Accelerated digitalization has transformed the dynamics of competition in the banking sector. Banks, today, face a double threat from nimble fintechs and Big Tech companies entering the banking and financial services space.

While fintechs have enhanced customer experience, non-banking Big Tech companies approach customer needs holistically and not as point transactions. This has resulted in a proliferation of players who are threatening banks’ traditional revenue streams like payments and credit services.

Customer expectations are constantly evolving too. Digital natives who seek hyper-personalized services in a mobile first world do not want to spend too much time on their banking needs.

Banks must modify business and technology strategies to thrive in such an environment. This four-part blog series explores the current state of banking ecosystems and discusses how banks can be future ready with an ecosystem strategy.

From ‘banking out of banks’ to ‘banking out of sight’

Banking has been moving out of banks since the 1960s. Until then, most banking transactions took place within the physical boundaries of a bank. With the advent of ATMs in 1967, a small set of those transactions could be initiated outside the branch. The arrival of channel banking in the mid-90s made it possible for transactions to be initiated outside a bank’s hardware, on a customer’s computer. This made physical banks invisible to customers. However a bank’s software was still required to trigger banking transactions.

With the advent of platform banking and banking as a service, transaction initiations have moved out of a bank’s software as well. In India, a UPI (Unified Payments Interface) transaction can be initiated from a third-party system, which houses neither the customer’s debit nor their credit account.

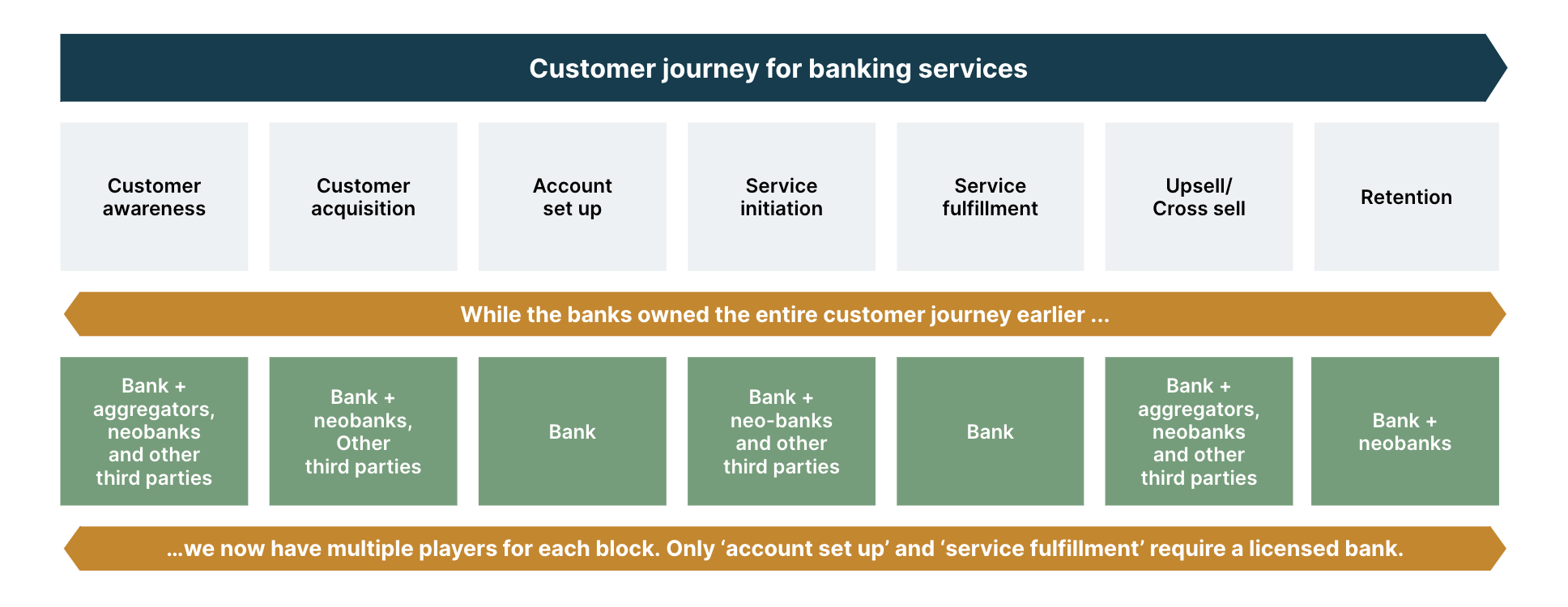

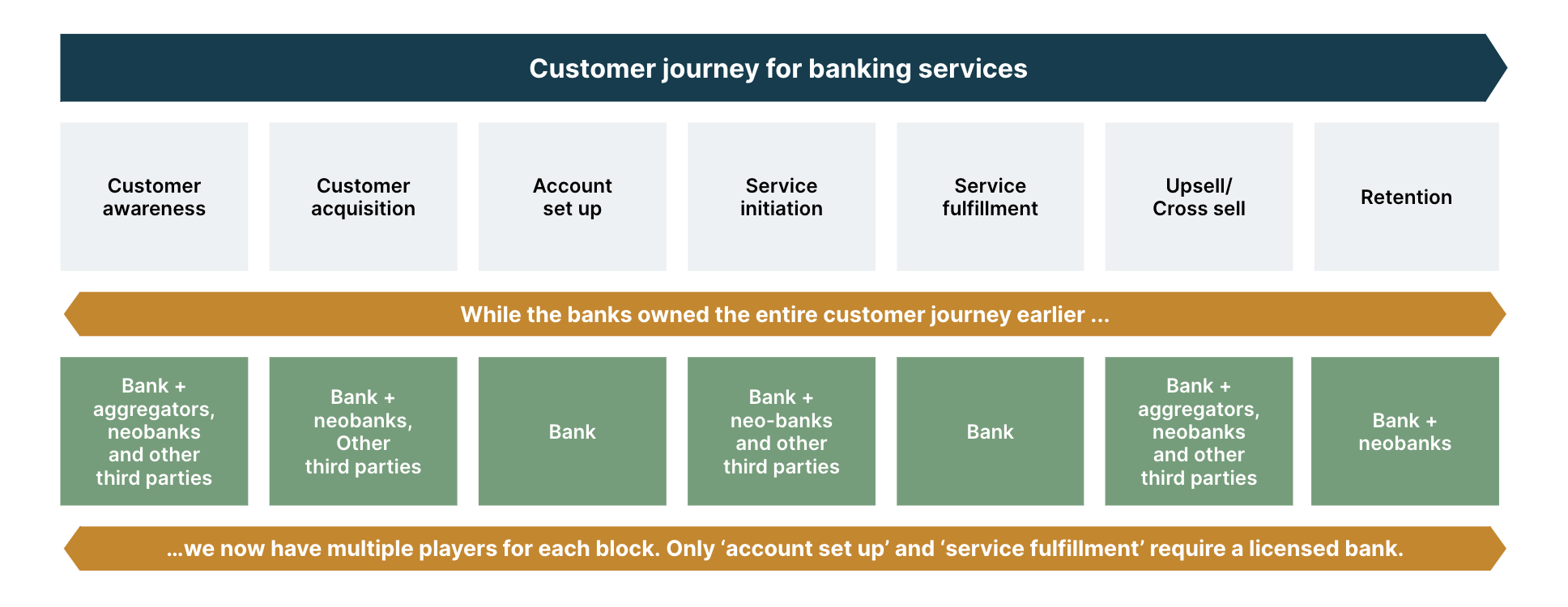

The moving out of bank transactions has been accompanied by an unbundling of the customer journey. From banks owning all the components of a customer’s journey, now, we see most aspects of banking being delivered via third parties.

Today, banking is being conducted out of sight and becoming a hidden component in a customer’s daily needs or life moments.

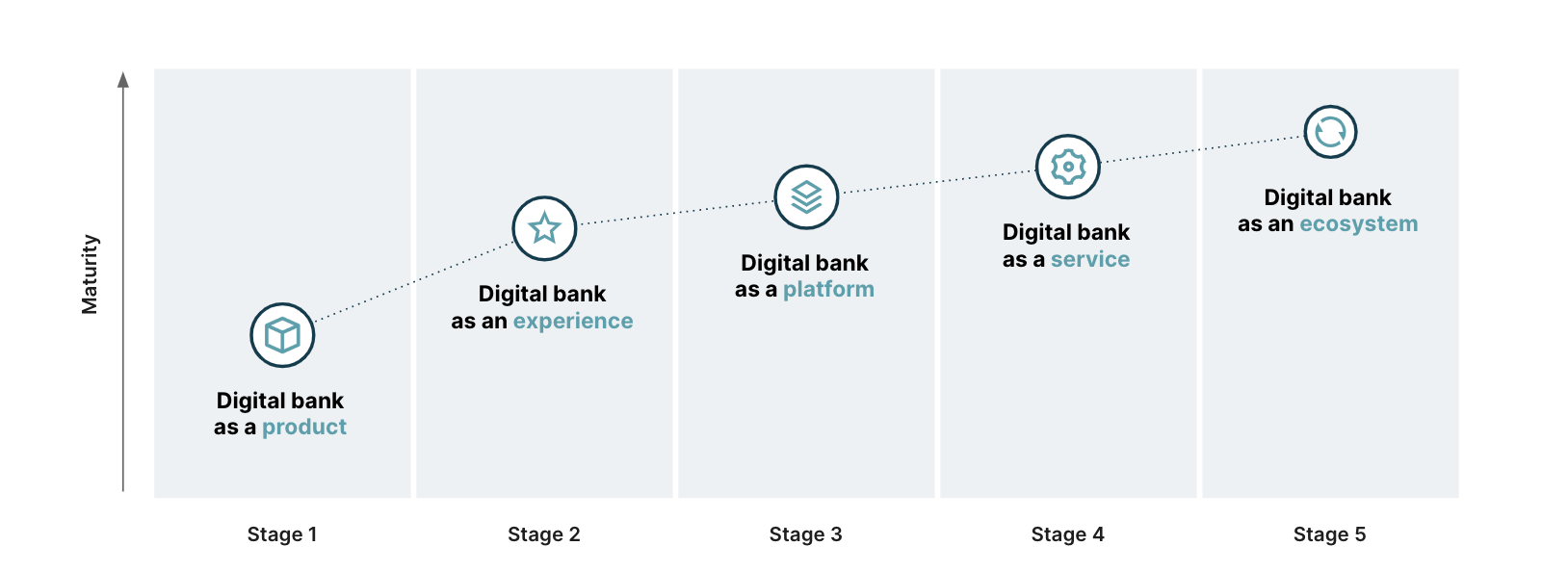

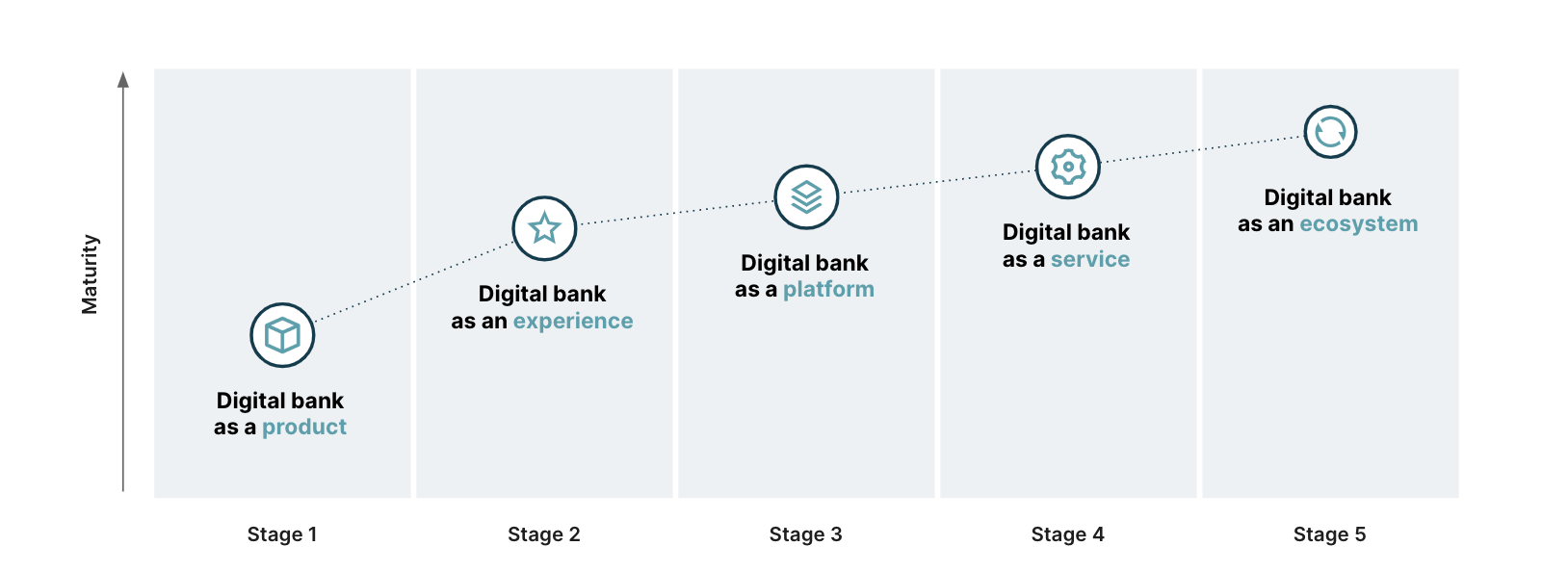

With open banking and the unbundling of banking services, banks are aggressively pushing digital transformation programs. At Thoughtworks, we see this transformation as a five-step journey.

The five stages of a bank’s digital transformation

With Banking as a Service (Baas) becoming the industry norm, we believe it is time for banks to go beyond BaaS given how people are already comfortable with managing all their financial moments digitally. The next state of transformation culminates in an open, holistic, unbiased and personalized ecosystem. Such a banking ecosystem acts as a network of companies, where every company works to deliver value to customers. The two main drivers of this evolution are:

A need for better experiences: when customers get used to great online experiences that are delivered by non-financial service companies, their expectations of the customer experience delivered by banking websites and apps increases. Traditional banks are struggling to keep pace with this trend, leaving unmet demands for other players to address.

The search for a whole offer: this requires the complete addressing of a customer’s need, rather than just delivering a point solution. It means companies focus on delivering an end-to-end customer solution. Increasingly, non-banking companies are stepping into banking services to provide ‘the whole offer.’ Amazon has multiple offerings (in partnership with financial services companies) to create whole offers for buyers and sellers.

Ecosystem participants work in financial and non-financial areas, pushing across traditional banking frontiers to deliver services to customers. The ecosystem includes all the financial moments of the customer journey. The already built platform is now further developed to enable ecosystem partners to publish and utilize each other’s services. Additionally, insights from the ecosystem can be packaged into ‘Insights as a Service’ for partners, allowing them to create customized offerings.

A closer look at banking ecosystems

As a part of their ecosystem strategy, banks need to answer two key questions:

What ecosystems do we participate in?

What role do we play in each ecosystem?

Ecosystems are classified into three broad categories: daily needs ecosystems, life moments ecosystems and purpose driven ecosystems.

|

Daily needs ecosystem |

Life moments ecosystem |

Purpose driven ecosystem |

Services provided

|

Broad range of day-to-day services |

In-depth capabilities for life events (buying a house or car) | Provide services towards advancing a social cause or purpose |

Frequency and value of transactions

|

High frequency, low value |

Low frequency, high value | High frequency, low value |

Market segment

|

Broad | Broad | Niche |

Within each ecosystem we identify three roles for a player (a bank can take on one or more roles):

Lead: leaders own the customer relationship and draw various ecosystem components together with the objective of addressing customer needs.

Participate: participants are constituents who are selling products and services via a platform.

Enable: enablers provide the technology platform required to enable the exchange between customers and content providers.

The first of this four blog series has looked at how banking has evolved over the years to reach its current landscape. We have also categorized ecosystems and their players in a way that helps better formulate ecosystem strategies. In the series, we explore the current landscape through the lens of the ecosystem categories and defined roles.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.