Digital innovation

COVID-19: Banks recalibrating for the future

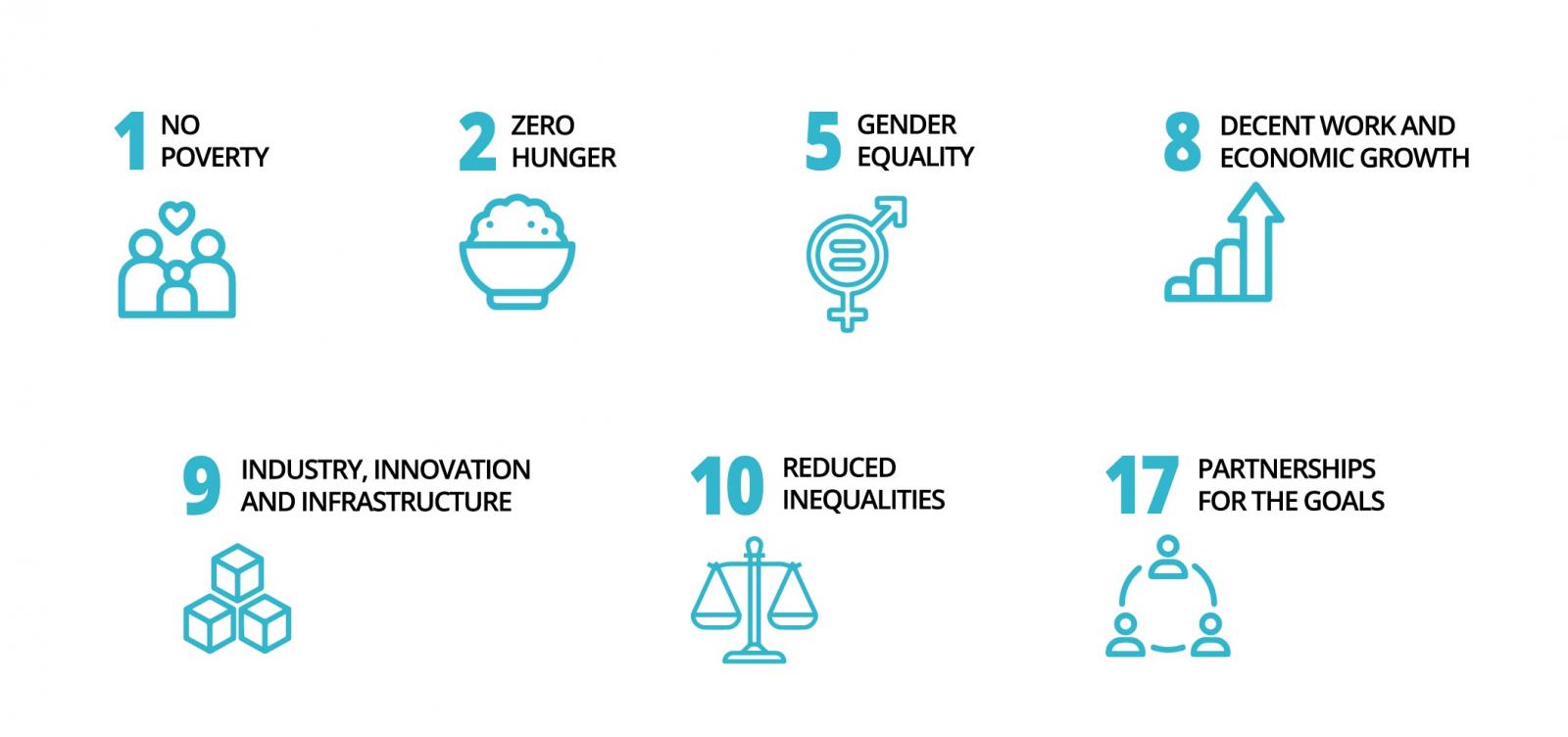

Source: Sustainable Development Goals

Source: Sustainable Development Goals

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.