The rapid shift towards digital banking is often touted as a solution for accessibility. But realities on the ground tell a different story.

A MasterCard study shows 28% of banks in developed countries are still inaccessible to people with disabilities. Many banking websites and mobile applications are not designed with universal access in mind; by some estimates, almost 60% of banks worldwide are failing to meet basic digital accessibility requirements. Rather than enhancing inclusion, digital banking can create new hurdles, from problematic color schemes to complex interfaces, that present challenges for people with limited dexterity or visual acuity.

This points to a missed opportunity, not just in terms of inclusivity and impact, but also for banks’ bottom lines. The World Health Organization estimates that 15-20% of the world’s population has a significant disability — a group with a collective spending power of US$13 trillion. With the global population aged 60+ expected to top 2 billion by 2050, demographics will also mandate more accessible approaches. In some markets, accessibility lapses come with a heavy cost. Over 4,000 lawsuits were filed in the US alone last year targeting websites or apps that allegedly presented barriers to people with disabilities.

Driven in part by such factors, we’ve seen a proliferation of accessible technology, with AI-enabled smart glasses, cutting-edge bionic limbs, smartphone-compatible braille keyboards and other innovations hitting the market. Banks, too, have been rolling out solutions like voice-enabled POS terminals to extend the accessibility of their services. For financial services, one emerging technology could prove an accessibility game-changer: neurotechnology and brain-computer interfaces (BCIs).

While the field is nascent, it is expected to grow from just $1.74 billion in 2022 to over $6 billion by the end of the decade. By allowing a person to control external devices using only their brain signals, BCIs promise to vastly enhance the accessibility ecosystem. Individuals with severe motor limitations or multiple impairments who struggle with physical or voice commands, even when using assistive technologies, will be able to make and execute financial decisions independently. Importantly, BCIs could also enable significant leaps forward in security and experience for a broader segment of the banking customer base. This paper will explore what BCIs involve, where the technology stands and how financial institutions can prepare for the transformation it will bring.

The strategic imperative: Potential use cases

While BCI technology is most mature in healthcare and gaming, promising use cases in these sectors bolster optimism that "neural banking" is both a realistic prospect and can enhance the inclusivity of financial interactions.

A June 2025 research paper by Utsav Gambhir of Bentley University suggests that brain signals might communicate a person’s perceptions of risk and confidence about a decision before these become conscious awareness. This indicates that finance-related thoughts create unique neural patterns that can be detected and measured using technologies like functional magnetic resonance imaging (fMRI).

While fMRI technology is typically found in labs, more accessible, portable and non-invasive BCI technologies like wearable electroencephalography (EEG) and magnetoencephalography (MEG) headsets can also work with neural patterns.

Within the financial industry, institutions like J.P. Morgan have acknowledged the potential of "pay by brainwave" technology. This could make it possible to eliminate physical payment methods completely and significantly streamline transactions by identifying specific neural patterns around payment intent.

A 2025 study found that BCIs offer a more efficient and natural means to perform banking tasks, like processing business transactions, tracking accounts and performing security checks. Neural banking achieves this through two key innovations:

Direct neural control: Imagine a financial transaction being as immediate and intuitive as a thought. Neural banking allows for direct thought-to-action execution, creating an effortless user experience with no physical action required. For payment security, neural banking does more than simply nudge customers toward better decisions; it enables "intelligent friction," where the system can differentiate between low-risk transactions like buying a coffee, and high-risk decisions that require extra cognitive engagement and protective measures.

Brainwave-based authentication: Traditional security methods constantly struggle to keep pace with increasingly sophisticated fraud techniques, but brainwave-based authentication could render these obsolete. A person's unique neural signature can’t be forged, which makes it a new gold standard for identity verification. This technology can also monitor brain signals for signs of stress or coercion, acting as a critical safeguard against forced transactions.

Potential applications aren’t limited to security or user experience. Based on neurofinance research, neurotechnology could theoretically detect even subconscious emotional states or cognitive biases during financial decisions by monitoring how specific brain regions are activated. Early detection of emotional influences could alert users to pause and reconsider significant transactions, for example, by identifying when stress or fear is overriding rational analysis. While significant technological advancement will be required to make this a reality, it could represent a massive boost to financial decision-making.

The Pay-by-Thought Model: A new paradigm for payments

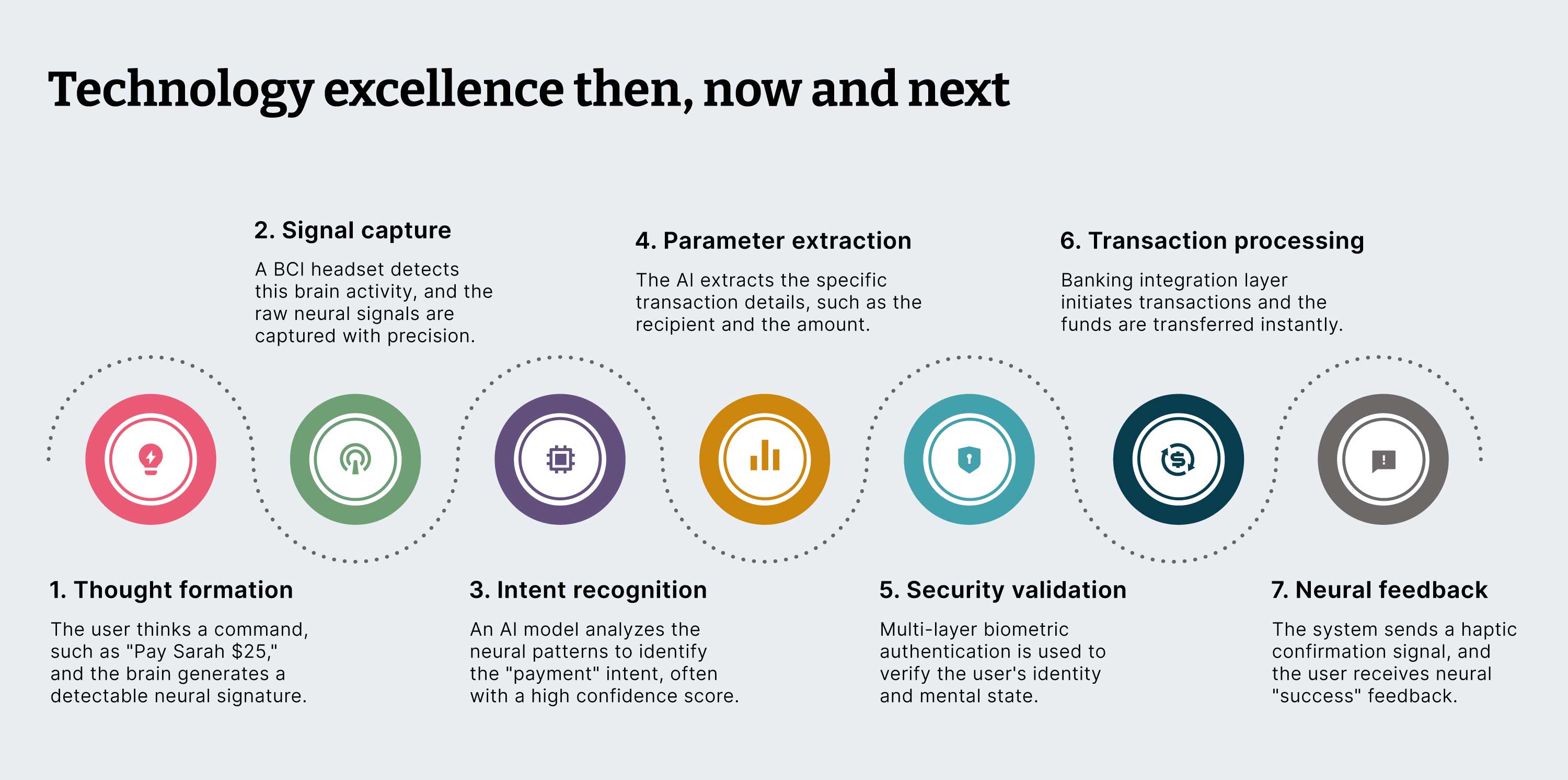

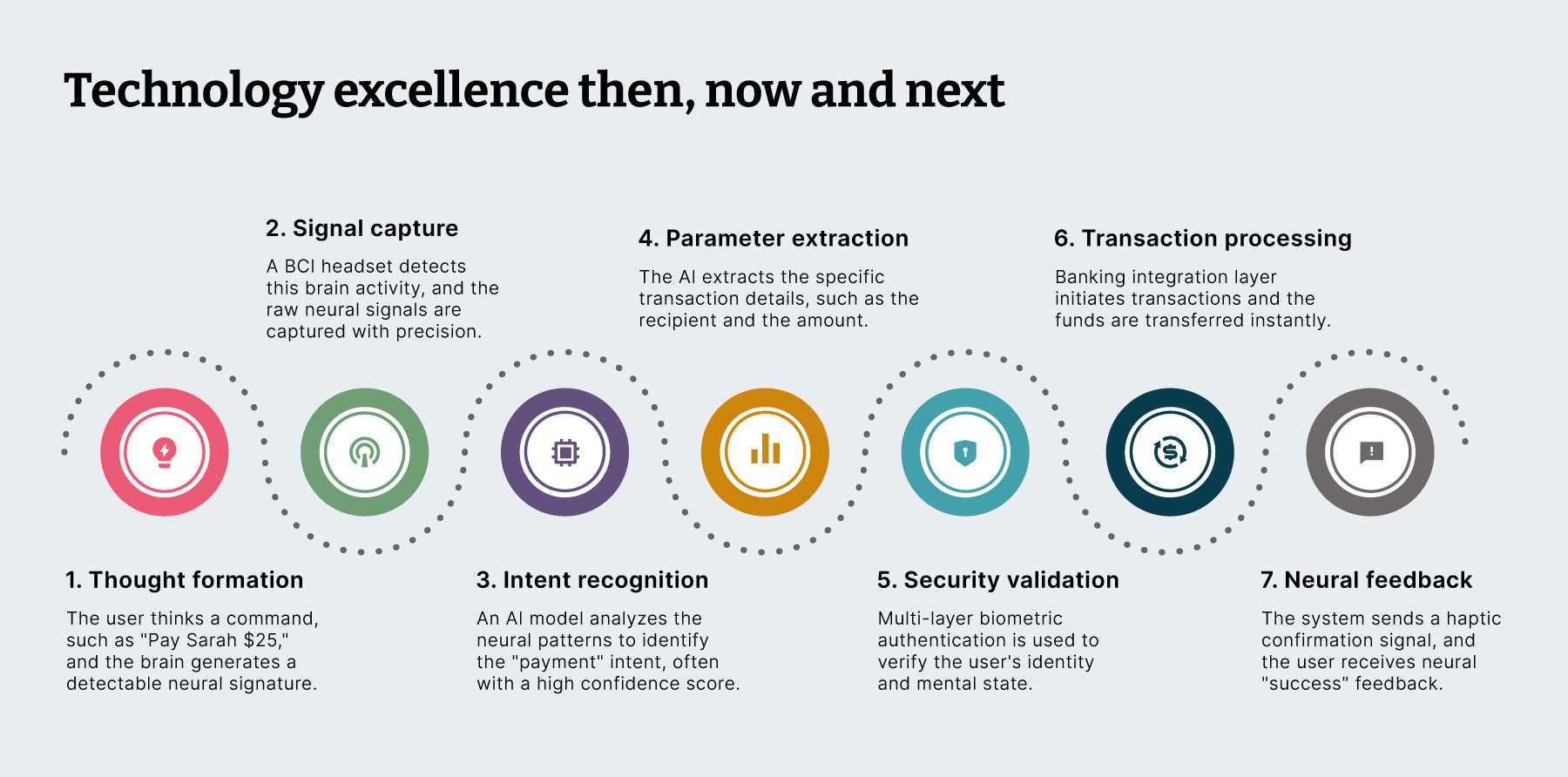

To bring the "pay by thought" model to life, we’ll explore a use case illustrated in the flow below, which starts with a customer thinking: “Pay my friend Sarah $25.” This process concludes with a secure financial transaction executed to the customer’s specifications. From start to finish, it moves through seven stages: Thought formation, signal capture, intent recognition, parameter extraction, security validation, transaction processing and neural feedback.

This flow includes the advanced technology and robust security protocols required for a technologically feasible, financially viable and trustworthy neural banking system. It incorporates complex neurological detection, AI analysis and multi-layered security measures that synchronize smoothly with real-time banking integration.

Neural banking architecture

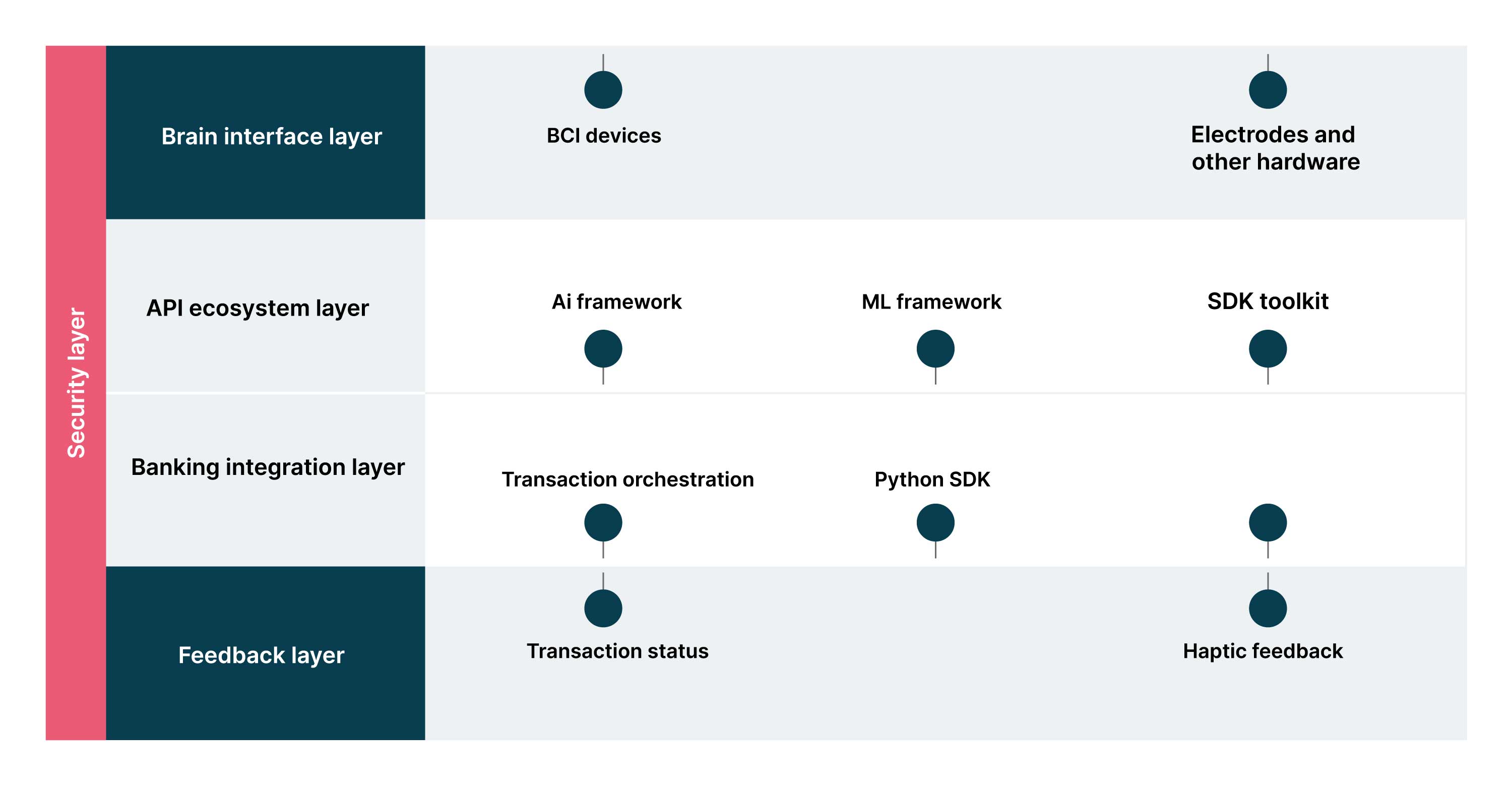

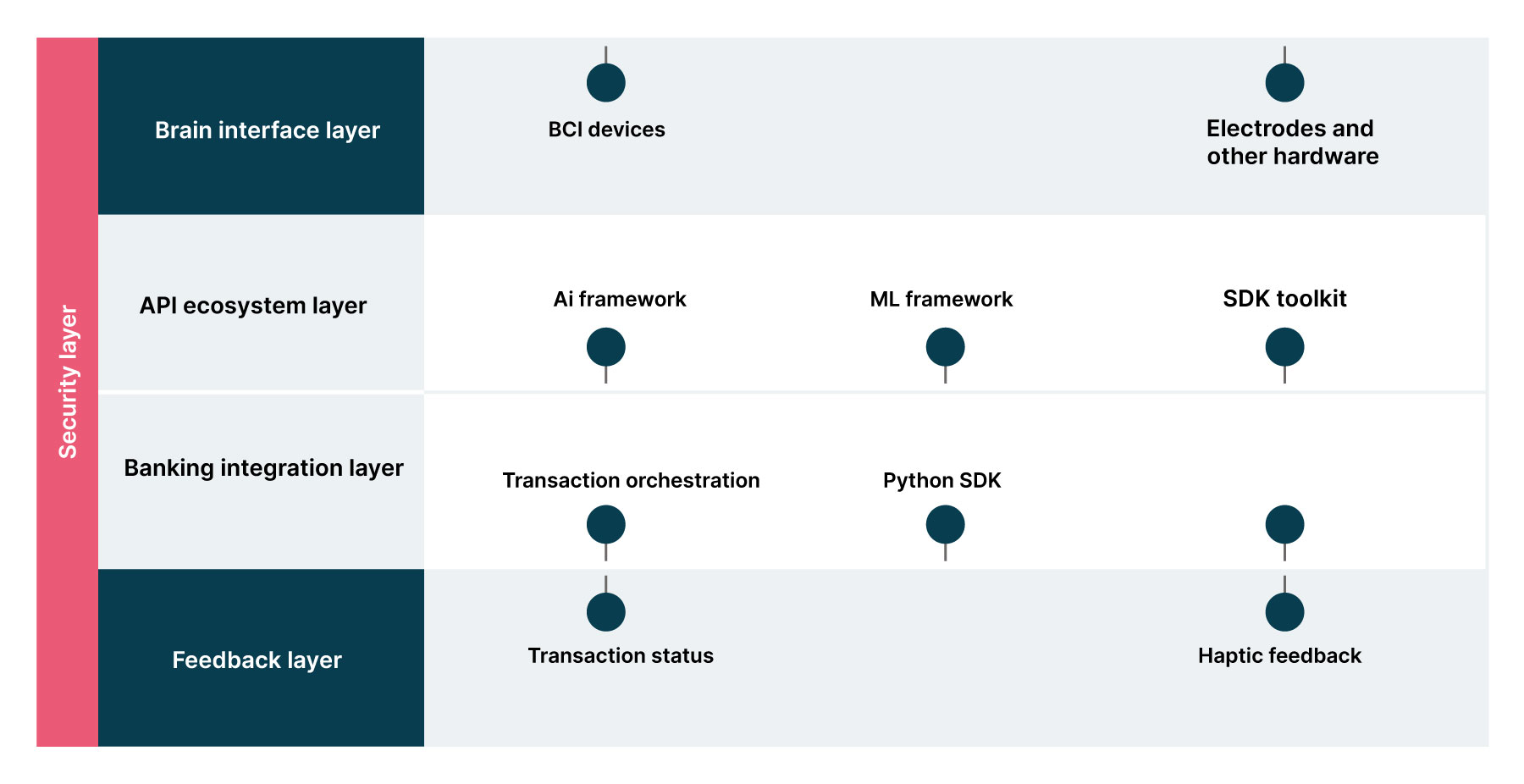

As the "pay by thought" model illustrates, it takes a sophisticated, multi-layered architecture to orchestrate the journey from a mere thought to a completed financial transaction through neural interfaces. The diagram below depicts the five critical layers involved in the neural banking system:

Brain interface layer: This layer uses BCI devices, like headsets, to capture a user's brain signals.

API ecosystem layer: This API ecosystem layer uses AI and machine learning to translate raw brain signals into financial commands and intent.

Banking integration layer: This custom layer is responsible for executing the commands by interfacing with existing banking systems.

Feedback layer: This layer uses the OpenBCI tech stack, an ecosystem of open-source solutions for brainwave data acquisition and usage, to respond to the user with real-time confirmation or alerts based on the transaction's status.

Security layer: Running across all other layers, this layer employs the OpenBCI tech stack to authenticate users via their unique neural signatures and detect fraudulent activity.

Managing risk with responsible development principles

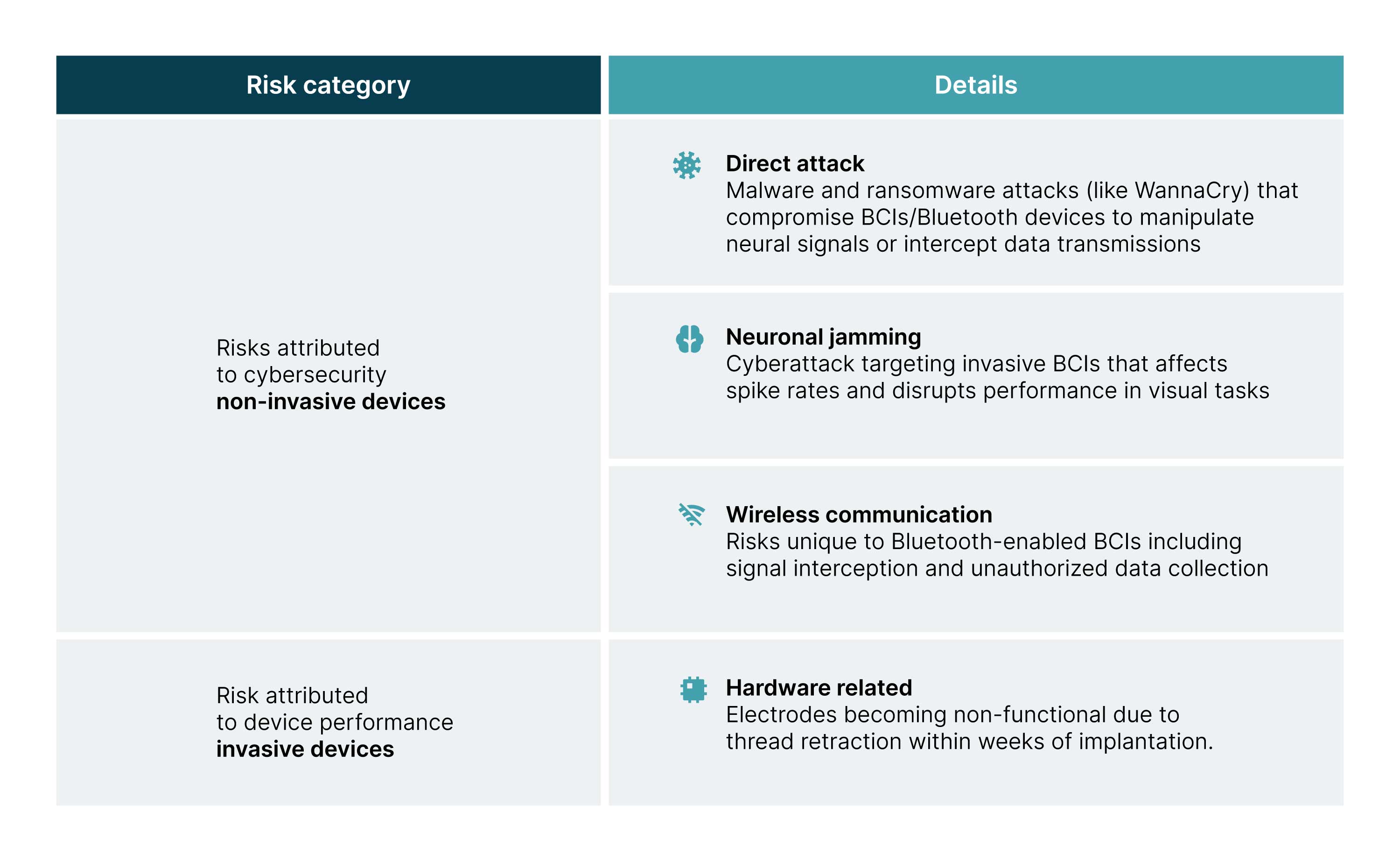

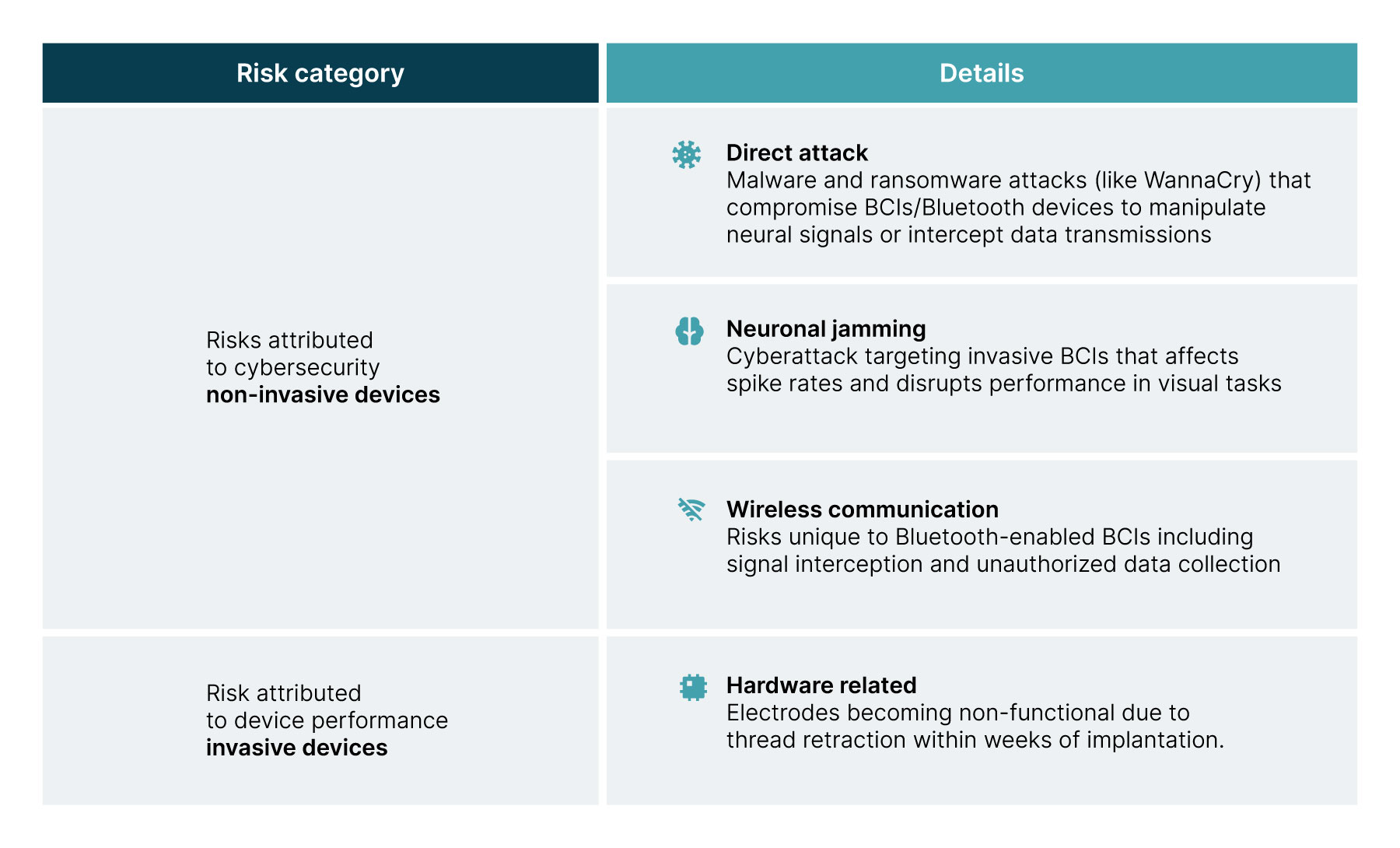

While BCI technology has huge potential in financial services, important safety, security and reliability considerations must be addressed before it can be adopted by the banking mainstream. Vulnerabilities are inherent in both non-invasive and invasive devices, as the table below shows:

This makes a managed and responsible approach to the adoption of neural banking, spearheaded by senior leadership, essential. Such an approach should include:

Cybersecurity: Neural banking introduces new cybersecurity considerations, including attacks that could manipulate neural signals or intercept data transmissions. Financial-grade security protocols, including advanced encryption and secure enclaves for neural data processing, are non-negotiable.

Privacy: The emerging legal and ethical frameworks around neural data require a proactive "privacy-by-design" approach. This includes transparent data handling practices, explicit consent mechanisms and a commitment to processing only necessary financial-related thoughts.

Regulatory engagement: Financial regulators will be required to create and implement new guidelines for neural banking. Institutions must proactively collaborate with regulators to develop appropriate standards and foster an environment of trust and compliance.

Organizational change management: Leadership must prepare organizations for the rise of neural banking. This includes addressing employee concerns about job displacement and managing customer adoption through clear communication and a phased, gradual implementation strategy that maintains traditional access methods.

To embed principles like these and map out the other impacts neural banking may have on the organization and its stakeholders, leaders should consider referencing the best practices explored in the Responsible Technology Playbook, which Thoughtworks created in collaboration with the UN to guide the institution on its technology adoption journey. The Playbook provides guidance on ensuring that the use of emerging technologies not only aligns with business goals, but also avoids causing social and environmental harm by adhering to principles of inclusivity, bias awareness and transparency.

In the race to explore new possibilities, institutions can’t lose sight of the core goals of inclusion and enhancing accessibility. Our experience with projects like Bahmni, an open digital medical record for low-resource healthcare settings in India and Nepal, has demonstrated the need for new technology to serve user needs and adapt to their unique challenges, from disabilities to severely limited budgets. Whether through prioritizing open-source software, designing interfaces to meet accessibility principles or providing hands-on training, ensuring solutions can be readily adopted by the communities (or customers) they are designed to serve is vital.

Preparing for liftoff

Neural finance is not a distant vision, but an accelerating reality driven by advancements in neurotechnology. Companies like Neuralink and Synchron are already conducting human trials, with participants successfully controlling digital devices hands-free.

While non-invasive BCI systems like wearable EEG headsets are making this tech more accessible, invasive technologies (like microelectrode arrays) are also rapidly advancing, promising higher accuracy and bandwidth for more complex tasks. This diverse technological landscape means institutions can choose a strategic path that aligns with their risk tolerance and long-term vision.

All that said, as this article has illustrated, it is still relatively early days for a technology that will also bring significant technical, ethical and security challenges that must be carefully navigated. To ensure they’re adequately prepared for a future in which thinking becomes banking, we encourage financial institutions to engage in pilot programs, research partnerships and proactive collaboration with regulators and technology developers.

As the technology continues to mature, banks should carefully examine opportunities where neural interfaces could complement existing accessibility and user experience strategies. Our experiences not just in adopting emerging technologies, but deploying these technologies for social good, have prepared us to support financial institutions as they apply innovation to better serve diverse customer needs in a changing digital landscape.