Eons ago, one of us (Nag) was involved with a large consumer products company that wanted to launch a new brand of salt. Naturally, they embarked on a gigantic market research (MR) project. The team carried out focus groups across the length and breadth of India, including little Padrauna in Uttar Pradesh, India.

They undertook rigorous quantitative surveys with home makers and restaurants. They asked about their attitudes towards nutrition, observed them cooking and recorded their reactions to our proposed USP - healthy for the heart. By the time the test-market in Hyderabad had begun, they had researched every aspect over a year - name, price, point-of-purchase displays, you name it. Happily, it all worked out - two decades later the brand is still thriving.

Back to the present. We often meet companies led by successful ex-FMCG executives, who want our help in building innovative digital products across industries like travel, eCommerce and banking. Why not start with extensive market research, they ask. “Let’s take uncertainty risk out, especially since the idea is unproven,” one executive said. However, empirical evidence from the digital world is against them.

Digital native companies favor hypothesis-driven approach

The canonical case - Instagram. There were several photo apps prior to them, including Nag’s favourite, Flickr. The creators of Instagram would have struggled to accurately describe what was so unique about their proposition. Focus group attendees and survey respondents would not have got the picture, so to speak. Certainly not well enough for their inputs to be of much value.

What Instagram did was invest in minimal upfront market research and launch. The rest, as we know, is history.

Consumers took to Instagram because the filters made their photos look good, and sharing right from their phones was suddenly super-easy. Even as a business worth billions to its parent, Facebook, Instagram’s little to no-MR approach continues. When they want to introduce a new product feature, they take it live for a sample group of their enormous user base, watch for feedback and then make necessary tweaks before a global launch or going back to the drawing board. In doing this, Instagram leverages what’s popularly called the Build-Measure-Learn (BML) approach. We shall return to it.

Which approach is right for you? The 10 dimensions to investigate.

Executives aren’t wrong in wanting to reduce risk. Millions are at stake, and, more so during a crisis like the one we currently find ourselves in, budgets are not easy to come by. In fact, both MR and BML (which includes user research) are ways to reduce risk, and improve odds of success.

Which approach is right for a digital offering? The answer may have been clear-cut for a purely digital product like Instagram. But, many digital products do have an offline component. A peer-to-peer delivery service may have a strong digital footprint while still requiring the back-end logistics of say, a supply chain.

Here's our guide that covers the 10 dimensions you need to investigate when navigating the launch of your digital product -

How quick is your market or industry’s pace of change?

How dynamic is your industry or the market you function in?

(players, consumer tastes, ecosystem, regulatory atmosphere etc.)

How mature is the market?

Are you creating a new market or capturing share in an existing one?

Does your product serve a well-known and well-understood need?

Can people easily imagine what you are proposing to create?

What’s your GTM budget?

How much can you earmark for pre-build/pre-launch research?

How complex is your product? (number of moving parts in the 'whole product', sophistication of the user interface etc. )

How effort intensive is creating a minimally viable offering of your product?

For eg. creating a prototype of an automobile is effort intensive and expensive. However, an MVP of an app for automobile users to buy car accessories or schedule a service could be far simpler.

Is there potential for network effects?

Does your product gain value as more suppliers and buyers buy into it?

For eg. an app that merely moves an existing offline service, online (like paying a bill) may not benefit from a network effect. However, the value to a user of a social networking app, exponentially increases as more users buy into said app.

How cost and effort intensive is triggering adoption for your offering?

Does it require a massive nation-wide marketing campaign and distribution or is there potential for virality?

How easy is it to evolve your offering post launch?

(feature updates, versions 2.0 and more)

How stable is the socioeconomic environment over the next few years?

If you find that your answers to these questions largely veer towards the right blue side (which in likely the case for most digital offerings), chances are you are better served by investing your time and money into getting your ideas out into consumers hands to test their responses, rather than commissioning time-consuming and expensive market studies. This is not to say that it is necessary to jump in heads-first with no research whatsoever. Rather, we want product owners to base the scale and value of such research on the intended product-objective.

For instance, perhaps you have an idea in your head that you’d like to test out with consumers, but in order to do that, you’d like to have some insights to even articulate your hypotheses and maybe decide which user segments you’d like to test this out with. Often, this can be achieved by secondary research - spending a short time-boxed period assimilating consumer studies and reports from reputable sources, understanding the competitive landscape (if there’s any), reasons for any past failed attempts etc. Once you have this basic understanding in place, you can move forward quickly validating your hypotheses with your target user segments. There could be multiple approaches to doing this - in the next section we’ll talk about one approach we like to adopt when creating new digital B2C offerings.

Most Tech@Core ideas are best validated through Build-Measure-Learn

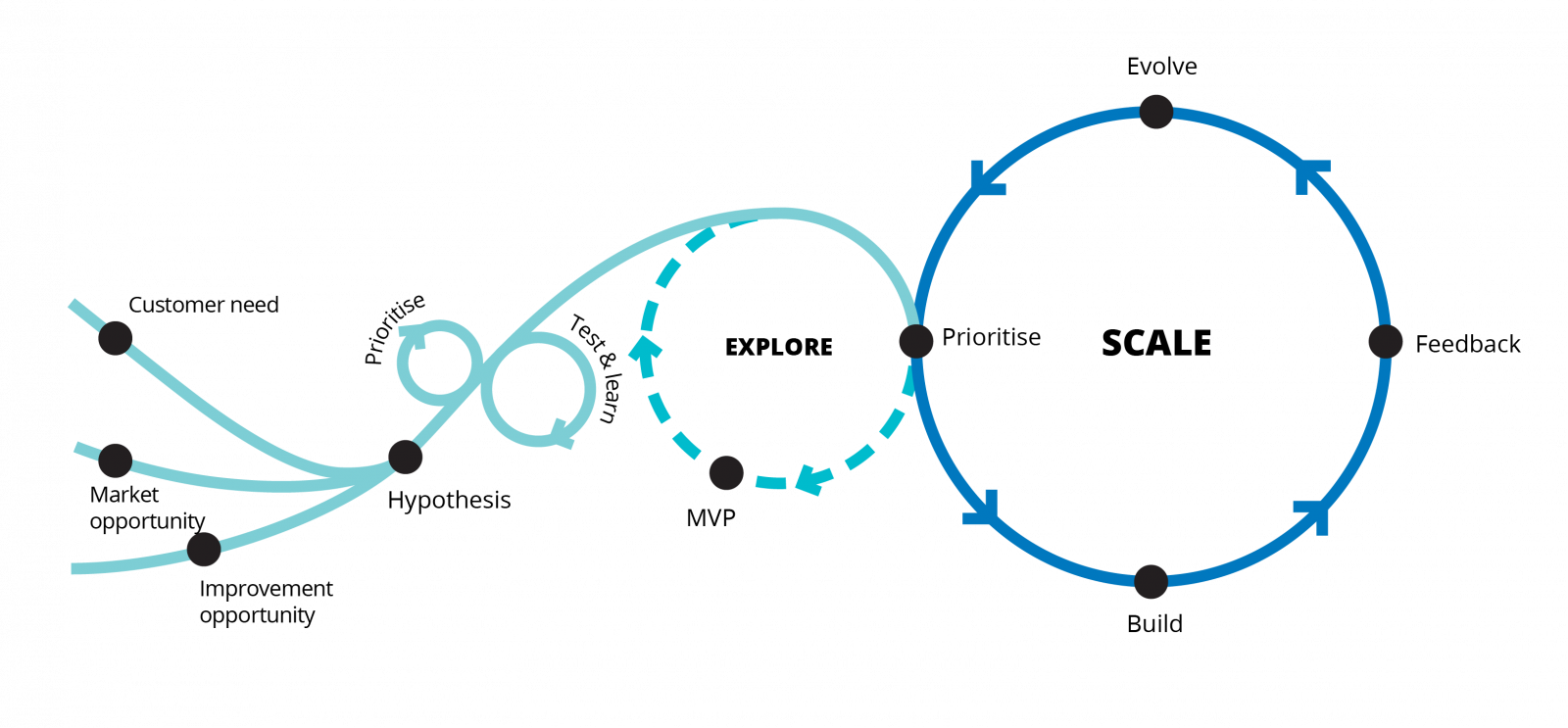

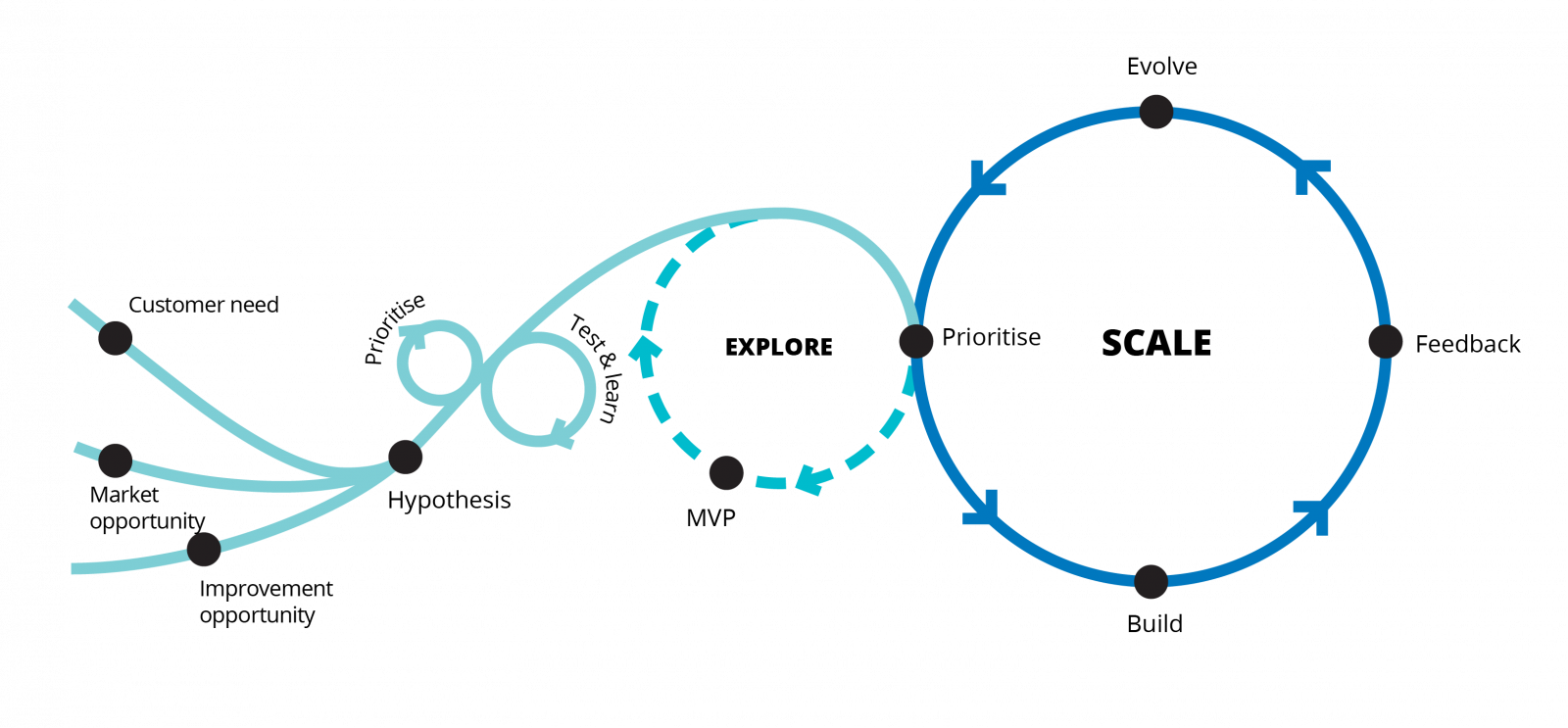

To an executive that cut their teeth in a traditional business, the Instagram approach might look like a dangerous, “figure it out along the way” approach. But, there is a method to the madness. Underlying is an important insight: digital products are best validated through real-world usage. You begin with a hypothesis about your offering, make a minimalist version of the product, put it in front of your customers for feedback, and make rapid changes till you get it right.

The method has become de rigueur in the digital world. The toolkit is rich - two examples are business model canvas and A/B testing which allows you to rapidly tweak one variable at a time in response to customer feedback.

A method suited to digital-heavy offerings

Start with a customer insight and a vision. Six weeks of market and user research. Form a hypothesis to validate. Invest time and energy in making it to market as fast as possible with an MVP, which allows you to get customer feedback. When you get your “formula” right (which hopefully will be sooner than later), scale the product. The key is to have the tech infrastructure to support rapid experimentation.

One effective manner of testing and validating hypotheses for digital customer-facing experiences, is via a phase of rapid prototyping. This involves planning a time-boxed design sprint in which medium-fidelity visual designs of the proposed solutions/customer journeys are created and packaged for quick testing with the identified target segments.

Some of the key benefits of this approach are -

It ensures quick feedback on a divergent set of ideas with different user groups at a relatively low-cost, low-risk manner, before converging and investing more time and resources.

Through this process, you may unearth brand new pain points that you did not know even existed, allowing you to refine your ideas to resonate more with your target audience.

You can validate hypotheses and insights around needs and demand for your solution. Some of these hypotheses might have been driven by anecdotal evidence, secondary research, gut feel etc. This phase helps you sense-check some of those possible assumptions and potential demand for your solution.

Often ignored, the value of medium-fidelity prototypes extends beyond target group feedback. They can also help you align and inspire other teams or individuals within your organization, investors, strategic partners etc to rally behind your cause. The more aligned you are early on in the process, the higher your chances of giving your idea the impetus it needs to succeed.

By the end of this phase, you should have a fairly good view of your product, in a very short period of time with minimal investment.

This allows you to define your MVP fairly quickly and then look to get working software out into the hands of your consumers for real on-the-ground feedback that will loop back into your iterative development process.

So, we jump ahead to building a product? Isn’t that financially risky?

We see it as just the opposite. Remember the 10 dimensions we asked you to evaluate earlier? If you found yourself on the blue side of things, more often than not, a build-measure-learn approach could yield a better return on your investment. Contrast taking all the time and money you might spend on months of extensive market research, with using it instead to get real market-tested results to work with.

So, if you’re concerned with the financial risk of what seems like a “leap before you look” method, do not think about build-measure-learn as eschewing research in order to rush to market. Instead think of the investment in prototyping and building an MVP as a different approach to customer research, one which could, with comparable time and resources, give you a real-world understanding of your customer, while at the same time getting your product out quicker to market. In a world as increasingly digital as ours, speed is of the essence.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.