Value-Driven Digital Business

History is rife with inflection points, like the Brexit decision in the United Kingdom, or the 2016 election in the United States. Sometimes these events are instantly recognized as historic turning points, other times recognition comes slowly. One such slowly evolving inflection point began in the early 2000’s and has accelerated in the last 5 years—the transition from a cost-driven view of IT to one that is value-driven. We could also characterize this inflection point as changing focus from efficiency to responsiveness.

In 2003 Nicholas Carr wrote a controversial article in the Harvard Business Review titled, “IT Doesn’t Matter” [1], arguing that IT had become a commodity and therefore could not contribute to sustainable competitive advantage. Ten years later, Rita McGrath, professor at Columbia Business School, wrote that in today’s fast-paced, uncertain world that sustainable competitive advantage itself was no more, being replaced by transient competitive advantage in which learning and adapting quickly was the ticket to success[2]. In Carr’s world, technology should be governed by cost considerations. In McGrath’s, responsiveness and value should drive technology.

The problem is that while CEOs strategize about becoming digital businesses, their IT departments are still mired in processes, practices, and success measures developed for a cost-control world. In a cost-control culture the bulk of investment dollars are inwardly focused on such areas as accounting, reducing distribution costs, and efficient manufacturing—with external customer focus being mostly an afterthought. The height of this internal focus was the mid-1990’s infatuation with Business Process Re-engineering (BPR).

To begin moving from a cost-centric to a value-centric view of technology, you need to start with a comprehensive way of discussing and measuring value.

Clarifying Value

Wikipedia defines business value as an “informal term that includes all forms of value that determine the health and well-being of the firm in the long run. Business value expands concept of value of the firm beyond economic to include other forms of value such as employee value, customer value, supplier value, channel partner value, alliance partner value, managerial value, and societal value. Many of these forms of value are not directly measured in monetary terms.”

Cost is one dimensional. It is measured in quantitative, monetary terms—dollars, euros, pounds. Value is multi-dimensional. It can be quantitative, as in monetary, or qualitative, as in “stylish” for clothes or “safe” for cars. Many managers and executives who come from cost-driven cultures have a difficult time with qualitative value measures and, therefore, tend to grasp for quantitative measures of activity to describe the qualitative value they seek. They fear losing control. This might be an issue if value-based management operated on the long traditional planning and execution time scale, but it doesn’t. The operating model for value-based management is inherently iterative and moves at a substantially faster pace providing rapid feedback to validate your decision making. In other words, it is more responsive.

Value measures are harder to describe than cost, but that isn’t a reason to abandon value measures. Measuring and allocating cost, from the lowest level to the highest, is relatively easy while doing the same with value isn’t. Cost can be determined for a day’s work (8 hours x $yy/per hour) or ordering price for a widget and assigned to a project, a department, or a product. Costs can then be “rolled up” to divisions, product lines, programs, etc. Extensive cost accounting practices are an integral part of most organization’s financial management. It’s time to put the same emphasis to value accounting.

In a value-driven portfolio management process, for example, you may: 1) have different value dimensions for different segments of the portfolio, and 2) rank initiatives relatively. New business initiatives might be “valued” in customer interest (number engaging with an online offer for example) versus a legacy system upgrade that might be valued on cost savings or reducing technical debt.

Granted, assessing value at the same precision as cost is difficult. However, once an organization commits to value-based prioritization, they become creative at figuring out how to accomplish it. You have to become adept at finding value metrics for smaller increments of work, often using data science. Furthermore, fuzzy measures of important things are better than precise measures of unimportant things.

Business Benefits and Customer Value

There is another dimension of value analysis that is proving highly beneficial to enterprises—separating the ideas of customer value (external) from business value (internal). Separating these concepts is so important, we have begun using the terms “value” for customer value and “benefits” for internal business value. As an example, let’s say your company sells outdoor equipment. A benefit-oriented outcome might be “to increase customer sales of hiking boots” while a customer-value outcome might be “to hike in the outdoors, in a variety of weather and terrain conditions, in comfort, stability, and style.”

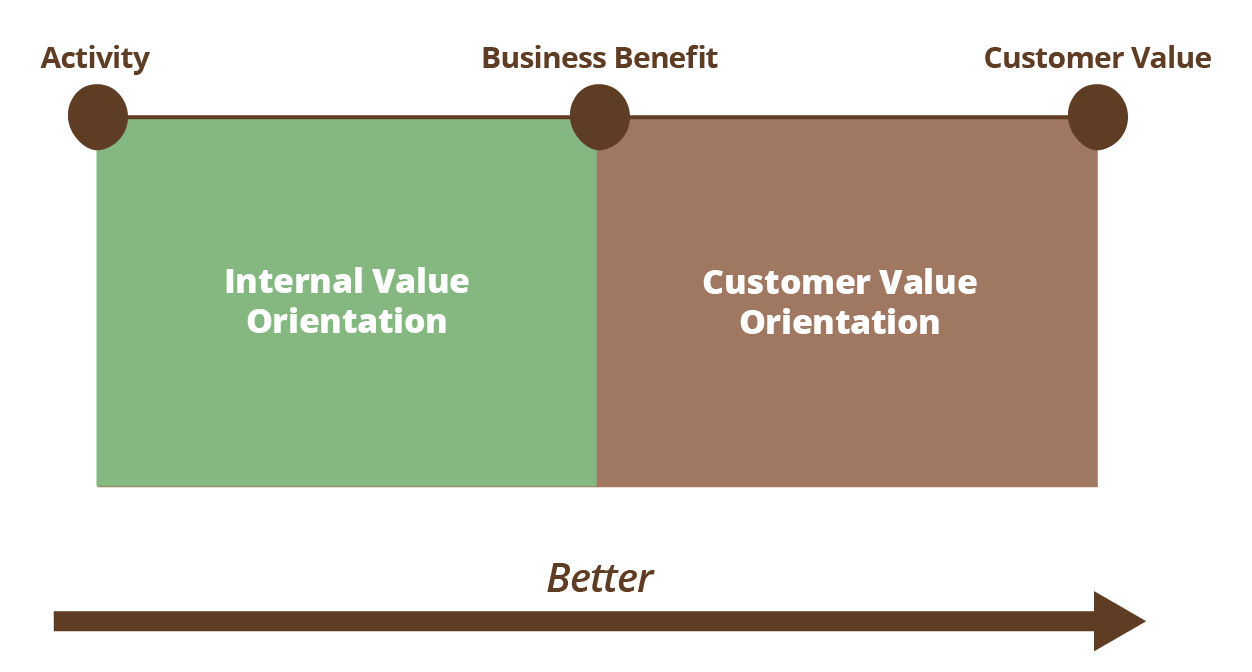

You can postulate a spectrum of value “measures” from activity, to business benefit, to customer value. Obviously, measures of customer value are most useful and activity measures least useful in describing the desired outcome. Unfortunately, many organizations use activity measures (for example, velocity in software development or number of impressions in marketing) that rarely correlate to value. It would be like measuring an author’s worth by measuring typing speed. Moving across this spectrum of measures isn’t easy, it isn’t straight forward, but it is necessary to build a value-driven organization.

Measures of success should be as Customer Value oriented as possible.

We believe that measures of success should be as customer value oriented as possible. One benefit of describing value in this way is that you think from a customer perspective first. Rather than thinking first of how to increase sales, you think about how to deliver value to your customer. The assumption is that there is a greater likelihood that increasing customer value will generate business benefits than thinking of business benefits first will generate increasing customer value. Value, using this definition, helps us focus on the external customer experience rather than the internal benefit. The better we understand what constitutes a great customer experience, the more likely we are to create value for the customer and in turn benefits our business. Using the outdoor equipment company example, rather than thinking first of how to increase sales, you would think about what constitutes customer comfort—and realize that sock choice may be as important as boot choice.

An example of the internal/external focus difference arises in interface design. As any long-suffering internal system “user” will complain, “the user experience with this application is really awful, but we have no choice, we have to use what IT gives us.” External users are completely different—design a poor customer experience and they just go elsewhere.

Value-centered cultures looks outward to customers first, building systems that enhance customer experience—giving rise to interest in such topics as UX and design thinking.

Potholes and Pitfalls

Over the last decade there has been a growing interest in value management, particularly in the lean and agile communities. Lean practices, value mapping for example, have emphasized value versus non-value adding activities. Agile practitioners have developed practices for measuring different kinds of value and allocating those values to successively smaller increments, from business and customer outcomes to individual software features.

However, many organizations haven’t understood the profound changes required to move from cost-based, internally focused IT to a broader technology operation that is value-driven and externally focused. Planning and strategy need to change. Organization structure needs to change. Technology delivery practices need to change. Portfolio management needs to change. Measures of success need to change. Transitioning from a cost-driven, to a value-driven culture is much more difficult than it first appears. It’s not that cost containment isn’t important anymore; it’s just that it isn’t the most important—it isn’t the primary objective.

As with any new approach, there are potholes and pitfalls to keep in mind while making your transition.

Learning versus Planning

In complexity theory there is a concept called the Edge of Chaos. This “edge”, lodged between randomness and structure, is where maximum learning creates an environment for innovation. Balancing on this edge requires everyone work in a messier, exciting realm where uncertainty is embraced and solutions may be ephemeral. It is not a safe place, but it is the place where organizations will invent the future.

In the past, prescriptive planning was de rigueur. Today, it is insufficient, and maybe even dangerous. Certainly plans are important; you need to envision a future state. But you need a different attitude about planning—one that embraces frequent and sometimes significant change as an integral part of learning. Jim has labeled this approach as one of Envision-Evolve rather than Plan-Do. This Envision-Evolve cycle can be characterized by shrinking upfront time (we’ll correct later), coming up with measures of success that enhance learning, and using a fast, iterative learning cycle. Traditional Plan-Do approaches usually have a long Plan cycle and a long Do cycle that minimize opportunities for altering the plan and may even discourage team members from course correcting, even if it makes sense to do so. In the Envision-Evolve approach, fast iterations minimize time spent going down the wrong path.

An issue with cost-driven cultures, particularly in today’s volatile world, is that they tend to be slow to change. They are not completely unchanging, but plan changes are limited to small “adjustments”. Value-driven cultures, on the other hand, are designed so they can, if needed, pivots in significant ways and do so quickly. Cost-driven cultures tend to be prescriptive—as in “plan the work and work the plan.” Value-driven cultures are constantly asking—would another direction improve our value delivery?

Portfolio Management: Fostering Innovation

Between strategy and execution lies the netherworld of funding. Traditional portfolio management processes attempt to predict future ROI based on predetermined plans.There isn’t anything wrong with ROI used in the appropriate circumstance. However, there are other measures better able to inform decision-making for innovation. To foster innovation, portfolio priorities need to be based on a hypothesis of value creation and described by customer-value oriented measures of success. In this way, we move from predicting value to exploring opportunities to maximize value.

What we need is a more dynamic approach to portfolio management, one that is fast, lightly governed, managed by collaborative decision making, iterative, and value-driven. We should be driven by what’s the next most valuable initiative to undertake, not the initiative that was “planned” 18 months ago. Many companies have articulated a reasonable future digital strategy, but their funding allocation doesn’t reflect the new strategy. Politics and old processes often thwart the best intentioned strategy. Many of the “agile” scaling frameworks have perpetuated these traditional approaches.

Because value is multidimensional—internal versus external, quantitative (monetary) versus qualitative (customer satisfaction)—it is preferable to prioritize investment alternatives on a relative basis. In value-driven portfolio management you prioritize initiatives (projects, programs, and products) based on the relative value of each initiative (it’s faster, less time consuming and accurate enough) and monitor progress by measuring actual results. Practices like this contribute to a lighter weight (greatly reduced effort) approach to portfolio governance that is at the same time more effective at funding the future.

Paradox, not Problem

Most multi-dimensional issues are not problems to be solved but paradoxes to be managed. Problems tend to have singular solutions—do this, or that. Paradoxes are harder; they envision a range of responses depending upon context and situation. Being value-driven doesn’t mean ignoring cost just as being cost-driven didn’t mean ignoring value. Being value-driven means making value the primary objective and cost a constraint. The essence of paradox management is finding the right balance point, one that shifts from time to time as organizations adapt to the future. Similarly, the balance between planning and evolving isn’t a problem; it’s a paradox to be constantly managed. Value versus cost isn’t a single dimensional problem to be solved once. This paradox shifts back and forth over time as organizations evolve and external factors impact decisions.

Fuzzy Numbers Lead to Fuzzy Action

Some managers are concerned that fuzzier numbers lead to fuzzier actions, and they are more susceptible to manipulation or question. Some values, especially those measured qualitatively, are difficult to compare and are subject to manipulation by those assigning value. Relative value scoring may also lead to manipulation by leaders if they are operating in a traditional control culture. The chances for manipulation will diminish as you get better at defining and measuring key outcomes, and we need to remember that “all” measurement systems are prone to manipulation, especially if they are intended to punish rather than enlighten. This “gaming the system” can be controlled by utilizing measures of the actual value created after the fact to drive decisions to continue investment or pivot. You don’t assume all is well because you are “on plan”, we require a steady stream of evidence to support future decisions.

Conclusion

We are not in a Nicholas Carr world anymore; we are in a Rita McGrath world. Cost-driven organizations continue to get incremental outcomes in a world of exponential opportunities. Technology needs to move rapidly from a mechanism to reduce internal costs to being the cornerstone of building digital enterprises. Enterprises making this transformation need to abandon the restraints of a cost-driven strategy and open the future by striving to create value—first for customers and secondly for the enterprise. However, it is not a transformation for the faint of heart. It requires abandoning your practices, processes, and measurements that have stood the test of time. It requires your technologists to deepen their understanding of what creates value in your organization. Your technologists and business colleagues must learn to co-create the value your customers want and the business benefits it yields.

Resources

[1] Harvard Business Review, May 2003.

[2] (McGrath, 2013) The End of Competitive Advantage: How to Keep Your Strategy Moving as Fast as Your Business. Boston: Harvard Business Review Press.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.