Collaborating for success: An effective approach for fintechs to partner with large institutions

As the market evolves, the winners will be those organizations who adapt their way of working to enable true partnerships, supported by a tech platform that enables collaboration; shifting the relationship from vendor-purchaser to an effective partnership with shared common outcomes and ensuring end customer value is delivered.

To get there organizations need to make adjustments to culture, ways of working and technology.

Current State

An executive at a large Financial Services Institution (FSI) in Australia recently lamented, “we have a history of killing fintechs we work with”. Like an elephant dancing with a mouse, without any intended malice, more often than not a large enterprise will end up suffocating their smaller partners.

All the major banks have investment arms with portfolios abundant with up-and-coming fintechs. Unfortunately, hidden behind those portfolios is a graveyard of failed partnerships that has burnt through many investment funds, which confirms the mutual suspicions held by both sides regarding compatibility.

When it comes to working together, large organizations are afraid of the reputational damage and risk of working with upstart companies that just ‘don’t understand’ the regulatory environment and responsibilities of a ‘serious’ financial services institution. Fintechs in turn proclaim that their agility, product focus and engineering efficiency is out of kilter with large financial organizations which they are quite possibly bad-mouthing in their publicity and recruitment drives.

As word gets out that a large FSI is trying something new with a fintech, more and more internal stakeholders get wind of the initiative and pile in with their compliance and feature requests. Before you know it a simple 2 month trial to test customer appetite has become a 12 to 18 month multi-million dollar behemoth drowning in program managers and steering committees.

What’s broken?

Looking into why this doesn’t work reveals some common patterns of engagement. Large FSIs are used to working in a model of vendor and supplier. The implication of this is that one organization is supplying something and the other is receiving. This works if we are talking about purely the purchase of a good or service, however, it starts to unravel when there is the need and expectation of additional benefits to the relationship from both sides. This is where the concept of a partnership becomes a better model and has a better definition of the roles required by each organization.

The forming of a vendor / supplier relationship is typically slow, painful and expensive and often co-ordinated by lawyers and procurement managers rather than product owners. Due diligence is onerous and difficult for the participants creating barriers to entry and delays in the onset of the engagement.

The vendor-like nature of the relationship means that specified requirements and detailed documented interfaces are often stipulated before working together, leaving no room for innovation in response to what is learnt from the customer.

Win-win-win

So far we’ve seen what doesn’t work, so what do we need to do to address those challenges and foster healthier working relationships? The characteristics of a good, effective partnership will include elements of the following;

- Low friction engagement: The organizations will be able to test the waters and execute on experiments without the burden of up front investments. A simplified engagement decreases the risk while protecting strategic advantages.

- Seamless customer experience: Keeping the end customer front of mind and being conscious of the need for that customer to not have to alter their way of interacting with each organization.

- Complementary features: Adding to that seamless customer experience there is likely to be low, if any, distinction between the user experience of features and methods of accessing those features.

- Appropriate exposure: Exposure of brand and recognition of the partnership enables the two organizations to still have their identities and recognition for what they bring to the experience.

- Clarity around monetization: This is best positioned up front using monetization models that can allow experimentation to continue with reasonable assumptions around the business benefits of investing in the relationship.

- Simple accessibility: Ideally to the point of being self service and self paced.

This is not a new model and there are some great examples of effective partnerships that are already providing win-win-win outcomes.

Several ‘digital native’ organizations have harnessed cooperative models that are reaping benefits for themselves (in customer uptake and core product usage), their partners (in getting more niche functionality to the masses) and end customers (in getting a richer set of features in a product they are happy to use).

Collaboration software giant Atlassian has long harnessed the power of other organizations to supplement their products with features. Confluence allows plugins to be developed and integrated to provide a richer experience in document creation and editing. Atlassian extends this model so that they actually provide a marketplace for the numerous additions. It is quite rare to now see deployments of this product without the enhancements and enrichments provided by other organizations. They have followed similar models with other products in their suite.

Customer relationship management software producer Salesforce has produced a similar model where integrations and plugins help broaden the featureset of the core product and extend the reach of the product to more customers and additional industries. Their open approach and exposed platform has fostered innovation within their product ecosystem and has often bridged the feature gap for customers with specific needs in specific industries.

In software development itself, the integrated development environment Eclipse has become the base platform for many other product-based development environments. This has happened due to their open design and exposed platform.

But where does this leave financial services? With tight regulation and compliance hoops to jump through, surely it has lagged due to these additional burdens and complexities? Well maybe not.

Looking at the Chinese landscape there has been the emergence and prospering of mega corporations Alibaba and Tencent. Major payment platforms like Alipay and Wechat Pay have built up a platform that encourages other organizations to assemble solutions on top and cater for specific customer needs. The concept of ‘Zhong-Tai’ was born from this experience and contains lessons for organizations around the world.

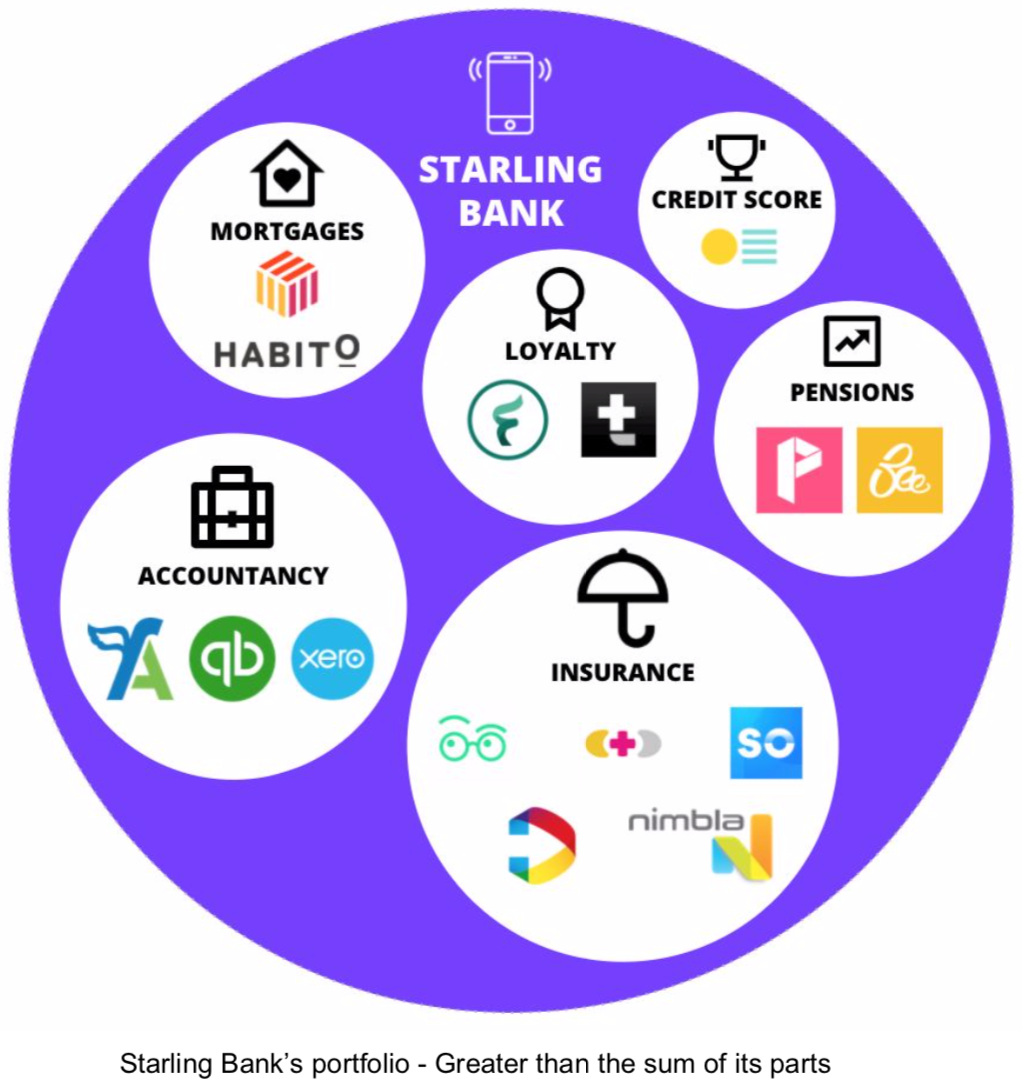

Similarly, Starling bank in the UK has embraced a model where they quickly bring new features to market and allow end customers to choose particular partner organizations to realize some of the functionality that they require. This is still maintained within their core banking application and leverages a common experience.

But how do we get there?

The common aspects of the effective partnerships has been a ‘platform’. Often an overused word, a true platform concentrates on the consumer of the platform. Calling something a platform will in itself not enable success. But there are some common characteristics and principles of a platform that will give it the best chance of fostering partnerships that become effective.

- Open it up: create a very low barrier to initial entry. Understand the consumer of the platform and concentrate on a positive developer experience. Give them the tools and environments to experiment. Make sure it has an effective sandbox.

- Don’t just expose the data: produce a platform for features to plugin. Design for external functionality, expecting it and embracing it rather than just allowing it.

- Build multidirectional interfaces: data will invariably need to flow in both directions to be effective. Understand the timeliness of the data and make considered usage of synchronous and asynchronous interfaces.

- Design for security: for both parties and very visibly to the end customer. Invest in the security model so that it is flexible but well understood. The model should give the consumer the knowledge of how the model works without stifling their ability to innovate.

- Simplify the path to engagement: have existing models for legal diligence and allow monetization to be achievable through simple models. Not everything needs to exist up front, but make it clear what the engagement model does need to look like. Make it attractive to the consumers with reasonable mechanisms for monetizing that can be understood before investments are made.

- Standardize if possible: look to standards but be willing to be a market leader if the standards aren’t there yet. Standards invariably move quite slowly. Understand the direction of relevant standards and take some initiatives that drive it faster. If the ultimate introduction of the standards requires change it is still likely to involve less work than starting from nothing.

- Nurture the platform as a product: this is not a single capital investment that needs to be built, tested and released. This is a living investment that should change and adapt as the market drives it. Use Hackathons, developer incentives, etc. Ensure that you incorporate the feedback.

Extend this with another small slice whilst rolling learnings back in from each iteration. This strategy still requires an understanding of the vision of the platform so decisions made along the way keep an alignment to that vision.

Summary

Fintechs and large organizations working together effectively is often the fastest and most cost-effective way to test new market propositions at scale. All parties benefit:

- FSIs: by accelerating the speed to market and learning customer focus

- Fintechs: who gain access to large client base; and learn the realities of scale and regulation compliance needed to truly succeed

- Customers: who are rewarded with innovative products and features while still protecting their financial security

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.

Related Blogs

-

Digital innovationRisk-based pricing: Strategies for a new reality in bankingLearn more

Digital innovationRisk-based pricing: Strategies for a new reality in bankingLearn more -

Digital innovationBanks confront new customer demands, and the question: When to create or collaborate?Learn more

Digital innovationBanks confront new customer demands, and the question: When to create or collaborate?Learn more -

Digital innovationDigital banking is now for everyone, how will you choose to compete?Learn more

Digital innovationDigital banking is now for everyone, how will you choose to compete?Learn more