Digital innovation

Economic crisis: an unusual catalyst for financial inclusion

Primarily, there are three kinds of instant payment mechanisms that differ from one another in small but significant ways:

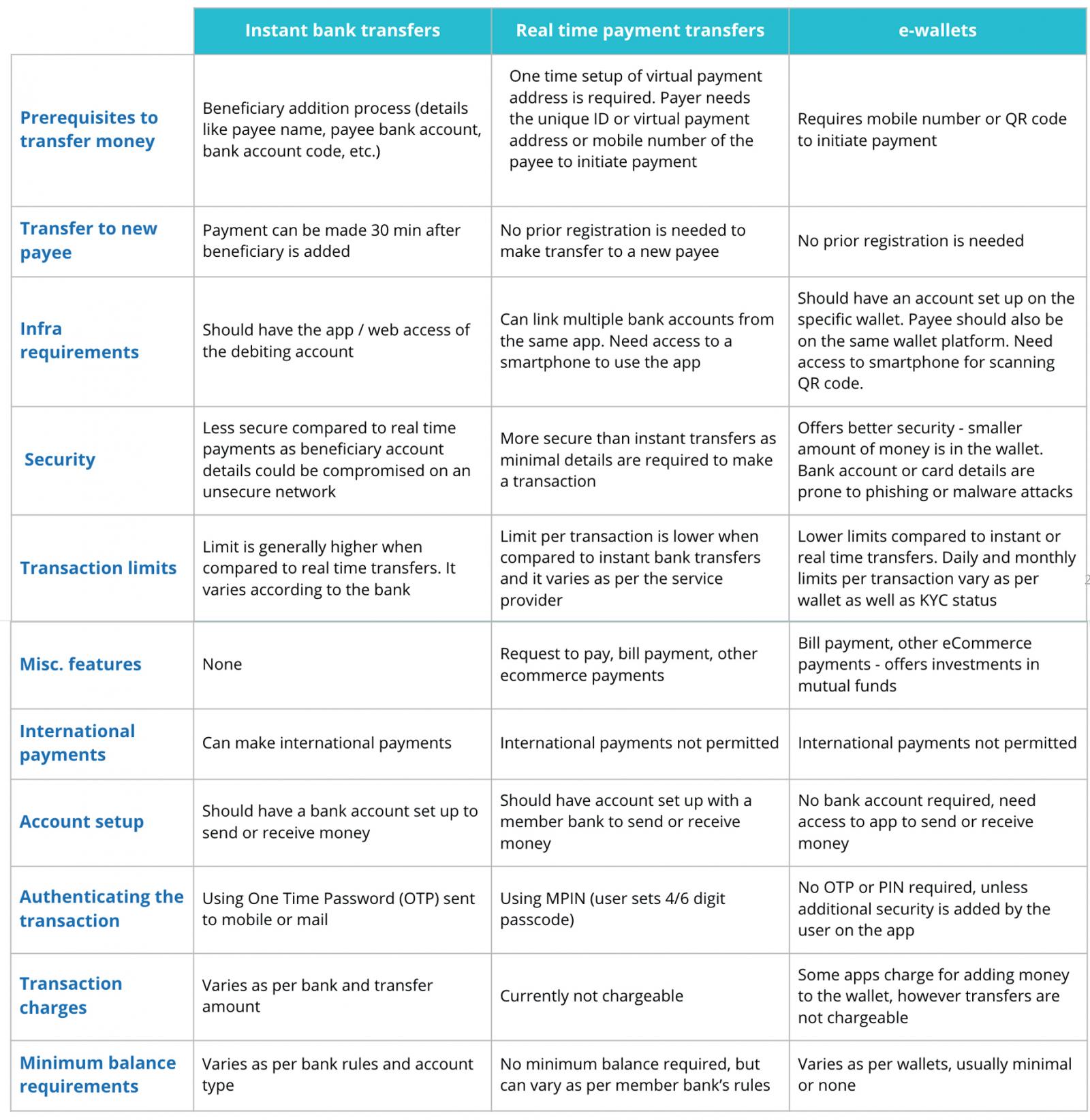

Here are the key characteristics summarized below:

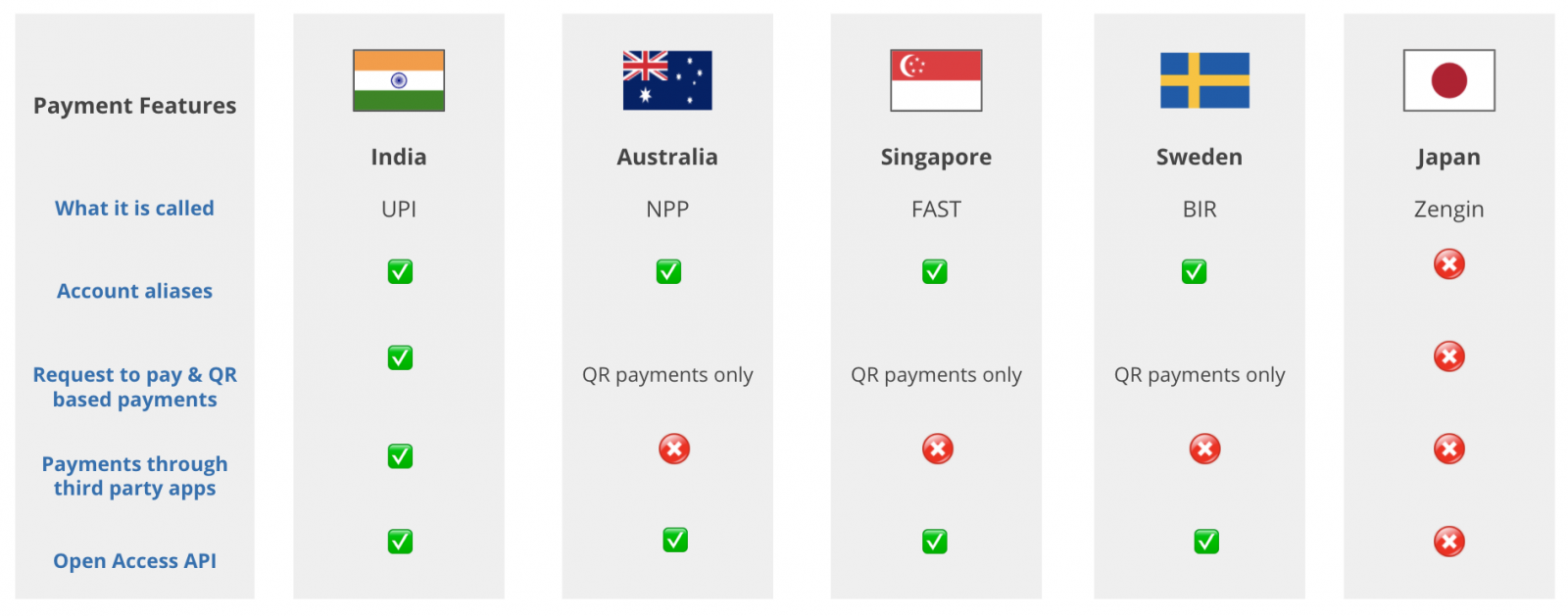

Instant payment infrastructure is currently live in 56 countries including Singapore, India, Poland, US, etc. Over the next few years, 5 more countries - Canada, Peru, Indonesia, New Zealand, Colombia are expected to offer instant payments

Instant payment infrastructure is currently live in 56 countries including Singapore, India, Poland, US, etc. Over the next few years, 5 more countries - Canada, Peru, Indonesia, New Zealand, Colombia are expected to offer instant payments

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.