for a bank license and partnering with other banks to provide licensed services

Digi banks operate by:

Adopting new tech that is further enhanced by leveraging current UI trends. As their infrastructural requirement is only technology, digital banks can substantially reduce building costs. AI tech is a foundational pillar and customer data is analyzed by modernized platforms to make strategic decisions.

Acquiring a license that helps banks (like Revolut) provide full-fledged banking services online – checking accounts, prepaid services, debit or credit cards, currency exchanges, crypto, money transfer, retail, and savings accounts. Digital banks have a lean operating model which makes them cost-effective and they are able to offer competitive pricing to customers as against the traditional brick-and-mortar banks.

Digital banks make a profit and provide benefits to the customer by doing the following:

Lowering fees and costs

Including ancillary services payment, interests for deposits, credits and credit or debit card transactions

Seeking interchange fees when a customer purchases debit and credit cards and for overdue credit

Seeking interest on deposits and when accounts are opened

Ensuring ease of banking through seamless onboarding, offering a variety of products and tapping into the existing ecosystem for enhanced benefits

The road ahead for digital banks

Digital banking is a step in the right direction when it comes to financial inclusion and bundling banking services with other financial services. Examples include opening bank accounts for immigrants that do not require traditional documentation.

Digital banks have the potential to be disruptors and catalysts for traditional banks to invest in new-age technology and re-engineer age-old customer journeys.

However, as digital banks are gathering momentum their sustained profitability is a challenge. Against a backdrop of fierce competition and revenue stream reduction, banks have to more interactively engage with customers while differentiating themselves in an already crowded market. One of the most effective ways to do this is payment-linked rewards.

Additionally, to better leverage customer data opportunities, digi banks can work with a specialist payment-linked rewards provider to integrate the payment information and rewards program data with a digital loyalty commerce ecosystem - an opportunity to engage with consumers by leveraging data to deliver dynamic value.

Another challenge is that we are yet to see how efficiently digi banks can navigate regulation and compliance, data and cyber security, seamless API integration and expansion of products and services.

Harnessing the global digital banking market opportunity

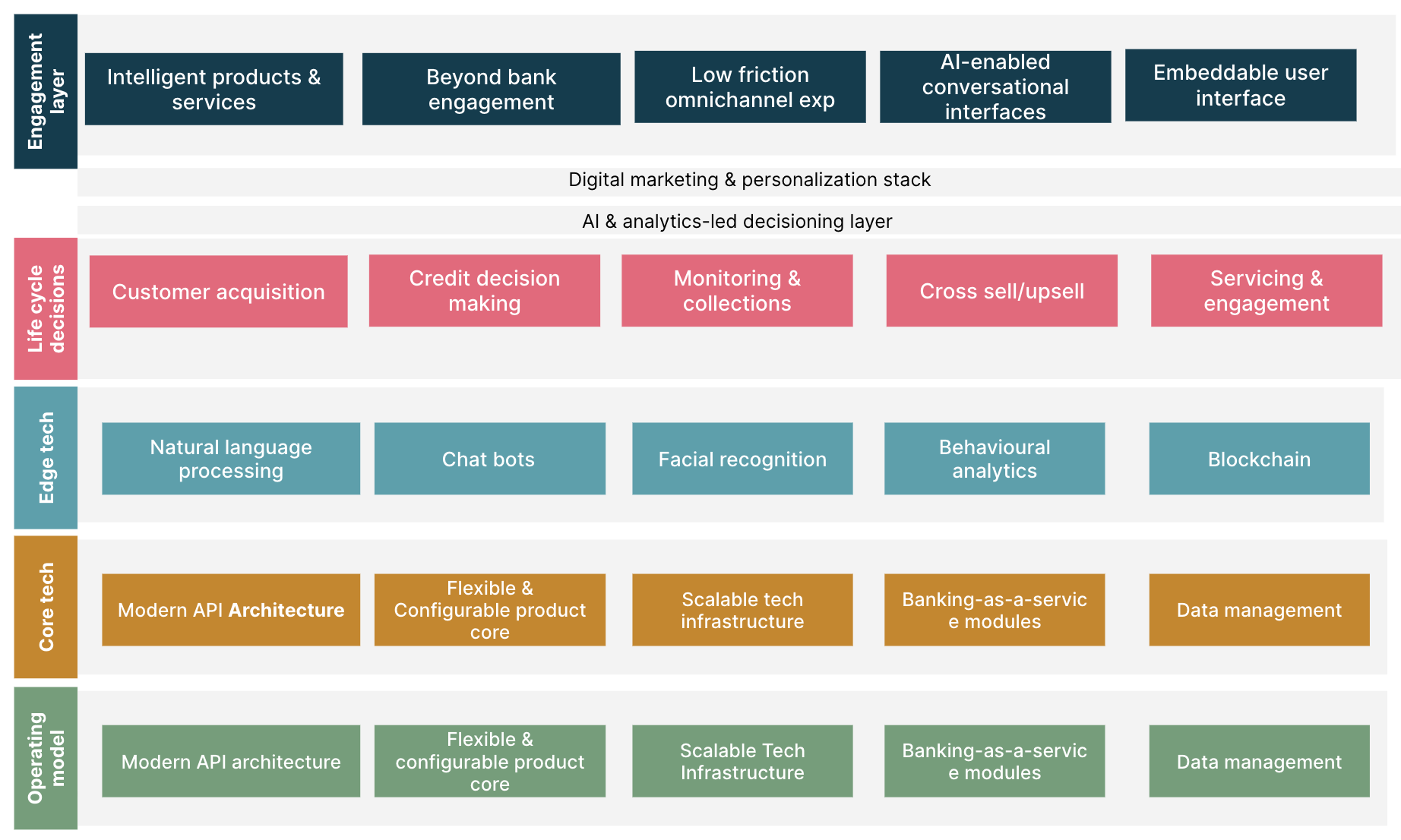

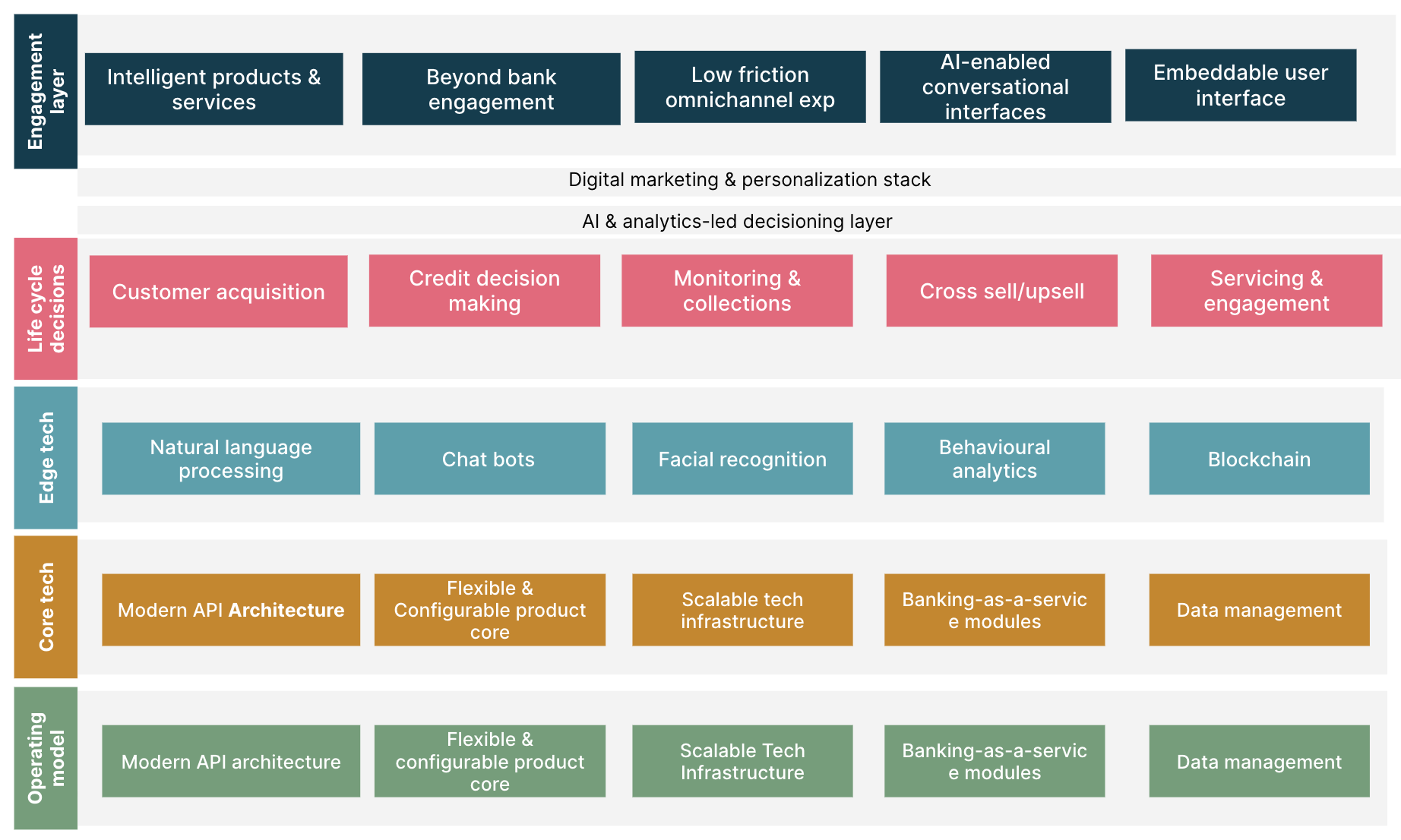

Shared below is a structure for the digital bank of the future. We believe digi banks will need to adopt an AI-first mindset and build a holistic set of capabilities across four interconnected layers as shown below:

Structure of the AI–digital bank of the future according, McKinsey

Engagement layer: Digi banks will have to create unique customer experiences and build capabilities to meet customer expectations. The experiences will have to be simple, intuitive, fast, responsive and delightful. They will need to be low-friction, low-latency and highly customizable mobile-first journeys.

Digital marketing and personalization stack: The experiences should be available where customers need them the most by seamlessly integrating themselves with ecosystem partners. This will enable customers to discover and consume offerings that are beyond the bank’s core platforms.

Additionally, experiences will have to be hyper-personalized which means the digi bank’s product innovation engine should allow for the discovery of unarticulated customer needs and be flexible enough to introduce innovative new products. For this, the engagement layer will need to link to models in its decisioning layer, sending customers real-time personalized offers, nudges and recommendations.

AI and analytics-led decisioning layer: Hyper-personalization requires granular AI-driven decisions to be made across the entire customer life cycle. ML models across domains including credit analytics, product and channel propensity, fatigue (how often digi banks are reaching out to customers) and risk (attrition, collections) should identify the next-best action for customers.

To deploy such ML models, digi banks will need to create data ingestion pipelines. The collected data from these pipelines should include both traditional and non-traditional banking customer information like transaction data, clickstream data from the bank’s platforms (app or website) or data from third-party partnerships. This collection of data when stored in a unified platform will aggregate, enrich and maintain a 360-degree view of existing and potential users.

Digi banks will also have to rapidly deploy, test and iterate on models in live production environments - requiring ML operations (MLOps) and close coordination between data science, product, technology and business teams to ensure models are built for live and efficient production deployment.

Core technology and data layer: Developing experiences in the engagement layer and personalizing the decisioning layer require modern technology and a data core. Digi banks unencumbered by legacy decisions build their core tech – a cloud-based, flexible and highly configurable banking core that helps engineering teams rapidly launch new product variants through easy configurations.

Digi banks, on this journey, have to make judicious decisions on what components to build and what to outsource. Additionally, their data management should enable data liquidity and the ability to access, ingest and manipulate data across systems and models.

Building the right capabilities: This is a fundamental determinant of a digi bank’s speed and agility. It influences how the banks attract and organize talent across their teams. A successful digi bank embodies an aspirational vision and culture for the organization which attracts talent to banking and critical non-banking domains, including designers, architects, engineers and data scientists. Since these banks adopt the latest technology processes they are able to attract and retain top talent; tech architects and developers.

Digi banks benefit from full-stack platform-based autonomous teams. Required skill sets further revenue, enhance engagement, ensure service quality and increase operational efficiencies. Calibrating organizational rhythms and processes promotes innovation and rapid experimentation while adhering to regulation and compliance norms.

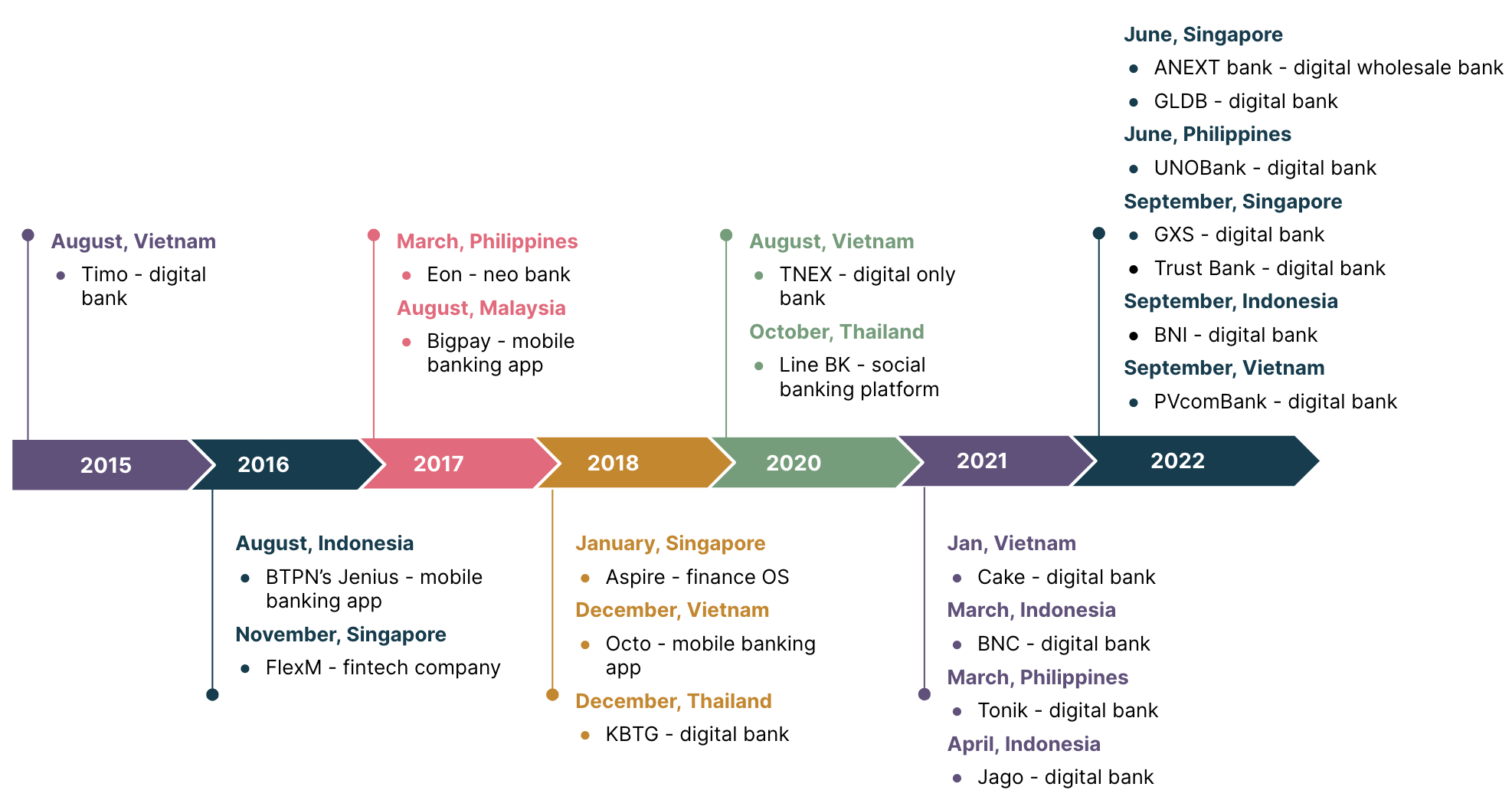

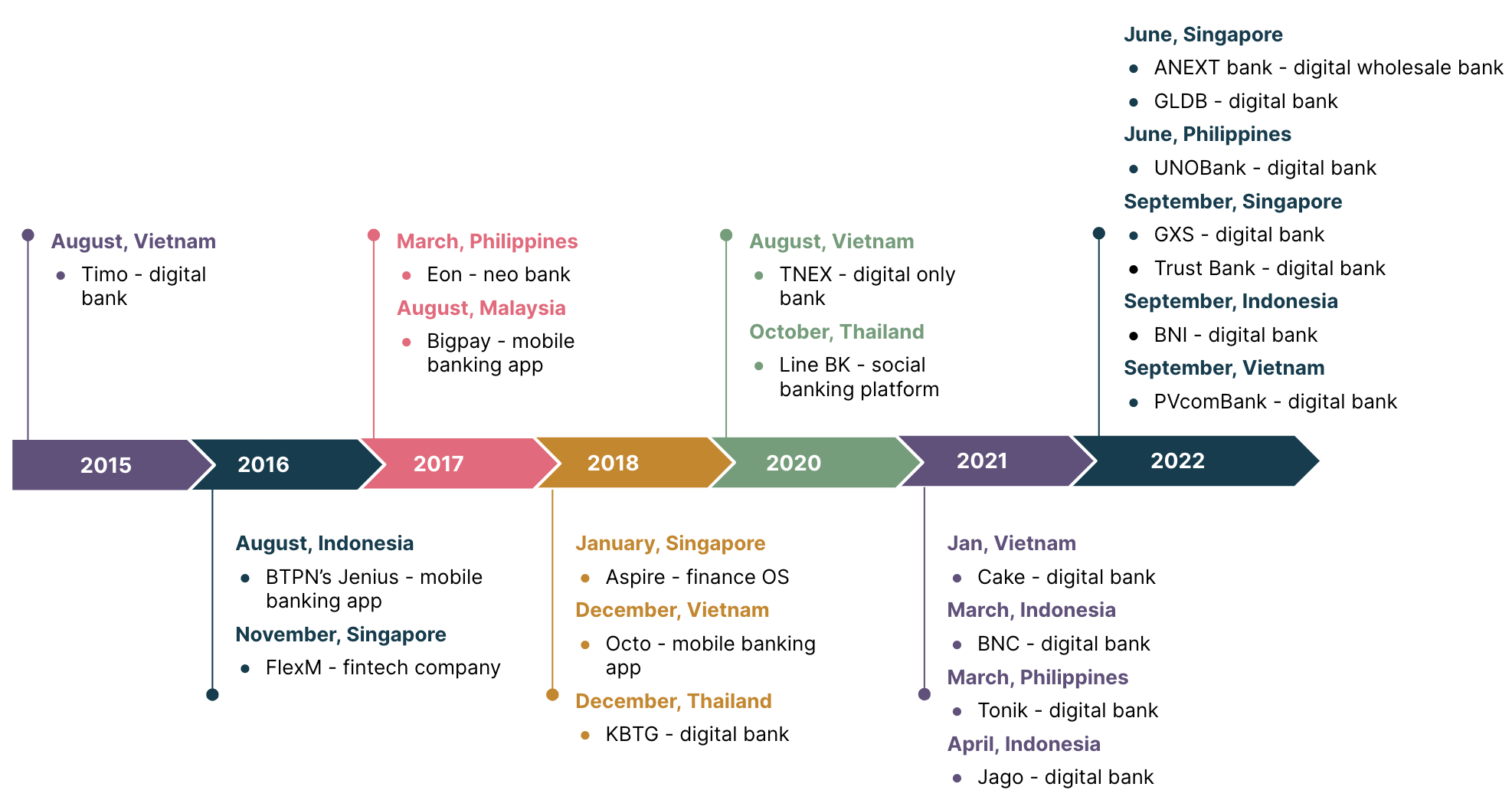

Rise of digi banks in South East Asia (SEA)

There is a faster adoption to digi banks in theSEA region as compared with other geographies. The digital financial services market in SEA is expected to reach $38 billion by 2025. This includes digital payments, digital lending, and digital insurance, besides digital banking.

One of the most important trends in the region is how most of the digi banking licenses are given to fintech consortiums. This builds upon the existing advantage that consortiums have over traditional banks – access to a network of already available customers and being ahead of the technology curve. In part two of this blog series, we explore, in more detail, how and why digi banks are expanding so rapidly in the South East Asian market.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.