Over the last decade, the traditional acquirer processing model has evolved to become a more commoditized and less profitable business. On one hand, merchants are looking for advanced service providers that can offer services beyond the standard processing functions; on the other hand, players in the merchant acquiring fields are looking for opportunities to expand progressively and capture more value chains.

According to the Global Digital Payment Forecasts Report 2022, global cashless transactions are expected to grow at an annual rate of approximately 18% from 2020 to 2025. By 2025, the volume of non-cash transactions in the global market is predicted to exceed $800 billion.

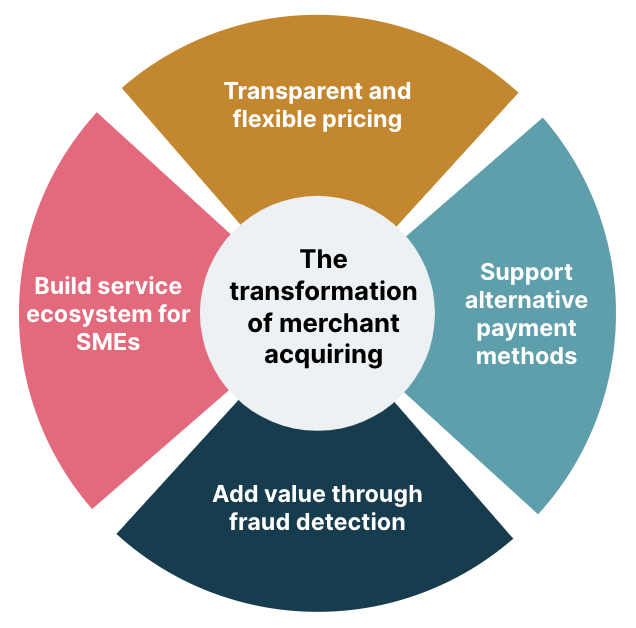

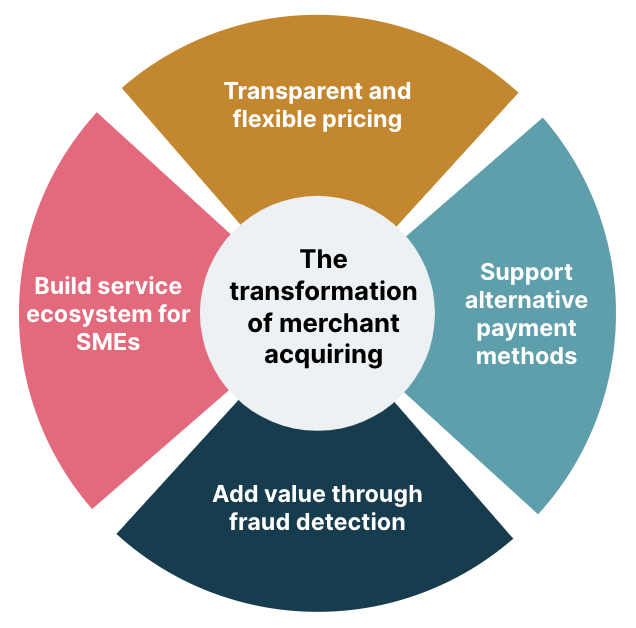

To capitalize on the opportunities created by increased demand and digitization, merchant acquirers should consider implementing the following four strategies.

1. Transparent and flexible pricing

Pricing models for card processing can be confusing, particularly when it comes to the two main pricing concepts: blended rate and Interchange++ rate.

A blended rate is based on a fixed rate of the gross transaction, which makes it easier for small to medium-sized merchants to forecast the cost in their budget and protects them against cost swings. However, from the acquirer's perspective, the worst case scenario would be losing money if the rate itself (which is always 0.25% of the gross transaction) isn't sufficient to cover the interchange and scheme fee costs.

The Interchange++ rate is based on the following formula: interchange fee + scheme fee + 0.5% of the gross transaction. It is the most transparent pricing model, as it allows the merchant to see exactly how much they would pay to each party during the transaction, providing valuable information for building pricing strategies. This model is subject to cost swings and is therefore better suited for more established merchants.

So if a merchant were to process a transaction for $100 using Visa, the cost for the merchant with a blended rate would be $2.5 while it would be $2.11 with the Interchange++ rate. Meanwhile, the acquirer revenue would be $2.5 (interchange fee - scheme fee) while it would be $0.5 with the Interchange++ rate.

Merchants that are part of larger groups can negotiate scheme fees with Visa, Mastercard, or Amex. This is particularly appealing if the acquirer can apply the actual/negotiated scheme fee for the members of these merchant groups along with offering least cost processing methods, all of which could be lower than the standard published fee.

2. Highly integrated systems that can support alternative payment methods

Alternative payment methods refer to any kind of payment that isn’t cash or a major international credit card brand. For example, mobile wallets, real time bank transfers, direct debit etc.

Customers decide not to complete a purchase for different reasons including the unavailability of preferred payment methods. This leads to cart abandonment. With cart abandonment rates already averaging almost 75%, merchants should support as many alternative payment methods as possible and acquirers should allow merchants to add the latest payment methods at speed without introducing new complexity.

The popularity of these payment methods varies greatly by location. In China, for instance, mobile wallets (specifically WeChat Pay and Alipay) dominate the market; while in the Netherlands, iDEAL has 83% of the market share. Despite the increasing popularity of alternative payment methods, it is still difficult for merchants to decide which payment method is worth offering to their customers. It is the merchant acquirers' obligation to research preferred payment methods and recommend wisely. Acquirers should provide the full payment technology stack to best support merchants.

3. Build a service ecosystem for SMEs

Nowadays, SMEs (small and medium enterprises) are increasingly aware of the importance of adopting digitized methods to reduce their administrative burden and costs. Merchant acquirers should provide service ecosystems for SMEs, as it would remove many existing pain points.

Offer a ‘business-in-a-box’ solution

The revenue of fundamental payment processing services can be limited for an SME due to the costs involved. But there are profit growth points if additional services such as accounting, cash flow management etc. can be supported. Depending on their level of financial digitizing, different SMEs need different services from acquirers. Start-ups might require the full package, while existing customers might just need these additional services. The one constant is that having everything taken care of on a single platform and with a preferential fee is always easier. Essentially, it’s time for merchant acquirers to offer a ‘business-in-a-box’ solution where additional available APIs can be easily integrated by SMEs based on their needs.

Furthermore, due to the wide range of SMEs and the limited commonalities across various industries, it is imperative for merchant acquirers to possess specialized knowledge in each field when developing services. While some features may be applicable to all businesses, it is essential to tailor them to specific merchant categories, such as restaurants, retail and hospitality. Even within the same industry, the size of the merchant can significantly impact their needs.

Easy and fast onboarding process

Small business owners often have limited time and prefer turnkey solutions that can be implemented quickly, rather than time-consuming setups. One approach to address this issue is to introduce a simplified "merchant code" specifically designed for SMEs, instead of a conventional point-of-sale configuration.

4. Adding value through fraud detection

Potential fraud in the form of charge-backs is a big risk for merchants, as it can jeopardize their cash flow and even lead to bankruptcy. This makes fraud protection in the acquiring process very valuable.

Online businesses are particularly vulnerable to this kind of fraud, so acquirers need to monitor them closely, particularly high-risk retailers. One thing they can do is to make sure these businesses are assigned with the correct MCC (merchant category code) so that card issuers can use MCCs to categorize, track or restrict certain types of purchases. Having fraud investigation teams in place to protect merchants against charge-backs is something else acquirers should do.

With the recession, insider fraud has increased, making it even more important for acquirers to identify fraudulent card usage at retailers. For example, if an acquirer detects that a large number of refunds have been processed by a single POS in a short period of time they should alert the merchants to help them quickly take action against possible inside fraud.

Conclusion

With the continuous growth of global cashless transactions, acquirers can differentiate themselves from competitors by providing transparent and flexible pricing models, supporting alternative payment methods, building service ecosystems for SMEs, and adding value through fraud detection. Implementing these four strategies can help acquirers seize fresh new opportunities and regain profitability.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.